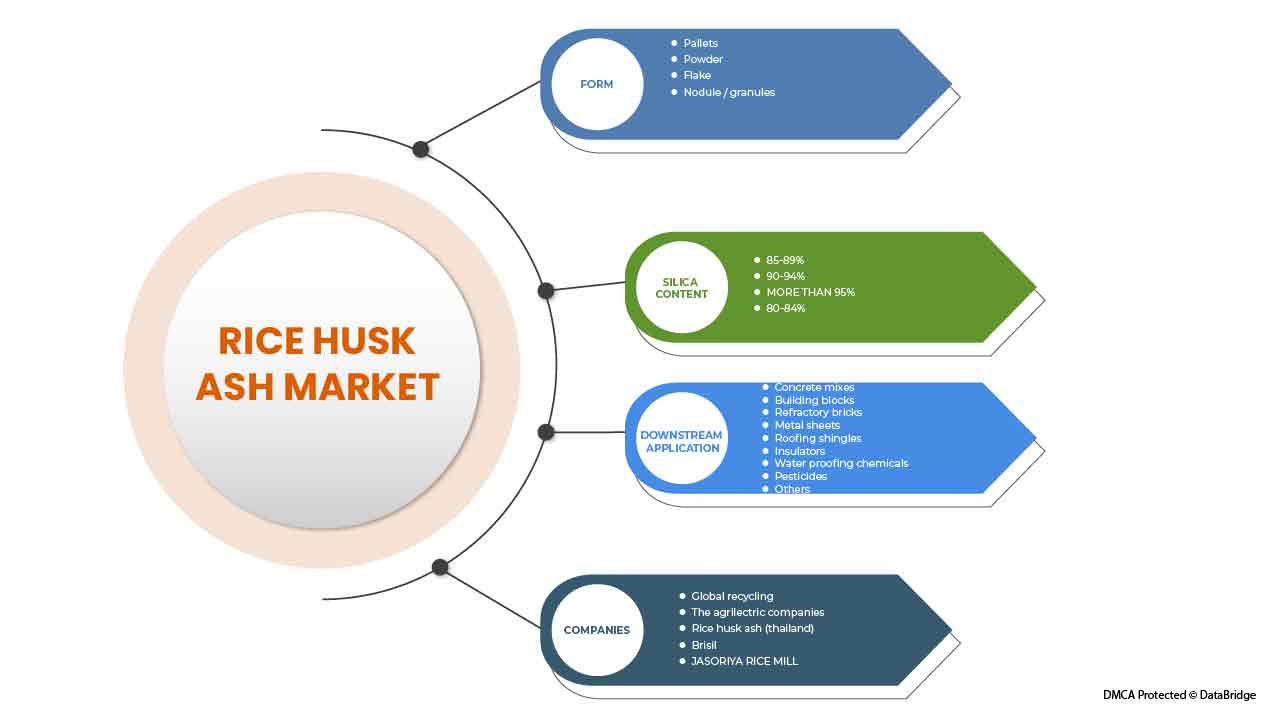

亚太稻壳灰市场,按形式(托盘、粉末、薄片、结节/颗粒)、硅含量(80-84%、85-89%、90-94%、95% 以上)、下游应用(混凝土混合物、建筑砌块、耐火砖、金属板、屋顶瓦、绝缘体、防水化学品、杀虫剂、其他)行业趋势和预测到 2029 年。

市场分析和见解

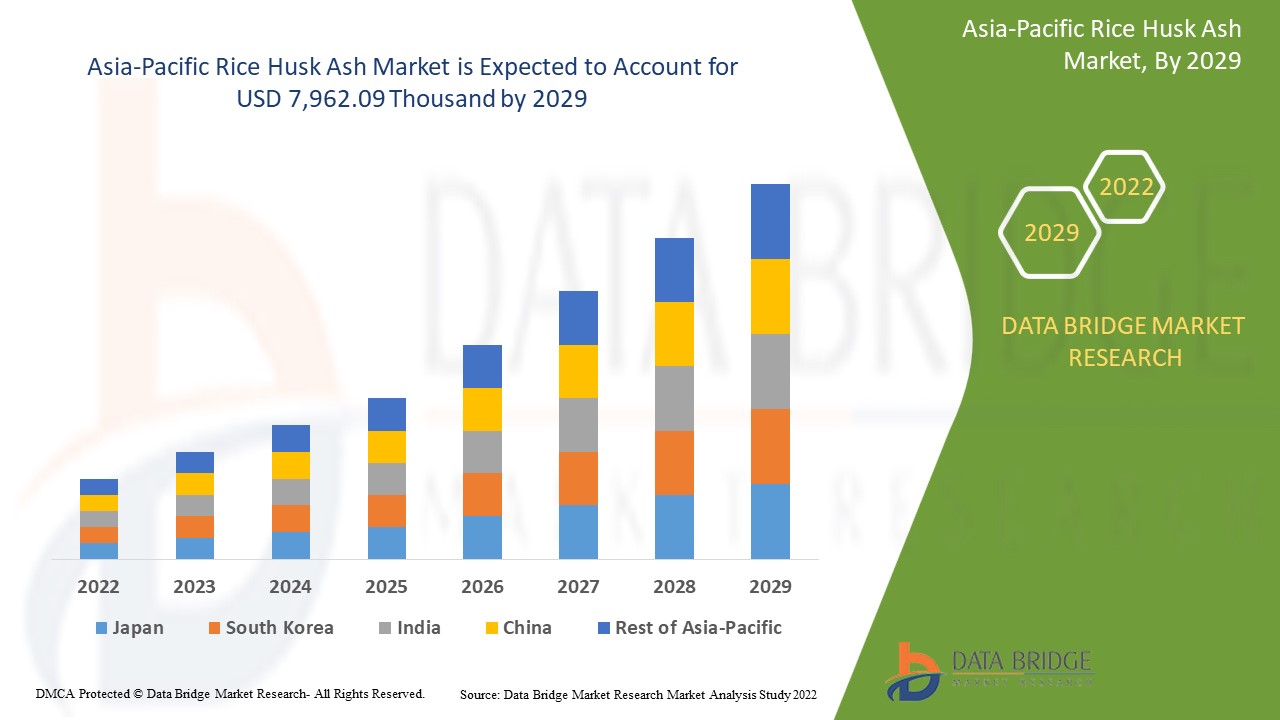

预计亚太地区稻壳灰市场将在 2022 年至 2029 年的预测期内实现显着增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场将以 5.9% 的复合年增长率增长,预计到 2029 年将达到 7,962.09 万美元。推动亚太地区稻壳灰市场增长的主要因素是由于其二氧化硅含量高,在建筑行业的产品范围广泛。

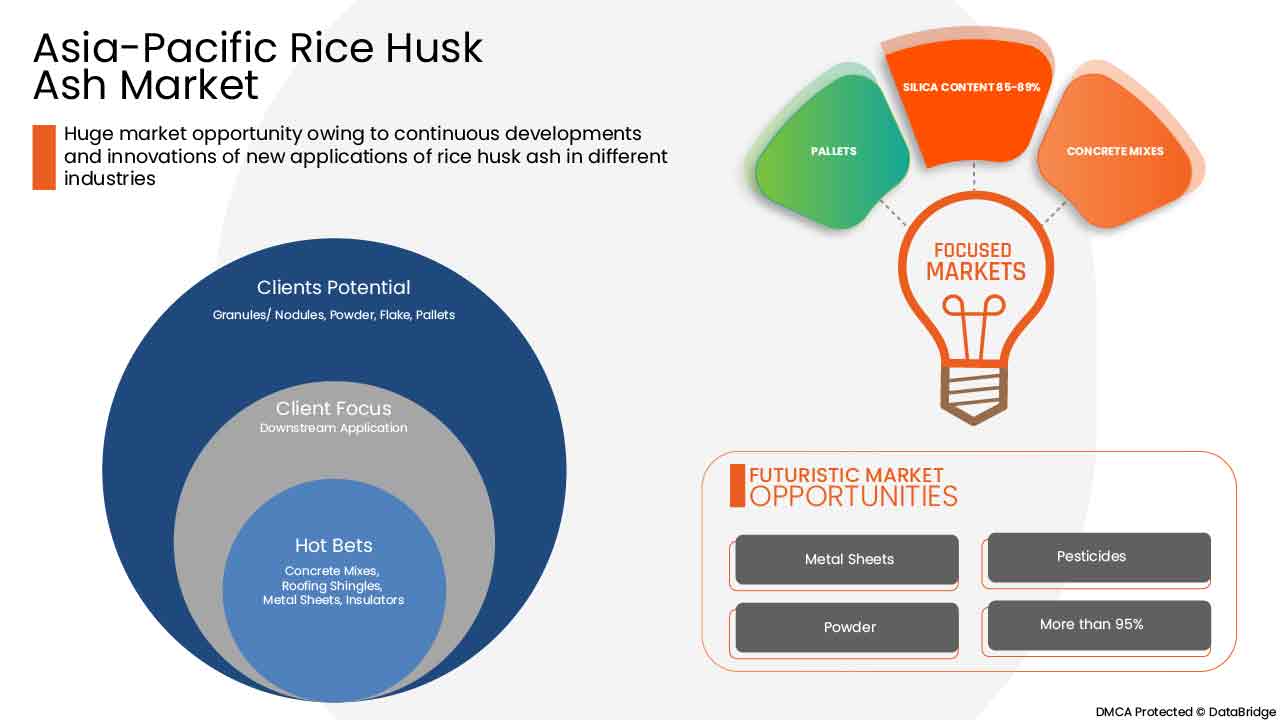

由于硅含量高,建筑行业产品范围广泛,预计将推动亚太地区稻壳灰市场的发展。人们对使用稻壳灰的技术优势的认识不断提高,预计将推动亚太地区稻壳灰市场的增长。

可能对亚太稻壳灰市场产生负面影响的主要限制因素是使用稻壳灰的水/水泥比问题以及替代品的强大市场覆盖率。

由于遵守环境监管规范以及原材料成本和制造成本较低,预计不断增长的需求将为亚太稻壳灰市场提供机会。

然而,与稻壳灰有关的处理问题以及对稻谷生产的高度依赖预计将对亚太地区稻壳灰市场的增长构成挑战。

亚太稻壳灰市场报告提供了市场份额、新发展、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元)、销量(千吨)、定价(美元) |

|

涵盖的领域 |

按形式(颗粒、粉末、薄片、结节/颗粒)、硅含量(80-84%、85-89%、90-94%、超过 95%)、下游应用(混凝土混合物、建筑砌块、耐火砖、金属板、屋顶瓦、绝缘体、防水化学品、杀虫剂等) |

|

覆盖国家 |

日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰以及亚太地区其他地区 |

|

涵盖的市场参与者 |

Astrra Chemicals、Global Recycling、KV Metachem、Brisil、Rice Husk Ash (Thailand)、Guru Corporation、JASORIYA RICE MILL、PIONEER Carbon 等。 |

市场定义

稻壳灰是稻田脱壳后回收的天然副产品。稻壳外壳一般由30%木质素、20%二氧化硅和50%纤维素组成,如果通过受控热分解进行焚烧,残渣就会变成灰烬。

稻壳灰是在稻壳受控燃烧后产生的,具有较高的火山灰性质和反应性。它被认为是建筑行业中合适的胶凝材料,既可以替代水泥,也可以作为外加剂。作为外加剂,稻壳灰可生产高强度混凝土,而用稻壳灰替代水泥可生产低成本的建筑砌块。稻壳灰用于生产轻质建筑材料,因为添加 RHA 可使混凝土更轻。

亚太稻壳灰市场动态

驱动程序

- 由于二氧化硅含量高,产品范围广泛适用于建筑行业

在亚太地区,由于建筑业的发展,稻壳灰的应用越来越广泛,因为它被广泛用作火山灰、填料、添加剂、磨料、油吸附剂、清扫组分和搪瓷悬浮剂。在水泥工业中,稻壳灰因其无定形二氧化硅而用于制造混凝土。它被用来替代普通波特兰水泥 (OPC),这是一种非常昂贵且主要的混凝土成分。使用稻壳灰有助于生产低成本的建筑砌块。低成本的建筑砌块在亚太地区非常受欢迎。

因此,建筑行业越来越多地使用稻壳灰来制造混凝土和混凝土制品以及其他用具产品(如浴室地板),预计将推动亚太地区稻壳灰市场的发展。

- 提高对稻壳灰技术优势的认识

稻壳灰的主要用途是在建筑行业中作为混合水泥中的辅助胶凝材料 (SCM),因为将稻壳灰添加到波特兰水泥中可以改善最终混合物的某些性能

此外,稻壳灰基混凝土混合物在海洋环境中具有出色的抗氯离子渗透性。因此,这些混凝土混合物在海洋环境施工活动中的应用正在增长。除了这些应用之外,稻壳灰还用于其他领域,例如屋顶瓦片、防水化学品、石油泄漏吸收剂、特种涂料、阻燃剂、杀虫剂和生物肥料,这些都可能推动亚太地区稻壳灰市场的增长。

- 优质二氧化硅产量增长

该地区各终端行业对二氧化硅的需求不断增长,而亚太地区的水田种植率很高,这增加了稻壳灰的使用量。建筑、钢铁、陶瓷和耐火材料等行业越来越多地使用从稻壳灰中提取的高质量二氧化硅。这为市场增长带来了积极的前景。水泥和建筑行业越来越多地选择使用稻壳灰代替硅灰和粉煤灰,这将影响市场。除了环境和经济优势外,低能耗和更简单的纯二氧化硅获取方法有望推动市场发展,同时为开发稻壳灰的新工业应用创造新的机会。

机会

- 由于遵守环境监管规范而导致需求不断增长

稻壳是一种有机废物,产量巨大。它是碾米和农业生物质工业的主要副产品。因此,其他行业使用稻壳灰副产品有助于减少浪费,稻壳灰可用作许多材料和应用中的添加剂,例如耐火砖、绝缘材料制造和阻燃剂材料。此外,稻壳灰因其在酸度校正方面的良好土壤效果而越来越受欢迎并获得监管机构的批准。因此,将稻壳灰用于各种其他用途预计将为亚太地区稻壳灰市场的增长提供丰厚的机会。

- 增加稻壳灰在橡胶轮胎生产中的使用

使用从稻壳灰中提取的二氧化硅还有其他好处。从沙子等传统来源提取二氧化硅所消耗的能量要高得多。从沙子中提取二氧化硅需要加热到 1,400 摄氏度。相比之下,从稻壳灰中提取二氧化硅所需的温度仅为 100 摄氏度。此外,稻壳灰中的二氧化硅使胎面具有更好的强度和刚度,并降低了滚动阻力。这有望为亚太地区稻壳灰市场的增长提供机会。

限制/挑战

- 使用稻壳灰的水灰比问题

稻壳灰在一定量的情况下可以改善混凝土的性能,但随着稻壳灰的用量增加,水泥和混凝土的强度趋于降低,因为稻壳灰比水泥更细,需要更多的水才能沉淀下来。这极大地影响了强度,预计这将限制亚太稻壳灰市场对稻壳灰的使用

- 替代品的强大市场覆盖率

仅靠从稻壳灰中生产二氧化硅无法满足对二氧化硅的需求。传统的二氧化硅生产方法仍然是首选,并用于满足各行业对原材料日益增长的需求。此外,燃烧稻壳生产稻壳灰会产生大量污染,影响其增长并限制其在预测期内的使用。这将加剧并使替代品的市场更加强大。

- 与稻壳灰有关的处置问题

采用高科技技术处理稻壳灰和水等废物,而一些碾米厂也将稻壳灰用于良好的生态用途,如土壤复原和提高肥力。此外,为了解决这个问题,稻壳灰被用于不同的应用,以便安全处理。人们正在考虑几种处理稻壳灰的方法,使其商业用途更加可行和高效。然而,稻壳灰的不当处理和各碾米厂设施的缺乏是一个严峻的挑战,可能会阻碍预测期内市场的增长。

- 高度依赖稻米生产

稻壳灰的产量百分比还取决于大米的碾磨率和可用的大米类型。此外,大米是喀里夫或冬季作物,只在一年中的特定时间即冬季生长。因此,可能无法全年大量供应稻壳灰,这可能会影响稻壳灰在其他行业(如水泥行业、二氧化硅生产行业、轮胎行业等)的其他应用的可用性。此外,还有一个问题是亚洲占世界稻米产量的 90% 以上。稻米是印度和中国等许多亚洲国家的主要粮食作物。2018 年,印度仅占世界稻米产量的 21% 左右。因此,其他地区很难获得原材料和成品等资源。因此,稻壳的地理分布有限以及水稻对稻壳的完全依赖是亚太稻壳灰市场需要克服的严峻挑战,才能在预测期内实现显着增长。

COVID-19 对亚太稻壳灰市场影响甚微

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和运输受限。然而,全球运营和供应链中的稻壳灰受到了重大影响,多家制造工厂仍在运营。在后疫情时代,服务提供商在采取卫生和安全措施后继续提供稻壳灰。

最新动态

- Brisil 因其解决废物利用问题的技术而获得了各种国家和国际奖项和认可。其中包括来自创新领袖奖学金、全球清洁技术创新计划和《经济时报》等的认可

- PIONEER Carbon 的生产设施已通过 ISO 14001 和 BS OHSAS 1800 认证。这些认证确保公司对其产品实施严格的质量检查规程并遵守环境管理系统

- Guru Corporation 已通过 ISO 9001: 2008 和 ISO 14001: 2004 质量控制程序和制造工艺认证。这提高了该公司在亚太稻壳灰市场的声誉

亚太稻壳灰市场范围

亚太稻壳灰市场根据形态、硅含量和下游应用进行分类。这些细分市场之间的增长将帮助您分析主要的行业增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

形式

- 颗粒/结节

- 托盘

- 薄片

- 粉末

根据形态,亚太稻壳灰市场分为颗粒/结节、块状、片状和粉末。

硅含量

- 80-84%

- 85-89%

- 90-94%,

- 超过 95%

根据二氧化硅含量,亚太稻壳灰市场分为80-84%、85-89%、90-94%和95%以上。

下游应用

- 混凝土混合物

- 屋顶瓦片

- 构建模块

- 耐火砖

- 金属板

- 绝缘子

- 防水化学品

- 农药

- 其他的

根据下游应用,亚太稻壳灰市场分为混凝土混合料、屋顶瓦、建筑砌块、耐火砖、金属板、绝缘体、防水化学品、杀虫剂等。

亚太地区稻壳灰区域分析/见解

亚太稻壳灰市场根据国家、形式、硅含量和下游应用进行分类。亚太稻壳灰市场分为日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰以及亚太其他地区。

由于中国对使用稻壳灰的技术优势的认识不断提高,预计中国将主导亚太稻壳灰市场。

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新车和替换车销售、国家人口统计数据和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了亚太地区品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和亚太稻壳灰市场份额分析

亚太稻壳灰 市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上数据点仅与公司对亚太稻壳灰市场的关注有关。

亚太稻壳灰 市场的一些知名参与者包括 Astrra Chemicals、Global Recycling、KV Metachem、Brisil、Rice Husk Ash (Thailand)、Guru Corporation、JASORIYA RICE MILL、PIONEER Carbon 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、全球与区域以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 ASIA PACIFIC IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – ASIA PACIFIC RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 59

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 ASIA PACIFIC RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 INDONESIA

9.1.7 AUSTRALIA & NEW ZEALAND

9.1.8 PHILIPPINES

9.1.9 MALAYSIA

9.1.10 SINGAPORE

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ASIA PACIFIC RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 48 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 50 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 52 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 54 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 56 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 58 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 60 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 62 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 64 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 66 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 68 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 70 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 72 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 74 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 76 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 78 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 80 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 82 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 84 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 86 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 88 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 90 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 92 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 94 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 96 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 98 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 100 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 102 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 104 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 106 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 108 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 110 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 112 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 113 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 114 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 115 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 116 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 118 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 120 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 122 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 123 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 124 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 126 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 128 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 129 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 130 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 131 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 132 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 134 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 136 REST OF ASIA-PACIFIC RICE HUSK ASH, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 REST OF ASIA-PACIFIC RICE ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

图片列表

FIGURE 1 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC RICE HUSK ASH MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE ASIA PACIFIC RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 20 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 21 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 22 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 23 ASIA-PACIFIC RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC RICE HUSK ASH MARKET: BY FORM (2022 - 2029)

FIGURE 28 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。