北美肉类提取物市场,按产品(牛肉提取物、猪肉提取物、鸡肉提取物、鱼提取物、羊肉提取物、其他肉类提取物)、类型(原料、提取物)、形式(粉末、糊状、液体)、功能(调味剂、培养基制备等)、类别(常规、有机)、应用(食品和饮料、制药/实验室研究)、国家(美国、加拿大、墨西哥)行业趋势和预测到 2029 年。

市场分析与洞察 :北美肉类提取物市场

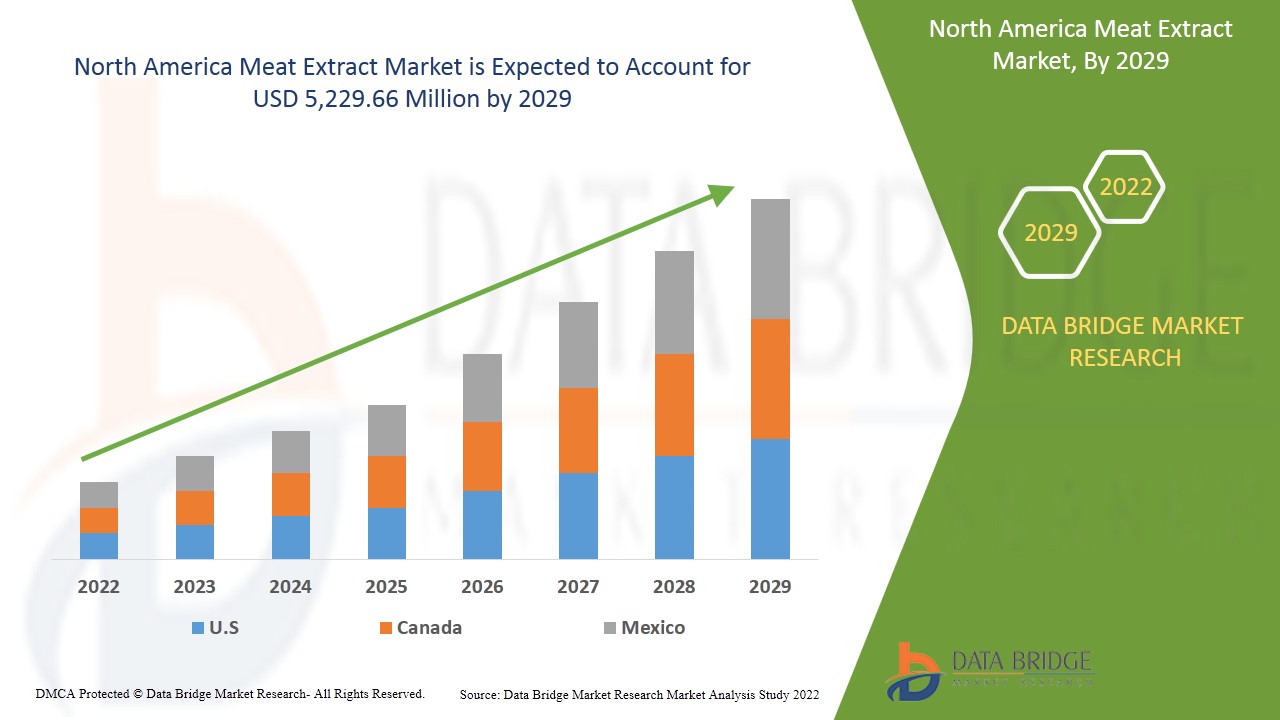

北美肉类提取物市场预计将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 6.3%,预计到 2029 年将达到 52.2966 亿美元。消费者对富含蛋白质的食品和饮料的需求不断增长,预计将推动北美肉类提取物市场的增长。

肉精含有肉的浓缩精华。它是从牛肉、鸡肉、猪肉、海鲜等动物来源获得的富含肉汁的物质。肉精富含蛋白质,具有多种健康益处,如增强免疫力、建立和修复健康的肌肉、骨骼、皮肤和血细胞等。它广泛用于工业和商业用途。它通过改善食品的口感和风味,充当加工食品和饮料的调味剂。它还用于生物研究中的培养基制备和其他用途,如工业发酵、分析微生物学等。

肉提取物有两种类型,原汁和提取物,用作调味剂、制备培养基和其他用途。对高营养价值的肉提取物的需求不断增长,加上肉提取物在微生物学中广泛用于培养培养基,预计将推动北美肉提取物市场的增长。然而,政府机构制定的严格法规可能会阻碍市场的增长。

对富含蛋白质产品的需求不断增长预计将为肉类提取物制造商创造巨大的机会,而市场参与者之间的激烈竞争可能会对市场的增长提出挑战。

北美肉类提取物市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和北美肉类提取物市场情况,请联系 Data Bridge Market Research 获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

北美 肉类提取物市场范围和市场规模

北美肉类提取物市场根据产品、类型、形式、功能、类别和应用进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据产品,北美肉类提取物市场分为牛肉提取物、猪肉提取物、鸡肉提取物、鱼提取物、羊肉提取物和其他肉类提取物。2022 年,由于餐厅、酒店、度假村等食品行业供应牛肉和牛肉制品的增加,牛肉提取物市场预计将占据北美肉类提取物市场的主导地位。

- 根据类型,北美肉类提取物市场分为原汤和提取物。2022 年,由于原汤需求不断增长,预计原汤将主导北美肉类提取物市场,因为原汤可以增强加工产品的口感,增加产品的风味。

- 根据形态,北美肉类提取物市场分为粉末、糊状和液体。由于需求不断增长,粉末市场预计将在 2022 年占据北美肉类提取物市场的主导地位,因为它们在许多零售店和超市中很容易买到,并且在许多研究实验室中广泛用于制备培养基。

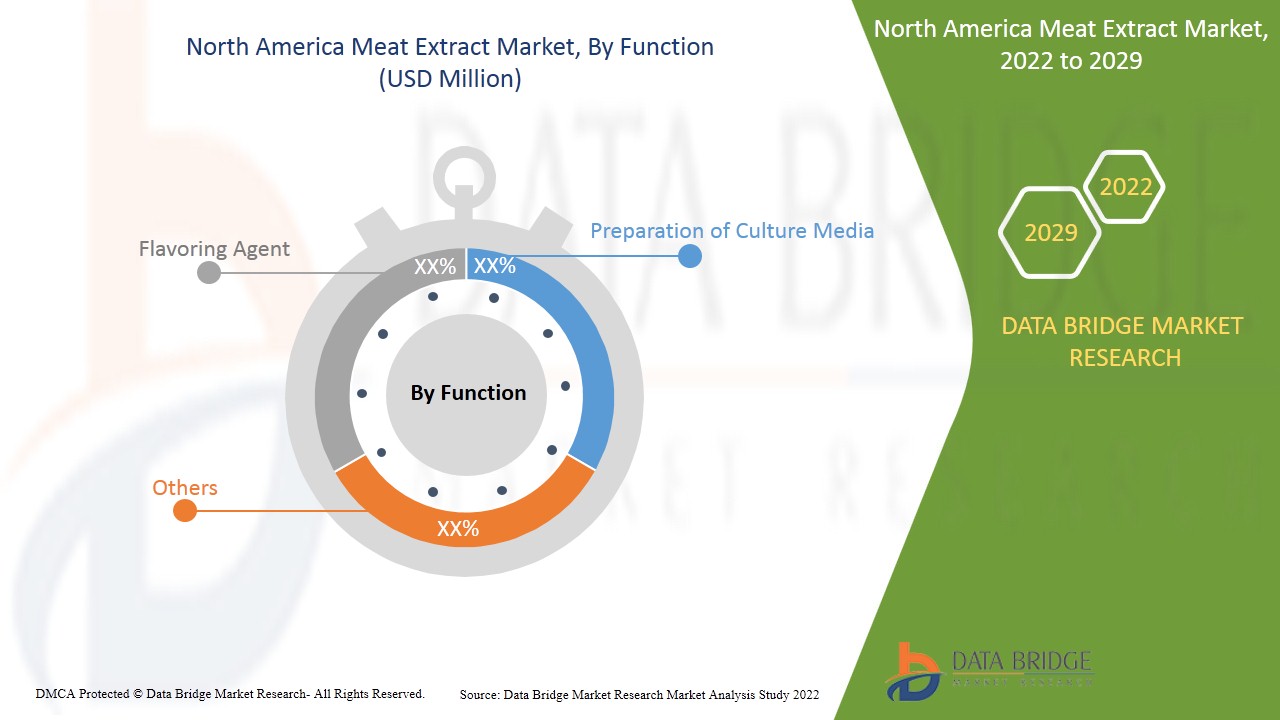

- 根据功能,北美肉类提取物市场分为调味剂、培养基制剂和其他。 2022 年,调味剂市场预计将主导北美肉类提取物市场,因为调味剂可以提升产品的知名度,为食品提供美味,提升口感。

- 根据类别,北美肉类提取物市场分为有机和传统两类。2022 年,传统产品预计将主导北美肉类提取物市场,因为它们价格低廉,应用广泛,例如培养基制备、调味剂等。

- 根据应用,北美肉类提取物市场分为食品和饮料以及制药/实验室研究。 2022 年,食品和饮料部门预计将主导北美肉类提取物市场,因为食品服务行业的需求激增,因为它们在食品制造商、商业消费者和其他方面充当调味剂。

北美肉类提取物市场国家层面分析

对北美肉类提取物市场进行了分析,并按上述国家、产品、类型、形式、功能、类别和应用提供了市场规模信息。

北美肉类提取物市场报告涵盖的一些国家包括美国、加拿大、墨西哥。由于该地区餐饮业的蓬勃发展,美国有望主导北美肉类提取物市场。由于主要制造商之间的战略联盟,加拿大也可能主导该地区。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、销售渠道的影响。

主要市场参与者日益增长的战略活动正在推动北美肉类提取物市场的增长

北美肉类提取物市场还为您提供了每个国家在特定市场增长的详细市场分析。此外,它还提供有关市场参与者战略和地理分布的详细信息。数据适用于 2011 年至 2020 年的历史时期。

竞争格局和北美 肉类提取物市场份额分析

北美肉类提取物市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对北美肉类提取物市场的关注有关。

北美肉类提取物市场的一些主要公司包括 Kerry、Thermo Fisher Scientific Inc.、BD、PACIFIC FOODS OF OREGON, LLC、Bare Bones、Bonafide Provisions、Hardy Diagnostics、MP BIOMEDICALS、Nikken Foods Co., Ltd、Abbexa、Alpha Biosciences、Bio Basic Inc.、HiMedia Laboratories、Essentia Protein Solutions、NEOGEN Corporation、International Dehydrated Foods, Inc.、Proliant Biologicals, LLC. 以及其他国内公司。DBMR 分析师了解竞争优势,并为每个竞争对手分别提供竞争分析。

世界各地的公司也发起了许多合同和协议,这也加速了北美肉类提取物市场的发展。

例如,

- 2018 年 7 月,PACIFIC FOODS OF OREGON, LLC 推出了一系列营养丰富的有机汤,采用有机鸡骨汤制成,令人食欲大开。每份汤含有 7-10 克蛋白质和 400-600 毫克钠。汤由干净的有机食材制成。新产品旨在通过推出汤和肉汤的新组合来吸引更多消费者,并增强业务

- 2021 年 6 月,据 Industry Dive 报道,Kerry 以约 10 亿美元收购了清洁标签、低钠防腐剂专家 Niacet。此次收购旨在利用其肉制品保鲜技术、肉类干燥和制粒工艺以及其他应用

市场参与者的合作、产品发布、业务扩展、奖励和认可、合资企业等策略增强了公司在北美肉类提取物市场的影响力,这也有利于该组织的利润增长。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEAT EXTRACT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 COMPARATIVE ANALYSIS WITH PARENT MARKET

4.3 LIST OF SUBSTITUTES IN THE NORTH AMERICA MEAT EXTRACT MARKET

4.4 NORTH AMERICA MEAT EXTRACT MARKET: MARKETING STRATEGIES

4.4.1 LAUNCHING INNOVATIVE MEAT EXTRACT PRODUCTS

4.4.2 THOUGHTFUL PACKAGING

4.4.3 A VAST NETWORK OF DISTRIBUTION

4.5 RAW MATERIAL PRICING ANALYSIS

4.6 SUPPLY CHAIN OF NORTH AMERICA MEAT EXTRACT MARKET

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MEAT EXTRACT PRODUCTION/PROCESSING

4.6.3 MARKETING & DISTRIBUTION

4.6.4 END USERS

4.7 VALUE CHAIN OF NORTH AMERICA MEAT EXTRACT MARKET

5 NORTH AMERICA MEAT EXTRACT MARKET- REGULATORY FRAMEWORKS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH NUTRITIONAL VALUE OF MEAT EXTRACT

6.1.2 SURGE IN THE DEMAND FOR CLEAN LABEL FOOD

6.1.3 EXTENSIVE USE OF MEAT EXTRACT IN MICROBIOLOGY TO GROW CULTURE MEDIA

6.1.4 INCREASING AWARENESS REGARDING DIET CLAIMS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS LAID BY THE GOVERNMENT BODIES

6.2.2 HIGH IMPACT OF RELIGIOUS SENTIMENTS ON THE MARKET

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR PROTEIN-RICH PRODUCTS

6.3.2 RISE IN CHANGING NORTH AMERICA DIET TRENDS AND INCREASING HEALTH-CONSCIOUS CONSUMERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG MARKET PLAYERS

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 NORTH AMERICA MEAT EXTRACT MARKET, BY TYPE

7.1 OVERVIEW

7.2 STOCK

7.3 EXTRACT

8 NORTH AMERICA MEAT EXTRACT MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 FLAVORING AGENT

8.3 PREPARATION OF CULTURE MEDIA

8.4 OTHERS

9 NORTH AMERICA MEAT EXTRACT MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA MEAT EXTRACT MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 BEEF EXTRACT

10.2.1 BEEF EXTRACT, BY TYPE

10.2.2 STOCK

10.2.3 EXTRACT

10.3 PORK EXTRACT

10.3.1 PORK EXTRACT, BY TYPE

10.3.2 STOCK

10.3.3 EXTRACT

10.4 CHICKEN EXTRACT

10.4.1 CHICKEN EXTRACT, BY TYPE

10.4.2 STOCK

10.4.3 EXTRACT

10.5 FISH EXTRACT

10.5.1 FISH EXTRACT, BY TYPE

10.5.2 STOCK

10.5.3 EXTRACT

10.6 LAMB EXTRACT

10.6.1 LAMB EXTRACT, BY TYPE

10.6.2 STOCK

10.6.3 EXTRACT

10.7 OTHER MEAT EXTRACTS

11 NORTH AMERICA MEAT EXTRACT MARKET, BY FORM

11.1 OVERVIEW

11.2 POWDER

11.3 PASTE

11.4 LIQUID

12 NORTH AMERICA MEAT EXTRACT MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 SOUP BROTHS

12.2.1.2 READY-TO-EAT MEALS

12.2.1.3 SEASONING & SAUCES

12.2.1.4 PROCESSED FOODS

12.2.1.4.1 INSTANT NOODLES

12.2.1.4.2 INSTANT SOUP POWDER

12.2.1.4.3 OTHERS

12.2.1.5 MEAT BASED SNACKS

12.2.1.5.1 SAUSAGES

12.2.1.5.2 MEATBALLS

12.2.1.5.3 MEAT BURGERS

12.2.1.5.4 NUGGETS

12.2.1.5.5 OTHERS

12.2.1.6 BAKERY & CONFECTIONERY PRODUCTS

12.2.1.7 BEVERAGES

12.2.1.8 SPORTS NUTRITION

12.2.1.9 OTHERS

12.2.2 FOOD & BEVERAGE, BY FORM

12.2.2.1 POWDER

12.2.2.2 PASTE

12.2.2.3 LIQUID

12.3 PHARMACEUTICAL/LABORATORY RESEARCH

12.3.1 PHARMACEUTICAL/LABORATORY RESEARCH, BY TYPE

12.3.1.1 MICROBIOLOGICAL ANALYSIS

12.3.1.2 ANIMAL HEALTH VACCINES

12.3.1.3 OTHERS

12.3.2 PHARMACEUTICAL/LABORATORY RESEARCH, BY FORM

12.3.2.1 POWDER

12.3.2.2 PASTE

12.3.2.3 LIQUID

13 NORTH AMERICA MEAT EXTRACT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA MEAT EXTRACT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 KERRY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 BD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NH FOODS AUSTRALIA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 PACIFIC FOODS OF OREGON, LLC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 ARIAKE JAPAN CO.LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ESSENTIA PROTEIN SOLUTIONS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 A. COSTANTINO & C.SPA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ABBEXA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ALPHA BIOSCIENCES

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BARE BONES

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 BIO BASIC INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BONAFIDE PROVISIONS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CARNAD

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 COLIN INGRÉDIENTS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HARDY DIAGNOSTICS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 HIMEDIA LABORATORIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 INTERNATIONAL DEHYDRATED FOODS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 JBS NORTH AMERICA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MAVERICK BIOSCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 MEIOH BUSSAN CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 MP BIOMEDICALS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 NEOGEN CORPORATION.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 NIKKEN FOODS CO., LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 PROLIANT BIOLOGICALS LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 PT. FOODEX INDONESIA

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

17 QUESTIONARE:

18 RELATED REPORTS

表格列表

TABLE 1 COMPARISON OF MEAT EXTRACT WITH MEAT (PER 100G)

TABLE 2 LIST OF MEAT EXTRACT SUBSTITUTES

TABLE 3 BEEF MEAT PRICES

TABLE 4 CHICKEN MEAT PRICES

TABLE 5 TURKEY MEAT PRICES

TABLE 6 OTHER POULTRY MEAT PRICES

TABLE 7 PORK MEAT PRICES

TABLE 8 SEAFOOD MEAT PRICES

TABLE 9 BEEF MEAT PRICE AS PER COUNTRY

TABLE 10 CHICKEN MEAT PRICES AS PER COUNTRY

TABLE 11 NUTRITIONAL INFORMATION OF BEEF MEAT EXTRACT (PER 100 GRAMS)

图片列表

FIGURE 1 NORTH AMERICA MEAT EXTRACT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEAT EXTRACT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEAT EXTRACT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEAT EXTRACT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEAT EXTRACT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEAT EXTRACT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEAT EXTRACT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MEAT EXTRACT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MEAT EXTRACT MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA MEAT EXTRACT MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 HIGH NUTRITIONAL VALUE OF MEAT EXTRACT IS EXPECTED TO DRIVE THE NORTH AMERICA MEAT EXTRACT MARKET IN THE FORECAST PERIOD

FIGURE 12 BEEF EXTRACT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEAT EXTRACT MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA MEAT EXTRACT MARKET

FIGURE 14 VALUE CHAIN OF NORTH AMERICA MEAT EXTRACT MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEAT EXTRACT MARKET

FIGURE 16 NORTH AMERICA MEAT EXTRACT MARKET, BY TYPE, 2021

FIGURE 17 NORTH AMERICA MEAT EXTRACT MARKET, BY FUNCTION, 2021

FIGURE 18 NORTH AMERICA MEAT EXTRACT MARKET, BY CATEGORY, 2021

FIGURE 19 NORTH AMERICA MEAT EXTRACT MARKET, BY PRODUCT, 2021

FIGURE 20 NORTH AMERICA MEAT EXTRACT MARKET, BY FORM, 2021

FIGURE 21 NORTH AMERICA MEAT EXTRACT MARKET, BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA MEAT EXTRACT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA MEAT EXTRACT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA MEAT EXTRACT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA MEAT EXTRACT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA MEAT EXTRACT MARKET: BY PRODUCT (2022 & 2029)

FIGURE 27 NORTH AMERICA MEAT EXTRACT MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。