Global Broadcast Equipment Market

市场规模(十亿美元)

CAGR :

%

USD

8.90 Billion

USD

12.82 Billion

2024

2032

USD

8.90 Billion

USD

12.82 Billion

2024

2032

| 2025 –2032 | |

| USD 8.90 Billion | |

| USD 12.82 Billion | |

|

|

|

|

Global Broadcast Equipment Market Segmentation, By Frequency (Low Frequency, Medium Frequency, High Frequency, Very High Frequency, Ultra-High Frequency and Super-High Frequency), Technology (Analog Broadcast and Digital Broadcast), Power Range (High Power Range and Low Power Range), Content Type (Audio/Visual, Video and Audio), Product Type (Transmitters & Repeaters, Dish Antennas, Encoders, Amplifiers, Modulators, Switches, Video Servers and Others), Application (IPTV, Television, Cable Television and Radio) - Industry Trends and Forecast to 2032

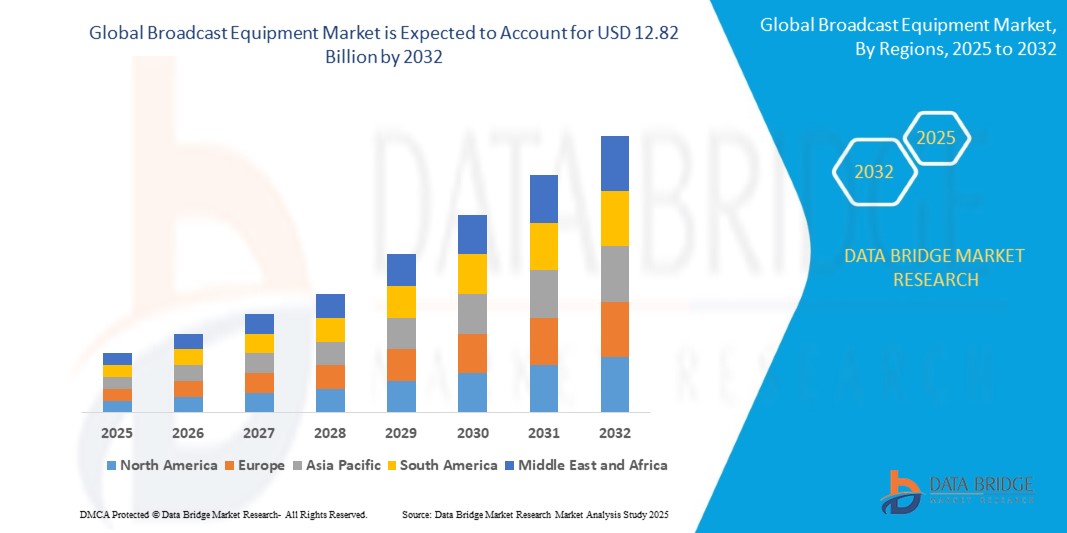

Broadcast Equipment Market Size

- The global broadcast equipment market size was valued atUSD 7.92 billion in 2024and is expected to reachUSD 12.82 billion by 2032, at aCAGR of 6.20%during the forecast period

- This growth is driven by factors such as the rising demand for ultra-HD content, increased adoption of IP-based broadcasting, and the rapid expansion of OTT platforms and digital broadcasting globally

Broadcast Equipment Market Analysis

- Broadcast equipment includes devices used for radio and television production and transmission, such as encoders, transmitters, cameras, and modulators. These are essential for content creation, signal processing, and distribution across various platforms

- The market growth is significantly driven by the rising consumption of high-definition and Ultra HD content, increasing demand for OTT streaming, and transition from analog to digital broadcasting

- North America is expected to dominate the broadcast equipment market with a market share of 38.5%, due to presence of major media and broadcasting companies, advanced technological infrastructure, and early adoption of digital and IP-based broadcasting systems

- Asia-Pacific is expected to be the fastest growing region in the broadcast equipment market with a market share of 34.5%, during the forecast period due to rapid digital transformation, expanding internet penetration, and rising demand for high-quality content across emerging economies

- Digital broadcast segment is expected to dominate the market with a market share of 70.5% due to its superior transmission quality, spectrum efficiency, and ability to support HD and 4K content. It enables seamless integration with IP-based and OTT platforms, aligning with the industry's shift toward digital transformation

Report Scope andBroadcast Equipment Market Segmentation

|

Attributes |

Broadcast Equipment KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Broadcast Equipment Market Trends

“Shift Toward IP-Based Broadcasting and Cloud-Enabled Workflows”

- One prominent trend shaping the broadcast equipment market is the growing adoption of IP-based broadcasting and cloud-enabled workflows, replacing traditional SDI-based systems

- This shift enhances operational flexibility, scalability, and cost-efficiency, allowing broadcasters to streamline content production and distribution across multiple platforms

- For instance, broadcasters are increasingly leveraging cloud platforms for remote production, live streaming, and content storage, enabling real-time collaboration and faster content delivery

- These advancements are revolutionizing broadcast infrastructure, supporting the demand for hybrid and remote production setups, and fueling the adoption of advanced, software-defined broadcast equipment

Broadcast Equipment Market Dynamics

Driver

“Rising Demand for High-Quality Content and OTT Expansion”

- The surge in consumer demand for high-definition (HD), 4K, and Ultra HD content is a major driver accelerating the growth of the global broadcast equipment market

- This demand is further fueled by the rapid expansion of over-the-top (OTT) platforms, which require advanced broadcasting infrastructure to deliver seamless, high-quality streaming experiences across multiple devices

- Broadcast service providers are increasingly investing in next-generation equipment to enhance production quality, reduce latency, and support multi-platform content delivery

For instance,

- According to the Motion Picture Association’s 2023 report, global OTT streaming subscriptions exceeded 1.8 billion, highlighting a sharp rise in digital content consumption and the need for robust broadcast equipment to support growing data and performance demands

- Consequently, the widespread consumer preference for on-demand, high-resolution content continues to drive significant investments in modern broadcast technologies and equipment

Opportunity

“Integration of AI and Automation in Broadcasting Workflows”

- The integration of artificial intelligence and automation in broadcast equipment presents a significant opportunity for enhancing content production, management, and distribution efficiency

- AIcan be used for real-time content indexing, speech-to-text transcription, automated video editing, and targeted content recommendation, streamlining operations and reducing manual labor

- In addition, broadcasters can leverage AI-driven analytics to understand viewer preferences, personalize content delivery, and optimize advertising strategies for greater audience engagement

For instance,

- In February 2024, according to a report by Deloitte, AI-powered tools are increasingly being used by media houses for automated metadata tagging and quality control, significantly reducing post-production time and improving operational efficiency in live and recorded broadcasts

- The use of AI in broadcast equipment also supports remote and cloud-based production, enabling broadcasters to deliver high-quality, real-time content at reduced costs, thereby opening new avenues for growth and innovation in the industry

Restraint/Challenge

“High Capital Investment and Infrastructure Cost”

- The high cost associated with acquiring and maintaining advanced broadcast equipment poses a major challenge to market growth, especially for small- and medium-sized broadcasters and production houses

- Equipment such as 4K/8K cameras, transmitters, encoders, and IP-based infrastructure can involve substantial upfront investments and require continuous upgrades to remain compatible with evolving technologies

- This financial burden often limits the ability of smaller market players to adopt next-generation systems, restricting market penetration in cost-sensitive regions

For instance,

- In October 2024, according to a report by TV Tech, transitioning to IP-based workflows and 4K broadcasting can cost broadcasters millions of dollars in infrastructure upgrades and workforce training, creating a barrier to widespread adoption among smaller players

- Consequently, the high capital expenditure and associated operational costs can slow down the adoption of modern broadcast technologies, particularly in developing regions and among budget-constrained entities, thereby restraining overall market growth

Broadcast Equipment Market Scope

The market is segmented on the basis of frequency, technology, power range, content type, product type, and application

|

Segmentation |

Sub-Segmentation |

|

By Frequency |

|

|

By Technology |

|

|

By Power Range |

|

|

By Content Type |

|

|

By Product Type |

|

|

ByApplication |

|

In 2025, the digital broadcast is projected to dominate the market with a largest share in technology segment

The digital broadcast segment is expected to dominate the broadcast equipment market with the largest share of 70.5% in 2025 due to its superior transmission quality, spectrum efficiency, and ability to support HD and 4K content. It enables seamless integration with IP-based and OTT platforms, aligning with the industry's shift toward digital transformation. In addition, regulatory mandates for digital switchover in many countries are accelerating its adoption globally.

The dish antennas is expected to account for the largest share during the forecast period in product type market

In 2025, the dish antennas segment is expected to dominate the market with the largest market share of 25.9% due to its widespread use in satellite broadcasting, especially in remote and underserved regions. Dish antennas offer reliable signal reception over long distances and are essential for both direct-to-home (DTH) and commercial broadcast applications. Their cost-effectiveness and ability to support high-quality, uninterrupted transmission further drive their demand.

Broadcast Equipment Market Regional Analysis

“North America Holds the Largest Share in the Broadcast Equipment Market”

- North America dominates thebroadcast equipment market with a market share of estimated 38.5%, driven, by presence of major media and broadcasting companies, advanced technological infrastructure, and early adoption of digital and IP-based broadcasting systems

- U.S.holds a market share of 60.5%, due to its robust demand for 4K and UHD content, widespread OTT consumption, and strong investments in next-generation broadcasting technologies

- The region benefits from strong R&D capabilities, significant government support for digital innovation, and a high concentration of broadcast infrastructure providers

- In addition, the increasing popularity of sports and live events, coupled with advanced content delivery systems, continues to fuel demand for modern broadcast solutions across North America

“Asia-Pacific is Projected to Register the HighestCAGR in the Broadcast Equipment Market”

- Asia-Pacificis expected to witness the highest growth rate in thebroadcast equipment marketwith a market share of 34.5%, driven by rapid digital transformation, expanding internet penetration, and rising demand for high-quality content across emerging economies

- Countries such as China, India, South Korea, and Japan are driving market expansion due to large-scale investments in broadcasting infrastructure and the growth of OTT platforms catering to vast, content-hungry audiences

- Japan remains a mature and technologically advanced market, with broadcasters adopting 8K production and transmission technologies ahead of global peers, particularly for major events and sports coverage

- India is projected to exhibit the fastest CAGR of 12.4%, supported by increasing smartphone usage, government initiatives for digital broadcasting, and growing adoption of cloud-based and IP-enabled production workflows

Broadcast Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Harmonic, Inc.(U.S.)

- CommScope(U.S.)

- Grass Valley(Canada)

- Global Invacom (U.K.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Evertz(Canada)

- General Dynamics Mission Systems, Inc. (U.S.)

- Sencore (U.S.)

- AvL Technologies (U.S.)

- EVS Broadcast Equipment (Belgium)

- Belden Inc. (U.S.)

- Elma Electronic (Switzerland)

- Broadcast Electronics (U.S.)

- OMB (Spain)

- Wellav Technologies Ltd. (China)

- ACORDE Technologies S.A. (Spain)

- Eletec (France)

- ETL Systems Ltd (U.K.)

- Clyde Broadcast Technology Ltd (U.K.)

Latest Developments in Global Broadcast Equipment Market

- In April 2025, FEMA lifted a 65-day hold on USD 38 million in grant reimbursements to the Corporation for Public Broadcasting (CPB). This funding supports public media stations in upgrading their infrastructure, including transitions to advanced technologies such as ATSC 3.0 and digital alert capabilities, enhancing public alert systems across the U.S.

- In the 2025 NAB Show in Las Vegas, broadcasters and technology companies highlighted advancements in NextGen TV (ATSC 3.0). With availability in 76% of U.S. households, features such as High Dynamic Range (HDR) video and immersive Dolby Atmos audio were demonstrated. Companies such as Gray Media showcased enhancements including HDR10+ and Dolby Vision for live events, reflecting the industry's momentum in transforming viewing experiences through advanced broadcasting technologies

- In April 2024, Haivision Systems, a leading provider of real-time video networking and visual collaboration solutions, announced a successful integration of its advanced video encoders, decoders, and mobile video transmitters with Sony Corporation’s Creators’ Cloud for Enterprise. This collaboration highlights the effectiveness of Haivision's technology in conjunction with Sony's cloud production platform

- In February 2024, Sony unveiled the PDT-FP1, a dedicated portable data transmitter designed for high-speed, low-latency video and still image data transport over 5G networks. This innovative wireless communication device, when attached to a camera, facilitates rapid transmission from image capture to delivery, making it ideal for applications such as news reporting, event photography, and broadcast video production

- In January 2021, Electec announced the DDS digital broadcast FM transmitters and DDS radio digital FM modulator, available at 88-108 MHz frequency modulation 30 to 600 watts and 1.2 kilowatts for commercial and community radio stations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。