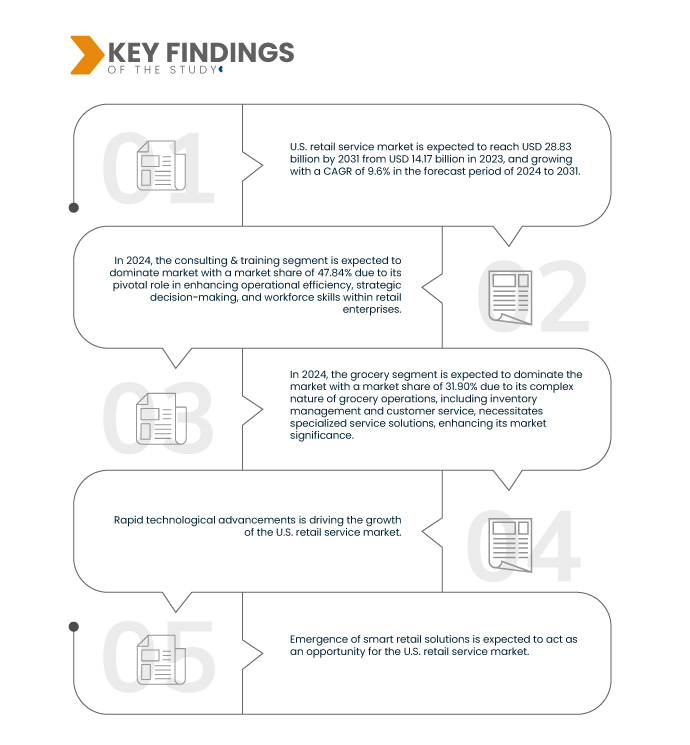

The retail industry in the U.S. has witnessed a profound digital transformation driven by rapid technological advancements. Technologies such as Artificial Intelligence (AI), and Internet of Things (IoT) are revolutionizing the way retailers operate, cooperate with customers, and manage their businesses. The technological advancements serve as a significant driver for the U.S. retail service market, particularly in the domains of consulting & training, installation & integration, and support & maintenance. The IoT ecosystem in retail comprises interconnected devices and sensors embedded in physical objects such as products, shelves, and even clothing. These devices collect real-time data on customer preferences, inventory levels, and store conditions. IoT technology enables retailers to create immersive shopping experiences, track inventory in real-time, and implement smart store solutions like automated checkout systems and smart shelves.

Access Full Report: https://www.databridgemarketresearch.com/zh/reports/us-retail-service-market

Data Bridge Market Research analyzes that the U.S. Retail Service Market is expected to reach a value of USD 28.83 billion by 2031 from USD 14.17 billion in 2023, at a CAGR of 9.6% during the forecast period of 2024 to 2031.

Key Findings of the Study

Increasing Complexity of Retail Operations

One significant trend contributing to this evolution is the increasing complexity of retail operations. This complexity stems from the adoption of omni-channel strategies and the integration of online and offline sales channels. As retailers strive to deliver seamless shopping experiences through various touchpoints, they face numerous problems in managing their operations effectively. The increasing complexity of retail operations serves as a driver for the demand for retail services, including consulting, training, installation, integration, and support & maintenance.

Retailers are embracing omni-channel strategies to meet the expectations of modern consumers who demand convenience, flexibility, and consistency across all shopping channels. Omni-channel retailing involves integrating various sales channels, including brick-and-mortar stores, e-commerce websites, mobile apps, social media platforms, and more, to create a unified shopping experience. However, implementing and managing omni-channel operations create significant challenge for retailers, including inventory synchronization, order fulfilment, pricing consistency, and customer data management. Specialized consulting services are essential to help retailers navigate these issues and develop strategies to optimize their omni-channel operations.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Services (Consulting & Training, Installation & Integration, and Support & Maintenance), Application (Grocery, General Merchandise, Fashion/Specialty, Fuel & Convenience, Hospitality, Restaurant, Travel, Entertainment, and Others)

|

|

Market Players Covered

|

NCR Voyix Corporation (U.S.), HCL Technologies Limited (India), ExlService Holdings, Inc. (U.S.), Wipro (India), Aspire Systems (India), Fujitsu (Japan), Infosys Limited (India), CGI Inc. (Canada), Diebold Nixdorf, Incorporated (U.S.), Oracle (U.S.), Retail Services Group U.S.), Deloitte (U.K.), and Accenture (Ireland) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The U.S. retail service market is segmented into two notable segments based on services and application.

- On the basis of services, the U.S. retail service market is segmented into consulting & training, installation & integration, and support & maintenance

In 2024, the consulting & training segment is expected to dominate U.S. Retail Service Market

In 2024, the consulting & training segment is expected to dominate U.S. retail service market with a market share of 47.84% due to its pivotal role in enhancing operational efficiency, strategic decision-making, and workforce skills within retail enterprises. By providing tailored guidance and education, this segment addresses the increasing complexity of retail operations and fosters a customer-centric approach, ultimately driving sustainable growth and competitive advantage in the ever-evolving retail landscape.

- On the basis of application, the U.S. retail service market is segmented into grocery, general merchandise, fashion/specialty, fuel & convenience, hospitality, restaurant, travel, entertainment, and others

In 2024, the grocery segment is expected to dominate the U.S. Retail Service Market

In 2024, the grocery segment is expected to dominate the U.S. retail service market with a market share of 31.90% due to its complex nature of grocery operations, including inventory management and customer service, necessitates specialized service solutions, enhancing its market significance.

Major Players

Data Bridge Market Research analyzes HCL Technologies Limited (India), Wipro (India), Aspire Systems (India), Infosys Limited (India), and Deloitte (U.K.) as the major companies operating in the U.S. retail service market.

Market Developments

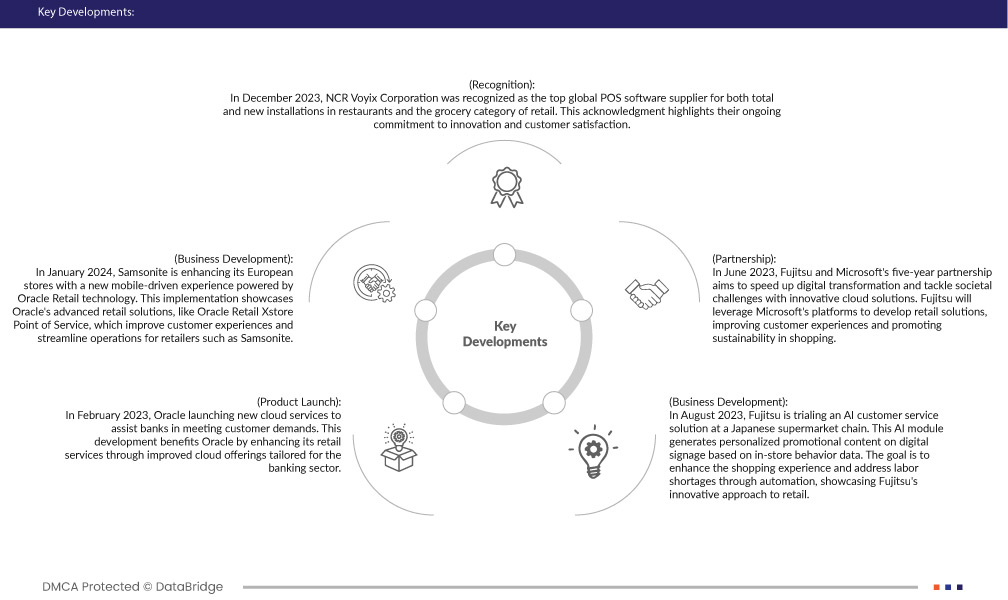

- In December 2023, NCR Voyix Corporation was recognized as the top global POS software supplier for both total and new installations in restaurants and the grocery category of retail. This acknowledgment highlights their ongoing commitment to innovation and customer satisfaction

- In January 2024, Samsonite is enhancing its European stores with a new mobile-driven experience powered by Oracle Retail technology. This implementation showcases Oracle's advanced retail solutions, like Oracle Retail Xstore Point of Service, which improve customer experiences and streamline operations for retailers such as Samsonite

- In February 2023, Oracle launching new cloud services to assist banks in meeting customer demands. This development benefits Oracle by enhancing its retail services through improved cloud offerings tailored for the banking sector

- In August 2023, Fujitsu is trialing an AI customer service solution at a Japanese supermarket chain. This AI module generates personalized promotional content on digital signage based on in-store behavior data. The goal is to enhance the shopping experience and address labor shortages through automation, showcasing Fujitsu's innovative approach to retail

- In June 2023, Fujitsu and Microsoft's five-year partnership aims to speed up digital transformation and tackle societal challenges with innovative cloud solutions. Fujitsu will leverage Microsoft's platforms to develop retail solutions, improving customer experiences and promoting sustainability in shopping

As per Data Bridge Market Research analysis: For more detailed information about U.S. retail service market report, click here – https://www.databridgemarketresearch.com/zh/reports/us-retail-service-market