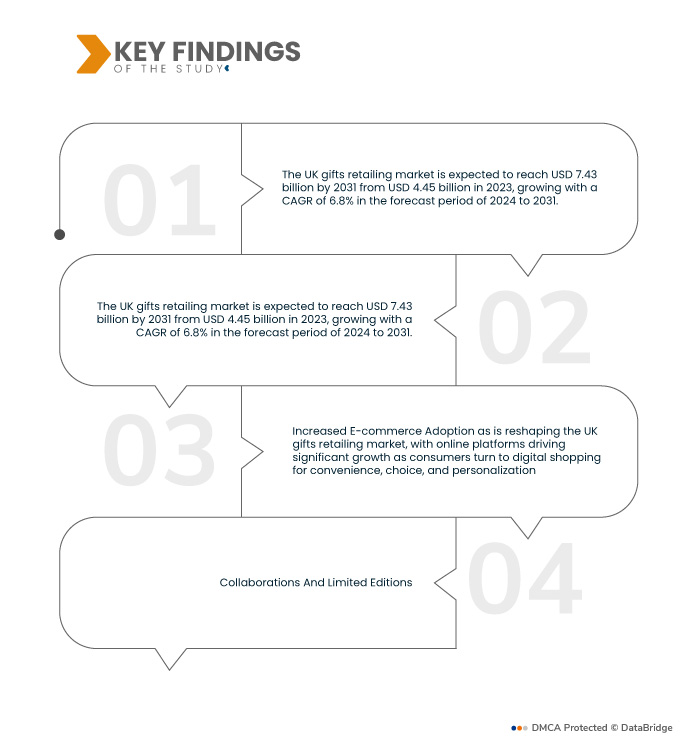

電子商務的普及正在重塑英國禮品零售市場,隨著消費者為了方便、選擇多和個人化而轉向數位購物,線上平台推動了顯著成長。疫情加速了這一趨勢,隨著消費者期望的不斷變化,越來越多的零售商正在投資於增強的線上體驗、簡化的支付方式和更快的送貨服務。這種轉變使得較小和小眾品牌能夠接觸到更廣泛的受眾,從而形成了一個競爭激烈的市場,消費者可以在其中探索傳統高街產品之外的精選和獨特的禮品選擇。因此,英國禮品零售市場正在經歷更大的數位轉型,從而增加了線上銷售和客戶參與度

訪問完整報告 @ https://www.databridgemarketresearch.com/reports/uk-gifts-retailing-market

Data Bridge Market Research 分析稱,英國禮品零售市場預計將從 2023 年的 44.5 億美元增至 2031 年的 74.3 億美元,在 2024 年至 2031 年的預測期內,複合年增長率為 6.8%。

研究的主要發現

企業禮品需求不斷成長

英國禮品零售市場對企業禮品的需求正在不斷增長,這是因為企業尋求個人化和高品質的禮品來加強客戶關係並表彰員工成就。隨著遠距和混合工作重塑工作場所動態,企業禮品已成為維持參與度和忠誠度、增強品牌認知度和培養商譽的有效工具。這種需求支持了電子商務的成長,零售商提供各種可客製化、奢華和永續的禮品選擇,以滿足企業客戶的特定需求,使英國禮品零售市場成為企業關係建立策略的重要參與者。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024年至2031年

|

基準年

|

2023

|

歷史歲月

|

2022(2016-2022 年可自訂)

|

定量單位

|

收入(十億美元)

|

涵蓋的領域

|

產品(禮券、個人化禮品、食品和飲料禮籃、玩具和遊戲、鮮花和巧克力、化妝品和香水、電子產品和小玩意、服裝和配件、家居裝飾和家具、珠寶、書籍和文具、健康和水療產品、紀念品和新奇物品、季節性裝飾品、辦公桌配件、禮品場合、賀卡)、節日禮物父親節禮品)、價格範圍(大眾、高級)、收件人特定禮品(男士/女士禮品、公司禮品、兒童禮品)、禮品卡和代金券(數位禮品卡、體驗式代金券)、特色禮品(訂閱盒、美食和食品禮品)、道德和永續禮品(公平貿易產品、環保和永續禮品)、個人化趨勢(客製化包裝、雕刻和刺繡)、技術整合(電子禮品平台、擴增實境和虛擬實境)、分銷管道(線上、線下)

|

涵蓋的市場參與者

|

亞馬遜(美國)、Card Factory plc。 (英國)、阿里巴巴集團控股有限公司(中國)、沃爾瑪(美國)、Beyond, Inc.(美國)、AGC, LLC. (美國)、Williams-Sonoma, Inc.(美國)、梅西百貨。 (美國)、迪士尼(美國)、Enesco, LLC. (美國)、MARKS & SPENCER(英國)、Hallmark Licensing, LLC(美國)、Etsy, Inc.(愛爾蘭)、Cimpress(愛爾蘭)、Getting Personal(英國)、Zazzle Inc(美國)、Pinnacle Promotions(美國)、RedbuRedbutions。 (澳洲)、AG Custom Gifts(美國)、funkypigeon.com Limited(英國)、Fat Brain Toy Co.(美國)和 Cafepress Inc.(美國)

|

報告涵蓋的數據點

|

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。

|

細分分析

英國禮品零售市場根據產品、特定場合禮品、價格範圍、特定收件人禮品、禮品卡和代金券、特色禮品、道德和可持續禮品、個人化趨勢、技術整合和分銷管道分為十個顯著的部分。

- 根據產品,英國禮品零售市場分為禮券、個人化禮品、食品和飲料禮籃、玩具和遊戲、鮮花和巧克力、化妝品和香水、電子產品和小工具、服裝和配件、家居裝飾和家具、珠寶、書籍和文具、健康和水療產品、紀念品和新奇物品、季節性裝飾品、辦公桌配件、禮品、賀卡等。

到 2024 年,禮券市場預計將佔據主導地位,市佔率達到 14.67%

到 2024 年,禮券預計將佔據市場主導地位,佔有 14.67% 的份額,因為它用途廣泛、使用方便,可以讓收禮者選擇自己的禮物。

- 根據特定場合的禮物,英國禮品零售市場分為生日禮物、節日禮物、週年紀念禮物、節日禮物、情人節禮物、畢業禮物、母親節 - 父親節禮物等。

2024 年,生日禮品市場預計將佔據主導地位,市佔率達 31.60%

到 2024 年,生日禮品預計將佔據市場主導地位,佔有 31.60% 的市場份額,因為生日是普遍慶祝的節日,並且持續推動對禮品購買的高需求。

- 根據價格範圍,英國禮品零售市場分為大眾禮品和高端禮品。預計到 2024 年,大眾禮品將佔據市場主導地位,市佔率達 72.32%。

- 根據收件人特定的禮物,英國禮品零售市場分為男士/女士禮物、公司禮物、兒童禮物和其他禮物。預計到 2024 年,男士/女士禮物將佔據市場主導地位,市佔率達 53.06%

- 根據禮品卡和代金券,英國禮品零售市場分為數位禮品卡和體驗式代金券。到 2024 年,數位禮品卡預計將佔據市場主導地位,市佔率達到 70.42%

- 根據特色禮品,英國禮品零售市場分為訂閱盒和美食及食品禮品。預計到 2024 年,訂閱盒將佔據市場主導地位,市佔率達 73.44%

- 根據道德和永續禮品,英國禮品零售市場細分為公平貿易產品和環保和永續禮品。預計到 2024 年,公平貿易產品將佔據市場主導地位,市佔率達 66.63%

- 根據個人化趨勢,英國禮品零售市場細分為客製化包裝和雕刻刺繡。到 2024 年,客製化包裝預計將佔據市場主導地位,市佔率達到 55.53%

- 在科技整合的基礎上,英國禮品零售市場細分為電子禮品平台以及擴增實境和虛擬實境。預計到 2024 年,電子禮品平台將佔據市場主導地位,市佔率達 84.16%

- 根據分銷管道,英國禮品零售市場分為線上和線下。預計到 2024 年,線上平台將佔據市場主導地位,市佔率達到 64.89%

主要參與者

Data Bridge Market Research 分析了亞馬遜(美國)、Card Factory plc。 (英國)、阿里巴巴集團控股有限公司(中國)、沃爾瑪(美國)、Beyond, Inc.(美國)是英國禮品零售市場的主要公司。

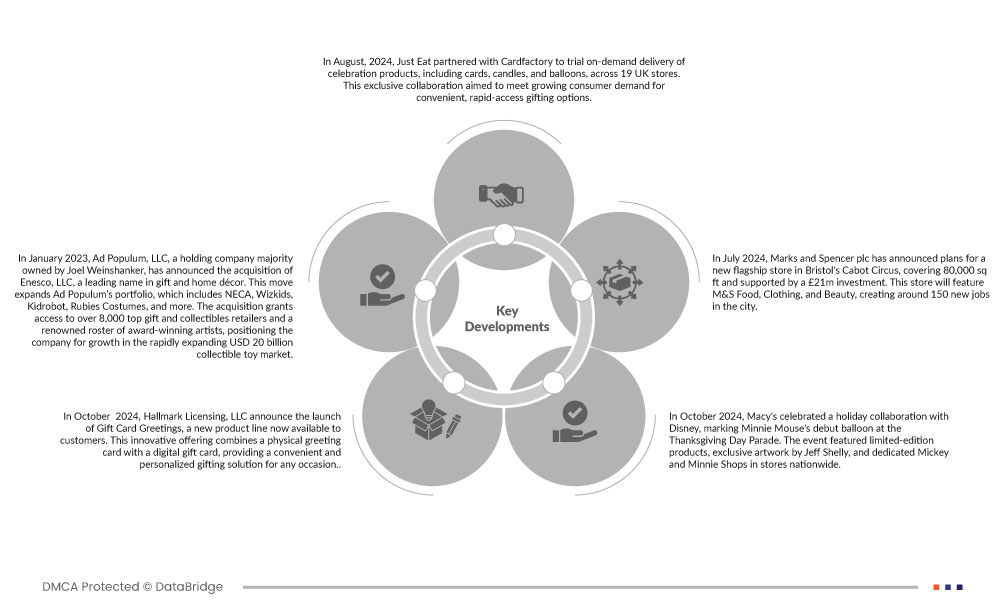

市場開發

- 2024 年 8 月,Just Eat 與 Cardfactory 合作,在英國 19 家門市試行按需配送慶祝產品,包括卡片、蠟燭和氣球。此次獨家合作旨在滿足消費者對便利、快速送禮選擇日益增長的需求

- 2023 年 1 月,由 Joel Weinshanker 控股的控股公司 Ad Populum, LLC 宣布收購禮品和家居裝飾領域的領先品牌 Enesco, LLC。此舉擴大了 Ad Populum 的產品組合,其中包括 NECA、Wizkids、Kidrobot、Rubies Costumes 等。此次收購使該公司能夠接觸到 8,000 多家頂級禮品和收藏品零售商以及一群知名的獲獎藝術家,從而在快速擴張的 200 億美元收藏玩具市場中佔據優勢地位

- 2024 年 10 月,Hallmark Licensing, LLC 宣布推出禮品卡問候語,這是現已向客戶推出的新產品系列。這項創新產品將實體賀卡與數位禮品卡結合在一起,為任何場合提供便利、個人化的禮品解決方案

- 2024 年 5 月,10 月,梅西百貨與迪士尼慶祝節日合作,米妮老鼠氣球首次亮相感恩節遊行。這次活動展出了限量版產品、傑夫謝利的獨家藝術品以及全國各地商店的米奇和米妮專賣店

- 2024 年 7 月,瑪莎百貨宣布計畫在布里斯託的卡伯特廣場開設一家新的旗艦店,佔地 8 萬平方英尺,投資 2,100 萬英鎊。這家商店將銷售瑪莎百貨的食品、服裝和美容產品,為該市創造約 150 個新工作機會

根據 Data Bridge 市場研究分析:

在英國禮品零售市場,英國憑藉其先進的製造業和對技術和研發的大量投資佔據主導地位。主要工業參與者的存在和嚴格的品質控制法規推動了各行業對精確測量解決方案的需求。

有關英國禮品零售市場的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/uk-gifts-retailing-market