由於數位化需求的不斷增長以及通訊和網路技術的廣泛應用,市場正在經歷顯著的成長。這些因素正在成為成長的動力,改變著全國各個產業。

首先,數位化的興起正在徹底改變英國的工業格局,企業越來越多地整合數位技術來提高營運效率、自動化和數據驅動的決策。工業嵌入式 PC 在這一轉變中發揮著至關重要的作用,是互聯繫統的支柱。它們能夠實現即時數據處理、控制和監控,這對於智慧製造、製程自動化和工業 4.0 計劃至關重要。

訪問完整報告 @ https://www.databridgemarketresearch.com/reports/uk-industrial-embedded-pc-market

Data Bridge Market Research 分析稱,英國工業嵌入式 PC 市場預計在 2023 年至 2030 年的預測期內以 4.7% 的複合年增長率增長,到 2030 年預計將達到 171,189.44 萬美元。工業 PC 的優勢和功能的成長預計將推動市場的成長,因為這將導致其在各國的需求不斷增加。

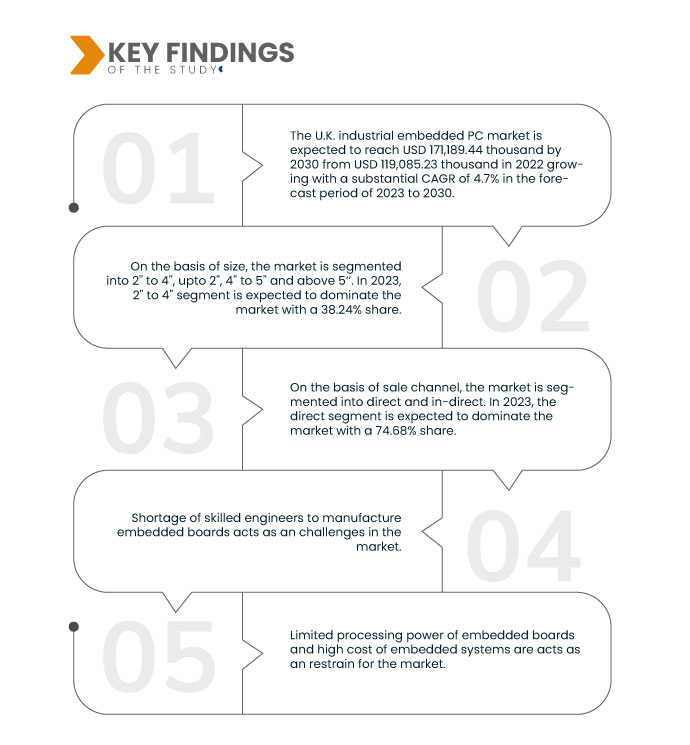

研究的主要發現

工業PC優勢和能力的成長可能推動市場成長

工業PC為涉及各個終端使用者的企業提供了巨大的優勢。它們能夠承受惡劣的環境條件,包括極端溫度、灰塵、濕度和振動,確保在具有挑戰性的工業環境中可靠運作。這些 PC 通常具有延長的產品生命週期,提供長期可用性和支持,這對於依賴穩定和持久計算解決方案的行業至關重要。此外,工業嵌入式電腦體積小巧,易於整合到空間受限的工業系統和機械中。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2023年至2030年

|

基準年

|

2022

|

歷史歲月

|

2021(可自訂為 2015 – 2020)

|

定量單位

|

收入(千美元)

|

涵蓋的領域

|

主機板類型(ATX 主機板、EATX 主機板、Micro ATX 主機板、Mini ITX 主機板和 Nano-ITX 嵌入式主機板)、尺寸(2 吋至 4 吋、最大 2 吋、4 吋至 5 吋和 5 吋以上)、作業系統(Windows、Linux 和其他)、2 吋、4 吋至 5 吋和 5 吋以上)、作業系統(Windows、Lin? GB SSD 和 512 GB SSD)、銷售通路(直接和間接)、最終用戶(流程工業和離散工業)

|

覆蓋國家

|

英國

|

涵蓋的市場參與者

|

凌華科技股份有限公司(台灣)、美國微芯科技股份有限公司(美國)、安富利公司(德國)、艾訊科技股份有限公司(台灣)、美國博威爾科技股份有限公司(美國)、BVM Ltd(英國)、控創科技股份有限公司(德國)、Impulse Embedded Limited(英國)、研揚科技股份有限公司(台灣股份有限公司)

|

報告涵蓋的數據點

|

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置表示的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析。

|

細分分析

英國工業嵌入式PC 市場根據主機板類型、尺寸、作業系統、儲存、銷售管道和最終用戶分為六個顯著的部分。

- 根據主機板類型,市場分為 ATX 主機板、EATX 主機板、micro ATX 主機板、mini ITX 主機板和 nano-ITX 嵌入式主機板。

2023 年,ATX 主機板領域預計將主導英國工業嵌入式 PC 市場。

2023 年,ATX 主機板市場預計將佔據 32.95% 的份額,因為它提供了標準化和多功能的外形尺寸,使其在英國的工業應用中得到廣泛採用,並且它們與各種組件的兼容性和充足的擴展選項使其成為可靠且適應性強的嵌入式 PC 解決方案的首選。

- 根據尺寸,市場分為 2 英寸至 4 英寸、2 英寸以下、4 英寸至 5 英寸和 5 英寸以上。預計到 2023 年,2 吋至 4 吋部分將佔據市場主導地位,佔有 38.24% 的份額。

- 根據作業系統,市場分為 Windows、Linux 和其他。預計到 2023 年,窗戶市場將佔據 81.63% 的市場。

- 根據存儲,市場細分為 128 GB SSD、64 GB SSD、32 GB SSD、256 GB SSD、320 GB SSD 和 512 GB SSD。到 2023 年,128 GB SSD 市場預計將佔據主導地位,佔有 42.86% 的份額。

- 根據銷售管道,市場分為直接銷售和間接銷售。預計到 2023 年,直銷市場將佔據 74.68% 的市佔率。

- 根據最終用戶,市場細分為流程工業和離散工業。

到 2023 年,流程工業領域預計將主導英國工業嵌入式 PC 市場。

2023 年,流程工業預計將佔據市場主導地位,佔有 59.51% 的份額,因為流程工業包括製造業、化學加工、石油和天然氣、製藥以及食品和飲料等行業,嚴重依賴自動化、控制和數據視覺化來簡化操作並確保高效的生產流程。

主要參與者

Data Bridge Market Research 分析了 ADLINK Technology Inc.(台灣)、Microchip Technology Inc.(美國)、Avnet, Inc.(德國)、Axiomtek Co., Ltd.(台灣)和 American Portwell Technology, Inc.(美國)作為英國工業嵌入式 PC 市場的主要市場參與者。

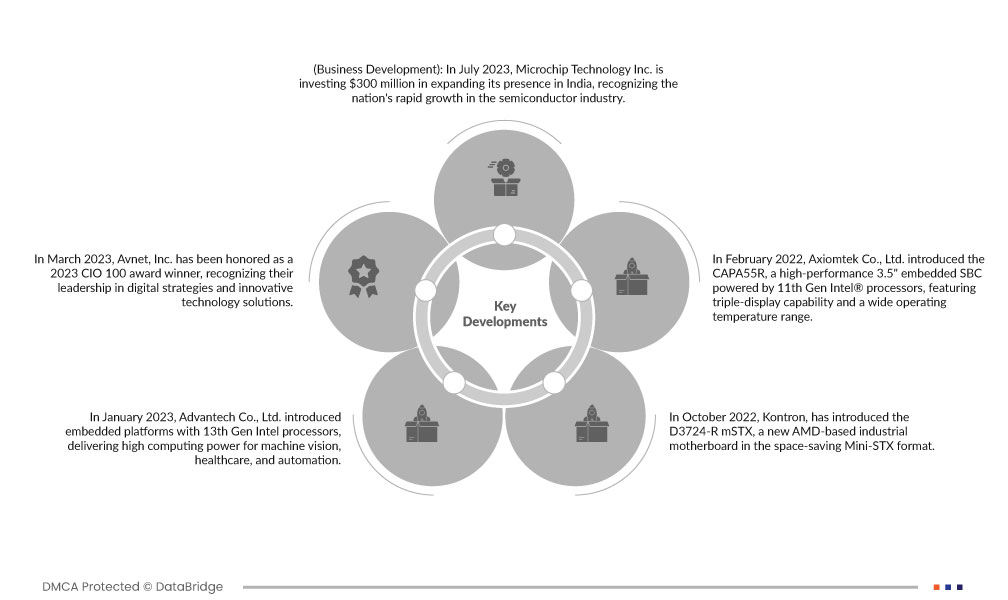

市場開發

- 2023 年 7 月,美國微晶片科技公司 (Microchip Technology Inc.) 將投資 3 億美元擴大在印度的業務,以表彰該國半導體產業的快速成長。該計劃包括設施改進、工程實驗室擴建、人才招聘以及對技術聯盟和教育機構的支持。預計到 2026 年,印度半導體市場規模將成長三倍,Microchip 的承諾將鞏固其在全球半導體研究和設計重要中心的地位,使該公司和印度的半導體生態系統都受益。

- 2023 年 3 月,安富利公司榮獲 2023 年 CIO 100 獎,以表彰其在數位策略和創新技術解決方案方面的領導地位。該獎項體現了安富利對 IT 卓越發展的承諾以及致力於為客戶提供尖端解決方案的決心,展示了其在從人工智慧到永續發展等各個領域的持續創新。

- 2023年1月,研華科技推出搭載英特爾第13代處理器的嵌入式平台,為機器視覺、醫療保健與自動化領域提供強大的運算能力。這些解決方案提供出色的效能、英特爾的混合架構、DDR5 記憶體和 PCIe Gen5,以實現突破性的效能。研華憑藉高速工業 I/O 和設計服務,為物聯網設備開發人員提供穩定性、可擴展性和高效的管理。

- 2022 年 10 月,Kontron 推出了 D3724-R mSTX,這是一款基於 AMD 的新型工業主機板,採用節省空間的 Mini-STX 格式。這款高性能主機板配備最多四個 4K 解析度的獨立顯示器,非常適合賭場遊戲、數位看板、醫療顯示器等圖形密集型應用。 D3724-R mSTX 基於整合 AMD Radeon Vega 顯示卡的 AMD Ryzen Embedded R2000 系列處理器,其效能比其前身 R1000 系列高出許多。三種主機板版本可供客戶選擇最適合其要求的運算能力。控創產品組合的這項新增功能擴大了其在英國市場工業應用領域的產品範圍,為以圖形為中心的嵌入式 PC 解決方案提供了更多選擇和效能。

- 2022年2月,艾訊科技股份有限公司(Axiomtek Co., Ltd.)推出了CAPA55R,這是一款高效能3.5吋嵌入式單板電腦(SBC),搭載第11代英特爾處理器,具有三螢幕顯示功能和寬工作溫度範圍。它配備高達64GB的DDR4記憶體、多個M.2插槽和豐富的連接選項,是圖形密集型工業物聯網應用的理想選擇。其設計著重於散熱和系統集成,旨在簡化開發流程並縮短產品上市時間,使其成為工業控制、機器視覺、數位看板和其他物聯網相關應用領域的寶貴資產。

有關英國工業嵌入式 PC 市場報告的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/uk-industrial-embedded-pc-market