蠟乳液是一種穩定的混合物,由微小的蠟顆粒在乳化劑的幫助下均勻地分散在水中。這種配方賦予蠟乳液多種優越的性能,使其成為多個行業的多功能添加劑。在塗料和油漆中,它們可作為有效的添加劑,提供諸如改善耐刮性、防水性和消光效果等優點。造紙和包裝行業利用蠟乳液來增強紙製品的表面光澤、印刷性和防潮性。此外,在建築領域,它們可用作防水劑、固化劑以及砂漿和混凝土配方中的添加劑,提高耐久性和性能。紡織業使用蠟乳液來賦予織物柔軟性和防水性。此外,蠟乳液是化妝品中不可或缺的一部分,有助於配製乳霜、乳液和其他個人護理產品。蠟乳液具有多種用途和功能優勢,在增強各行各業各種材料的性能方面發揮著至關重要的作用。

訪問完整報告 @ https://www.databridgemarketresearch.com/reports/north-america-wax-emulsion-market

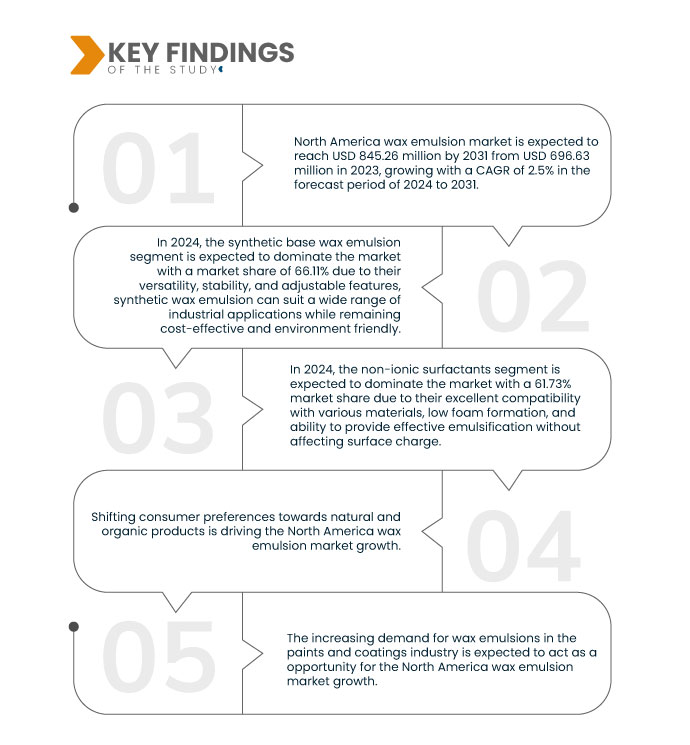

Data Bridge Market Research 分析稱,北美蠟乳液市場預計在 2024 年至 2031 年期間以 2.5% 的複合年增長率增長,預計到 2031 年將從 2023 年的 6.9663 億美元增至 8.4526 億美元。

研究的主要發現

各終端產業需求成長

蠟乳液具有多種優勢,可滿足終端使用產業不斷變化的需求。例如,在油漆和塗料領域,蠟乳液用於改善塗層性能屬性,如耐刮擦性、光澤度、附著力和耐久性。同樣,蠟乳液用於紡織品整理應用,以增加柔軟度、防水性和抗皺性等品質。它們能夠滿足獨特的行業要求,使其成為各種生產過程中必不可少的組成部分。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024年至2031年

|

基準年

|

2023

|

歷史歲月

|

2022(可自訂為2016-2021)

|

定量單位

|

收入(百萬美元)

|

涵蓋的領域

|

材料基礎(合成基礎蠟乳液和天然基礎蠟乳液)、乳化劑(非離子界面活性劑、陰離子界面活性劑和陽離子界面活性劑)、最終用戶行業(油漆和塗料、紡織品、化妝品、粘合劑和密封劑、建築和木工、食品工業等)

|

覆蓋國家

|

美國、加拿大和墨西哥

|

涵蓋的市場參與者

|

H&R GROUP(德國)、PMC Group, Inc.(英國)、Repsol(西班牙)、Michelman, Inc.(美國)、Henry Company(美國)、Micro Powders, Inc.(美國)、CHT Germany GmbH(德國)、南京天石新材料科技有限公司(中國)、Paraffinwaxco, Inc.(伊朗)、Thebrizco, Inc.公司(美國)、Hexion(美國)、ALTANA(德國)、Sasol Limited(南非)、SHAMROCK(美國)和 Wacker Chemie AG(德國)等

|

報告涵蓋的數據點

|

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置代表的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析

|

細分分析

北美蠟乳液市場根據材料基礎、乳化劑和最終用戶產業分為三個顯著的部分。

- 根據材料基礎,北美蠟乳液市場分為合成基礎蠟乳液和天然基礎蠟乳液

預計到 2024 年,合成基礎蠟乳液將主導北美蠟乳液市場

到 2024 年,合成基礎蠟乳液預計將佔據市場主導地位,市場份額為 66.11%,這得益於其多功能性、穩定性和可調節性,合成蠟乳液可適用於廣泛的工業應用,同時保持成本效益和環境友好性。

- 根據乳化劑,北美蠟乳液市場分為非離子界面活性劑、陰離子界面活性劑和陽離子界面活性劑

預計到 2024 年,非離子界面活性劑將主導北美蠟乳液市場

2024 年,非離子界面活性劑預計將佔據市場主導地位,佔有 61.73% 的市場份額,因為它們與各種材料具有出色的兼容性、泡沫形成率低,並且能夠在不影響表面電荷的情況下提供有效的乳化作用。

- 根據最終用戶產業,北美蠟乳液市場細分為油漆和塗料、紡織品、化妝品、黏合劑和密封劑、建築和木工、食品工業等。 2024 年,油漆和塗料領域預計將佔據市場主導地位,市佔率達到 31.27%

主要參與者

Data Bridge Market Research 認為以下公司是北美蠟乳液市場的主要參與者,包括 BASF SE(德國)、Sasol Limited(南非)、Hexion(美國)、Michelman, Inc.(美國)和 ALTANA(德國)。

市場發展

- 2023 年 6 月,Michelman, Inc. 榮獲創新研究交流 (IRI) 企業公民卓越獎,成為首屆得獎者。這不僅認可了 Michelman 在營運中對永續發展的奉獻,也認可了其在推動數位印刷、包裝、複合材料、技術紡織品、農業和建築塗料等不同領域的永續實踐方面發揮的重要作用。 IRI 卓越獎頒獎典禮於 2023 年 5 月 24 日在費城舉行的 IRI 頒獎晚宴上舉行。該獎項認可了米歇爾曼對永續發展的承諾,為建立正面形象和提高聲譽做出了貢獻。這種認可可能會吸引有環保意識的客戶、合作夥伴和投資者

- 2022年4月,瓦克推出了「固體和濃縮物」產品線,以滿足化妝品行業對固體或濃縮型護髮和個人護理產品日益增長的需求。他們在展位上展示的配方突出了有機矽(尤其是 BELSIL DADM 3240 E)在增強這些濃縮或固體無水產品性能方面的重要作用。在這些配方中,瓦克有機矽乳液作為護髮產品的活性成分。這些產品的油相含有兩種類型的矽酮:氨基聚二甲基矽氧烷交聯聚合物和聚二甲基矽氧烷。透過乳液,形成一個鬆散的網絡,包裹頭髮纖維,滋養頭髮並提供持久的保護。該公司的這項配方是朝著創造新型護髮產品邁出的一步。這將有助於提高公司的產品收入

- 2022 年 4 月,Shamrock 宣布擴大一系列永續生物基蠟添加劑。這些特種性能添加劑體現了公司致力於透過永續環保產品回收和促進循環經濟

- 2021 年 11 月,H&R 集團宣布投資 2 億馬來西亞林吉特(4,800 萬美元)在霹靂州紅土坎建立一家專業製造工廠。 H&R 是全球領先的可持續精煉商和特殊增塑劑、增量油、軟化劑和蠟的營銷商。工程擬分三期建設,設計產能15萬噸/年。第一階段和第二階段將致力於利用礦物、合成和可再生資源生產特殊塑化劑、白油和蠟乳液。這將加強該公司在該國的影響力

- 2020 年 1 月,PMC Group, Inc. 與 Lanxess Organometallics GmbH 最終確定 PMC Groupthink 將收購 Lanxess 有機錫特種產品線。該交易於2019年11月13日首次披露,並於2019年12月30日成功完成。此次收購涵蓋朗盛全球有機錫催化劑、有機錫特種產品及中間體產品線。隨著朗盛有機錫特種產品的加入,PMC 集團公司現在可以實現其產品組合的多樣化,為客戶提供更廣泛的解決方案。這種多樣化可能為 PMC Group, Inc. 開闢新的市場和客戶群。

區域分析

從地理上看,北美蠟乳液市場報告涵蓋的國家包括美國、加拿大和墨西哥。

根據數據橋市場研究分析

預計美國主導北美蠟乳液市場

由於終端用戶行業的需求不斷增長以及技術的進步,美國預計將主導北美蠟乳液市場。建築和基礎設施活動的增加以及包裝行業需求的增加也推動了該國市場的成長。

有關北美蠟乳液市場報告的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/north-america-wax-emulsion-market