耐火材料由陶瓷、氧化铝、二氧化硅、氧化镁和其他材料制成,旨在抵抗现代制造业面临的极高温度。它们比金属更耐热,用于衬砌许多工业过程中的热表面。耐火产品通常属于预成型或未成型组合物。耐火材料用于容纳热量并保护加工设备免受高温影响。二氧化硅、氧化铝和粘土等各种材料都用于制造耐火材料,这些耐火材料广泛应用于铸造、钢铁、玻璃等多个行业,这些行业都暴露在极端的化学和温度条件下。

访问完整报告@https://www.databridgemarketresearch.com/reports/global-refractories-market

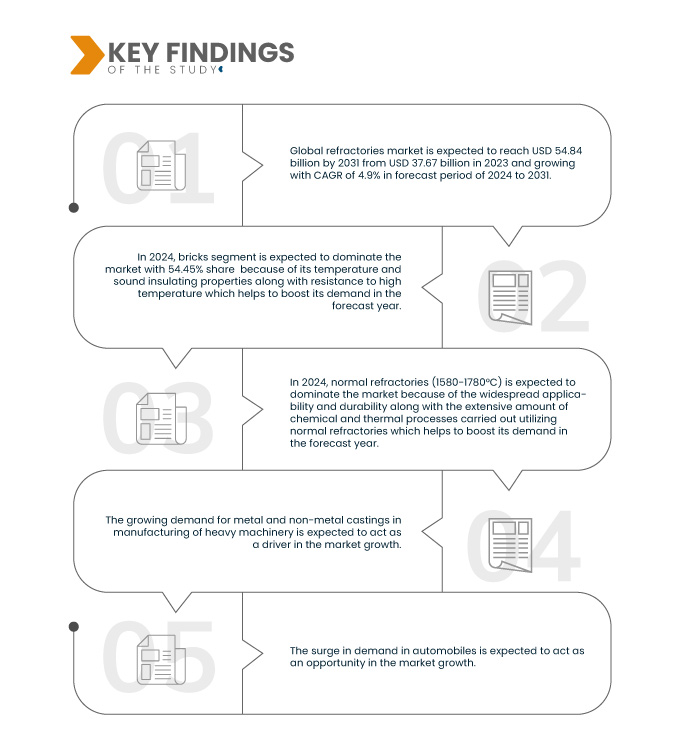

Data Bridge Market Research 分析称, 全球耐火材料市场 预计将从 2023 年的 376.7 亿美元增至 2031 年的 548.4 亿美元,在 2024 年至 2031 年的预测期内,复合年增长率为 4.9%。

研究主要发现

新兴经济体基础设施增长加快

随着新兴国家经济增长,建筑活动激增,包括住宅、商业和工业基础设施的开发。这导致水泥和玻璃制造等行业对耐火材料的需求增加,这些材料用于窑炉。钢铁行业是耐火材料的主要消费者。基础设施的增长往往意味着建筑项目对钢铁的需求增加。因此,钢铁行业扩大了生产能力,推动了高炉、转炉和其他高温设备内衬对耐火材料的需求。建筑物、道路和其他基础设施的建设需要大量的水泥。耐火材料在水泥制造过程中必不可少,特别是在将原材料加热到高温的窑炉中。

报告范围和市场细分

|

报告指标

|

细节

|

|

预测期

|

2024年至2031年

|

|

基准年

|

2023

|

|

历史性的一年

|

2022(可定制为 2016 – 2021)

|

|

定量单位

|

收入(十亿美元)

|

|

涵盖的细分市场

|

产品类型(粘土和非粘土)、碱度(酸性和中性耐火材料和碳)、形式类型(砖、整体式和其他)、熔化温度(普通耐火材料 (1580-1780°C)、高耐火材料 (1780-2000) °C) 和超级耐火材料 (>2000°C))、技术(等静压、滑动浇口机构等)、应用(钢铁、水泥和石灰、能源和化工、玻璃、有色金属和其他的)

|

|

涵盖的市场参与者

|

圣戈班业绩 陶瓷 & Refractories (PCR)(圣戈班子公司)(法国)、TYK CORPORATION(日本)、无锡南方耐火材料有限公司(中国)、Coorstek(美国)、Refratechnic(德国)、HWI(美国)、AluChem (美国)、ALTEO(法国)、CerCo Corporation(美国)、Almatis Gmbh(德国)、Allied Mineral Products, Inc.(美国)、Magnezit Group(俄罗斯)、Minerals Technologies Inc.(美国)、濮阳耐火材料集团有限公司,有限公司(中国),摩根先进材料(英国),IFGL耐火材料有限公司(印度),黑崎播磨株式会社(日本),品川耐火材料有限公司(日本)、RHI Magnesita GmbH(奥地利)、Lhoist(比利时)、Vesuvius(英国)和 Imerys(法国)等

|

|

报告中涵盖的数据点

|

除了对市场价值、增长率、细分市场、地理覆盖范围和主要参与者等市场情景的洞察之外,Data Bridge 市场研究策划的市场报告还包括深度专家分析、患者流行病学、渠道分析、定价分析和监管框架

|

细分分析

全球耐火材料市场根据产品类型、碱度、形式类型、熔化温度、应用和技术分为六个显著的部分。

- 根据产品类型,市场分为粘土和非粘土

2024年,粘土细分市场预计将主导全球耐火材料市场

到 2024 年,粘土细分市场预计将占据市场主导地位,市场份额为 60.47%,因为产品价格范围更便宜,且具有耐用性和耐热性。

- 根据碱度,市场分为酸性和中性耐火材料和碳

2024年,酸性和中性耐火材料领域预计将主导全球耐火材料市场

到2024年,酸性和天然耐火材料由于其耐高温和酸性炉渣条件以及广泛的适用市场,预计将占据市场主导地位,市场份额为71.21%。

- 根据形式类型,市场分为砖块、整体式等。 2024年,砖块领域预计将主导市场,市场份额为54.45%

- 根据熔化温度,市场细分为普通耐火材料(1580-1780°C)、高耐火材料(1780-2000°C)和超级耐火材料(>2000°C)。预计到 2024 年,普通耐火材料(1580-1780°C)将占据市场主导地位,市场份额为 52.56%

- 根据技术,市场细分为等静压、滑动门机构和其他。 2024 年,滑动门机构部分预计将占据市场主导地位,市场份额为 66.36%。

- 根据应用,市场分为钢铁、水泥和石灰、能源和化工、玻璃、有色金属等。 2024年,钢铁板块预计将主导市场,市场份额达77.30%

主要参与者

Data Bridge Market Research 分析了 IFGL Refractories Limited(印度)、RHI Magnesita GmbH(奥地利)、Vesuvius(英国)、Morgan Advanced Materials(英国)、HWI(美国)作为该市场的主要市场参与者。

市场发展

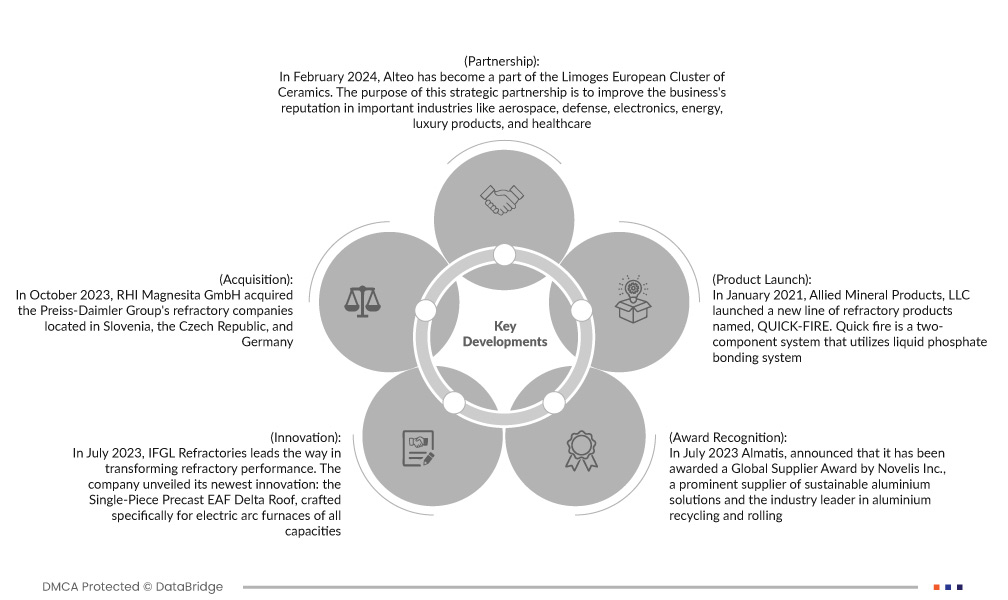

- 2024 年 2 月,Alteo 成为利摩日欧洲陶瓷产业集群的一部分。此次战略合作旨在提高企业在航空航天、国防、电子、能源、奢侈品和医疗保健等重要行业的声誉。通过此次合作,Alteo 利用创新方法和卓越合作伙伴网络的知识巩固了其市场领导者地位。此举表明,该公司持续致力于创新和支持法国工业增长,以满足全球范围内对特种氧化铝日益增长的需求

- 2023 年 10 月,RHI Magnesita GmbH 收购了 Preiss-Daimler 集团位于斯洛文尼亚、捷克共和国和德国的耐火材料公司。 PD Refractories 作为加工行业工业用优质氧化铝基耐火材料的制造商,在玻璃和铝工业中占据着重要地位。 PD Refractories 提供多种产品,包括高铝特种砖、铝土矿、红柱石、二氧化硅、耐火粘土和菱镁砖

- 2023 年 7 月,IFGL 耐火材料在耐火材料性能转型方面处于领先地位。该公司不断致力于突破极限,推出了最新的创新产品:单件式预制 EAF Delta Roof,专为各种容量的电弧炉而设计。单件式预制 EAF Delta Roof 强化了 IFGL Refractories 对创新和客户满意度的承诺,推动公司的增长和成功

- 2023 年 7 月,安迈宣布荣获诺贝丽斯公司 (Novelis Inc.) 颁发的全球供应商奖。诺贝丽斯公司是可持续铝解决方案的杰出供应商,也是铝回收和轧制领域的行业领导者。安迈因其为诺贝丽斯提供的服务和产品而被授予联盟奖。诺贝丽斯全球供应商奖表彰企业杰出的协作和高标准的绩效,促进弹性供应链和可持续创新

有关全球耐火材料市场报告的更多详细信息,请点击此处 –https://www.databridgemarketresearch.com/reports/global-refractories-market