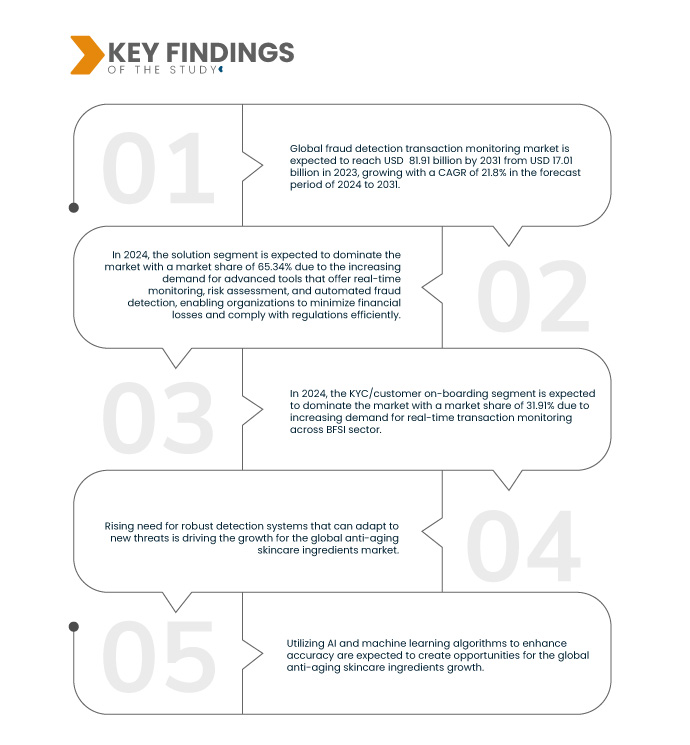

隨著金融詐欺計畫不斷發展且變得更加複雜,對能夠有效適應新威脅的強大詐欺偵測系統的需求日益增長。傳統的詐欺檢測方法往往難以跟上詐欺手段的快速變化,因此金融機構和企業必須實施先進的檢測系統。這些系統需要利用人工智慧和機器學習等尖端技術來即時分析大量交易數據,識別可能表明存在詐欺活動的模式和異常。

Data Bridge Market Research 分析稱,全球詐欺檢測交易監控市場預計將從 2023 年的 170.1 億美元增至 2031 年的 819.1 億美元,在 2024 年至 2031 年的預測期內,複合年增長率為 21.8%。

研究的主要發現

更重視身份驗證和認證

對身分驗證和認證的高度重視正在改變詐欺偵測和交易監控的格局。透過結合生物辨識認證、多因素驗證和人工智慧驅動的身份分析等先進技術,金融機構可以更準確地驗證用戶身份並檢測詐欺活動。這種強有力的方法有助於降低與未經授權的存取和詐欺交易相關的風險,提高金融系統的整體安全性和可靠性。隨著身分驗證技術的發展,它們將在加強詐欺偵測機制和確保交易監控流程的完整性方面發揮關鍵作用。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024年至2031年

|

基準年

|

2023

|

歷史歲月

|

2022(2016-2021 年可自訂)

|

定量單位

|

收入(十億美元)

|

涵蓋的領域

|

產品(解決方案和服務)、功能(KYC/客戶入職、案例管理、監視清單篩選、儀表板和報告等)、部署(本地和雲端)、組織規模(大型組織和中小型組織)、應用(支付詐欺偵測、洗錢偵測、帳戶接管保護、身分盜竊預防等)、垂直產業(銀行、金融服務和保險 (BFSI)、零售、 IT和電信

|

覆蓋國家

|

美國、加拿大、墨西哥、德國、法國、英國、義大利、西班牙、俄羅斯、土耳其、比利時、荷蘭、瑞士、挪威、芬蘭、丹麥、瑞典、波蘭、歐洲其他地區、日本、中國、韓國、印度、澳洲、紐西蘭、新加坡、泰國、馬來西亞、印尼、菲律賓、台灣、越南、亞太其他地區、阿聯酋、歐洲地區和其他地區

|

涵蓋的市場參與者

|

亞馬遜網路服務公司(美國)、LexisNexis(Reed Elsevier 子公司)(美國)、萬事達卡(美國)、TATA Consultancy Services Limited(印度)、Fiserv, Inc.(美國)、SAS Institute Inc.(美國)、ACI Worldwide(美國)、甲骨文(美國)、NICE(IQ)、FICO(美國)、美國)、英國)、美國)、NICE(EIQ Solutions、FICO) ULC(納斯達克公司子公司)(加拿大)、GB Group plc ('GBG')(英國)、INFORM SOFTWARE(德國)、Quantexa(英國)、Sum and Substance Ltd(英國)、DataVisor, Inc.(美國)、Hawk(德國)、Featurespace Limited(英國)、INETCO Systems Ltd(加拿大)、Aeon)、Aeon(英國), Inc.TCO Systems Ltd.(加拿大) Ltd.(匈牙利)、Feedzai(葡萄牙)和 Sanction Scanner(英國)等

|

報告涵蓋的數據點

|

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。

|

細分分析

全球詐欺偵測交易監控市場根據產品、功能、部署模式、組織規模、應用和垂直領域分為六個顯著的部分。

- 根據產品類型,全球詐欺偵測交易監控市場細分為解決方案和服務

預計到 2024 年,解決方案領域將主導全球詐欺偵測交易監控市場

到 2024 年,由於對提供即時監控、風險評估和自動詐欺偵測的先進工具的需求不斷增加,解決方案部門預計將佔據市場主導地位,市場份額達到 65.34%,使組織能夠最大限度地減少財務損失並有效地遵守法規。

- 根據功能,全球詐欺偵測交易監控市場細分為 KYC/客戶入職、案例管理、監視清單篩選、儀表板和報告等

2024 年,KYC/客戶入職領域預計將主導全球詐欺偵測交易監控市場

到 2024 年,由於 BFSI 產業對即時交易監控的需求不斷增加,KYC/客戶入職領域預計將佔據市場主導地位,市場佔有率達到 31.91%。

- 根據部署模式,全球詐欺偵測交易監控市場分為雲端和本地。預計到 2024 年,雲端運算領域將佔據主導地位,市場佔有率達到 57.80%

- 根據組織規模,全球詐欺偵測交易監控市場分為大型組織和中小型組織。 2024 年,大型組織預計將佔據市場主導地位,市場佔有率達到 62.49%

- 根據應用,全球詐欺偵測交易監控市場細分為支付詐欺偵測、洗錢偵測、帳戶接管保護、身分盜竊預防等。 2024 年,支付詐欺偵測領域預計將佔據市場主導地位,市佔率達 37.84%

- 在垂直基礎上,全球詐欺偵測交易監控市場細分為銀行、金融服務和保險(BFSI)、零售、IT 和電信、政府和國防、醫療保健、製造業、能源和公用事業等。 2024 年,銀行、金融服務和保險 (BFSI) 領域預計將佔據市場主導地位,市場佔有率為 38.98%

主要參與者

Data Bridge Market Research 分析了亞馬遜網路服務公司 (美國)、LexisNexis Risk Solutions (美國)、萬事達卡 (美國)、TATA Consultancy Services Limited (印度)、Fiserv, Inc. (美國) 等在全球詐欺檢測交易監控市場運營的主要公司。

市場發展

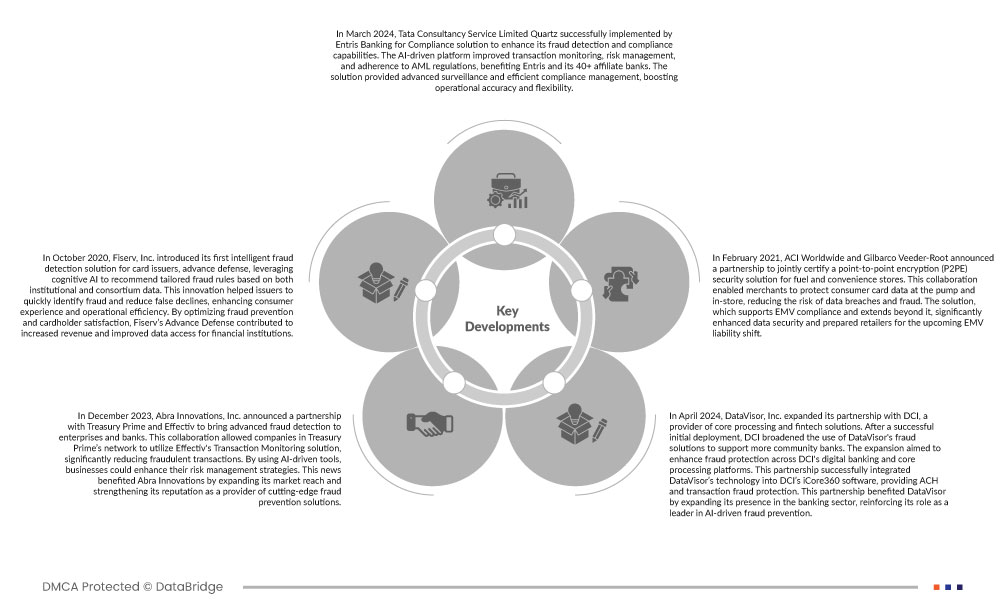

- 2023年7月,萬事達卡在英國推出了一款名為「消費者詐欺風險」的人工智慧驅動的即時反詐騙工具,並與勞埃德銀行、哈利法克斯銀行和國民威斯敏斯特銀行等九家主要銀行合作。該系統旨在利用人工智慧預測和阻止詐欺交易,在資金離開受害者帳戶之前檢測出詐騙行為。 TSB 是首批採用該工具的銀行之一,四個月內詐欺偵測率提高了 20%。萬事達卡預計,該系統的廣泛使用每年可在英國阻止近 1.27 億美元的詐騙支付

- 2024 年 8 月,LexisNexis 在 ILTACON 上推出了 LexisNexis Protégé,這是一款整合在第三代 Lexis+ AI 中的突破性法律 AI 助理。該公告展示了 Protégé 為法律領域提供的個人化、用戶控制的人工智慧功能,並引起了廣泛關注。這項創新使 LexisNexis 成為利用先進的生成式人工智慧轉變法律工作流程的領導者,推動了產業發展並提升了公司的聲譽

- 2024 年 4 月,亞馬遜網路服務公司 (Amazon Web Services, Inc.) 最近擴大了與 Zilch 的合作,以利用 AWS 的 AI 和 ML 服務(例如 Amazon SageMaker 和 Amazon Bedrock)推動 AI 創新。此次合作使 Zilch 能夠顯著增強資料處理能力、縮短開發時間並改善客戶個人化和詐欺偵測能力。 AWS 的擴大使用預計將在未來兩年內加速 Zilch 的銷售並提高模型性能

- 2023 年 7 月,萬事達卡在英國推出了基於人工智慧的消費者詐欺風險解決方案,顯著提高了支付詐騙的即時偵測能力。該技術可幫助 TSB 防止詐騙支付,並透過在資金損失之前識別詐欺交易,每年可能為英國節省 1 億英鎊。該解決方案的擴展旨在加強詐欺預防並恢復對數位銀行的信任

- 2024年3月,塔塔諮詢服務有限公司成功實施了Entris Banking for Compliance解決方案的Quartz,以增強其詐欺偵測和合規能力。這個人工智慧驅動的平台改善了交易監控、風險管理和反洗錢法規的遵守,使 Entris 及其 40 多家附屬銀行受益。該解決方案提供了先進的監控和高效的合規管理,並提高了營運的準確性和靈活性

- 2020 年 10 月,Fiserv, Inc. 推出了首個針對發卡機構的智慧詐欺偵測解決方案——進階防禦,利用認知人工智慧根據機構和聯盟數據推薦量身定制的詐欺規則。這項創新幫助發卡機構快速識別詐欺行為並減少誤拒,進而提升消費者體驗和營運效率。透過優化詐欺預防和持卡人滿意度,Fiserv 的 Advance Defense 有助於增加收入並改善金融機構的數據訪問

- 2024 年 8 月,塔塔諮詢服務有限公司被 IDC MarketScape 評為全球企業分析與財務與會計 AI 業務流程服務領導者。此認可凸顯了 TCS 在高階分析、人工智慧和產生人工智慧方面的廣泛能力,提高了整個金融價值鏈的效率和決策能力。這項榮譽彰顯了 TCS 致力於推動客戶數位轉型和價值創造的承諾

區域分析

從地理上看,全球詐欺檢測交易監控市場報告涵蓋的國家有美國、加拿大、墨西哥、德國、法國、英國、義大利、西班牙、俄羅斯、土耳其、比利時、荷蘭、瑞士、挪威、芬蘭、丹麥、瑞典、波蘭、歐洲其他地區、日本、中國、韓國、印度、澳洲、紐西蘭、新加坡、泰國、馬來西亞、印尼、菲律賓、台灣、越南、亞太地區其他地區、阿聯酋、沙烏地阿拉伯、南非、埃及、以色列、巴林、阿曼、卡達、科威特、中東和非洲其他地區、巴西、阿根廷和南美洲其他地區。

根據 Data Bridge 市場研究分析:

預計北美將在全球詐欺偵測交易監控市場中佔據主導地位並成為成長最快的地區

北美預計將在詐欺偵測交易監控市場佔據主導地位,因為其在詐欺偵測和交易監控市場的主導地位主要得益於其強勁的金融部門、先進的技術公司以及對資料隱私和安全的高度重視,該地區對資料隱私和安全的高度重視為採用先進的詐欺預防措施營造了有利的環境。

有關全球詐欺偵測交易監控市場報告的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/global-fraud-detection-transaction-monitoring-market