X 射线检测系统用于对样品区域进行无损检测。 X 射线检测系统用于通过非破坏性方法检测材料中的缺陷。 X 射线检测系统的优点包括更好的质量控制机制、轻松验证缺失产品、改进数据收集、降低产品召回风险等等。在 X 射线检查系统中,要检查的物体及其图像是使用 X 射线生成的。反过来,它通过图像处理软件进行处理,以验证缺失的物品、绘制形状分析、验证包装完整性并检测任何污染。

访问完整报告@https://www.databridgemarketresearch.com/reports/china-x-ray-inspection-system-market

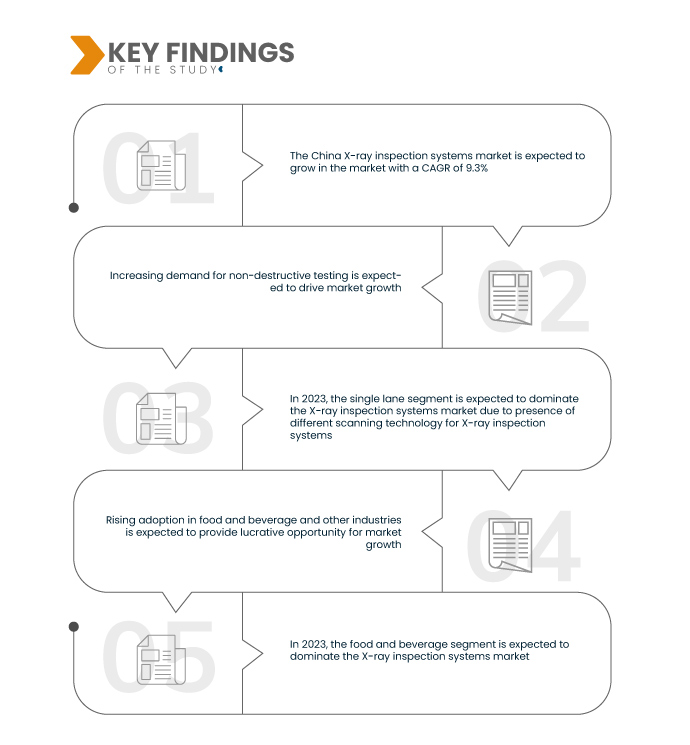

数据桥市场研究分析认为 中国X射线检测系统市场 预计在 2023 年至 2030 年的预测期内以 9.3% 的复合年增长率增长,到 2030 年预计将达到 115,734.45 万美元。便携式和移动检查系统的发展预计将推动市场增长。

研究主要发现

各种应用的自动化程度大幅提高 预计将推动市场

自动化已成为许多行业(包括汽车、电子和航空航天)的重点关注点,因为它提供了多种好处,包括提高生产率、改进质量控制和降低劳动力成本。 X 射线检测系统通过在制造过程中对产品和组件进行无损检测,在自动化中发挥着至关重要的作用。因此,对自动化的需求不断增长,对包括中国在内的全球范围内对 X 射线检测系统的需求产生了积极影响。中国 X 射线检测系统市场的市场参与者正在通过增加检测系统的产品组合来应对

因此,对自动化的需求不断增长预计将推动中国X射线检测系统市场的发展。市场参与者正在通过投资开发新型先进的自动化 X 射线检测系统来响应这一需求,以提高速度、准确性和效率。预计这将导致各行业更多地采用 X 射线检测系统,这将创造巨大的机会,并有望促进市场增长。

报告范围和市场细分

|

报告指标

|

细节

|

|

预测期

|

2023年至2030年

|

|

基准年

|

2022年

|

|

历史岁月

|

2021年(可定制为2015-2020年)

|

|

数量单位

|

收入(千美元)

|

|

涵盖的细分市场

|

产品(硬件、软件和服务)、成像技术(基于胶片的成像和 数字成像)、尺寸(2D、3D)、产品类型(包装产品、散装产品、泵送等)、扫描技术(高清技术、超高清技术等)、通道数(单通道、多通道) Lane 等)、最终用户(石油和天然气、发电、政府基础设施、食品和饮料、航空航天、汽车、制药和保健品等)

|

|

覆盖国家

|

中国

|

|

涵盖的市场参与者

|

Sesotec GmbH(德国)、ISHIDA CO.LTD.(日本)、Loma Systems(英国)、Mekitec group(美国)、ANRITSU CORPORATIONA(日本)、METTLER TOLEDO(美国)、Shimadzu Corporation(日本)、SYSTEM SQUARE INC.(日本)、Viscom AG(德国)、North Star Imaging Inc.(美国)、Nikon Corporation(美国)、A&D Company, Limited(日本)、Smiths Detection Group Ltd.(英国)和 Scienscope(美国)

|

|

报告中涵盖的数据点

|

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的见解外,数据桥市场研究策划的市场报告还包括深入的专家分析、按地域代表的公司生产和产能、经销商和合作伙伴的网络布局、详细和更新的价格趋势分析以及供应链和需求的赤字分析。

|

细分分析:

中国 X 射线检测系统市场根据产品、成像技术、尺寸、产品类型、扫描技术、通道数量和最终用户分为七个显着部分。

- 根据产品供应情况,中国X射线检测系统市场分为硬件、软件和服务。

2023 年,硬件领域预计将主导中国 X 射线检测系统市场

到2023年,由于无损检测需求不断增加,硬件领域预计将主导中国X射线检测系统市场。硬件预计将主导市场,市场份额为57.66%

- 根据成像技术,中国X射线检测系统市场分为胶片成像和数字成像。

2023年,数字成像领域预计将主导中国X射线检测系统市场

到 2023 年,数字成像预计将主导 X 射线检查系统市场,市场份额为 68.44%,是最先进的 X 射线检查形式,可在计算机上立即生成数字射线照相图像。

- 根据尺寸,中国X射线检测系统市场分为2D和3D。 2023年,2D预计将主导中国X射线检测系统市场的增长,市场份额最高,达58.26%

- 根据产品类型,中国X射线检测系统市场分为包装产品、非包装产品、泵送产品等。 2023年,包装产品检测系统预计将主导中国X射线检测系统市场,市场份额为46.59%

- 根据扫描技术,中国X射线检测系统市场分为高清技术、超高清技术等。 2023年,高清技术预计将主导中国X射线检测系统市场,市场份额达54.06%

- 根据通道数量,中国X射线检测系统市场分为单通道、双通道和多通道。 2023年,单通道预计将主导中国X射线检测系统市场,市场份额为42.25%

- 根据最终用途,中国X射线检测系统市场分为石油和天然气、发电、政府基础设施、食品和饮料、航空航天、汽车、制药和保健品等。 2023年,食品饮料预计将主导中国X射线检测系统市场,市场份额为24.53%

主要参与者

Data Bridge Market Research 认为以下公司为中国 X 射线检测系统市场的主要市场参与者:梅特勒-托利多(美国)、岛津株式会社(日本)、史密斯探测集团有限公司(英国)、尼康计量公司(美国)、和 ANRITSU CORPORATION(日本)等。

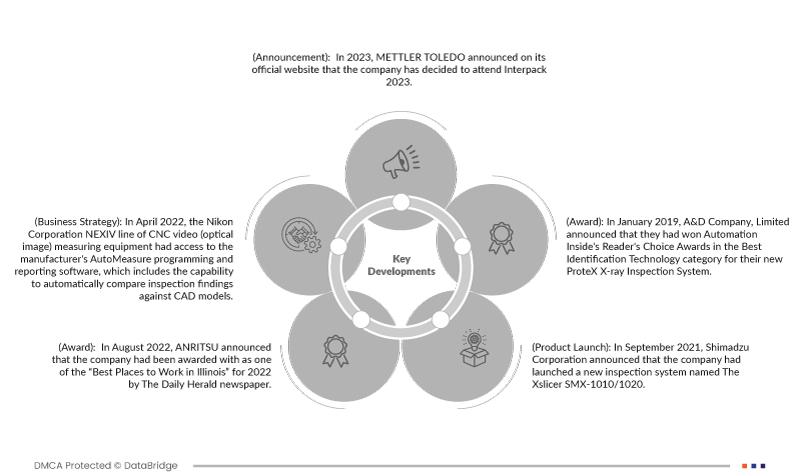

最近的发展

- 2023年,梅特勒-托利多在其官方网站上宣布,公司决定参加Interpack 2023,旨在通过此举为公司的产品组合吸引潜在客户,扩大其在中国X射线检测系统市场的认可度。

- 2022 年 4 月,尼康公司的 NEXIV 系列 CNC 视频(光学图像)测量设备可以访问制造商的 AutoMeasure 编程和报告软件,其中包括自动将检查结果与 CAD 模型进行比较的功能。该程序最新版本 AutoMeasure 版本 13 中的两项新功能甚至使没有经验的用户也能从系统中获得最佳性能。它们通过降低运营费用和提高生产率为制造公司或检验机构提供竞争优势

- 2022 年 8 月,安立宣布该公司被《每日先驱报》评为 2022 年“伊利诺伊州最佳工作场所”之一。该公司获得了这一认可,并利用它在整个美国地区推广其公司文化和产品组合。这使得该公司能够通过增加中国 X 射线检测系统市场的产品销量来获得收入

- 2021 年 9 月,岛津制作所宣布该公司推出了一款名为 Xslicer SMX-1010/1020 的新型检测系统。该产品提供了更好的图像质量,并且该产品的探测器采集速度也有所提高。此次发布提升了公司在中国 X 射线检测系统市场的影响力

- 2019 年 1 月,A&D Company, Limited 宣布,他们的新型 ProteX X 射线检测系统赢得了 Automation Inside 读者选择奖的最佳识别技术类别。 ProteX X 射线系统因其一系列有用的功能而获得提名,这些功能旨在确保最大效率,同时简化检查流程 公司专注于具有模拟和数字转换功能的广泛多样的测量、称重和医疗设备作为其核心技术。此次认可对公司的发展产生了重大影响

有关中国X射线检测系统市场报告的更多详细信息,请点击此处 –https://www.databridgemarketresearch.com/reports/china-x-ray-inspection-system-market