亚太和东南亚 X 射线检测系统市场较为分散,有许多全球参与者。这些公司提供具有竞争力的价格、各种解决方案和创新产品,并在全球范围内提供服务。由于区域和国际层面参与者的存在,供应商和制造商为所有预算提供具有不同解决方案和功能的产品和服务。无损检测需求的增长主要推动了全球牙科诊所管理软件市场。此外,安全法规和质量标准的增长进一步推动了市场。然而,X 射线检查系统相关的高成本预计将限制市场增长。此外,替代检查系统的存在预计将挑战市场增长。然而,食品和饮料行业的日益普及预计将为市场增长提供利润丰厚的机会。

访问完整报告@https://www.databridgemarketresearch.com/reports/asia-pacific-and-sea-x-ray-inspection-system-market

亚太和东南亚 X 射线检测系统市场

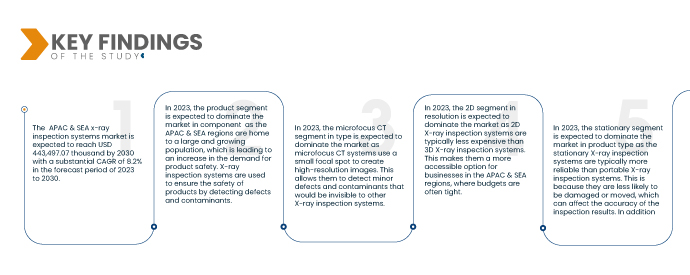

Data Bridge Market Research 分析称, 亚太和东南亚 X 射线检测系统市场 预计将从 2022 年的 237,694.39 万美元增至 2030 年的 443,497.07 万美元,在 2023 年至 2030 年的预测期内,复合年增长率将大幅达到 8.2%。

研究的主要发现

无损检测需求增加

该市场是分散的,有许多全球参与者。这些公司提供具有竞争力的价格、各种解决方案和创新产品,并在全球范围内提供服务。由于区域和国际层面的参与者的存在,供应商和制造商为所有预算提供具有不同解决方案和功能的产品和服务。无损检测需求的增长主要推动了全球牙科诊所管理软件市场。此外,安全法规和质量标准的增长进一步推动了市场。然而,X 射线检查系统相关的高成本预计将限制市场增长。此外,替代检查系统的存在预计将挑战市场增长。然而,食品和饮料行业的日益普及预计将为市场增长提供利润丰厚的机会。

报告范围和市场细分

|

报告指标

|

细节

|

|

预测期

|

2023年至2030年

|

|

基准年

|

2022年

|

|

历史岁月

|

2021 年(可定制为 2015 - 2020 年)

|

|

定量单位

|

收入(千美元)

|

|

涵盖的细分市场

|

组件(产品、软件和服务)、类型(微焦点 CT 和高能 CT)、分辨率(2D 和 3D)、产品类型(台式、便携式和固定式)、源(高达 200 KV、200 KV – 400 KV、和大于400 KV),重量(小于500 KG,500 KG - 1000 KG,1000 KG - 3000 KG,3000 KG -5000 KG,大于5000 KG),应用(缺陷检测,结构和装配分析,失效分析、基于图像的有限元分析、质量控制、计量尺寸和公差分析、孔隙率和复合材料分析、逆向工程等)、最终用户(汽车、航空航天、电子、制造、石油和天然气、食品、医疗等)、分销渠道(直接渠道和间接渠道)

|

|

覆盖国家

|

中国、日本、韩国、印度、台湾、澳大利亚和新西兰、东南亚、新加坡、泰国、马来西亚、印度尼西亚、菲律宾、越南、缅甸、老挝和东南亚其他地区

|

|

涵盖的市场参与者

|

Shimadzu Corporation(日本)、Nikon Metrology Inc.(尼康公司的子公司)(美国)、Thermo Fisher Scientific Inc.(美国)、ZEISS(德国)、TOSHIBA IT & CONTROL SYSTEMS CORPORATION(东芝株式会社的子公司)(日本) )、丹东奥龙辐射仪器集团有限公司(中国)、日立有限公司(日本)、欧姆龙公司(中国)、理学株式会社(日本)、彗星集团(瑞士)、贝克休斯公司(美国)、North Star Imaging Inc.(美国)、济南地平线进出口有限公司(中国)、荣玛科技(苏州)精密有限公司(中国)和 Werth Inc(德国)

|

|

报告中涵盖的数据点

|

除了对市场价值、增长率、细分市场、地理覆盖范围和主要参与者等市场情景的洞察之外,Data Bridge Market Research 策划的市场报告还包括深度专家分析、患者流行病学、海报模型分析、Pestel 分析、定价分析和监管框架

|

细分分析:

根据组件、类型、来源、产品类型、重量、分辨率、应用、最终用户和分销渠道,市场分为九个显着部分。

- 根据组件,市场分为产品、软件和服务。

该产品领域在零部件领域占据主要市场份额

该产品细分市场在组织规模细分市场中占有主要市场份额,因为该产品细分市场可能采用了可提供卓越性能和功能的先进技术。这些进步可能包括更高分辨率的成像、更高的精度、更快的扫描速度或满足特定行业需求的创新功能。到2023年,该产品领域预计将以67.32%的市场份额主导市场。

- 根据类型,市场分为微焦点 CT 和高能 CT。

微焦点 CT 细分市场占据该类型细分市场的主要市场份额

2023 年,微焦点 CT 领域预计将以 64.60% 的市场份额占据市场主导地位,因为微焦点 CT 具有高分辨率成像功能,可以对复杂结构和组件进行详细检查和分析。这在航空航天、汽车、电子和医疗设备等精度和准确度至关重要的行业中尤其有益。

- 根据分辨率,市场分为 2D 和 3D。到 2023 年,2D 细分市场预计将以 60.59% 的市场份额占据主导地位。

- 根据产品类型,市场分为固定式、便携式和台式。到 2023 年,固定式细分市场预计将以 59.19% 的市场份额主导市场。

- 根据来源,市场分为 200 KV 以下、200 KV-400 KV 和 400 KV 以上。到 2023 年,200 KV 以下的细分市场预计将以 63.76% 的市场份额主导市场。

- 根据重量,市场分为500KG-1000KG、500KG以下、1000KG-3000KG、3000KG-5000KG、5000KG以上。 2023年,500KG-1000KG细分市场预计将以57.57%的市场份额主导市场。

- 根据应用,市场细分为缺陷检测、结构和装配分析、故障分析、计量/尺寸和公差分析、基于图像的有限元分析、质量控制、孔隙率和复合材料分析、逆向工程等。到 2023 年,缺陷检测领域预计将以 27.81% 的市场份额占据市场主导地位。

- 根据最终用户,市场分为食品、汽车、石油和天然气、电子、航空航天、制造、医疗等。 2023年,食品领域预计将以26.36%的市场份额主导市场。

- 根据分销渠道,市场分为直接渠道和间接渠道。到2023年,直接渠道预计将以79.07%的市场份额占据市场主导地位。

主要参与者

Data Bridge Market Research 认为以下公司为市场的主要参与者:Shimadzu Corporation(日本)、Nikon Metrology Inc.(尼康公司的子公司)(美国)、Thermo Fisher Scientific Inc.(美国)、ZEISS(德国) )、东芝信息技术控制系统株式会社(东芝株式会社的子公司)(日本)、丹东奥龙辐射仪器集团有限公司(中国)、日立制作所(日本)、欧姆龙株式会社(中国)、理学株式会社(日本) )、Comet Group(瑞士)、Baker Hughes Company(美国)、North Star Imaging Inc.(美国)、济南地平线进出口有限公司(中国)、荣玛科技(苏州)精密有限公司.(中国)和Werth Inc(德国)。

市场发展

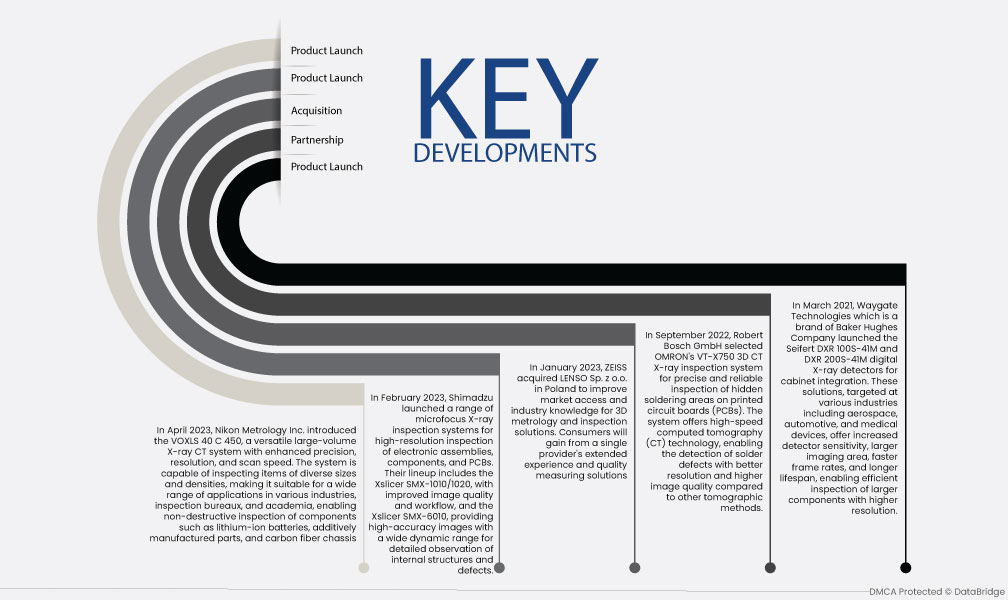

- 2023 年 4 月,尼康计量公司推出了 VOXLS 40 C 450,这是一款多功能大容量 X 射线 CT 系统,可提供更高的精度、分辨率和扫描速度。该系统能够检查各种尺寸和密度的物品,使其适用于各种行业、检查局和学术界的广泛应用,可对锂离子电池、增材制造部件和碳纤维底盘等部件进行无损检查

- 2023 年 2 月,岛津推出了一系列微焦点 X 射线检测系统,用于对电子组件、元件和 PCB 进行高分辨率检测。他们的产品阵容包括具有改进的图像质量和工作流程的 Xslicer SMX-1010/1020,以及提供宽动态范围的高精度图像的 Xslicer SMX-6010,用于详细观察内部结构和缺陷

- 2023 年 1 月,蔡司收购了 LENSO Sp。 z oo 位于波兰,旨在改善 3D 计量和检测解决方案的市场准入和行业知识。消费者将从单一提供商的丰富经验和质量测量解决方案中受益

- 2022 年 9 月,罗伯特·博世有限公司选择了欧姆龙的 VT-X750 3D CT X 射线检测系统,用于精确可靠地检测印刷电路板 (PCB) 上的隐藏焊接区域。该系统提供高速计算机断层扫描 (CT) 技术,与其他断层扫描方法相比,能够以更好的分辨率和更高的图像质量检测焊料缺陷。 VT-X750 支持汽车行业对高质量 PCB 检测的要求,通过其先进的功能(例如人工智能编程和物联网实施)有助于提高安全性和生产力

- 2022年3月,贝克休斯公司旗下品牌Waygate Technologies推出了用于机柜一体化的Seifert DXR 100S-41M和DXR 200S-41M数字X射线探测器。这些解决方案针对航空航天、汽车和医疗设备等各个行业,提供更高的探测器灵敏度、更大的成像面积、更快的帧速率和更长的使用寿命,从而能够以更高分辨率有效检测更大的组件。这些探测器配备了 Waygate Technologies 专有的 Dynamic 41 探测器技术,可提供卓越的图像质量、稳定性和可重复性,从而提高客户的生产力和价值

- 2021年1月,Yxlon举办了三场线上活动,介绍新发布的Cheetah和Cougar EVO微焦点X射线系列产品。展示了迈向自动化的下一步,并在“创新是进化的基础 - 进化赋予您力量”的座右铭下提供了可大大提高电子元件 X 射线检测效率的新选项。通过此次推出,该公司可以满足更多需求顾客

区域分析

从地区来看,市场报告涵盖的国家/地区包括日本、中国、韩国、印度、澳大利亚、新西兰、台湾、新加坡、泰国、马来西亚、印度尼西亚、菲律宾、越南、缅甸、老挝以及亚太地区和东南亚其他地区。

根据 Data Bridge 市场研究分析:

中国是 2023 - 2030 年预测期内的市场

由于无损检测需求的增加,预计中国将主导市场。

预计 2023 年至 2030 年预测期内,中国将成为亚太和东南亚 X 射线检测系统市场增长最快的地区

中国地区预计将以 26.55% 的市场份额主导市场,预计到 2030 年将达到 140,682.14 万美元,2023 年至 2030 年的预测期内复合年增长率为 10.6%。横跨汽车、电子、制药和食品加工等多个领域的大型制造业。这些行业对质量控制和检测的需求推动了对 X 射线检测系统的需求。

有关亚太地区和东南亚 X 射线检测系统市场报告的更多详细信息,请单击此处 –https://www.databridgemarketresearch.com/reports/asia-pacific-and-sea-x-ray-inspection-system-market