North America Walk In Refrigerators And Freezers Market

Размер рынка в млрд долларов США

CAGR :

%

USD

6.63 Billion

USD

10.18 Billion

2025

2033

USD

6.63 Billion

USD

10.18 Billion

2025

2033

| 2026 –2033 | |

| USD 6.63 Billion | |

| USD 10.18 Billion | |

|

|

|

|

Сегментация рынка холодильных и морозильных камер в Северной Америке по типу (автономные, с выносным конденсатором, с мультиплексным конденсатором и другие), типу системы (системы с выносным управлением, предварительно собранные системы с выносным управлением, стандартные системы с верхним и боковым креплением, системы с седловидным креплением, системы с верхним расположением холодильной камеры, системы с рулонным охлаждением и другие), типу дверей (однодверные, двухдверные, трехдверные и другие), технологии (ручная, полуавтоматическая и полностью автоматическая), типу штор (ленточные и воздушные), каналам сбыта (прямые продажи/B2B, электронная коммерция , специализированные магазины и другие), конечным пользователям (коммерческие, жилые и другие) - тенденции отрасли и прогноз до 2033 года.

Каковы объем и темпы роста рынка холодильных и морозильных камер в Северной Америке?

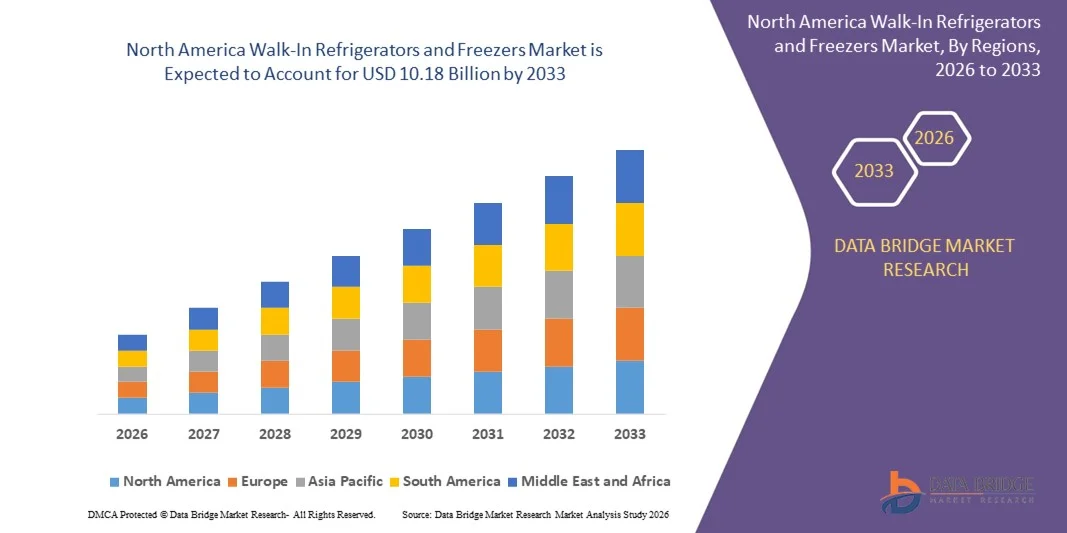

- Объем рынка холодильных и морозильных камер в Северной Америке в 2025 году оценивался в 6,63 млрд долларов США и, как ожидается, достигнет 10,18 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 5,1% в течение прогнозируемого периода.

- Технологические достижения в области компрессорных и холодильных систем являются движущей силой и стимулируют спрос на рынке холодильных и морозильных камер в Северной Америке.

- Высокое энергопотребление и значительный углеродный след сдерживают спрос на рынке холодильных и морозильных камер в Северной Америке.

Основные выводы по рынку холодильных и морозильных камер:

- Урбанизация и связанные с ней изменения в образе жизни потребителей открывают новые возможности для рынка холодильных и морозильных камер в Северной Америке.

- Жесткие государственные правила в отношении выбросов ХФУ являются препятствием для снижения спроса на рынке холодильных и морозильных камер в Северной Америке.

- США доминировали на североамериканском рынке холодильных и морозильных камер, занимая 41,36% выручки в 2025 году. Это стало возможным благодаря развитой пищевой промышленности, широкому распространению организованной розничной торговли, повсеместному внедрению инфраструктуры холодовой цепи, а также строгим правилам безопасности и хранения пищевых продуктов в коммерческих, промышленных и медицинских учреждениях.

- По прогнозам, Канада продемонстрирует самый быстрый среднегодовой темп роста (CAGR) в размере 10,95% в период с 2026 по 2033 год на рынке холодильных и морозильных камер Северной Америки, чему способствуют рост потребления замороженных продуктов, расширение розничной торговли продуктами питания и увеличение инвестиций в современную инфраструктуру для хранения продуктов в холодильных камерах.

- Сегмент автономных систем доминировал на рынке, занимая, по оценкам, 42,3% к 2025 году, благодаря простоте установки, компактным размерам и пригодности для небольших и средних коммерческих кухонь и торговых точек.

Обзор отчета и сегментация рынка холодильных и морозильных камер

|

Атрибуты |

Основные тенденции рынка холодильных и морозильных камер: анализ рынка. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, анализ ценообразования, анализ доли брендов, опросы потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Какова ключевая тенденция на рынке холодильных и морозильных камер?

Растущий спрос на высококачественные, улучшающие вкус и специализированные холодильные и морозильные камеры.

- На рынке холодильных и морозильных камер наблюдается рост спроса на премиальные, крафтовые и ароматизированные молочные продукты, призванные предложить потребителям, стремящимся к высококачественным молочным продуктам, аутентичный вкус и изысканные впечатления.

- Производители представляют специализированные холодильные и морозильные камеры с использованием натуральных ингредиентов, минимальным количеством добавок, натуральным процессом копчения и уникальными региональными вкусовыми профилями, чтобы удовлетворить меняющиеся предпочтения потребителей.

- Растущий интерес к деликатесам, сырным тарелкам ручной работы и изысканным кулинарным блюдам ускоряет внедрение холодильных и морозильных камер в розничной торговле, гостиничном бизнесе и сфере общественного питания.

- Например, такие компании, как Arla Foods, Saputo, Sargento, Leprino Foods и Dairygold, расширяют свой ассортимент, добавляя копченый чеддер, гауду, моцареллу и премиальные смеси сыров.

- Растущая популярность домашнего питания в ресторанном стиле, закусок на основе сыра и премиальных товаров в розничной торговле в США, Северной Америке и Азиатско-Тихоокеанском регионе стимулирует расширение рынка.

- Поскольку потребители отдают приоритет насыщенным вкусам и высокому качеству, холодильные и морозильные камеры остаются важнейшим сегментом на рынке деликатесных сыров.

Какие ключевые факторы влияют на рынок холодильных и морозильных камер?

- Растущая потребительская предпочтение к молочным продуктам с насыщенным вкусом и высококачественным сортам сыра в значительной степени способствует внедрению холодильных и морозильных камер.

- Например, в 2024–2025 годах такие компании, как Saputo, Arla Foods и Sargento, запустили новые товарные позиции и форматы упаковки, разработанные специально для розничной торговли, электронной коммерции и предприятий общественного питания.

- Растущий спрос на готовые к употреблению блюда, изысканные сэндвичи, блюда фьюжн-кухни и закуски на основе сыра расширяет применение холодильных и морозильных камер в домашних хозяйствах и коммерческих предприятиях.

- Расширение сети современных розничных магазинов, специализированных сырных лавок и онлайн-платформ для продажи продуктов питания повышает доступность продукции и расширяет охват потребителей.

- Рост потребления в сетях общественного питания, ресторанах быстрого обслуживания и заведениях быстрого питания способствует росту рынка.

- Благодаря росту располагаемых доходов, изменению вкусовых предпочтений и инновациям в переработке молочной продукции, рынок холодильных и морозильных камер, как ожидается, будет демонстрировать устойчивый долгосрочный рост.

Какой фактор препятствует росту рынка холодильных и морозильных камер?

- Повышенные производственные затраты, связанные с натуральным копчением, использованием молока премиум-класса и длительными периодами созревания, ограничивают конкурентоспособность цен на холодильные и морозильные камеры.

- В 2024–2025 годах волатильность цен на сырое молоко, энергоносители и логистику привела к увеличению операционных расходов для мировых производителей.

- Сокращенный срок годности и строгие требования к хранению в условиях холодовой цепи ограничивают распространение продукции, особенно на развивающихся рынках.

- Низкая осведомленность потребителей в развивающихся регионах о специализированных холодильных и морозильных камерах замедляет их внедрение.

- Конкуренция со стороны плавленого сыра, ароматизированных паст и растительных альтернатив создает ценовое давление и давление на полки магазинов.

- Для решения этих проблем компании сосредотачиваются на оптимизации процессов, инновационных упаковочных решениях, расширении дистрибьюторских сетей и просвещении потребителей, чтобы ускорить глобальное внедрение холодильных и морозильных камер.

Как сегментируется рынок холодильных и морозильных камер?

Рынок сегментирован по типу, типу системы, типу дверей, технологии, типу штор, каналу сбыта и конечному пользователю .

- По типу

В зависимости от типа, рынок холодильных и морозильных камер сегментируется на автономные, с выносным конденсатором, с мультиплексным конденсатором и другие. Сегмент автономных камер доминировал на рынке с предполагаемой долей в 42,3% в 2025 году, что обусловлено простотой установки, компактными размерами и пригодностью для небольших и средних коммерческих кухонь и торговых точек. Автономные установки предлагают встроенные компрессоры, упрощенное техническое обслуживание и более низкие первоначальные затраты, что делает их популярными среди кафе, ресторанов и магазинов шаговой доступности.

Ожидается, что сегмент многоканальных конденсационных систем будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствует расширение их применения в крупных супермаркетах, отелях и промышленных холодильных складах. Многоканальные системы обеспечивают масштабируемость, энергоэффективность и возможности централизованного управления, позволяя операторам одновременно управлять несколькими холодильными установками, что способствует их внедрению в коммерческих объектах большой мощности.

- По типу системы

В зависимости от типа системы рынок сегментируется на системы дистанционного управления, предварительно собранные системы дистанционного управления, стандартные системы с верхним креплением, системы бокового крепления, системы с седловидным креплением, системы с верхним расположением, рулонные системы и другие. Сегмент систем дистанционного управления доминировал с долей 38,7% в 2025 году, чему способствовали высокая эффективность охлаждения, гибкость размещения и пригодность для больших холодильных камер.

Прогнозируется, что рынок предварительно собранных систем дистанционного управления будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствуют более быстрая установка, снижение затрат на рабочую силу и минимальные требования к сборке на месте. Растущее внедрение таких решений в сетевых супермаркетах, коммерческих кухнях и предприятиях общественного питания ускоряет их рост.

- По типу двери

В зависимости от типа дверей рынок сегментируется на однодверные, двухдверные, трехдверные и другие. Сегмент двухдверных дверей доминировал с долей 44,1% в 2025 году, предлагая улучшенную доступность, энергоэффективность и совместимость с коммерческими кухнями с высокой проходимостью.

Ожидается, что сегмент трехдверных холодильных установок будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему будет способствовать спрос со стороны крупных ресторанов, отелей и операторов холодильных складов, которым требуется несколько отсеков для одновременного доступа и эффективного управления запасами.

- С помощью технологий

В зависимости от технологии рынок сегментируется на холодильные и морозильные камеры с ручным, полуавтоматическим и полностью автоматическим управлением. Полуавтоматический сегмент доминировал, занимая 47,5% рынка в 2025 году, обеспечивая баланс между оперативным управлением, надежностью и энергоэффективностью.

Прогнозируется, что полностью автоматизированные системы будут расти самыми быстрыми темпами в период с 2026 по 2033 год, чему будет способствовать растущее внедрение холодильного оборудования с поддержкой IoT, интеллектуального мониторинга и автоматизированного контроля температуры на коммерческих и промышленных объектах.

- По типу штор

Рынок сегментирован на ленточные и воздушные завесы. Сегмент ленточных завес занимал наибольшую долю рынка в 63,2% в 2025 году, что обусловлено простотой установки, экономией энергии и предотвращением утечек холодного воздуха в холодильных камерах.

Ожидается, что сегмент воздушных завес будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему будет способствовать спрос со стороны предприятий розничной торговли премиум-класса, сетей общественного питания и промышленных холодильных складов, требующих передовых методов управления воздушными потоками и соблюдения гигиенических норм.

- По каналам сбыта

По типу дистрибуции рынок сегментируется на прямые продажи/B2B, электронную коммерцию, специализированные магазины и другие. Канал прямых продаж/B2B доминировал с долей в 52,8% в 2025 году, чему способствовали оптовые заказы от супермаркетов, отелей и коммерческих кухонь.

Ожидается, что электронная коммерция будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствует увеличение онлайн-закупок со стороны небольших ресторанов, специализированных розничных магазинов и предприятий, работающих на дому, которые стремятся к удобному оформлению заказов и доставке на дом.

- С точки зрения конечного пользователя

В зависимости от конечного пользователя рынок сегментируется на коммерческий, жилой и прочий. Коммерческий сегмент доминировал с долей 58,4% в 2025 году, чему способствовало широкое использование в ресторанах, кафе, отелях и промышленных холодильных складах.

Прогнозируется, что сегмент бытовой техники будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствуют растущая популярность домашней кулинарии, высококачественные кухонные гарнитуры и растущий спрос на крупногабаритные бытовые холодильники в городских домохозяйствах.

Какой регион занимает наибольшую долю рынка холодильных и морозильных камер?

- США доминировали на североамериканском рынке холодильных и морозильных камер, занимая 41,36% выручки в 2025 году. Это стало возможным благодаря развитой пищевой промышленности, широкому распространению организованной розничной торговли, повсеместному внедрению инфраструктуры холодовой цепи, а также строгим правилам безопасности и хранения пищевых продуктов в коммерческих, промышленных и медицинских учреждениях.

- Растущий спрос со стороны супермаркетов, гипермаркетов, сетей общественного питания, поставщиков услуг по хранению фармацевтической продукции и крупных холодильных складов значительно стимулирует внедрение энергоэффективных, высокопроизводительных холодильных и морозильных камер в регионе.

- Развитые внутренние производственные мощности, непрерывный технологический прогресс, раннее внедрение интеллектуальных холодильных систем и постоянные инвестиции со стороны глобальных и региональных производителей продолжают укреплять лидерство Северной Америки на рынке холодильных и морозильных камер.

Анализ рынка холодильных и морозильных камер в Канаде

По прогнозам, Канада продемонстрирует самый быстрый среднегодовой темп роста (CAGR) в размере 10,95% в период с 2026 по 2033 год на рынке холодильных и морозильных камер Северной Америки, чему способствуют рост потребления замороженных продуктов, расширение розничной торговли продуктами питания и увеличение инвестиций в современную инфраструктуру холодильных складов. Внедрение экологически чистых хладагентов, соблюдение норм устойчивого развития и растущий спрос со стороны предприятий общественного питания и фармацевтической промышленности продолжают ускорять расширение рынка.

Какие компании занимают лидирующие позиции на рынке холодильных и морозильных камер?

В отрасли производства холодильных и морозильных камер лидируют преимущественно хорошо зарекомендовавшие себя компании, в том числе:

- Lancer Worldwide (США)

- Haier Inc. (Китай)

- Холодильник Foster (Великобритания)

- BSH Hausgeräte GmbH (Германия)

- AB Electrolux (Швеция)

- Precision Refrigeration Ltd (Великобритания)

- Корпорация Hussmann (Panasonic) (США)

- Danfoss A/S (Дания)

- Колпак (Велбильт, Инк.) (США)

- Master-Bilt (США)

- Норлейк, Инк. (США)

- Американоолер ООО (США)

- Империал Браун (США)

- Thermo-Kool (США)

- Bally Refrigerated Boxes, Inc. (США)

- USA Cooler (США)

Какие последние тенденции наблюдаются на мировом рынке холодильных и морозильных камер?

- В августе 2025 года компания Everidge представила линейку мобильных холодильных установок Cool on the Move, предлагающих модули размером 6x8, 6x12 и 6x16 футов, которые функционируют как холодильные и морозильные камеры и работают от стандартных розеток 120 В или генераторов. Разработанные для таких отраслей, как общественное питание, здравоохранение и службы экстренной помощи, эти модули обеспечивают надежное хранение продуктов в холоде во время транспортировки и на месте эксплуатации. Этот запуск подчеркивает растущий спрос на гибкие и мобильные решения для хранения в холоде в различных отраслях.

- В июне 2025 года компания Amerikooler выпустила холодильную камеру AK Series 3 Quick Ship Walk-In, разработанную для быстрой доставки и установки при сохранении высокой энергоэффективности. Оснащенная изоляцией из пенополистирола AK-XPS компрессорного класса R-29, прочным стальным полом и интегрированной цифровой системой мониторинга, эта система ориентирована на клиентов, которым требуется быстрая установка без ущерба для производительности. Эта разработка подчеркивает ориентацию рынка на скорость, эффективность и надежность эксплуатации.

- В ноябре 2024 года компания KPS Global представила DEFENDOOR — усовершенствованную систему защиты, разработанную для повышения долговечности дверей и снижения затрат на техническое обслуживание холодильных и морозильных камер в условиях высокой проходимости. Минимизируя повреждения дверей и продлевая срок службы продукции, система помогает предприятиям розничной торговли и общественного питания, стремящимся к долгосрочной экономической эффективности. Это нововведение отражает растущее внимание к долговечности и ценности жизненного цикла в инфраструктуре холодильных складов.

- В январе 2024 года компания Hussmann, входящая в состав Panasonic, запустила программу Evolve Technologies для поддержки решений в области холодильной техники с низким потенциалом глобального потепления, использующих экологически чистые хладагенты, такие как R-744 (CO₂) и R-290 (пропан). Эта инициатива направлена на решение проблем, связанных с регулированием и экологическими аспектами, а также на повышение экологичности холодильной техники. Запуск программы демонстрирует переход отрасли к экологически чистым и перспективным технологиям в области холодильной техники.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.