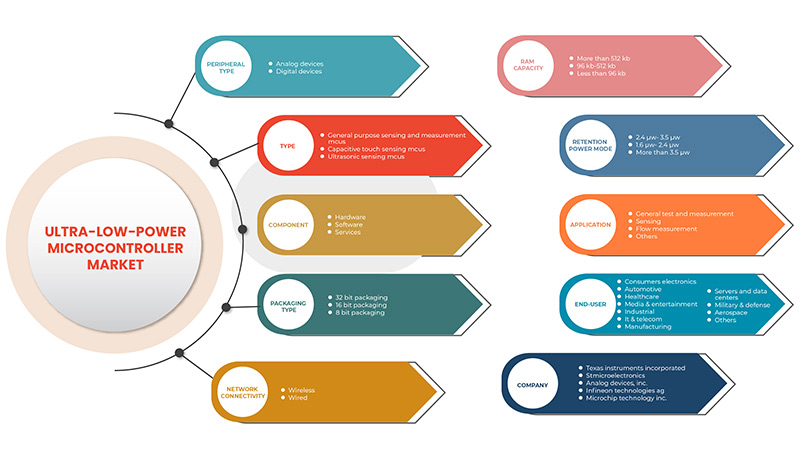

North America Ultra-Low-Power Microcontroller Market, By Peripheral Type (Analog Devices, Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs, Ultrasonic Sensing MCUs), Component (Hardware, Software, Services), Packaging Type (32 Bit Packaging, 16 Bit Packaging, 8 Bit Packaging), Network Connectivity (Wireless, Wired), RAM Capacity (More than 512 Kb, 96 Kb-512 Kb, Less than 96 Kb), Retention Power Mode (2.4 μW- 3.5 μW, 1.6 μW- 2.4 μW, More than 3.5 μW), Application (General Test and Measurement, Sensing, Flow Measurement, Others)– Industry Trends and Forecast to 2029.

North America Ultra-Low-Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others. With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

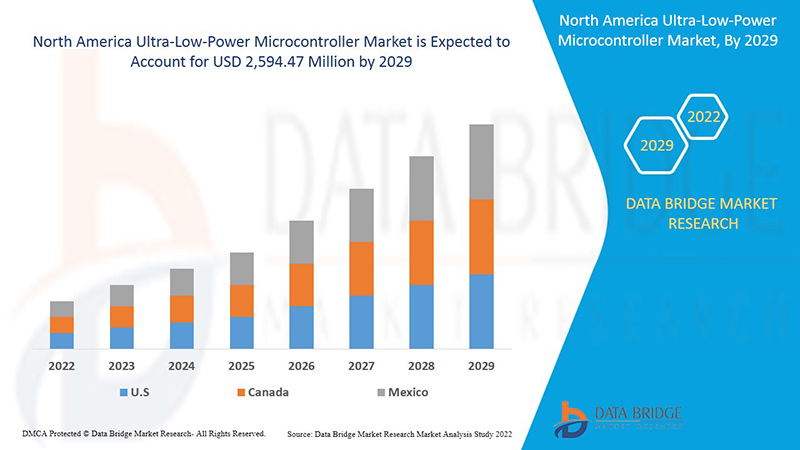

Data Bridge Market Research analyses that the ultra-low-power microcontroller market is expected to reach the value of USD 2,594.47 million by the year 2029, at a CAGR of 10.7% during the forecast period. "Analog Devices" accounts for the most prominent peripheral type segment in the respective market owing to rise in need of detection of signals and converting into digital form. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Тип периферийного устройства (аналоговые устройства, цифровые устройства), тип (универсальные микроконтроллеры для измерения и измерения, микроконтроллеры для емкостного сенсорного измерения, микроконтроллеры для ультразвукового сенсорного измерения), компонент (аппаратное обеспечение, программное обеспечение, услуги), тип упаковки (32-битная упаковка, 16-битная упаковка, 8-битная упаковка), сетевое подключение (беспроводное, проводное), емкость ОЗУ (более 512 Кб, 96-512 Кб, менее 96 Кб), режим сохранения мощности (2,4 мкВт- 3,5 мкВт, 1,6 мкВт- 2,4 мкВт, более 3,5 мкВт), применение (общее тестирование и измерение, зондирование, измерение расхода, другое) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке |

|

Охваченные участники рынка |

Texas Instruments Incorporated (США), STMicroelectronics (Швейцария), Analog Devices, Inc. (США), NXP Semiconductors (Нидерланды), EM Microelectronic (Швейцария), Nuvoton Technology Corporation (Китай), Seiko Epson Corporation (Япония), Microchip Technology Inc. (США), Broadcom (США), Semiconductor Components Industries, LLC (США), Holtek Semiconductor Inc. (Китай), Zilog, Inc. (США), Silicon Laboratories (США), Infineon Technologies AG (Германия), Renesas Electronics Corporation (Япония), Profichip USA (США), e-peas (Бельгия), Ambiq Micro, Inc. (США), TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Япония) |

Определение рынка

Микроконтроллер сверхнизкого энергопотребления (ULP) позволяет периферийным узлам интеллектуально обрабатывать локализованные данные с минимальным потреблением системной мощности. Это позволяет клиентам продлить срок службы батареи и время между зарядками, что позволяет использовать их дольше. Меньшие размеры батареи и более длительное время между заменами продукта на месте обеспечивают экономию средств для конечных пользователей. Сверхнизкое энергопотребление является очень важным требованием для работы с небольшими источниками энергии (для уменьшения размера) и отсутствия проблем с локальным нагревом. Микроконтроллеры сверхнизкого энергопотребления предлагают разработчикам энергоэффективных встраиваемых систем и приложений баланс между производительностью, мощностью, безопасностью и экономической эффективностью. Эти полупроводниковые устройства находят применение в транспортных средствах, роботах, офисных машинах, медицинских устройствах, мобильных радиопередатчиках, торговых автоматах и бытовой технике, среди прочих устройств. По сути, это простые миниатюрные персональные компьютеры (ПК), предназначенные для управления небольшими функциями более крупного компонента без сложной операционной системы (ОС) на стороне клиента. С модернизацией технологий и ростом спроса на периферийные вычислительные устройства с энергосберегающими характеристиками растет количество микроконтроллеров сверхнизкого энергопотребления.

Влияние COVID-19 на рынок микроконтроллеров сверхмалого энергопотребления

COVID-19 повлиял на различные отрасли обрабатывающей промышленности в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Полупроводниковая промышленность серьезно пострадала от пандемии. Полупроводниковая промышленность столкнулась с огромным дефицитом чипов, что привело к сбоям в цепочках поставок.

Динамика рынка микроконтроллеров со сверхмалым энергопотреблением включает:

- Увеличение государственных инвестиций для поддержки развития Интернета вещей по всему миру

По всему миру правительство увеличило инвестиции в сектор IoT для поддержки проектов умных городов и повышения уровня связности в сельской местности. Это создало огромные возможности для игроков в области производства полупроводников, чтобы предложить эффективные решения MCU с ультранизким энергопотреблением, удовлетворяющие растущий спрос.

- Растущая популярность устройств Интернета вещей с низким энергопотреблением

Отрасли и компании используют возможность внедрения IoT, поскольку базовые технологии быстро развиваются. Интернет вещей, похоже, готов проникнуть в основное бизнес-использование.

- Растущий спрос на микроконтроллеры с низким энергопотреблением в интеллектуальных устройствах

Рынок носимых приложений для персонального оздоровления и медицины быстро растет. Новые технологические достижения и меняющийся образ жизни привели к росту использования интеллектуальных устройств по всему миру.

- Растущий спрос на микроконтроллеры в области искусственного интеллекта

Достижения в области силовой электроники оставили позади понимание того, что для выполнения задач машинного обучения и глубокого обучения требуется высокопроизводительное оборудование, при этом обучение и вывод на периферии выполняются шлюзами, периферийными серверами или центрами обработки данных. Во все большем числе случаев новейшие микроконтроллеры, некоторые со встроенными ускорителями МО, смогли перенести МО на периферийные устройства.

- Растущий спрос на приложения для управления умным домом и зданием

Мир становится более связанным, чем когда-либо, и Интернет вещей (IoT) позволил бытовым приборам стать частью сетей автоматизации умного дома. Это приводит к более тихим и энергоэффективным конструкциям бытовых приборов, управляемым интуитивно понятным управлением на основе датчиков. Теперь продукты можно легко объединять, формируя широко распространенные цифровые сети со встроенным интеллектом и коммуникацией. Эта тенденция обеспечивает более высокий уровень функциональности и удобства для технически подкованных потребителей.

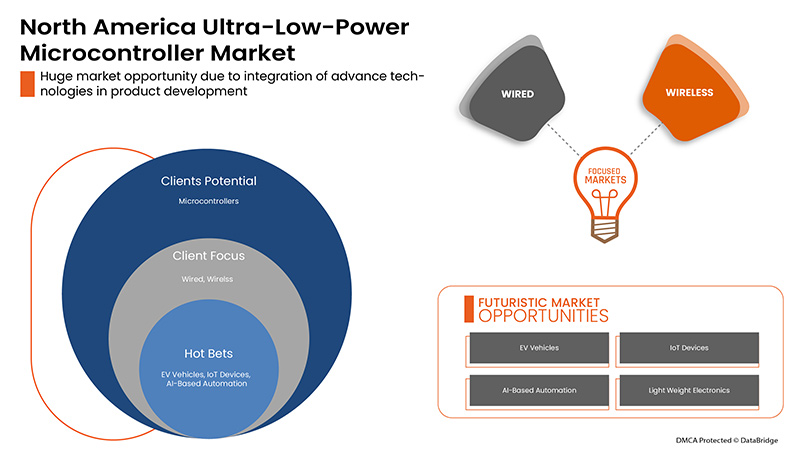

- Растущее внедрение силовой электроники в автомобильные технологии

Автомобильные технологии развиваются более быстрыми темпами с ростом разработок в области автономных транспортных средств и электромобилей. Во всем мире все больше внимания уделяется увеличению производства и внедрению электромобилей для снижения нагрузки на ископаемое топливо и контроля воздействия на окружающую среду.

Ограничения/Проблемы, с которыми сталкивается рынок микроконтроллеров сверхмалого энергопотребления

- Более низкое внедрение микроконтроллеров со сверхнизким энергопотреблением по сравнению с микроконтроллерами с низким и высоким энергопотреблением

Микроконтроллеры высокой и низкой мощности присутствуют на рынке уже давно и достигли зрелости как и технологии на рынке полупроводников по сравнению с микроконтроллерами сверхнизкой мощности. Это ставит перед производителями микроконтроллеров сверхнизкой мощности задачу успешного увеличения внедрения этих микроконтроллеров в конкуренции с микроконтроллерами низкой и высокой мощности.

- Огромные проблемы с выбросами углерода в секторе производства полупроводников

Спрос на полупроводники, такие как сверхмаломощные микроконтроллеры, растет, поскольку жизнь становится все более цифровой, а чипы — ключевым компонентом приложений от стиральных машин до искусственного интеллекта. Производство в полупроводниковой промышленности — это ресурсоемкий бизнес, который оказывает огромное влияние на окружающую среду.

В этом отчете о рынке микроконтроллеров сверхнизкого энергопотребления содержатся сведения о новых последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке микроконтроллеров сверхнизкого энергопотребления, свяжитесь с Data Bridge Market Research для получения аналитического обзора. Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Последние события

- В июне 2021 года Texas Instruments Incorporated объявила о планах приобретения 300-мм полупроводникового завода (или «fab») Micron Technology в Лехи, штат Юта, за 900 миллионов долларов США. С помощью этого компания стремилась укрепить свое конкурентное преимущество в производстве и технологиях. Это позволило компании расширить контроль над своей цепочкой поставок.

- В мае Ambiq Micro, Inc. и Winbond Electronics Corporation, глобальный поставщик решений для полупроводниковой памяти, объединили усилия, чтобы объединить HyperRAM и Apollo4 для поставки системных решений с ультранизким энергопотреблением для конечных точек IoT и носимых устройств. Это должно было помочь конечным точкам IoT и носимым устройствам продлить срок службы батареи.

Масштаб рынка микроконтроллеров сверхнизкого энергопотребления в Северной Америке

Рынок микроконтроллеров сверхнизкого энергопотребления сегментирован на основе типа периферии, типа, компонента, типа упаковки, сетевого подключения, емкости ОЗУ, режима сохранения мощности, приложения и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип периферийного устройства

- Аналоговые Устройства

- Цифровые устройства

По типу периферийных устройств рынок микроконтроллеров сверхмалого энергопотребления сегментируется на аналоговые устройства и цифровые устройства.

Тип

- Микроконтроллеры общего назначения для измерения и обнаружения

- Емкостные микроконтроллеры с сенсорным экраном

- Ультразвуковое зондирование MCUS

По типу рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на универсальные сенсорные и измерительные MCUS, емкостные сенсорные MCUS и ультразвуковые сенсорные MCUS.

Компонент

- Аппаратное обеспечение

- Программное обеспечение

- Услуги

По компонентному составу рынок микроконтроллеров со сверхмалым энергопотреблением сегментируется на аппаратное обеспечение, программное обеспечение и услуги.

Тип упаковки

- 8-битная упаковка

- 16-битная упаковка

- 32-битная упаковка

По типу корпуса рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на 8-битный, 16-битный и 32-битный корпус.

Сетевое подключение

- Проводной

- Беспроводной

По принципу сетевого подключения рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на беспроводные и проводные.

Емкость оперативной памяти

- Менее 96 кб,

- 96 кб-512 кб

- Более 512 кб

По объему оперативной памяти рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на менее 96 кб, 96–512 кб и более 512 кб.

Режим удержания мощности

- 1,6 мкВт- 2,4 мкВт,

- 2,4 мкВт- 3,5 мкВт

- Более 3,5 мкВт

По режиму сохранения мощности рынок микроконтроллеров сверхмалого энергопотребления сегментируется на 1,6 мкВт-2,4 мкВт, 2,4 мкВт-3,5 мкВт и более 3,5 мкВт.

Приложение

- Общие испытания и измерения

- Ощущение

- Измерение расхода

- Другие

По области применения рынок микроконтроллеров сверхмалого энергопотребления сегментируется на общие контрольно-измерительные приборы, датчики, расходомеры и другие.

Конечный пользователь

- Здравоохранение

- Промышленный

- Производство

- ИТ и Телеком

- Военные и оборонные

- Аэрокосмическая промышленность

- Медиа и развлечения

- Автомобильный

- Серверы и центры обработки данных

- Бытовая электроника

- Другие

По потребителю рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на здравоохранение, промышленность, производство, ИТ и телекоммуникации, военную и оборонную промышленность, аэрокосмическую промышленность, медиа и развлечения, автомобилестроение, серверы и центры обработки данных, бытовую электронику и другие.

Региональный анализ/информация о рынке микроконтроллеров с ультранизким энергопотреблением

Проведен анализ рынка микроконтроллеров со сверхнизким энергопотреблением, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу периферийного устройства, типу, компоненту, типу корпуса, сетевому подключению, объему ОЗУ, режиму сохранения мощности, области применения и конечному пользователю, как указано выше.

В отчете о рынке микроконтроллеров со сверхнизким энергопотреблением рассматриваются следующие страны: США, Канада и Мексика в Северной Америке.

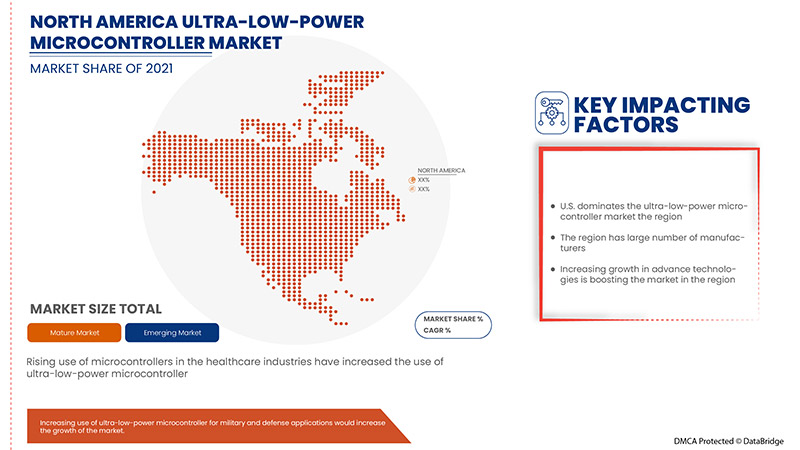

США доминируют на рынке микроконтроллеров сверхнизкого энергопотребления, поскольку в регионе много местных игроков. США стали центром для некоторых ведущих компаний в полупроводниковой промышленности.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка микроконтроллеров со сверхнизким энергопотреблением

The ultra-low-power microcontroller market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultra-low-power microcontroller market.

Some of the major players operating in the ultra-low-power microcontroller market are Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., NXP Semiconductors, EM Microelectronic, Nuvoton Technology Corporation, Seiko Epson Corporation, Microchip Technology Inc., Broadcom, Semiconductor Components Industries, LLC, Holtek Semiconductor Inc., Zilog, Inc., Silicon Laboratories, LAPIS Semiconductor, Co., Ltd., Infineon Technologies AG, Renesas Electronics Corporation, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Profichip USA, e-peas, Ambiq Micro, Inc., TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 PERIPHERAL TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS

5.1.2 GROWING POPULARITY OF LOW-BATTERY-POWERED IOT DEVICES

5.1.3 INCREASING DEMAND FOR LOW POWER CONSUMING MCU IN SMART DEVICES

5.1.4 RISING DEMAND FOR MICROCONTROLLERS IN EDGE AI

5.1.5 INCREASING DEMAND FOR SMART HOME AND BUILDING MANAGEMENT APPLICATIONS

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES IN ULTRA-LOW-POWER MICROCONTROLLER

5.2.1 HUGE CARBON FOOTPRINT ISSUES IN SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF POWER ELECTRONICS IN AUTOMOTIVE TECHNOLOGIES

5.3.2 SURGE IN GOVERNMENT INVESTMENTS TO SUPPORT IOT GROWTH ACROSS THE GLOBE

5.3.3 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LOWER ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE

6.1 OVERVIEW

6.2 ANALOG DEVICES

6.3 DIGITAL DEVICES

7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE

7.1 OVERVIEW

7.2 GENERAL PURPOSE SENSING AND MEASUREMENT MCUS

7.3 CAPACITIVE TOUCH SENSING MCUS

7.4 ULTRASONIC SENSING MCUS

8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 PROCESSORS

8.2.2 MEMORY

8.2.3 POWER SUPPLY UNIT

8.2.4 SENSORS

8.2.5 CONTROLLER

8.2.6 OTHERS

8.3 SOFTWARE

8.4 SERVICES

8.4.1 IMPLEMENTATION & INTEGRATION

8.4.2 TRAINING & CONSULTING

8.4.3 SUPPORT & MAINTENANCE

9 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 32 BIT PACKAGING

9.3 16 BIT PACKAGING

9.4 8 BIT PACKAGING

10 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.3 WIRED

11 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY

11.1 OVERVIEW

11.2 MORE THAN 512 KB

11.3 96 KB-512 KB

11.4 LESS THAN 96 KB

12 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE

12.1 OVERVIEW

12.2 2.4 ΜW- 3.5 ΜW

12.3 1.6 ΜW- 2.4 ΜW

12.4 MORE THAN 3.5 ΜW

13 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 GENERAL TEST AND MEASUREMENT

13.3 SENSING

13.4 FLOW MEASUREMENT

13.5 OTHERS

14 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER

14.1 OVERVIEW

14.2 CONSUMERS ELECTRONICS

14.2.1 SMARTPHONES

14.2.2 DESKTOP

14.2.3 TABLETS

14.2.4 LAPTOPS

14.2.5 SMART WATCHES

14.3 AUTOMOTIVE

14.3.1 INFOTAINMENT

14.3.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

14.4 HEALTHCARE

14.4.1 PORTABLE MEDICAL DEVICES

14.4.2 WEARABLE MEDICAL PATCHES

14.5 MEDIA & ENTERTAINMENT

14.6 INDUSTRIAL

14.6.1 BUILDING AUTOMATION

14.6.2 ROBOTICS

14.6.3 MACHINE VISION

14.6.4 AUTOMATED GUIDED VEHICLES

14.6.5 HUMAN–MACHINE INTERFACE (HMI)

14.7 IT & TELECOM

14.8 MANUFACTURING

14.9 SERVERS AND DATA CENTERS

14.1 MILITARY & DEFENSE

14.11 AEROSPACE

14.11.1 AVIONICS AND DEFENSE SYSTEMS

14.11.2 UNMANNED AERIAL VEHICLES

14.12 OTHERS

15 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEXAS INSTRUMENTS INCORPORATED

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STMICROELECTRONICS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ANALOG DEVICES, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 INFINEON TECHNOLOGIES AG

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MICROCHIP TECHNOLOGY INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 RENESAS ELECTRONICS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 NXP SEMICONDUCTORS

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMBIQ MICRO, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BROADCOM

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EM MICROELECTRONIC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 E-PEAS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 HOLTEK SEMICONDUCTOR INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 LAPIS SEMICONDUCTOR CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 NUVOTON TECHNOLOGY CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PROFICHIP USA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SEIKO EPSON CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SILICON LABORATORIES

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZILOG, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 3 NORTH AMERICA ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 9 NORTH AMERICA GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 NORTH AMERICA ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 17 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 19 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 NORTH AMERICA SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 23 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 25 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 27 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 29 NORTH AMERICA 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 31 NORTH AMERICA 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 33 NORTH AMERICA 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 35 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 37 NORTH AMERICA WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 39 NORTH AMERICA WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 41 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 43 NORTH AMERICA MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 47 NORTH AMERICA LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 49 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 51 NORTH AMERICA 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 53 NORTH AMERICA 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 55 NORTH AMERICA MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 57 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 61 NORTH AMERICA SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 63 NORTH AMERICA FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 65 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 67 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 69 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 71 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 73 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 75 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 77 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 79 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 81 NORTH AMERICA MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 83 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 85 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 NORTH AMERICA IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 89 NORTH AMERICA MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 91 NORTH AMERICA SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 93 NORTH AMERICA MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 95 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 97 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 99 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 101 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 103 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 105 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 107 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 109 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 113 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 115 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 117 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 119 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 121 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 123 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 125 NORTH AMERICA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 129 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 131 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 133 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 135 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 137 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 139 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 140 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 141 U.S. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.S. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 143 U.S. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 145 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 147 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 148 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 149 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 150 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 151 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 152 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 153 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 155 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 157 U.S. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 U.S. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 161 U.S. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 163 U.S. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 165 U.S. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 167 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 168 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 169 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 171 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 172 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 173 CANADA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 CANADA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 175 CANADA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 CANADA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 177 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 178 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 179 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 180 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 181 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 183 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 184 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 185 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 187 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 188 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 189 CANADA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 CANADA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 CANADA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 CANADA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 193 CANADA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 CANADA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 195 CANADA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 CANADA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 197 CANADA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 199 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 201 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 203 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 204 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 205 MEXICO HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 MEXICO HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 207 MEXICO SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 MEXICO SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 209 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 210 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 211 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 212 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 213 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 214 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 215 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 216 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 217 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 219 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 220 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 221 MEXICO CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 MEXICO CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 MEXICO AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 MEXICO AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 225 MEXICO HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 MEXICO HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 227 MEXICO INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 MEXICO INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 229 MEXICO AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 MEXICO AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

Список рисунков

FIGURE 1 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS IS EXPECTED TO DRIVE THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 ANALOG DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET

FIGURE 16 SHARE OF ELECTRICITY FLOW THROUGH POWER ELECTRONICS IN THE U.S. (2005–2030) (IN %)

FIGURE 17 NUMBER OF WEARABLE DEVICES IN U.S. FROM 2014 TO 2019 (IN MILLIONS)

FIGURE 18 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2021

FIGURE 19 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2021

FIGURE 21 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2021

FIGURE 23 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2021

FIGURE 24 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2021

FIGURE 25 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2021

FIGURE 27 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY PERIPHERAL TYPE (2022-2029)

FIGURE 32 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.