Рынок серной кислоты в Северной Америке по сырью (металлургические заводы, элементарная сера, колчеданная руда и другие), форме (концентрированная, серная кислота Боме 66 градусов, кислота Башни/Гловера, камерная/удобрительная кислота, аккумуляторная кислота и разбавленная серная кислота), процессу производства (контактный процесс, процесс в свинцовой камере, процесс получения мокрой серной кислоты, метабисульфитный процесс и другие), каналу сбыта (офлайн и онлайн), применению (удобрения, химическое производство, нефтепереработка, металлообработка, автомобилестроение, текстиль, производство лекарств, целлюлозно-бумажная промышленность, промышленность и другие). Тенденции и прогнозы в отрасли до 2029 года.

Анализ и размер рынка серной кислоты в Северной Америке

Серная кислота — сильная кислота с гигроскопическими характеристиками и окислительными свойствами. Она используется в производстве удобрений, химической промышленности, синтетических тканей и пигментов. Другие области применения включают производство аккумуляторов, травление металла и другие промышленные производственные процессы. На рынке серная кислота доступна в различных концентрациях, таких как 98%, 96,5%, 76%, 70% и 38%. Большое количество серной кислоты используется для производства сульфатов калия и удобрений.

Серная кислота — это высококоррозионная, бесцветная вязкая жидкость и один из наиболее используемых химикатов в различных отраслях промышленности по производству удобрений, целлюлозно-бумажной, горнодобывающей и химической промышленности. Наибольшее количество серной кислоты используется для производства фосфорной кислоты, используемой, в свою очередь, для производства фосфатных удобрений, дигидрофосфата кальция и фосфатов аммония. Она также используется для производства сульфата аммония, необходимого удобрения в условиях дефицита серы.

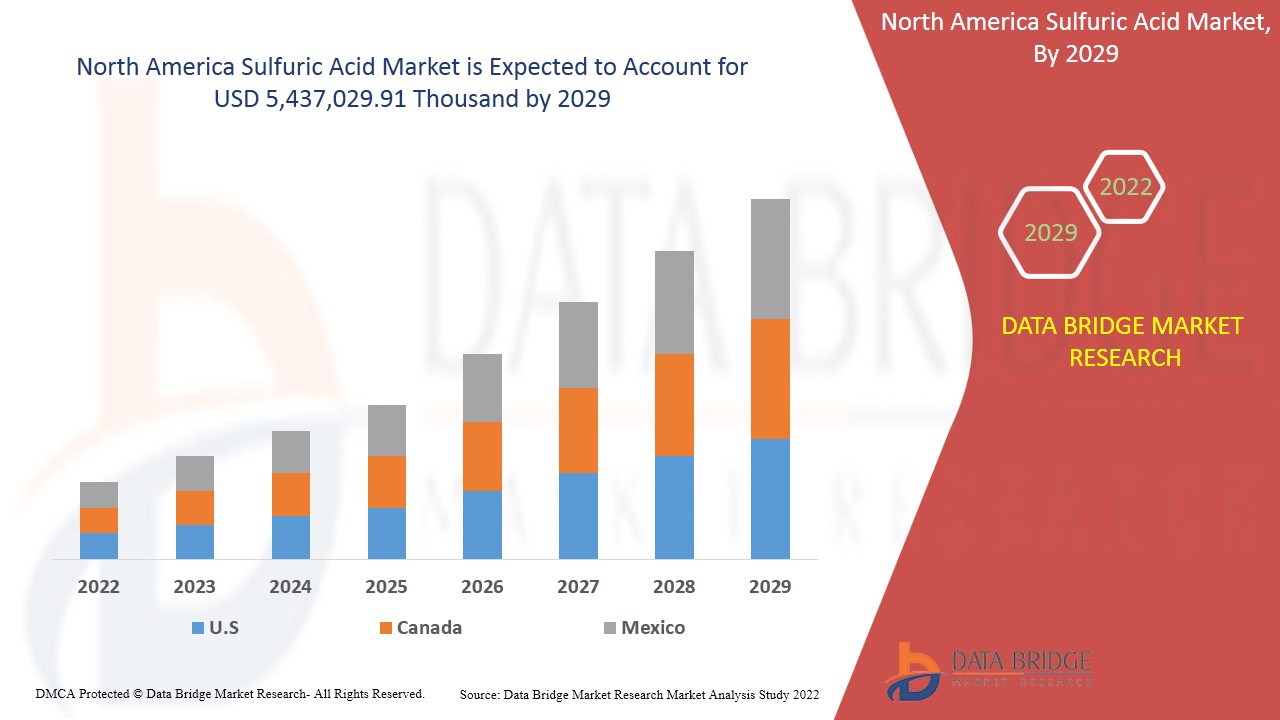

Растущий спрос на удобрения в сельскохозяйственной отрасли и растущий спрос на серную кислоту в различных отраслях промышленности являются одними из факторов, повышающих спрос на серную кислоту на рынке. Data Bridge Market Research анализирует, что рынок серной кислоты, как ожидается, достигнет значения 5 437 029,91 тыс. долларов США к 2029 году при среднегодовом темпе роста 3,5% в течение прогнозируемого периода. «Удобрения» составляют наиболее заметный сегмент применения на соответствующем рынке из-за роста спроса на удобрения на основе фосфата. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и сценарий климатической цепочки.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в тыс. долл. США, объемы в тыс. тонн, цены в долл. США |

|

Охваченные сегменты |

По сырью (металлоплавильные заводы, элементарная сера, колчеданная руда и другие), форме (концентрированная, 66-градусная серная кислота Боме, кислота Башни/Гловера, камерная/удобрительная кислота, аккумуляторная кислота и разбавленная серная кислота), процессу производства (контактный процесс, процесс свинцовой камеры, процесс получения влажной серной кислоты, метабисульфитный процесс и другие), каналу сбыта (офлайн и онлайн), применению (удобрения, химическое производство, нефтепереработка, металлообработка, автомобилестроение, текстиль, производство лекарств, целлюлозно-бумажная промышленность, промышленность и другие) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке |

|

Охваченные участники рынка |

LANXESS (Кельн, Германия), Brenntag GmbH (дочерняя компания Brenntag SE) (Эссен, Германия), Adisseo (Энтони, Франция), Veolia (Париж, Франция), Univar Solutions Inc (Иллинойс, США), NORAM Engineering & Construction Ltd. (Ванкувер, Канада), Nouryon (Амстердам, Нидерланды), International Raw Materials LTD (Пенсильвания, США), BASF SE (Людвигсхафен, Германия), Aurubis AG (Гамбург, Германия), Nyrstar (Бюдель, Нидерланды), Merck KGaA (Дармштадт, Германия), Shrieve (Техас, США) |

Определение рынка

Серная кислота — бесцветная, не имеющая запаха и вязкая жидкость, растворимая в воде при любых концентрациях. Это сильная кислота, получаемая путем окисления растворов диоксида серы и используемая в больших количествах в качестве промышленного и лабораторного реагента. Серная кислота или серная кислота, также известная как купоросное масло, — это минеральная кислота, состоящая из серы, кислорода и водорода, с молекулярной формулой H2SO4 и температурой плавления 10 °C, температурой кипения 337 °C. США являются крупнейшим потребителем удобрений из-за возросшего спроса на удобрения на основе серной кислоты в регионе.

Нормативная база

- ПРАВИЛА МИНИСТЕРСТВА ТРАНСПОРТА США: Серная кислота классифицируется как опасный груз в соответствии с правилами Министерства транспорта США в соответствии с 49 CFR 172.101. Идентификационный номер ООН: UN 2796 Правильное транспортное наименование: Серная кислота с содержанием кислоты не более 51 процента или аккумуляторная кислота, жидкая Номер и описание класса опасности: 8 (едкое вещество) Упаковочная группа: PG II DOT Требуется маркировка(и): Класс 8 (едкое вещество) Номер североамериканского руководства по реагированию на чрезвычайные ситуации (2012): 157

COVID-19 оказал минимальное влияние на рынок серной кислоты

COVID-19 повлиял на различные производственные отрасли в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако дисбаланс между спросом и предложением и его влияние на ценообразование считаются краткосрочными и, как ожидается, восстановятся по мере окончания этой пандемии. Из-за остановки производственных операций в различных отраслях по всему миру спрос на серную кислоту значительно снизился. Кроме того, из-за постоянно снижающихся потребностей в автомобильной нефтепереработке и многих других отраслях снижается маржа производителей, которую они получают от поставок серной кислоты. Однако правительства принимают меры по смягчению налогов, бюджетного дефицита и других мер, чтобы минимизировать последствия. Эти меры могут стабилизировать ситуацию с серной кислотой в будущем и помочь рынку расти так же, как до пандемии.

Динамика рынка серной кислоты включает:

- Растущий спрос на удобрения в сельскохозяйственной отрасли

Удобрение — это химический материал, добавляемый к культурам для повышения общей урожайности. Фермеры используют его для улучшения мощности почвы, что помогает увеличить производство культур. Он содержит основные питательные вещества, такие как (калий, азот и фосфор), необходимые для роста растений. Спрос на высококачественные удобрения в сельскохозяйственной отрасли растет. Несколько удобрений производятся из серной кислоты, что помогает увеличить урожайность и плодородие почвы. Серную кислоту можно легко смешивать с почвой и жидкими удобрениями.

- Растущий спрос на серную кислоту в различных отраслях промышленности

Серная кислота используется в металлообрабатывающей промышленности, производстве удобрений и сельском хозяйстве, автомобилестроении, нефте- и газопереработке и других отраслях. Она больше используется в чистящих средствах, используемых в металлообрабатывающей промышленности для очистки поверхности стального листа, известной как травление, и используется для удаления коррозии с изделий из железа. В удобрениях серная кислота производит суперфосфат извести и сульфат аммония. С ростом спроса на богатые питательными веществами продовольственные культуры потребность и использование серной кислоты в удобрениях увеличивается

- Значительный рост в химической промышленности

Химическая промышленность производит нефтехимические продукты, полимеры и промышленные химикаты. Серная кислота является необходимым товарным химикатом, используемым в основном для производства фосфорной кислоты . Она используется для производства нескольких химикатов с высоким спросом в химической промышленности. Рост рынка увеличивается из-за более высоких потребностей в соляной кислоте, азотной кислоте, сульфатных солях, синтетических моющих средствах, красителях и пигментах, взрывчатых веществах и других препаратах.

- Растущее использование в переработке отходов печатных плат

Отходы, образующиеся от электрических и электронных устройств, вызывают огромную озабоченность во всем мире. С сокращением жизненного цикла большинства электронных устройств и отсутствием подходящих технологий переработки в ближайшие годы будут образовываться огромные электронные и электрические отходы. Из отходов печатных плат извлекаются различные металлы, такие как золото, медь, никель, серебро, цинк, железо и платина. Извлечение из отходов печатных плат осуществляется с использованием таких процессов, как микроволновый пиролиз, кислотное выщелачивание, экстракция растворителем и окислительное осаждение. Эффективность выщелачивания меди составляет приблизительно 95% при использовании выщелачивающего агента, состоящего из серной кислоты и перекиси водорода.

- Растущий спрос на аккумуляторы в автомобильной промышленности

Использование серной кислоты в аккумуляторах помогает автомобилям сохранять энергию в течение длительного времени, тем самым обеспечивая более длительный срок службы аккумуляторов и транспортных средств. Таким образом, ожидается, что растущая автомобильная промышленность в сегменте электромобилей предоставит прибыльные возможности для роста рынка серной кислоты в Северной Америке.

- Обилие серы как сырья

При производстве серной кислоты различные элементы серы подвергаются нескольким процессам и производят кислотную форму серы. Во всем мире сера в изобилии доступна, что создает преимущество для производителей серной кислоты.

Ограничения/Проблемы, с которыми сталкивается рынок серной кислоты

- Опасности для здоровья, связанные с серной кислотой

Серная кислота — мощная дипротонная кислота. Она экзотермична по своей природе и проявляет гигроскопические свойства. Она является мощным окислителем и реагирует со многими металлами при высоких температурах. Концентрированная H2SO4 также является сильным дегидратирующим агентом. Добавление воды в концентрированную серную кислоту является мощной реакцией и может привести к взрывам. Таким образом, увеличение опасности для здоровья, связанной с использованием серной кислоты на коже, глазах и других органах, вероятно, будет препятствовать спросу на серную кислоту на рынке Северной Америки.

- Трудности, связанные с транспортировкой и обработкой серной кислоты

Серная кислота обладает дегидратирующими свойствами, поскольку серная кислота поглощает влагу и воду из окружающей среды. Это бесцветное соединение, которое является токсичным и должно храниться и поддерживаться в определенном диапазоне температур. Его перевозят и транспортируют в резервуаре или контейнере из нержавеющей стали с минимальной концентрацией около 90% и температурой не выше 35ºC. Кроме того, ожидается, что опасения, связанные с транспортировкой и обработкой серной кислоты, будут бросать вызов рынку серной кислоты в прогнозируемый период 2022-2029 гг.

В этом отчете о рынке серной кислоты содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке серной кислоты, свяжитесь с Data Bridge Market Research для получения аналитического обзора . Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Последние события

- В ноябре 2020 года Airedale Chemical Company Limited приобрела компанию Alutech, которая предлагает ряд решений по обработке металлов, включая отбеливатели алюминия и очистители для предварительной обработки. Это развитие помогает компании увеличить спрос на серную кислоту, что увеличило ее прибыль.

- В мае 2017 года BASF SE представила новый катализатор серной кислоты, предпочтительный из-за его уникальной геометрической формы. Это обновление помогает компании увеличить производственные мощности, что в будущем принесет доход.

Масштаб рынка серной кислоты в Северной Америке

Рынок серной кислоты сегментирован на основе сырья, формы, производственного процесса, канала сбыта и применения. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Сырье

- Плавильные заводы основных металлов

- Элементарная сера

- Пиритовая руда

- Другие

На основе сырья рынок серной кислоты сегментирован на плавильные заводы, элементарную серу, пиритную руду и др. Элементарная сера составляет крупнейший рынок и, как ожидается, будет демонстрировать высокие темпы роста из-за обильной доступности серы по всему миру.

Форма

- Концентрированный (98%)

- Кислота Тауэра/Гловера (77,67%)

- Камера/Удобрение Кислота (62,8%)

- Аккумуляторная кислота (33,5%)

- Серная кислота Боме 66 градусов (93%)

- Разбавленная серная кислота (10%)

На основе формы рынок серной кислоты сегментирован на концентрированную (98%), башенную/перчаточную кислоту (77,67%), камерную/удобрительную кислоту (62,8%), аккумуляторную кислоту (33,5%), 66-градусную серную кислоту Боме (93%) и разбавленную серную кислоту (10%). Камерная/удобрительная кислота (62,8%) занимает крупнейший рынок и, как ожидается, будет демонстрировать высокий рост, поскольку она доступна в высоком кислотном диапазоне и снижает уровень pH почвы, что улучшает усвоение питательных веществ.

Процесс производства

- Процесс контакта

- Процесс в свинцовой камере

- Процесс получения мокрой серной кислоты

- Процесс метабисульфита

- Другие

На основе производственного процесса рынок серной кислоты сегментируется на контактный процесс, процесс в свинцовой камере, процесс мокрой серной кислоты, метабисульфитный процесс и др. Контактный процесс занимает самый большой рынок и, как ожидается, будет демонстрировать высокий рост, поскольку он снижает выбросы вредных газов при производстве серной кислоты.

Канал распространения

- Оффлайн

- Онлайн

На основе канала сбыта североамериканский рынок серной кислоты сегментирован на офлайн и онлайн. Офлайн сегмент составляет крупнейший рынок, и ожидается, что он будет демонстрировать высокий рост, поскольку транспортировка большого количества в соседнюю страну проста.

Приложение

- Удобрения

- Химическое производство

- Переработка нефти

- Обработка металла

- Автомобильный

- Текстиль

- Производство лекарств

- Целлюлозно-бумажная промышленность

- Промышленный

- Другие

На основе сферы применения рынок серной кислоты сегментируется на удобрения, химическое производство, нефтепереработку, металлообработку, автомобилестроение, текстиль, производство лекарств, целлюлозно-бумажную промышленность, промышленность и др. Ожидается, что удобрения будут доминировать в сегменте применения, поскольку спрос на серные удобрения растет для выращивания сельскохозяйственных культур и повышения плодородия почв.

Региональный анализ/анализ рынка серной кислоты

Проведен анализ рынка серной кислоты, а также предоставлены сведения о размерах рынка и тенденциях по странам, сырью, форме, производственному процессу, каналу сбыта и области применения, как указано выше.

В отчете по рынку серной кислоты рассматриваются следующие страны: США, Канада и Мексика в Северной Америке.

США доминируют на рынке серной кислоты из-за присутствия большого количества производителей и растущего спроса со стороны различных отраслей промышленности, таких как химическое производство удобрений и т. д. Ожидается, что в США будет наблюдаться значительный рост в прогнозируемый период с 2022 по 2029 год из-за растущего спроса на аккумуляторы в автомобильной промышленности региона.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка серной кислоты

Конкурентная среда рынка серной кислоты содержит сведения по конкурентам. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии в Северной Америке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании в применении. Приведенные выше данные касаются только фокуса компаний на рынке серной кислоты.

Среди основных игроков, работающих на рынке серной кислоты, можно назвать LANXESS, Brenntag GmbH (дочерняя компания Brenntag SE), Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, BASF SE, Aurubis AG, Nyrstar, Merck KGaA, Shrieve и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE NORTH AMERICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 NORTH AMERICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 NORTH AMERICA SULFURIC ACID MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 NORTH AMERICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 NORTH AMERICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 NORTH AMERICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 NORTH AMERICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 NORTH AMERICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.S. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.S. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.S. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.S. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.S. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.S. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 CANADA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 CANADA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 CANADA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 CANADA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 CANADA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 CANADA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 CANADA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 CANADA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 CANADA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 CANADA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 CANADA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 CANADA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 CANADA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 CANADA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 MEXICO SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 MEXICO SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 MEXICO SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 MEXICO SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 MEXICO FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 MEXICO PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 MEXICO METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 MEXICO DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 MEXICO CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 MEXICO CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 MEXICO TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 MEXICO INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 MEXICO AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 MEXICO PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 MEXICO OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

Список рисунков

FIGURE 1 NORTH AMERICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SULFURIC ACID MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF NORTH AMERICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 NORTH AMERICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 NORTH AMERICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 NORTH AMERICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 NORTH AMERICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 NORTH AMERICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.