North America Pv Module Encapsulant Film Market

Размер рынка в млрд долларов США

CAGR :

%

USD

386.62 Million

USD

1,438.59 Million

2024

2032

USD

386.62 Million

USD

1,438.59 Million

2024

2032

| 2025 –2032 | |

| USD 386.62 Million | |

| USD 1,438.59 Million | |

|

|

|

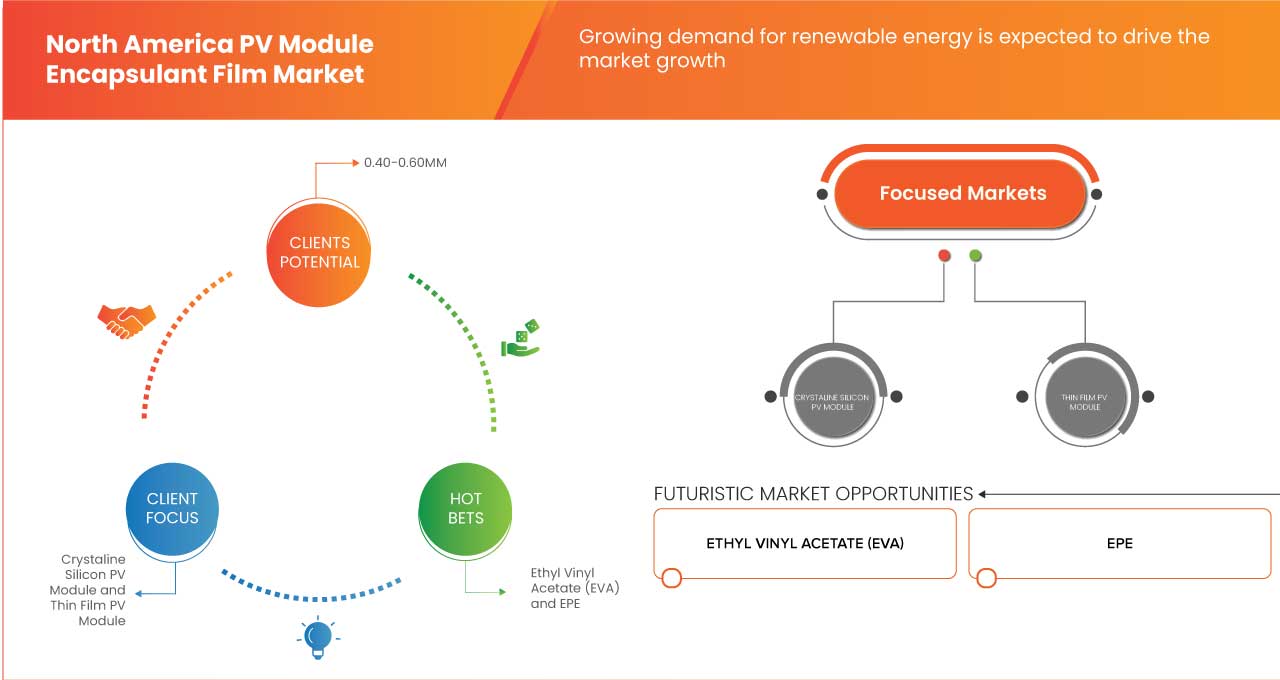

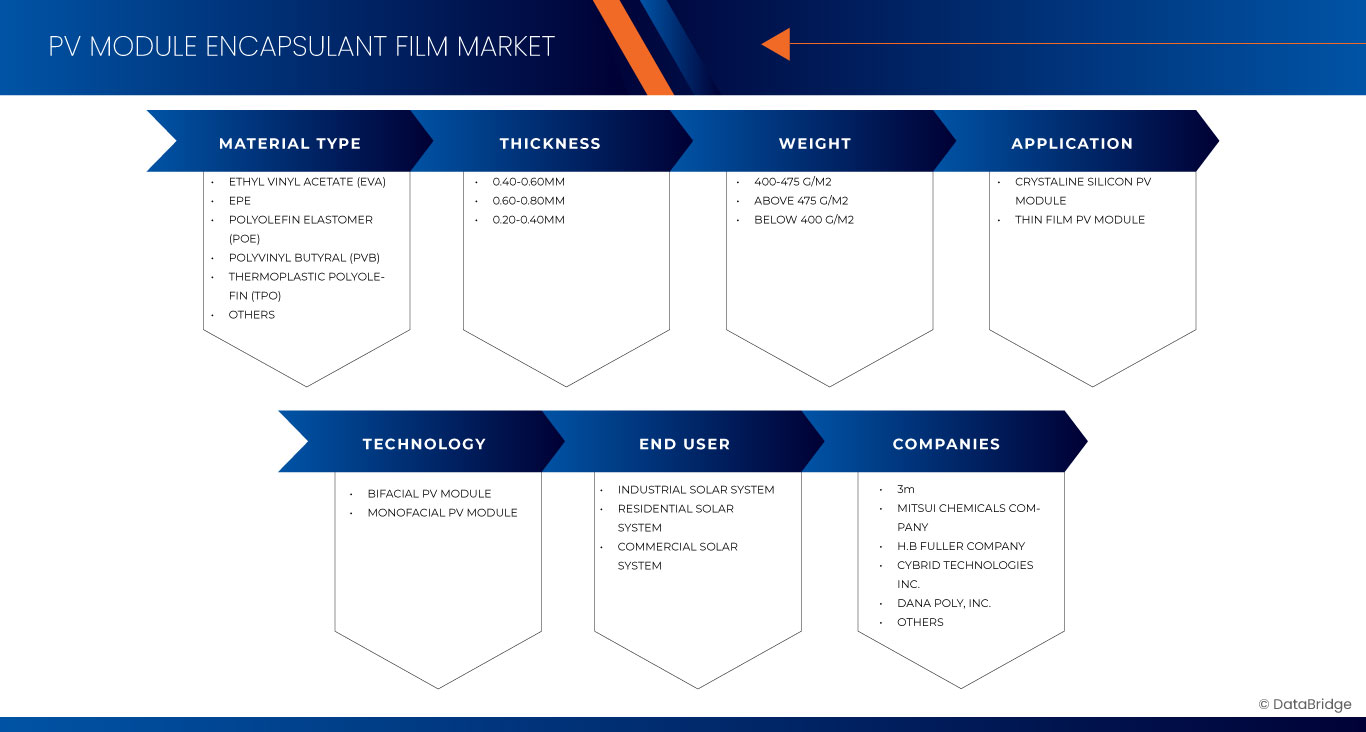

North America PV Module Encapsulant Film Market Segmentation, By Material Type (Ethyl Vinyl Acetate (EVA), EPE, Polyolefin Elastomer (POE), Polyvinyl Butyral (PVB), Thermoplastic Polyolefin (TPO), and others), Thickness (0.40-0.60MM, 0.60-0.80MM, and 0.20-0.40MM), Weight (400-475 G/M2, Above 475 G/M2, and Below 400 G/M2), Application (Crystaline Silicon PV Module, and Thin Film PV Module), Technology (Bifacial PV Module and Monofacial PV Module), End Use (Industrial Solar System, Residential Solar System, and Commercial Solar System) – Industry Trends and Forecast to 2032

North America PV Module Encapsulant Film Market Analysis

A PV module encapsulant film is a crucial component in solar panels, designed to protect and enhance the performance of photovoltaic (PV) cells. These films, typically made from materials like ethylene-vinyl acetate (EVA), act as a protective layer that insulates the solar cells from environmental factors such as moisture, dust, and UV radiation. This encapsulation ensures the durability and longevity of the solar panels, making them more reliable and efficient.

The market for PV module encapsulant films is growing in North America due to several factors. The increasing demand for renewable energy sources, driven by government initiatives and policies promoting solar energy, is a significant driver. Additionally, advancements in encapsulation materials and technologies have improved the efficiency and cost-effectiveness of solar panels, further boosting their adoption. The growing awareness of climate change and the need for sustainable energy solutions also contribute to the rising demand for PV module encapsulant films in the region.

North America PV Module Encapsulant Film Market Size

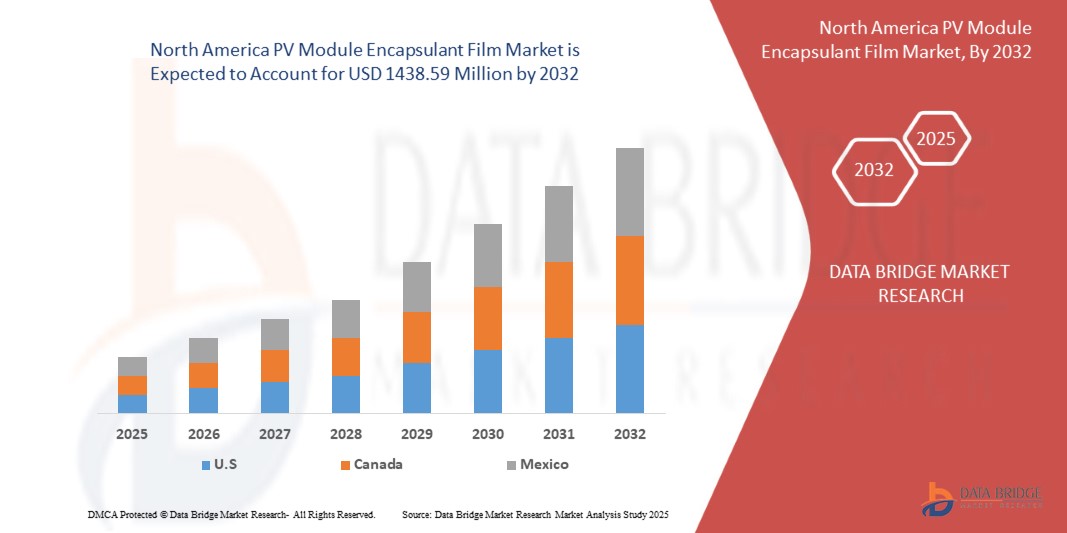

The North America PV module encapsulant film market is expected to reach USD 1438.59 million by 2032 from USD 386.62 million in 2024, growing with a substantial CAGR of 18.2% in the forecast period of 2025 to 2032.

North America PV module encapsulant film market Trends

“Increasing Installation of Rooftop Solar by Commercial and Residential Sectors”

The rising installation of rooftop solar systems in both the commercial and residential sectors is one of the most significant drivers for the growth of the North America PV Module Encapsulant Film Market. This shift toward solar energy is largely driven by the increasing demand for clean, renewable energy, government incentives, and the falling cost of solar technology. As more commercial buildings and homes adopt solar panels, the need for high-quality, durable encapsulant films has surged.

В коммерческом секторе многие предприятия обращаются к солнечным установкам на крышах, чтобы сократить расходы на электроэнергию и достичь целей устойчивого развития. Компании, от крупных розничных торговцев до производственных предприятий, все чаще используют солнечные панели, чтобы сократить расходы на электроэнергию и минимизировать свой углеродный след. Эти крупномасштабные установки требуют высокопроизводительных инкапсулирующих пленок, чтобы гарантировать долговечность и производительность солнечных модулей с течением времени. Инкапсулирующие пленки обеспечивают необходимую защиту от факторов окружающей среды, таких как влажность, УФ-излучение и механическое напряжение, гарантируя, что солнечные панели будут работать с оптимальной эффективностью.

Область отчета и сегментация рынка

|

Атрибуты |

Обзор рынка инкапсулированной пленки для фотоэлектрических модулей в Северной Америке |

|

Охваченные сегменты |

По типу материала : этилвинилацетат (EVA), EPE, полиолефиновый эластомер (POE), поливинилбутираль (PVB), термопластичный полиолефин (TPO) и другие По толщине : 0,40-0,60 мм, 0,60-0,80 мм и 0,20-0,40 мм По весу : 400-475 г/м2, выше 475 г/м2 и ниже 400 г/м2 По применению : (кристаллический кремниевый фотоэлектрический модуль, тонкопленочный фотоэлектрический модуль) и технологии (двусторонний фотоэлектрический модуль и односторонний фотоэлектрический модуль) По технологии : двусторонний фотоэлектрический модуль и односторонний фотоэлектрический модуль По конечному использованию : промышленная солнечная система, бытовая солнечная система и коммерческая солнечная система |

|

Страны, охваченные |

США, Канада и Мексика |

|

Ключевые игроки рынка |

3M (США), Mitsui Chemicals Company (Япония), HB Fuller Company (США), Cybrid Technologies Inc. (Китай), Dana Poly, Inc. (США) и JA Solar Technology Co.,Ltd. (Китай) |

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Определение рынка инкапсулированной пленки для фотоэлектрических модулей в Северной Америке

PV-пленка-герметик — это защитный слой, используемый в фотоэлектрических (PV) модулях для защиты солнечных элементов от факторов окружающей среды, таких как влага, пыль и механические повреждения, обеспечивая их долгосрочную производительность и прочность. Эти пленки обычно изготавливаются из таких материалов, как этиленвинилацетат (EVA), полиолефины (POE) или другие современные полимеры.

Динамика рынка инкапсулированной пленки для фотоэлектрических модулей в Северной Америке

Драйверы

- Растущий спрос на возобновляемые источники энергии

Рынок инкапсуляционной пленки для фотоэлектрических (PV) модулей в Северной Америке переживает значительный рост, обусловленный в основном растущим спросом на возобновляемые источники энергии, в частности, на солнечную энергию. Переход к более чистым, более устойчивым энергетическим решениям стал доминирующей тенденцией, поскольку правительства и предприятия отдают приоритет сокращению выбросов углерода и принятию альтернативных источников зеленой энергии. В результате резко возрос спрос на солнечные фотоэлектрические системы, что, в свою очередь, стимулирует рост рынка инкапсуляционной пленки для фотоэлектрических модулей.

Инкапсулирующие пленки являются важнейшими компонентами солнечных панелей, поскольку они обеспечивают структурную поддержку, защищают ячейки от воздействия окружающей среды и повышают общую производительность и долговечность фотоэлектрических модулей. Эти пленки, обычно изготавливаемые из таких материалов, как этиленвинилацетат (EVA), жизненно важны для обеспечения долговечности солнечных модулей, что важно, учитывая долгосрочный характер инвестиций в солнечную энергетику. С расширением солнечных установок растет спрос на высококачественные инкапсулирующие пленки, чтобы гарантировать надежность и эффективность солнечных панелей с течением времени.

Например,

- Согласно статье REN21, в 2023 году спрос на возобновляемые источники энергии будет расти, а в Северной Америке будет наблюдаться значительное внедрение солнечной энергии. Этот рост стимулирует рынок инкапсуляционных пленок для фотоэлектрических модулей, поскольку инкапсуляционные пленки защищают солнечные панели, обеспечивая долговечность. Расширение солнечной мощности подчеркивает приверженность региона к устойчивому удовлетворению энергетических потребностей и снижению зависимости от ископаемого топлива

- Согласно статье IRENA, в сентябре 2024 года рост возобновляемой энергии, при этом затраты на солнечную и ветровую энергию достигнут исторического минимума. В Северной Америке этот всплеск подпитывает рынок инкапсулирующей пленки для фотоэлектрических модулей, поскольку солнечные установки быстро расширяются, что обусловлено доступностью, целями устойчивого развития и политикой, поддерживающей внедрение возобновляемой энергии в жилом и коммерческом секторах

Технологические достижения и инновации в области инкапсулированных пленок

Североамериканский рынок инкапсуляционной пленки для фотоэлектрических (PV) модулей переживает устойчивый рост, в значительной степени обусловленный технологическими достижениями и инновациями в материалах инкапсуляционной пленки и производственных процессах. Инкапсуляционные пленки являются важнейшими компонентами фотоэлектрических (PV) модулей, поскольку они защищают солнечные элементы от влаги, УФ-излучения и механических напряжений, обеспечивая при этом эффективную светопропускаемость и электроизоляцию.

Инновации в технологии инкапсуляционной пленки направлены на повышение производительности, долговечности и экологической устойчивости. Разработка современных материалов, таких как этиленвинилацетат (EVA) с улучшенными свойствами сшивания, термопластичные полиолефины (TPO) и поливинилбутираль (PVB), привела к инкапсулянтам с превосходной термической стабильностью и устойчивостью к расслаиванию. Эти инновации имеют решающее значение, поскольку солнечные панели подвергаются воздействию суровых условий окружающей среды в течение 20–30 лет.

Например,

- В феврале 2024 года, согласно статье Королевского химического общества, инновации в инкапсуляционных материалах, таких как термопластичные полиолефины (ТПО) и усовершенствованные прозрачные проводящие пленки. Эти материалы повышают долговечность солнечных панелей, эффективность и адаптивность к двусторонним технологиям. Такие достижения стимулируют североамериканский рынок инкапсуляционных пленок для фотоэлектрических модулей, что соответствует растущему принятию высокопроизводительных солнечных энергетических систем

- В январе 2023 года, согласно статье John Wiley & Sons, Inc, инновации в инкапсуляционных пленках, включая термопластичные материалы и УФ-стабилизированные полимеры, которые повышают эффективность и срок службы солнечных панелей. Эти достижения отвечают растущему принятию двусторонних и тандемных фотоэлектрических технологий, стимулируя североамериканский рынок инкапсуляционных пленок для фотоэлектрических модулей в ответ на ускоряющееся расширение возобновляемой энергетики в регионе

Возможности

- Прогресс в области двусторонних солнечных модулей

Североамериканский рынок инкапсуляционных пленок для фотоэлектрических (PV) модулей стал свидетелем значительных возможностей, в первую очередь обусловленных достижениями в области двусторонних солнечных модулей. Двусторонние солнечные модули, которые захватывают солнечный свет как с передней, так и с задней стороны панели, обеспечивают более высокую энергоэффективность и производительность по сравнению с традиционными односторонними солнечными панелями. По мере роста внедрения двусторонних модулей ожидается рост спроса на усовершенствованные инкапсуляционные пленки, являющиеся ключевым компонентом этих модулей.

Герметизирующие пленки играют важную роль в фотоэлектрических модулях, обеспечивая структурную целостность, долговечность и защиту от факторов окружающей среды, таких как влажность, колебания температуры и УФ-излучение. Развитие двусторонних солнечных технологий выдвинуло необходимость в герметизирующих пленках, которые могут поддерживать уникальный дизайн и эксплуатационные характеристики этих модулей. В отличие от традиционных односторонних панелей, двусторонние модули часто устанавливаются в средах, где они могут использовать отраженный свет, и, как таковые, герметизирующие пленки должны быть оптимизированы для этого двустороннего сбора энергии.

Одним из основных достижений в технологии инкапсуляции для двусторонних модулей является разработка прозрачных, высокопрочных и эффективных материалов, которые пропускают больше света к задней стороне солнечных элементов. Эта прозрачность в сочетании с улучшенной влагостойкостью и устойчивостью к УФ-излучению повышает общую выработку энергии и долговечность панелей.

Например,

- В октябре 2023 года, согласно статье Mibet Energy, Достижения в области двусторонних солнечных модулей значительно повысили их эффективность за счет захвата солнечного света как с передней, так и с задней стороны панели. Эти инновации включают в себя повышенную долговечность с закаленным стеклом, которое устойчиво к повреждениям от ультрафиолета и экстремальным погодным условиям. Двусторонние панели также обеспечивают лучшую производительность при рассеянном свете, меньшую деградацию с течением времени и более длительные гарантии по сравнению с односторонними панелями, что делает их идеальными для коммерческих и коммунальных приложений

Рост двусторонних солнечных модулей открывает значительные возможности для североамериканского рынка инкапсуляционной пленки для фотоэлектрических модулей. Достижения в технологии инкапсуляции, предлагающие улучшенную прозрачность, долговечность и производительность, соответствуют растущему спросу на более высокую эффективность солнечной энергии. Эта тенденция будет стимулировать инновации и позиционировать Северную Америку как ключевого игрока в переходе на возобновляемые источники энергии.

Сдержанность/Вызов

- Высокие первоначальные капитальные затраты

Высокие первоначальные капитальные затраты, связанные с солнечными фотоэлектрическими (PV) системами, остаются основным сдерживающим фактором. Внедрение солнечной энергии требует существенных первоначальных инвестиций, включая стоимость солнечных панелей, инверторов, установки и инкапсулирующих пленок, что влияет на процесс принятия решений как для коммерческого, так и для жилого сектора.

Для коммерческих и частных клиентов первоначальные капитальные затраты на солнечную фотоэлектрическую систему могут быть пугающими. Хотя солнечная энергия обещает долгосрочную экономию, первоначальные затраты на покупку и установку системы остаются высокими. Герметизирующие пленки, которые защищают солнечные элементы и увеличивают долговечность фотоэлектрических модулей, являются критически важным компонентом общей стоимости солнечной системы. Хотя эти пленки необходимы для обеспечения высокой производительности, их стоимость вносит свой вклад в общее финансовое бремя. Для частных клиентов, даже с такими стимулами, как налоговые льготы и скидки, общие первоначальные расходы часто рассматриваются как непомерные, особенно для тех, у кого ограниченный доступ к финансированию или капиталу.

Масштаб рынка инкапсуляционной пленки для фотоэлектрических модулей в Северной Америке

Рынок сегментирован на основе типа материала, толщины, веса, применения, технологии и конечного использования. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

По типу материала

- Этилвинилацетат (ЭВА)

- Этилвинилацетат (ЭВА), ПО ТИПУ МАТЕРИАЛА

- Прозрачный ЭВА

- Белый ЭВА

- Анти-ПИД EVA

- Этилвинилацетат (ЭВА), ПО ТИПУ МАТЕРИАЛА

- ЭПЕ

- Полиолефиновый эластомер (ПОЭ)

- Поливинилбутираль (ПВБ)

- Термопластичный полиолефин (ТПО)

- Другие

По толщине

- 0,40-0,60 ММ

- 0,60-0,80 ММ

- 0,20-0,40 ММ

По весу

- 400-475 Г/М2

- ВЫШЕ 475 Г/М2

- НИЖЕ 400 Г/М2

По применению

- Фотоэлектрический модуль из кристаллического кремния

- Фотоэлектрический модуль из кристаллического кремния, ПО ТИПУ

- Поликристаллический модульный клей

- Монокристаллический модульный клей

- Фотоэлектрический модуль из кристаллического кремния, ПО ТИПУ

- Тонкопленочный фотоэлектрический модуль

По технологии

- Двусторонний фотоэлектрический модуль

- Односторонний фотоэлектрический модуль

По конечному использованию

- Промышленная солнечная система

- Жилая солнечная система

- Коммерческая солнечная система

Региональный анализ рынка инкапсулированной пленки для фотоэлектрических модулей в Северной Америке

Анализ рынка и предоставление информации о его размерах и тенденциях. Рынок сегментирован по типу материала, толщине, весу, применению, технологии и конечному использованию.

Страны, охваченные рынком: США, Канада, Мексика.

Ожидается, что США будут доминировать на рынке и станут самой быстрорастущей страной благодаря технологическим достижениям и инновациям в области инкапсулированных пленок.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка внутри страны, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран.

Кроме того, при проведении прогнозного анализа данных по стране учитываются наличие и доступность брендов Северной Америки, а также проблемы, с которыми они сталкиваются из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка инкапсулирующей пленки для фотоэлектрических модулей в Северной Америке

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии в Северной Америке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Лидерами рынка инкапсуляционной пленки для фотоэлектрических модулей в Северной Америке являются:

- 3M (США)

- Mitsui Chemicals Company (Япония)

- Компания HB Fuller (США)

- Cybrid Technologies Inc. (Китай)

- Dana Poly, Inc. (США)

- JA Solar Technology Co.,Ltd. (Китай)

Последние разработки на рынке инкапсуляционной пленки для фотоэлектрических модулей в Северной Америке

- В сентябре 2024 года компания HB Fuller приобрела HS Butyl Limited, ведущего производителя высококачественных бутиловых лент в Великобритании. Это приобретение укрепляет позиции HB Fuller на мировом рынке гидроизоляционных лент и расширяет ее присутствие в Европе, где рынок значительно больше, чем в Северной Америке. Оно также открывает возможности для роста в области инженерных клеев

- В мае 2024 года компания HB Fuller приобрела ND Industries, лидера в области решений для фиксации и герметизации крепежных деталей. Это приобретение расширяет предложения HB Fuller в таких быстрорастущих секторах, как автомобилестроение, электроника и аэрокосмическая промышленность. Бренд Vibra-Tite компании ND Industries и ее опыт в области предварительно нанесенных покрытий расширяют возможности HB Fuller в области инженерных клеев, создавая новые возможности для инноваций и решений для клиентов

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 PRICE AND COST COMPETITIVENESS

4.6.3 SUPPLY CHAIN RELIABILITY AND LEAD TIMES

4.6.4 TECHNICAL CAPABILITIES AND EXPERTISE

4.6.5 SUSTAINABILITY AND COMPLIANCE

4.6.6 REPUTATION AND TRACK RECORD

4.6.7 INNOVATION AND LONG-TERM PARTNERSHIP

4.6.8 RISK MITIGATION AND FINANCIAL STABILITY

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT'S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 PRODUCTION CAPACITY OVERVIEW

4.8.1 MARKET DEMAND FOR SOLAR ENERGY

4.8.2 TECHNOLOGICAL ADVANCEMENTS IN ENCAPSULANT FILM MATERIALS

4.8.3 RAW MATERIAL AVAILABILITY AND SUPPLY CHAIN DYNAMICS

4.8.4 REGULATORY AND POLICY INFLUENCES

4.8.5 COMPETITIVE LANDSCAPE AND KEY PLAYERS

4.9 RAW MATERIAL COVERAGE

4.9.1 ETHYLENE VINYL ACETATE (EVA)

4.9.1.1 TRANSPARENT EVA

4.9.1.2 WHITE EVA

4.9.1.3 ANTI-PID EVA

4.9.2 POLYVINYL BUTYRAL (PVB)

4.9.3 POLYOLEFIN ELASTOMER (POE)

4.9.4 THERMOPLASTIC POLYOLEFIN (TPO)

4.9.5 EPE

4.9.6 OTHERS (IONOMERS AND SILICONES)

4.9.7 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGY ADVANCEMENTS BY MANUFACTURERS

4.11.1 ADVANCED MATERIAL CHEMISTRY AND FORMULATION

4.11.2 IMPROVED OPTICAL PROPERTIES AND EFFICIENCY

4.11.3 DEVELOPMENT OF NEW MATERIALS FOR ENCAPSULANT FILMS

4.11.4 ADVANCED MANUFACTURING MACHINES FOR SHRINKAGE-RESISTANT FILMS

4.11.5 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR RENEWABLE ENERGY

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN ENCAPSULANT FILMS

6.1.3 INCREASING INSTALLATION OF ROOFTOP SOLAR BY COMMERCIAL AND RESIDENTIAL SECTORS

6.1.4 DECLINING COSTS OF SOLAR PV COMPONENTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL CAPITAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE ENERGY SOURCES

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENT IN BIFACIAL SOLAR MODULES

6.3.2 LARGE-SCALE SOLAR PROJECTS, SUPPORTED BY FEDERAL AND STATE-LEVEL INCENTIVES

6.3.3 CIRCULAR ECONOMY AND SUSTAINABILITY INITIATIVES

6.4 CHALLENGES

6.4.1 PERFORMANCE DEGRADATION ISSUES

6.4.2 STRINGENT REGULATIONS AND EVOLVING SAFETY STANDARDS

7 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 ETHYL VINYL ACETATE (EVA)

7.2.1 ETHYL VINYL ACETATE (EVA), BY MATERIAL TYPE

7.3 EPE

7.4 POLYOLEFIN ELASTOMER (POE)

7.5 POLYVINYL BUTYRAL (PVB)

7.6 THERMOPLASTIC POLYOLEFIN (TPO)

7.7 OTHERS

8 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY THICKNESS

8.1 2.1 OVERVIEW

8.2 0.40-0.60MM

8.3 0.60-0.80MM

8.4 0.20-0.40MM

9 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY WEIGHT

9.1 OVERVIEW

9.2 400-475 G/M2

9.3 ABOVE 475 G/M2

9.4 BELOW 400 G/M2

10 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CRYSTALINE SILICON PV MODULE

10.2.1 CRYSTALINE SILICON PV MODULE, BY TYPE

10.3 THIN FILM PV MODULE

11 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 BIFACIAL PV MODULE

11.3 MONOFACIAL PV MODULE

12 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY END USE

12.1 OVERVIEW

12.2 INDUSTRIAL SOLAR SYSTEM

12.3 RESIDENTIAL SOLAR SYSTEM

12.4 COMMERCIAL SOLAR SYSTEM

13 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 3M

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MITSUI CHEMICALS ICT MATERIA, INC

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 H.B. FULLER COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CYBRID TECHNOLOGIES INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 DANA POLY, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 JA SOLAR TECHNOLOGY CO.,LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 REGULATION COVERAGE

TABLE 2 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 4 NORTH AMERICA ETHYL VINYL ACETATE (EVA) IN PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA CRYSTALINE SILICON PV MODULE IN PV MODULE ENCAPSULANT FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 13 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 15 U.S. ETHYL VINYL ACETATE (EVA) IN PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. CRYSTALINE SILICON PV MODULE IN PV MODULE ENCAPSULANT FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. PV MODULE ENCAPSULANT FILM MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 22 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 24 CANADA ETHYL VINYL ACETATE (EVA) IN PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 26 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 27 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 28 CANADA CRYSTALINE SILICON PV MODULE IN PV MODULE ENCAPSULANT FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 30 CANADA PV MODULE ENCAPSULANT FILM MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 31 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 33 MEXICO ETHYL VINYL ACETATE (EVA) IN PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 35 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 36 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MEXICO CRYSTALINE SILICON PV MODULE IN PV MODULE ENCAPSULANT FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO PV MODULE ENCAPSULANT FILM MARKET, BY END USE, 2018-2032 (USD THOUSAND)

Список рисунков

FIGURE 1 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET

FIGURE 2 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: REGIONAL VS COUNTRIES MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: SEGMENTATION

FIGURE 12 SIX SEGMENTS COMPRISE NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, BY MATERIAL (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR RENEWABLE ENERGY IS EXPECTED TO DRIVE THE NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET IN THE FORECAST PERIOD

FIGURE 16 THE ETHYL VINYL ACETATE (EVA) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL LIDAR MARKET

FIGURE 24 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY MATERIAL TYPE, 2024

FIGURE 25 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY THICKNESS, 2024

FIGURE 26 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY WEIGHT, 2024

FIGURE 27 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY TECHNOLOGY, 2024

FIGURE 29 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: BY END USE, 2024

FIGURE 30 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: SNAPSHOT (2024)

FIGURE 31 NORTH AMERICA PV MODULE ENCAPSULANT FILM MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.