Рынок услуг по обеспечению безопасности технологических процессов в Северной Америке по предложению (решения и услуги), уровню полноты безопасности (уровень 1, уровень 2, уровень 3 и уровень 4), конечному пользователю (непрерывное производство, автомобилестроение и дискретное производство, коммунальные услуги, государственный сектор, строительство и недвижимость, розничная торговля и другие). Отраслевые тенденции и прогноз до 2030 года.

Анализ и размер рынка услуг по обеспечению безопасности технологических процессов в Северной Америке

Рынок услуг по обеспечению безопасности процессов демонстрирует высокий рост из-за все более широкого внедрения норм и стандартов безопасности в различных отраслевых вертикалях, таких как нефть и газ, фармацевтика, продукты питания и напитки и другие. Отрасли стали более строгими к нормам безопасности, поскольку инциденты могут повлечь за собой большие потери для отрасли как с точки зрения жизни, так и имущества. Отрасли сосредоточены на внедрении решений по безопасности и проведении анализа опасностей для определения факторов риска и дополнительных процессов для снижения этих рисков. Более того, с ростом цифровизации разработка систем безопасности процессов обеспечивает автоматизацию в соответствии и легкую интеграцию с системами управления организаций. Это обеспечивает безотказный контроль всего процесса и помогает оптимизировать производительность и прибыль.

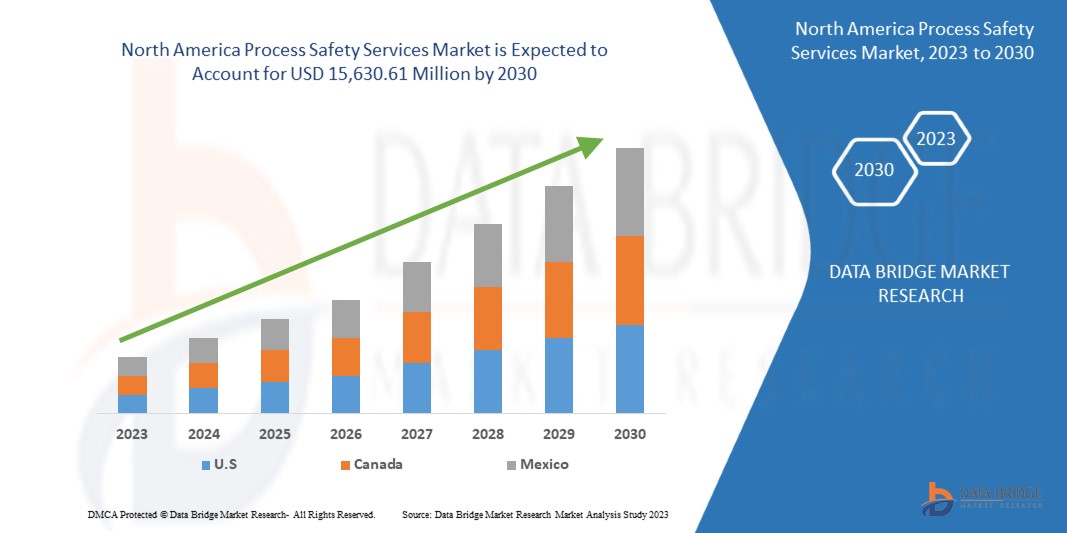

Data Bridge Market Research анализирует, что рынок услуг по безопасности процессов в Северной Америке, как ожидается, достигнет значения 15 630,61 млн долларов США к 2030 году, при среднегодовом темпе роста 11,4% в течение прогнозируемого периода. Отчет о рынке услуг по безопасности процессов в Северной Америке также всесторонне охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2023-2030 |

|

Базовый год |

2022 |

|

Исторические годы |

2021 (можно настроить на 2015-2020) |

|

Количественные единицы |

Доход в миллионах, цены в долларах США |

|

Охваченные сегменты |

По предложению (решения и услуги), уровню полноты безопасности (уровень 2, уровень 3, уровень 1 и уровень 4), конечному пользователю (непрерывное производство, автомобилестроение и дискретное производство, коммунальные услуги, правительство, строительство и недвижимость, розничная торговля и другие) |

|

Охваченные регионы |

США, Канада и Мексика |

|

Охваченные участники рынка |

Siemens, Johnson Controls, Honeywell International Inc., Emerson Electric Co., Schneider Electric, Bureau Veritas, SGS SA, Rockwell Automation, ABB, DEKRA, OMRON Corporation, Intertek Group plc, TÜV SÜD, SOCOTEC, MISTRAS Group, HIMA, Ingenero, Inc., Smith & Burgess Process Safety Consulting, Process Engineering Associates, and LLC, ioKinetic, LLC и другие |

Определение рынка

Безопасность процессов — это структура управления целостностью операционных систем и процессов, которые обрабатывают опасные вещества. Она опирается на принципы хорошего проектирования, инжиниринга, а также практики эксплуатации и обслуживания. Она занимается предотвращением и контролем событий, которые могут высвобождать опасные материалы и энергию. Услуги и управление безопасностью процессов включают проектирование, сертификацию, проверку и тестирование процессов в соответствующих отраслях или организациях для предотвращения опасных аварий, проблем с качеством, повреждений цепочки поставок и оборудования. Услуги по безопасности процессов помогают клиентам в удовлетворении их потребностей в безопасности процессов и управлении рисками. Услуги по безопасности процессов помогают клиентам во всех аспектах безопасности процессов, от создания полных программ управления безопасностью процессов до помощи в выполнении различных элементов.

Динамика рынка услуг по обеспечению безопасности технологических процессов в Северной Америке

В этом разделе рассматривается понимание рыночных драйверов, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

ВОДИТЕЛИ

- Растущая потребность в улучшении управления производством и эффективности продукции

Услуги по безопасности процессов помогают управлять целостностью операционных систем и процессов, которые обрабатывают опасные материалы. Они могут помочь в выявлении, понимании, контроле и предотвращении инцидентов, связанных с процессом. Если происходит какой-либо инцидент, он может оказать неблагоприятное воздействие на производственный процесс и эффективность продукта в случае любого инцидента во время текущего процесса. Продукт может протечь или повредиться в случае аварии. Однако с внедрением решений по безопасности процессов потери продукта могут быть сведены к минимуму, а эффективность производства может быть повышена, что приведет к высокому росту рынка услуг по безопасности процессов.

- Стремительный рост числа опасных инцидентов

Опасный инцидент относится к утечке или выбросу химикатов , радиоактивных материалов или биологических материалов внутри здания или окружающей среды, что приводит к огромным потерям людей, инфраструктуры или окружающей среды. Опасные материалы могут вызывать опасные инциденты, включая взрывчатые вещества, легковоспламеняющиеся и горючие вещества, яды и радиоактивные материалы.

Многие отрасли, такие как химические и фармацевтические заводы, горнодобывающая промышленность, производство потребительских товаров, целлюлозно-бумажная промышленность , автомобилестроение, нефтегазовая промышленность и производственные операции, содержат опасные среды, где пожары и взрывы являются основными проблемами безопасности. Небольшая искра в нефтегазовой промышленности, на нефтеперерабатывающем заводе или химическом заводе может вызвать пожар или взрыв, который может повредить оборудование и окружающую среду и, что еще хуже, привести к гибели людей.

Таким образом, в связи с ростом числа опасных инцидентов, аварий и взрывов производители внедряют и выбирают различные услуги по обеспечению безопасности технологических процессов, чтобы гарантировать безопасность рабочих, производственных предприятий и окружающей среды, что является движущей силой роста рынка.

ВОЗМОЖНОСТИ

- Растущий спрос на услуги по обеспечению безопасности технологических процессов в фармацевтической и пищевой промышленности

С ростом населения Северной Америки, уровня жизни и урбанизации растет также спрос на качественные продукты питания, лекарства и медицинскую помощь. Непредвиденные вспышки эпидемий и пандемий предупредили правительства мира о нехватке инфраструктуры здравоохранения. Правительства вкладывают большие средства в сектор здравоохранения и исследования и разработки современных фармацевтических препаратов. Необходимо обеспечить надлежащий надзор за переработкой пищевых продуктов, а также провести несколько проверок качества и инспекций, чтобы создать новое окно возможностей для роста рынка услуг по безопасности процессов в Северной Америке.

СДЕРЖИВАНИЕ/ВЫЗОВ

- Сложности, связанные со стандартами внедрения

Отрасли в значительной степени полагаются на полезный набор инструментов для снижения вероятности инцидентов и травм на рабочем месте. Они включают в себя несколько правил, политик, процедур и различные механические средства защиты, такие как средства индивидуальной защиты и ограждения машин. Они очень полезны для внедрения, но также могут быть крайне недостаточными. Независимо от того, насколько хорошо они спроектированы или усвоены, эти устройства не могут предотвратить все инциденты на сложных рабочих местах. Более того, при внедрении стандартов безопасности может возникнуть несколько сложностей. Все оборудование и системы должны быть согласованы с системами безопасности.

Стандарты промышленной безопасности могут смягчить риск и защитить от вероятного риска. Однако внедрение этих стандартов может привести к ряду изменений в отрасли и повлечь за собой дополнительные расходы, которые могут стать серьезным сдерживающим фактором для роста рынка услуг по безопасности процессов.

- Недостаточная осведомленность в вопросах безопасности технологических процессов среди представителей промышленности

Отраслям необходимо внедрять услуги по обеспечению безопасности процессов в свою деятельность по многим причинам, таким как соблюдение нормативных требований, обеспечение безопасности цепочек поставок, предотвращение аварий и опасных событий, соблюдение требований по предотвращению загрязнения, а также стандартизация и сертификация упаковки, дистрибуции и качества продукции и т. д.

Многим малым и средним предприятиям не хватает осведомленности и ресурсов для найма служб по обеспечению безопасности процесса. Из-за этого их способность конкурировать на рынке затруднена, поскольку потребители в основном ищут поставщиков, сертифицированных в соответствии с правилами и качеством. Компании, разрабатывающие продукты без соблюдения протоколов безопасности и правил, установленных правительством, рискуют, что их продукт будет снят с производства.

Таким образом, недостаточная осведомленность различных производственных компаний о необходимости внедрения адекватных систем и решений безопасности может ограничить рост рынка услуг по обеспечению безопасности технологических процессов.

Недавнее развитие

- В октябре 2020 года компания ABB оцифровала управление жизненным циклом безопасности процессов, запустив ABB Ability Safety Insight, представляющий собой набор цифровых программных приложений, которые поддерживают компании в секторах энергетики и переработки на протяжении всего жизненного цикла управления безопасностью процессов. Это помогло компании улучшить свои предложения по управлению безопасностью процессов на рынке.

- В августе 2018 года Honeywell International Inc. заключила соглашение о реселлерстве с Applied Engineering Solutions, Inc. В рамках этого соглашения компания интегрировала программное обеспечение aeSolutions и aeShield от Applied Engineering Solutions, Inc в свой новый пакет безопасности процессов. Эта интеграция объединила требования HAZOP/LOPA, SRS и SIL Verification от aeShield с Honeywell Safety Builder, Process Safety Analyzer и Trace в пакет безопасности процессов. Это помогло компании улучшить свой пакет безопасности процессов на рынке.

Масштаб рынка услуг по обеспечению безопасности технологических процессов в Северной Америке

Рынок услуг по безопасности процессов в Северной Америке сегментирован на основе предложения, уровня целостности безопасности и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Предлагая

- Решение

- Услуги

По принципу предложения рынок услуг по обеспечению безопасности технологических процессов сегментируется на решения и услуги.

По уровню безопасности

- Уровень 1

- Уровень 2

- Уровень 3

- Уровень 4

По уровню полноты безопасности рынок услуг по обеспечению безопасности технологических процессов сегментируется на уровень 1, уровень 2, уровень 3 и уровень 4.

Конечным пользователем

- Процесс производства

- Автомобилестроение и дискретное производство

- Коммунальные услуги

- Правительство

- Строительство и недвижимость

- Розничная торговля

- Другие

По признаку конечного пользователя рынок услуг по обеспечению безопасности технологических процессов сегментируется на непрерывное производство, автомобилестроение и дискретное производство, коммунальные услуги, государственный сектор, строительство и недвижимость, розничную торговлю и другие.

Региональный анализ/информация о рынке услуг по обеспечению безопасности технологических процессов в Северной Америке

Проведен анализ рынка услуг по обеспечению безопасности технологических процессов в Северной Америке, а также предоставлены сведения о размерах рынка и тенденциях по регионам, предложениям, уровню полноты безопасности и конечным пользователям, как указано выше.

В отчете о рынке услуг по обеспечению безопасности технологических процессов в Северной Америке рассматриваются следующие страны: США, Канада и Мексика.

Ожидается, что в 2023 году США будут доминировать в регионе Северной Америки, поскольку страна имеет большую и разнообразную промышленную базу, которая включает такие секторы, как нефтегазовая, химическая и обрабатывающая промышленность.

В разделе отчета, посвященном региону, также приводятся отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных региона рассматриваются наличие и доступность брендов Северной Америки и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Конкурентная среда и анализ доли рынка услуг по безопасности технологических процессов в Северной Америке

Конкурентная среда рынка услуг по безопасности процессов в Северной Америке содержит данные по конкурентам. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии в Северной Америке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта и доминировании приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком услуг по безопасности процессов в Северной Америке.

Среди основных игроков, работающих на североамериканском рынке услуг по обеспечению безопасности технологических процессов, можно назвать Siemens, Johnson Controls, Honeywell International Inc., Emerson Electric Co., Schneider Electric, Bureau Veritas, SGS SA, Rockwell Automation, ABB, DEKRA, OMRON Corporation, Intertek Group plc, TÜV SÜD, SOCOTEC, MISTRAS Group, HIMA, Ingenero, Inc., Smith & Burgess Process Safety Consulting, Process Engineering Associates, and LLC, ioKinetic, LLC и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 REGULATORY STANDARDS

4.2.1 OVERVIEW

4.2.2 COMAH

4.2.3 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 1999 (COMAH): EMERGENCY PLANNING FOR MAJOR ACCIDENTS

4.2.4 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 2015 (COMAH):

4.2.5 HAZOP

4.2.6 SIF-PRO

4.2.7 IEC 61508

4.2.8 IEC 61511

4.2.9 BATTERY TESTING

4.2.9.1 UL-9540

4.2.9.2 UL-9540A

4.2.9.3 IEC 62133

4.2.9.4 IS 1651

4.2.10 NFPA 855

4.2.11 DSEAR

4.3 STANDARDS AND DIRECTIVES ANALYSIS

4.3.1 OVERVIEW

4.3.2 PROCESS SAFETY MANAGEMENT (PSM)

4.3.3 UNITED STATES ENVIRONMENTAL PROTECTION AGENCY (EPA)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR IMPROVEMENT IN MANUFACTURING MANAGEMENT AND PRODUCT EFFICIENCY

5.1.2 STRINGENT GOVERNMENT REGULATIONS FOR HEALTH, SAFETY, AND ENVIRONMENT (HSE)

5.1.3 SURGING GROWTH IN THE NUMBER OF HAZARDOUS INCIDENTS

5.1.4 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES

5.2 RESTRAINTS

5.2.1 HIGH COST OF EXPENDITURE FOR PROCESS SAFETY SYSTEMS

5.2.2 COMPLEXITIES ASSOCIATED WITH IMPLEMENTATION STANDARDS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR PROCESS SAFETY SERVICES IN PHARMACEUTICAL AND FOOD PROCESSING INDUSTRIES

5.3.2 INCREASING NEED TO REDUCE HAZARDOUS EVENTS IN OIL AND GAS INDUSTRY

5.3.3 RISING NEED FOR TRAINING FOR THE ENGINEER, OPERATOR, AND MAINTENANCE PROFESSIONALS

5.3.4 INCREASING GROWTH OF INDUSTRY 4.0

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AMONG INDUSTRIES FOR PROCESS SAFETY

6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 PSM PROGRAM MANAGEMENT

6.2.2 MECHANICAL INTEGRITY PROGRAM

6.2.3 EMERGENCY PLANNING AND RESPONSE

6.2.4 PROCESS SAFETY INFORMATION (PSI)

6.2.5 PROCESS HAZARD ANALYSIS (PHA)

6.2.6 CONTRACTOR MANAGEMENT PROGRAM

6.2.7 PRE-STARTUP SAFETY REVIEW (PSSR)

6.2.8 STANDARD OPERATING PROCEDURES (SOP)

6.2.9 DUST HAZARD ANALYSIS (DSA)

6.2.10 MANAGEMENT OF CHANGE (MOC)

6.2.11 COMPLIANCE MANAGEMENT

6.2.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

6.2.13 OTHERS

6.3 SERVICES

6.3.1 TESTING

6.3.2 CERTIFICATION AND INSPECTION

6.3.3 CONSULTING

6.3.4 TRAINING

6.3.5 AUDITING

7 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL

7.1 OVERVIEW

7.2 LEVEL 2

7.3 LEVEL 3

7.4 LEVEL 1

7.5 LEVEL 4

8 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 PROCESS MANUFACTURING

8.2.1 PROCESS MANUFACTURING, BY OFFERING

8.2.1.1 SOLUTION

8.2.1.1.1 PSM PROGRAM MANAGEMENT

8.2.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.2.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.2.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.2.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.2.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.2.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.2.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.2.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.2.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.2.1.1.11 COMPLIANCE MANAGEMENT

8.2.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.2.1.1.13 OTHERS

8.2.1.2 SERVICES

8.2.1.2.1 TESTING

8.2.1.2.2 CERTIFICATION AND INSPECTION

8.2.1.2.3 CONSULTING

8.2.1.2.4 TRAINING

8.2.1.2.5 AUDITING

8.2.2 PROCESS MANUFACTURING, BY TYPE

8.2.2.1 CHEMICAL

8.2.2.2 CONSUMER GOODS

8.2.2.2.1 FOOD AND BEVERAGE

8.2.2.2.2 PERSONAL CARE MANUFACTURING

8.2.2.2.3 OTHERS

8.2.2.3 PHARMACEUTICAL

8.2.2.4 METALS AND MINING

8.2.2.5 OIL AND GAS

8.2.2.6 PULP AND PAPER

8.2.2.7 OTHERS

8.3 AUTOMOTIVE AND DISCRETE MANUFACTURING

8.3.1 SOLUTION

8.3.1.1 PSM PROGRAM MANAGEMENT

8.3.1.2 MECHANICAL INTEGRITY PROGRAM

8.3.1.3 EMERGENCY PLANNING AND RESPONSE

8.3.1.4 PROCESS SAFETY INFORMATION (PSI)

8.3.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.3.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.3.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.3.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.3.1.9 DUST HAZARD ANALYSIS (DSA)

8.3.1.10 MANAGEMENT OF CHANGE (MOC)

8.3.1.11 COMPLIANCE MANAGEMENT

8.3.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.3.1.13 OTHERS

8.3.2 SERVICES

8.3.2.1 TESTING

8.3.2.2 CERTIFICATION AND INSPECTION

8.3.2.3 CONSULTING

8.3.2.4 TRAINING

8.3.2.5 AUDITING

8.4 UTILITIES

8.4.1 UTILITIES, BY OFFERING

8.4.1.1 SOLUTION

8.4.1.1.1 PSM PROGRAM MANAGEMENT

8.4.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.4.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.4.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.4.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.4.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.4.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.4.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.4.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.4.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.4.1.1.11 COMPLIANCE MANAGEMENT

8.4.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.4.1.1.13 OTHERS

8.4.1.2 SERVICES

8.4.1.2.1 TESTING

8.4.1.2.2 CERTIFICATION AND INSPECTION

8.4.1.2.3 CONSULTING

8.4.1.2.4 TRAINING

8.4.1.2.5 AUDITING

8.4.2 UTILITIES, BY TYPE

8.4.2.1 WASTE DISPOSAL

8.4.2.2 ELECTRICITY

8.4.2.3 HEAT

8.4.2.4 WATER

8.5 GOVERNMENT

8.5.1 SOLUTION

8.5.1.1 PSM PROGRAM MANAGEMENT

8.5.1.2 MECHANICAL INTEGRITY PROGRAM

8.5.1.3 EMERGENCY PLANNING AND RESPONSE

8.5.1.4 PROCESS SAFETY INFORMATION (PSI)

8.5.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.5.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.5.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.5.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.5.1.9 DUST HAZARD ANALYSIS (DSA)

8.5.1.10 MANAGEMENT OF CHANGE (MOC)

8.5.1.11 COMPLIANCE MANAGEMENT

8.5.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.5.1.13 OTHERS

8.5.2 SERVICES

8.5.2.1 TESTING

8.5.2.2 CERTIFICATION AND INSPECTION

8.5.2.3 CONSULTING

8.5.2.4 TRAINING

8.5.2.5 AUDITING

8.6 CONSTRUCTION AND REAL ESTATE

8.6.1 SOLUTION

8.6.1.1 PSM PROGRAM MANAGEMENT

8.6.1.2 MECHANICAL INTEGRITY PROGRAM

8.6.1.3 EMERGENCY PLANNING AND RESPONSE

8.6.1.4 PROCESS SAFETY INFORMATION (PSI)

8.6.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.6.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.6.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.6.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.6.1.9 DUST HAZARD ANALYSIS (DSA)

8.6.1.10 MANAGEMENT OF CHANGE (MOC)

8.6.1.11 COMPLIANCE MANAGEMENT

8.6.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.6.1.13 OTHERS

8.6.2 SERVICES

8.6.2.1 TESTING

8.6.2.2 CERTIFICATION AND INSPECTION

8.6.2.3 CONSULTING

8.6.2.4 TRAINING

8.6.2.5 AUDITING

8.7 RETAIL

8.7.1 SOLUTION

8.7.1.1 PSM PROGRAM MANAGEMENT

8.7.1.2 MECHANICAL INTEGRITY PROGRAM

8.7.1.3 EMERGENCY PLANNING AND RESPONSE

8.7.1.4 PROCESS SAFETY INFORMATION (PSI)

8.7.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.7.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.7.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.7.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.7.1.9 DUST HAZARD ANALYSIS (DSA)

8.7.1.10 MANAGEMENT OF CHANGE (MOC)

8.7.1.11 COMPLIANCE MANAGEMENT

8.7.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.7.1.13 OTHERS

8.7.2 SERVICES

8.7.2.1 TESTING

8.7.2.2 CERTIFICATION AND INSPECTION

8.7.2.3 CONSULTING

8.7.2.4 TRAINING

8.7.2.5 AUDITING

8.8 OTHERS

9 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 SIEMENS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 JOHNSON CONTROLS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 TÜV SÜD

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 EMERSON ELECTRIC CO.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 SCHNEIDER ELLECTRIC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ABB

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 BUREAU VERITAS

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 DEKRA

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 HONEYWELL INTERNATIONAL INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SOLUTION PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HIMA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INGENERO, INC

12.11.1 COMPANY SNAPSHOT

12.11.2 SERVICE PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 INTERTEK GROUP PLC

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 IOKINETIC, LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 MISTRAS GROUP, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENTS

12.15 OMRON CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PROCESS ENGINEERING ASSOCIATES, LLC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 ROCKWELL AUTOMTAION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SGS SA

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 SMITH & BURGESS PROCESS SAFETY CONSULTING

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 SOCOTEC

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA LEVEL 2 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LEVEL 3 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LEVEL 1 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA LEVEL 4 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 67 U.S. PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 71 U.S. PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 73 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 74 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 75 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 78 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 79 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 80 U.S. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 81 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 82 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 83 U.S. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 85 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 86 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 87 U.S. CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 88 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 89 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 90 U.S. RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 91 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 92 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 93 CANADA PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 97 CANADA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 98 CANADA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 99 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 100 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 101 CANADA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 CANADA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 CANADA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 104 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 105 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 106 CANADA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 107 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 108 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 109 CANADA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 CANADA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 111 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 112 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 113 CANADA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 114 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 115 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 116 CANADA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 117 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 118 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 119 MEXICO PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 120 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 MEXICO PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 123 MEXICO PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 MEXICO PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 125 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 126 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 127 MEXICO PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 130 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 131 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 132 MEXICO UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 133 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 134 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 135 MEXICO UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MEXICO GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 137 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 138 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 139 MEXICO CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 140 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 141 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 142 MEXICO RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 143 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 144 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: END USER COVERAGE GRID

FIGURE 12 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 13 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES IS EXPECTED TO DRIVE NORTH AMERICA PROCESS SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET

FIGURE 16 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY OFFERING, 2022

FIGURE 17 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY SAFETY INTEGRITY LEVEL, 2022

FIGURE 18 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY END USER, 2022

FIGURE 19 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY TYPE (2023-2030)

FIGURE 24 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: COMPANY SHARE 2022(%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.