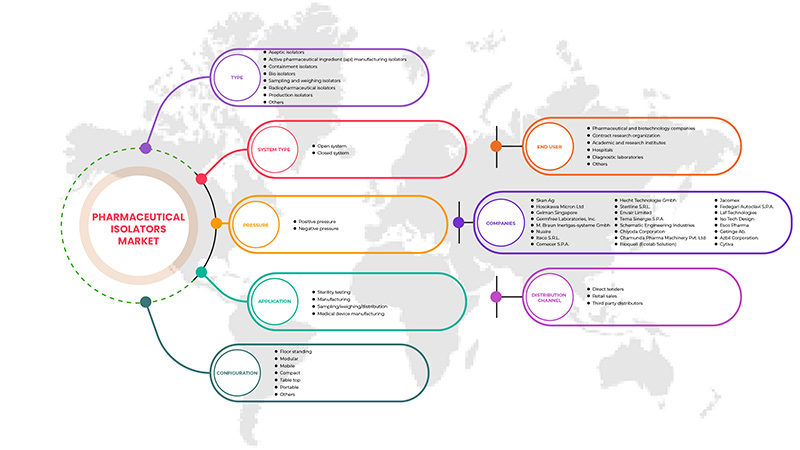

Рынок фармацевтических изоляторов в Северной Америке по типу (асептические изоляторы, изоляторы сдерживания, биоизоляторы, изоляторы для отбора проб и взвешивания, изоляторы для производства активных фармацевтических ингредиентов (API), радиофармацевтические изоляторы, производственные изоляторы и другие), тип системы (закрытая система, открытая система), давление (положительное давление, отрицательное давление), конфигурация (напольные, модульные, мобильные, компактные, настольные, портативные и другие), применение (испытания на стерильность, производство, отбор проб/взвешивание/распределение, производство медицинских приборов ), конечный пользователь (больницы, диагностические лаборатории, академические и научно-исследовательские институты, фармацевтические и биотехнологические компании, контрактные исследовательские организации и другие), канал сбыта (прямые торги, розничные продажи, сторонние дистрибьюторы). Тенденции отрасли и прогноз до 2029 года.

Анализ и информация о рынке фармацевтических изоляторов в Северной Америке

Фармацевтические изоляторы используются в фармацевтической промышленности в качестве барьерной системы, не допускающей загрязнения. Микробиологическое тестирование, обработка клеточной терапии, передовое фармацевтическое (ATMP) производство, а также взвешивание, упаковка и распределение стерильных инъекционных продуктов — вот лишь некоторые из применений фармацевтических изоляторов. Использование фармацевтических изоляторов обусловлено непрерывным ростом фармацевтического рынка в развивающихся и развитых странах и увеличением расходов на НИОКР для производства инновационных методов лечения. Передовые медицинские изоляторы и требования фармацевтической промышленности побудили крупных производителей развивать отрасль медицинских изоляторов. Рост использования опасных соединений, увеличение стоимости несоблюдения требований и рост исследовательских лабораторий являются важными факторами, определяющими рынок фармацевтических изоляторов в прогнозируемый период.

Однако большинство экспертов не согласны с тем, что регулирующие органы больше не препятствуют таким прорывам, как разработка фармацевтических изоляторов.

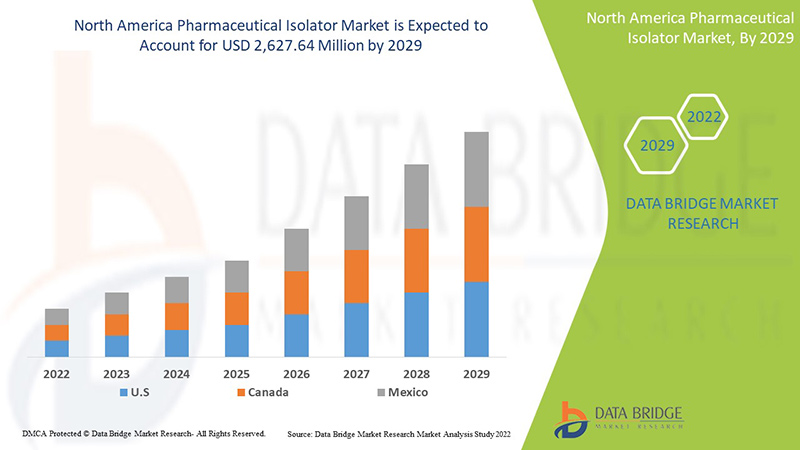

Data Bridge Market Research анализирует, что рынок фармацевтических изоляторов в Северной Америке, как ожидается, достигнет значения 2 627,64 млн долларов США к 2029 году при среднегодовом темпе роста 14,6% в течение прогнозируемого периода. Тип составляет самый большой сегмент типа на рынке из-за быстрого спроса на фармацевтические изоляторы в регионе. Этот отчет о рынке также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

По типу (асептические изоляторы, изоляторы сдерживания, биоизоляторы, изоляторы для отбора проб и взвешивания, изоляторы для производства активных фармацевтических ингредиентов (API), радиофармацевтические изоляторы, производственные изоляторы, другие), тип системы (закрытая система, открытая система), давление (положительное давление, отрицательное давление), конфигурация (напольные, модульные, мобильные, компактные, настольные, портативные, другие), применение (испытания на стерильность, производство, отбор проб/взвешивание/распределение, производство медицинских приборов), конечный пользователь (больницы, диагностические лаборатории, академические и научно-исследовательские институты, фармацевтические и биотехнологические компании, контрактные исследовательские организации, другие), канал сбыта (прямые тендеры, розничные продажи, сторонние дистрибьюторы). |

|

Страны, охваченные |

США, Канада и Мексика |

|

Охваченные участники рынка |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma и другие. |

Определение рынка фармацевтических изоляторов в Северной Америке

Концепция изоляции, достаточно известная в фармацевтической промышленности, защищает процесс от оператора и/или оператора от процесса, одновременно защищая окружающую среду. Ключ к сдерживанию — минимальное воздействие. Контролируя диапазон воздействия ниже уровня опасности, установленного для соединения, оператор и окружающая среда надежно защищены. Таким образом, продукт защищен, и, следовательно, решается ключевой нормативный вопрос. Фармацевтический изолятор — это герметичное бактериальное ограждение, используемое в фармацевтической среде для асептического розлива и токсичного процесса. Он состоит из совершенно стерильного основного изолятора, в котором продукты обрабатываются, хранятся или упаковываются с использованием перчаток до плеч, размещенных на одной из стен. Фармацевтический изолятор позволяет контролировать и сдерживать фармацевтические процессы. Условия, необходимые для работы фармацевтического изолятора, — это стерильная среда и отсутствие жизнеспособных микроорганизмов. Фармацевтический изолятор гарантирует, что производственная зона и асептическая среда находятся в разных положениях. Фармацевтический промышленный изолятор экономически эффективен и эффективен по сравнению с чистыми помещениями для фармацевтической промышленности в асептической среде. Он создает контролируемую атмосферу в процессе микробиологического и фармацевтического производства, адаптируясь к различным стандартам сертификации, требуемым для изоляторов и барьеров ограниченного доступа. Он обеспечивает защиту продукта, операторов и окружающей среды одновременно.

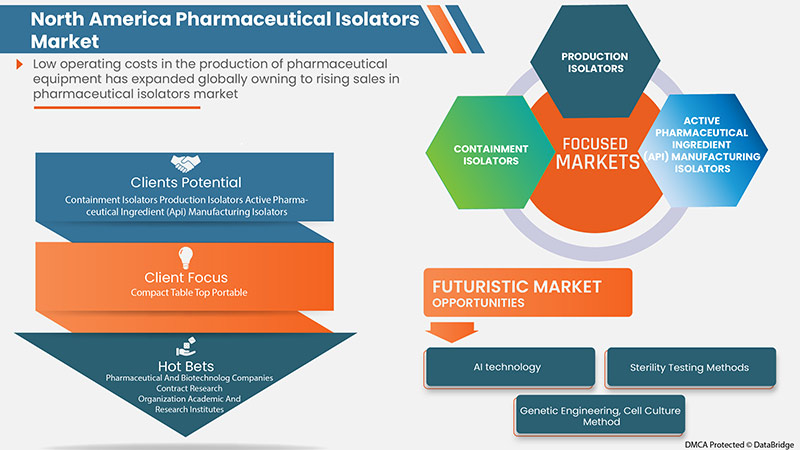

Обширные области применения фармацевтических изоляторов различаются по производственным и контрольным целям. Он используется при обработке, передаче или упаковке твердых, полутвердых или порошковых фармацевтических препаратов, обработке и заполнении растворов и инфузий. Фармацевтические изоляторы применяются при тестировании стерильности, асептической обработке тканей или биологических производственных систем или патогенных образцов и т. д. Его можно использовать для производства и контроля лекарственных средств и фармацевтических продуктов. Рост спроса на изоляторы в фармацевтической и биотехнологической промышленности, а также низкие эксплуатационные расходы, высокая степень поддержания асептических условий при производстве фармацевтических продуктов и растущий спрос биофармацевтической промышленности являются факторами, которые, как ожидается, будут стимулировать рост рынка в прогнозируемый период.

Кроме того, стратегическая инициатива участников рынка, технологический прогресс в фармацевтических изоляторах, высокая стерильность и увеличение инвестиций в инфраструктуру здравоохранения. Эти факторы увеличивают спрос на рынок фармацевтических изоляторов.

Динамика рынка фармацевтических изоляторов в Северной Америке

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

Растущий спрос на фармацевтические изоляторы в бурно развивающейся фармацевтической отрасли

Фармацевтический изолятор — это разделительное устройство, которое отделяет фармацевтическую процедуру или деятельность от оператора и прилегающей среды. Он используется для различных целей, таких как:

- Обеспечение категоризированной асептической среды для деятельности или процедуры и ее защита от микробного и немикробного загрязнения, исходящего от оператора и смежной среды, что называется защитой продукта.

- Защищает продукт от загрязнения, произведенного другим продуктом и процедурой, более того, в то же время или во время более ранних операций. Это называется защитой от загрязнения, произведенного методом, или перекрестного загрязнения.

Растущие проблемы загрязнения на производственных предприятиях, где используются изоляторы, создают спрос на фармацевтические изоляторы, помогающие в борьбе с загрязнением и дезактивацией.

- Низкие эксплуатационные расходы фармацевтических изоляторов

Корпуса, которые запечатаны до определенного стандарта герметичности, который включает в себя внутреннюю контролируемую среду, при модификации с окружающими условиями применение изолятора достигает от НИОКР по производству фармацевтических препаратов до лабораторного использования, особенно для микробиологического контроля качества. В то время как фармацевтическое асептическое производство имеет чрезвычайно высокие стандарты чистоты, почти полностью свободные от частиц и микробов среды для асептического производства.

В связи с ростом фармацевтической промышленности и расширением ассортимента продукции все большему числу производителей и поставщиков приходится задумываться об инвестициях в новейшие технологии чистых помещений.

Асептическая обработка фармацевтических препаратов является основным фактором, который необходимо включить в надлежащую производственную практику, соответствующую государственным нормам. Высокая стоимость поддержания асептических условий с помощью технологии чистых помещений, которая примерно на 62% выше, чем у фармацевтических изоляторов, заставляет производителей приобретать технологию изоляторов и ограничивает общую стоимость производства фармацевтической продукции.

Сдержанность

Строгие государственные правила

Активные фармацевтические ингредиенты (АФИ) и промежуточные продукты для фармацевтического использования (например, биологические, радиофармацевтические и фармацевтические), а также те, которые используются для производства лекарственных препаратов для клинических испытаний, регулируются в соответствии с Разделами 1A и 2, Частью C Правил по пищевым продуктам и лекарственным средствам.

- Раздел 1A, часть C Правил по пищевым продуктам и лекарственным препаратам описывает виды деятельности, для которых требуется соблюдение надлежащей производственной практики (GMP), и которые должны быть продемонстрированы до выдачи лицензии на создание АФИ (EL).

- Раздел 2, часть C Правил по пищевым продуктам и лекарственным средствам определяет требования GMP к АФИ и промежуточным продуктам АФИ, которые интерпретируются в настоящем руководящем документе.

Из-за этого строгого регулирования со стороны правительства, которое необходимо соблюдать при производстве в соответствии с Руководящими принципами надлежащей производственной практики (GMP) для активных фармацевтических ингредиентов (API) - (GUI-0104), сдерживаются темпы роста рынка.

Возможность

-

Стратегические инициативы участников рынка

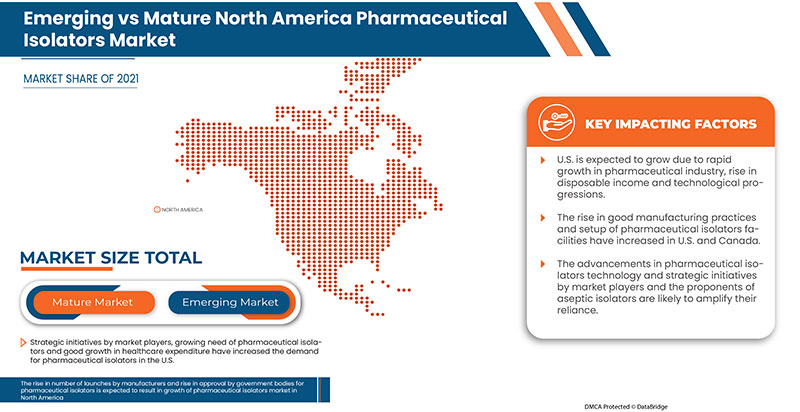

Рост рынка фармацевтических изоляторов увеличивает потребность в стратегических бизнес-идеях. Это включает в себя партнерство, расширение бизнеса и другие разработки. Растущий спрос на фармацевтические препараты значительно увеличивает спрос на вспомогательные вещества, и чтобы справиться с этим спросом, компании строят новые производственные площадки среди других стратегических инициатив.

Такие стратегические инициативы, как запуск новых продуктов, заключение соглашений и расширение бизнеса со стороны основных игроков рынка, будут способствовать росту рынка фармацевтических изоляторов и, как ожидается, откроют новые возможности для рынка медицинских дисплеев в Северной Америке.

Испытание

Отсутствие квалифицированных специалистов

Нехватка квалифицированных специалистов может поставить под сомнение темпы восстановления и роста в одном месте. Часто люди, которые остаются безработными в одном месте, обладают навыками, которых не хватает в другом месте. Более того, быстрый технологический прогресс в этой области также приводит к отсутствию специалистов.

Нехватка квалифицированных специалистов при работе с фармацевтическими изоляторами представляет собой серьезную проблему при выборе и разработке фармацевтических изоляторов. Данные Phys.org 2003 упоминают, что отрасли медицинских дисплеев сталкиваются с нехваткой рабочих из-за возросшего спроса на фармацевтические изоляторы в Азиатско-Тихоокеанском регионе и острой нехватки микрочипов, используемых в светодиодных и ЖК-дисплеях, что увеличивает сроки выполнения заказов на производство ЖК-дисплеев.

Поскольку требования к навыкам слишком высоки, это проявилось в проблеме удержания и управления специалистами с определенными навыками. Более того, технологический прогресс является еще одним аспектом, который приводит к увеличению спроса на квалифицированных специалистов. Неврологи сообщают о значительных неудовлетворенных потребностях в поддерживающей терапии и барьерах в своих центрах, и только небольшое меньшинство оценивает себя как компетентно предоставляющих поддерживающую терапию. Существует острая необходимость в обучении неврологов и специалистов для лечения деменции и закупки доступных ресурсов поддерживающей терапии. Нехватка обученных и опытных специалистов и постоянные пробелы в навыках ограничивают перспективы трудоустройства и доступ к качественным рабочим местам. Поэтому очевидно, что наличие специалистов, обладающих адекватными навыками, как ожидается, будет бросать вызов росту рынка.

Влияние COVID-19 на рынок фармацевтических изоляторов в Северной Америке

Пандемия COVID-19 стала самой серьезной угрозой в мире. Она посеяла хаос во многих магазинах и предприятиях по всему миру. С другой стороны, пандемия предоставила фармацевтическим и биофармацевтическим компаниям множество возможностей для расширения их научно-исследовательской деятельности с целью разработки новых вакцин против нового коронавируса. Компании проводят клинические испытания, чтобы попытаться остановить распространение вируса COVID-19. Поставщики фармацевтических изоляторов для биофармацевтических организаций получают больше возможностей по мере увеличения числа клинических испытаний.

Производители принимают различные стратегические решения, чтобы восстановиться после COVID-19. Игроки проводят многочисленные НИОКР-мероприятия, запускают продукты и создают стратегические партнерства для улучшения технологий и результатов испытаний, задействованных на фармацевтическом рынке медицинских дисплеев.

Последние события

- В июне 2022 года компания объявила о партнерстве с Medical Supply Company (MSC) для продвижения и обслуживания оборудования Jacomex для фармацевтической и фармацевтической промышленности в Ирландии. MSC имеет многолетний признанный опыт на рынке с полевыми командами, наиболее приближенными к клиентам, а коммерческая команда компании, в настоящее время работающая за рубежом, имела удовольствие приветствовать Сиан Мерфи и завершить соглашение между Jacomex и MSC. Начало длительного и плодотворного сотрудничества. Это помогло компании расширить свой бизнес.

- В январе 2022 года Clario заключила партнерство с XingImaging, компанией по производству радиофармацевтических препаратов и приобретению позитронно-эмиссионной томографии (ПЭТ), для проведения клинических испытаний ПЭТ-визуализации для тестирования новых терапевтических средств в Китае. Партнерство предполагает совместное использование совместных ресурсов и экспертов по нейронауке Clario и XingImaging для ускорения запуска клинических испытаний и разработки лекарств в Китае.

Масштаб рынка фармацевтических изоляторов в Северной Америке

Рынок фармацевтических изоляторов в Северной Америке сегментирован по типу, давлению, применению, конфигурации, типу системы, конечному пользователю и каналу сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ, ПО ТИПУ

- АСЕПТИЧЕСКИЕ ИЗОЛЯТОРЫ

- ИЗОЛЯТОРЫ СОДЕРЖАНИЯ

- БИОИЗОЛЯТОРЫ

- ИЗОЛЯТОРЫ ДЛЯ ОТБОРА ПРОБ И ВЗВЕШИВАНИЯ

- ИЗОЛЯТОРЫ ДЛЯ ПРОИЗВОДСТВА АКТИВНЫХ ФАРМАЦЕВТИЧЕСКИХ ИНГРЕДИЕНТОВ (АФИ)

- РАДИОФАРМАЦЕВТИЧЕСКИЕ ИЗОЛЯТОРЫ

- ПРОИЗВОДСТВЕННЫЕ ИЗОЛЯТОРЫ

- ДРУГИЕ

По типу рынок фармацевтических изоляторов в Северной Америке сегментируется на асептические изоляторы, изоляторы с защитным покрытием, биоизоляторы, изоляторы для отбора проб и взвешивания, изоляторы для производства активных фармацевтических ингредиентов (АФИ), радиофармацевтические изоляторы, производственные изоляторы и другие.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ, ПО ТИПУ СИСТЕМЫ

- ЗАКРЫТАЯ СИСТЕМА

- ОТКРЫТАЯ СИСТЕМА

В зависимости от типа системы рынок фармацевтических изоляторов в Северной Америке сегментируется на закрытые системы и открытые системы.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ, ПО ДАВЛЕНИЮ

- ПОЛОЖИТЕЛЬНОЕ ДАВЛЕНИЕ

- ОТРИЦАТЕЛЬНОЕ ДАВЛЕНИЕ

По типу давления рынок фармацевтических изоляторов в Северной Америке сегментируется на два типа: с положительным и отрицательным давлением.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ, ПО КОНФИГУРАЦИИ

- НАПОЛЬНЫЙ

- МОДУЛЬНЫЙ

- МОБИЛЬНЫЙ

- КОМПАКТНЫЙ

- СТОЛЕШНИЦА

- ПОРТАТИВНЫЙ

- ДРУГИЕ

По конфигурации рынок фармацевтических изоляторов в Северной Америке сегментируется на напольные, модульные, мобильные, компактные, настольные, переносные и другие.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ ПО ОБЛАСТИ ПРИМЕНЕНИЯ

- ИСПЫТАНИЕ НА СТЕРИЛЬНОСТЬ

- ПРОИЗВОДСТВО

- ОТБОР ПРОБ/ВЗВЕШИВАНИЕ/РАСПРЕДЕЛЕНИЕ

- ПРОИЗВОДСТВО МЕДИЦИНСКИХ ИЗДЕЛИЙ

- ДРУГИЕ

В зависимости от сферы применения рынок фармацевтических изоляторов в Северной Америке сегментируется на следующие направления: тестирование на стерильность, производство, отбор проб/взвешивание/распределение, производство медицинских приборов и другие.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ, ПО КОНЕЧНОМУ ПОЛЬЗОВАТЕЛЮ

- БОЛЬНИЦЫ

- ДИАГНОСТИЧЕСКИЕ ЛАБОРАТОРИИ

- АКАДЕМИЧЕСКИЕ И НАУЧНО-ИССЛЕДОВАТЕЛЬСКИЕ ИНСТИТУТЫ

- ФАРМАЦЕВТИЧЕСКИЕ И БИОТЕХНОЛОГИЧЕСКИЕ КОМПАНИИ

- КОНТРАКТНЫЕ ИССЛЕДОВАТЕЛЬСКИЕ ОРГАНИЗАЦИИ

- ДРУГИЕ

По признаку конечного пользователя рынок фармацевтических изоляторов в Северной Америке сегментирован на больницы, диагностические лаборатории, академические и научно-исследовательские институты, фармацевтические и биотехнологические компании, контрактные исследовательские организации и т. д.

РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ В СЕВЕРНОЙ АМЕРИКЕ ПО КАНАЛУ СБЫТА

- ПРЯМОЙ ТЕНДЕР

- РОЗНИЧНЫЕ ПРОДАЖИ

- СТОРОННИЕ ДИСТРИБЬЮТОРЫ

По каналам сбыта рынок фармацевтических изоляторов в Северной Америке сегментируется на прямые торги, розничные продажи и сторонних дистрибьюторов.

Региональный анализ/информация о рынке фармацевтических изоляторов в Северной Америке

Проведен анализ рынка фармацевтических изоляторов в Северной Америке и предоставлена информация о размере рынка по типу, давлению, применению, конфигурации, типу системы, конечному пользователю и каналу сбыта.

The countries covered in this market report U.S., Canada, and Mexico. In 2022, the U.S. is dominating due to the presence of key market players in the largest consumer market with high GDP and rise in technological advancement in agriculture sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Pharmaceutical Isolator Market Share Analysis

North America pharmaceutical isolator market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America pharmaceutical isolator market.

Some of the major players operating in the North America pharmaceutical isolator market are Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Research Methodology: North America Pharmaceutical Isolator Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 U.S. PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 U.S. CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 U.S. ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 U.S. HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 U.S. DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 CANADA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 CANADA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 CANADA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 CANADA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 CANADA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 CANADA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 MEXICO PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 MEXICO CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 MEXICO DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 MEXICO PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 NORTH AMERICAPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 NORTH AMERICA PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 NORTH AMERICA PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.