North America Paper Bags Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.23 Billion

USD

1.88 Billion

2024

2032

USD

1.23 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Сегментация рынка бумажных пакетов в Северной Америке, по видам продукции (плоские бумажные пакеты, многослойные бумажные мешки, мешки с открытым верхом, склеенные клапаны, бумажные пакеты с замком, самооткрывающиеся пакеты (SOS), пакеты-стойки и другие), использование (одноразовые и многоразовые), вместимость (менее 1 кг, от 1 до 5 кг, от 5 до 10 кг и более 10 кг), размер (маленький, средний, большой и очень большой), запечатывание и ручка (термосварка, ручка длиной с руку, зип-лок, скрученная ручка, плоская ручка и другие), форма (прямоугольная, квадратная, круглая и другие), канал сбыта (магазины шаговой доступности, супермаркеты/гипермаркеты, специализированные магазины, электронная коммерция и другие), конечный потребитель (продукты питания и напитки, товары для животных) Корма, косметическая продукция, сельское хозяйство, строительство, фармацевтика, химикаты и др. – тенденции отрасли и прогноз до 2032 года

Размер рынка бумажных пакетов

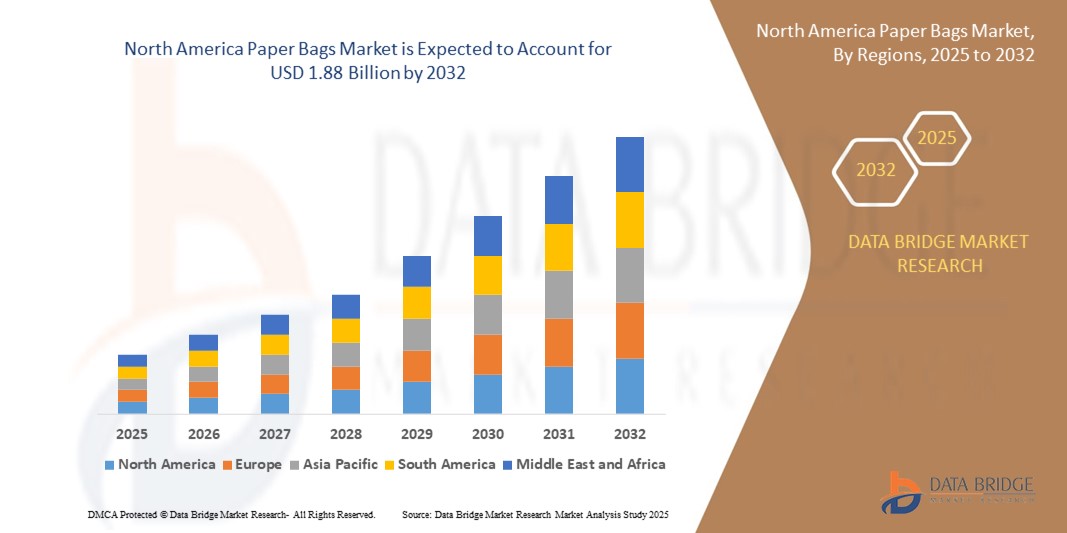

- Объем рынка бумажных пакетов в Северной Америке в 2024 году оценивался в 1,23 млрд долларов США , а к 2032 году , как ожидается, он достигнет 1,88 млрд долларов США при среднегодовом темпе роста 5,5% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен переходом на экологичные упаковочные решения и растущим давлением со стороны регулирующих органов с целью сокращения использования одноразового пластика, что приводит к более широкому использованию бумажных пакетов в розничной торговле, сфере общественного питания и промышленности.

- Более того, растущая осведомлённость потребителей о воздействии на окружающую среду в сочетании с растущим спросом на биоразлагаемые и перерабатываемые альтернативы позиционируют бумажные пакеты как предпочтительный выбор как среди брендов, так и среди потребителей. Эти факторы ускоряют переход с пластика на бумагу, тем самым значительно стимулируя рост отрасли.

Анализ рынка бумажных пакетов

- Бумажные пакеты — это экологичная упаковка, изготовленная из крафт-бумаги или переработанной бумаги, которая широко используется для упаковки продуктов питания, одежды и других потребительских товаров. Они доступны в различных типах, размерах и вариантах запечатывания, что делает их востребованными в розничной торговле, сфере общественного питания, фармацевтике и строительстве.

- Растущий спрос на бумажные пакеты обусловлен, прежде всего, правительственными запретами на пластик, целями устойчивого развития, поставленными корпорациями, а также растущим использованием бумажных пакетов в качестве инструмента брендинга в премиальных и экологически чистых розничных магазинах.

- США доминировали на рынке бумажных пакетов с долей 83,10% в 2024 году благодаря ужесточению нормативных ограничений на использование пластика и росту внедрения экологичной упаковки в розничной торговле, сфере общественного питания и продуктовых магазинах. Растущий спрос на перерабатываемые, биоразлагаемые альтернативы и повышенная сознательность потребителей в отношении окружающей среды сделали США региональным лидером.

- Ожидается, что Канада станет регионом с самыми быстрыми темпами роста рынка бумажных пакетов в течение прогнозируемого периода благодаря национальной политике сокращения использования пластика и значительному переходу потребителей к экологически чистой упаковке.

- В 2024 году сегмент одноразовых пакетов доминировал на рынке, занимая 64,2% рынка благодаря строгим гигиеническим требованиям в фармацевтической и пищевой промышленности. Упор на нормативные требования к контролю загрязнения и удобству утилизации упаковки привел к широкому распространению одноразовых бумажных пакетов. Они также экономически эффективны для крупных предприятий, особенно в динамично развивающихся сферах, таких как розничная торговля и предприятия общественного питания.

Объем отчета и сегментация рынка бумажных пакетов

|

Атрибуты |

Ключевые данные о рынке бумажных пакетов |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка бумажных пакетов

«Растущее внедрение биоразлагаемых материалов»

- Рынок бумажных пакетов переживает бурный рост, поскольку компании и потребители все чаще отдают предпочтение экологичной упаковке, а переход на биоразлагаемые и перерабатываемые материалы становится определяющей тенденцией.

- Например, такие компании, как International Paper Company, Mondi Group, Smurfit Kappa и WestRock, представляют инновационные бумажные пакеты, изготовленные из крафт-бумаги, полученной из экологически чистых источников, биопластика и компостируемых покрытий, чтобы удовлетворить нормативный и потребительский спрос на экологичные упаковочные решения.

- Сектор продуктов питания и напитков, а также розничная торговля и электронная коммерция стремительно переходят на бумажные пакеты для еды на вынос, продуктов питания и доставки, что обусловлено запретами на одноразовый пластик и потребностью в упаковке, соответствующей экологическим инициативам.

- Современные материалы, такие как более тонкая и прочная крафт-бумага и влагостойкие покрытия, повышают долговечность и универсальность бумажных пакетов, позволяя использовать их для более широкого спектра продуктов, включая скоропортящиеся и насыпные грузы.

- Брендинг и кастомизация набирают популярность: розничные торговцы и рестораны быстрого обслуживания используют бумажные пакеты с индивидуальной печатью для продвижения принципов устойчивого развития и улучшения потребительского опыта.

- В заключение следует отметить, что сочетание роста электронной коммерции, мер регулирования и инициатив в области устойчивого развития позиционирует бумажные пакеты как важнейший компонент будущего упаковки и логистики в Азиатско-Тихоокеанском регионе, при этом лидеры рынка инвестируют в новые технологии и расширяют линейки экологически чистых продуктов.

Динамика рынка бумажных пакетов

Водитель

« Переход на экологически чистые альтернативы пластику »

- Растущее глобальное движение за сокращение пластиковых отходов является основным драйвером рынка бумажных пакетов в Азиатско-Тихоокеанском регионе, при этом законодательные запреты и предпочтения потребителей ускоряют переход на биоразлагаемые и перерабатываемые варианты.

- Например, такие компании, как International Paper Company, Mondi Group, Smurfit Kappa и WestRock, наращивают производство бумажных пакетов для крупных розничных торговцев и поставщиков услуг общественного питания по всему Китаю, Индии, Австралии и Юго-Восточной Азии, которые заменяют пластиковые пакеты, чтобы соответствовать нормативным требованиям и достичь целей устойчивого развития.

- Рост электронной коммерции и прямых поставок потребителям стимулирует спрос на легкие, защитные и экономичные бумажные пакеты в различных секторах.

- Удобство, возможность печати и очевидные экологические преимущества бумажных пакетов делают их предпочтительным выбором как для крупных предприятий, так и для малого бизнеса, стремящегося улучшить свою экологическую репутацию.

- Увеличение инвестиций в инфраструктуру переработки и развитие производства местной бумаги, сертифицированной FSC, дополнительно способствуют переходу к упаковочным решениям на основе бумаги.

Сдержанность/Вызов

«Высокие издержки производства и ограничения по сырью»

- Производство бумажных пакетов обходится дороже, чем производство пластиковых аналогов, из-за более высоких затрат на сырье, энергию и воду, что может ограничить их внедрение на чувствительных к стоимости рынках.

- Например, средняя импортная цена на бумажные мешки и пакеты в Азиатско-Тихоокеанском регионе достигла 2778 долларов США за тонну в 2018 году, при этом такие страны, как Япония, платили до 3754 долларов США за тонну, что свидетельствует о значительной изменчивости цен и давлении со стороны издержек в регионе.

- Бумажные пакеты, как правило, менее долговечны, особенно во влажных условиях или при интенсивном использовании, что делает их менее подходящими для транспортировки жидкостей, замороженных продуктов или крупногабаритных предметов. Колебания цен и поставок сырья, такого как древесная масса и переработанная бумага, а также необходимость применения методов устойчивого лесопользования могут повлиять на стабильность цен и надежность цепочки поставок.

- Ограниченная инфраструктура переработки и нестабильные системы сбора в некоторых регионах Азиатско-Тихоокеанского региона препятствуют цикличности бумажных пакетов, особенно пакетов из смешанных материалов.

- Экологические проблемы, связанные с вырубкой лесов и углеродным следом производства бумаги, сохраняются, особенно в регионах, где отсутствуют развитые технологии переработки отходов или устойчивое лесопользование.

Объем рынка бумажных пакетов

Рынок сегментирован по типу продукта, использованию, емкости, размеру, герметизации и ручке, форме, каналу сбыта и конечному потребителю.

- Побочные продукты

Рынок противовирусных препаратов сегментируется по видам продукции: плоские бумажные пакеты, многослойные бумажные мешки, пакеты с открытым горлом, пакеты с клеевым клапаном, бумажные пакеты с замком, пакеты-самооткрывающиеся (SOS), пакеты-стойки и другие. Сегмент плоских бумажных пакетов обеспечил наибольшую долю рынка в 2024 году благодаря их экологичности, доступной цене и широкому использованию для упаковки лёгких товаров, таких как хлебобулочные изделия и фармацевтические препараты. Эти пакеты особенно популярны для одноразового использования, где биоразлагаемость и минимальное воздействие на окружающую среду являются критически важными факторами закупки. Их лёгкая персонализация и совместимость с технологиями печати дополнительно повышают узнаваемость бренда и продукта для конечных потребителей.

Прогнозируется, что сегмент вертикальной упаковки (Stand-Up Pouch) будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год благодаря растущему спросу на гибкую, многоразовую и компактную упаковку. Эти пакеты обеспечивают длительный срок хранения и защиту от загрязнений, что делает их идеальными для фармацевтической и косметической продукции. Их эстетическая привлекательность, удобство и адаптируемость как для сухих, так и для жидких продуктов также ускоряют внедрение в розничной торговле и электронной коммерции.

- По использованию

По способу использования рынок подразделяется на сегменты одноразового и многоразового использования. В 2024 году сегмент одноразового использования занимал наибольшую долю рынка – 64,2%, что обусловлено строгими гигиеническими требованиями в фармацевтической и пищевой промышленности. Упор на контроль загрязнения и удобство утилизации упаковки со стороны регулирующих органов привел к широкому распространению одноразовых бумажных пакетов. Они также экономически эффективны для крупных предприятий, особенно в динамично развивающихся сферах, таких как розничная торговля и предприятия общественного питания.

Ожидается, что сегмент многоразовой упаковки будет расти самыми быстрыми темпами в период с 2025 по 2032 год, что обусловлено растущими инициативами в области устойчивого развития и предпочтением потребителями экологически ответственных упаковочных решений. Такие пакеты всё чаще используются премиальными брендами и супермаркетами для продвижения экологичных потребительских привычек, сохраняя при этом прочность и эстетическую привлекательность.

- По вместимости

По вместимости рынок сегментирован на контейнеры весом менее 1 кг, от 1 до 5 кг, от 5 до 10 кг и более 10 кг. Сегмент контейнеров весом от 1 до 5 кг лидировал на рынке в 2024 году благодаря своей универсальности для широкого спектра отраслей конечного потребления, включая пищевую, фармацевтическую и кормовую промышленность. Этот диапазон вместимости оптимально подходит для работы как со скоропортящимися, так и с нескоропортящимися продуктами, не жертвуя удобством и эффективностью хранения.

Ожидается, что сегмент контейнеров весом более 10 кг продемонстрирует наибольший рост в прогнозируемый период, что обусловлено расширением промышленного применения в сельском хозяйстве, строительстве и химической промышленности. Эти пакеты обеспечивают прочную структурную целостность, экономичность при транспортировке насыпью и совместимость с автоматизированными системами наполнения и обработки.

- По размеру

В зависимости от размера рынок сегментируется на контейнеры малого, среднего, большого и сверхбольшого размера. Сегмент среднего размера обеспечил наибольшую долю рынка в 2024 году благодаря идеальному балансу вместимости, портативности и удобства использования. Этот сегмент пользуется большой популярностью в розничной торговле, сфере общественного питания и фармацевтике, где компактная, но функциональная упаковка имеет решающее значение.

Прогнозируется, что сегмент сверхбольших размеров будет расти самыми быстрыми темпами в период с 2025 по 2032 год, чему будет способствовать повышение требований к обработке сыпучих грузов и спрос на экологичные альтернативы пластиковым мешкам. Эти мешки всё чаще используются в строительстве и сельском хозяйстве, где требуется упаковка большого объёма, прочная и устойчивая к погодным условиям.

- Герметизацией и обработкой

По типу запечатывания и ручек рынок сегментируется на следующие категории: термосвариваемые, с длинной ручкой, с замком-молнией, с крученой ручкой, с плоской ручкой и другие. Сегмент термосвариваемых упаковок доминировал на рынке в 2024 году благодаря превосходной прочности запечатывания, защите от вскрытия и широкому применению в фармацевтической и пищевой упаковке. Термосваривание обеспечивает целостность продукта, продлевая срок его годности, минимизируя утечки и порчу.

Ожидается, что сегмент упаковок с застежкой-молнией (Ziplock) будет демонстрировать самые высокие темпы роста, поскольку возможность повторного закрытия становится ключевым потребительским спросом, обусловленным удобством и многоразовым использованием. Интеграция функций застежки-молнии с биоразлагаемыми материалами также набирает обороты, особенно в городской и премиальной розничной упаковке.

- По форме

По форме рынок делится на прямоугольные, квадратные, круглые и другие. Сегмент прямоугольных пакетов занял наибольшую долю в 2024 году, став фаворитом благодаря практичности хранения, возможности штабелирования и возможности нанесения печати и этикеток. Прямоугольные пакеты широко используются в таких отраслях, как фармацевтика и косметика, где важны доступность на полках и эффективность эксплуатации.

Ожидается, что сегмент круглой упаковки продемонстрирует наибольший рост в прогнозируемый период благодаря растущему спросу на инновационную и дифференцированную упаковку для премиальных и нишевых категорий товаров. Круглые пакеты обеспечивают визуальную уникальность и часто используются брендами, стремящимися выделиться среди потребителей.

- По каналу распространения

По каналам сбыта рынок сегментируется на магазины шаговой доступности, супермаркеты/гипермаркеты, специализированные магазины, интернет-магазины и другие. Сегмент супермаркетов/гипермаркетов занимал доминирующую долю в 2024 году благодаря тенденциям оптовых закупок и прямой видимости упакованных товаров. Эти магазины служат основными точками приобретения многоразовых и фирменных бумажных пакетов, особенно в городских центрах.

Прогнозируется, что электронная коммерция будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год благодаря росту популярности онлайн-покупок и моделей доставки на дом. Поскольку упаковка становится ключевой точкой контакта с брендом, интернет-магазины всё чаще переходят на бумажные решения в целях экологичности и эстетической привлекательности.

- Конечным пользователем

По типу конечного потребителя рынок сегментирован на следующие категории: продукты питания и напитки, корма для животных, косметическая продукция, сельское хозяйство, строительство, фармацевтика, химическая продукция и другие. Сегмент продуктов питания и напитков лидировал на рынке в 2024 году благодаря высокому объему потребления, высоким гигиеническим стандартам и быстрому переходу на биоразлагаемую упаковку. Эти пакеты обеспечивают безопасное хранение, термостабильность и четкую маркировку продукции.

Прогнозируется, что сегмент фармацевтической продукции будет расти самыми быстрыми темпами в период с 2025 по 2032 год в связи с ужесточением нормативных требований к экологичной вторичной упаковке, стерильной защите и прослеживаемости. Растущий спрос на бумажные пакеты с улучшенными барьерными свойствами и защитой от несанкционированного вскрытия дополнительно способствует расширению сегмента.

Региональный анализ рынка бумажных пакетов

- США доминировали на рынке бумажных пакетов, обеспечив наибольшую долю выручки в 83,10% в 2024 году, что обусловлено ужесточением нормативных ограничений на использование пластика и растущим внедрением экологичной упаковки в розничной торговле, сфере общественного питания и продуктовых магазинах. Растущий спрос на перерабатываемые биоразлагаемые альтернативы и повышенная сознательность потребителей в отношении охраны окружающей среды вывели США в лидеры региона.

- Широкое присутствие крупных производителей бумажных пакетов в сочетании с развитой розничной инфраструктурой и корпоративными инициативами в области устойчивого развития продолжает стимулировать спрос на продукцию. Кроме того, поддержка со стороны местных и федеральных запретов на одноразовый пластик ускоряет переход на бумажную упаковку.

- Рынок США также выигрывает от растущих инноваций в области дизайна бумажных пакетов, их прочности и возможности повторного использования, что еще больше укрепляет его доминирующее положение на рынке устойчивой упаковки в Северной Америке.

Обзор рынка бумажных пакетов в Канаде

Прогнозируется, что Канада будет демонстрировать самые высокие среднегодовые темпы роста на североамериканском рынке бумажных пакетов в период с 2025 по 2032 год, чему будут способствовать национальные программы сокращения использования пластика и активный переход потребителей к экологичной упаковке. Растущее предпочтение многоразовых и высококачественных бумажных пакетов, особенно в сфере общественного питания и розничной торговли, стимулирует спрос. Государственная поддержка экологичных альтернатив упаковки и растущие инвестиции в отечественные производственные мощности способствуют дальнейшему развитию рынка.

Обзор рынка бумажных пакетов в Мексике

Ожидается, что рынок бумажных пакетов в Мексике будет демонстрировать устойчивый рост в период с 2025 по 2032 год, чему будут способствовать рост розничной торговли, расширение деятельности предприятий общественного питания и усиление давления, направленного на сокращение пластиковых отходов. Повышение уровня экологической осведомлённости, а также развитие нормативно-правовой базы и региональных торговых связей побуждают местных производителей наращивать производство бумажных пакетов для удовлетворения внутреннего и экспортного спроса.

Доля рынка бумажных пакетов

Лидерами отрасли по производству бумажных пакетов являются в основном хорошо зарекомендовавшие себя компании, среди которых:

- Компания WestRock (США)

- Смерфит Каппа (Ирландия)

- International Paper (США)

- Группа компаний «Интепласт» (США)

- PAPIER-METTLER KG (Германия)

- PackagingPro (Австралия)

- JINAN XINSHUNYUAN PACKING CO., LTD (Китай)

- Монди (Великобритания)

- Thai Showa Paxxs Co., Ltd. (Таиланд)

- Conitex Sonoco (США)

Последние события на рынке бумажных пакетов в Северной Америке

- В июле 2025 года EP Group запустила целевую кампанию, призывающую ритейлеров одежды обновить ассортимент бумажных пакетов, что свидетельствует о стремлении к более качественным и экологичным упаковочным решениям в швейной отрасли. Ожидается, что этот шаг повлияет на стандарты розничной упаковки и повысит спрос на премиальные бумажные пакеты, соответствующие бренду.

- В июне 2025 года компания Mondi представила свой пакет PaperPlus Bag Advanced для вторичной переработки/переработки – высокопроизводительное решение, разработанное специально для влагочувствительных товаров и обеспечивающее снижение содержания пластика. Это нововведение усиливает тенденцию к использованию гибридной бумажной упаковки и укрепляет позиции Mondi в сегментах промышленной упаковки и упаковки для электронной коммерции, уделяя особое внимание функциональности и экологичности.

- В июне 2024 года компания Mondi совместно с Cemex представила в Испании пакет SolmixBag, что стало значительным шагом вперёд в области упаковки строительных материалов. Создавая пакет, растворяющийся в процессе смешивания цемента, Mondi вносит вклад в повышение эффективности и устойчивости строительного сектора, способствуя более широкому внедрению в отрасли экологичных решений, сокращающих отходы.

- В октябре 2024 года компания Coles представила моющийся бумажный пакет по цене 15 долларов США, способный выдерживать нагрузку до 20 кг и машинную стирку. Это нововведение отражает растущую тенденцию потребителей к прочной и многоразовой упаковке, подкрепляя отказ розничного сектора от одноразового пластика и расширяя возможности для производителей долговечных бумажных пакетов.

- В ноябре 2024 года Primark выпустил праздничные бумажные пакеты для покупок с красной полосой, которую можно использовать повторно в качестве подарочной упаковки. Этот креативный подход к упаковке двойного назначения повышает вовлеченность покупателей и способствует достижению целей устойчивого развития, позиционируя бумажные пакеты как универсальное и экологически ответственное решение для розничной торговли.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.