North America Lumber Pallet Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.17 Billion

USD

3.42 Billion

2025

2033

USD

2.17 Billion

USD

3.42 Billion

2025

2033

| 2026 –2033 | |

| USD 2.17 Billion | |

| USD 3.42 Billion | |

|

|

|

|

Сегментация рынка пиломатериалов в Северной Америке по типу продукции (поддоны из брусьев, поддоны из блоков, двухсторонние поддоны, двухстворчатые поддоны и другие), типу древесины (хвойные и лиственные породы), размеру (800 x 1200 мм, 1000 x 1200 мм, 800 x 600 мм, 914 x 914 мм, 1118 x 1118 мм, 1200 x 1000 мм и другие), каналу сбыта (офлайн и онлайн), конечному пользователю (пищевая промышленность, фармацевтика, химическая промышленность, розничная торговля, автомобильная промышленность и другие) — тенденции отрасли и прогноз до 2033 года.

Размер рынка поддонов для пиломатериалов в Северной Америке

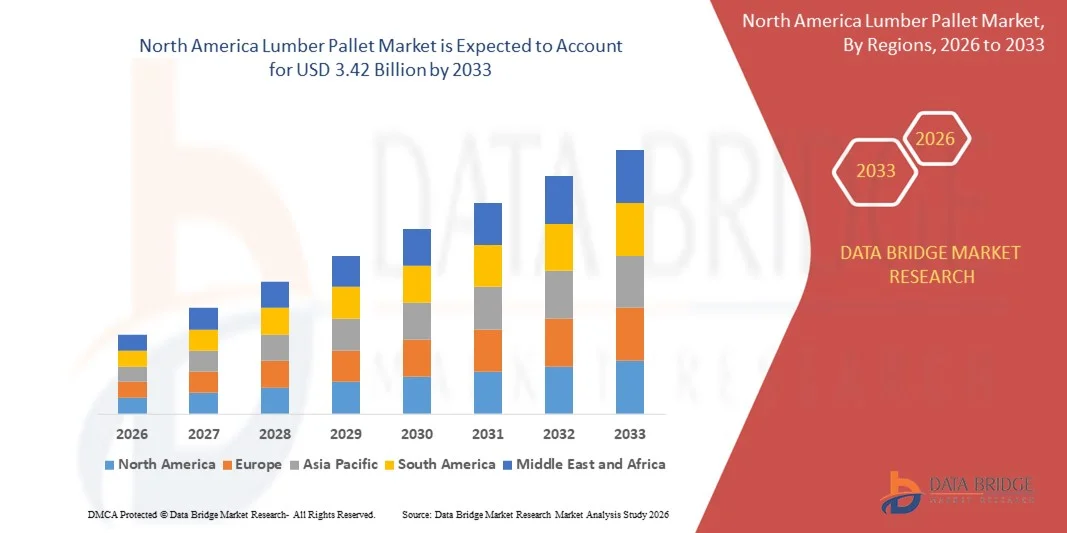

- Объем рынка пиломатериалов на поддонах в Северной Америке в 2025 году оценивался в 2,17 млрд долларов США и, как ожидается, достигнет 3,42 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 5,8% в течение прогнозируемого периода.

- Рост рынка в значительной степени обусловлен устойчивым расширением глобальной торговли, складской деятельности и логистики, что продолжает увеличивать спрос на надежные и экономически эффективные решения для обработки материалов в различных отраслях.

- Кроме того, растущее использование поддонов в пищевой промышленности, розничной торговле и производстве для безопасного хранения и транспортировки товаров усиливает рыночный спрос. Эти факторы в совокупности поддерживают стабильное потребление пиломатериалов на поддонах и положительно влияют на общий рост рынка.

Анализ рынка поддонов для пиломатериалов в Северной Америке

- Поддоны для пиломатериалов, служащие важными несущими платформами для хранения и транспортировки, остаются критически важными для операций в цепочках поставок как внутри страны, так и за рубежом благодаря своей долговечности, возможности многократного использования и совместимости со стандартным погрузочно-разгрузочным оборудованием.

- Растущая потребность в эффективной обработке сыпучих грузов, все большее внимание к стандартизированной упаковке и непрерывное перемещение товаров по промышленным цепочкам поставок в совокупности поддерживают спрос на деревянные поддоны и усиливают их важность в глобальной логистической экосистеме.

- В 2025 году США доминировали на рынке пиломатериалов на поддонах благодаря масштабным логистическим операциям, большому объему внутренней и международной торговли, а также высокому спросу со стороны розничной торговли, пищевой промышленности и обрабатывающей промышленности.

- Ожидается, что в прогнозируемый период Канада станет самой быстрорастущей страной на рынке пиломатериалов на поддонах благодаря расширению трансграничной торговли с США, росту пищевой и фармацевтической промышленности, а также увеличению числа инициатив по модернизации складских помещений.

- Сегмент поддонов из брусьев доминировал на рынке, занимая 58,5% в 2025 году, благодаря низкой стоимости, простой конструкции и широкому применению на складах и в внутренней логистике. Эти поддоны легко ремонтируются и подходят для крупномасштабных перевозок с умеренными требованиями к нагрузке. Их малый вес способствует эффективной обработке и транспортировке. Стандартизированные конструкции дополнительно повышают эффективность работы. Высокая доступность сырья из хвойных пород древесины поддерживает крупномасштабное производство. Этот устойчивый спрос обеспечивает им лидирующие позиции на рынке.

Обзор отчета и сегментация рынка пиломатериалов на поддонах

|

Атрибуты |

Ключевые тенденции рынка поддонов для пиломатериалов. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ производства и потребления, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Тенденции рынка пиломатериалов на поддонах в Северной Америке

Растущее внедрение экологически чистых и переработанных деревянных поддонов.

- Ключевой тенденцией на рынке поддонов из древесины является растущее внедрение экологически чистых и переработанных деревянных поддонов, обусловленное ужесточением экологических норм и корпоративными обязательствами в области устойчивого развития в глобальных цепочках поставок. Компании отдают приоритет поддонам, изготовленным из переработанной древесины и древесины, полученной из ответственных источников, чтобы сократить образование отходов и углеродный след, связанный с логистическими операциями.

- Например, компания UFP Industries расширила свой ассортимент поддонов, изготовленных из переработанной и вторично используемой древесины, поддерживая цели устойчивого развития крупных розничных и пищевых дистрибьюторских компаний. Такие инициативы укрепляют принципы экономики замкнутого цикла в отрасли производства поддонов и способствуют более широкому внедрению экологически чистых решений в этой области.

- Крупные компании, занимающиеся пулом и управлением поддонами, активно интегрируют поддоны из переработанной древесины в замкнутые системы, чтобы продлить срок службы поддонов и минимизировать потребление сырья. Такой подход способствует оптимизации затрат и одновременно соответствует требованиям к отчетности в области устойчивого развития, предъявляемым мировыми брендами.

- В пищевой промышленности все чаще отдают предпочтение поддонам из переработанной древесины, которые соответствуют гигиеническим и безопасным стандартам, а также отвечают требованиям устойчивого развития. Этот сдвиг усиливает спрос на поддоны, которые обеспечивают баланс между прочностью, соответствием стандартам и экологической ответственностью.

- Производители также инвестируют в разработку решений для поддонов из конструкционной и композитной древесины, в которых используются древесные отходы и побочные продукты. Эта тенденция повышает эффективность использования материалов и снижает зависимость от ресурсов первичной древесины.

- В целом, растущее внимание к устойчивому снабжению, сокращению отходов и соблюдению нормативных требований меняет методы производства поддонов. Эта тенденция усиливает переход рынка к экологически ответственным решениям в области производства деревянных поддонов в различных отраслях.

Динамика рынка пиломатериалов на поддонах в Северной Америке

Водитель

Расширение глобальной логистики, складского хранения и деятельности в сфере электронной коммерции.

- Быстрое расширение глобальных логистических сетей, складской инфраструктуры и операций электронной коммерции является основным фактором роста рынка поддонов для пиломатериалов, поскольку поддоны остаются необходимыми для эффективного хранения и транспортировки товаров. Увеличение объёмов перевозок потребительских товаров, промышленной продукции и сырья поддерживает высокий спрос на стандартизированные решения для поддонов.

- Например, компания CHEP продолжает расширять свои услуги по объединению паллет и логистике для поддержки крупных розничных и электронных торговых цепочек, обеспечивая эффективную обработку материалов в распределительных центрах. Это расширение подчеркивает критически важную роль паллет в логистических средах с высокой пропускной способностью.

- Рост организованной розничной торговли и сторонних логистических компаний еще больше стимулирует потребление паллет, поскольку централизованные склады в значительной степени полагаются на паллеты для управления запасами и выполнения заказов. Эта зависимость обеспечивает стабильное использование паллет как во внутренней, так и в трансграничной торговле.

- Производственные отрасли также наращивают мощности по выпуску и распределению продукции, что увеличивает потребность в надежных грузоподъемных устройствах, способных выдерживать многократные операции по перемещению грузов. Поддоны для пиломатериалов отличаются прочностью и совместимостью с автоматизированными системами обработки грузов, что способствует их широкому распространению.

- В совокупности расширение логистической, складской и электронной коммерческой инфраструктуры укрепляет фундаментальную роль пиломатериалов на поддонах в глобальных цепочках поставок и способствует устойчивому росту рынка.

Сдержанность/Вызов

Волатильность цен на пиломатериалы и доступности сырья.

- Рынок пиломатериалов на поддонах сталкивается со значительными проблемами из-за волатильности цен на древесину и колебаний доступности сырья, что напрямую влияет на производственные затраты и рентабельность. Изменения в поставках древесины, нормативные ограничения и рыночный спрос создают неопределенность для производителей поддонов.

- Например, такие компании, как Greif, столкнулись с ростом издержек, связанных с колебаниями цен на пиломатериалы, что потребовало корректировки цен и мер по повышению операционной эффективности для поддержания рентабельности. Эти колебания издержек усложняют заключение долгосрочных ценовых соглашений с клиентами.

- Производителям также приходится справляться с растущей конкуренцией за пиломатериалы со стороны строительной и мебельной отраслей, что усугубляет проблемы с закупкой сырья. Эта конкуренция оказывает дополнительное давление на стратегии закупок.

- Для смягчения колебаний цен за счет использования переработанной древесины и композитных поддонов требуются инвестиции в новые производственные мощности, что увеличивает капитальные затраты. Балансирование между контролем затрат и инициативами в области устойчивого развития остается сложной задачей.

- В целом, нестабильность цен на пиломатериалы и проблемы с поставками сырья продолжают ограничивать гибкость рынка. Эти факторы вынуждают производителей оптимизировать источники поставок, диверсифицировать материалы и корректировать ценовые стратегии для поддержания своей деятельности в условиях колеблющихся затрат.

Обзор рынка пиломатериалов на поддонах в Северной Америке

Рынок сегментирован по типу продукции, типу древесины, размеру, каналу сбыта и конечному потребителю.

- По типу продукции

В зависимости от типа продукции рынок поддонов для пиломатериалов сегментируется на поддоны с балочными перекладинами, поддоны с блочными перекладинами, двухсторонние поддоны, двухстворчатые поддоны и другие. Сегмент поддонов с балочными перекладинами доминировал на рынке, занимая наибольшую долю в 58,5% в 2025 году, благодаря низкой стоимости, простой конструкции и широкому применению на складах и в внутренней логистике. Эти поддоны легко ремонтируются и подходят для крупномасштабных перевозок с умеренными требованиями к нагрузке. Их малый вес способствует эффективной обработке и транспортировке. Стандартизированные конструкции дополнительно повышают эффективность работы. Высокая доступность сырья из хвойных пород древесины поддерживает крупномасштабное производство. Устойчивый спрос обеспечивает им лидирующие позиции на рынке.

Ожидается, что сегмент блочных поддонов продемонстрирует самый быстрый рост в период с 2026 по 2033 год, обусловленный растущим спросом на перевозку тяжелых грузов и экспортные операции. Блочные поддоны обеспечивают четырехсторонний доступ, улучшая обработку материалов на автоматизированных складах. Их повышенная прочность и устойчивость соответствуют потребностям международных перевозок. Рост использования в фармацевтической и пищевой логистике способствует внедрению. Развитие автоматизации складов еще больше ускоряет спрос. Эти факторы делают блочные поддоны ключевым сегментом роста.

- По типу древесины

В зависимости от типа древесины рынок поддонов для пиломатериалов сегментируется на хвойные и лиственные породы. В 2025 году сегмент хвойных пород доминировал на рынке благодаря более низким затратам, меньшему весу и доступности. Поддоны из хвойных пород позволяют ускорить производство и широко используются в розничной торговле и логистике товаров повседневного спроса. Их достаточная несущая способность соответствует большинству стандартных применений. Сертификаты экологической устойчивости дополнительно стимулируют их использование. Высокая частота замены обеспечивает стабильный спрос. Эти факторы поддерживают доминирование сегмента.

Прогнозируется, что сегмент древесины твердых пород будет расти самыми быстрыми темпами в течение прогнозируемого периода, чему способствует спрос на прочные и долговечные поддоны. Древесина твердых пород обладает большей прочностью и ударопрочностью, что важно для тяжелой промышленности. Более длительный срок службы снижает общие затраты на замену. Рост экспортных поставок способствует внедрению. Автомобильная и промышленная отрасли все чаще отдают предпочтение поддонам из древесины твердых пород. Это стимулирует более быстрый рост сегмента.

- По размеру

По размеру рынок деревянных поддонов сегментирован на размеры 800 x 1200 мм, 1000 x 1200 мм, 800 x 600 мм, 914 x 914 мм, 1118 x 1118 мм, 1200 x 1000 мм и другие. Сегмент 1200 x 1000 мм доминировал на рынке в 2025 году благодаря своей совместимости с мировыми стандартами морских перевозок и контейнерных перевозок. Этот размер обеспечивает эффективное использование пространства на складах и в транспортных системах. Он широко используется в пищевой, напиточной и розничной торговле. Стандартизация снижает сложность обработки. Высокая региональная востребованность стимулирует объемный спрос. Эти факторы обеспечивают ему лидирующую долю на рынке.

Ожидается, что сегмент паллет размером 800 x 1200 мм продемонстрирует самый быстрый рост в период с 2026 по 2033 год, чему способствуют рост европейской торговли и трансграничной логистики. Соответствие стандартам европаллет обеспечивает плавную интеграцию. Рост организованной розничной торговли и электронной коммерции стимулирует спрос. Эффективное распределение грузов повышает безопасность. Расширение экспорта способствует внедрению новых технологий. Это создает предпосылки для сильного роста сегмента.

- По каналам сбыта

По каналам сбыта рынок пиломатериалов на поддоны сегментируется на офлайн и онлайн. В 2025 году наибольшую долю занимал офлайн-сегмент, чему способствовали налаженные отношения с поставщиками и практика оптовых закупок. Офлайн-закупки позволяют осуществлять индивидуальную настройку и контроль качества. Крупные производители предпочитают прямые закупки из-за надежности поставок. Немедленная доступность обеспечивает бесперебойную работу. Долгосрочные контракты стабилизируют цены. Эти факторы поддерживают доминирование офлайн-сегмента.

Ожидается, что в прогнозируемый период наиболее быстрыми темпами будет расти онлайн-сегмент, чему способствуют цифровые закупки и расширение электронной коммерции B2B. Онлайн-платформы предлагают прозрачное ценообразование и более широкий доступ к поставщикам. Малые и средние предприятия все чаще внедряют цифровые методы закупок для экономии времени. Повышение надежности логистики способствует укреплению доверия. Цифровизация цепочки поставок ускоряет внедрение цифровых технологий. Это подпитывает быстрый рост онлайн-сегмента.

- С точки зрения конечного пользователя

В зависимости от конечного потребителя рынок деревянных поддонов сегментирован на пищевую промышленность и производство напитков, фармацевтику, химическую промышленность, розничную торговлю, автомобильную промышленность и другие отрасли. Сегмент пищевой промышленности и производства напитков доминировал на рынке в 2025 году благодаря большим объемам перевозок упакованных и скоропортящихся товаров. Поддоны имеют решающее значение для хранения и транспортировки в рамках холодовой цепи. Постоянный спрос со стороны перерабатывающих и распределительных центров поддерживает объемы продаж. Соблюдение гигиенических стандартов приводит к частой замене поддонов. Высокий уровень розничного потребления поддерживает их использование. Эти факторы укрепляют лидерство на рынке.

Ожидается, что в период с 2026 по 2033 год сегмент фармацевтической продукции будет расти самыми быстрыми темпами, чему способствуют расширение производства товаров медицинского назначения и глобальная дистрибуция лекарственных препаратов. Регулируемые цепочки поставок требуют стандартизированных и долговечных паллет. Рост логистики с регулируемой температурой поддерживает спрос. Увеличение экспорта медицинских изделий еще больше стимулирует их внедрение. Акцент на безопасном обращении ускоряет использование. Это позиционирует фармацевтическую отрасль как самый быстрорастущий сегмент конечных потребителей.

Региональный анализ рынка поддонов для пиломатериалов в Северной Америке

- США доминировали на рынке пиломатериалов, занимая наибольшую долю выручки в 2025 году, что было обусловлено масштабными логистическими операциями, большим объемом внутренней и международной торговли, а также высоким спросом со стороны розничной торговли, пищевой промышленности и обрабатывающей промышленности.

- Растущая зависимость от палетизированных перевозок в центрах выполнения заказов электронной коммерции, у сторонних логистических компаний и на крупных складских объектах продолжает поддерживать устойчивый спрос на пиломатериалы на паллетах в промышленных и коммерческих цепочках поставок.

- Сильное присутствие ключевых игроков рынка, таких как UFP Industries, Greif и Kamps Pallets, а также хорошо развитые сети по переработке и объединению поддонов, включая CHEP, укрепляют лидирующие позиции США. Ожидается, что постоянные инвестиции в логистическую инфраструктуру, готовые к автоматизации решения для поддонов и эффективные системы обработки материалов позволят стране сохранить доминирующее положение в течение прогнозируемого периода.

Анализ рынка пиломатериалов на поддонах в Канаде

По прогнозам, Канада продемонстрирует самый быстрый среднегодовой темп роста на рынке пиломатериалов в Северной Америке в период с 2026 по 2033 год, чему способствуют расширение трансграничной торговли с США, рост пищевой и фармацевтической промышленности, а также увеличение числа инициатив по модернизации складов. Например, CHEP и региональные поставщики поддонов поддерживают канадских розничных продавцов и производителей посредством программ объединения и повторного использования поддонов, что повышает эффективность цепочки поставок. Растущий спрос на стандартизированные поддоны в логистике холодовой цепи, значительные запасы лесных ресурсов и растущее внимание к устойчивым и перерабатываемым решениям в области упаковки из древесины ускоряют рост рынка, позиционируя Канаду как самый быстрорастущий рынок в регионе.

Анализ рынка пиломатериалов на поддонах в Мексике

Ожидается, что Мексика будет демонстрировать устойчивый рост с 2026 по 2033 год, чему способствуют расширение производственных центров, рост производства автомобилей и электроники, а также увеличение экспортно-ориентированной логистической деятельности. Такие компании, как UFP Industries и CHEP, поддерживают спрос на поддоны за счет производственных мощностей, услуг по объединению грузов и трансграничной логистической интеграции. Рост индустриальных парков, увеличение прямых иностранных инвестиций и соответствие североамериканским стандартам цепочки поставок продолжают способствовать стабильному использованию поддонов для пиломатериалов. Увеличение использования в сельскохозяйственном экспорте и розничной торговле дополнительно способствует стабильному росту рынка на протяжении всего прогнозируемого периода.

Доля рынка поддонов для пиломатериалов в Северной Америке

В отрасли производства пиломатериалов на поддонах доминируют хорошо зарекомендовавшие себя компании, в том числе:

- Гриф (США)

- UFP Industries, Inc. (США)

- PALLETBIZ (Германия)

- Группа PGS (Франция)

- UAB Vigidas Pack (Литва)

- LOSCAM (Австралия)

- JGD Pallets (Великобритания)

- Palcon LLC (США)

- Фалькенхан АРГ (Германия)

- Conquest Joinery (UK)

- SandS — производитель ящиков и поддонов (США)

- Империал Тимбер (Великобритания)

- HG Timber Ltd. (Великобритания)

- Йоханнесбургская лесопромышленная компания (Южная Африка)

- Premier Pallets, Inc. (США)

- Компания Rowlinsons Packaging Ltd. (Великобритания)

- Christies Industries (Великобритания)

Последние тенденции на рынке пиломатериалов на поддонах в Северной Америке

- В июле 2024 года компания WestRock расширила свой портфель экологически чистой упаковки, увеличив производственные мощности по выпуску поддонов из древесины с добавлением переработанного волокна, тем самым укрепив свои позиции в сфере экологически ответственных логистических решений. Это развитие поддерживает растущий спрос со стороны розничной торговли и цепочек поставок продуктов питания, стремящихся к снижению воздействия на окружающую среду, одновременно усиливая конкуренцию в сегменте экологически чистых поддонов и влияя на решения о закупках среди крупных покупателей.

- В сентябре 2023 года компания CHEP расширила свое присутствие в Азии, открыв новый распределительный центр во Вьетнаме, что укрепило ее возможности по обслуживанию быстрорастущего логистического рынка Юго-Восточной Азии. Этот шаг улучшает доступность паллет в регионе и сокращает сроки доставки, позволяя CHEP укреплять отношения с клиентами и получать конкурентное преимущество в быстрорастущем логистическом центре.

- В августе 2023 года компания UFP Industries объявила о запуске новой линейки экологически чистых поддонов, изготовленных из переработанных материалов, что напрямую отвечает растущим требованиям устойчивого развития в промышленных цепочках поставок. Эта инициатива позиционирует компанию как лидера в области экологически ответственных решений для поддонов, помогая привлекать клиентов, ориентированных на устойчивое развитие, и способствуя долгосрочному расширению доли рынка.

- В июле 2023 года компания Kamps Pallets заключила стратегическое партнерство с крупным логистическим провайдером для повышения эффективности цепочки поставок и сроков доставки. Это сотрудничество улучшает надежность обслуживания и сроки выполнения заказов, что является критически важными конкурентными преимуществами на рынке пиломатериалов на поддонах, способствуя тем самым удержанию клиентов и расширению присутствия на рынке.

- В сентябре 2022 года компания ArbaBlox инвестировала 51,34 миллиона долларов США в завод по производству паллетных блоков в городе Уинона, штат Миссисипи, что стало ее первым крупномасштабным предприятием по производству композитных паллетных блоков. Используя отходы лесопильных заводов, проект укрепляет устойчивое снабжение материалами для паллет, одновременно поддерживая спрос со стороны предприятий общественного питания и промышленности. При поддержке государственных и местных властей предприятие увеличивает региональные производственные мощности, способствует созданию рабочих мест и укрепляет переход рынка к решениям из конструкционной и композитной древесины для производства паллет.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.