North America Interventional Cardiology Peripheral Vascular Devices Market

Размер рынка в млрд долларов США

CAGR :

%

USD

9,596.92 Million

USD

3.27 Million

2022

2029

USD

9,596.92 Million

USD

3.27 Million

2022

2029

| 2023 –2029 | |

| USD 9,596.92 Million | |

| USD 3.27 Million | |

|

|

|

|

Рынок интервенционной кардиологии и периферических сосудистых устройств в Северной Америке, по продукту ( баллоны для ангиопластики , стенты, катетеры, стент-графты для эндоваскулярного восстановления аневризмы, фильтры нижней полой вены (НПВ), устройства для модификации бляшек, аксессуары и устройства для изменения гемодинамического потока), тип (обычный и стандартный), процедура (вмешательство в подвздошную артерию, бедренно-подколенные вмешательства, большеберцовые вмешательства (ниже колена), периферическая ангиопластика, артериальная тромбэктомия и периферическая атерэктомия), показание ( периферические артериальные заболевания и коронарное вмешательство), возрастная группа (гериатрическая, взрослая и детская), конечный пользователь (больницы, амбулаторные хирургические центры , дома престарелых, клиники и другие), канал сбыта (прямой тендер, сторонние дистрибьюторы и другие), страна (США, Канада и Тенденции развития отрасли (Мексика) и прогноз до 2029 года

Анализ рынка и аналитика: рынок интервенционной кардиологии и периферических сосудистых устройств в Северной Америке

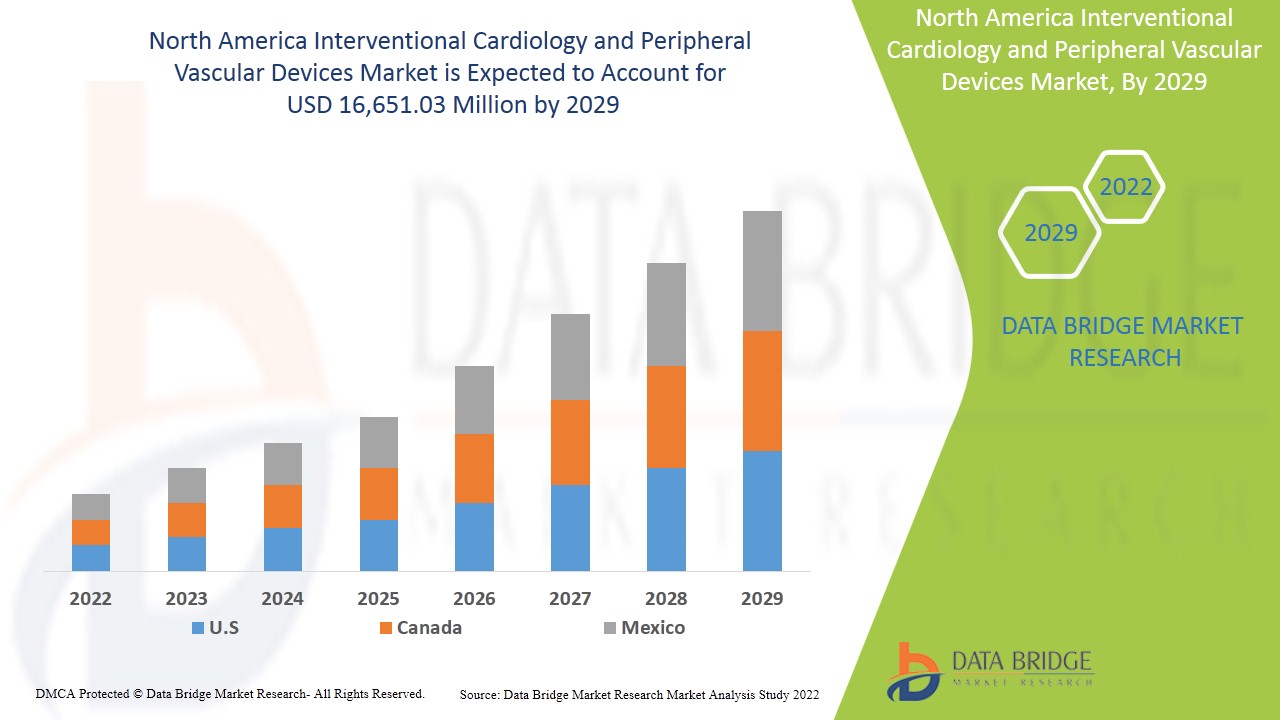

Ожидается, что рынок интервенционной кардиологии и периферических сосудистых устройств в Северной Америке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, рынок будет расти со среднегодовым темпом роста 7,7% в прогнозируемый период с 2022 по 2029 год и, как ожидается, достигнет 16 651,03 млн долларов США к 2029 году с 9 596,92 млн долларов США в 2021 году. Рост распространенности ишемической болезни сердца , ишемической болезни сердца и сосудистых заболеваний, а также рост осведомленности о своевременном лечении и использовании устройств, вероятно, станут основными факторами, которые будут стимулировать спрос на рынке в прогнозируемый период.

Термин «интервенционная кардиология» – это область медицины в рамках специализации «кардиология и периферические сосудистые устройства», которая использует усовершенствованные, традиционные и передовые, а также другие диагностические методы для оценки кровотока и давления в коронарных артериях и камерах сердца, а также технические процедуры и лекарственные препараты для лечения патологий, нарушающих функцию сердечно-сосудистой системы. Интервенционная кардиология и периферические сосудистые устройства используются, поскольку они вносят изменения в малоподвижный образ жизни. Это снижает риск осложнений хронических заболеваний сердца, таких как ишемическая болезнь сердца, ишемическая болезнь сердца и сосудистые заболевания.

Ишемическая болезнь сердца является основной причиной смерти среди женщин. Знания о сердечно-сосудистых заболеваниях могут способствовать здоровому образу жизни. Достаточная осведомленность о симптомах и их факторах риска может помочь снизить подверженность населения модифицируемым факторам риска и способствовать разработке стратегий профилактики и контроля. Знание симптомов сердечно-сосудистых заболеваний позволит своевременно начать лечение.

Драйверами роста североамериканского рынка устройств для интервенционной кардиологии и лечения периферических сосудов являются растущая распространенность ишемической болезни сердца, ишемической болезни сердца и других сосудистых заболеваний, рост осведомленности о своевременном лечении и использовании устройств, технологический прогресс в области кардиологии и лечения периферических сосудов, возросший интерес к неинвазивной хирургии и благоприятная политика возмещения расходов. Однако факторами, которые, как ожидается, будут сдерживать рынок, являются рост стоимости устройств, риски, возникающие при их использовании, рост числа отзывов продукции и доступность альтернативных методов лечения. С другой стороны, стратегические инициативы участников рынка, рост расходов на здравоохранение и расширение исследований и разработок, а также рост численности гериатрического населения могут стать возможностью для роста североамериканского рынка устройств для интервенционной кардиологии и лечения периферических сосудов. Необходимость в квалифицированных специалистах, нехватка больничной инфраструктуры и получение разрешений регулирующих органов могут создать трудности для североамериканского рынка устройств для интервенционной кардиологии и лечения периферических сосудов.

В отчёте о рынке интервенционной кардиологии и периферических сосудистых устройств в Северной Америке представлена подробная информация о доле рынка, новых разработках и анализе продуктовой линейки, влиянии игроков на внутреннем и местном рынке, анализируются возможности, связанные с новыми источниками дохода, изменениями в регулировании рынка, сертификацией продукции, стратегическими решениями, выводом продуктов на рынок, расширением географии присутствия и технологическими инновациями. Чтобы понять анализ и рыночную ситуацию, свяжитесь с нами для получения аналитического брифинга. Наша команда поможет вам разработать решение, которое позволит вам достичь желаемой цели и повлиять на доход.

Объем и размер рынка интервенционной кардиологии и периферических сосудистых устройств в Северной Америке

Рынок интервенционной кардиологии и периферических сосудистых устройств в Северной Америке делится на семь сегментов: продукт, тип, процедура, показание, возрастная группа, конечный пользователь и канал сбыта.

- Рынок устройств для интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется по видам продукции: баллоны для ангиопластики, стенты, катетеры, стент-графты для эндоваскулярного восстановления аневризмы, фильтры для нижней полой вены (НПВ), устройства для модификации бляшек, аксессуары и устройства для изменения гемодинамического потока. Ожидается, что в 2022 году сегмент баллонов для ангиопластики будет доминировать на рынке устройств для интервенционной кардиологии и периферических сосудов в Северной Америке в связи с ростом числа случаев заболеваний периферических артерий, повышенным риском малоподвижного образа жизни, технологическим прогрессом в области баллонов для ангиопластики и наличием политики возмещения расходов на лечение заболеваний сердца в США.

- Рынок устройств для интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется по типу на традиционные и стандартные. Ожидается, что в 2022 году сегмент традиционных устройств будет доминировать на рынке устройств для интервенционной кардиологии и периферических сосудов в Северной Америке в связи с ростом распространенности сердечно-сосудистых заболеваний, таких как ишемическая болезнь сердца и сонных артерий, а также доступностью и предпочтением традиционных устройств для интервенционной кардиологии и периферических сосудов врачами и кардиологами, работающими в больницах США и Канады.

- Рынок интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется по принципу проведения: вмешательства на подвздошной, бедренно-подколенной, большеберцовой (ниже колена) артериях, периферическая ангиопластика, артериальная тромбэктомия и периферическая атерэктомия. Ожидается, что в 2022 году сегмент периферической ангиопластики будет доминировать на рынке интервенционной кардиологии и периферических сосудов в Северной Америке благодаря технологическому прогрессу, достигнутому за последнее десятилетие, и появлению современных устройств для периферической ангиопластики.

- Рынок интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется по показаниям на сегменты заболеваний периферических артерий и коронарных вмешательств. Ожидается, что в 2022 году сегмент заболеваний периферических артерий будет доминировать на рынке интервенционной кардиологии и периферических сосудов в Северной Америке в связи с ростом заболеваемости периферическими артериями, увеличением численности пожилого населения и увеличением числа одобренных продуктов.

- В зависимости от возрастной группы рынок интервенционной кардиологии и периферических сосудистых устройств в Северной Америке сегментирован на гериатрический, взрослый и детский. Ожидается, что в 2022 году гериатрический сегмент будет доминировать на североамериканском рынке интервенционной кардиологии и периферических сосудистых устройств. Они более уязвимы к различным сосудистым заболеваниям из-за слабого иммунитета и доступности программ возмещения расходов, таких как Medicare для лечения пожилых людей по минимальной стоимости в США.

- Рынок интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется по типу конечного потребителя на больницы, центры амбулаторной хирургии, дома престарелых, клиники и другие. Ожидается, что в 2022 году сегмент больниц будет доминировать на рынке интервенционной кардиологии и периферических сосудов в Северной Америке в связи с ростом числа хронических заболеваний сердца, таких как ишемическая болезнь сердца и сосудистые заболевания, увеличением числа хирургических операций, доступностью передового больничного оборудования и повышением осведомленности о лечении хронических заболеваний сердца в больницах.

- По каналам сбыта рынок устройств для интервенционной кардиологии и периферических сосудов в Северной Америке сегментируется на прямые тендеры, сторонних дистрибьюторов и другие. Ожидается, что в 2022 году сегмент сторонних дистрибьюторов будет доминировать на рынке устройств для интервенционной кардиологии и периферических сосудов в Северной Америке благодаря растущим предпочтениям клиентов, низким закупочным ценам и снижению экономии средств.

Анализ рынка интервенционной кардиологии и периферических сосудистых устройств в Северной Америке на уровне страны

Проведен анализ рынка интервенционной кардиологии и периферических сосудистых устройств в Северной Америке, а также предоставлена информация о размере рынка по продукту, типу, процедуре, показанию, возрастной группе, конечному пользователю и каналу сбыта.

В отчете о рынке устройств для интервенционной кардиологии и периферических сосудов в Северной Америке рассматриваются следующие страны: США, Канада и Мексика.

- Ожидается, что в 2022 году США будут доминировать благодаря наличию крупнейшего потребительского рынка с высоким ВВП. Кроме того, США имеют самые высокие расходы домохозяйств в мире и имеют торговые соглашения с несколькими странами, что делает их крупнейшим рынком потребительских товаров, росту числа пациентов, присутствию крупных игроков на рынке и ускоренному технологическому развитию в регионе.

В разделе отчета, посвященном отдельным странам, также рассматриваются факторы, влияющие на рынок, и изменения в регулировании рынка внутри страны, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, продажи на замену, демографические данные, нормативные акты и импортно-экспортные пошлины, являются одними из основных показателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при анализе прогнозных данных по странам учитываются присутствие и доступность североамериканских брендов, а также их сложности, связанные с высокой или низкой конкуренцией со стороны местных и отечественных брендов, и влияние каналов сбыта.

Потенциал роста интервенционной кардиологии и периферических сосудистых устройств в странах с развивающейся экономикой, а также стратегические инициативы участников рынка создают новые возможности на рынке интервенционной кардиологии и периферических сосудистых устройств в Северной Америке.

Рынок интервенционной кардиологии и периферических сосудов в Северной Америке также предоставляет подробный анализ роста в каждой стране в конкретной отрасли, включая продажи интервенционных кардиологических и периферических сосудистых устройств, влияние развития интервенционных кардиологических и периферических сосудистых устройств, а также изменения в нормативно-правовой базе, поддерживающие рынок интервенционной кардиологии и периферических сосудистых устройств. Данные доступны за период с 2019 по 2021 год.

Анализ конкурентной среды и доли рынка интервенционной кардиологии и периферических сосудистых устройств в Северной Америке

Конкурентная среда на рынке устройств для интервенционной кардиологии и периферических сосудов в Северной Америке содержит подробную информацию по конкурентам. В документе представлены общие сведения о компании, ее финансовые показатели, полученная выручка, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и оборудование, сильные и слабые стороны компании, запуск продукта, испытания продуктов, сертификация продуктов, патенты, широта ассортимента продукции, доминирующее положение в сфере применения, кривая жизненного цикла технологий. Представленные выше данные относятся только к рынку устройств для интервенционной кардиологии и периферических сосудов.

Некоторые крупные компании, поставляющие устройства для интервенционной кардиологии и периферических сосудов, включают Medtronic, BD., Cordis., Abbott., Boston Scientific Corporation, Cook, Cardiovascular Systems, Inc., AngioDynamics., Edwards Lifesciences Corporation., Biosensors International Group, Ltd., OrbusNeich Medical Company Limited, Merit Medical Systems., Terumo Medical Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Lepu Medical Technology(Beijing)Co., Ltd и Koninklijke Philips NV и другие.

Аналитики DBMR понимают конкурентные преимущества и проводят конкурентный анализ для каждого конкурента отдельно.

Стратегические инициативы участников рынка в сочетании с новыми технологическими достижениями в области интервенционной кардиологии и периферических сосудистых устройств в Северной Америке сокращают разрыв в лечении хронических ран.

Например,

- В январе 2022 года компания OrbusNeich Medical Co. Ltd. объявила о запуске нового продукта «Scoreflex NC» и получении предварительного одобрения (PMA) Управления по санитарному надзору за качеством пищевых продуктов и медикаментов США (FDA). Этот продукт представляет собой дилатационный катетер, предназначенный для использования в качестве дилатационного катетера при стенозе коронарных артерий, что расширяет географию её продукции.

Сотрудничество, совместные предприятия и другие стратегии участников рынка укрепляют позиции компании на рынке устройств для интервенционной кардиологии и периферических сосудов, что также дает организациям возможность улучшить свое предложение на североамериканском рынке устройств для интервенционной кардиологии и периферических сосудов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN PREVALENCE OF CHRONIC DISEASES, SUCH AS CORONARY ARTERY DISEASE, ISCHEMIC HEART DISEASE AND VASCULAR DISEASES

6.1.2 AWARENESS AMONG THE POPULATION ABOUT THE TREATMENT AND USE OF THE DEVICES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.1.4 FAVORABLE REIMBURSEMENT POLICIES

6.1.5 INCREASED INTEREST FOR MINIMALLY INVASIVE PROCEDURES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.2 RISKS OBSERVED WHILE USING INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 AVAILABILITY OF ALTERNATE TREATMENTS

6.3 OPPORTUNITIES

6.3.1 GROWING GERIATRIC POPULATION

6.3.2 RISING HEALTHCARE EXPENDITURE

6.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.4 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES & REGULATIONS

6.4.2 LACK OF HOSPITAL INFRASTRUCTURE

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ANGIOPLASTY BALLOONS

8.2.1 OLD/NORMAL BALLOONS

8.2.2 DRUG ELUTING BALLOONS

8.2.3 CUTTING AND SCORING BALLOONS

8.3 STENT

8.3.1 ANGIOPLASTY STENTS

8.3.2 CORONARY STENTS

8.3.2.1 BARE-METAL STENTS

8.3.2.2 DRUG-ELUTING STENTS (DES)

8.3.2.3 BIO ABSORBABLE STENTS

8.3.3 PERIPHERAL STENTS

8.3.4 OTHERS

8.4 CATHETERS

8.4.1 ANGIOGRAPHY CATHETERS

8.4.2 GUIDING CATHETERS

8.4.3 OTHERS

8.5 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

8.5.1 ABDOMINAL AORTIC ANEURYSM

8.5.2 THORACIC AORTIC ANEURYSM

8.6 INFERIOR VENA CAVA (IVC) FILTERS

8.6.1 RETRIEVABLE FILTERS

8.6.2 PERMANENT FILTERS

8.7 PLAQUE MODIFICATION DEVICES

8.7.1 THROMBECTOMY DEVICES

8.7.2 ATHERECTOMY DEVICES

8.8 HEMODYNAMIC FLOW ALTERATION DEVICES

8.8.1 EMBOLIC PROTECTION DEVICES

8.8.2 CHRONIC TOTAL OCCLUSION DEVICES

8.9 OTHERS AND ACCESSORIES

8.9.1 GUIDEWIRES

8.9.2 INTRODUCER SHEATHS

8.9.3 BALLOON INFLATION DEVICES

8.9.4 VASCULAR CLOSURE DEVICES

8.9.5 OTHERS

9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 STENTS

9.2.2 CATHETERS

9.2.3 GUIDEWIRES

9.2.4 VASCULAR CLOSURE DEVICES (VCD)

9.2.5 OTHERS

9.3 ADVANCED

9.3.1 BALLOON CATHETERS

9.3.2 STENT GRAFTS

10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 PERIPHERAL ANGIOPLASTY

10.2.1 ANGIOPLASTY BALLOONS

10.2.2 STENT

10.2.3 CATHETERS

10.2.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.2.5 INFERIOR VENA CAVA (IVC) FILTERS

10.2.6 PLAQUE MODIFICATION DEVICES

10.2.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.2.8 OTHERS AND ACCESSORIES

10.3 ILIAC INTERVENTION

10.3.1 ANGIOPLASTY BALLOONS

10.3.2 STENT

10.3.3 CATHETERS

10.3.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.3.5 INFERIOR VENA CAVA (IVC) FILTERS

10.3.6 PLAQUE MODIFICATION DEVICES

10.3.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.3.8 OTHERS AND ACCESSORIES

10.4 TIBIAL (BELOW-THE-KNEE) INTERVENTIONS

10.4.1 ANGIOPLASTY BALLOONS

10.4.2 STENT

10.4.3 CATHETERS

10.4.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.4.5 INFERIOR VENA CAVA (IVC) FILTERS

10.4.6 PLAQUE MODIFICATION DEVICES

10.4.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.4.8 OTHERS AND ACCESSORIES

10.5 ARTERIAL THROMBECTOMY

10.5.1 ANGIOPLASTY BALLOONS

10.5.2 STENT

10.5.3 CATHETERS

10.5.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.5.5 INFERIOR VENA CAVA (IVC) FILTERS

10.5.6 PLAQUE MODIFICATION DEVICES

10.5.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.5.8 OTHERS AND ACCESSORIES

10.6 PERIPHERAL ATHERECTOMY

10.6.1 ANGIOPLASTY BALLOONS

10.6.2 STENT

10.6.3 CATHETERS

10.6.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.6.5 INFERIOR VENA CAVA (IVC) FILTERS

10.6.6 PLAQUE MODIFICATION DEVICES

10.6.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.6.8 OTHERS AND ACCESSORIES

10.7 FEMOROPOPLITEAL INTERVENTIONS

10.7.1 ANGIOPLASTY BALLOONS

10.7.2 STENT

10.7.3 CATHETERS

10.7.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.7.5 INFERIOR VENA CAVA (IVC) FILTERS

10.7.6 PLAQUE MODIFICATION DEVICES

10.7.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.7.8 OTHERS AND ACCESSORIES

11 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION

11.1 OVERVIEW

11.2 PERIPHERAL ARTERIAL DISEASE

11.2.1 ATHEROSCLEROSIS

11.2.2 ABDOMINAL AORTIC ANEURYSM

11.2.3 LOWER EXTREMITY PERIPHERAL ARTERIAL DISEASE

11.2.4 SUPRA-INGUINAL ARTERIAL DISEASE

11.2.5 INFRA-INGUINAL ARTERIAL DISEASE

11.2.6 INFRA-POPLITEAL DISEASE

11.2.7 UPPER EXTREMITY OCCLUSIVE DISEASE

11.2.8 CAROTID ARTERY DISEASE

11.2.9 OTHERS

11.3 CORONARY INTERVENTION

11.3.1 ISCHEMIC HEART DISEASE

11.3.2 THORACIC AORTIC ANEURYSM

11.3.3 VALVE DISEASE

11.3.4 PERCUTANEOUS VALVE REPAIR OR REPLACEMENT

11.3.5 CONGENITAL HEART ABNORMALITIES

11.3.6 OTHERS

12 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 PEDIATRIC

13 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 PRIVATE

13.2.2 PUBLIC

13.3 AMBULATORY SURGICAL CENTERS

13.4 NURSING FACILITIES

13.5 CLINICS

13.6 OTHERS

14 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY DISTRIBUTORS

14.3 DIRECT TENDER

14.4 OTHERS

15 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BOSTON SCIENTIFIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.1.6 ACQUSITION

18.2 CORDIS.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.2.6 PRODUCT LAUNCHES

18.3 ABBOTT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.3.6 PRODUCT LAUNCHES

18.4 BD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 TERUMO CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.5.6 PARTNERSHIP

18.5.7 PRODUCT LAUNCH

18.6 ANGIODYNAMICS.(2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 B. BRAUN MELSUNGEN AG (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CARDIOVASCULAR SYSTEMS, INC. (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 COOK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.10.4 EXPANSION

18.10.5 PRODUCT LAUNCHES

18.11 EDWARDS LIFESCIENCES CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 KONINKLIJKE PHILIPS N.V.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.12.5 PRODUCT UPDATES

18.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD. (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 MEDTRONIC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.14.5 COLLABORATION

18.14.6 PRODUCT LAUNCH

18.15 MERIT MEDICAL SYSTEM

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 MICROPORT SCIENTIFIC CORPORATION.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.16.4.1 PRODUCT APPROVALS

18.17 ORBUSNEICH MEDICAL COMPANY LIMITED

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 PRODUCT LAUNCH

18.18 SMT

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 TELEFLEX INCORPORATED.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.19.5 ACQUISITIONS

18.2 W. L. GORE & ASSOCIATES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STENT IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GERIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ADULTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PEDIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA NURSING FACILITIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CLINICS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIRECT TENDER IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 99 U.S. ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 100 U.S. FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 103 U.S. ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 104 U.S. PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 105 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 106 U.S. PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 U.S. CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 109 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 U.S. HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 CANADA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 CANADA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 126 CANADA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 127 CANADA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 128 CANADA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 130 CANADA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 131 CANADA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 132 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 135 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 136 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 CANADA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 MEXICO INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 MEXICO OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MEXICO CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 153 MEXICO ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 156 MEXICO PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 157 MEXICO ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 159 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 160 MEXICO PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 161 MEXICO CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 162 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 163 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MEXICO HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED PREVALENCE OF CHRONIC CARDIAC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN NON-INVASIVE SURGERIES AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

FIGURE 15 NORTH AMERICA PREVALENCE AND DISABILITY RATE OF ISCHEMIC HEART DISEASE (IHD) IN 2021

FIGURE 16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2021

FIGURE 25 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2021

FIGURE 29 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT (2021-2029)

FIGURE 49 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.