North America Hydrochloric Acid Market

Размер рынка в млрд долларов США

CAGR :

%

USD

480.83 Million

USD

743.55 Million

2025

2033

USD

480.83 Million

USD

743.55 Million

2025

2033

| 2026 –2033 | |

| USD 480.83 Million | |

| USD 743.55 Million | |

|

|

|

|

Сегментация рынка соляной кислоты в Северной Америке по типу (синтетическая соляная кислота и побочный продукт), форме (на водной основе, водная и раствор), применению (травление стали, кислотная обработка нефтяных скважин, переработка руды, пищевая промышленность, очистка бассейнов, хлорид кальция и др.), каналу сбыта (электронная коммерция, B2B, специализированные магазины и др.), конечному потребителю (продукты питания и напитки, фармацевтика, текстильная, нефтегазовая, сталелитейная, химическая промышленность и др.) — тенденции отрасли и прогноз до 2033 г.

Размер рынка соляной кислоты в Северной Америке

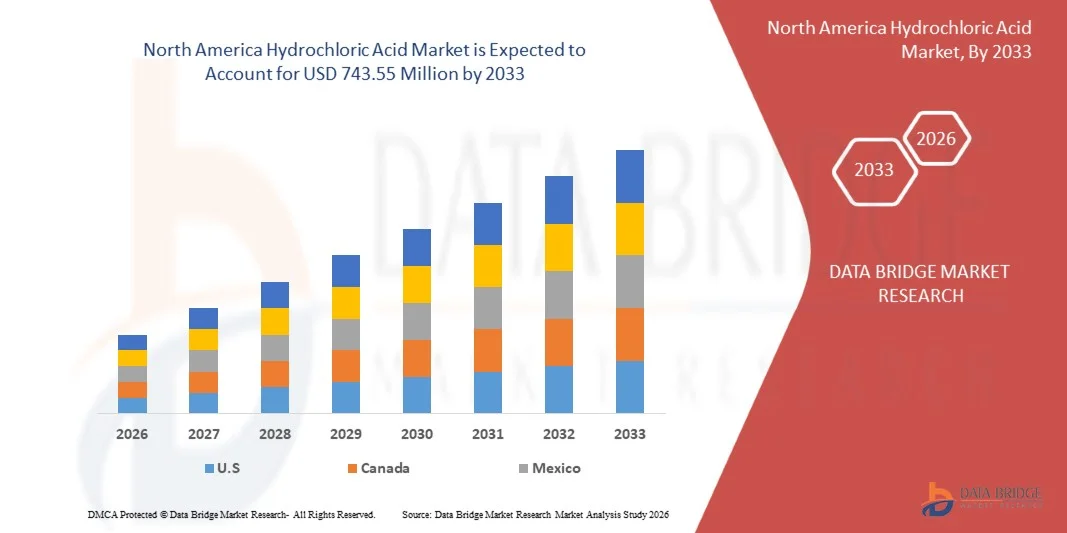

- Объем рынка соляной кислоты в Северной Америке в 2025 году оценивался в 480,83 млн долларов США и, как ожидается , достигнет 743,55 млн долларов США к 2033 году при среднегодовом темпе роста 5,6% в течение прогнозируемого периода.

- Рост рынка в значительной степени обусловлен растущим использованием соляной кислоты в ключевых промышленных процессах, таких как травление стали, кислотная обработка нефтяных скважин, пищевая промышленность и химический синтез, что обусловлено расширением производства и ростом спроса со стороны тяжёлой промышленности. Растущая потребность в высокочистой соляной кислоте в фармацевтической и электронной промышленности способствует дальнейшему росту объёмов производства и укрепляет перспективы её потребления.

- Более того, растущее использование соляной кислоты, побочного продукта хлорщелочного производства, и систем рекуперации, ориентированных на устойчивое развитие, повышает доступность поставок для секторов конечного потребления. Эти факторы ускоряют промышленное использование HCl и способствуют стабильному росту спроса в традиционных и новых областях применения.

Анализ рынка соляной кислоты в Северной Америке

- Соляная кислота, ключевой неорганический химикат, используемый для обработки металлов, контроля pH, химической обработки и восстановления ресурсов, остаётся основополагающим сырьем для таких отраслей, как сталелитейная, нефтегазовая, пищевая и фармацевтическая. Её универсальность и важная роль в крупномасштабных промышленных процессах продолжают усиливать её значимость в глобальном производстве и цепочке создания стоимости.

- Растущий спрос на соляную кислоту обусловлен, прежде всего, расширением инфраструктуры, увеличением объёмов разведки сырой нефти, требующих кислотной обработки, а также ростом потребления переработанных пищевых продуктов и специализированных химикатов. Эти факторы рынка усиливают долгосрочные тенденции потребления и способствуют устойчивому росту производства как синтетического, так и побочного HCl.

- В 2025 году США доминировали на североамериканском рынке соляной кислоты благодаря своей обширной экосистеме химического производства, мощной нефтеперерабатывающей промышленности и растущему потреблению в сфере металлообработки, производства продуктов питания и очистки воды.

- Ожидается, что Канада станет страной с самыми быстрыми темпами роста на североамериканском рынке соляной кислоты в течение прогнозируемого периода в связи с ростом промышленной активности в горнодобывающей промышленности, металлургии и очистке сточных вод.

- Сегмент синтетической соляной кислоты доминировал на рынке с долей 74,5% в 2025 году благодаря своей стабильной чистоте, контролируемому процессу производства и пригодности для отраслей, требующих точного химического состава. Производители предпочитают синтетические варианты для таких применений, как фармацевтика, пищевая промышленность и водоподготовка, где надежность качества напрямую влияет на производительность. Наличие крупных и экономически эффективных производственных мощностей укрепляет присутствие компании как в развитых, так и в развивающихся странах. Отрасли, использующие синтетическую соляную кислоту, выигрывают от единообразия концентраций, что снижает вариабельность процесса и повышает качество конечного продукта. Этот сегмент также развивается благодаря совершенствованию технологий обработки и росту инвестиций в химические производственные кластеры по всему миру, увеличивая свою долю рынка.

Область применения отчета и сегментация рынка соляной кислоты в Северной Америке

|

Атрибуты |

Ключевые данные о рынке соляной кислоты |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка соляной кислоты в Северной Америке

«Растущее внедрение систем производства соляной кислоты на основе рекуперации»

- Важной тенденцией на рынке соляной кислоты в Северной Америке является растущий переход к технологиям производства, основанным на рекуперации, которые позволяют эффективно повторно использовать газообразный хлористый водород, образующийся в процессе производства. Этот переход обусловлен необходимостью сокращения химических отходов, снижения производственных затрат и соблюдения экологических норм, способствующих устойчивому развитию промышленности.

- Например, компании Covestro AG и BASF SE внедрили системы рекуперации хлористого водорода, интегрированные в установки по производству поликарбоната и изоцианата. Эти замкнутые системы улавливают и преобразуют газообразный хлористый водород в пригодную для повторного использования соляную кислоту, повышая эффективность использования ресурсов и сокращая выбросы на химических предприятиях.

- Системы рекуперации всё шире внедряются в хлорщелочной и нефтехимической промышленности, поскольку эти процессы приводят к образованию большого количества побочного продукта – хлористого водорода. Превращая этот газ в товарную соляную кислоту, компании повышают операционную устойчивость, оптимизируя структуру затрат и повышая эффективность цепочки поставок.

- Рост технологических инноваций в установках регенерации кислоты, таких как мембранные сепараторы и модули термической регенерации, дополнительно повышает эффективность процесса. Эти достижения позволяют повысить чистоту продукции и минимизировать энергопотребление, что способствует долгосрочной экономической эффективности устойчивых систем производства кислоты.

- Кроме того, растущий интерес к циклическому химическому производству стимулирует интеграцию регенерированной соляной кислоты в цепочки создания стоимости в металлургии, пищевой промышленности и водоподготовке. Эта интеграция согласуется с глобальными усилиями по сокращению углеродного следа и повышению эффективности использования промышленных ресурсов.

- Широкое распространение производства соляной кислоты методом рекуперации отражает более широкую приверженность отрасли принципам устойчивого развития и эксплуатационной устойчивости. Поскольку компании продолжают инвестировать в замкнутые системы и экологичные производственные структуры, ожидается, что такие технологии зададут новые стандарты конкурентоспособности в производстве кислот и эффективности рекуперации ресурсов.

Динамика рынка соляной кислоты в Северной Америке

Водитель

«Растущий спрос на травление стали и кислотную обработку нефтяных скважин»

- Растущий спрос со стороны предприятий по травлению стали и кислотной обработке нефтяных скважин является ключевым фактором развития рынка соляной кислоты в Северной Америке. В производстве стали соляная кислота играет важнейшую роль в удалении загрязнений и оксидных пленок с металлических поверхностей перед цинкованием или нанесением покрытия, обеспечивая превосходное качество продукции и коррозионную стойкость.

- Например, компании ArcelorMittal и Tata Steel интегрировали собственные установки регенерации соляной кислоты на своих производственных предприятиях для обеспечения бесперебойных поставок для травления. Аналогичным образом, нефтесервисные компании, такие как Halliburton и Schlumberger, активно используют соляную кислоту для кислотной обработки с целью повышения проницаемости карбонатных коллекторов.

- Расширение проектов по разведке нефти и газа в сочетании с ростом нефтепереработки приводит к увеличению потребления соляной кислоты. Эффективность этого соединения в растворении минеральных отложений и очистке поверхностей скважин делает его незаменимым для поддержания эффективности добычи в процессе бурения и интенсификации притока.

- В сталелитейном производстве модернизация технологических установок и разработка современных линий травления дополнительно поддерживают долгосрочный спрос. Использование соляной кислоты в процессах непрерывного травления обеспечивает более чистую поверхность металла, более высокую производительность и снижение воздействия на окружающую среду по сравнению со старыми методами использования серной кислоты.

- Непрерывный рост числа проектов в строительстве, автомобилестроении и промышленной инфраструктуре по всему миру обеспечивает устойчивый спрос на высококачественную сталь, что обуславливает спрос на соляную кислоту. Совместное использование в энергетике, металлургии и обрабатывающей промышленности делает это соединение важнейшим промышленным химикатом, стимулирующим глобальную экономическую активность.

Сдержанность/Вызов

«Нестабильность поставок хлора и сырья»

- Нестабильность поставок и цен на хлор, ключевое сырье для производства соляной кислоты, представляет собой серьёзную проблему для производителей. Поскольку доступность хлора тесно связана с деятельностью предприятий хлорно-щелочной промышленности, колебания объёмов производства или спроса на каустическую соду со стороны перерабатывающей промышленности могут напрямую влиять на темпы производства соляной кислоты и стабильность цен.

- Например, в периоды дефицита хлора крупные производители, такие как Olin Corporation и Westlake Chemical, сообщали о производственных ограничениях и росте затрат на закупку производных продуктов, включая соляную кислоту. Этот дисбаланс поставок может привести к срыву контрактных обязательств и снижению рентабельности в зависимых отраслях.

- Цикличность производства хлора в сочетании с ограничениями в области логистики и хранения часто приводит к несоответствию динамики спроса и предложения. Поскольку соляную кислоту сложно транспортировать на большие расстояния из-за проблем безопасности, дефицит производства в регионе может привести к локальному росту цен и ограничению доступности.

- Кроме того, глобальные экономические колебания и перебои в обслуживании хлорщелочных предприятий могут ещё больше усугубить дефицит сырья. Колебания цен на энергоносители и производственные затраты также влияют на экономику производства хлора, что, в свою очередь, влияет на динамику цен на соляную кислоту в промышленных регионах.

- Обеспечение стабильных поставок сырья и разработка эффективных моделей производства, основанных на принципах рекуперации, будут иметь решающее значение для противодействия волатильности рынка. Ожидается, что стратегическое сотрудничество, обратная интеграция и внедрение циклических систем химического производства помогут стабилизировать цепочки поставок и обеспечить стабильный выпуск соляной кислоты в долгосрочной перспективе.

Объем рынка соляной кислоты в Северной Америке

Рынок сегментирован по типу, форме, применению, каналу сбыта и конечному пользователю.

• По типу

На основе типа рынок сегментирован на синтетическую соляную кислоту и побочную соляную кислоту. Сегмент синтетической соляной кислоты доминировал на рынке с наибольшей долей в 74,5% в 2025 году благодаря своей постоянной чистоте, контролируемому процессу производства и пригодности для отраслей, требующих точного химического состава. Производители предпочитают синтетические варианты для таких применений, как фармацевтика, пищевая промышленность и очистка воды, где надежность качества напрямую влияет на производительность. Наличие крупномасштабных, экономически эффективных производственных мощностей укрепляет его присутствие как в развитых, так и в развивающихся экономиках. Отрасли, использующие синтетическую соляную кислоту, выигрывают от единообразных уровней концентрации, которые снижают изменчивость процесса и повышают качество конечного продукта. Сегмент также развивается за счет лучших технологий обработки и растущих инвестиций в кластеры химического производства по всему миру, увеличивая свою долю рынка.

Прогнозируется, что сегмент побочного продукта – соляной кислоты – будет демонстрировать самые быстрые темпы роста в период с 2026 по 2033 год благодаря повышению его доступности на интегрированных сталелитейных и химических заводах. Этот тип продукта набирает популярность, поскольку отрасли ищут экономически эффективные альтернативы в связи с растущим вниманием к ресурсоэффективности и циклическому производству. Его применение усиливается по мере модернизации сталелитейных заводов и производства больших объемов побочного продукта – соляной кислоты, пригодного для последующего потребления. Многие секторы конечного потребления принимают варианты побочного продукта для таких применений, как металлообработка и интенсификация притока в нефтяные скважины, где сверхвысокая чистота не является обязательным требованием. Экологические соображения и снижение производственных затрат дополнительно ускоряют траекторию его роста на мировых рынках.

• По форме

По форме рынок сегментирован на водные, водные и растворные. Сегмент соляной кислоты на водной основе доминировал на североамериканском рынке соляной кислоты в 2025 году благодаря своей широкой применимости в химическом синтезе, обработке металлов и промышленной переработке. Соляная кислота на водной основе пользуется популярностью благодаря сбалансированным концентрациям, простоте использования и совместимости с крупными промышленными системами. Отрасли конечного потребления предпочитают эту форму, поскольку она обеспечивает стабильные скорости реакции и снижает риски, связанные с высококонцентрированными кислотными формами. Сегмент выигрывает от расширения производственных операций в сталелитейной и нефтегазовой отраслях, где широко используются варианты на водной основе. Его экономическая эффективность и безопасность обеспечивают постоянный спрос как среди покупателей оптовых партий, так и среди покупателей специализированной химии.

Ожидается, что сегмент водных растворов HCl будет демонстрировать самые высокие темпы роста в период с 2026 по 2033 год благодаря растущему применению в лабораториях, контролируемых промышленных применениях и прецизионном химическом синтезе. Эти формы обеспечивают настраиваемые уровни концентрации, отвечающие строгим эксплуатационным требованиям фармацевтической, пищевой и электронной промышленности. Росту также способствует повышение автоматизации систем дозирования, использующих стандартизированные форматы растворов для предотвращения вариабельности. Сегмент выигрывает от расширения применения в областях, где приоритет отдается стабильному химическому поведению и безопасности обращения. Такая гибкость в разработке рецептур способствует быстрому расширению его применения в развивающихся отраслях конечного потребления.

• По применению

На основе области применения рынок сегментирован на травление стали, кислотную обработку нефтяных скважин, переработку руды, пищевую промышленность, санитарию бассейнов, хлорид кальция и другие. Применение травления стали доминировало на рынке в 2025 году благодаря незаменимой роли кислоты в удалении окалины, ржавчины и примесей в процессе обработки стали. Соляная кислота обеспечивает превосходную эффективность травления по сравнению с альтернативными кислотами, предлагая более высокие скорости реакции и более чистую подготовку поверхности для последующих процессов. Расширение мирового производства стали, особенно в Азиатско-Тихоокеанском регионе, еще больше усиливает ее доминирование. Производители стали предпочитают HCl из-за ее возможности вторичной переработки через системы регенерации кислоты, что снижает воздействие на окружающую среду и эксплуатационные расходы. Сегмент сохраняет сильные позиции благодаря постоянной модернизации линий травления и спросу со стороны автомобильной, строительной и тяжелой промышленности.

Прогнозируется, что кислотная обработка нефтяных скважин будет демонстрировать самые высокие темпы роста в период с 2026 по 2033 год, что обусловлено увеличением объёмов бурения как традиционных, так и нетрадиционных месторождений. Соляная кислота пользуется популярностью благодаря своей способности растворять карбонаты, повышать проницаемость пласта и увеличивать дебит углеводородов. Расширение добычи сланцевых залежей и проектов по повышению нефтеотдачи повышает спрос на высокоэффективные растворы для кислотной обработки. Стремление отрасли к максимальному повышению производительности скважин и сокращению простоев способствует более широкому внедрению составов на основе HCl. Рост инвестиций в нефтесервисные услуги и передовые методы интенсификации притока выводит этот сегмент на передовые позиции в будущем росте.

• По каналу распространения

По каналам сбыта рынок сегментирован на интернет-магазины, B2B, специализированные магазины и другие. Канал сбыта B2B доминировал на североамериканском рынке соляной кислоты в 2025 году благодаря оптовым закупкам промышленных потребителей в сталелитейной, химической и нефтегазовой отраслях. Компании предпочитают прямые контракты на поставку, чтобы гарантировать бесперебойную поставку, стабильные цены и индивидуальный подход к концентрации. Производители и дистрибьюторы химической продукции укрепляют этот канал сбыта благодаря налаженным логистическим сетям и долгосрочным сервисным соглашениям. Крупные потребители получают выгоду от интегрированных систем хранения, транспортировки и безопасности, которые оптимизируют поставки больших объемов. Этот канал сбыта остается доминирующим, поскольку зависимость промышленности от контролируемых и своевременных поставок продолжает расти во всем мире.

Ожидается, что сегмент электронной коммерции будет демонстрировать самые быстрые темпы роста в период с 2026 по 2033 год благодаря цифровизации процессов закупок и развитию онлайн-торговли химической продукцией. Малые и средние предприятия всё чаще используют онлайн-платформы для прозрачного ценообразования, сравнения продукции и быстрого выполнения заказов. Платформы электронной коммерции упрощают доступ к паспортам безопасности, сертификатам и техническим спецификациям, позволяя принимать обоснованные решения. Переход к децентрализованным закупкам и спрос на более мелкую упаковку также способствуют росту. Расширение участия поставщиков химической продукции в онлайн-дистрибуции ускоряет развитие сегмента.

• Конечным пользователем

По типу конечного потребителя рынок сегментирован на следующие отрасли: продукты питания и напитки, фармацевтика, текстильная промышленность, нефтегазовая промышленность, сталелитейная промышленность, химическая промышленность и другие. В 2025 году сталелитейная промышленность доминировала на рынке благодаря масштабному потреблению соляной кислоты для травления, удаления окалины и оптимизации производства. Сталелитейные заводы используют HCl для очистки поверхностей, снижения уровня примесей и обеспечения эффективности прокатки и отделки. Непрерывный рост строительства, автомобилестроения и инфраструктуры поддерживает высокие уровни производства стали. Технологии регенерации кислоты дополнительно стимулируют внедрение, сокращая отходы и повышая экономическую эффективность. Сегмент выигрывает от постоянного расширения мощностей в основных регионах производства стали, что обеспечивает устойчивое доминирование.

Прогнозируется, что нефтегазовый сегмент будет расти самыми быстрыми темпами в период с 2026 по 2033 год, что обусловлено растущими требованиями к кислотной стимуляции, очистке скважин и операциям по повышению нефтеотдачи. Соляная кислота играет решающую роль в повышении нефтеотдачи пластов, особенно в карбонатных пластах, где кислотная обработка является обязательным условием. Рост добычи сланцевой нефти и бурения глубоких скважин повышает спрос на специализированные кислотные смеси. В этом секторе внедряются более современные химические решения для максимального повышения производительности и эксплуатационной эффективности. Рост глобальных инвестиций в проекты по разведке и добыче обеспечивает быстрое расширение этого сегмента конечного потребления.

Региональный анализ рынка соляной кислоты в Северной Америке

- США доминировали на североамериканском рынке соляной кислоты с самой большой долей выручки в 2025 году благодаря своей обширной экосистеме химического производства, мощной работе нефтеперерабатывающих заводов и росту потребления в сфере металлообработки, производства продуктов питания и очистки воды.

- Развитая промышленная база страны и развитые возможности производства хлорщелочи обеспечивают устойчивый спрос со стороны предприятий травления стали, бурения нефтяных скважин и фармацевтической отрасли. Упор правительства на повышение стандартов очистки воды и эффективности производства еще больше укрепляет лидерство США на рынке.

- Наличие крупных производителей химической продукции, постоянное внедрение инноваций в производственные технологии и стратегические партнёрства в цепочке поставок обеспечивают доминирование страны. Рост инвестиций в расширение производственных мощностей, автоматизацию и соблюдение экологических норм продолжает повышать эксплуатационную эффективность и способствовать росту рынка.

Обзор рынка соляной кислоты в Канаде и Северной Америке

Прогнозируется, что Канада будет демонстрировать самые высокие среднегодовые темпы роста на североамериканском рынке соляной кислоты в период с 2026 по 2033 год, чему будет способствовать рост промышленной активности в горнодобывающей промышленности, металлургии и очистке сточных вод. Строгие экологические нормы страны и растущее использование высокочистой соляной кислоты в химической промышленности стимулируют спрос. Канадские производители делают акцент на устойчивых методах производства и совершенствовании дистрибьюторских сетей для удовлетворения потребностей промышленности. Стратегическое сотрудничество с международными химическими компаниями и поддерживаемые государством инициативы по продвижению чистых технологий укрепляют конкурентоспособность Канады. Ожидается, что ориентация страны на ресурсоэффективность и модернизацию промышленности будет способствовать значительному росту в течение прогнозируемого периода.

Обзор рынка соляной кислоты в Мексике и Северной Америке

Ожидается, что в Мексике в период с 2026 по 2033 год будет наблюдаться устойчивый рост, обусловленный расширением обрабатывающей промышленности, автомобилестроения и строительства, которые в значительной степени зависят от соляной кислоты для обработки металлов и поверхностей. Растущая интеграция страны в североамериканские цепочки поставок стимулирует спрос на экономически эффективные и легкодоступные химические ресурсы. Рост инвестиций в отечественное химическое производство и растущее внедрение решений по очистке воды способствуют расширению рынка. Партнерские отношения между мексиканскими и мировыми производителями химической продукции способствуют повышению качества продукции, расширению возможностей сбыта и передаче технологий. Акцент Мексики на эффективность и устойчивое развитие промышленности лежит в основе её стабильной траектории роста на региональном рынке соляной кислоты в Северной Америке.

Доля рынка соляной кислоты в Северной Америке

В отрасли по производству соляной кислоты лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Olin Corporation (США)

- Occidental Petroleum Corporation (США)

- Shin-Etsu Chemical Co., Ltd. (Япония)

- BASF SE (Германия)

- ЮНИД (Южная Корея)

- Detrex Corporation – Italmatch Chemicals SpA (США/Италия)

- Tronox Holdings plc (США)

- IXOM (Австралия)

- Нурьон (Нидерланды)

- ERCO Worldwide – Superior Plus (Канада)

- SEQUENS (Франция)

- Formosa Plastics Corporation (Тайвань)

- Группа Tessenderlo (Бельгия)

- Westlake Chemical Corporation (США)

- Aditya Birla Chemicals (Индия)

- AGC Chemicals Americas (США/Япония)

- TOAGOSEI CO., LTD (Япония)

Последние события на рынке соляной кислоты в Северной Америке

- В ноябре 2025 года Агентство по охране окружающей среды США (EPA) ввело более строгие нормы выбросов в атмосферу для установок сжигания опасных отходов, ужесточив контроль за установками по регенерации соляной кислоты из отходов. Обновленные стандарты повышают потребность в передовых технологиях контроля выбросов, увеличивая эксплуатационные расходы и расходы на соблюдение требований для установок регенерации HCl. Ожидается, что это изменение повлияет на экономику производства побочной соляной кислоты, потенциально замедляя ввод новых мощностей по регенерации и побуждая производителей пересмотреть долгосрочные инвестиционные стратегии в системах переработки отходов в химикаты.

- В июле 2025 года компания Olin Corporation расширила мощности по производству соляной кислоты на своей производственной площадке в Луизиане, чтобы удовлетворить растущий спрос со стороны предприятий сталелитейной промышленности, химического синтеза и водоподготовки. Это расширение расширяет возможности Olin по удовлетворению региональных и международных потребностей в поставках, снижает зависимость от импорта и стабилизирует доступность продукции в различных сегментах конечного потребления. Повышая надежность производства, Olin также усиливает свои конкурентные преимущества в цепочке создания стоимости хлор-щелочи, поддерживая баланс рынка в условиях роста потребления.

- В январе 2025 года компания Jones-Hamilton Co. завершила приобретение компании Nexchlor LLC, значительно расширив свои возможности по производству соляной кислоты и географию присутствия. Эта интеграция укрепляет позиции компании на мировом рынке, повышая надежность поставок и обеспечивая более широкий охват более чем в 20 странах. С назначением Джона Каппса на должность руководителя подразделения HCl компания стремится оптимизировать свою деятельность и улучшить стратегическую координацию. Генеральный директор Тим Пуре подчеркнул, как объединенный опыт позволит улучшить отношения с клиентами и долгосрочные показатели поставок.

- В августе 2024 года компания Westlake Corporation провела публичные слушания, на которых обсуждалось предложение об установке двух печей для получения соляной кислоты, работающих на опасных отходах, предназначенных для извлечения HCl из промышленных отходов. Проект подчеркивает растущее внимание отрасли к ресурсоэффективности и устойчивым методам производства. Несмотря на то, что участники из числа местного населения выразили обеспокоенность по поводу воздействия на окружающую среду и безопасность, эксперты в области регулирующих органов подчеркнули необходимость строгого соблюдения требований по удалению загрязняющих веществ в соответствии с Законом о сохранении и восстановлении ресурсов. Реализация проекта может улучшить региональное предложение и поддержать модели циклического производства, хотя контроль со стороны регулирующих органов и отзывы местного населения могут повлиять на окончательные сроки реализации.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.