Рынок фитнес-оборудования в Северной Америке по типу продукции (силовые тренажеры, кардиотренажеры, анализаторы состава тела , оборудование для мониторинга фитнеса и другие), применению (снижение веса, бодибилдинг, физическая подготовка, умственная подготовка и другие), полу (мужчины и женщины), типу покупателя (частное лицо, учреждение и другие), использованию (жилые и коммерческие помещения), типу (на открытом воздухе и в помещении), конечному пользователю (оздоровительные клубы/тренажерные залы, домашние потребители, отели, корпорации, больницы и медицинские центры, государственные учреждения и другие), каналу сбыта (розничные магазины, специализированные и спортивные магазины, универмаги и дискаунтеры, интернет-магазины и другие) — тенденции отрасли и прогноз до 2030 года.

Анализ и аналитика рынка фитнес-оборудования в Северной Америке

Растущее стремление к здоровью и фитнесу теперь движет индустрией тренажеров. Рост рынка тренажеров обусловлен такими ключевыми факторами, как рост урбанизации, распространенность ожирения и хронических заболеваний из-за нездорового образа жизни, а также растущие корпоративные программы оздоровления и спрос со стороны различных отраслей. Более того, растущая осведомленность о последствиях роста ожирения, растущее гериатрическое население и растущий спрос на малоинвазивные и неинвазивные операции подпитывают общий рост рынка. С другой стороны, высокие затраты на установку или настройку оборудования или устройств и растущий спрос на перепродажу экономичного тренажерного оборудования, как ожидается, будут сдерживать рост рынка в течение прогнозируемого периода.

Однако внедрение других систем тренировок и изменение предпочтений клиентов сдерживают рост рынка фитнес-оборудования.

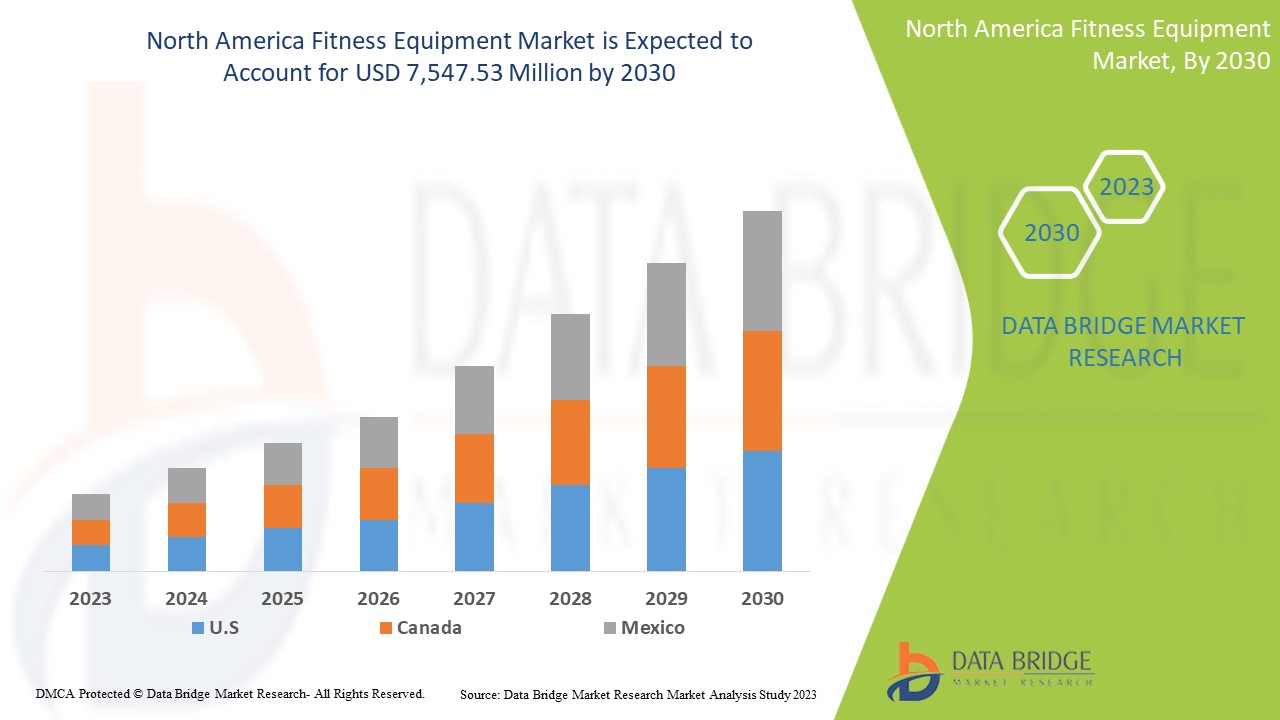

Data Bridge Market Research анализирует, что рынок фитнес-оборудования в Северной Америке, как ожидается, достигнет значения 7 547,53 млн долларов США к 2030 году, при среднегодовом темпе роста 7,3% в течение прогнозируемого периода. Этот рыночный отчет также охватывает анализ цен, патентный анализ и технологические достижения в деталях.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2023-2030 |

|

Базовый год |

2022 |

|

Исторические годы |

2021 (Можно настроить на 2020-2015) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

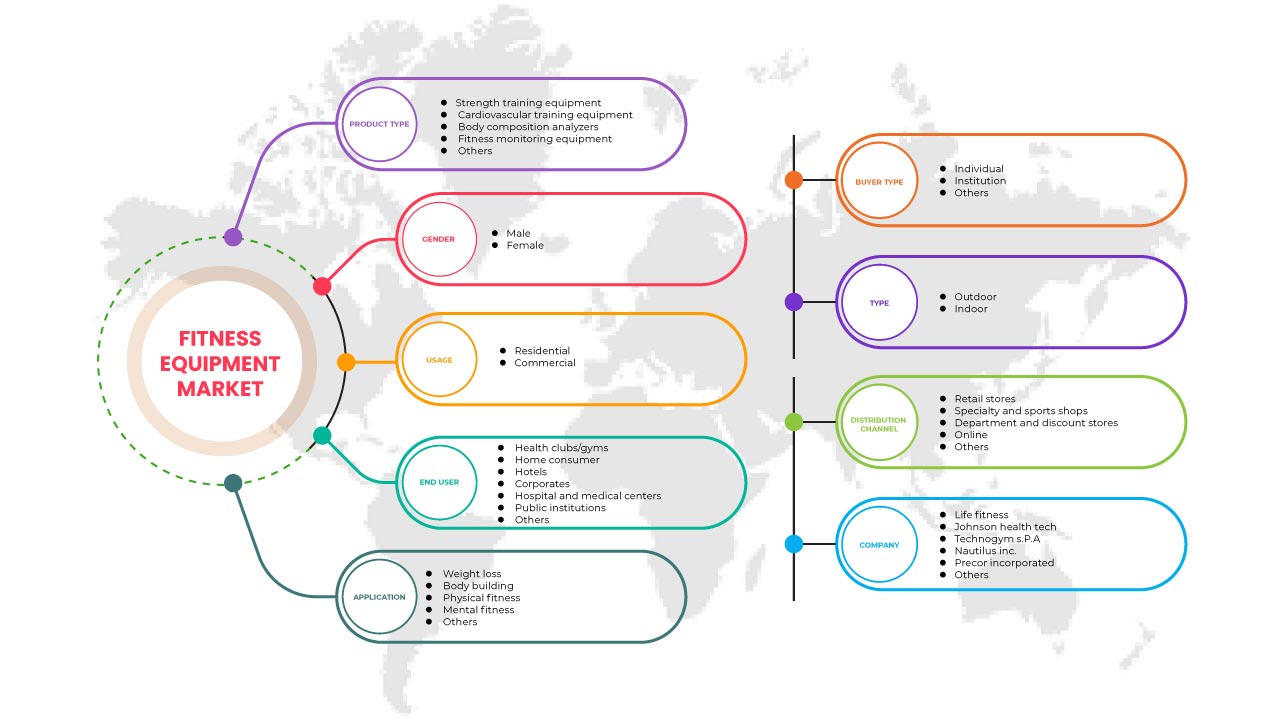

По типу продукта (силовые тренажеры, кардиотренажеры, анализаторы состава тела, оборудование для мониторинга фитнеса и другие), применению (снижение веса, бодибилдинг, физическая подготовка, умственная подготовка и другие), полу (мужчины и женщины), типу покупателя (частное лицо, учреждение и другие), использованию (жилые и коммерческие), типу (на открытом воздухе и в помещении), конечному пользователю (оздоровительные клубы/тренажерные залы, домашние потребители, отели, корпорации, больницы и медицинские центры, государственные учреждения и другие), каналу сбыта (розничные магазины, специализированные и спортивные магазины, универмаги и дискаунтеры, интернет-магазины и другие) |

|

Страны, охваченные |

США, Канада и Мексика |

|

Охваченные участники рынка |

Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS и Fitline India. |

Определение рынка фитнес-оборудования в Северной Америке

Фитнес-оборудование в основном относится к оборудованию, которое обычно используется во время любых физических или фитнес-активностей. Они помогают в повышении силы или для улучшения физической формы. Как правило, фитнес-оборудование включает в себя различное оборудование, такое как свободные веса, гребные тренажеры, беговые дорожки, силовые тренажеры, велотренажеры, эллиптический кросс-таннер и степпер среди прочего. Тренажерное оборудование - это машина, которая оказывает сопротивление человеку, когда он выполняет физические упражнения, чтобы увеличить силу и выносливость, контролировать вес и улучшить гибкость. Оно помогает улучшить личность и внешний вид. Беговые дорожки, эллиптические тренажеры, силовые тренажеры, свободные веса и другое тренажерное оборудование доступны. Эти устройства используются фитнес-центрами, спортзалами, домашними пользователями и корпоративными офисами. Согласно (VA.gov), кардиооборудование с предустановленными программами считается коммерческим. Используйте программы для людей с широким диапазоном аэробных способностей.

Динамика рынка фитнес-оборудования в Северной Америке

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Растет число людей, участвующих в соревнованиях по физической активности

Физическая активность имеет значительную пользу для здоровья сердца, тела и ума, а упражнения помогают предотвращать и контролировать неинфекционные заболевания, такие как сердечно-сосудистые заболевания, рак и диабет. В настоящее время люди во всем мире могут выносить результаты своих тяжелых фитнес-тренировок на соревновательные турниры и проверять свои навыки на различных функциональных фитнес-мероприятиях. Существует множество соревнований по фитнес-мероприятиям, таких как пауэрлифтинг, бодибилдинг, бег на длинные дистанции, забеги и соревнования по кросс-фитнесу. Поэтому многие компании и фитнес-организации проявили инициативу и организовали различные фитнес-соревнования и мероприятия на свежем воздухе. Уровень участия мужчин был выше (20,7 процента), чем женщин (18 процентов). Это включало спорт, упражнения и другие активные виды досуга.

Таким образом, растущее число людей, занимающихся физической активностью, стимулирует рост рынка.

- Пандемия Covid-19 привела к росту спроса на домашнее фитнес-оборудование

Пандемия COVID-19 оказала существенное положительное влияние на сектор фитнес-оборудования. Пандемия ввела новые нормы и правила, такие как социальное дистанцирование и карантины, чтобы предотвратить распространение вируса. В результате люди во всем мире были вынуждены оставаться дома, что привело к появлению новых тенденций, таких как работа на дому. Растущая популярность домашних тренировок увеличила спрос на тренажеры во время пандемии. Повышенное внимание к уходу за собой, физическим упражнениям и здоровью помогло фитнес-приложениям и платформам получить значительную популярность после пандемии. Кроме того, пандемия также подтолкнула любителей, не занимающихся фитнесом, уделять больше внимания поддержанию своего здоровья и физической формы, что, таким образом, помогает генерировать популярность.

Более того, пандемия COVID-19 также настолько увеличила спрос на домашнее фитнес-оборудование и фитнес-приложения, что количество проданных онлайн фитнес-оборудования и загрузок фитнес-приложений увеличилось почти на 30% в 2020 году.

Сдержанность

- Высокая стоимость фитнес-оборудования

Некоторое фитнес-оборудование, доступное по очень высоким ценам, особенно для стран со средним и низким уровнем дохода в развивающихся и слаборазвитых странах, выступает в качестве ограничивающего фактора для роста. С развитием технологий рост цен становится очевидным в случае высокотехнологичного фитнес-оборудования и носимых фитнес-устройств. Включение множества функций, таких как высококачественный дисплей, повышенная энергоэффективность, отслеживание дополнительных жизненно важных показателей, беспроводное подключение и обновленное программное обеспечение, среди прочего, напрямую увеличивает первоначальную стоимость фитнес-оборудования и фитнес-устройства. Использование различными потребителями носимых устройств увеличивает их расходы на фитнес-здравоохранение. Увеличение охвата приложений носимыми устройствами увеличивает спрос на них, что напрямую способствует их высокой стоимости.

Таким образом, высокая стоимость фитнес-оборудования сдерживает рост рынка.

Возможность

- Растущее проникновение платформ электронной коммерции, Интернета и смартфонов

Людям в современном мире нужен смартфон для общения, покупки продуктов, прохождения консультаций, осмотров у врачей, чтобы быть в курсе своей физической формы. Многие люди не могут думать или представить свою жизнь без смартфонов. Люди хотят быть в форме с помощью домашней методики в своем комфорте, а не в спортзалах и фитнес-клубах. Таким образом, фитнес-приложение действует как мост между людьми, получающими расписание фитнеса, план диеты и упражнения, среди прочего, просто используя свое фитнес-приложение. С технологическим прогрессом и развитием в странах все больше людей используют смартфоны в своей повседневной жизни.

Испытание

- Изменение предпочтений клиентов

Цифровой фитнес быстро стал спасителем отрасли, поскольку все больше людей привыкают к нему. Реалистично, что текущий бум цифрового фитнеса умрет, когда ограничения, связанные с карантином, ослабнут. Во время карантина онлайн-тренировки давали людям структуру, физическую форму, чувство общности и общение. Они поддерживали здоровье людей. Онлайн-тренировки останутся, поскольку потребители ожидают гибридных предложений в будущем. Хотя многие в конечном итоге возвращаются к своим обычным студийным занятиям, тренажерный зал, предлагающий онлайн-тренировки, более доступен для членов. Члены тренажерных залов становятся более осознанными в отношении цен, поскольку сегодня доступно множество вариантов фитнеса онлайн, и их конкурентоспособные цены. И поскольку тренажерные залы и студии готовятся к диверсификации в онлайн и студии в будущем, конкуренция становится жесткой. После первоначальной покупки люди готовы платить больше за услугу, которая соответствует их потребностям и обеспечивает дополнительную ценность. Они не обязательно ищут самый дешевый или высококачественный вариант; они ищут ценность.

Влияние COVID-19 на рынок фитнес-оборудования в Северной Америке

Пандемия COVID-19 оказала несколько положительное влияние на рынок фитнес-оборудования. Пандемия ввела новые нормы и правила, такие как социальное дистанцирование и локдауны, чтобы предотвратить распространение вируса. В результате люди по всему миру были вынуждены оставаться дома, что привело к новым тенденциям, таким как работа на дому; растущая популярность домашних тренировок увеличила спрос на тренажеры во время пандемии. Повышенное внимание к уходу за собой, физическим упражнениям и здоровью помогло фитнес-приложениям и платформам получить значительную поддержку после пандемии.

Производители принимают различные стратегические решения, чтобы восстановиться после COVID-19. Игроки проводят многочисленные НИОКР-мероприятия, запускают продукты и создают стратегические партнерства для улучшения технологий и результатов испытаний, задействованных на рынке.

Последние события

- В сентябре 2022 года компания Nautilus, Inc., лидер инноваций в области домашнего фитнеса, объявила о запуске беговой дорожки Bowflex BXT8J с совместимостью с адаптивным фитнес-приложением JRNY у избранных партнеров в сети и магазинах розничной торговли, предоставляя клиентам комплексное фитнес-решение по доступной цене. Беговая дорожка Bowflex BXT8J предлагает высокопроизводительное кардио и возможность сопряжения устройства пользователя с адаптивным фитнес-приложением JRNY. Это помогло компании расширить свой продуктовый портфель

- В июне 2022 года Johnson Health Tech объявила о приобретении фитнес-подразделения Cravatex Brands Limited, бывшего дистрибьютора Johnson Health Tech, став первой компанией по производству фитнес-оборудования, которая имеет дочернюю компанию в Индии, находящуюся в полной собственности. Благодаря постоянным инвестициям в разработку продукции и производственным навыкам Johnson Health Tech модернизировала фитнес-индустрию. Это помогло компании расширить свой бизнес

Объем рынка фитнес-оборудования в Северной Америке

Рынок фитнес-оборудования Северной Америки сегментирован по типу продукта, применению, полу, типу покупателя, использованию, типу, конечному пользователю и каналу сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ, ПО ТИПУ ПРОДУКЦИИ

- Силовые тренажеры

- Оборудование для кардиотренировок

- Анализаторы состава тела

- Оборудование для мониторинга фитнеса

- Другие

По типу продукции рынок фитнес-оборудования в Северной Америке сегментируется на силовые тренажеры, кардиотренажеры, анализаторы состава тела, оборудование для мониторинга фитнеса и другие.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ ПО ОБЛАСТИ ПРИМЕНЕНИЯ

- Потеря веса

- Бодибилдинг

- Физическая подготовка

- Умственная подготовка

- Другие

По сфере применения рынок фитнес-оборудования в Северной Америке сегментируется на следующие категории: оборудование для снижения веса, бодибилдинга, физической подготовки, умственной подготовки и другие.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ, ПО ПОЛУ

- Мужской

- Женский

По половому признаку рынок фитнес-оборудования в Северной Америке сегментируется на мужской и женский.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ ПО ТИПУ ПОКУПАТЕЛЯ

- Индивидуальный

- Учреждение

- Другие

В зависимости от типа покупателя рынок фитнес-оборудования в Северной Америке сегментируется на индивидуальных клиентов, учреждения и прочих.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ ПО ИСПОЛЬЗОВАНИЮ

- Жилой

- Коммерческий

По характеру использования рынок фитнес-оборудования в Северной Америке сегментируется на бытовой и коммерческий.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ, ПО ТИПУ

- На открытом воздухе

- В помещении

По типу рынок фитнес-оборудования в Северной Америке сегментируется на оборудование для помещений и для улицы.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ ПО КОНЕЧНОМУ ПОЛЬЗОВАТЕЛЮ

- Оздоровительные клубы/тренажерные залы

- Потребители на дому

- Отели

- Корпорации

- Больницы и медицинские центры

- Государственные учреждения

- Другие

По типу конечного пользователя рынок фитнес-оборудования в Северной Америке сегментируется на оздоровительные клубы/тренажерные залы, домашних потребителей, гостиницы, корпорации, больницы и медицинские центры, государственные учреждения и другие.

РЫНОК ФИТНЕС-ОБОРУДОВАНИЯ В СЕВЕРНОЙ АМЕРИКЕ ПО КАНАЛАМ СБЫТА

- Розничные магазины

- Специализированные и спортивные магазины

- Универмаги и дискаунтеры

- Онлайн

- Другие

По каналам сбыта рынок фитнес-оборудования в Северной Америке сегментируется на розничные магазины, специализированные и спортивные магазины, универмаги и дискаунтеры, интернет-магазины и другие.

Региональный анализ/информация о рынке фитнес-оборудования в Северной Америке

Проведен анализ рынка фитнес-оборудования в Северной Америке и предоставлена информация о размере рынка с учетом страны, типа продукта, сферы применения, пола, типа покупателя, использования, типа, конечного пользователя и канала сбыта.

Рынок фитнес-оборудования Северной Америки состоит из стран США, Канады и Мексики. Ожидается, что США будет расти за счет увеличения инвестиций в НИОКР и новейших передовых технологий и изобретений в фитнес-оборудовании.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Fitness Equipment Market Share Analysis

North America fitness equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America fitness equipment market.

Some of the major players operating in the North America fitness equipment market are Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM S.p.A, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS, and Fitline India among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FITNESS EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF PEOPLE INVOLVED IN PHYSICAL ACTIVITIES COMPETITIONS

5.1.2 COVID-19 PANDEMIC RESULTED IN A RISING DEMAND FOR HOME FITNESS EQUIPMENT

5.1.3 INCREASING POPULARITY OF FITNESS GEAR AROUND THE GLOBE

5.1.4 INCREASED TECHNOLOGICAL ADVANCEMENT IN THE FITNESS SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH FITNESS EQUIPMENT

5.2.2 LACK OF SKILLED FITNESS PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 GROWING PENETRATION OF E-COMMERCE PLATFORMS, THE INTERNET, AND SMARTPHONES

5.3.2 MULTIPLE APPLICATION COVERAGE

5.3.3 INCREASING NUMBER OF GYMS & FITNESS CLUBS

5.4 CHALLENGES

5.4.1 PATIENT INFORMATION PRIVACY POLICIES

5.4.2 SHIFTING OF CUSTOMER PREFERENCES

6 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 STRENGTH TRAINING EQUIPMENTS

6.2.1 DUMBBELLS

6.2.1.1 FIXED

6.2.1.2 ADJUSTABLE

6.2.2 BARBELLS

6.2.2.1 STRAIGHT BARBELLS

6.2.2.2 SAFETY SQUAT BARS

6.2.2.3 EZ CURL BARS

6.2.2.4 TRICEPS BARS

6.2.2.5 TRAP BARS

6.2.2.6 AXEL BARS

6.2.2.7 SWISS BARS

6.2.2.8 FARMERS WALK HANDLES

6.2.2.9 THICK GRIP BARS

6.2.2.10 OTHERS

6.2.3 BACHES AND RACKS

6.2.4 FREE WEIGHTS

6.2.5 PLATE LOADED

6.2.6 CABLE MACHINES

6.2.7 MULTISTATIONS

6.2.8 SINGLE STATIONS

6.2.9 RESISTANCE BANDS

6.2.9.1 POWER RESISTANCE BANDS

6.2.9.2 TUBE RESISTANCE BANDS WITH HANDLES

6.2.9.3 MINI-BANDS

6.2.9.4 LIGHT THERAPY RESISTANCE BANDS

6.2.9.5 BANDS

6.2.9.6 OTHERS

6.2.10 TRX SUSPENSION TRAINER

6.2.11 KETTLEBELLS

6.2.12 ACCESSORIES

6.2.13 OTHERS

6.3 CARDIOVASCULAR TRAINING EQUIPMENTS

6.3.1 TREADMILLS

6.3.2 ELLIPTICAL CROSS TRAINER

6.3.3 STATIONARY BIKES

6.3.4 ROWING MACHINES

6.3.5 STAIR STEPPER

6.3.6 OTHERS

6.4 FITNESS MONITORING EQUIPMENTS

6.4.1 SMART WATCH

6.4.2 FITNESS BANDS

6.4.3 PATCHES

6.4.4 OTHERS

6.5 BODY COMPOSITION ANALYZERS

6.5.1 BIO-IMPEDANCE ANALYSERS

6.5.2 DUAL ENERGY X-RAY ABSORPTIOMETRY EQUIPMENT

6.5.3 SKINFOLD CALLIPERS

6.5.4 AIR DISPLACEMENT PLETHYSMOGRAPHY EQUIPMENT

6.5.5 HYDROSTATIC WEIGHING EQUIPMENT

6.5.6 OTHERS

6.6 OTHERS

7 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BODY BUILDING

7.3 WEIGHT LOSS

7.4 PHYSICAL FITNESS

7.5 MENTAL FITNESS

7.6 OTHERS

8 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

9.1 OVERVIEW

9.2 INDIVIDUALS

9.3 INSTITUTION

9.4 OTHERS

10 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HEALTH CLUBS/GYMS

12.3 PUBLIC INSTITUTIONS

12.4 HOTELS

12.5 HOME CONSUMERS

12.6 CORPORATES

12.7 HOSPITAL & MEDICAL CENTERS

12.8 OTHERS

13 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL STORES

13.3 ONLINE

13.4 SPECIALTY & SPORTS SHOPS

13.5 DEPARTMENTAL & DISCOUNT STORES

13.6 OTHERS

14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 LIFE FITNESS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 IFIT

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 JOHNSON HEALTH TECH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHNOGYM S.P.A

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NAUTILUS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AFTON

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BFT FITNESS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BODY-SOLID INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CORE HEALTH & FITNESS, LLC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FITKING FITNESS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FITLINE INDIA

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 FITNESS WORLD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 IMPULSE (QINGDAO) HEALTH TECH CO., LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 PRECOR INCORPORATED.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 REALLEADER FITNESS CO., LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANDONG AOXINDE FITNESS EQUIPMENT CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHANDONG LIZHIXING FITNESS TECHNOLOGY CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHANGHAI DEFINE HEALTH TECH CO LTD,

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TORQUE FITNESS.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 True

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 YANRE FITNESS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BODY BUILDING IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA WEIGHT LOSS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MENTAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FEMALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA INDIVIDUALS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COMMERCIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RESIDENTIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OUTDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTH CLUBS/GYMS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PUBLIC INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOTELS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CONSUMERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CORPORATES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITAL AND MEDICAL CENTERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPECIALTY AND SPORTS SHOP IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA DEPARTMENTAL & DISCOUNT STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 63 U.S. FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 U.S. FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 73 U.S. FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 75 U.S. FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 U.S. FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 78 CANADA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 CANADA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 88 CANADA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 90 CANADA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 92 CANADA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 MEXICO FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 MEXICO FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FITNESS EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FITNESS EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FITNESS EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FITNESS EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FITNESS EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FITNESS EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA FITNESS EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CARDIOVASCULAR DISEASES AND RISING DEMAND FOR FITNESS EQUIPMENT IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FITNESS EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 12 STRENGTH TRAINING EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET

FIGURE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2022

FIGURE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2022

FIGURE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2022

FIGURE 31 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2022

FIGURE 35 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2022

FIGURE 39 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 44 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA FITNESS EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 51 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.