North America Electrical Steel Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.22 Billion

USD

6.94 Billion

2024

2032

USD

4.22 Billion

USD

6.94 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 6.94 Billion | |

|

|

|

|

Рынок электротехнической стали в Северной Америке по типу (незернистая электротехническая сталь и зерновая электротехническая сталь), толщине (0,23 мм, 0,27 мм, 0,30 мм, 0,35 мм, 0,5 мм, 0,65 мм и другие), потерям в сердечнике (менее 0,9 Вт/кг, 0,90–0,99 Вт/кг, 1,00–1,29 Вт/кг, 1,30–1,39 Вт/кг и выше 1,39 Вт/кг), плотности потока (выше 1,76 Тесла, 1,73–1,76 Тесла, 1,69–1,73 Тесла, 1,65–1,69 Тесла, менее 1,65 Тесла), применению (двигатели, Трансформаторы, генераторы электроэнергии, индукторы, электрические балласты, батареи, преобразователи, шунтирующие реакторы, сердечники с обмоткой и др.), конечный пользователь (энергетика, машиностроение, автомобилестроение, строительство, бытовая техника и др.) — тенденции отрасли и прогноз до 2032 г.

Размер рынка электротехнической стали

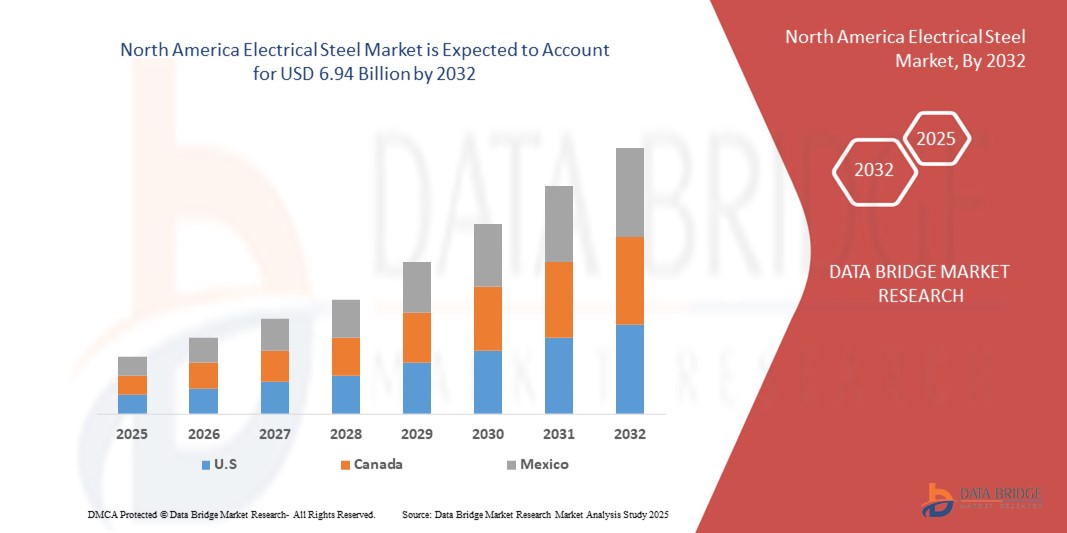

- Объем рынка электротехнической стали в Северной Америке оценивается в 4,22 млрд долларов США в 2024 году и, как ожидается, достигнет 6,94 млрд долларов США к 2032 году при среднегодовом темпе роста 6,4% в течение прогнозируемого периода .

- Рост рынка обусловлен в первую очередь ростом спроса на энергоэффективное электрооборудование, достижениями в производстве электромобилей (ЭМ) и расширением инфраструктуры возобновляемой энергетики.

- Кроме того, растущее внимание к снижению потерь в сердечниках трансформаторов и двигателей в сочетании с технологическими достижениями в производстве электротехнической стали ускоряет ее внедрение на рынке в различных отраслях промышленности.

Анализ рынка электротехнической стали

- Электротехническая сталь, известная своей высокой магнитной проницаемостью и низкими потерями в сердечнике, является важнейшим материалом, используемым в производстве двигателей, трансформаторов и генераторов электроэнергии, обеспечивая энергоэффективность и производительность электрических систем.

- Растущий спрос на электротехническую сталь обусловлен быстрым развитием автомобильного сектора, особенно электромобилей, а также все более широким использованием возобновляемых источников энергии, таких как энергия ветра и солнца.

- Канада доминировала на рынке электротехнической стали в Северной Америке с наибольшей долей выручки в 45,12% в 2024 году, что обусловлено ее устойчивым энергетическим сектором, значительными инвестициями в возобновляемые источники энергии и хорошо налаженной производственной базой.

- Ожидается, что США станут самой быстрорастущей страной на североамериканском рынке электротехнической стали в течение прогнозируемого периода, чему будут способствовать растущее внедрение электромобилей, государственные стимулы для чистой энергии и инновации в области применения электротехнической стали.

- Сегмент неструктурированной электротехнической стали занял самую большую долю рынка в 56,49% в 2023 году, что обусловлено его универсальным применением в электродвигателях, генераторах и бытовых приборах, особенно в США, где растет спрос на электромобили (ЭМ) и энергоэффективные устройства.

Область применения отчета и сегментация рынка электротехнической стали

|

Атрибуты |

Ключевые данные о рынке электротехнической стали |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка электротехнической стали

«Растущая интеграция современных материалов и производственных технологий»

- На рынке электротехнической стали Северной Америки наблюдается значительная тенденция к интеграции современных материалов и инновационных производственных технологий.

- Такие достижения, как улучшенные формулы сплавов и усовершенствованные методы обработки, такие как литье тонких слябов и непрерывный отжиг, оптимизируют магнитные свойства, включая высокую проницаемость и низкие потери в сердечнике.

- Современные решения на основе электротехнической стали обеспечивают более эффективное преобразование энергии, сокращая потери энергии в таких устройствах, как трансформаторы и электродвигатели.

- Например, производители разрабатывают высококачественную незернистую электротехническую сталь (NGOES) с превосходными магнитными свойствами, чтобы удовлетворить требования высокопроизводительных двигателей электромобилей (ЭМ) и систем возобновляемой энергии.

- Эта тенденция повышает эффективность и устойчивость применения электротехнической стали, делая ее все более привлекательной для таких отраслей, как автомобилестроение и энергетика.

- Разрабатываются новые изоляционные покрытия и лаки с улучшенными термическими и электрическими свойствами для дальнейшего снижения потерь в сердечнике и повышения производительности пластин электротехнической стали.

Динамика рынка электротехнической стали

Водитель

«Растущий спрос на электромобили и инфраструктуру возобновляемой энергии»

- Растущий потребительский и промышленный спрос на электромобили (ЭМ) и возобновляемые источники энергии, такие как энергия ветра и солнца, является основным драйвером рынка электротехнической стали в Северной Америке.

- Электротехническая сталь имеет решающее значение для производства энергоэффективных трансформаторов, двигателей и генераторов, которые являются важными компонентами электромобилей и систем возобновляемой энергии.

- Правительственные распоряжения, особенно в Канаде и США, направленные на продвижение энергоэффективности и устойчивых энергетических решений, ускоряют внедрение электротехнической стали.

- Распространение технологий интеллектуальных сетей и модернизация электротехнической инфраструктуры в Северной Америке дополнительно способствуют расширению применения электротехнической стали, обеспечивая эффективное распределение и передачу электроэнергии.

- Автопроизводители и энергетические компании все чаще используют высокопроизводительную электротехническую сталь, такую как NGOES, чтобы соответствовать строгим стандартам эффективности и повысить производительность системы.

- Канада доминирует на рынке благодаря своему лидерству в области внедрения возобновляемых источников энергии и развития инфраструктуры, в то время как США являются самой быстрорастущей страной, движимой устойчивым производством электромобилей и достижениями в области генерации электроэнергии.

Сдержанность/Вызов

«Высокие издержки производства и нестабильность цепочки поставок»

- Значительные первоначальные инвестиции, необходимые для производства высококачественной электротехнической стали, включая современное производственное оборудование и сырье, такое как ферросилиций, создают препятствие для роста рынка, особенно в регионах, чувствительных к затратам.

- Сложность производства тонколистовой электротехнической стали с точными магнитными свойствами увеличивает производственные затраты, что может сдерживать ее внедрение в некоторых областях применения.

- Нарушения в цепочке поставок, такие как колебания доступности сырья и цен, еще больше усложняют производство и влияют на стабильность рынка.

- Кроме того, опасения по поводу экологических норм и соблюдения стандартов устойчивого развития усложняют производственные процессы, увеличивая эксплуатационные расходы.

- Эти факторы могут ограничивать расширение рынка, особенно в новых областях применения, где чувствительность к затратам является существенной проблемой.

- Несмотря на эти проблемы, постоянное совершенствование методов повышения эффективности производства и переработки отходов помогает смягчить некоторые из этих ограничений, что соответствует приоритетам Северной Америки в области устойчивого развития.

Сфера применения рынка электротехнической стали

Рынок сегментирован по типу, толщине, потерям в сердечнике, плотности потока, области применения и конечному пользователю.

- По типу

На основе типа рынок электротехнической стали в Северной Америке сегментируется на незернистую электротехническую сталь (NGOES) и зернистую электротехническую сталь (GOES). Сегмент незернистой электротехнической стали доминировал с наибольшей долей выручки на рынке в 56,49% в 2023 году, что обусловлено его универсальным применением в электродвигателях, генераторах и бытовых приборах, особенно в США, где растет спрос на электромобили (ЭМ) и энергоэффективные устройства. Его изотропные магнитные свойства делают его идеальным для вращающихся машин, повышая эффективность и производительность.

Ожидается, что сегмент электротехнической стали с ориентированным зерном продемонстрирует самые высокие темпы роста в 6,7% с 2025 по 2032 год, что обусловлено ростом спроса на энергоэффективные трансформаторы в сетях распределения электроэнергии. Технологические достижения в области GOES, такие как улучшенные магнитные свойства и снижение потерь в сердечнике, еще больше стимулируют его внедрение в высокопроизводительных приложениях, таких как большие трансформаторы и генераторы.

- По толщине

На основе толщины рынок электротехнической стали в Северной Америке сегментируется на 0,23 ММ, 0,27 ММ, 0,30 ММ, 0,35 ММ, 0,5 ММ, 0,65 ММ и др. Ожидается, что сегмент 0,23 ММ будет доминировать с долей рынка 42,52% в 2024 году благодаря его широкому использованию в небольших трансформаторах, двигателях и бытовых приборах, таких как холодильники и кондиционеры, где превосходная эффективность в снижении потерь в сердечнике имеет решающее значение.

Ожидается, что сегмент 0,30 ММ продемонстрирует самые высокие темпы роста в 7,2% в период с 2025 по 2032 год, что обусловлено растущим спросом в автомобильной промышленности, особенно в отношении двигателей электромобилей, где такая толщина обеспечивает баланс магнитных характеристик и механической прочности.

- По потерям в ядре

На основе потерь в сердечнике рынок электротехнической стали в Северной Америке сегментируется на Менее 0,9 Вт/кг, 0,90 Вт/кг - 0,99 Вт/кг, 1,00 Вт/кг - 1,29 Вт/кг, 1,30 Вт/кг - 1,39 Вт/кг и Выше 1,39 Вт/кг. Ожидается, что сегмент Менее 0,9 Вт/кг займет наибольшую долю рынка в 43,14% в 2024 году, поскольку электротехническая сталь с низкими потерями в сердечнике имеет решающее значение для высокоэффективных приложений, таких как трансформаторы и двигатели электромобилей, что соответствует фокусу региона на энергоэффективности и устойчивости.

Прогнозируется, что сегмент от 0,90 Вт/кг до 0,99 Вт/кг будет быстро расти в период с 2025 по 2032 год, что обусловлено его использованием в экономичных, высокопроизводительных двигателях и генераторах, особенно в секторе возобновляемой энергетики Канады, где энергоэффективные материалы пользуются большим спросом.

- По плотности потока

На основе плотности потока рынок электротехнической стали в Северной Америке сегментируется на более 1,76 Тесла, 1,73 Тесла до 1,76 Тесла, 1,69 Тесла до 1,73 Тесла, 1,65 Тесла до 1,69 Тесла и менее 1,65 Тесла. Ожидается, что сегмент выше 1,76 Тесла будет доминировать с долей рынка 605,04% в 2024 году, что обусловлено его важнейшей ролью в отраслях производства электроэнергии, особенно в США, где материалы с высокой плотностью потока используются в современных трансформаторах и генераторах для поддержки модернизации сетей.

Ожидается, что сегмент от 1,73 Тесла до 1,76 Тесла продемонстрирует значительный рост в период с 2025 по 2032 год, поскольку он удовлетворяет растущий спрос на эффективную электротехническую сталь для электродвигателей и возобновляемых источников энергии, где важны высокие магнитные характеристики.

- По применению

На основе сферы применения рынок электротехнической стали в Северной Америке сегментируется на двигатели, трансформаторы, генераторы электроэнергии, индукторы, электрические балласты, батареи, преобразователи, шунтирующие реакторы, сердечники и другие. Сегмент двигателей занимал самую большую долю рынка в 245,23% в 2023 году, что обусловлено растущим внедрением электромобилей и промышленной автоматизации, особенно в США, где электротехническая сталь повышает эффективность двигателей за счет минимизации потерь энергии.

Ожидается, что сегмент трансформаторов будет расти самыми быстрыми темпами в 7,1% в период с 2025 по 2032 год, что будет обусловлено увеличением инвестиций в модернизацию сетей и проекты в области возобновляемых источников энергии, особенно в Канаде, где высокоэффективные трансформаторы имеют решающее значение для интеграции ветровой, солнечной и гидроэнергетики.

- Конечным пользователем

На основе конечного потребителя рынок электротехнической стали Северной Америки сегментируется на энергетику и электроэнергию, машиностроение, автомобилестроение, строительство, бытовую технику и другие. Сегмент энергетики и электроэнергетики доминировал с долей рынка 35% в 2023 году, что обусловлено широким использованием электротехнической стали в трансформаторах и генераторах для производства и распределения электроэнергии, особенно в секторе возобновляемой энергетики Канады.

Ожидается, что в автомобильном сегменте будут наблюдаться самые высокие темпы роста в 7,9% в период с 2025 по 2032 год, что обусловлено ростом производства электромобилей в США, где электротехническая сталь необходима для высокоэффективных двигателей и других электрифицированных компонентов, что соответствует стремлению региона к устойчивой мобильности.

Региональный анализ рынка электротехнической стали

- Канада доминировала на рынке электротехнической стали в Северной Америке с наибольшей долей выручки в 45,12% в 2024 году, что обусловлено ее устойчивым энергетическим сектором, значительными инвестициями в возобновляемые источники энергии и хорошо налаженной производственной базой.

- Ожидается, что США станут самой быстрорастущей страной на североамериканском рынке электротехнической стали в течение прогнозируемого периода, чему будут способствовать растущее внедрение электромобилей, государственные стимулы для чистой энергии и инновации в области применения электротехнической стали.

Обзор рынка электротехнической стали в США

США являются самой быстрорастущей страной на рынке электротехнической стали в Северной Америке, чему способствует высокий спрос в автомобильном секторе, особенно для электродвигателей, и растущие инвестиции в инфраструктуру возобновляемой энергии. Тенденция к энергоэффективности и ужесточение правил, способствующих использованию устойчивых материалов, еще больше стимулируют расширение рынка. Растущее использование автопроизводителями электротехнической стали в высокопроизводительных двигателях дополняет продажи на вторичном рынке, создавая разнообразную экосистему продуктов .

Обзор рынка электротехнической стали в Канаде

Канада доминировала на рынке электротехнической стали Северной Америки с самой высокой долей выручки в 78,9% в 2024 году, что обусловлено ее развитым энергетическим и электроэнергетическим сектором и растущим внедрением электротехнической стали в трансформаторах и двигателях. Сосредоточение на модернизации устаревшей электрической инфраструктуры и растущий спрос на энергоэффективные решения стимулируют рост рынка. Сильное внутреннее производство и правительственные инициативы, продвигающие чистую энергию, еще больше усиливают проникновение на рынок .

Доля рынка электротехнической стали

Электротехническую сталелитейную промышленность в основном представляют известные компании, в том числе:

- ArcelorMittal (Люксембург)

- Cleveland-Cliffs Inc. (США)

- Nippon Steel Corporation (Япония)

- POSCO (Южная Корея)

- Voestalpine AG (Австрия)

- Thyssenkrupp AG (Германия)

- JFE Steel Corporation (Япония)

- Корпорация United States Steel (США)

- Аперам (Люксембург)

- Baosteel Group Corporation (Китай)

- Tata Steel (Индия)

- АК Стил (США)

- Группа НЛМК (Россия)

- Steel Authority of India Limited (Индия)

- Cogent Power Limited (Великобритания)

Каковы последние события на рынке электротехнической стали в Северной Америке?

- В апреле 2024 года ArcelorMittal объявила о планах построить передовой производственный объект стоимостью 1,2 млрд долларов США в Калверте, штат Алабама, предназначенный для производства 150 000 метрических тонн незерновой электротехнической стали (NOES) в год. Эта специальная сталь жизненно важна для двигателей электромобилей (EV), генераторов и систем возобновляемой энергии. Инициатива устраняет критический пробел в цепочке поставок США, снижая зависимость от импорта и поддерживая цели администрации Байдена по достижению нулевых выбросов. При поддержке Министерства энергетики США проект получил 280,5 млн долларов США в виде инвестиционных налоговых льгот в рамках программы 48C Закона о снижении инфляции, признающей электротехническую сталь критически важным материалом для технологий чистой энергии.

- В декабре 2023 года Nippon Steel Corporation через свою дочернюю компанию NIPPON STEEL NORTH AMERICA, INC. объявила о приобретении United States Steel Corporation (US Steel) за 14,9 млрд долларов США, что стало одним из крупнейших иностранных поглощений в истории производства США. Сделка, завершенная в июне 2025 года, позиционирует Nippon Steel как доминирующего игрока на рынке стали в Северной Америке, особенно в производстве электротехнической стали — важнейшего материала для электродвигателей, трансформаторов и систем возобновляемой энергии.

- В октябре 2023 года корпорация United States Steel Corporation (US Steel) открыла новую линию по производству электротехнической стали без зернистой структуры (NGO) на своем заводе Big River Steel в Оцеоле, штат Арканзас. С годовой производительностью 200 000 метрических тонн эта линия является крупнейшей в своем роде в США, превосходя по объему других отечественных производителей. На предприятии используется до 90% переработанного стального лома, что снижает выбросы углерода на 70–80% по сравнению с традиционными методами. Линия производит сталь InduX™, необходимую для двигателей электромобилей, генераторов и систем возобновляемой энергии, что усиливает роль US Steel в продвижении инфраструктуры чистой энергии.

- В мае 2023 года JFE Shoji Power Canada, подразделение JFE Holdings, объявило о крупной инициативе по расширению в сотрудничестве со стратегическими партнерами для удовлетворения растущего спроса на компоненты из электротехнической стали, используемые в силовых и распределительных трансформаторах. Компания взяла на себя обязательство вложить значительные инвестиции в новое оборудование и развитие рабочей силы, стремясь увеличить производственные мощности не менее чем на 40% для сердечников распределительных трансформаторов и более чем вдвое для больших сердечников силовых трансформаторов к концу 2023 года. Этот шаг поддерживает быстрый рост инфраструктуры чистой энергии по всей Северной Америке, включая модернизацию сетей и усилия по электрификации

- В январе 2023 года компания Cleveland-Cliffs Inc. представила линейку продукции MOTOR-MAX® — высокочастотные неориентированные электротехнические стали (HF NOES), разработанные для тяговых двигателей электромобилей, генераторов и другого вращающегося оборудования. Эти стали оптимизированы для низких потерь в сердечнике и высокой энергоэффективности на частотах выше 60 Гц, что делает их идеальными для электромобилей и систем возобновляемой энергии. Будучи единственным в США производителем электротехнических сталей автомобильного качества, компания Cleveland-Cliffs разработала MOTOR-MAX для поддержки внутреннего производства, снижения рисков в цепочке поставок и снижения выбросов парниковых газов за счет производства в электродуговых печах (EAF) с использованием переработанных материалов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ELECTRICAL STEEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS (LOW)

4.2.2 THREAT OF SUBSTITUTES (MODERATE)

4.2.3 BARGAINING POWER OF BUYERS (HIGH)

4.2.4 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.2.5 COMPETITIVE RIVALRY (HIGH)

4.3 VENDOR SELECTION CRITERIA

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 HIGH-PERMEABILITY GRADES:

4.4.2 NANO-CRYSTALLINE AND AMORPHOUS ALLOYS:

4.4.3 LASER SCRIBING TECHNOLOGY:

4.4.4 ADVANCED COATING TECHNIQUES:

4.4.5 3D PRINTING AND ADDITIVE MANUFACTURING:

4.4.6 DIGITAL TWIN TECHNOLOGY:

4.4.7 AI AND MACHINE LEARNING IN QUALITY CONTROL:

4.4.8 IMPROVED RECYCLING PROCESSES:

4.5 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR SUSTAINABLE ENERGY SOURCES SUCH AS WIND AND HYDROPOWER

6.1.2 INCREASING DEMAND FOR STEEL IN MOTORS OF HYBRID/ELECTRICAL VEHICLES

6.1.3 RISING DEMAND OF THE HIGH PERMEABILITY GRADES ALLOY CORE AND WEIGHT REDUCTION MATERIALS IN THE POWER INDUSTRY

6.1.4 GAIN IN POPULARITY OF NON GRAIN ORIENTED ELECTRICAL STEEL IN HOUSEHOLD APPLIANCES

6.2 RESTRAINTS

6.2.1 DISTORTION IN PROPERTIES OF ELECTRICAL STEEL DUE TO TEMPERATURE VARIATIONS

6.2.2 IMPROPER AND INADEQUATE ELECTRONICS WASTE DISPOSAL SYSTEMS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN APPLICATION OF ELECTRIC VEHICLES

6.3.2 INCREASING DEMAND FOR ELECTRICAL STEEL IN ENERGY STORAGE SYSTEMS

6.3.3 RISE IN STRINGENT ENVIRONMENT REGULATIONS AIMED FOR REDUCING GREENHOUSE GASES EMISSION

6.4 CHALLENGES

6.4.1 THE TENDENCY OF STEEL TO CORRODE OVER TIME ON EXPOSURE TO MOISTURE AND AIR

6.4.2 FLUCTUATION IN RAW MATERIAL PRICES

7 NORTH AMERICA ELECTRICAL STEEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-GRAIN ORIENTED ELECTRICAL STEEL

7.2.1 NON-GRAIN ORIENTED ELECTRICAL STEEL, BY TYPE

7.2.2 NON-GRAIN ORIENTED ELECTRICAL STEEL, BY CATEGORY

7.3 GRAIN ORIENTED ELECTRICAL STEEL

7.3.1 GRAIN ORIENTED ELECTRICAL STEEL, BY TYPE

8 NORTH AMERICA ELECTRICAL STEEL MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 0.23 MM

8.3 0.27 MM

8.4 0.30 MM

8.5 0.35 MM

8.6 0.5 MM

8.7 0.65 MM

8.8 OTHERS

9 NORTH AMERICA ELECTRICAL STEEL MARKET, BY CORE LOSSES

9.1 OVERVIEW

9.2 LESS THAN 0.9 W/KG

9.3 0.90 W/KG TO 0.99 W/KG

9.4 1.00 W/KG TO 1.29 W/KG

9.5 1.30 W/KG TO 1.39 W/KG

9.6 ABOVE 1.39 W/KG

10 NORTH AMERICA ELECTRICAL STEEL MARKET, BY FLUX DENSITY

10.1 OVERVIEW

10.2 ABOVE 1.76 TESLA

10.3 1.73 TESLA TO 1.76 TESLA

10.4 1.69 TESLA TO 1.73 TESLA

10.5 1.65 TESLA TO 1.69 TESLA

10.6 LESS THAN 1.65 TESLA

11 NORTH AMERICA ELECTRICAL STEEL MARKET, BY END-USER

11.1 OVERVIEW

11.2 ENERGY AND POWER

11.3 ENGINEERING

11.4 AUTOMOTIVE

11.5 BUILDING AND CONSTRUCTION

11.6 HOUSEHOLD APPLIANCES

11.7 OTHERS

12 NORTH AMERICA ELECTRICAL STEEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 MOTORS

12.2.1 MOTORS, BY PRODUCT TYPE

12.2.2 MOTORS, BY CATEGORY

12.3 TRANSFORMERS

12.3.1 TRANSFORMERS, BY PRODUCT TYPE

12.3.2 TRANSFORMERS, BY APPLICATION

12.4 POWER GENERATORS

12.4.1 POWER GENERATORS, BY PRODUCT TYPE

12.4.2 POWER GENERATORS, BY APPLICATION

12.5 INDUCTORS

12.5.1 INDUCTORS, BY PRODUCT TYPE

12.6 ELECTRICAL BALLASTS

12.6.1 ELECTRICAL BALLASTS, BY PRODUCT TYPE

12.7 BATTERY

12.7.1 BATTERY, BY PRODUCT TYPE

12.8 CONVERTORS

12.8.1 CONVERTORS, BY PRODUCT TYPE

12.9 SHUNT REACTORS

12.9.1 SHUNT REACTORS, BY PRODUCT TYPE

12.1 WOUND CORES

12.10.1 WOUND CORES, BY PRODUCT TYPE

12.11 OTHERS

12.11.1 OTHERS, BY PRODUCT TYPE

13 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ELECTRICAL STEEL MARKET : COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 CLEVELAND-CLIFFS INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 JFE STEEL CORPORATION.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 ARCELORMITTAL

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 1.3.3RECENT DEVELOPMENTS

16.4 VOESTALPINE AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 THYSSENKRUPP AG

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BAOSTEEL CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 C.D. WÄLZHOLZ GMBH & CO. KG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 NIPPON STEEL CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 POSCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 TC METAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO.

16.10.3 RECENT DEVELOPMENTS

16.11 TEMPEL (A SUBSIDIARY OF WORTHINGTON STEEL )

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 REGULATION COVERAGE

TABLE 2 NEW MODEL ANNOUNCEMENT OF ELECTRICAL CARS

TABLE 3 NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 4 NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 5 NORTH AMERICA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA ELECTRICAL STEEL MARKET, BY THCIKNESS, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 14 NORTH AMERICA MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031, (USD MILLION)

TABLE 15 NORTH AMERICA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 16 NORTH AMERICA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

TABLE 17 NORTH AMERICA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA POWER GENERATORSIN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 21 NORTH AMERICA BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 22 NORTH AMERICA CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 23 NORTH AMERICA SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 24 NORTH AMERICA WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 26 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 27 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY, 2022-2031 (MILLION TONS)

TABLE 28 U.S. ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 29 U.S. ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 30 U.S. NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 32 U.S. GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 U.S. ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 34 U.S. ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 35 U.S. ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 36 U.S. ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 37 U.S. MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 38 U.S. MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 39 U.S. TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 40 U.S. TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 U.S. POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 42 U.S. POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 U.S. INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 44 U.S. ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 45 U.S. BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 46 U.S. CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 47 U.S. SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 48 U.S. WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 49 U.S. OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 50 U.S. ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 51 CANADA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 52 CANADA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 53 CANADA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 54 CANADA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 55 CANADA GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 56 CANADA ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 57 CANADA ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 58 CANADA ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 59 CANADA ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 CANADA MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 61 CANADA MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 62 CANADA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 63 CANADA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 CANADA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 65 CANADA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 66 CANADA INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 68 CANADA BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 69 CANADA CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 70 CANADA SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 71 CANADA WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 72 CANADA OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 73 CANADA ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 74 MEXICO ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 75 MEXICO ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 76 MEXICO NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 77 MEXICO NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 78 MEXICO GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 79 MEXICO ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 80 MEXICO ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 81 MEXICO ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 82 MEXICO ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 MEXICO MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 84 MEXICO MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 85 MEXICO TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 86 MEXICO TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 87 MEXICO POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 88 MEXICO POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 MEXICO INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 90 MEXICO ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 91 MEXICO BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 92 MEXICO CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 93 MEXICO SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 94 MEXICO WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 95 MEXICO OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 96 MEXICO ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA ELECTRICAL STEEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRICAL STEEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRICAL STEEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRICAL STEEL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRICAL STEEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRICAL STEEL MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA ELECTRICAL STEEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ELECTRICAL STEEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ELECTRICAL STEEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ELECTRICAL STEEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA ELECTICAL STEEL MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE

FIGURE 13 EXECUTIVE SUMMARY : NORTH AMERICAL ELECTRICAL STEEL MARKET

FIGURE 14 INCREASING DEMAND FOR STEEL IN MOTORS OF HYBRID/ELECTRICAL VEHICLES IS THE KEY DRIVER FOR THE NORTH ELECTRICAL STEEL MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 15 NON-GRAIN ORIENTED ELECTRICAL STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRICAL STEEL MARKET IN 2024 AND 2031

FIGURE 16 STRATEGIC DECISIONS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA ELECTRICAL STEEL MARKET

FIGURE 20 STEEL PRICE (2020) (USD DOLLAR/METRIC TON)

FIGURE 21 NORTH AMERICA ELECTRICAL STEEL MARKET: BY PRODUCT TYPE, 2023

FIGURE 22 NORTH AMERICA ELECTRICAL STEEL MARKET: BY THICKNESS, 2023

FIGURE 23 NORTH AMERICA ELECTRICAL STEEL MARKET: BY CORE LOSSES, 2023

FIGURE 24 NORTH AMERICA ELECTRICAL STEEL MARKET: BY FLUX DENSITY, 2023

FIGURE 25 NORTH AMERICA ELECTRICAL STEEL MARKET: BY END-USER, 2023

FIGURE 26 NORTH AMERICA ELECTRICAL STEEL MARKET: BY APPLICATION, 2023

FIGURE 27 NORTH AMERICA ELECTRICAL STEEL MARKET: SNAPSHOT (2023)

FIGURE 28 NORTH AMERICA ELECTRICAL STEEL MARKET COMPANY SHARE 2023 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.