North America Elderly Monitors Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.02 Billion

USD

1.59 Billion

2024

2032

USD

1.02 Billion

USD

1.59 Billion

2024

2032

| 2025 –2032 | |

| USD 1.02 Billion | |

| USD 1.59 Billion | |

|

|

|

|

Сегментация рынка устройств для мониторинга пожилых людей в Северной Америке по продукту (устройства мониторинга безопасности, прокладки, средства связи, мониторы активности, мониторы местоположения, системы вызова лиц, осуществляющих уход, носимые устройства, сетевые системы видеонаблюдения и другие), модальность (портативные и стационарные), тип мониторинга (мониторинг веса, телемедицина, мониторинг температуры, вовлечение пациентов, цифровое управление диабетом , домашнее телемедицина и другие), шкала остроты зрения (шкала высокой остроты зрения, шкала средней остроты зрения и шкала низкой остроты зрения), возраст (от 65 до 74, от 75 до 84 и 85 лет и старше), пол (мужчины и женщины), конечный пользователь (больницы, дома престарелых, организации по уходу на дому, учреждения по уходу на дому, учреждения по уходу за пожилыми людьми и другие), применение (предотвращение и обнаружение падений, мониторинг здоровья и другие), канал сбыта (прямые тендеры, розничные продажи и другие) — тенденции отрасли и прогноз 2032

Размер рынка мониторов для пожилых людей в Северной Америке

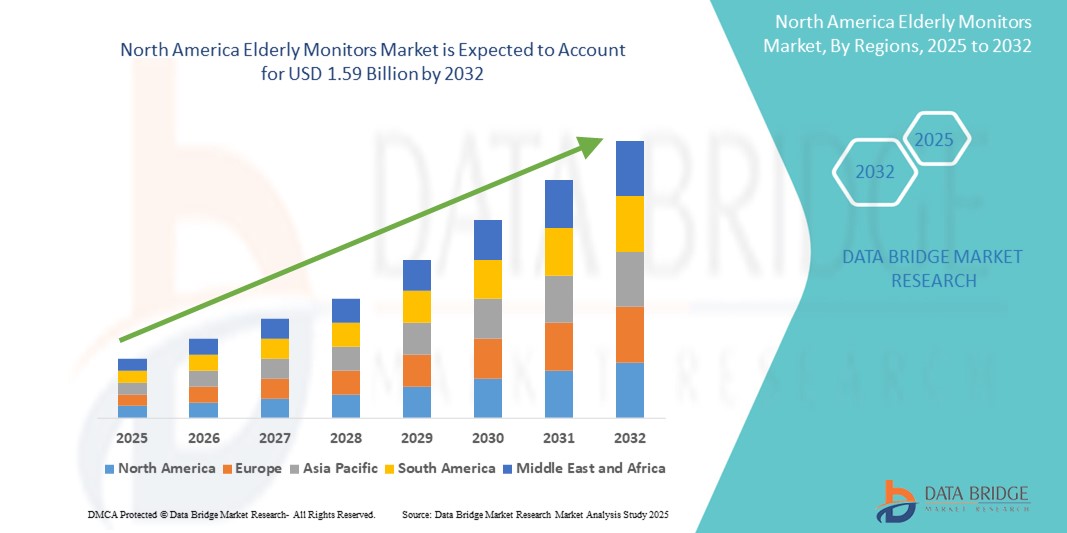

- Объем рынка устройств мониторинга для пожилых людей в Северной Америке в 2024 году оценивался в 1,02 млрд долларов США и, как ожидается , достигнет 1,59 млрд долларов США к 2032 году при среднегодовом темпе роста 5,70% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен старением населения во всем мире, а также достижениями в области медицинских технологий и услуг, ориентированных на пожилых людей, что приводит к резкому росту спроса на продукты и решения, разработанные с учетом уникальных потребностей пожилых людей в учреждениях по уходу за пожилыми людьми и домах престарелых.

- Более того, растущий потребительский спрос на безопасную, доступную и качественную медицинскую помощь, а также развитие вспомогательных технологий для жизни, устройств дистанционного мониторинга и инфраструктуры, удобной для пожилых людей, превращают уход за пожилыми в важнейший компонент глобальных систем здравоохранения. Эти факторы ускоряют внедрение решений по уходу за пожилыми людьми, тем самым значительно стимулируя рост отрасли.

Анализ рынка мониторов для пожилых людей в Северной Америке

- Мониторы для пожилых людей, обеспечивающие возможность удаленного мониторинга состояния здоровья и безопасности, становятся важнейшими компонентами современной гериатрической помощи как в домах престарелых, так и в домах престарелых благодаря своему повышенному удобству, отслеживанию данных в режиме реального времени и бесшовной интеграции с экосистемами телемедицины.

- Растущий спрос на системы мониторинга пожилых людей обусловлен, прежде всего, ростом старения населения, ростом распространенности хронических заболеваний и растущим предпочтением решений для пожилых людей, которые обеспечивают душевное спокойствие как пациентам, так и лицам, осуществляющим уход.

- США доминируют на североамериканском рынке устройств мониторинга состояния пожилых людей, чему способствуют быстрое внедрение подключенных медицинских устройств, высокая доля пожилого населения и сильное присутствие таких крупных игроков рынка, как Philips, Medtronic и Abbott.

- Ожидается, что в Канаде будет зафиксирован самый высокий среднегодовой темп роста на североамериканском рынке устройств мониторинга пожилых людей, что обусловлено быстрым старением населения, растущим вниманием к независимости пожилых людей и государственной поддержкой услуг телемедицины.

- Женский сегмент доминировал на североамериканском рынке мониторов для пожилых людей с долей рынка 56,4% в 2024 году, поскольку женщины составляют большую долю стареющего населения. Эта демографическая тенденция обусловлена более высокой продолжительностью жизни женщин, что приводит к повышению спроса на решения для мониторинга пожилых людей, адаптированные к их конкретным потребностям в области здоровья и безопасности.

Область применения отчета и сегментация рынка устройств для мониторинга пожилых людей в Северной Америке

|

Атрибуты |

Обзор рынка устройств для мониторинга пожилых людей в Северной Америке |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка мониторинга пожилых людей в Северной Америке

« Внедрение предиктивной аналитики на основе искусственного интеллекта »

- Заметной и растущей тенденцией на рынке устройств для мониторинга состояния пожилых людей в Северной Америке является внедрение предиктивной аналитики на основе искусственного интеллекта для прогнозирования проблем со здоровьем до их возникновения, улучшения профилактической помощи и сокращения числа экстренных вмешательств.

- Например, системы мониторинга состояния пожилых людей теперь используют алгоритмы машинного обучения для анализа данных о состоянии здоровья в режиме реального времени и исторических данных, таких как нарушения сна, нарушения походки или нерегулярный сердечный ритм, чтобы прогнозировать потенциальные риски, такие как падения, проблемы с сердцем или дыхательная недостаточность.

- Эти прогностические модели встроены в носимые датчики, системы «умных» кроватей и инструменты мониторинга окружающей среды, обеспечивая непрерывную, ненавязчивую оценку благополучия пожилых людей.

- Интеграция с облачными платформами гарантирует мгновенный доступ лиц, осуществляющих уход, врачей и членов семьи к оповещениям и оценкам рисков, что способствует своевременному медицинскому реагированию и разработке индивидуальных планов лечения.

- Производители отдают приоритет решениям, которые сочетают в себе прогностическую аналитику с удобными панелями управления и удаленным доступом, что делает их подходящими как для учреждений по уходу за больными, так и для независимых моделей старения на месте.

- Растущий акцент на проактивном вмешательстве, а не на реактивной помощи, обусловлен ростом численности пожилого населения, ростом расходов на здравоохранение и переходом к ценностно-ориентированной помощи в Северной Америке.

Динамика рынка мониторов для пожилых людей в Северной Америке

Водитель

«Растущая потребность в дистанционном мониторинге в связи с ростом численности пожилого населения и ростом спроса»

- Рост численности стареющего населения в Северной Америке в сочетании с растущим предпочтением независимого образа жизни среди пожилых людей существенно обуславливает спрос на решения для мониторинга состояния пожилых людей во всем регионе.

- Например, в феврале 2024 года компания Philips Healthcare запустила модернизированную платформу удалённого мониторинга со встроенной системой обнаружения падений и отслеживания жизненно важных показателей, направленную на улучшение ухода за пожилыми людьми как на дому, так и в учреждениях по уходу за пожилыми людьми. Ожидается, что подобные инновации, предлагаемые ключевыми компаниями, ускорят рост рынка в прогнозируемый период.

- Поскольку семьи стремятся обеспечить безопасность и здоровье пожилых близких, сохраняя при этом их независимость, устройства для наблюдения за пожилыми людьми предлагают расширенные функции, такие как непрерывное отслеживание состояния здоровья, системы оповещения о чрезвычайных ситуациях и мониторинг местоположения, что делает их привлекательной альтернативой постоянному личному уходу.

- Более того, развитие цифровых медицинских технологий и распространение экосистем «умных домов» делают системы мониторинга пожилых людей более доступными и облегчают их интеграцию в существующую инфраструктуру здравоохранения и образа жизни.

- Удобство удаленных проверок, уведомления в режиме реального времени для лиц, осуществляющих уход, и возможность отслеживать такие параметры, как частота сердечных сокращений, активность или сон с помощью мобильных приложений, являются основными факторами растущего внедрения этих решений как в учреждениях стационарного, так и долгосрочного ухода.

- Растущая тенденция к персонализированному здравоохранению, наряду с государственной поддержкой инициатив по старению на месте и программами возмещения расходов на телемедицину, продолжает способствовать расширению рынка устройств для мониторинга состояния пожилых людей в Северной Америке.

Сдержанность/Вызов

« Опасения относительно конфиденциальности данных и высоких затрат на внедрение »

- Опасения, связанные с конфиденциальностью данных и высокой первоначальной стоимостью систем мониторинга, остаются существенными препятствиями для их более широкого внедрения на рынке. Устройства, отслеживающие состояние здоровья и передвижения, требуют постоянного подключения и сбора данных, что вызывает опасения несанкционированного доступа или неправомерного использования конфиденциальных медицинских данных.

- Например, широко освещаемые нарушения в сфере здравоохранения и устройств Интернета вещей усилили обеспокоенность потребителей и поставщиков в отношении безопасности удаленных данных пациентов.

- Чтобы решить эту проблему, производители уделяют все больше внимания внедрению сквозного шифрования, методов управления данными, соответствующих требованиям HIPAA, и систем многофакторной аутентификации, чтобы успокоить пользователей и обеспечить безопасную обработку личной медицинской информации.

- Кроме того, первоначальные затраты на комплексные системы мониторинга состояния пожилых людей, включая датчики, носимые устройства и облачные программные платформы, могут оказаться непомерно высокими, особенно для небольших учреждений по уходу и семей с низким доходом.

- В то время как базовые носимые устройства и системы оповещения стали более доступными, передовые платформы с мониторингом жизненно важных показателей в режиме реального времени, видеонаблюдением и аналитикой на основе искусственного интеллекта часто имеют высокую цену.

- Чтобы преодолеть эти препятствия, усилия по обеспечению государственной поддержки возмещения расходов, пакеты комплексных услуг и доступные модульные решения имеют решающее значение для поощрения внедрения во всех группах дохода и учреждениях по уходу на североамериканском рынке.

Рынок мониторов для пожилых людей в Северной Америке

Рынок сегментирован по продукту, модальности, типу мониторинга, шкале остроты зрения, возрасту, полу, конечному пользователю, области применения и каналу сбыта.

- По продукту

По видам продукции рынок устройств для мониторинга состояния пожилых людей в Северной Америке сегментируется на устройства для мониторинга безопасности, сенсорные экраны, средства связи, мониторы активности, локационные мониторы, системы вызова сиделок, носимые устройства, сетевые системы видеонаблюдения и другие. Сегмент носимых устройств доминировал на рынке с долей выручки 28,6% в 2024 году благодаря росту использования интеллектуальных носимых технологий для отслеживания состояния здоровья и безопасности в режиме реального времени.

Ожидается, что сегмент сетевых систем видеонаблюдения будет расти самыми быстрыми темпами в год на уровне 21,9% в период с 2025 по 2032 год, что обусловлено спросом на круглосуточное удаленное наблюдение.

- По модальности

По принципу модальности рынок мониторов для пожилых людей в Северной Америке сегментируется на портативные и стационарные. Наибольшая доля портативного сегмента в 2024 году составила 65,1%, что обусловлено гибкостью и удобством использования в условиях домашнего ухода.

Прогнозируется, что сегмент фиксированной связи будет расти среднегодовыми темпами на 13,4% в период с 2025 по 2032 год, чему будут способствовать инвестиции в инфраструктуру мониторинга домов престарелых и больниц.

- По типу мониторинга

По типу мониторинга рынок устройств для мониторинга пожилых людей в Северной Америке сегментируется на следующие категории: мониторинг веса, телемедицина, мониторинг температуры, взаимодействие с пациентами, цифровое управление диабетом, домашняя телемедицина и другие. Телемедицина лидировала на рынке с долей 23,8% в 2024 году благодаря расширению виртуальных консультаций и удаленной диагностики.

Прогнозируется, что в сфере цифрового управления диабетом будет зафиксирован самый быстрый среднегодовой темп роста на уровне 20,3% в период с 2025 по 2032 год, что обусловлено ростом распространенности диабета среди пожилых людей.

- По шкале остроты зрения

По шкале остроты зрения рынок мониторов для пожилых людей в Северной Америке сегментируется на два уровня: высокий, средний и низкий. Наибольшая доля рынка в 2024 году (47,5%) пришлась на сегмент мониторов со средней остротой зрения, что обусловлено высокой долей пожилых людей, нуждающихся в умеренном мониторинге.

Ожидается, что сегмент средств индивидуальной защиты будет расти самыми быстрыми темпами в год на 17,6% в период с 2025 по 2032 год, что будет отражать рост числа тяжелобольных пожилых людей.

- По возрасту

По возрастному признаку рынок мониторов для пожилых людей в Северной Америке сегментирован на группы от 65 до 74 лет, от 75 до 84 лет и от 85 лет и старше. В 2024 году наибольшая доля рынка (45,2%) пришлась на возрастную группу от 75 до 84 лет, что обусловлено ростом заболеваемости хроническими заболеваниями.

Ожидается, что в группе 85 лет и старше будет наблюдаться самый быстрый среднегодовой темп прироста населения — 18,1% в период с 2025 по 2032 год — из-за более высокой продолжительности жизни и растущей потребности в интенсивном мониторинге.

- По полу

По половому признаку рынок мониторов для пожилых людей в Северной Америке сегментирован на мужской и женский. В 2024 году женский сегмент доминировал с долей 56,4%, поскольку женщины составляют большую долю пожилого населения.

Ожидается, что среднегодовой темп роста мужского сегмента составит 14,9% в период с 2025 по 2032 год, что обусловлено повышением осведомленности о здоровье и увеличением продолжительности жизни среди пожилых мужчин.

- Конечным пользователем

По типу конечного пользователя североамериканский рынок мониторов для пожилых людей сегментирован на больницы, дома престарелых, организации по уходу на дому, учреждения по уходу на дому, дома престарелых и другие. Наибольшая доля в 2024 году пришлась на сегмент учреждений по уходу на дому – 31,7%, что обусловлено растущей популярностью услуг поддержки пожилых людей на дому.

Прогнозируется, что сегмент учреждений по уходу за пожилыми людьми будет расти самыми быстрыми темпами в год на уровне 20,7% в период с 2025 по 2032 год, что будет обусловлено расширением учреждений по уходу за пожилыми людьми.

- По применению

По области применения рынок устройств для мониторинга здоровья пожилых людей в Северной Америке сегментируется на сегменты обнаружения и предотвращения падений, мониторинга состояния здоровья и другие. В 2024 году сегменты обнаружения и предотвращения падений занимали лидирующие позиции на рынке, занимая 44,5% рынка, что обусловлено высоким риском падений среди пожилых людей.

Ожидается, что среднегодовой темп роста мониторинга здоровья составит 19,2% в период с 2025 по 2032 год, что обусловлено спросом на отслеживание хронических заболеваний и персонализированную помощь.

- По каналу распространения

По каналам сбыта североамериканский рынок мониторов для пожилых людей сегментируется на прямые поставки, розничные продажи и прочие. Наибольшая доля прямых поставок в 52,8% в 2024 году пришлась на закупки институциональными покупателями.

Прогнозируется, что объем розничных продаж будет расти самыми быстрыми среднегодовыми темпами на уровне 22,4% в период с 2025 по 2032 год, чему будет способствовать рост доступности товаров онлайн и покупательской активности потребителей.

Региональный анализ рынка мониторов для пожилых людей в Северной Америке

- Северная Америка доминировала на рынке устройств для мониторинга пожилых людей с наибольшей долей выручки в 41,7% в 2024 году, что обусловлено ростом численности гериатрического населения, ростом бремени хронических заболеваний и расширением применения моделей телемедицины и домашнего ухода.

- Потребители в регионе высоко ценят безопасность, удобство и информацию о состоянии здоровья, предоставляемую устройствами для мониторинга пожилых людей, которые включают в себя системы обнаружения падений, удаленный мониторинг жизненно важных показателей и устройства отслеживания местоположения.

- Этот высокий спрос дополнительно поддерживается высокими расходами на здравоохранение, хорошо развитой инфраструктурой цифрового здравоохранения и благоприятными государственными инициативами, поощряющими старение на месте и удаленный уход.

Обзор рынка мониторинга пожилых людей в США

Рынок мониторов для пожилых людей в США в 2024 году занял наибольшую долю выручки в Северной Америке – 83,5%. Этому способствовало быстрое внедрение подключенных медицинских устройств, высокая доля пожилых людей и сильное присутствие таких крупных игроков, как Philips, Medtronic и Abbott. Растущая популярность услуг домашнего ухода, растущая распространенность хронических заболеваний, таких как деменция, и повышение доступности удобных носимых устройств для мониторинга состояния здоровья стимулируют расширение рынка. Более того, интеграция с искусственным интеллектом и мобильными приложениями улучшает поддержку лиц, осуществляющих уход, в режиме реального времени, тем самым улучшая результаты лечения и соблюдение пациентами предписаний.

Обзор рынка мониторинга пожилых людей в Канаде

Ожидается, что рынок устройств мониторинга для пожилых людей в Канаде будет расти с многообещающими среднегодовыми темпами в течение прогнозируемого периода, что обусловлено быстрым старением населения, растущим вниманием к самостоятельности пожилых людей и государственной поддержкой услуг телемедицины. Система здравоохранения страны инвестирует в технологические инструменты мониторинга для управления нагрузкой пациентов в больницах и повышения эффективности ухода на дому. Спрос на системы предотвращения падений, устройства мониторинга соблюдения режима приема лекарств и системы оповещения заметно растет в учреждениях по уходу за престарелыми и домах престарелых.

Обзор рынка мониторинга пожилых людей в Мексике

Ожидается, что рынок устройств мониторинга состояния пожилых людей в Мексике будет расти стабильными среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать рост численности пожилого населения, повышение осведомленности о проблемах, связанных со старением, и более широкое использование решений для домашнего здравоохранения. Государственные инициативы по укреплению инфраструктуры первичной медико-санитарной помощи и цифрового здравоохранения, в частности, посредством государственно-частного партнерства, ускоряют внедрение технологий мониторинга состояния пожилых людей как в городских, так и в пригородных районах.

Доля рынка мониторов для пожилых людей в Северной Америке

Индустрия мониторов для пожилых людей в Северной Америке представлена в основном хорошо зарекомендовавшими себя компаниями, среди которых:

- Конинклийке Philips NV (Нидерланды)

- Вансвью (Китай)

- Корпорация Smart Care Giver (США)

- Resideo Technologies, Inc. (США)

- Care Innovations, LLC (США)

- Бостонская научная корпорация (США)

- Биотроник (Германия)

- Эбботт (США)

- Medtronic (Ирландия)

- Reolink (Гонконг)

- Арло (США)

- AlertONE (США)

- Живые технологии (Австралия)

- EarlySense (Израиль)

- Kwido (Идеальные решения) (Испания)

- Эмфит (Финляндия)

- Withings (Франция)

- Omron Healthcare, Inc. (Япония)

- AMC Health (США)

- General Electric (США)

Последние разработки на рынке мониторов для пожилых людей в Северной Америке

- В сентябре 2023 года Google объявила о планах выхода на рынок устройств для мониторинга состояния здоровья пожилых людей – носимых устройств, предназначенных для мониторинга состояния здоровья пожилых людей. Ожидаемые функции включают напоминания о приеме лекарств, мониторинг жизненно важных показателей и обнаружение падений. Эта инновация, которая все еще находится на стадии разработки, соответствует постоянным усилиям отрасли по улучшению ухода за пожилыми людьми с помощью передовых и комплексных решений для мониторинга.

- В августе 2022 года компания Samsung Electronics Co Ltd вышла на рынок устройств для мониторинга здоровья пожилых людей с Galaxy Watch4, скопировав достижения Apple в области обнаружения падений. Galaxy Watch4, обладающий разнообразными функциями мониторинга здоровья, включая измерение уровня кислорода в крови, ЭКГ и пульсометр, готов составить конкуренцию новейшим смарт-часам Apple, что отражает постоянный интерес отрасли к инновационным и комплексным решениям для мониторинга здоровья пожилых людей.

- В октябре 2021 года компания GENERAL ELECTRIC заключила партнерское соглашение с Verizon Business для создания межстранового испытательного стенда, использующего сверхширокополосную сеть 5G от Verizon. Это сотрудничество расширило портфель продуктов GENERAL ELECTRIC благодаря внедрению передовых технологий. Использование технологии 5G позволило компании внедрять инновации и предлагать передовые решения, способствуя развитию её предложений.

- В июне 2021 года компания Koninklijke Philips NV сотрудничала с голландским банком развития FMO в целях расширения доступа к качественной первичной медицинской помощи в Африке. Это стратегическое партнерство увеличило расходы на здравоохранение в регионе и способствовало расширению бизнеса Philips, позволив компании внести свой вклад в улучшение инфраструктуры и услуг здравоохранения в африканских сообществах.

- В сентябре 2021 года компания Apple Inc. выпустила Apple Watch Series 6 с функцией автономного обнаружения падений, что свидетельствует о прогрессе на рынке устройств для мониторинга состояния пожилых людей. Продвинутый мониторинг состояния здоровья и отслеживание состояния в режиме реального времени повысили его привлекательность. Это соответствует растущему спросу на инновационные решения и отражает общую тенденцию в секторе мониторинга состояния пожилых людей.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.