North America Drive Shaft Market

Размер рынка в млрд долларов США

CAGR :

%

USD

5.05 Billion

USD

7.69 Billion

2024

2032

USD

5.05 Billion

USD

7.69 Billion

2024

2032

| 2025 –2032 | |

| USD 5.05 Billion | |

| USD 7.69 Billion | |

|

|

|

|

Сегментация рынка приводных валов в Северной Америке по компонентам (скользящие вилки, валы вилок, концевые вилки, ответные фланцы, фланцевые вилки, сварные вилки, центральные вилки, шлицевые скользящие штыри, промежуточные штыри и другие), типу конструкции (полый вал и сплошной вал), типу приводного вала (приводной вал Hotchkiss, приводной вал с крутящей трубкой, гибкий приводной вал и приводной вал со вставной трубкой), типу положения (передняя ось и задняя ось), типу материала ( углеродистая сталь , алюминий, нержавеющая сталь , композитные материалы, углеродное волокно и другие), типу транспортного средства (легковые автомобили и коммерческий транспорт), каналу продаж (OEM и вторичный рынок) — тенденции отрасли и прогноз до 2032 года.

Размер рынка приводных валов в Северной Америке

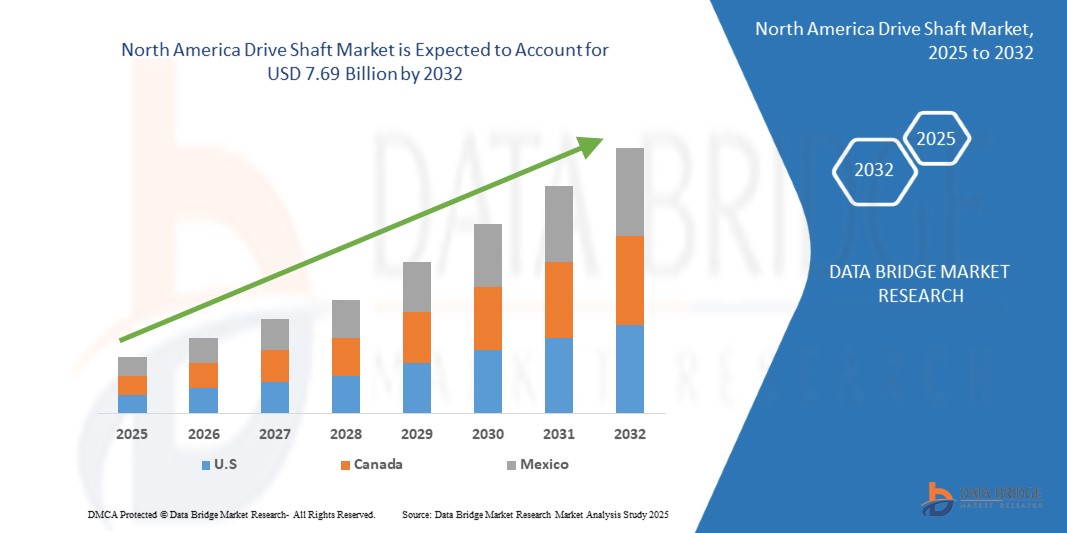

- Объем мирового рынка приводных валов в Северной Америке оценивался в 5,05 млрд долларов США в 2024 году и, как ожидается , достигнет 7,69 млрд долларов США к 2032 году при среднегодовом темпе роста 5,40% в течение прогнозируемого периода.

- Рост рынка обусловлен в первую очередь увеличением производства транспортных средств, переходом на легкие автомобильные компоненты для повышения топливной экономичности и растущим спросом на системы полного привода (AWD) и полного привода (4WD) для легковых и коммерческих автомобилей.

- Кроме того, усовершенствования в области таких материалов, как углеродное волокно и алюминий, а также растущие ожидания потребителей относительно производительности транспортных средств и снижения выбросов улучшают конструкцию и долговечность приводного вала, тем самым способствуя долгосрочному расширению рынка.

Анализ рынка приводных валов в Северной Америке

- Рынок приводных валов в Северной Америке, необходимый для передачи крутящего момента и вращения в транспортных средствах, играет решающую роль в производительности автомобилей, особенно коммерческих, легковых автомобилей и внедорожной техники, благодаря своей эффективности, долговечности и способности поддерживать высокопроизводительные трансмиссии.

- Рост рынка приводных валов в Северной Америке обусловлен, прежде всего, ростом производства транспортных средств, повышением спроса на легкие и экономичные компоненты, а также ускорением перехода к электрическим и гибридным транспортным средствам, для которых требуются специализированные решения в области приводных валов.

- США доминировали на североамериканском рынке приводных валов с самой большой долей выручки в 76,12% на североамериканском рынке приводных валов в 2024 году, что было обусловлено высоким спросом на внедорожники, грузовики и высокопроизводительные автомобили, оснащенные сложными трансмиссиями.

- Ожидается, что рынок приводных валов в Канаде будет расти самыми быстрыми темпами среднегодового темпа роста на уровне 6,08% в прогнозируемый период, чему будут способствовать прочные отношения в автомобильной торговле с США в рамках USMCA и растущее предпочтение легких коммерческих автомобилей в городской логистике.

- Сегмент скользящих вилок доминировал на рынке с наибольшей долей выручки в 38,4% в 2024 году благодаря их широкому использованию для компенсации перемещения приводного вала во время движения подвески и их важной роли в обеспечении плавной передачи мощности.

Объем отчета и сегментация рынка приводных валов

|

Атрибуты |

Ключевые сведения о рынке приводных валов |

|

Охваченные сегменты |

|

|

Охваченные страны |

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

Тенденции рынка приводных валов в Северной Америке

Легкие материалы и передовые технологии производства для повышения производительности

- Заметной и растущей тенденцией на североамериканском рынке приводных валов является переход к использованию лёгких материалов, таких как алюминий и углеродное волокно, в сочетании с прецизионными технологиями производства для повышения топливной экономичности, производительности и долговечности автомобилей. Эта тенденция усиливается нормативными требованиями к снижению выбросов и стремлением производителей оригинального оборудования (OEM) улучшить динамику автомобилей.

- Например, компания Dana Incorporated предлагает усовершенствованные карданные валы из углеродного волокна, которые на 70% легче традиционных стальных, помогая автопроизводителям достигать целей по экономии топлива без ущерба для прочности. Аналогичным образом, компания American Axle & Manufacturing (AAM) разработала высокопроизводительные алюминиевые карданные валы, используемые в ряде лёгких грузовиков и спортивных автомобилей по всей Северной Америке.

- Интеграция точного машиностроения и систем автоматизированного проектирования (САПР) позволила производителям оптимизировать геометрию вала, улучшить балансировку и снизить вибрации, что привело к более плавному ходу и снижению уровня шума, вибрации и жесткости.

- Эти инновации особенно важны в Северной Америке, где на автомобильном рынке доминируют внедорожники и лёгкие грузовики. Автопроизводители всё чаще выбирают усовершенствованные приводные валы, чтобы обеспечить более высокий крутящий момент электрических и гибридных силовых агрегатов без ущерба для веса и надёжности.

- Эта тенденция также меняет сектор вторичного рынка, поскольку энтузиасты производительности и операторы автопарков ищут модернизированные системы приводных валов для повышения эффективности и передачи мощности.

- Поскольку производители оригинального оборудования и поставщики первого уровня продолжают инвестировать в НИОКР для соответствия меняющимся стандартам, использование современных материалов и производственных технологий станет определяющей чертой региональной отрасли приводных валов в ближайшие годы.

Динамика рынка приводных валов в Северной Америке

Водитель

Рост производства автомобилей и спроса на системы полного привода

- Постоянный рост производства транспортных средств, особенно внедорожников, кроссоверов и грузовиков, по всей Северной Америке, в сочетании с растущим предпочтением потребителей полноприводным (AWD) и полноприводным (4WD) системам, является основным драйвером рынка приводных валов.

- Поскольку потребители отдают предпочтение универсальности, внедорожным возможностям и безопасности в различных условиях вождения, производители оснащают все большее количество транспортных средств современными системами трансмиссии, каждая из которых требует прочных и эффективных приводных валов.

- Например, Ford и General Motors расширили свои предложения по полному и полному приводу в новых моделях внедорожников и пикапов, что напрямую способствовало росту спроса как на приводные валы OEM, так и на приводы вторичного рынка.

- Кроме того, рост сегмента легких коммерческих автомобилей (LCV), активно используемых для логистики и доставки товаров в сфере электронной коммерции, еще больше повышает требования к приводным валам из-за частого использования и необходимости надежной передачи мощности.

- Наряду с растущими ожиданиями потребителей нормативные требования по повышению топливной экономичности побуждают автопроизводителей перепроектировать приводные валы с использованием более легких и эффективных материалов, что повышает темпы замены и инноваций в секторе.

- В целом, сочетание растущих объемов производства, усовершенствований трансмиссии и технологических инноваций продолжает укреплять североамериканский рынок приводных валов.

Сдерживание/Проблема:

волатильность цен на сырье и проблемы интеграции в электромобилях

- Одной из ключевых проблем североамериканского рынка приводных валов является волатильность цен на сырье, особенно на сталь, алюминий и композиты из углеродного волокна, что может существенно повлиять на производственные затраты и рентабельность.

- Например, колебания на мировых товарных рынках, усугубляемые торговой напряженностью и сбоями в цепочках поставок, часто приводят к непоследовательным ценам на основные материалы, что влияет как на производителей оригинального оборудования, так и на поставщиков первого уровня в их способности масштабировать экономически эффективные решения.

- Кроме того, растущий переход на электромобили (ЭМ), которые обычно имеют другую архитектуру трансмиссии, например, встроенные в колеса двигатели или меньшее количество движущихся компонентов, создает проблемы интеграции для традиционных конструкций приводных валов.

- Хотя некоторые платформы электромобилей по-прежнему используют приводные валы (особенно в конфигурациях с двумя двигателями или полным приводом), многие новые конструкции электрических силовых агрегатов исключают необходимость в традиционных системах, что потенциально снижает долгосрочный спрос в определенных сегментах транспортных средств.

- Таким образом, производители вынуждены адаптироваться, внедряя инновационные решения в области приводных валов, совместимые с компоновкой электромобилей, одновременно контролируя производственные затраты на фоне роста цен на материалы.

- Устранение этих ограничений посредством дальновидных стратегий проектирования, вертикальной интеграции для улучшения источников материалов и инвестиций в компоненты, совместимые с электромобилями, будет иметь решающее значение для поддержания конкурентоспособности в развивающемся североамериканском автомобильном ландшафте.

Объем рынка приводных валов в Северной Америке

Рынок автомобильных приводных валов сегментирован на семь основных сегментов в зависимости от компонента, типа конструкции, типа приводного вала, типа положения, типа материала, типа транспортного средства и канала продаж.

- По компонентам

По типу компонентов рынок сегментируется на скользящие вилки, валы вилок, концевые вилки, ответные фланцы, фланцевые вилки, сварные вилки, центральные вилки, шлицевые вилки вилки, промежуточные вилки вилки и другие. Сегмент скользящих вилок доминировал на рынке, обеспечивая наибольшую долю выручки в 38,4% в 2024 году благодаря их широкому применению для компенсации перемещения приводного вала во время движения подвески и их важнейшей роли в обеспечении плавной передачи мощности. Скользящие вилки пользуются высоким спросом как в легковых, так и в лёгких коммерческих автомобилях благодаря своей долговечности и экономичности.

Прогнозируется, что сегмент фланцевых вилок будет демонстрировать самый быстрый среднегодовой темп роста в 8,9% в период с 2025 по 2032 год, что обусловлено растущим спросом на тяжёлые грузовики, внедорожную технику и коммерческий транспорт. Способность выдерживать высокие крутящие моменты и обеспечивать надёжные соединения делает их незаменимыми в современных трансмиссиях, где производительность и надёжность имеют первостепенное значение.

- По типу конструкции

По типу конструкции рынок сегментируется на два сегмента: с полым валом и сплошным валом. Сегмент с полым валом доминировал на рынке с долей выручки 53,5% в 2024 году, главным образом благодаря лёгкой конструкции, уменьшенной инерции и превосходной топливной экономичности. Автопроизводители предпочитают использовать полые валы в легковых автомобилях и электромобилях, поскольку они повышают общую производительность автомобиля и соответствуют нормативным требованиям по выбросам.

Ожидается, что сегмент цельных валов продемонстрирует самый быстрый среднегодовой темп роста в 7,6% в период с 2025 по 2032 год, что обусловлено их растущим применением в тяжёлых условиях, требующих повышенной прочности и крутящего момента. Цельные валы особенно популярны в грузовиках, автобусах и промышленных транспортных средствах, где прочность и грузоподъёмность важнее снижения веса.

- По типу приводного вала

По типу приводного вала рынок сегментирован на приводной вал Hotchkiss, приводной вал с торсионной трубкой, гибкий приводной вал и приводной вал с скользящей трубкой. В 2024 году приводной вал Hotchkiss занял лидирующие позиции, составив 31,7% выручки благодаря широкому применению в заднеприводных легковых автомобилях и лёгких грузовиках. Простая конструкция, экономичность и проверенная надёжность обеспечивают ему прочное положение на рынке.

Ожидается, что сегмент гибких приводных валов будет демонстрировать самый быстрый среднегодовой темп роста в 9,3% в период с 2025 по 2032 год, что обусловлено растущим спросом на электромобили, гибридные автомобили и специализированную промышленную технику. Гибкие валы обеспечивают более плавную передачу крутящего момента, улучшенное поглощение вибраций и компактную интеграцию, что делает их идеальными для применения в лёгких автомобильных системах.

- По типу должности

По типу расположения рынок сегментируется на передние и задние оси. Сегмент задних осей доминировал на рынке с долей выручки 48,2% в 2024 году, что обусловлено высокой распространенностью заднеприводных конфигураций в легких грузовиках, внедорожниках и коммерческих автомобилях. Для эффективной передачи крутящего момента на большие расстояния задним осям требуются прочные приводные валы.

Прогнозируется, что сегмент передних приводов будет расти самыми быстрыми темпами в 8,1% в период с 2025 по 2032 год, в основном благодаря растущему использованию полноприводных и переднеприводных автомобилей среди легковых автомобилей. Растущий потребительский спрос на повышенную устойчивость, топливную экономичность и тягу в компактных автомобилях и кроссоверах стимулирует спрос на приводные валы передней оси.

- По типу материала

По типу материала рынок сегментируется на следующие сегменты: углеродистая сталь, алюминий, нержавеющая сталь, композитные материалы, углеродное волокно и другие. Наибольшая доля выручки в 2024 году (56,9%) пришлась на сегмент углеродистой стали, которая пользуется популярностью благодаря своей прочности, долговечности и экономичности как в легковых, так и в коммерческих автомобилях. Приводные валы из углеродистой стали остаются стандартным выбором для традиционных автомобилей с ДВС.

Ожидается, что сегмент углеродного волокна будет расти самыми быстрыми темпами в среднем на 10,4% в период с 2025 по 2032 год, благодаря растущему использованию углеродного волокна в автомобилях высокой производительности, автомобилях класса люкс и электромобилях. Его лёгкость и превосходное соотношение прочности и веса делают его идеальным материалом для повышения топливной экономичности и сокращения выбросов, что соответствует глобальным целям устойчивого развития.

- По типу транспортного средства

По типу транспортного средства рынок сегментирован на легковые и коммерческие автомобили. Сегмент легковых автомобилей доминировал на рынке с долей выручки 51,4% в 2024 году, что обусловлено ростом производства седанов, внедорожников и хэтчбеков по всему миру. Рост урбанизации, располагаемого дохода и переход на подключенные автомобили также способствуют распространению технологий.

Прогнозируется, что сегмент коммерческого транспорта будет демонстрировать самый быстрый среднегодовой темп роста в 7,8% в период с 2025 по 2032 год, в связи с расширением мировой логистики и строительства. Тяжёлые грузовики и автобусы требуют прочных, высокопроизводительных приводных валов, способных выдерживать высокие крутящие нагрузки и длительный срок службы.

- По каналу продаж

По каналам продаж рынок сегментирован на OEM-производителей и вторичный рынок. Сегмент OEM-производителей доминировал на рынке с долей выручки 58,7% в 2024 году, что обусловлено ростом мирового производства автомобилей и стремлением производителей устанавливать современные облегченные приводные валы на этапе первичной сборки. Поставки OEM-производителей обеспечивают стабильное качество, соблюдение нормативных требований и гарантийные обязательства для конечных пользователей.

Прогнозируется, что сегмент вторичного рынка будет демонстрировать самый быстрый среднегодовой темп роста в 8,6% в период с 2025 по 2032 год, что обусловлено старением автомобилей, более высокой частотой их замены и спросом на индивидуальную настройку. Коммерческие автопарки и частные владельцы автомобилей обращаются к решениям вторичного рынка в целях экономии средств и доступности специализированных компонентов.

Региональный анализ рынка приводных валов в Северной Америке

- США доминировали на североамериканском рынке приводных валов с самой большой долей выручки в 76,12% на североамериканском рынке приводных валов в 2024 году, что было обусловлено высоким спросом на внедорожники, грузовики и высокопроизводительные автомобили, оснащенные сложными трансмиссиями.

- Рост производства полноприводных моделей в сочетании с возросшим интересом к внедорожным и утилитарным автомобилям стимулирует рост рынка. Кроме того, инвестиции в платформы электромобилей и лёгкие композитные материалы стимулируют отечественных производителей к модернизации технологий приводных валов.

- Развитый сектор вторичного рынка и растущие темпы замены автопарка также способствуют устойчивому росту

Обзор рынка приводных валов в Канаде.

Прогнозируется, что рынок приводных валов в Канаде будет расти самыми быстрыми среднегодовыми темпами на уровне 6,08% в прогнозируемый период, чему будут способствовать прочные торговые отношения с США в рамках USMCA и растущая популярность лёгких коммерческих автомобилей в городской логистике. Суровые зимние условия и неровная местность также стимулируют спрос на автомобили с полным и полным приводом, усиливая потребность в прочных и высокопроизводительных приводных валах. Кроме того, растущий интерес к электромобилям и гибридным автомобилям стимулирует увеличение инвестиций в лёгкие решения для приводных валов.

Обзор рынка приводных валов в Мексике.

Мексика становится ключевым игроком на североамериканском рынке приводных валов, и ожидается её быстрый рост до 2032 года. Будучи крупным производственным центром для мировых автопроизводителей, страна выигрывает от рентабельного производства и квалифицированной рабочей силы. Активная деятельность OEM-производителей, особенно в сфере сборки автомобилей и экспорта комплектующих, стимулирует местный спрос на приводные валы. Ожидается, что дальнейшее расширение автомобильных производственных мощностей в сочетании с инвестициями в инфраструктуру и торговыми преимуществами значительно увеличит вклад Мексики в региональный рынок.

Доля рынка приводных валов в Северной Америке

Лидерами рынка приводных валов являются:

- Johnson Power, Ltd. (США)

- ACPT Inc. (США)

- American Axle & Manufacturing, Inc. (США)

- D&F Propshafts (Великобритания)

- Cummins Inc. (США)

- Neapco Inc. (США)

- Nexteer Automotive (США)

- Dorman Products (США)

- HYUNDAI WIA CORP (Южная Корея)

- Корпорация JTEKT (Япония)

- КОМПАНИЯ TIMKEN (США)

- Hitachi Astemo, Ltd. (Япония)

- GSP EUROPE GmbH (Германия)

- КОРПОРАЦИЯ TUNGALOY (Япония)

- GKN Automotive Limited (Великобритания)

Последние события на мировом рынке приводных валов в Северной Америке

- В апреле 2023 года компания Dana Incorporated, ведущий американский производитель трансмиссий и систем электропривода, объявила о расширении своего завода по производству облегченных приводных валов в Огайо для удовлетворения растущего спроса со стороны производителей электромобилей (ЭМ) и гибридных автомобилей. Новое предприятие специализируется на производстве передовых алюминиевых и композитных приводных валов, поддерживая усилия OEM-производителей по повышению топливной экономичности и снижению веса автомобилей. Это расширение укрепляет стратегические позиции Dana в поставках приводных валов нового поколения по всей Северной Америке.

- В марте 2023 года компания American Axle & Manufacturing (AAM) представила новую линейку модульных систем приводных валов, разработанных специально для электрифицированных и гибридных трансмиссий. Эти системы обеспечивают улучшенную передачу крутящего момента и снижение уровня шума, вибрации и неровностей (NVH), что делает их подходящими как для лёгких электромобилей, так и для спортивных автомобилей. Это нововведение подчёркивает стремление AAM гармонизировать свой ассортимент продукции с переходом автомобильной промышленности на электрификацию.

- В марте 2023 года компания Neapco Holdings LLC, известный поставщик трансмиссий со штаб-квартирой в Мичигане, представила на крупной автомобильной выставке в Детройте свою новую разработку – приводные валы из полимера, армированного углеродным волокном (CFRP). Эти приводные валы, предназначенные для автомобилей класса люкс и автомобилей с высокими эксплуатационными характеристиками, отличаются повышенной прочностью, уменьшенной вращающейся массой и более высокой топливной экономичностью. Этот запуск знаменует собой неизменное внимание Neapco к интеграции высококачественных материалов и созданию лёгких решений.

- В феврале 2023 года компания GKN Automotive расширила свой североамериканский инженерный центр в Оберн-Хиллз, штат Мичиган, для поддержки НИОКР по разработке передовых технологий приводных валов для электромобилей и полноприводных автомобилей. Расширение включает в себя испытательные стенды для терморегулирования и моделирования долговечности, что отражает инвестиции компании в перспективные решения для трансмиссий, адаптированные к меняющимся потребностям OEM-производителей.

- В январе 2023 года компания Spicer Drivetrain (бренд Dana) представила серию приводных валов для вторичного рынка, ориентированную на повышение производительности, для владельцев Jeep и внедорожников по всей Северной Америке. Новая линейка включает в себя усиленные стальные и алюминиевые приводные валы, разработанные для автомобилей с лифтованной подвеской и эксплуатации в условиях высокой нагрузки, ориентированные на любителей бездорожья и отвечающие растущему спросу на кастомизированные модификации трансмиссии на вторичном рынке.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.