Рынок услуг по обеспечению безопасности сердца в Северной Америке по услугам (измерения ЭКГ/холтеровское мониторирование, измерения артериального давления , услуги по оценке безопасности сердца in vitro, визуализация сердечно-сосудистой системы, телеметрический мониторинг в реальном времени, централизованное перечитывание ЭКГ, неинвазивная визуализация сердца, физиологическое стресс-тестирование, тщательные исследования QT, моделирование TQT и реакции на воздействие, агрегация тромбоцитов и другие услуги), фаза (фаза 1, фаза 2 и фаза 3), тип (комплексные услуги и отдельные услуги), конечный пользователь ( фармацевтические и биофармацевтические компании, контрактные исследовательские организации и научно-исследовательские институты) — отраслевые тенденции и прогноз до 2029 года.

Анализ рынка и идеи

Рынок услуг по обеспечению безопасности сердца в Северной Америке обусловлен такими факторами, как увеличение числа клинических испытаний, растущее число основных участников рынка и инновации в технологиях, которые повышают его спрос, а также увеличение инвестиций в исследования и разработки, что приводит к росту рынка. В настоящее время проводятся различные исследования, которые, как ожидается, создадут конкурентное преимущество для производителей в разработке новых и инновационных систем услуг по обеспечению безопасности сердца , что, как ожидается, предоставит различные другие возможности на рынке услуг по обеспечению безопасности сердца. Однако ожидается, что строгие государственные правила утверждения будут сдерживать рост.

Отчет о рынке услуг по обеспечению безопасности сердца в Северной Америке содержит подробную информацию о доле рынка, новых разработках и анализе линейки продуктов, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического резюме, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели. Масштабируемость и расширение бизнеса розничных подразделений в развивающихся странах различных регионов и партнерство с поставщиками для безопасного распространения машин и лекарственных препаратов являются основными факторами, которые стимулировали спрос на рынке в прогнозируемый период.

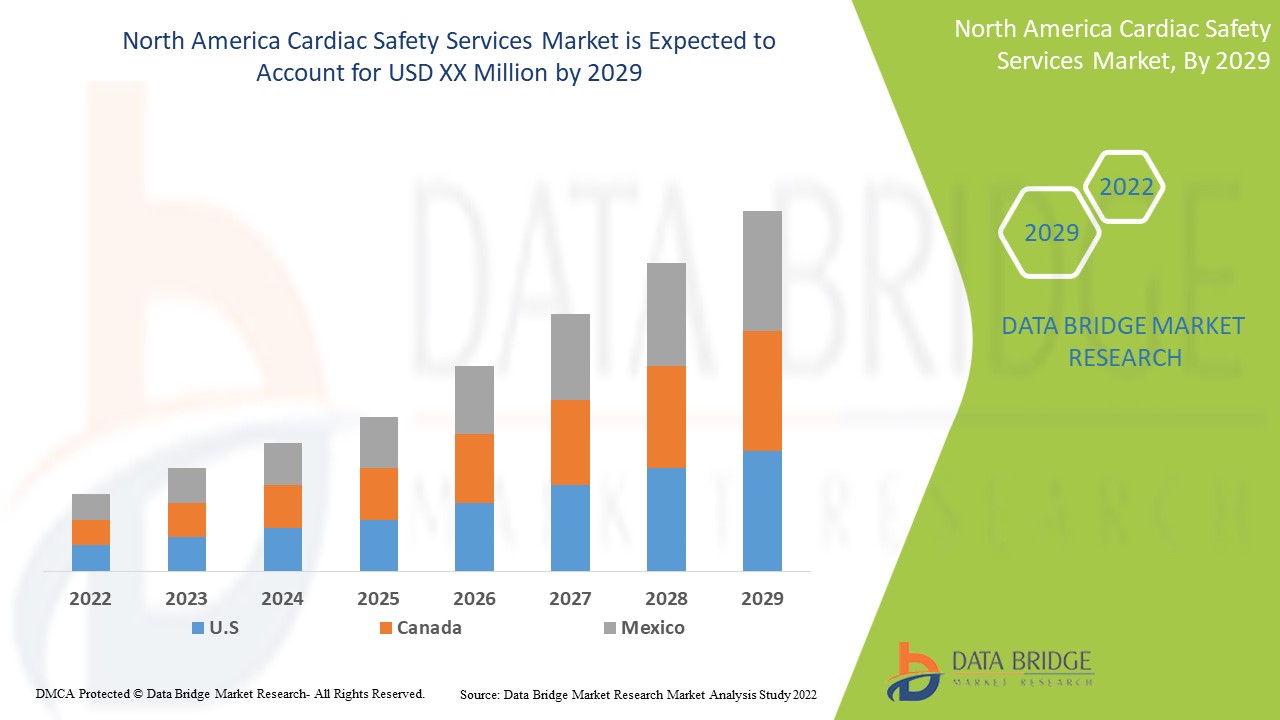

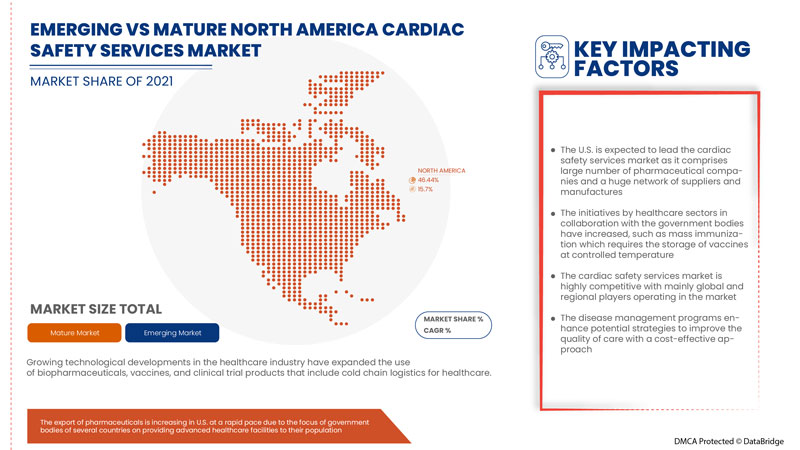

Рынок услуг по обеспечению безопасности сердца в Северной Америке является благоприятным и направлен на замедление прогрессирования заболевания. Data Bridge Market Research анализирует, что рынок услуг по обеспечению безопасности сердца в Северной Америке будет расти в среднем на 15,7% в течение прогнозируемого периода с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По услугам (измерения ЭКГ/холтеровское мониторирование, измерения артериального давления, услуги по оценке безопасности сердца in vitro, визуализация сердечно-сосудистой системы, телеметрический мониторинг в реальном времени, центральное перечитывание ЭКГ, неинвазивная визуализация сердца, физиологическое стресс-тестирование, тщательные исследования QT, моделирование TQT и реакции на воздействие, агрегация тромбоцитов и другие услуги), фаза (фаза 1, фаза 2 и фаза 3), тип (комплексные услуги и отдельные услуги), конечный пользователь (фармацевтические и биофармацевтические компании, контрактные исследовательские организации и научно-исследовательские институты) |

|

Страны, охваченные |

США, Канада и Мексика |

|

Охваченные участники рынка |

Koninklijke Philips NV, Laboratory Corporation of America Holdings, IQVIA, Medpace, Ncardia, Certara, Eurofins Scientific, SGS SA, Banook, Celerion, Biotrial, NEXEL Co., Ltd, Richmond Pharmacology, PhysioStim, Shanghai Medicilon Inc, Clario, PPD Inc и другие. |

Определение рынка:

Услуги по обеспечению безопасности сердца обычно помогают поддерживать и разрабатывать клинические испытания и другие исследования, необходимые для мониторинга безопасности сердца. Спрос на рынок услуг по обеспечению безопасности сердца увеличился как в развитых, так и в развивающихся странах, и причиной этого является увеличение числа клинических испытаний и запусков продуктов. Рынок услуг по обеспечению безопасности сердца растет за счет внедрения инновационных продуктов, увеличения количества технологических продуктов и роста располагаемого дохода. Рынок будет расти в прогнозируемый период за счет исследования развивающихся рынков, стратегических инициатив участников рынка, увеличения расходов на здравоохранение.

Динамика рынка услуг кардиологической безопасности в Северной Америке

Драйверы

- Увеличение количества клинических испытаний

Клиническое исследование — это хорошо структурированная система, которая существует уже сотни лет и по-прежнему является основой нормативных требований, необходимых для одобрения препарата. В последнее время в области клинических исследований наблюдается значительный прогресс, что увеличило количество клинических исследований и, как ожидается, будет способствовать росту рынка.

Произошли различные изменения в регулировании клинических испытаний, что привело к увеличению количества клинических испытаний и их положительных результатов.

Например,

- Согласно статье Medical News, значительно увеличилось количество испытаний из-за повышения качества клинических испытаний, например, обязательного обучения всего персонала. Кроме того, в 2017 году NIH заявил, что все исследователи и сотрудники должны пройти обучение по надлежащей клинической практике (GCP) в испытаниях, которые финансирует NIH

Увеличение расходов на здравоохранение и финансирование

Объем денежных средств, используемых страной на здравоохранение, и темпы их роста с течением времени зависят от широкого спектра экономических и социальных факторов, включая механизмы финансирования и структуру организации системы здравоохранения.

Расходы на здравоохранение увеличились в развитых странах и странах с развивающейся экономикой, поскольку располагаемый доход людей растет. Чем больше денег тратится на здравоохранение, тем здоровее население страны.

Возможность

- Рост разработки новых лекарств

Клинические испытания жизненно важны для открытия и разработки новых лекарств для лечения болезней. Это лучший способ для исследователей узнать, какие методы лечения работают или не работают на людях. Разработка лекарств характеризуется как формирование новых методов лечения в виде лекарств или устройств для лечения различных заболеваний, таких как рак, эндокринные, метаболические и другие.

- Таким образом, клинические испытания являются наиболее эффективным способом обеспечения безопасности и эффективности терапевтического препарата перед его выпуском на рынок и потреблением человеком, включая оценку безопасности для сердца, которая является неотъемлемой частью перед тем, как любой медицинский продукт поступит на рынок.

Сдержанность/Вызов

Правильная оценка и отчетность по клиническим данным по безопасности для сердца имеет важное значение. Одобрение и отзыв продукции для любых медицинских продуктов зависят от оценки безопасности для сердца. Поэтому необходимо предоставлять и проводить оценку безопасности для сердца в соответствии с правовой процедурой, в противном случае это приведет к позднему одобрению продукта, что, как ожидается, сдержит рост рынка.

Например,

- Согласно статье IQVIA, было 47 случаев отзыва лекарств после выхода на рынок в период с 1957 по 2007 год, в которых 45% из них были вызваны опасениями относительно сердечно-сосудистой токсичности. Аналогично, 27% потенциальных новых молекул лекарств, которые потерпели неудачу на доклинической стадии за последние два десятилетия, сделали это из-за сердечно-сосудистой токсичности, поскольку они не соответствовали требуемым нормативным требованиям

Сегментация рынка услуг кардиологической безопасности в Северной Америке

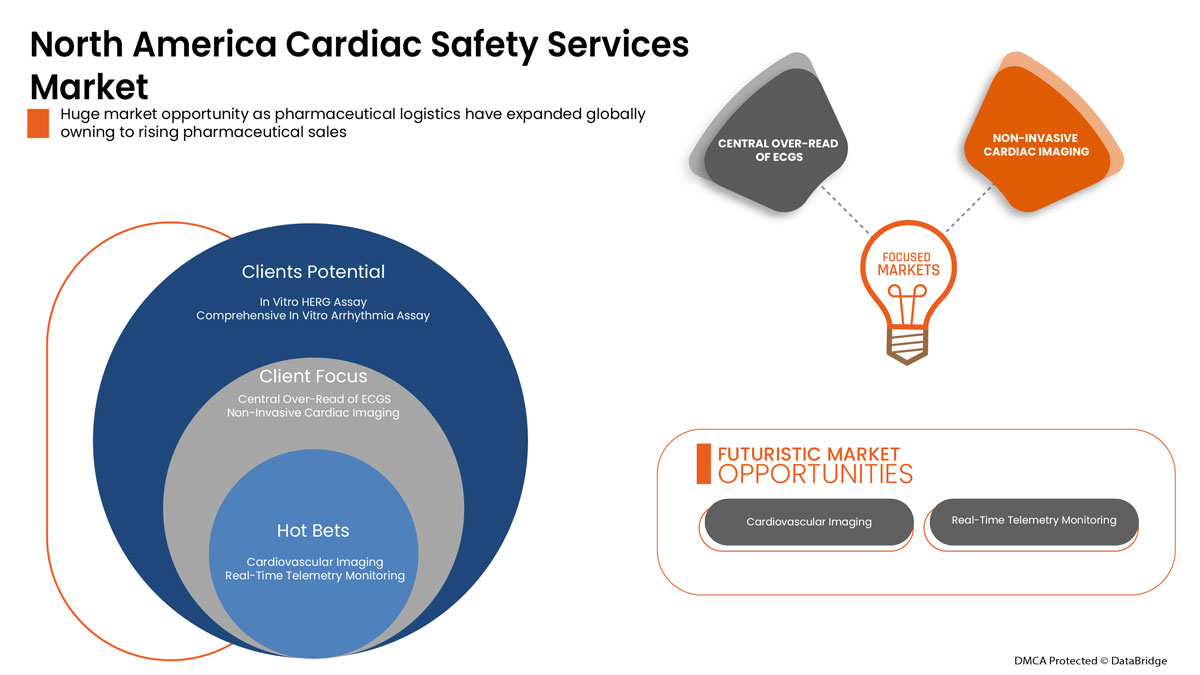

Рынок услуг по обеспечению безопасности сердца в Северной Америке классифицируется по типу, услугам, фазе и конечному пользователю. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

Услуги

- ЭКГ/холтеровские измерения

- Измерение артериального давления

- Услуги по оценке безопасности сердца in vitro

- Сердечно-сосудистая визуализация

- Телеметрический мониторинг в реальном времени

- Центральное перечитывание ЭКГ

- Неинвазивная кардиологическая визуализация

- Физиологическое стресс-тестирование

- Тщательные исследования QT

- TQT и моделирование реакции на воздействие

- Агрегация тромбоцитов

- Другие услуги

На основе услуг рынок услуг по обеспечению безопасности сердца сегментирован на следующие услуги: измерения ЭКГ /холтеровское мониторирование, измерения артериального давления, услуги по оценке безопасности сердца in vitro, визуализация сердечно-сосудистой системы , телеметрический мониторинг в реальном времени, централизованное перечитывание ЭКГ, неинвазивная визуализация сердца, физиологическое стресс-тестирование, тщательные исследования QT, моделирование TQT и реакции на воздействие, агрегация тромбоцитов и другие услуги.

Фаза

- Фаза 1

- Фаза 2

- Фаза 3

На основе фаз рынок услуг по обеспечению кардиобезопасности сегментируется на фазу 1, фазу 2 и фазу 3.

Тип

- Интегрированные услуги

- Отдельные услуги

По типу рынок услуг по обеспечению кардиобезопасности сегментируется на интегрированные услуги и автономные услуги.

Конечный пользователь

- Фармацевтические и биофармацевтические компании

- Контрактные исследовательские организации

- Научно-исследовательский институт

По признаку конечного пользователя рынок услуг по обеспечению безопасности сердца сегментирован фармацевтическими и биофармацевтическими компаниями, контрактными исследовательскими организациями, а также академическими и научно-исследовательскими институтами.

Региональный анализ/информация служб кардиологической безопасности

Проведен анализ услуг по обеспечению безопасности сердечно-сосудистых заболеваний, а также предоставлены сведения о размерах рынка и тенденциях по типу, услугам, фазе и конечному пользователю, как указано выше.

В отчете о службах безопасности кардиологических заболеваний рассматриваются следующие страны: США, Канада и Мексика.

Ожидается, что США будут доминировать за счет роста технологического прогресса в развивающихся регионах.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и услуг по обеспечению безопасности сердечно-сосудистых заболеваний

Конкурентная среда рынка услуг кардиологической безопасности Северной Америки содержит сведения о конкурентах. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Северной Америке, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта и доминирование приложений. Приведенные выше данные относятся только к фокусу компаний на рынке услуг кардиологической безопасности.

Среди основных игроков на рынке можно назвать Koninklijke Philips NV, Laboratory Corporation of America Holdings, IQVIA, Medpace, Ncardia, Certara, Eurofins Scientific, SGS SA, Banook, Celerion, Biotrial, NEXEL Co., Ltd, Richmond Pharmacology, PhysioStim, Shanghai Medicilon Inc, Clario, PPD Inc и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, анализ Северной Америки против региона и доли поставщика. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CARDIAC SAFETY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6 INDUSTRY INSIGHT

6.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.2 PATENT ANALYSIS

6.3 PATENT FLOW DIAGRAM

6.4 KEY PATIENT ENROLLMENT STRATEGIES

6.5 PRICING STRATEGY

7 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASE IN THE NUMBER OF CLINICAL TRIALS

8.1.2 INCREASE IN HEALTHCARE EXPENDITURE AND FUNDING

8.1.3 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

8.1.4 INCREASE IN R&D ACTIVITIES

8.2 RESTRAINTS

8.2.1 HIGH COST OF CARDIAC SAFETY EVALUATION

8.2.2 STRICT REGULATORY

8.3 OPPORTUNITIES:

8.3.1 INCREASE IN NEW DRUG DEVELOPMENT

8.3.2 RISE IN THE EXPANSION OF THE CARDIAC SAFETY SERVICES

8.4 CHALLENGES

8.4.1 TIME-CONSUMING PROCEDURE

8.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CARDIAC SAFETY EVALUATION

9 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES

9.1 OVERVIEW

9.2 ECG/HOLTER MEASUREMENTS

9.3 BLOOD PRESSURE MEASUREMENTS

9.4 IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES

9.4.1 HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS

9.4.1.1 1 CONCENTRATIONS

9.4.1.2 4 CONCENTRATIONS

9.4.2 COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA)

9.4.2.1 3 CONCENTRATIONS

9.4.2.2 5 CONCENTRATIONS

9.4.3 IN VITRO HERG ASSAY

9.4.4 OTHERS

9.5 CARDIOVASCULAR IMAGING

9.6 REAL TIME TELEMETRY MONITORING

9.7 CENTRAL OVER-READ OF ECGS

9.8 NON-INVASIVE CARDIAC IMAGING

9.9 PHYSIOLOGIC STRESS TESTING

9.1 THOROUGH QT STUDIES

9.11 TQT AND EXPOSURE RESPONSE MODELLING

9.12 PLATELET AGGREGATION

9.13 OTHERS

10 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY PHASE

10.1 OVERVIEW

10.2 PHASE I

10.3 PHASE II

10.4 PHASE III

11 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY TYPE

11.1 OVERVIEW

11.2 INTEGRATED SERVICES

11.3 STANDALONE SERVICES

12 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES

12.3 CONTRACT RESEARCH ORGANIZATIONS

12.4 ACADEMIC AND RESEARCH INSTITUTE

13 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.1.5.1 AGREEMENTS

15.1.5.2 ACQUISITION

15.2 PPD INC. (SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 INVESTMENT

15.3 KONINKLIJKE PHILIPS N.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 IQVIA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 ACQUISITION

15.5 LABORATORY CORPORATION OF AMERICA HOLDINGS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 NEW LABORATORY

15.5.5.2 ACQUISITION

15.6 BANOOK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 AGREEMENT

15.7 BIOTRIAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.7.3.1 NEW CENTER OPENING

15.8 CELERION

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 NEW CENTER OPENING

15.9 CERTARA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 CONTRACT

15.9.4.2 ACQUISITION

15.1 CLARIO

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 PRODUCT EXPANSION

15.11 MEDPACE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.11.4.1 ACQUISITION

15.12 NCARDIA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.12.3.1 PARTNERSHIP

15.13 NEXEL CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.3.1 JOINT VENTURE

15.13.3.2 PARTNERSHIP

15.14 PHYSIOSTIM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 RICHMOND PHARMACOLOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 EVENT

15.16 SGS SA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 SHANGHAI MEDICILON INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 PARTNERSHIP

15.17.3.2 PARTNERSHIP

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 2 PROBABILITY OF SUCCESS BY CLINICAL TRIAL PHASE TO THERAPEUTIC AREA

TABLE 3 MORTALITY RATES FROM CLINICAL TRIALS AND EUROPEAN SAFETY AND EXPOSURE SURVEY (ESES), DEATHS PER 100 (PYE)

TABLE 4 ADHERENCE RATE TO COMMON CARDIOVASCULAR MEDICATION

TABLE 5 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 6 INITIATIVES TO INCREASE ENROLLMENT IN CLINICAL TRIALS AMONG UNDERREPRESENTED POPULATIONS

TABLE 7 ESTIMATED COST OF CARDIAC SAFETY EVALUATION DEVICES

TABLE 8 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ECG/HOLTER MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BLOOD PRESSURE MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CARDIOVASCULAR IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA REAL TIME TELEMETRY MONITORING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CENTRAL OVER-READ OF ECGS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NON-INVASIVE CARDIAC IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA PHYSIOLOGIC STRESS TESTING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THOROUGH QT STUDIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA TQT AND EXPOSURE RESPONSE MODELLING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PLATELET AGGREGATION IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PHASE I IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PHASE II IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PHASE III IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA INTEGRATED SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA STANDALONE SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTE IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 U.S. CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 46 U.S. COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 U.S. CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 CANADA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 52 CANADA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 53 CANADA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CANADA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 55 CANADA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 MEXICO CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 58 MEXICO IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 MEXICO HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 60 MEXICO COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 61 MEXICO CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: MARKET END USER GRID

FIGURE 9 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR CARDIAC SAFETY SERVICES ARE EXPECTED TO DRIVE THE NORTH AMERICA CARDIAC SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ECG/HOLTER MEASUREMENTS SUBSTITUTE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CARDIAC SAFETY SERVICES MARKET IN 2022 & 2029

FIGURE 13 PATIENT FLOW DIAGRAM FOR ANY RANDOM DRUG

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CARDIAC SAFETY SERVICES MARKET

FIGURE 15 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2021

FIGURE 16 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 19 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2021

FIGURE 20 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2021

FIGURE 24 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES (2022-2029)

FIGURE 36 NORTH AMERICA CARDIAC SAFETY SERVICES MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.