North America Business Process As A Service Bpaas Market

Размер рынка в млрд долларов США

CAGR :

%

USD

24.78 Billion

USD

69.23 Billion

2024

2032

USD

24.78 Billion

USD

69.23 Billion

2024

2032

| 2025 –2032 | |

| USD 24.78 Billion | |

| USD 69.23 Billion | |

|

|

|

|

Сегментация рынка бизнес-процессов как услуги (BPaaS) в Северной Америке по решению (платформа и услуги), модели развертывания (публичное облако, частное облако и гибрид), бизнес-процесс (финансы и бухгалтерский учет, человеческие ресурсы (HR и расчет заработной платы), продажи и маркетинг, обслуживание и поддержка клиентов (опыт клиентов), операции, аналитика, закупки и управление цепочками поставок и другие), размер организации (крупные предприятия и малые и средние предприятия (МСП)), приложение (вспомогательная, управленческая, операционная и связанная рыночная зона), модель доставки в облаке (служба бизнес-процессов на основе SaaS (служба SaaS BP), служба бизнес-процессов на основе PaaS (служба PaaS BP) и служба бизнес-процессов на основе IaaS (служба IaaS BP)), конечный пользователь (банковское дело, финансовые услуги и страхование (BFSI), государственный сектор, ИТ и телекоммуникации, производство, здравоохранение, розничная торговля и электронная коммерция, СМИ и развлечения и другие) — отрасль Тенденции и прогноз до 2032 года

Размер рынка бизнес-процессов как услуг (BPaaS)

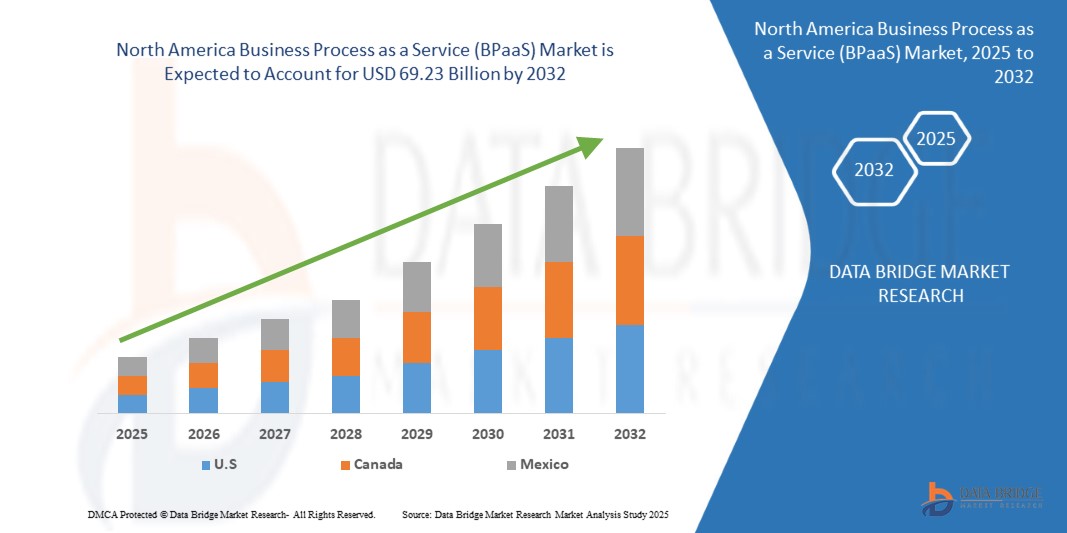

- Объем рынка бизнес-процессов как услуг (BPaaS) в Северной Америке в 2024 году оценивался в 24,78 млрд долларов США , а к 2032 году , как ожидается, он достигнет 69,23 млрд долларов США при среднегодовом темпе роста 13,7% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим переходом предприятий к облачной инфраструктуре и стратегиям цифровой трансформации, что обеспечивает оптимизацию операций, экономическую эффективность и масштабируемость различных бизнес-функций.

- Кроме того, растущий спрос на автоматизацию, аналитику на основе искусственного интеллекта и гибкие модели предоставления услуг позиционирует BPaaS как предпочтительное решение для организаций, стремящихся модернизировать процессы и повысить операционную гибкость, тем самым значительно ускоряя рост отрасли.

Анализ рынка бизнес-процессов как услуг (BPaaS)

- Бизнес-процесс как услуга (BPaaS) определяется как предоставление услуг аутсорсинга бизнес-процессов (BPO) на базе облачных технологий и многопользовательской среды. Услуги часто автоматизированы, и в случаях, когда требуются услуги специалистов, для каждого клиента не существует выделенного пула сотрудников. Модели ценообразования – это коммерческие термины, основанные на использовании или подписке. Модель BPaaS как облачного сервиса доступна через интернет-технологии.

- Растущий спрос на BPaaS обусловлен в первую очередь растущим внедрением инициатив цифровой трансформации, возросшей зависимостью от облачной инфраструктуры и растущей потребностью в гибких, управляемых данными и ориентированных на результат решениях для бизнес-процессов.

- США доминировали на рынке бизнес-процессов как услуг (BPaaS) с долей 72,7% в 2024 году благодаря широкому внедрению облачных технологий, передовой ИТ-инфраструктуры и сильному присутствию глобальных поставщиков BPaaS по всей стране.

- Ожидается, что Мексика станет регионом с самыми быстрыми темпами роста на рынке бизнес-процессов как услуг (BPaaS) в течение прогнозируемого периода благодаря быстрому росту сектора ИТ-услуг в стране в сочетании с растущим спросом на доступные и гибкие решения по аутсорсингу бизнес-процессов.

- Сегмент финансов и бухгалтерского учета доминировал на рынке с долей 25,9% в 2024 году благодаря спросу на стандартизированные, соответствующие нормативным требованиям финансовые операции, которые повышают точность и сокращают накладные расходы. Автоматизированные услуги по выставлению счетов, расчету налогов и составлению отчетности критически важны для крупных предприятий, стремящихся оптимизировать аудит и обеспечить финансовую прозрачность.

Область применения отчета и сегментация рынка бизнес-процесса как услуги (BPaaS)

|

Атрибуты |

Ключевые аспекты рынка бизнес-процессов как услуг (BPaaS) |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

Тенденции рынка бизнес-процессов как услуг (BPaaS)

«Растущие инициативы цифровой трансформации»

- Значительной и быстрорастущей тенденцией на рынке BPaaS в Северной Америке является широкое внедрение компаниями стратегий цифровой трансформации, направленных на модернизацию операций, повышение гибкости и снижение эксплуатационных расходов с помощью облачных решений по аутсорсингу бизнес-процессов.

- Например, в мае 2024 года компания DXC Technology совместно с SAP представила решение DXC Fast RISE, призванное помочь предприятиям ускорить реализацию проектов по внедрению S/4HANA, оптимизировать рабочие процессы и обеспечить более быстрое получение цифровых результатов.

- Организации всё чаще интегрируют BPaaS с такими технологиями, как ИИ, аналитика и RPA, для оптимизации критически важных бизнес-функций, таких как управление персоналом, финансы и поддержка клиентов. Например, решения таких компаний, как IBM и Oracle, предлагают интеллектуальные возможности автоматизации, которые улучшают процесс принятия решений и повышают эффективность работы.

- Переход к моделям, основанным на результатах, и ценообразованию с оплатой по факту использования набирает обороты, поскольку компании фокусируются на результатах, ориентированных на ценность. Запуск SPS модели BPaaS, основанной на результатах, в январе 2024 года отражает эту тенденцию, обеспечивая большую финансовую гибкость и операционную прозрачность.

- Интеграция BPaaS с более широкими облачными экосистемами и корпоративными программными платформами обеспечивает централизованное управление бизнес-процессами, обеспечивая бесперебойную связь между отделами и отслеживание показателей производительности в режиме реального времени.

- Эта тенденция меняет подход организаций к масштабируемости, инновациям и соблюдению требований, побуждая поставщиков разрабатывать более модульные, интеллектуальные и адаптивные предложения BPaaS, которые соответствуют меняющимся потребностям предприятий.

Динамика рынка бизнес-процессов как услуг (BPaaS)

Водитель

«Растёт обеспокоенность по поводу безопасности данных из-за внешних взломов»

- Растущая обеспокоенность по поводу утечек данных, атак программ-вымогателей и несоблюдения нормативных требований обуславливает спрос на решения BPaaS с надежной архитектурой безопасности и системами соответствия требованиям.

- Например, такие крупные поставщики, как Accenture и Capgemini, расширяют свои предложения BPaaS, добавляя расширенные функции кибербезопасности и стандарты шифрования для удовлетворения корпоративных и отраслевых требований.

- Поскольку организации все чаще переносят такие важные процессы, как расчет заработной платы, финансы и закупки, на облачные платформы, потребность в безопасном управлении доступом, обнаружении угроз и мониторинге в режиме реального времени становится критически важной.

- BPaaS обеспечивает централизованные возможности надзора и аудита, которые помогают компаниям поддерживать целостность данных, снижать подверженность рискам и соблюдать такие нормативные требования, как GDPR, HIPAA и PCI-DSS.

- Растущая сложность киберугроз в сочетании с более строгими международными правилами делает безопасность данных главным приоритетом для компаний, внедряющих BPaaS, тем самым усиливая его ценностное предложение как безопасной и соответствующей требованиям модели обслуживания.

Сдержанность/Вызов

«Нехватка ИТ-навыков и знаний в слаборазвитых странах»

- Серьезным препятствием для внедрения BPaaS в слаборазвитых и развивающихся экономиках является ограниченная доступность квалифицированных ИТ-специалистов и низкий уровень цифровой грамотности среди предприятий.

- Например, многие предприятия малого и среднего бизнеса в некоторых частях Африки и Юго-Восточной Азии сталкиваются с задержками при внедрении BPaaS из-за недостаточной ИТ-инфраструктуры и нехватки специалистов, обученных управлению облачными процессами.

- Сложность интеграции платформ BPaaS с устаревшими системами, а также необходимость понимания архитектуры облака часто затрудняют развертывание в регионах, где не хватает технических знаний.

- Небольшие организации в этих регионах также могут испытывать трудности с выбором поставщика, настройкой процессов и поддержкой после внедрения из-за нехватки собственных ИТ-ресурсов. В результате предприятия не спешат переходить на модели BPaaS, опасаясь задержек внедрения, перебоев в обслуживании или долгосрочной зависимости от сторонних поставщиков.

- Чтобы преодолеть эту проблему, поставщикам BPaaS необходимо инвестировать в локальные партнерства, программы обучения и упрощенные решения по адаптации, которые отвечают потребностям менее зрелых в цифровом отношении рынков и помогают устранить пробелы в навыках.

Сфера применения рынка бизнес-процессов как услуг (BPaaS)

Рынок сегментирован на основе решения, модели развертывания, бизнес-процесса, размера организации, приложения, модели доставки в облаке и конечного пользователя.

• По решению

По принципу решения рынок бизнес-процессов как услуг (BPaaS) сегментируется на платформы и сервисы. Наибольшая доля выручки в 2024 году пришлась на сегмент услуг, что обусловлено растущей потребностью предприятий в аутсорсинге непрофильных, но важных бизнес-процессов для повышения эффективности, масштабируемости и контроля затрат. Поставщики услуг предлагают комплексные возможности, такие как автоматизация, поддержка соответствия требованиям и адаптация к конкретной предметной области, что особенно актуально для организаций, переживающих цифровую трансформацию.

Ожидается, что сегмент платформ будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на централизованные, настраиваемые среды, поддерживающие множество бизнес-функций с интегрированной аналитикой и автоматизацией процессов. Организации внедряют платформы BPaaS для стандартизации рабочих процессов, улучшения процесса принятия решений в режиме реального времени и обеспечения бесшовной интеграции между подразделениями и системами.

• По модели развертывания

По модели развертывания рынок сегментируется на публичное облако, частное облако и гибридное облако. Сегмент публичного облака доминировал на рынке в 2024 году благодаря более низким первоначальным затратам, простоте развертывания и масштабируемости, что делает его идеальным вариантом для предприятий, которым нужна гибкость без значительных инвестиций в инфраструктуру. Предложения BPaaS в публичном облаке часто включают в себя дополнительные услуги, такие как обновления в режиме реального времени, автоматическое масштабирование и непрерывный мониторинг безопасности.

Прогнозируется, что гибридная модель развертывания будет развиваться самыми быстрыми темпами в период с 2025 по 2032 год, что обусловлено стремлением организаций найти баланс между контролем над конфиденциальными бизнес-данными и гибкостью и экономической эффективностью публичного облака. Гибридные модели позволяют компаниям выполнять критически важные операции в частных средах, используя публичное облако для динамических рабочих нагрузок.

• По бизнес-процессу

В зависимости от бизнес-процессов рынок BPaaS сегментируется на следующие сегменты: финансы и бухгалтерский учет, управление персоналом (HR и расчет заработной платы), продажи и маркетинг, обслуживание и поддержка клиентов (клиентский опыт), операционная деятельность, аналитика, закупки и управление цепочками поставок и другие. Сегмент финансов и бухгалтерского учета занимал наибольшую долю рынка в 25,9% в 2024 году благодаря спросу на стандартизированные, соответствующие нормативным требованиям финансовые операции, которые повышают точность и сокращают накладные расходы. Автоматизированные услуги по выставлению счетов, расчету налогов и составлению отчетности критически важны для крупных предприятий, стремящихся оптимизировать аудит и обеспечить финансовую прозрачность.

Ожидается, что обслуживание и поддержка клиентов (клиентский опыт) станут самым быстрорастущим сегментом, поскольку компании всё чаще отдают предпочтение персонализированной многоканальной поддержке на основе искусственного интеллекта и аналитики в режиме реального времени. Решения BPaaS для обслуживания клиентов помогают предприятиям сократить время реагирования, повысить уровень удовлетворенности и удержания клиентов благодаря интегрированным CRM-инструментам и виртуальным помощникам.

• По размеру организации

В зависимости от размера организации рынок BPaaS сегментируется на крупные предприятия и малые и средние предприятия (МСП). Крупные предприятия доминировали на рынке в 2024 году благодаря своей сложной производственной структуре и более широкому использованию аутсорсинга процессов для снижения затрат и оптимизации рабочих процессов. Такие организации, как правило, инвестируют в масштабируемые модели BPaaS для модернизации устаревших систем и соответствия глобальным бизнес-процессам.

Прогнозируется, что сегмент малого и среднего бизнеса будет расти наиболее быстрыми темпами, чему будет способствовать растущая доступность недорогих модульных решений BPaaS, адаптированных для небольших предприятий. Малые и средние предприятия получают выгоду от услуг по предоставлению процессов по запросу, которые устраняют необходимость в выделенных ИТ-отделах и позволяют сосредоточиться на развитии основного бизнеса.

• По применению

По сфере применения рынок подразделяется на вспомогательные, управленческие, операционные и связанные. В 2024 году лидирующие позиции на рынке занимали операционные приложения, что отражает острую потребность в аутсорсинге повседневных бизнес-функций, таких как расчет заработной платы, регистрация клиентов и обработка транзакций, специализированным поставщикам. Эти процессы, как правило, характеризуются большим объемом и наиболее выгодны от автоматизации и масштабируемости.

Ожидается, что сегмент рынка подключенных устройств будет демонстрировать самые быстрые темпы роста к 2032 году благодаря растущей конвергенции BPaaS с Интернетом вещей, искусственным интеллектом и средами обработки данных в реальном времени, особенно в логистике, производстве и умной розничной торговле. Такая интеграция обеспечивает непрерывную оптимизацию процессов, предиктивное обслуживание и расширенный анализ потребностей клиентов.

• По модели облачной доставки

На основе облачной модели предоставления услуг рынок BPaaS сегментируется на SaaS, PaaS и IaaS-сервисы бизнес-процессов. Наибольшую долю в 2024 году составили SaaS-сервисы бизнес-процессов благодаря своей простоте подключения, низким требованиям к обслуживанию и быстрому внедрению в широкий спектр бизнес-функций. SaaS-решения особенно востребованы для таких задач, как адаптация HR-специалистов, формирование счетов и интеграция с CRM.

Ожидается, что услуги бизнес-процессов IaaS будут демонстрировать самые высокие темпы роста в течение прогнозируемого периода, поскольку предприятия стремятся получить больший контроль над инфраструктурой для поддержки индивидуальных рабочих процессов и операций, требующих соблюдения нормативных требований. IaaS предоставляет гибкие и масштабируемые ресурсы, идеально подходящие для компаний, которым необходимо масштабировать инфраструктуру одновременно с автоматизацией процессов.

• Конечным пользователем

По типу конечного пользователя рынок сегментируется на следующие сферы: банковское дело, финансовые услуги и страхование (BFSI), государственный сектор, ИТ и телекоммуникации, производство, здравоохранение, розничная торговля и электронная коммерция, СМИ и развлечения и другие. Сегмент BFSI доминировал на рынке BPaaS в 2024 году благодаря своей высокой зависимости от безопасных, соответствующих требованиям и масштабируемых внутренних операций, таких как обработка заявок, одобрение кредитов и составление отчётности для регулирующих органов.

Ожидается, что сектор здравоохранения будет расти самыми высокими темпами среднегодового темпа роста, что обусловлено резким ростом объемов цифровых медицинских карт, телемедицины и нормативной документации. Решения BPaaS помогают поставщикам медицинских услуг оптимизировать выставление счетов, взаимодействие с пациентами, обработку страховых требований и соблюдение требований законодательства, позволяя им сосредоточиться на результатах лечения пациентов и одновременно оптимизировать административную эффективность.

Региональный анализ рынка бизнес-процессов как услуг (BPaaS)

- США доминировали на рынке бизнес-процессов как услуг (BPaaS) с наибольшей долей выручки в 72,7% в 2024 году, что обусловлено широким внедрением облачных технологий, передовой ИТ-инфраструктуры и сильным присутствием глобальных поставщиков BPaaS по всей стране.

- Растущий спрос на экономически эффективные и масштабируемые решения по аутсорсингу бизнес-процессов среди предприятий в сочетании с растущими инициативами цифровой трансформации в банковском секторе, здравоохранении и розничной торговле продолжают ускорять рост рынка BPaaS в США.

- Благоприятная нормативная поддержка облачных сервисов, повышенное внимание к автоматизации и интеграция искусственного интеллекта и аналитики в бизнес-процессы еще больше укрепляют позиции США как ведущего центра инноваций и внедрения BPaaS.

Обзор рынка BPaaS в Канаде

Ожидается, что рынок BPaaS в Канаде будет демонстрировать устойчивый рост в период с 2025 по 2032 год, чему будет способствовать активизация цифровизации в государственном и частном секторах. Растущее внимание страны к повышению операционной эффективности в сочетании с внедрением облачных платформ средними предприятиями стимулирует спрос на решения BPaaS. Акцент Канады на улучшении качества услуг в таких отраслях, как здравоохранение, финансы и государственное управление, а также интеграция искусственного интеллекта и аналитики данных в аутсорсинговые процессы создают благоприятные условия для расширения BPaaS.

Обзор рынка BPaaS в Мексике

Прогнозируется, что Мексика будет демонстрировать самые высокие среднегодовые темпы роста на североамериканском рынке BPaaS в прогнозируемый период с 2025 по 2032 год. Быстрый рост сектора ИТ-услуг в стране в сочетании с растущим спросом на доступные и гибкие решения для аутсорсинга бизнес-процессов стимулирует внедрение BPaaS. Близость Мексики к США, квалифицированная рабочая сила и постоянные инвестиции в цифровую инфраструктуру усиливают её роль в региональных сетях предоставления BPaaS. Растущая цифровая трансформация банковских, розничных и клиентских операций дополнительно ускоряет развитие рынка BPaaS в Мексике.

Доля рынка бизнес-процессов как услуг (BPaaS)

Лидерами отрасли бизнес-процессов как услуг (BPaaS) в первую очередь являются хорошо зарекомендовавшие себя компании, в том числе:

- Корпорация IBM (США)

- Капджемини (Франция)

- Cognizant (США)

- Oracle (США)

- Wipro Limited (Индия)

- Accenture (Ирландия)

- Tata Consultancy Services Limited (Индия)

- HCL Technologies Limited (Индия)

- NTT DATA, Inc. (США)

- DXC Technology Company (США)

- Open Text Corporation (Канада)

- ФУДЗИТСУ (Япония)

- Генпакт (США)

- ADP, Inc. (США)

- Высадка (США)

- UKG Inc. (США)

- WNS (Holdings) Ltd. (Индия)

- Conduent, Inc. (США)

- Expertel SA "proceedit" (Люксембург)

- TIBCO Software Inc. (США)

- Entercoms (США)

- Авалок (Швейцария)

- Шеер ПАС Дойчланд ГмбХ (Германия)

- Ceridian HCM, Inc. (США)

Последние разработки на рынке бизнес-процессов как услуг (BPaaS) в Северной Америке

- В мае 2024 года компания DXC Technology, ведущий поставщик технологических услуг, запустила DXC Fast RISE совместно с SAP — новое дополнение к своему портфелю услуг. Это решение предназначено для ускорения развертывания проектов S/4HANA, помогая клиентам оптимизировать процессы цифровой трансформации более эффективно.

- В январе 2024 года компания SPS из Цюриха, крупный игрок на рынке BPaaS, представила новое предложение BPaaS, ориентированное на результат, с моделью оплаты по факту использования. Этот сервис делает акцент на экспертных знаниях в данной области, квалифицированных специалистах и передовых технологиях, помогая клиентам перейти от моделей капитальных затрат (CapEx) к более гибким моделям операционных расходов (OpEx).

- В мае 2020 года компания Wipro Limited объявила о запуске решения «бизнес-процесс как услуга» для финансового и бухгалтерского учета в партнерстве с NetSuite. Это комплексное решение для управления бизнес-процессами F&A, которое помогает повысить гибкость бизнеса, удобство для пользователей и эффективность процессов. BPaaS позволяет клиентам управлять и контролировать свои финансовые и бухгалтерские процессы на стандартизированной платформе. Это помогло компании расширить свой портфель продуктов на рынке.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.