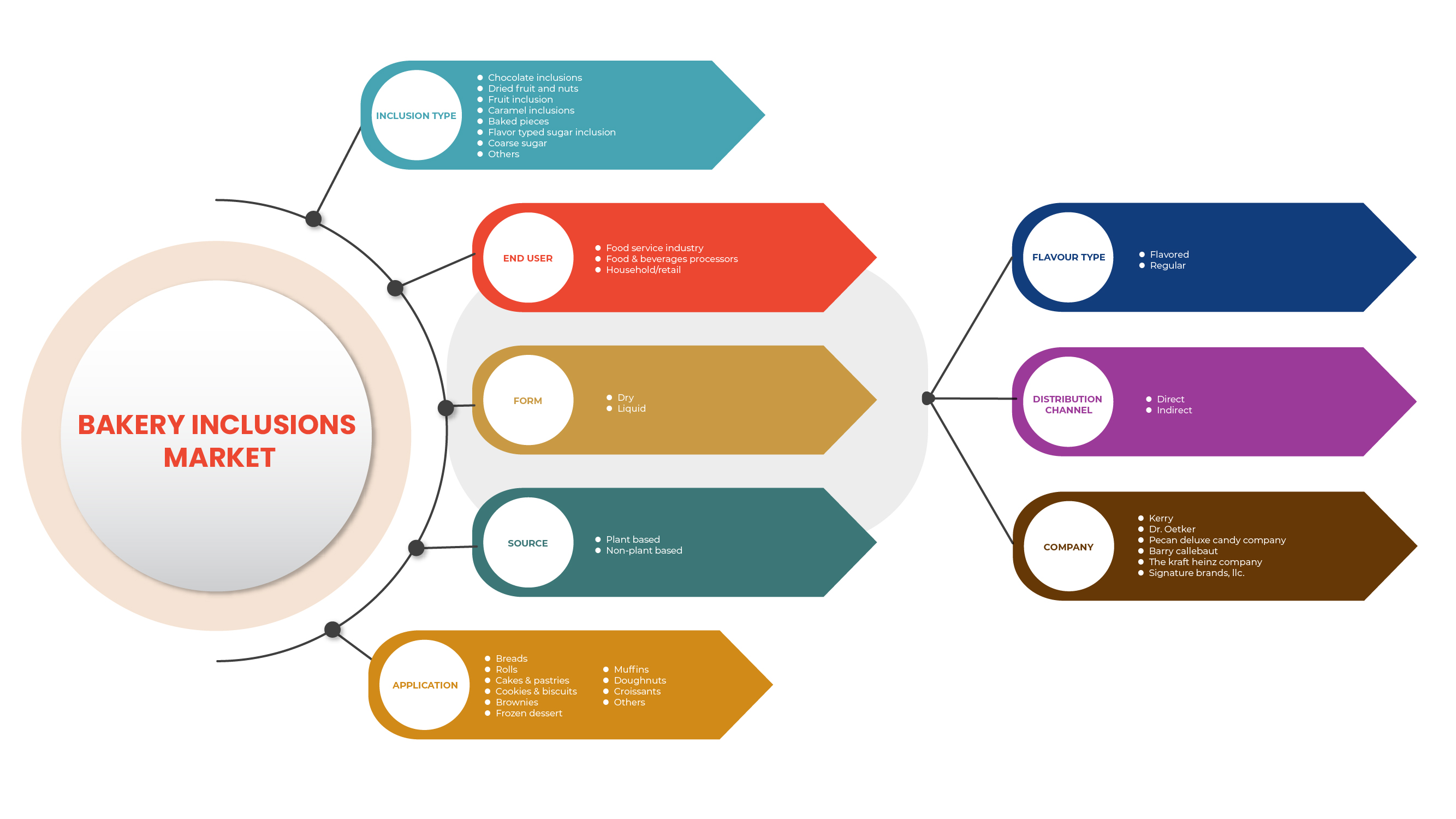

Рынок включений для выпечки в Северной Америке по типу включений (шоколадные включения, карамельные включения , сухофрукты и орехи, крупный сахар, выпечка, фруктовые включения, ароматизированные сахарные включения и другие), конечный пользователь (производители продуктов питания и напитков, сфера общественного питания, бытовая/розничная торговля), форма (сухие и жидкие), источник (растительного и нерастительного происхождения), применение (хлеб, кексы, пончики, круассаны, рулеты, торты и пирожные, печенье и бисквиты и другие), ароматизатор (ароматизатор и обычный), канал сбыта (прямой и косвенный) — отраслевые тенденции и прогноз до 2029 года.

Анализ рынка и идеи

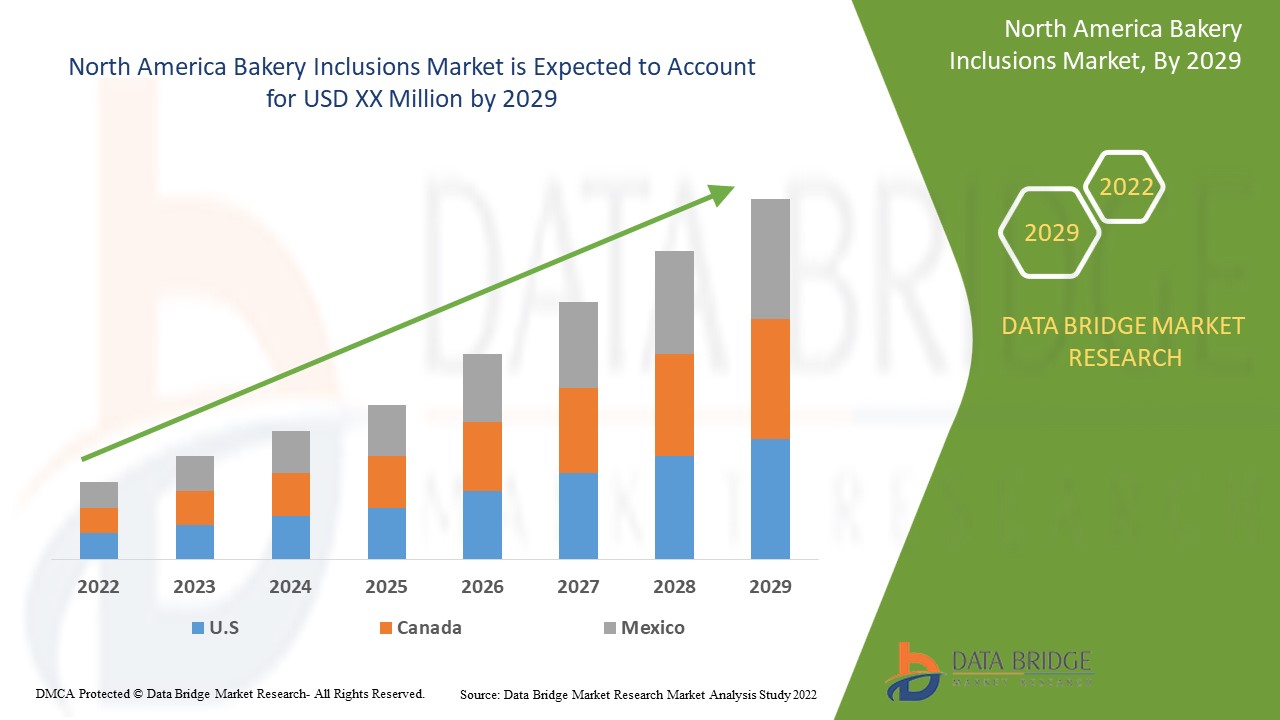

Основным фактором роста рынка хлебопекарных включений является быстро меняющийся образ жизни, а также рост работающего населения. Главным фактором, определяющим спрос на хлебопекарные включения, является растущий спрос на обработанные продукты питания с некоторой добавленной стоимостью. Кроме того, растущие располагаемые доходы, быстрая урбанизация, а также растущий спрос на готовые закуски и кондитерские изделия также повышают общий спрос на рынок хлебопекарных включений в течение прогнозируемого периода. Более того, различные функциональные свойства, предлагаемые включениями, и растущий спрос на хлебобулочные и кондитерские изделия также служат основными драйверами увеличения спроса на рынок хлебопекарных включений. Кроме того, наличие большого количества приложений в секторе продуктов питания и напитков также повышает рост рынка хлебопекарных включений. Data Bridge Market Research анализирует, что рынок хлебопекарных включений в Северной Америке будет расти со среднегодовым темпом роста 7,5% в течение прогнозируемого периода с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2020 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу включения (шоколадные включения, карамельные включения, сухофрукты и орехи, крупный сахар, выпечка, фруктовые включения, ароматизированные сахарные включения и другие), конечный пользователь (производители продуктов питания и напитков, сфера общественного питания, бытовая/розничная торговля), форма (сухие и жидкие), источник (растительного и нерастительного происхождения), применение (хлеб, кексы, пончики, круассаны, рулеты, торты и пирожные, печенье и бисквиты и другие), ароматизатор (ароматизатор и обычный), канал сбыта (прямой и косвенный) |

|

Страны, охваченные |

США, Канада и Мексика |

|

Охваченные участники рынка |

Kerry, Dr. Oetker, Pecan Deluxe Candy Company, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Cacau Foods do Brasil., Shantou Hehe Technology Co., Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, Paulaur Corporation, GÜNTHART & Co. KG, Signature Brands, LLC и другие |

Динамика рынка хлебопекарных включений в Северной Америке

Драйверы

- Рост потребления хлебобулочных изделий

Хлебобулочные изделия включают дрожжевой формовой хлеб, подовый хлеб, лепешки, печенье, торты, кексы, печенье, булочки, слоеные и мучные лепешки. Они изготавливаются из разной муки, такой как пшеничная мука, мука из сорго и многих смесей разной муки, с различными составами разбавителей, эмульгаторов, усилителей вкуса, консервантов и многих других ингредиентов для улучшения желаемой текстуры, цвета, вкуса и аромата. В хлебобулочных изделиях используются различные включения, такие как шоколадные включения, включения карамели, сухофрукты и орехи, грубый сахар, выпеченные кусочки, фруктовые включения и ароматизированные сахарные включения и т. д. Эти включения придают вкус и текстуру хлебобулочным изделиям.

- Польза для здоровья в сочетании со вкусом в выпечке на основе фруктов и орехов

Включения из сухофруктов являются предпочтительными в глобальном масштабе из-за увеличения спроса на менее сахаристые продукты, поскольку растет распространенность ожирения. Эти фруктовые включения придают продуктам естественную сладость. Наиболее распространенными фруктовыми включениями, используемыми на рынке, являются яблоко, абрикос, банан, вишня, черная смородина, рига, виноград, манго, ананас и персик, среди прочих.

Фруктовые включения обеспечивают пользу для здоровья, такую как антиоксиданты, витамины, минералы и другие функциональные преимущества для здоровья. Кроме того, из-за развивающейся тенденции использования природных источников сахара в включениях и отказа от обработанного сахара растет спрос на фруктовые включения. Это также привлекает внимание потребителей, заботящихся о своем здоровье, по всему миру.

Возможности

- Рост спроса на продукты быстрого приготовления

Спрос на решения по времени для ужина со стороны современных клиентов стремительно растет, поскольку поведение потребителей в плане потребления пищи заметно меняется. В то время как у людей все больше не хватает времени и навыков, чтобы готовить еду для своих домов, многие потребители готовы тратить деньги на рынке готовых к употреблению продуктов. Этот фактор увеличил спрос на розничный рынок полуфабрикатов.

Пандемия коронавируса меняет образ жизни потребителей в сторону потребления комфортной еды, поскольку большинство международных локаций вынуждены ограничивать передвижение и закрывать свои границы. Потребность в предварительно приготовленной еде имеет первостепенное значение в этот период, особенно в США, где пандемия сильно ударила по стране.

Ограничения/Проблемы

- Ограниченный срок хранения хлебобулочных изделий

Основная проблема для хлебобулочных изделий — сохранение их свежести с точки зрения вкуса, текстуры и аромата. Хлебобулочные изделия имеют ограниченный срок годности. Различные ферменты генетически модифицированы для повышения свежести хлебобулочных изделий путем поддержания надлежащей текстуры, стабильности, свежести, объема и аромата хлебобулочных изделий. Эти ферменты оказывают вредное воздействие на здоровье человека, что, как ожидается, ограничит рынок хлебобулочных изделий.

Влияние COVID-19 на рынок хлебопекарных включений в Северной Америке

COVID-19 в некоторой степени повлиял на рынок хлебопекарных включений в Северной Америке. Из-за карантина производственный процесс был остановлен, а спрос со стороны конечных пользователей также снизился, что повлияло на рынок. После COVID спрос на хлебопекарные включения увеличился из-за изменений в моделях покупок потребителей и постепенного сдвига в сторону увеличения спроса на хлебопекарные включения среди различных конечных пользователей, таких как автомобилестроение, аэрокосмическая и оборонная промышленность, электроника и электротехника, строительство и другие.

Последние события

- В январе 2022 года компания Pecan Deluxe Candy Company получила награду за качество и безопасность пищевых продуктов 2021 года. Эта награда помогла компании привлечь больше клиентов

- В апреле 2021 года компания Pecan Deluxe Candy Company запустила Popping Boba. Этот запуск продукта помог компании расширить свой продуктовый портфель

- В сентябре 2021 года Dr. Oetker приобрел Kuppies, forays. Это приобретение помогло компании расширить свое присутствие и портфолио

- В апреле 2021 года компания Pecan Deluxe Candy Company запустила Popping Boba. Этот запуск продукта помог компании расширить свой продуктовый портфель

- В сентябре 2021 года Nimbus Foods Ltd заключила стратегическое партнерство с Herza. Herza — ведущий производитель функционального шоколада и смесей для использования в пищевой промышленности. Это партнерство помогло компании расширить ассортимент продукции

Масштаб рынка хлебопекарных включений в Северной Америке

Рынок включений для выпечки в Северной Америке сегментирован по типу включения, вкусу, форме, конечному пользователю, источнику, применению и каналу сбыта. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

ТИП ВКЛЮЧЕНИЯ

- Шоколадные включения

- Сухофрукты и орехи

- включение фруктов

- Вкрапления карамели

- Запеченные кусочки

- Включение сахара по вкусу

- Крупный сахар

- Другие

По типу включений рынок включений для выпечки в Северной Америке сегментируется на шоколадные включения, карамельные включения, сухофрукты и орехи, грубый сахар, выпечные изделия, фруктовые включения, ароматизированные сахарные включения и другие.

КОНЕЧНЫЙ ПОЛЬЗОВАТЕЛЬ

- Индустрия общественного питания

- Переработчики продуктов питания и напитков

- Бытовая техника/Розничная торговля

По типу конечного потребителя рынок хлебопекарных добавок в Северной Америке сегментируется на предприятия по переработке продуктов питания и напитков, сферу общественного питания и бытовую/розничную торговлю.

ФОРМА

- Сухой

- Жидкость

По форме рынок хлебопекарных добавок в Северной Америке сегментируется на сухие и жидкие.

ИСТОЧНИК

- На растительной основе

- Не на растительной основе

По источнику происхождения рынок хлебопекарных добавок в Северной Америке сегментируется на растительные и нерастительные.

ПРИЛОЖЕНИЕ

- Хлеб

- Рулоны

- Торты и пирожные

- Печенье и бисквиты

- Брауни

- Замороженный десерт

- Маффины

- Пончики

- Круассаны

- Другие

По сфере применения рынок наполнителей для хлебобулочных изделий в Северной Америке сегментируется на хлеб, кексы, пончики, круассаны, рулеты, торты и пирожные, печенье и бисквиты и другие.

ТИП ВКУСА

- Ароматный

- Обычный

По вкусовым качествам рынок наполнителей для выпечки в Северной Америке сегментируется на ароматизированные и обычные.

КАНАЛ РАСПРОСТРАНЕНИЯ

- Прямой

- Косвенный

По каналам сбыта рынок хлебопекарных добавок в Северной Америке сегментируется на прямой и косвенный.

Региональный анализ/инсайты рынка хлебопекарных включений в Северной Америке

Проведен анализ рынка наполнителей для выпечки в Северной Америке, а также предоставлены сведения о размерах рынка и тенденциях по типу наполнителя, вкусу, форме, конечному пользователю, источнику, области применения и каналу сбыта.

Отчет о рынке добавок для выпечки охватывает следующие регионы: США, Канада и Мексика.

Ожидается, что в прогнозируемый период США будут доминировать на североамериканском рынке добавок для выпечки в связи с ростом потребления хлебобулочных изделий.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые и заменяющие продажи, демография страны, эпидемиология заболеваний и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с высокой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Конкурентная среда и анализ доли рынка хлебопекарных включений в Северной Америке

Конкурентная среда рынка включений для выпечки в Северной Америке содержит подробную информацию по конкурентам. Включенные сведения включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Северной Америке, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование в применении. Приведенные выше данные относятся только к фокусу компаний на рынке включений для выпечки в Северной Америке.

Среди основных игроков на рынке кондитерских изделий можно назвать Kerry, Dr. Oetker, Pecan Deluxe Candy Company, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Cacau Foods do Brasil., Shantou Hehe Technology Co.,Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, Paulaur Corporation, GÜNTHART & Co. KG, Signature Brands, LLC и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли компании на рынке, стандарты измерения, анализ Северной Америки против региона и доли поставщика. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAKERY INCLUSIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 BRAND LEVEL VS PRIVATE LABEL

4.3 FUTURE TRENDS

4.3.1 TASTE

4.3.2 LOW SUGAR, LOW CALORIE, AND CLEAN LABEL DEMAND

4.4 HOW FLAVORS ARE DELIVERED TO BAKERY PRODUCERS

4.4.1 INTERNAL FLAVORING

4.4.2 FILLINGS AND ICING

4.5 IMPORT & EXPORT ANALYSIS OF NORTH AMERICA BAKERY INCLUSION MARKET

4.5.1 IMPORT-EXPORT ANALYSIS OF CHOCOLATE

4.5.2 IMPORT-EXPORT ANALYSIS OF EDIBLE FRUIT AND NUTS

4.6 MARKETING STRATEGIES

4.7 PATENT ANALYSIS OF NORTH AMERICA BAKERY INCLUSIONS MARKET

4.7.1 DBMR ANALYSIS

4.7.2 COUNTRY-LEVEL ANALYSIS

4.7.3 YEARWISE ANALYSIS

4.8 NORTH AMERICA BAKERY INCLUSION MARKET PRODUCTION AND CONSUMPTION

5 SUPPLY CHAIN OF NORTH AMERICA BAKERY INCLUSIONS MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 PROCESSED INCLUSIONS:

5.4 MARKETING AND DISTRIBUTION

5.5 END USERS

6 NORTH AMERICA BAKERY INCLUSION MARKET: REGULATIONS

6.1 COMMISSION REGULATION (EU)

6.2 EUROPEAN UNION

6.3 REGULATIONS BY USFDA

6.4 GOVERNMENT OF CANADA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMPTION OF BAKERY PRODUCTS

7.1.2 HEALTH BENEFITS COMBINED WITH TASTE IN FRUIT- AND NUT-BASED BAKERY INCLUSIONS

7.1.3 QUALITY CLAIMS AND CERTIFICATIONS FOR INCLUSIONS LEND CREDIBILITY TO END PRODUCTS

7.1.4 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF BAKERY PRODUCTS

7.2.2 DECREASE IN ADOPTION OF BAKERY PRODUCTS DUE TO INCREASED HEALTH CONSCIOUSNESS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN DEMAND FOR CONVENIENT FOOD PRODUCTS

7.3.2 GROW IN DEMAND FOR VEGAN AND PLANT-BASED BAKERY PRODUCTS

7.3.3 TECHNOLOGY INTERVENTION IN INCLUSIONS PROPELLING UTILIZATION IN DIFFERENT APPLICATIONS

7.4 CHALLENGES

7.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7.4.2 STRINGENT GOVERNMENT REGULATIONS

8 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE

8.1 OVERVIEW

8.2 CHOCOLATE INCLUSIONS

8.2.1 CHOCOLATE CHUNKS

8.2.1.1 DARK

8.2.1.2 MILK

8.2.1.3 WHITE

8.2.2 CHOCOLATE FLAKES

8.2.2.1 DARK

8.2.2.2 MILK

8.2.2.3 WHITE

8.2.3 CHOCOLATE SYRUPS

8.2.3.1 DARK

8.2.3.2 MILK

8.2.3.3 WHITE

8.2.4 OTHERS

8.2.4.1 DARK

8.2.4.2 MILK

8.2.4.3 WHITE

8.3 DRIED FRUITS AND NUTS

8.3.1 ALMOND

8.3.2 WALNUTS

8.3.3 HAZELNUTS

8.3.4 CASHEW

8.3.5 CHESTNUTS

8.3.6 BRAZIL NUTS

8.3.7 MACADAMIA NUTS

8.3.8 HICKORY NUTS

8.3.9 RESINS

8.3.10 OTHERS

8.4 FRUIT INCLUSION

8.4.1 BERRIES

8.4.1.1 STRAWBERRY

8.4.1.2 BLACKBERRY

8.4.1.3 CRANBERRY

8.4.1.4 BLUEBERRY

8.4.1.5 RASPBERRY

8.4.1.6 OTHERS

8.4.2 CHERRY

8.4.3 APPLE

8.4.4 BANANA

8.4.5 CITRUS FRUITS

8.4.5.1 LEMON

8.4.5.2 LIME

8.4.5.3 ORANGE

8.4.5.4 GRAPE FRUIT

8.4.5.5 OTHERS

8.4.6 BLACKCURRANT

8.4.7 MANGO

8.4.8 APRICOT

8.4.9 PINEAPPLE

8.4.10 PEACH

8.4.11 GRAPE

8.4.12 RIG

8.4.13 OTHERS

8.5 CARAMEL INCLUSIONS

8.5.1 NUTS SABLAGE

8.5.2 CARAMEL CRISPY BITES

8.5.3 CARAMEL CRUNCHES

8.6 BAKED PIECES

8.7 FLAVOR TYPED SUGAR INCLUSION

8.8 COARSE SUGAR

8.9 OTHERS

9 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE INDUSTRY

9.2.1 RESTAURANTS

9.2.2 HOTELS

9.2.3 CAFES

9.2.4 SHAKES AND SMOOTHIES PARLORS

9.2.5 OTHERS

9.3 FOOD & BEVERAGES PROCESSORS

9.4 HOUSEHOLD/RETAIL

10 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 FLAKES & CRUNCHES

10.2.2 CHIPS & NIBS

10.2.3 POWDER

10.2.4 CUBES/PIECES

10.2.5 GRANULES

10.3 LIQUID

10.3.1 CONCENTRATES

10.3.2 PUREE

11 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 PLANT BASED

11.3 NON-PLANT BASED

12 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BREADS

12.3 ROLLS

12.4 CAKES & PASTRIES

12.5 COOKIES & BISCUITS

12.6 BROWNIES

12.7 FROZEN DESSERT

12.8 MUFFINS

12.9 DOUGHNUTS

12.1 CROISSANTS

12.11 OTHERS

13 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 CARAMEL

13.2.2 BUTTERSCOTCH

13.2.3 STRAWBERRY

13.2.4 VANILLA

13.2.5 BLUEBERRY

13.2.6 MOCHA

13.2.7 BANANA

13.2.8 CHERRY

13.2.9 PEPPERMINT

13.2.10 OTHERS

13.3 REGULAR

14 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.2.1 STORE-BASED RETAILING

14.2.1.1 SUPERMARKETS/HYPERMARKETS

14.2.1.2 SPECIALTY STORES

14.2.1.3 CONVENIENCE STORES

14.2.1.4 WHOLESALERS

14.2.1.5 GROCERY STORES

14.2.1.6 OTHERS

14.2.2 NON-STORE RETAILING

14.2.2.1 ONLINE

14.2.2.2 VENDING

14.3 DIRECT

15 NORTH AMERICA BAKERY INCLUSIONS MARKET

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 DR. OETKER

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.1.4 SWOT ANALYSIS

18.2 KERRY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.2.5 SWOT ANALYSIS

18.3 BARRY CALLEBAUT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUS ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.3.5 SWOT ANALYSIS

18.4 THE KRAFT HEINZ COMPANY

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.4.5 SWOT ANALYSIS

18.5 PECAN DELUXE CANDY COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.5.4 SWOT ANALYSIS

18.6 AMERICAN SPRINKLE COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BRITANNIA SUPERFINE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 CACAU FOODS DO BRASIL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CAPE FOODS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 GIRRBACH SÜßWARENDEKOR GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GÜNTHART & CO. KG

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HANNS G. WERNER GMBH + CO. KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 NIMBUS FOODS LTD

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 PAULAUR CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 SHANTOU HEHE TECHNOLOGY CO.,LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SIGNATURE BRANDS, LLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 4 EXPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 5 CANADA'S BAKERY PRODUCTS, MARKET SIZE BY RETAIL VALUE SALES

TABLE 6 PRODUCTION AND CONSUMPTION OF BREAD 2020

TABLE 7 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BERRIES INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.S. BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 U.S. FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 U.S. BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 U.S. DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 U.S. LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 U.S. BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 73 U.S. BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 77 U.S. INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 U.S. STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 U.S. NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 CANADA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 CANADA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 CANADA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 CANADA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 CANADA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 97 CANADA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 CANADA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 CANADA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 CANADA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 CANADA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 MEXICO BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 MEXICO FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 MEXICO BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 MEXICO DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 MEXICO LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 120 MEXICO BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 MEXICO INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MEXICO STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 MEXICO NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BAKERY INCLUSIONS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BAKERY INCLUSIONS MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAKERY INCLUSIONS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BAKERY INCLUSIONS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAKERY INCLUSIONS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAKERY INCLUSIONS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAKERY INCLUSIONS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND OF BAKERY PRODUCTS AND INCREASE IN DEMAND OF READY TO EAT PRODUCTS ARE LEADING THE GROWTH OF THE NORTH AMERICA BAKERY INCLUSIONS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCLUSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAKERY INCLUSIONS MARKETIN 2022 & 2029

FIGURE 12 PATENT REGISTERED FOR BAKERY INCLUSIONS, BY COUNTRY

FIGURE 13 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 14 SUPPLY CHAIN OF NORTH AMERICA BAKERY INCLUSIONS MARKET

FIGURE 15 VALUE CHAIN OF NORTH AMERICA BAKERY INCLUSIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA BAKERY INCLUSIONS MARKET

FIGURE 17 AVERAGE ANNUAL EXPENDITURE BY BAKERY PRODUCTS (2017-2020)

FIGURE 18 WORLDWIDE GDP PER CAPITA INCOME (2015-2020)

FIGURE 19 U.S. BAKERY PRODUCTS SALES SHARED IN 2021

FIGURE 20 GLOBAL NUMBER OF PEOPLE SIGNING TO 'VEGANUARY' CAMPAIGN, (2014-2019)

FIGURE 21 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE, 2021

FIGURE 22 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY END USER, 2021

FIGURE 23 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY FORM, 2021

FIGURE 24 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY SOURCE, 2021

FIGURE 25 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY FLAVOR TYPE, 2021

FIGURE 27 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 NORTH AMERICA BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 33 NORTH AMERICA BAKERY INCLUSIONS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.