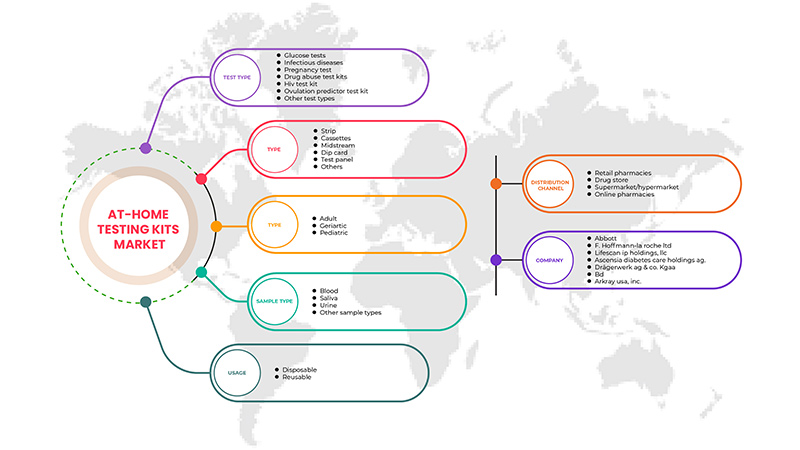

North America At-Home Testing Kits Market, By Test Type (Pregnancy Test, HIV Test Kit, Diabetes, Infectious Diseases, Glucose Tests, Ovulation Predictor Test Kit, Drug Abuse Test Kit, and Others), Type (Cassette, Strip, Midstream, Test Panel, Dip Card and Others), Age (Pediatric, Adult and Geriatric), Sample Type (Urine, Blood, Saliva and Other Sample Types), Usage (Disposable and Reusable), Distribution Channels (Retail Pharmacies, Drug Store, Supermarket/Hypermarket and Online Pharmacies)- Industry Trends and Forecast to 2029.

North America At-Home Testing Kits Market Analysis and Insights

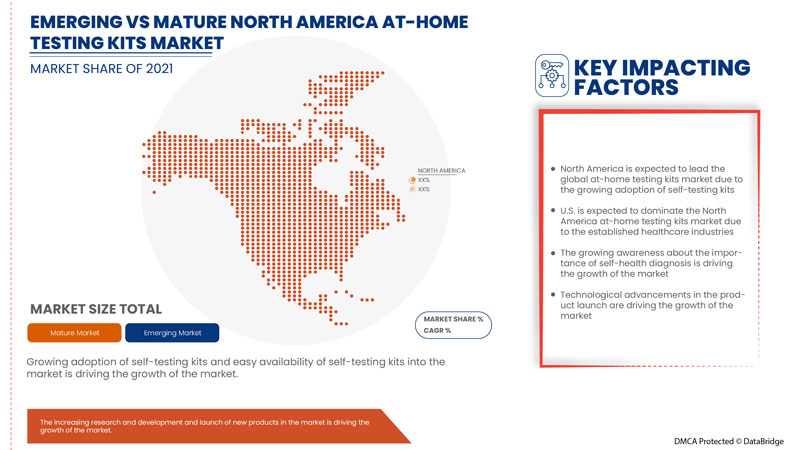

North America at-home testing kits market is expected to grow as earlier, people used to visit hospitals often, even for basic problems, but due to the rising awareness regarding several products, this behavior has changed and has turned the trend. At-home or self-testing kits are easily available at pharmacies, and it has become extremely easy to procure them. Various medical companies are venturing into this space as they rapidly manufacture self-test kits.

This widespread availability can also be attributed to online pharmacies' medical start-ups, making availability easier by clicking a button. In addition, these self-testing kits are available without any prescription which can easily drive the at-home testing kits market. At-home testing kits allow end-users to collect their specimen at home and then either perform the tests at home or send that specimen to the lab for testing. At-home testing kits have undoubtedly eased the process of confirming the person's concern, whether it is a home pregnancy test or HIV, or any other infectious diseases test.

These at-home testing kits are easy to use and are affordable too. However, there is always a doubt about the accuracy of the results that has become a restraint for the North America at-home testing kits market. A false positive result of a test may cause anxiety and stress to the person, even if they do not have it. It is very upsetting and disturbing to the person to receive false positive or negative results. Today, many companies produce rapid diagnostic test kits for COVID-19, which can be performed at home. But there are various accuracy-related issues due to which the distribution of those at-home test kits that has been suspended from verifying their reliability.

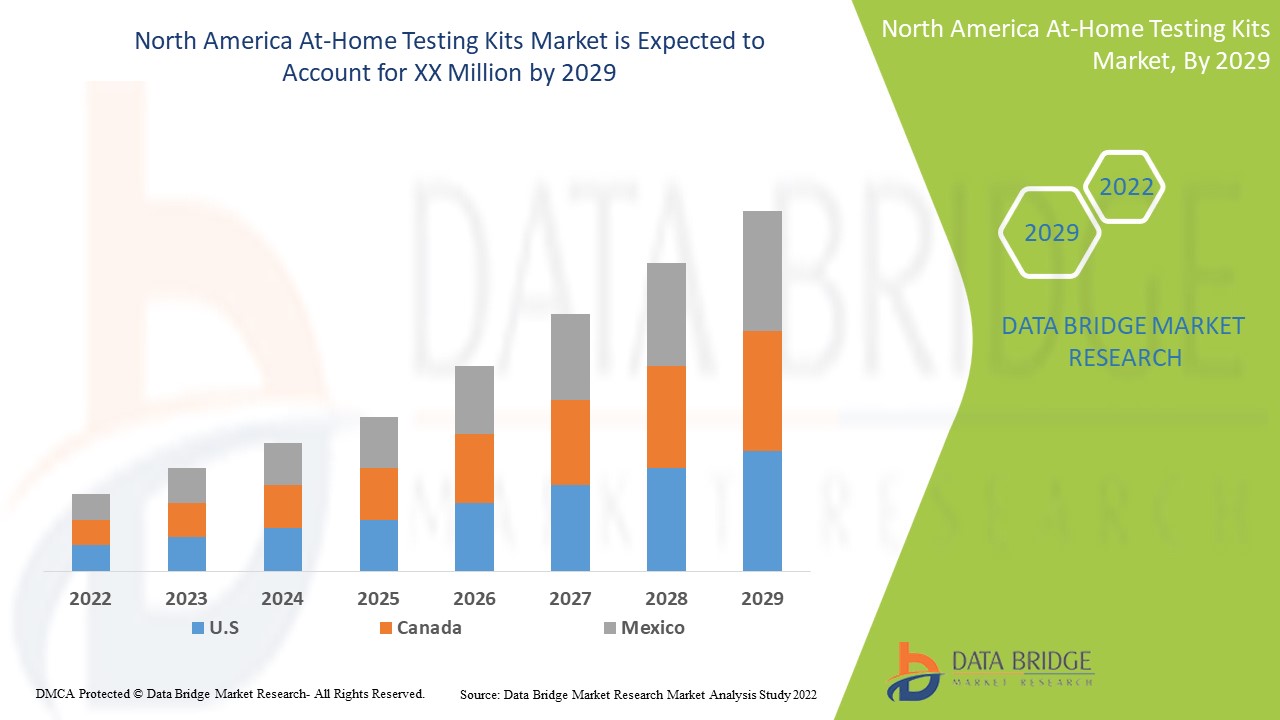

Data Bridge Market Research analyzes that the North America at-home testing kits market will grow at a CAGR of 6.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

По типу теста (тест на беременность, набор для тестирования на ВИЧ, диабет, инфекционные заболевания, тесты на глюкозу, набор для определения овуляции, набор для тестирования на злоупотребление наркотиками и другие), типу (кассета, полоска, струйный тест, тестовая панель, карта с тест-полосками и другие), возрасту (детский, взрослый и гериатрический), типу образца (моча, кровь, слюна и другие типы образцов), использованию (одноразовые и многоразовые), каналам распространения (розничные аптеки, аптека, супермаркет/гипермаркет и интернет-аптеки) |

|

Страны, охваченные |

США, Канада и Мексика |

|

Охваченные участники рынка |

Abbott, Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd, BD, Drägerwerk AG & Co. KGaA, LifeScan IP Holdings, LLC, Ascensia Diabetes Care Holdings AG., Nectar Lifesciences Ltd. (Rapikit), ACON Laboratories, Inc., Quidel Corporation., ARKRAY USA, Inc., BTNX INC., Atomo Diagnostics, Eurofins Scientific, Piramal Enterprises Ltd., Bionime Corporation., Nova Biomedical, Cardinal Health., OraSure Technologies, Biolytical Laboratories Inc., Everlywell, Inc., SA Scientific Ltd., Clearblue (дочерняя компания Swiss Precision Diagnostics GmbH), Biosynex, PRIMA Lab SA, MP BIOMEDICALS., Sterilab Services, Chembio Diagnostics, Inc., BioSure, Selfdiagnostics OU и другие |

Определение рынка наборов для домашнего тестирования в Северной Америке

Наборы для домашнего тестирования означают инструменты для тестирования, которые помогают людям проводить тесты дома и получать быстрые результаты за минуту. Они также включают в себя оборудование для мониторинга здоровья, чтобы постоянно проверять и контролировать здоровье пациента с диабетом. Домашние тесты очень удобны для проведения с комфортом дома и доступны по очень доступной цене. Самотесты обычно являются усовершенствованными версиями быстрых наборов для тестирования в месте оказания помощи, которые изначально были разработаны для медицинских работников и могут быть выполнены обычным человеком. Их процессы, упаковка и инструкции были упрощены, чтобы провести человека через этапы прохождения теста. Доступны различные наборы для домашнего тестирования, включая тесты на ВИЧ, тест на беременность, диабет, тест на овуляцию, инфекционные заболевания, такие как малярия, COVID-19 и другие. Для проведения этих быстрых домашних тестов в качестве образца можно взять кровь, мочу и ротовую жидкость.

Динамика рынка наборов для домашнего тестирования в Северной Америке

Драйверы

- Растущее внедрение наборов для самотестирования

Раньше люди часто посещали больницы, даже с простыми проблемами. Однако с ростом осведомленности о нескольких продуктах это поведение изменилось и изменило тенденцию. В настоящее время люди предпочитают делать основные тесты дома с помощью тест-наборов, прежде чем идти к врачу.

Это стало еще более заметным из-за этой пандемии, поскольку люди стали чаще использовать наборы для самостоятельного тестирования из-за ряда ограничений. Это оказалось скрытым благом как для больниц, так и для пациентов, поскольку больницы и так уже перегружены и могут полностью сосредоточиться на пациентах с COVID-19, а пациенты могут сэкономить значительные средства на визитах к врачу и оплате лекарств. Это стало очень удобным для потребителей, поскольку они могут быстро узнать результаты своих тестов на кончиках пальцев.

- Легкая доступность наборов для самотестирования в аптеках

Домашние или самотестирующие наборы легко доступны в аптеках, и их стало легко приобрести. Различные медицинские компании выходят на этот рынок, поскольку они быстро производят наборы для самотестирования.

Такая широкая доступность также может быть связана с медицинскими стартапами интернет-аптек, которые упрощают доступность нажатием кнопки. Кроме того, эти наборы для самотестирования доступны без рецепта.

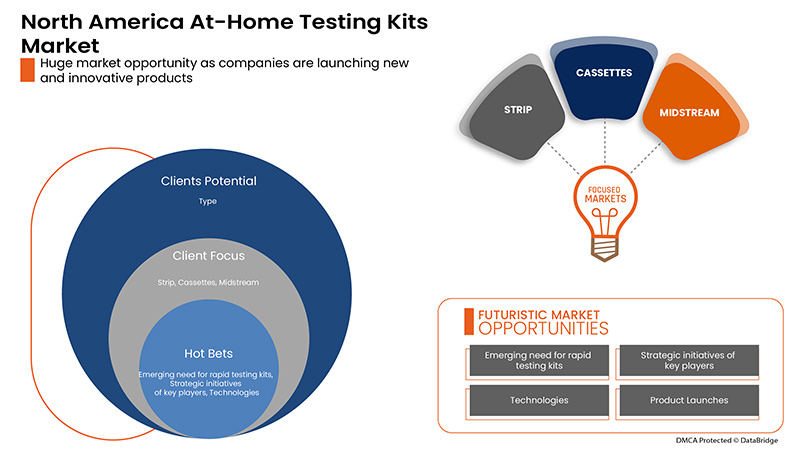

Возможность

- Появление передовых технологий

Новейшие технологии имеют решающее значение для создания очень передовых и надежных медицинских продуктов. В различных медицинских устройствах искусственный интеллект (ИИ) и машинное обучение (МО) являются важными аспектами сектора здравоохранения, способными повысить безопасность пациентов и административные процессы за счет автоматизации работы и более быстрой производительности.

Несомненно, что по умолчанию диагностические инструменты на базе ИИ будут продолжать развиваться. ИИ сделал лишь скромные шаги в сторону огромной и многомерной возможности в секторе здравоохранения.

Сдержанность/Вызов

- Неточность результатов, полученных с помощью наборов для самотестирования

Домашние тест-комплекты позволяют конечным пользователям собирать образцы дома и проводить тесты дома или отправлять образцы в лабораторию для тестирования. Домашние тест-комплекты, несомненно, упростили процесс подтверждения беспокойства человека, будь то домашний тест на беременность, тест на ВИЧ или любой другой инфекционный тест.

Эти наборы для домашнего тестирования просты в использовании и доступны по цене. Однако всегда есть сомнения относительно точности результатов. Домашний мониторинг COVID-19 может быть более комфортным, чем посещение больницы или кабинета врача. Это также поможет снизить риск распространения или приобретения коронавируса во время скрининга.

Однако ложноположительный результат теста может вызвать у человека беспокойство и стресс, даже если у него его нет. Получение ложноположительных или отрицательных результатов очень расстраивает и беспокоит человека. Сегодня многие компании производят наборы для быстрой диагностики COVID-19, которые можно проводить дома, но существуют различные проблемы, связанные с точностью, из-за которых распространение этих домашних наборов для тестирования было приостановлено до проверки их надежности.

Влияние COVID-19 на рынок наборов для домашнего тестирования в Северной Америке

COVID-19 оказал большое влияние на рынок наборов для домашнего тестирования. Рынок наборов для домашнего тестирования расширяется в результате возросшей популярности наборов для самостоятельного и самостоятельного тестирования (DIY) из-за их удобства и быстрых результатов. Потребители обеспокоены надежностью наборов для быстрого домашнего тестирования, что может помешать расширению рынка наборов для домашнего тестирования. Наборы для быстрого тестирования на COVID-19 сейчас срочно необходимы компаниям для снижения смертности пациентов и повышения показателей выздоровления пациентов, а также увеличения рынка наборов для домашнего тестирования для пациентов с диабетом и пациентов с проблемами сердца. Это создает большую рыночную возможность для наборов для домашнего тестирования.

Недавнее развитие

- В марте 2022 года LifeScan IP Holdings, LLC объявила, что продукт компании OneTouch Verio Flex возглавил рейтинг лучших стандартных глюкометров Forbes Health по цене, доступным тест-полоскам, цветовому диапазону индикатора, небольшому образцу крови и компактному дизайну. Это помогло компании расширить свое глобальное присутствие на рынке

Объем рынка наборов для домашнего тестирования в Северной Америке

Рынок наборов для домашнего тестирования в Северной Америке подразделяется на шесть заметных сегментов на основе типа теста, типа, возраста, типа образца, использования и каналов распространения. Рост среди этих сегментов поможет вам проанализировать сегменты роста рынка в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип теста

- Тест на беременность

- Тест-набор на ВИЧ

- Диабет

- Инфекционные заболевания

- Тесты на глюкозу

- Набор для определения овуляции

- Тестовый набор для определения злоупотребления наркотиками

- Другие

В зависимости от типа теста рынок наборов для домашнего тестирования в Северной Америке сегментирован на тесты на беременность, тесты на ВИЧ, диабет, инфекционные заболевания, тесты на глюкозу, тесты для прогнозирования овуляции, тесты на злоупотребление наркотиками и другие.

Тип

- Кассета

- Полоска

- Средний поток

- Тестовая панель

- Дип-карта

- Другие

По типу рынок наборов для домашнего тестирования в Северной Америке сегментируется на кассеты, полоски, мидстрим, тест-панели, тест-карты и другие.

Возраст

- Педиатрический

- Взрослый

- гериатрический

В зависимости от возраста рынок наборов для домашнего тестирования в Северной Америке сегментирован на педиатрический, взрослый и гериатрический.

Тип образца

- Моча

- Кровь

- Слюна

- Другие

В зависимости от типа образца рынок наборов для домашнего тестирования в Северной Америке сегментируется на мочу, кровь, слюну и другие.

Использование

- Одноразовый

- Многоразовый

В зависимости от использования рынок наборов для домашнего тестирования в Северной Америке сегментируется на одноразовые и многоразовые.

Каналы распространения

- Розничные аптеки

- Аптека

- Супермаркет/Гипермаркет

- Интернет-аптеки

По каналам сбыта рынок наборов для домашнего тестирования в Северной Америке сегментирован на розничные аптеки, аптечные пункты, супермаркеты/гипермаркеты и интернет-аптеки.

Анализ/информация о региональном рынке наборов для домашнего тестирования в Северной Америке

Проведен анализ рынка наборов для домашнего тестирования в Северной Америке, а также предоставлены сведения о размерах рынка и тенденциях на основе типа теста, типа, возраста, типа образца, использования и каналов сбыта.

Отчет о рынке наборов для домашнего тестирования в Северной Америке охватывает следующие регионы: США, Канада и Мексика.

США доминируют на рынке наборов для домашнего тестирования в Северной Америке с точки зрения доли рынка и доходов рынка и продолжат процветать в течение прогнозируемого периода. Это связано с высокими расходами страны на здравоохранение и растущей осведомленностью о рынке наборов для домашнего тестирования в Северной Америке.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Конкурентная среда и анализ доли рынка наборов для домашнего тестирования в Северной Америке

Конкурентная среда рынка наборов для домашнего тестирования в Северной Америке содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Северной Америке, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, клинические испытания, анализ бренда, одобрение продукта, патенты, широта и широта продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком наборов для домашнего тестирования в Северной Америке.

Некоторые из основных игроков, работающих на рынке наборов для домашнего тестирования в Северной Америке, включают Abbott, ACON Laboratories, Inc., Rapikit, BD, Cardinal Health, B. Braun Melsungen AG, Piramal Enterprises Ltd., Siemens Healthcare GmbH, Quidel Corporation, Bionime Corporation, SA Scientific, ARKRAY USA, Inc., Nova Biomedical, AdvaCare Pharma, AccuBioTech Co., Ltd., Atlas Medical UK, TaiDoc Technology Corporation, Drägerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd, Sensing Self, PTE. Ltd, Atomo Diagnostics, RUNBIO BIOTECH CO., LTD., Mylan NV (дочерняя компания Viatris, Inc.), MP BIOMEDICALS, VedaLab, Shanghai Chemtron Biotech Co.Ltd. и Ascensia Diabetes Care Holdings AG, а также других отечественных игроков.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AT-HOME TESTING KITS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

2.8 MARKET POSITION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DISTRIBUTOR CHANNEL ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AT- HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN U.S

5.2 GUIDELINES FOR SELF-TESTING KITS

5.3 REGULATION IN EUROPE

5.4 GUIDELINES FOR TESTING KITS

5.5 REGULATION IN INDONESIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF SELF-TESTING KITS

6.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES

6.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF HIV DIAGNOSIS

6.1.4 EASE OF USE AND LOW COSTS OF RAPID SELF-TEST KITS

6.2 RESTRAINTS

6.2.1 INACCURACY OF RESULTS BY SELF-TESTING KITS

6.2.2 STRINGENT GOVERNMENT REGULATIONS FOR MANUFACTURING AND DISTRIBUTION OF TESTING KITS

6.3 OPPORTUNITIES

6.3.1 ADVENT OF ADVANCED TECHNOLOGIES

6.3.2 EMERGING NEED FOR RAPID TESTING KITS FOR COVID-19 PANDEMIC

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN THE MEDICAL TECHNOLOGY INDUSTRY

6.4.2 REDUCTION IN RESEARCH & DEVELOPMENT BUDGETS

7 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 GLUCOSE TESTS

7.3 INFECTIOUS DISEASES

7.4 PREGNANCY TEST

7.5 DRUG ABUSE TEST KITS

7.6 HIV TEST KIT

7.7 OVULATION PREDICTOR TEST KIT

7.8 OTHERS TEST TYPES

8 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CASSETTES

8.2.1 RETAIL PHARMACIES

8.2.2 ONLINE PHARMACIES

8.2.3 DRUG STORE

8.2.4 SUPERMARKET/HYPERMARKET

8.3 STRIP

8.3.1 RETAIL PHARMACIES

8.3.2 ONLINE PHARMACIES

8.3.3 DRUG STORE

8.3.4 SUPERMARKET/HYPERMARKET

8.4 MIDSTREAM

8.4.1 RETAIL PHARMACIES

8.4.2 ONLINE PHARMACIES

8.4.3 DRUG STORE

8.4.4 SUPERMARKET/HYPERMARKET

8.5 DIP CARD

8.5.1 RETAIL PHARMACIES

8.5.2 ONLINE PHARMACIES

8.5.3 DRUG STORE

8.5.4 SUPERMARKET/HYPERMARKET

8.6 TEST PANEL

8.6.1 RETAIL PHARMACIES

8.6.2 ONLINE PHARMACIES

8.6.3 DRUG STORE

8.6.4 SUPERMARKET/HYPERMARKET

8.7 OTHERS

9 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE

10.1 OVERVIEW

10.2 BLOOD

10.3 URINE

10.4 SALIVA

10.5 OTHER SAMPLE TYPES

11 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE

11.1 OVERVIEW

11.2 DISPOSABLE

11.3 REUSABLE

12 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS

12.1 OVERVIEW

12.2 RETAIL PHARMACIES

12.3 ONLINE PHARMACIES

12.4 DRUG STORE

12.5 SUPERMARKET/HYPERMARKET

13 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUS ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SIEMENS HEALTHCARE GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUS ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 F. HOFFMANN- LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DRÄGERWERK AG & CO. KGAA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 LIFESCAN IP HOLDINGS, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 COMPANY SHARE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 ASCENSIA DIABETES CARE HOLDINGS AG.

16.7.1 COMPANY SNAPSHOT

16.7.2 COMPANY SHARE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 NECTAR LIFESCIENCES LTD. (RAPIKIT)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 ACON LABORATORIES, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 QUIDEL CORPORATION.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ARKRAY USA, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 BTNX INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ATOMO DIAGNOSTICS

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 EUROFINS SCIENTIFIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 PIRAMAL ENTERPRISES LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 BIONIME CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NOVA BIOMEDICAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 CARDINAL HEALTH.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ORASURE TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 BIOLYTICAL LABORATORIES INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 EVERLYWELL, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SA SCIENTIFIC LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 CLEARBLUE (A SUBSIDIARY OF SWISS PRECISION DIAGNOSTICS GMBH)

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 BIOSYNEX

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 PRIMA LAB SA

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 MP BIOMEDICALS.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 STERILAB SERVICES

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 CHEMBIO DIAGNOSTICS, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 BIOSURE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 SELFDIAGNOSTICS OU

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA GLUCOSE TESTS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA INFECTIOUS DISEASES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DRUG ABUSE TEST KITS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HIV TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OVULATION PREDICTOR TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS TEST TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA STRIP IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA STRIP IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADULT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GERIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PEDIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BLOOD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA URINE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SALIVA IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHER SAMPLE TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DISPOSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA REUSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DRUG STORE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SUPERMARKET/HYPERMARKET IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 50 U.S. AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 53 U.S. CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 54 U.S. MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 55 U.S. DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 56 U.S. TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 57 U.S. AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 58 U.S. AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 60 U.S. AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 61 CANADA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 64 CANADA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 65 CANADA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 66 CANADA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 67 CANADA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 68 CANADA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 69 CANADA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 71 CANADA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 72 MEXICO AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 76 MEXICO MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 77 MEXICO DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 78 MEXICO TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 79 MEXICO AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AT-HOME TESTING KITS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AT-HOME TESTING KITS MARKET: MARKET POSITION COVERAGE GRID

FIGURE 7 NORTH AMERICA AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA AT-HOME TESTING KITS MARKET: DISTRIBUTOR CHANNEL ANALYSIS

FIGURE 10 NORTH AMERICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 11 GROWING ADOPTION OF SELF-TESTING KITS IS EXPECTED TO DRIVE NORTH AMERICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GLUCOSE TEST IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AT-HOME TESTING KITS MARKET

FIGURE 15 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2021

FIGURE 16 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, 2021

FIGURE 24 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2021

FIGURE 28 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2022-2029 (EURO MILLION)

FIGURE 29 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, 2021

FIGURE 32 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, 2022-2029 (EURO MILLION)

FIGURE 33 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA AT-HOME TESTING KITS MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE (2022-2029)

FIGURE 44 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.