Рынок SWIR на Ближнем Востоке и в Африке, по типу сканирования (линейное сканирование и сканирование по площади), по типу детектора (охлаждаемый и неохлаждаемый), по химическому составу ( арсенид галлия индия , теллурид кадмия ртути, антимонид индия (INSB), квантовые точки сульфида свинца и другие), по применению (машинное зрение, тепловидениегиперспектральное изображение , безопасность и наблюдение, фотоэлектричество и другие), по компоненту (оборудование, программное обеспечение и услуги), по отраслям (коммерческие, промышленные, медицинские, военные и оборонные и другие), по странам (ОАЭ, Саудовская Аравия, Египет, Израиль, Южная Африка и остальные страны Ближнего Востока и Африки), тенденции рынка и прогноз до 2028 года

Анализ рынка и идеи: рынок SWIR на Ближнем Востоке и в Африке

Анализ рынка и идеи: рынок SWIR на Ближнем Востоке и в Африке

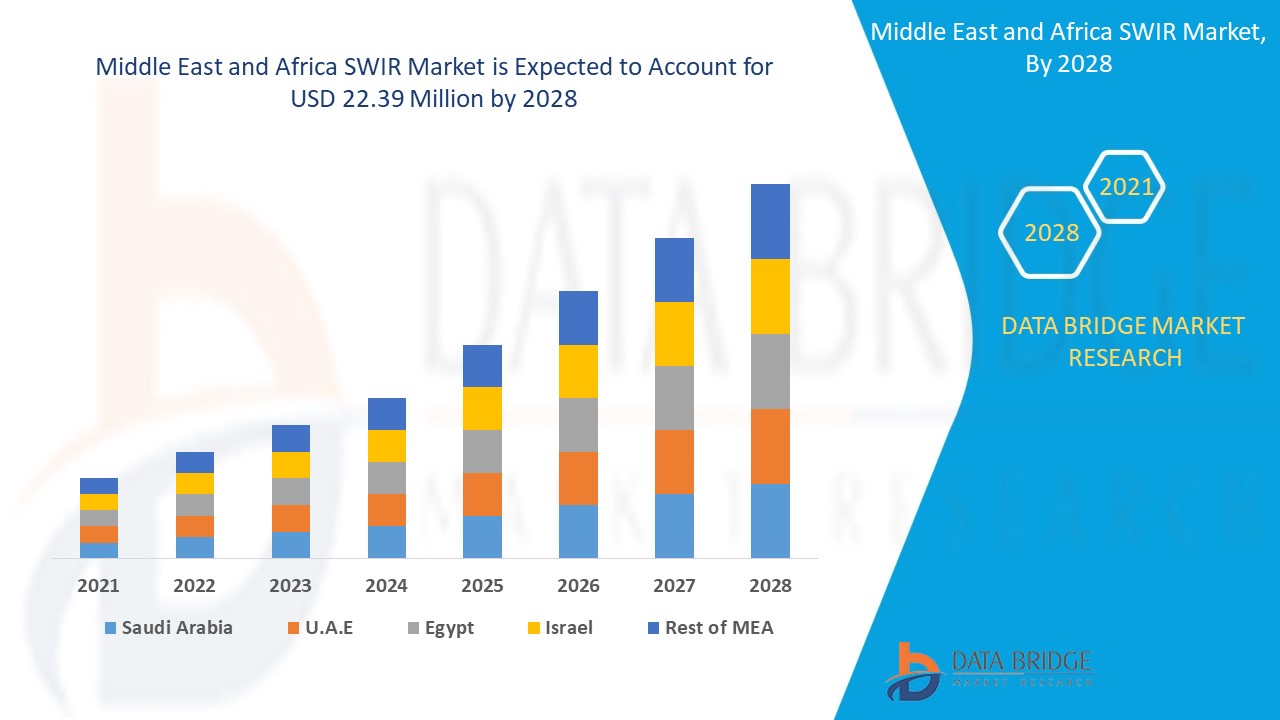

Ожидается, что рынок SWIR на Ближнем Востоке и в Африке будет расти в прогнозируемый период с 2021 по 2028 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 7,9% в прогнозируемый период с 2021 по 2028 год, а к 2028 году ожидается его объем в 22,39 млн долларов США. Растущий спрос на системы многоспектральной визуализации является основным фактором роста рынка.

Некоторые из факторов, которые движут рынком, - это растущий спрос на многоспектральные изображения и широкое внедрение технологии SWIR правительствами и государственным сектором. Спрос на многоспектральные изображения растет, поскольку они используются в ряде приложений, таких как точное земледелие, фармацевтическое производство, произведения искусства, биохимия и другие. Существует несколько областей применения многоспектральных изображений с SWIR, которые все еще развиваются и широко адаптируются. Многоспектральные камеры используются во многих отраслях и приложениях, таких как промышленный контроль, контроль качества продуктов питания и напитков, контроль и сортировка фармацевтической продукции, контроль цвета, мониторинг процессов и другие.

В этом отчете SWIR по рынку содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка SWIR на Ближнем Востоке и в Африке

Масштаб и размер рынка SWIR на Ближнем Востоке и в Африке

Рынок SWIR Ближнего Востока и Африки сегментирован на основе типа сканирования, типа детектора, химического состава, применения, компонента и отрасли. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе типа сканирования рынок SWIR на Ближнем Востоке и в Африке был сегментирован на линейное сканирование и зональное сканирование. Ожидается, что в 2021 году сегмент линейного сканирования будет доминировать на рынке из-за растущего использования SWIR для приложений линейного сканирования, таких как бумага, рулоны металла, оптоволокно, железнодорожный контроль, солнечные элементы, текстиль, фармацевтика, полупроводники и почтовая сортировка.

- На основе типа детектора рынок SWIR Ближнего Востока и Африки был сегментирован на охлаждаемые и неохлаждаемые. Ожидается, что в 2021 году неохлаждаемый сегмент будет доминировать на рынке, поскольку неохлаждаемые детекторы являются наиболее распространенным типом, используемым для тепловизионных устройств в этих регионах.

- На основе химического состава рынок SWIR Ближнего Востока и Африки был сегментирован на арсенид галлия индия, теллурид кадмия ртути, антимонид индия (INSB), квантовые точки сульфида свинца и другие. Арсенид галлия индия, теллурид кадмия ртути, антимонид индия (INSB), квантовые точки сульфида свинца далее подразделяются по компонентам на аппаратное обеспечение, программное обеспечение и услуги. Сегмент оборудования далее подразделяется по типу продукта на камеры, датчики и другие. Ожидается, что в 2021 году сегмент арсенида галлия индия будет доминировать на рынке, поскольку это наиболее распространенная технология, используемая в инфракрасной спектроскопии для изучения света в диапазоне SWIR.

- На основе сферы применения рынок SWIR на Ближнем Востоке и в Африке сегментирован на машинное зрение, тепловизионную съемку, гиперспектральную съемку, безопасность и наблюдение, фотоэлектрические системы и др. Ожидается, что в 2021 году сегмент безопасности и наблюдения будет доминировать на рынке из-за таких факторов, как растущее использование SWIR для безопасности и наблюдения в военных и оборонных приложениях.

- На основе компонентов рынок SWIR на Ближнем Востоке и в Африке сегментирован на оборудование, программное обеспечение и услуги. Сегмент услуг далее подразделяется на услуги тестирования и поддержку и обслуживание. Ожидается, что в 2021 году сегмент оборудования будет доминировать на рынке, поскольку камеры и датчики в основном используются для SWIR на Ближнем Востоке и в Африке.

- На основе отрасли рынок SWIR на Ближнем Востоке и в Африке был сегментирован на коммерческий, промышленный, медицинский, военный и оборонный и другие. Коммерческий, медицинский, военный и оборонный сегменты далее подразделяются по типу сканирования на линейное сканирование и сканирование области. Промышленный сегмент далее подразделяется на электронику и полупроводники, стекло, продукты питания и напитки, аэрокосмическую промышленность и другие. Электроника и полупроводники, стекло, продукты питания и напитки, аэрокосмическую промышленность снова подразделяются по типу сканирования на линейное сканирование и сканирование области. Ожидается, что в 2021 году промышленный сегмент будет доминировать на рынке, в основном за счет увеличения промышленной активности и сектора на Ближнем Востоке и в Африке.

Анализ рынка SWIR на уровне страны на Ближнем Востоке и в Африке

Проведен анализ рынка SWIR на Ближнем Востоке и в Африке, а также предоставлена информация о размере рынка по странам, типу сканирования, типу детектора, химическому составу, применению, компонентам и отраслям.

В отчете SWIR по рынку стран Ближнего Востока и Африки рассматриваются следующие страны: ОАЭ, Саудовская Аравия, Египет, Израиль, Южная Африка, а также остальные страны Ближнего Востока и Африки.

ОАЭ доминируют на рынке SWIR на Ближнем Востоке и в Африке благодаря таким факторам, как растущее внедрение инфракрасных камер SWIR в полупроводниковой промышленности и растущее внимание участников рынка к доступности экономически эффективных систем визуализации SWIR в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Ожидается, что рост потребности в повышении эффективности и производительности будет способствовать росту рынка.

Рынок SWIR Ближнего Востока и Африки также предоставляет вам подробный анализ рынка для каждой страны, рост в отрасли с продажами, продажами компонентов, влиянием технологического развития в SWIR и изменениями в сценариях регулирования с их поддержкой рынка SWIR. Данные доступны за исторический период 2019 года.

Конкурентная среда и анализ доли рынка SWIR на Ближнем Востоке и в Африке

Конкурентная среда рынка SWIR на Ближнем Востоке и в Африке содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие на Ближнем Востоке и в Африке, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, ширина и широта продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше точки данных связаны только с фокусом компаний, связанным с рынком SWIR на Ближнем Востоке и в Африке.

Основные игроки, рассмотренные в отчете: Sensors Unlimited (дочерняя компания Collins Aerospace), Teledyne Technologies Incorporated., Xenics NV, Lynred, Allied Vision Technologies GmbH, Hamamatsu Photonics KK, NIT, Photon Etc. Inc, Princeton Infrared Technologies, Inc., Raptor Photonics, IRCameras LLC, Intevac, Inc., Opgal Optronic Industries Ltd., InfraTec GmbH, TTP plc., Photonic Science and Engineering Limited, SWIR Vision Systems, Edmund Optics Inc., Atik Cameras Limited (дочерняя компания SDI Group), Silent Sentinel и другие. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие разработки продуктов также инициируются компаниями по всему миру, что также ускоряет рост рынка SWIR на Ближнем Востоке и в Африке.

Например,

- В ноябре 2019 года Hamamatsu Photonics KK объявила о выпуске новой InGaAs линейной сканирующей камеры для внутрипоточной инспекции SWIR. Эта новая камера идеально подходит для неразрушающего контроля в реальном времени с использованием визуализации SWIR. Эта новая камера также обеспечивает высокоэффективную и высокопроизводительную инспекцию. Этот запуск помог компании улучшить свои предложения на рынке.

- В январе 2021 года компания Allied Vision Technologies GmbH объявила об интеграции своей серии камер Goldeye SWIR с новыми инновационными датчиками Sony IMX990 и IMX991 InGaAs. В рамках этой интеграции четыре модели будут расширены инновационными датчиками, которые чувствительны как в видимом, так и в коротковолновом инфракрасном (SWIR) диапазоне. Это поможет компании расширить свои предложения на рынке.

Партнерство, совместные предприятия и другие стратегии увеличивают долю рынка компании за счет увеличения охвата и присутствия. Это также дает преимущество организации в улучшении своего предложения для SWIR за счет расширенного диапазона размеров.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SWIR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SCANNING TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 LIST OF CUSTOMERS UTILIZING SWIR AS PER COMPANY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR MULTISPECTRAL IMAGING SYSTEMS

6.1.2 RISING DEMAND FOR SHORTWAVE INFRARED CAMERAS IN MACHINE VISION APPLICATIONS

6.1.3 INCREASING PENETRATION OF SWIR IN THE MILITARY & DEFENCE SECTOR

6.1.4 GROWING ADOPTION OF NIGHT VISION TECHNOLOGIES

6.1.5 INCREASING DEMAND OF SWIR FOR APPLICATIONS IN AUTOMOTIVE, AND HEALTHCARE

6.2 RESTRAINTS

6.2.1 HIGH COST OF SWIR IMAGING SYSTEMS

6.2.2 STRINGENT REGULATIONS RELATED TO IMPORT AND EXPORT OF SWIR CAMERAS

6.3 OPPORTUNITIES

6.3.1 INCREASING INDUSTRIAL AUTOMATION WORLDWIDE

6.3.2 GROWING NUMBER OF SMARTPHONES USAGE

6.3.3 RISING POPULARITY OF MINIATURIZED SWIR SENSORS AND COMPONENTS

6.3.4 INCREASING USAGE OF SWIR FOR FIRE DETECTION

6.3.5 INCREASING EMPHASIS ON RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 ISSUES IN REDUCING THE COST OF SHORTWAVE INFRARED CAMERAS AND LIMITATIONS OF INGAAS SENSOR TECHNOLOGY

6.4.2 COMPLEXITIES INVOLVED IN DESIGNING OF MINIATURIZATION

7 IMPACT OF COVID-19 ON MIDDLE EAST AND AFRICA SWIR MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA SWIR MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND AND SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST AND AFRICA SWIR MARKET, BY SCANNING TYPE

8.1 OVERVIEW

8.2 LINE SCAN

8.3 AREA SCAN

9 MIDDLE EAST AND AFRICA SWIR MARKET, BY DETECTOR TYPE

9.1 OVERVIEW

9.2 COOLED

9.3 UNCOOLED

10 MIDDLE EAST AND AFRICA SWIR MARKET, BY CHEMICAL COMPOSITION

10.1 OVERVIEW

10.2 INDIUM GALLIUM ARSENIDE

10.2.1 HARDWARE

10.2.1.1 CAMERAS

10.2.1.2 SENSORS

10.2.1.3 OTHERS

10.2.2 SOFTWARE

10.2.3 SERVICES

10.3 MERCURY CADMIUM TELLURIDE

10.3.1 HARDWARE

10.3.1.1 CAMERAS

10.3.1.2 SENSORS

10.3.1.3 OTHERS

10.3.2 SOFTWARE

10.3.3 SERVICES

10.4 INDIUM ANTIMONIDE (INSB)

10.4.1 HARDWARE

10.4.1.1 CAMERAS

10.4.1.2 SENSORS

10.4.1.3 OTHERS

10.4.2 SOFTWARE

10.4.3 SERVICES

10.5 LEAD SULFIDE QUANTUM DOTS

10.5.1 HARDWARE

10.5.1.1 CAMERAS

10.5.1.2 SENSORS

10.5.1.3 OTHERS

10.5.2 SOFTWARE

10.5.3 SERVICES

10.6 OTHERS

11 MIDDLE EAST AND AFRICA SWIR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MACHINE VISION

11.3 THERMAL IMAGING

11.4 HYPERSPECTRAL IMAGING

11.5 SECURITY & SURVEILLANCE

11.6 PHOTOVOLTAICS

11.7 OTHERS

12 MIDDLE EAST AND AFRICA SWIR MARKET, BY COMPONENT

12.1 OVERVIEW

12.2 HARDWARE

12.3 SOFTWARE

12.4 SERVICES

12.4.1 TESTING SERVICES

12.4.2 SUPPORT & MAINTENANCE

13 MIDDLE EAST AND AFRICA SWIR MARKET, BY INDUSTRY

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 LINE SCAN

13.2.2 AREA SCAN

13.3 INDUSTRIAL

13.3.1 ELECTRONICS AND SEMICONDUCTORS

13.3.1.1 LINE SCAN

13.3.1.2 AREA SCAN

13.3.2 GLASS

13.3.2.1 LINE SCAN

13.3.2.2 AREA SCAN

13.3.3 FOOD & BEVERAGES

13.3.3.1 LINE SCAN

13.3.3.2 AREA SCAN

13.3.4 AEROSPACE

13.3.4.1 LINE SCAN

13.3.4.2 AREA SCAN

13.3.5 OTHERS

13.4 MEDICAL

13.4.1 LINE SCAN

13.4.2 AREA SCAN

13.5 MILITARY & DEFENCE

13.5.1 LINE SCAN

13.5.2 AREA SCAN

13.6 OTHERS

14 MIDDLE EAST AND AFRICA SWIR MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 U.A.E.

14.1.2 SAUDI ARABIA

14.1.3 ISRAEL

14.1.4 EGYPT

15 MIDDLE EAST AND AFRICA SWIR MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT

17 COMPANY PROFILES

17.1 SENSORS UNLIMITED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 TELEDYNE TECHNOLOGIES INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 PRINCETON INFRARED TECHNOLOGIES, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 HAMAMATSU PHOTONICS K.K.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 XENICS NV

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ALLIED VISION TECHNOLOGIES GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATIK CAMERAS LIMITED (A SUBSIDIARY OF SDI GROUP)

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 EDMUND OPTICS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 INFRATEC GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 INTEVAC, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 IRCAMERAS LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 LYNRED

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 NIT

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 OPGAL OPTRONIC INDUSTRIES LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 PHOTON ETC. INC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PHOTONIC SCIENCE AND ENGINEERING LIMITED

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 RAPTOR PHOTONICS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SILENT SENTINEL

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 SWIR VISION SYSTEMS

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 TTP PLC

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA LINE SCAN IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA AREA SCAN IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA COOLED IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA UNCOOLED IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA INDIUM ANTIMONIDE (INSB) IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA INDIUM ANTIMONIDE (INSB) IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA HARDWARE IN INDIUM ANTIMONIDE (INSB) IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA LEAD SULFIDE QUANTUM DOTS (PBS QD) IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA MACHINE VISION IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA THERMAL IMAGING IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA SECURITY & SURVEILLANCE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA PHOTOVOLTAICS IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA HARDWARE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SOFTWARE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SERVICES IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA COMMERCIAL IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA MEDICAL IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA MILITARY & DEFENCE IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA MILITARY & DEFENCE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA OTHERS IN SWIR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SWIR MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SWIR MARKET, BY COUNTRY, 2019-2028 (THOUSAND UNITS)

TABLE 49 MIDDLE EAST AND AFRICA SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA INDIUM ANTIMONIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA HARDWARE IN INDIUM ANTIMONIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA MILITARY AND DEFENSE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 72 U.A.E. SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 73 U.A.E. SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 74 U.A.E. SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 75 U.A.E. INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 76 U.A.E. HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 77 U.A.E. MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 78 U.A.E. HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 79 U.A.E. LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 80 U.A.E. HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 81 U.A.E. INDIUM ANTIMONIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 82 U.A.E. HARDWARE IN INDIUM ANTIMONIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 83 U.A.E. SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 84 U.A.E. SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 85 U.A.E. SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 U.A.E. SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 87 U.A.E. COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 88 U.A.E. MILITARY AND DEFENSE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 89 U.A.E. MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 90 U.A.E. INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 91 U.A.E. ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 92 U.A.E. FOOD AND BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 93 U.A.E. AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 94 U.A.E. GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 95 SAUDI ARABIA SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 96 SAUDI ARABIA SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 97 SAUDI ARABIA SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 98 SAUDI ARABIA INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 99 SAUDI ARABIA HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 100 SAUDI ARABIA MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 101 SAUDI ARABIA HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 102 SAUDI ARABIA LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 103 SAUDI ARABIA HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 104 SAUDI ARABIA INDIUM ANTIMONIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 105 SAUDI ARABIA HARDWARE IN INDIUM ANTIMONIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 106 SAUDI ARABIA SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 107 SAUDI ARABIA SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 108 SAUDI ARABIA SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 109 SAUDI ARABIA SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 110 SAUDI ARABIA COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 111 SAUDI ARABIA MILITARY AND DEFENSE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 112 SAUDI ARABIA MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 113 SAUDI ARABIA INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 114 SAUDI ARABIA ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 115 SAUDI ARABIA FOOD AND BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 116 SAUDI ARABIA AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 117 SAUDI ARABIA GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 118 ISRAEL SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 119 ISRAEL SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 120 ISRAEL SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 121 ISRAEL INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 122 ISRAEL HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 123 ISRAEL MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 124 ISRAEL HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 125 ISRAEL LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 126 ISRAEL HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 127 ISRAEL INDIUM ANTIMONIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 128 ISRAEL HARDWARE IN INDIUM ANTIMONIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 129 ISRAEL SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 130 ISRAEL SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 131 ISRAEL SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 132 ISRAEL SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 133 ISRAEL COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 134 ISRAEL MILITARY AND DEFENSE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 135 ISRAEL MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 136 ISRAEL INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 137 ISRAEL ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 138 ISRAEL FOOD AND BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 139 ISRAEL AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 140 ISRAEL GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 141 EGYPT SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 142 EGYPT SWIR MARKET, BY DETECTOR TYPE, 2019-2028 (USD MILLION)

TABLE 143 EGYPT SWIR MARKET, BY CHEMICAL COMPOSITION, 2019-2028 (USD MILLION)

TABLE 144 EGYPT INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 145 EGYPT HARDWARE IN INDIUM GALLIUM ARSENIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 146 EGYPT MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 147 EGYPT HARDWARE IN MERCURY CADMIUM TELLURIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 148 EGYPT LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 149 EGYPT HARDWARE IN LEAD SULFIDE QUANTUM DOTS IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 150 EGYPT INDIUM ANTIMONIDE IN SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 151 EGYPT HARDWARE IN INDIUM ANTIMONIDE IN SWIR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 152 EGYPT SWIR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 153 EGYPT SWIR MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 154 EGYPT SERVICES IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 155 EGYPT SWIR MARKET, BY INDUSTRY, 2019-2028 (USD MILLION)

TABLE 156 EGYPT COMMERCIAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 157 EGYPT MILITARY AND DEFENSE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 158 EGYPT MEDICAL IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 159 EGYPT INDUSTRIAL IN SWIR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 160 EGYPT ELECTRONICS AND SEMICONDUCTORS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 161 EGYPT FOOD AND BEVERAGES IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 162 EGYPT AEROSPACE IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

TABLE 163 EGYPT GLASS IN SWIR MARKET, BY SCANNING TYPE, 2019-2028 (USD MILLION)

Список рисунков

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA SWIR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA SWIR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SWIR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SWIR MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA SWIR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA SWIR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA SWIR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA SWIR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA SWIR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA SWIR MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR MULTISPECTRAL IMAGING SYSTEMS IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA SWIR MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 LINE SCAN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA SWIR MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA SWIR MARKET

FIGURE 14 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 15 MIDDLE EAST AND AFRICA SWIR MARKET, BY SCANNING TYPE, 2020

FIGURE 16 MIDDLE EAST AND AFRICA SWIR MARKET, BY DETECTOR TYPE, 2020

FIGURE 17 MIDDLE EAST AND AFRICA SWIR MARKET: BY CHEMICAL COMPOSITION, 2020

FIGURE 18 MIDDLE EAST AND AFRICA SWIR MARKET, BY APPLICATION, 2020

FIGURE 19 MIDDLE EAST AND AFRICA SWIR MARKET, BY COMPONENT, 2020

FIGURE 20 MIDDLE EAST AND AFRICA SWIR MARKET, BY INDUSTRY, 2020

FIGURE 21 MIDDLE EAST AND AFRICA SWIR MARKET: SNAPSHOT (2020)

FIGURE 22 MIDDLE EAST AND AFRICA SWIR MARKET: BY COUNTRY (2020)

FIGURE 23 MIDDLE EAST AND AFRICA SWIR MARKET: BY COUNTRY (2021 & 2028)

FIGURE 24 MIDDLE EAST AND AFRICA SWIR MARKET: BY COUNTRY (2020 & 2028)

FIGURE 25 MIDDLE EAST AND AFRICA SWIR MARKET: BY SCANNING TYPE (2021-2028)

FIGURE 26 MIDDLE EAST AND AFRICA SWIR MARKET: COMPANY SHARE 2020 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.