Рынок реторт-упаковки на Ближнем Востоке и в Африке , по типу продукции (пакеты, лотки, картон и другие), материалу (ПЭТ, полипропилен, алюминиевая фольга, полиамид (ПА), бумага и картон, EVOH и другие), каналу сбыта (офлайн и онлайн), конечному использованию (продукты питания, напитки, фармацевтические препараты и другие) — отраслевые тенденции и прогноз до 2029 г.

Анализ и размер рынка

Индустриализация и урбанизация изменили методы обработки и способы транспортировки сред или жидкостей, что привело к необходимости ретортной упаковки практически в каждой отрасли, где жидкости играют важную роль. Таким образом, рынок ретортной упаковки был обусловлен потребностью в более безопасном производстве и адекватной инфраструктуре.

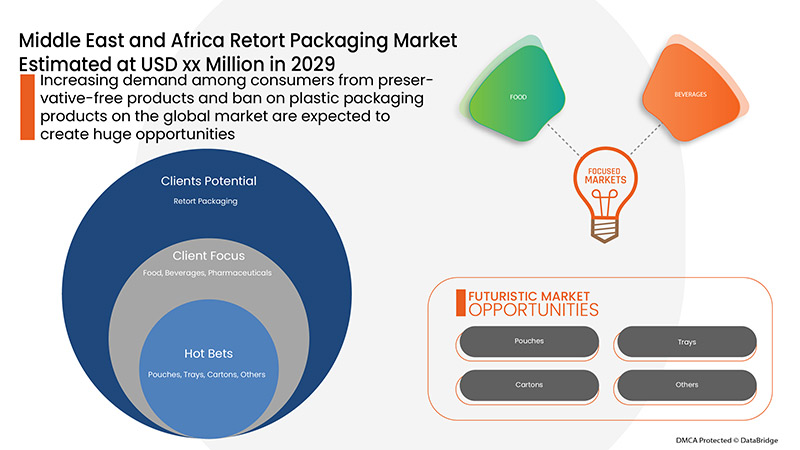

Некоторые из факторов, которые движут рынком, это растущий спрос среди потребителей на продукты без консервантов, растущий спрос на устойчивые и эстетичные упаковочные решения и растущий спрос на интеллектуальную упаковку, чтобы избежать пищевых отходов. Однако высокие затраты, связанные с научно-исследовательской деятельностью, являются сдерживающим фактором, препятствующим росту рынка.

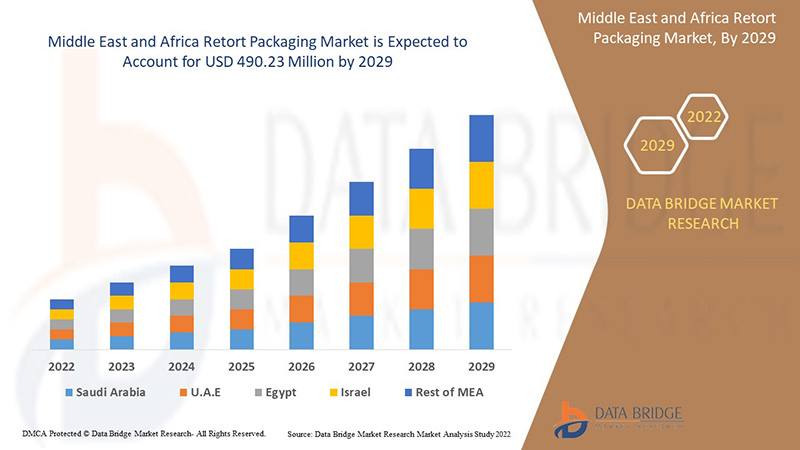

По данным Data Bridge Market Research, ожидается, что рынок ретортной упаковки достигнет 490,23 млн долларов США к 2029 году при среднегодовом темпе роста 4,6% в прогнозируемый период. «Пакеты» составляют крупнейший сегмент типа продукта на рынке ретортной упаковки, поскольку изменение моделей питания и растущее западное влияние привели к росту спроса на упакованные и порционные продукты питания. Отчет о рынке ретортной упаковки также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу продукции (пакеты, лотки, картонные коробки и другие), по материалу (ПЭТ, полипропилен, алюминиевая фольга, полиамид (ПА), бумага и картон, EVOH и другие), по каналу сбыта (офлайн и онлайн), по конечному использованию (продукты питания, напитки, фармацевтические препараты и другие) |

|

Страны, охваченные |

Южная Африка, Саудовская Аравия, ОАЭ, Израиль, Египет и остальная часть Ближнего Востока и Африки (БВА) как часть Ближнего Востока и Африки (БВА) |

|

Охваченные участники рынка |

ProAmpac, Coveris, FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak и другие. |

Определение рынка

Ретортная упаковка — это тип упаковки для пищевых продуктов, изготовленный из ламината гибкого пластика и металлической фольги. Она позволяет стерильно упаковывать широкий спектр продуктов питания и напитков, обработанных асептическим способом, и используется в качестве альтернативы традиционным методам промышленного консервирования. Упакованные продукты питания варьируются от воды до полностью приготовленных, термостабилизированных (термообработанных), высококалорийных (в среднем 1300 ккал) блюд, таких как Meals, Ready-to-Eat (MREs), которые можно есть холодными, разогревать, погрузив в горячую воду, или разогревать с помощью беспламенного подогревателя пайков, компонента питания, впервые представленного военными в 1992 году. Полевые пайки, космическое питание, рыбная продукция, походные обеды, быстрая лапша и такие компании, как Capri Sun и Tasty Bite, используют ретортную упаковку.

Изначально упаковка реторт была разработана для промышленного применения и органов. Постепенно конструкция была адаптирована в биофармацевтической промышленности для методов стерилизации с использованием совместимых материалов. И теперь она используется почти в каждой отрасли для безопасного производства и адекватной инфраструктуры, например, в пищевой промышленности и производстве напитков, а также в химической промышленности и других вертикалях.

Динамика рынка ретортной упаковки

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Растущий спрос среди потребителей на продукты без консервантов

Реторта происходит, когда нестерильные продукты герметично запечатываются, что буквально означает нестерильную упаковку. Упаковку загружают в сосуд высокого давления реторты и подвергают воздействию пара под давлением. Продукт также подвергается воздействию высоких температур в течение гораздо более длительного периода, чем при горячем розливе. Дополнительное время может значительно ухудшить общее качество и питательную ценность продукта.

Растущий спрос потребителей по всему миру на продукты без консервантов является ключевым фактором для рынка реторт-упаковки на Ближнем Востоке и в Африке. Поскольку потребители все больше беспокоятся о вредном воздействии консервантов в своих напитках, спрос на продукты без консервантов находится на пике.

- Рост спроса на ретортную упаковку со стороны авиакомпаний

В последнее время наблюдается все больший сдвиг потребителей в сторону устойчивых и экологически чистых вариантов упаковки, что дополнительно привело к появлению полностью перерабатываемой упаковки и стоячих пакетов различных конструкций. Помимо предоставления экологических преимуществ, устойчивая упаковка также может помочь компаниям увеличить прибыль и исключить ненужные производственные запасные части, тем самым повышая безопасность производственных линий и минимизируя затраты на утилизацию. Основная цель упаковки заключается не только в защите продукта от повреждений во время транспортировки, но и в защите склада и розничных магазинов перед продажей продукта. Для разных видов продуктов используются различные типы упаковки. Кроме того, ретортная упаковка используется для тяжелых и громоздких пищевых продуктов, а также для других продуктов.

- Растущий спрос на интеллектуальную упаковку для предотвращения пищевых отходов

Интеллектуальная упаковка предлагает различные решения для сокращения пищевых отходов, поскольку она обеспечивает различные индикаторы, чтобы избежать порчи продуктов. Таким образом, рост пищевых отходов привлекает потребителей к покупке продуктов в интеллектуальной упаковке.

Интеллектуальная упаковка включает в себя индикаторы (индикаторы времени-температуры; индикаторы целостности или газа; индикаторы свежести); штрихкоды и радиочастотные идентификационные метки (RFID); датчики (биосенсоры; газовые датчики; датчики кислорода на основе флуоресценции) и т. д. Таким образом, интеллектуальная упаковка помогает производителям продуктов питания отслеживать состояние своих продуктов питания в режиме реального времени, тем самым способствуя сокращению пищевых отходов.

Более того, интеллектуальная упаковка может также выступать в качестве основного инструмента для потребителей при выборе продуктов на уровне розничной торговли, поскольку концепции интеллектуальной упаковки могут позволить потребителям судить о качестве продуктов. В результате ожидается, что интеллектуальная упаковка будет играть важную роль в привлечении потребителей.

- Высокие затраты, связанные с научно-исследовательской деятельностью

Расходы на НИОКР напрямую связаны с исследованиями и разработками товаров или услуг компании и любой интеллектуальной собственности, созданной в этом процессе. Компания обычно несет расходы на НИОКР в процессе поиска и создания новых продуктов или услуг.

Компании, занимающиеся упаковкой, в значительной степени полагаются на свои возможности в области исследований и разработок; поэтому они могут относительно превзойти расходы на НИОКР. Например, изменение предпочтений потребителей с обычной упаковки на интеллектуальную и активную упаковку, повышение осведомленности потребителей о безопасности пищевых продуктов и т. д. Таким образом, компании должны инвестировать в научно-исследовательскую деятельность, чтобы диверсифицировать свой бизнес и найти новые возможности для роста по мере развития технологий.

- Запрет на пластиковую упаковку на рынке Ближнего Востока и Африки

С ростом экологических проблем в нескольких регионах правительство предприняло строгие шаги по запрету одноразовых пластиковых изделий и небиоразлагаемых упаковочных материалов на рынке. Это связано с тем, что пластиковые изделия разлагаются дольше и опасны для водных и наземных животных.

Например,

По оценкам Natural Environment, ежегодно погибает около 100 000 морских черепах и других морских животных, поскольку они задыхаются в мешках или принимают их за еду.

В Северной Америке запрещены одноразовые пластиковые пакеты, используемые для упаковки продуктов питания и потребительских товаров. В результате в регионе растет спрос на картонную и ретортную упаковку.

Несколько типов упаковки используются в различных целях, что приводит к образованию отходов и очень вредно для окружающей среды. Пластиковая упаковка используется для упаковки потребительских товаров, что приводит к образованию небиоразлагаемых пластиковых упаковочных отходов, выделяет токсичные газы в почву, что опасно для животных и грунтовых вод. Поэтому были приняты меры по запрету упаковки в пластиковые пакеты, поскольку она вредна для окружающей среды.

- Нарушение цепочки поставок из-за пандемии

COVID-19 нарушил цепочку поставок и сократил рынки ретортной упаковки по всему миру. Сбои привели к задержке запасов продукции, а также к снижению доступа и поставок продуктов питания и напитков. Из-за сохраняющегося COVID-19 были введены ограничения на транспортировку, импорт и экспорт материалов. Кроме того, из-за ограничения передвижения рабочих пострадало производство ретортной упаковки, из-за чего не был удовлетворен спрос потребителей. Кроме того, из-за ограничений на импорт и экспорт производителям стало сложно поставлять сырье и конечную продукцию по странам мира, что также повлияло на цены на ретортную упаковку. Таким образом, из-за продолжающихся ограничений из-за COVID-19 цепочка поставок ретортной упаковки была нарушена, что создает серьезную проблему для производителей.

Из-за продолжающейся пандемии COVID-19 и ограничений на передвижение произошел сбой в цепочке поставок, что представляет собой серьезную проблему для рынка реторт-упаковки на Ближнем Востоке и в Африке.

Влияние COVID-19 на рынок ретортной упаковки

COVID-19 оказал сильное влияние на рынок ретортной упаковки, поскольку почти все страны решили закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи товаров не первой необходимости, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, который работает в этой пандемической ситуации, — это основные услуги, которым разрешено открываться и запускать процессы.

Из-за вспышки пандемии, вызванной вирусом, многие мелкие секторы были закрыты, а с другой стороны, некоторые секторы решили сократить часть сотрудников, что привело к большой безработице. Реторт-упаковка также используется для упаковки продуктов, а также в промышленности. Из-за вспышки пандемии спрос на такую продукцию вырос до определенной степени, особенно в медицинском секторе, здравоохранении, фармацевтике, бакалейных товарах, электронной коммерции и различных других секторах. Но неожиданный спрос, наряду с ограниченными производственными мощностями и перебоями в цепочке поставок, продолжает вызывать трудности во всех этих отраслях.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологии, используемой в ретортной упаковке. Благодаря этому компании выведут на рынок передовые и точные контроллеры. Кроме того, использование ретортной упаковки государственными органами в пищевых продуктах и напитках привело к росту рынка.

Недавнее развитие

- В феврале 2021 года SEE объявила о приобретении Foxpak Flexibles Ltd. (Foxpak) в рамках SEE Ventures, своей инициативы по инвестированию в прорывные технологии и бизнес-модели для ускорения роста. Foxpak использовала возможности цифровой печати для прямой печати на своих гибких упаковочных материалах, чтобы расширить возможности брендов своих клиентов. Их решения можно быстро масштабировать в сторону увеличения или уменьшения, чтобы соответствовать производственным требованиям клиентов любого размера. Это приобретение поможет укрепить денежные потоки и прибыль. Еще больше расширяет упаковочный портфель компании.

- В декабре 2021 года Sonoco приобрела Ball Metalpack. Приобретение дополняет крупнейшую франшизу потребительской упаковки Sonoco. Ball Metalpack — ведущий производитель устойчивой металлической упаковки для продуктов питания и товаров для дома и крупнейший производитель аэрозолей в Северной Америке. Это приобретение поможет укрепить денежные потоки и прибыль. Еще больше расширяет упаковочный портфель компании.

Объем рынка реторт-упаковки на Ближнем Востоке и в Африке

Рынок ретортной упаковки сегментирован на основе типа продукта, материала, канала сбыта и конечного использования. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип продукта

- Подносы

- Мешочки

- Картонные коробки

- Другие

В зависимости от типа продукции рынок реторт-упаковки на Ближнем Востоке и в Африке сегментируется на лотки, пакеты, картонные коробки и другие виды.

Материал

- ДОМАШНИЙ ПИТОМЕЦ

- Полипропилен

- Алюминиевая фольга

- Полиамид (ПА)

- Бумага и картон

- ЭВОН

- Другие

По материалу рынок реторт-упаковки на Ближнем Востоке и в Африке сегментирован на ПЭТ, полипропилен, алюминиевую фольгу, полиамид (ПА), бумагу и картон, EVOH и другие.

Канал распространения

- Оффлайн

- Онлайн

На основе каналов сбыта рынок ретортной упаковки на Ближнем Востоке и в Африке сегментирован на офлайн и онлайн.

Конечное использование

- Еда

- Напитки

- Фармацевтика

- Другие

По признаку конечного использования рынок реторт-упаковки на Ближнем Востоке и в Африке сегментирован на следующие категории: продукты питания, напитки, фармацевтические препараты и другие.

Региональный анализ/информация о рынке ретортной упаковки

Проведен анализ рынка ретортной упаковки, а также предоставлены сведения о размерах рынка и тенденциях по типу продукта, материалу, каналу сбыта и отрасли конечного использования, как указано выше.

Страны, охваченные отчетом о рынке ретортной упаковки: Южная Африка, Саудовская Аравия, ОАЭ, Израиль, Египет и остальная часть Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA).

Южная Африка доминирует на рынке ретортной упаковки Азиатско-Тихоокеанского региона. Спрос в этом регионе, как ожидается, будет обусловлен ростом спроса на ретортную упаковку со стороны продуктов питания и напитков.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка реторт-упаковки

Конкурентная среда рынка ретортной упаковки содержит сведения по конкурентам. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии на Ближнем Востоке и в Африке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании в применении. Приведенные выше данные касаются только фокуса компаний на рынке ретортной упаковки.

Некоторые из основных игроков, работающих на рынке ретортной упаковки, включают ProAmpac, Coveris, Berry Middle East and Africa Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC., Sonoco Products Company, Amcor plc и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE MIDDLE EAST & AFRICA MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 U.A.E.

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY MIDDLE EAST & AFRICA INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Список таблиц

TABLE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MIDDLE EAST AND AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 MIDDLE EAST AND AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 SOUTH AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 SOUTH AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 SAUDI ARABIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 SAUDI ARABIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 EGYPT POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 EGYPT FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 U.A.E. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 U.A.E. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 U.A.E. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 ISRAEL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 ISRAEL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.