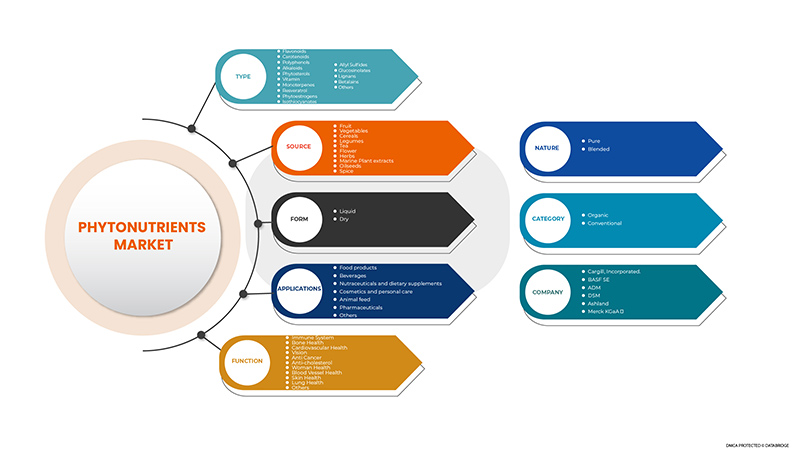

Middle East and Africa Phytonutrients Market, By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Function (Immune System, Vision, Skin Health, Bone Health, Cardiovascular Health, Anti-Cancer, Lung Health, Blood Vessel Health, Woman Health, Anti-Cholesterol, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, Marine Plant Extracts), Form (Liquid, Dry), Category (Organic, Conventional), Nature (Blended, Pure), Application (Food Products, Beverages, Nutraceuticals, and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, Others) Industry Trends and Forecast to 2029.

Middle East and Africa Phytonutrients Market Analysis and Insights

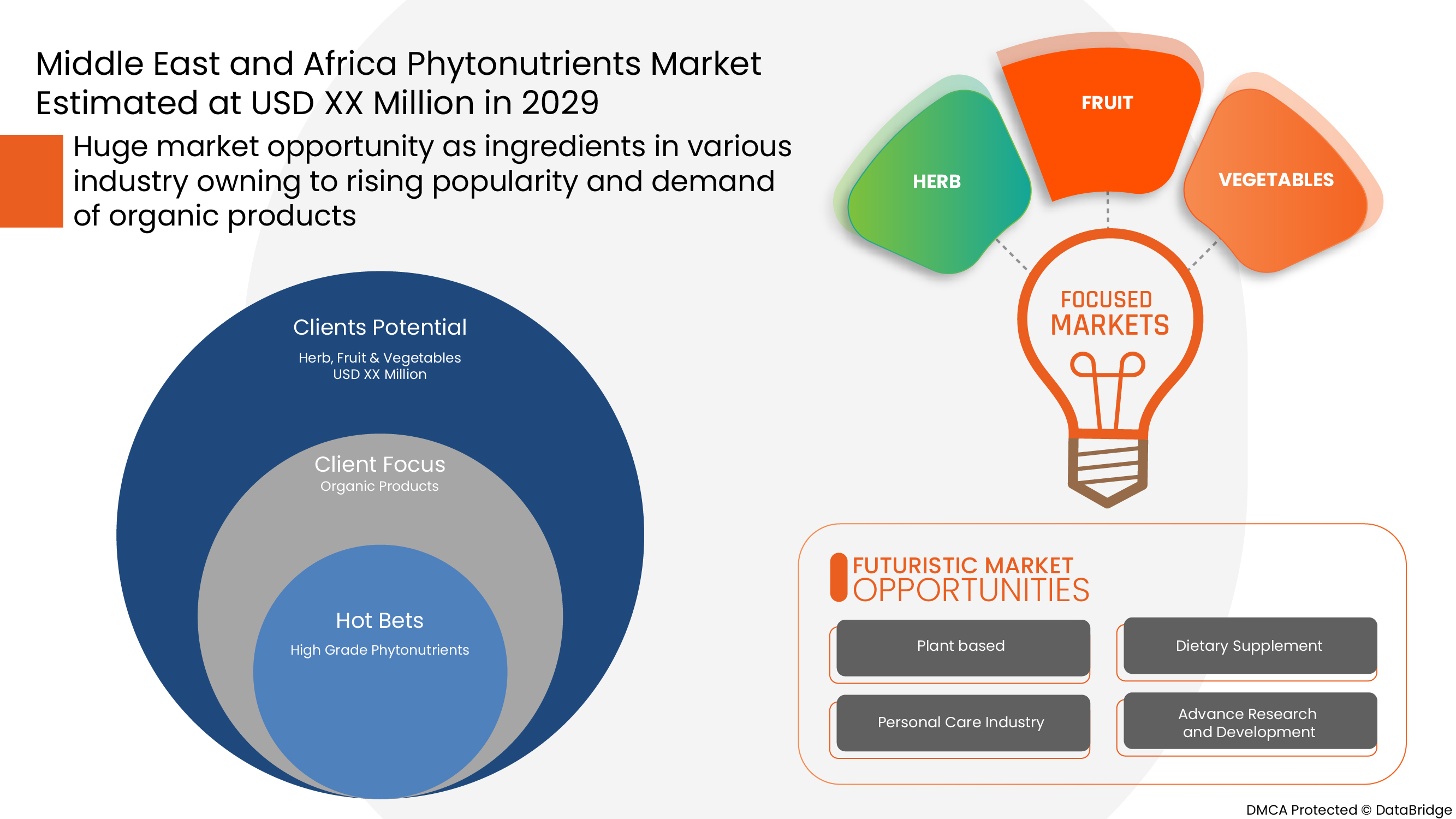

Increasing demand for phytonutrients in the food and beverage industries will accelerate the market demand. The rising focus on pharmaceutical industries to reduce cancer, diabetes, and heart disease will also enhance the global phytonutrients market's growth. Additionally, the need for phytonutrients in the feed and cosmetics industries is also expected to drive the market. The increase in demand for ayurvedic products is expected to act as an opportunity for the market.

The standard quality determination technique of phytonutrients and their products is inadequate, which is expected to restrain the growth of the Middle East and Africa phytonutrients market. Additionally, the phytonutrient supplements are insufficient in regulating products that involve marketing and promotion, which are the other factors anticipated to inhibit the development of the global phytonutrients market through the forecast term. The manufacturers of the phytonutrients focus on the R&D work on the extraction process of phytonutrients that may challenge competitors in the market.

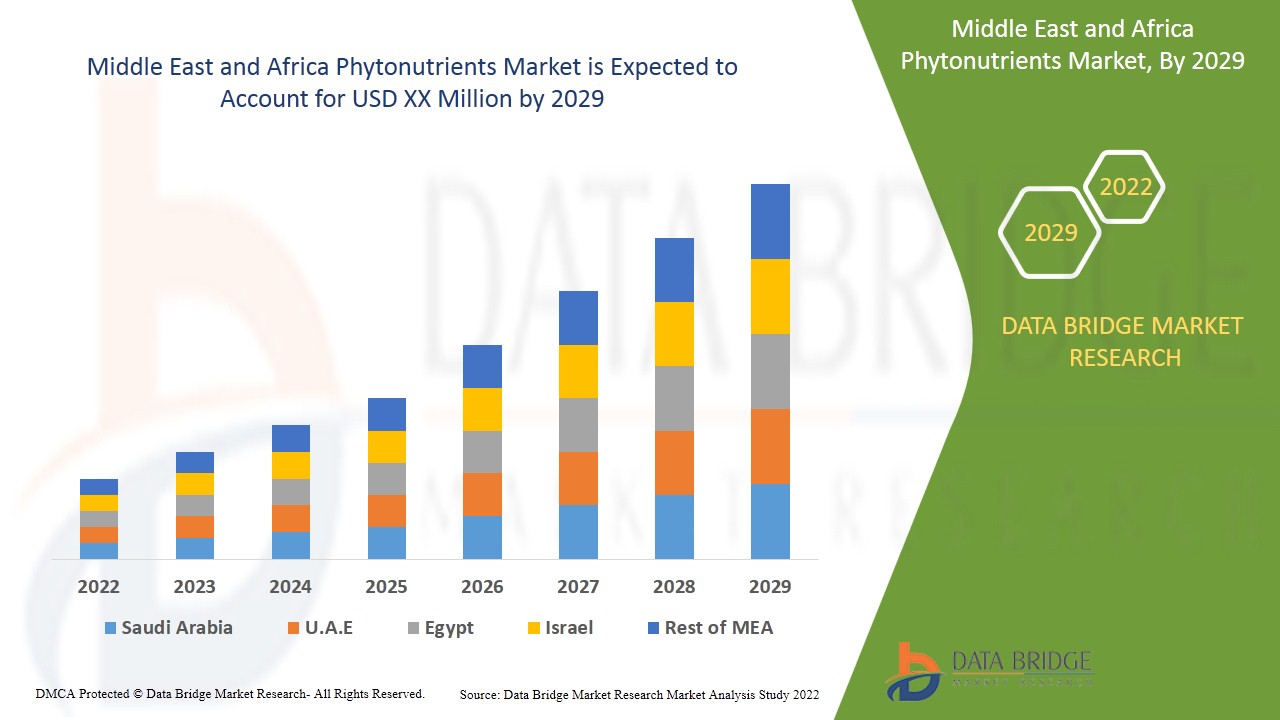

Data Bridge Market Research analyses that the Middle East and Africa phytonutrients market will grow at a CAGR of 7.2% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million, Volume in Units, Pricing in USD |

|

Segments Covered |

By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Function (Immune System, Vision, Skin Health, Bone Health, Cardiovascular Health, Anti-Cancer, Lung Health, Blood Vessel Health, Woman Health, Anti-Cholesterol, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, Marine Plant Extracts), Form (Liquid, Dry), Category (Organic, Conventional), Nature (Blended, Pure), Application (Food Products, Beverages, Nutraceuticals, and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Kuwait, Oman, Qatar, and the Rest of Middle East and Africa |

|

Market Players Covered |

ConnOils LLC, Ashland, Vitae Caps S.A., IFF Nutrition & Biosciences, Kothari Phytochemicals International, Sabinsa, Merck KGaA, BTSA, ExcelVite, NutriScience Innovations, LLC, Cyanotech Corporation, Bio-India Biologicals (BIB) Corporation, Brlb International, Hindustan Herbals, Lycored, DSM, ADM, BASF SE, Cargill, Incorporated., MANUS AKTTEVA BIOPHARMA LLP, Döhler GMBH, among others |

Middle East and Africa Phytonutrients Market Dynamics

Drivers

- Increasing Demand for Food & Beverage Products

Rising demand for food and beverages due to the increasing global population is expected to drive the demand for phytonutrients in the industry. Further, the increasing demand for natural ingredients-based food and beverages products because of rising concern about the quality and nutritional value of the food and beverages products is expected to drive the demand for phytonutrients in the food and beverages industry.

- Increasing Demand for Animal Feed

In the animal feed industry, phytonutrients are used as antioxidants in animal feed to enhance animal growth and protect animals from oxidative damage caused by free radicals. Phytonutrients help to enhance innate immunity in animals, especially poultry. The growth of phytonutrients in animal feed is attributed to some the factors such as growing demand for meat worldwide, growing poultry meat consumption, and others are expected to drive the demand for animal feed, which in turn, the demand for phytonutrients is likely to increase in the animal feed industry over the forecast period

Opportunities

- Growing Demand for Natural Skincare and Cosmetic Products

Ожидается, что растущая осведомленность потребителей о преимуществах натуральных или органических продуктов увеличит спрос на натуральные средства по уходу за кожей и косметические средства. Кроме того, растущие экологические проблемы, вероятно, увеличат спрос на продукцию в ближайшие годы. Кроме того, увеличится спрос на фитохимические вещества в средствах по уходу за кожей и косметических средствах, такие как куркумин, ресвератрол, эпикатехин, эллаговая кислота и апигенин, используемые в косметических формулах для борьбы со старением кожи. Таким образом, ожидается, что увеличение спроса на натуральные средства по уходу за кожей и косметические средства станет возможностью для рынка фитонутриентов Ближнего Востока и Африки.

Ограничения/Проблемы

- Побочные эффекты избыточного потребления фитонутриентов

Фитонутриенты полезны для организма человека. Однако избыточное потребление некоторых фитонутриентов может иметь побочные эффекты. Фитохимические вещества, токсичные для человека, известны как фитотоксины. Некоторые фитонутриенты обладают свойствами муравьиных питательных веществ, которые мешают усвоению питательных веществ. А некоторые фитонутриенты, такие как полифенолы и флавоноиды, являются прооксидантами в больших количествах.

Таким образом, ожидается, что побочные эффекты, вызванные чрезмерным потреблением фитонутриентов, поставят под угрозу спрос на рынке фитонутриентов на Ближнем Востоке и в Африке.

В этом отчете о рынке фитонутриентов Ближнего Востока и Африки содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке фитонутриентов Ближнего Востока и Африки, свяжитесь с Data Bridge Market Research для получения аналитического обзора; наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок фитонутриентов на Ближнем Востоке и в Африке

Влияние пандемии COVID-19 привело к карантину в большинстве стран для ограничения распространения вируса, что сильно повлияло на все виды промышленности. Рост рынка фитонутриентов на Ближнем Востоке и в Африке во всем мире создал чрезвычайную неопределенность из-за вспышки COVID-19. Поддержание движения продуктов питания по всей пищевой цепочке имеет важное значение для пищевой промышленности и индустрии напитков. Большинство компаний возобновили работу после правительственных указаний, что положительно повлияло на рост рынка в последующие годы.

Недавнее развитие

- В марте 2021 года DSM выпустила в Австралии ampli-D — в три раза более быструю форму добавки витамина D. Этот запуск продукта помог компании расширить свой продуктовый портфель

Масштаб рынка фитонутриентов на Ближнем Востоке и в Африке

Рынок фитонутриентов Ближнего Востока и Африки сегментирован по типу, источнику, природе, категории, форме, функции и применению. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип

- Флавоноиды

- Каротиноиды

- Полифенолы

- Алкалоиды

- Фитостеролы

- Витамины

- Монотерпены

- Ресвератрол

- Фитоэстрогены

- Изотиоцианаты

- Аллилсульфиды

- Глюкозинолаты

- Лигнаны

- Беталаины

- Другие.

По типу рынок фитонутриентов Ближнего Востока и Африки сегментируется на флавоноиды, каротиноиды, полифенолы, алкалоиды, фитостерины, витамины, монотерпены, ресвератрол, фитоэстрогены, изотиоцианаты, аллилсульфиды, глюкозинолаты, лигнаны, беталаины и другие.

Форма

- Сухой

- Жидкость

По форме рынок фитонутриентов на Ближнем Востоке и в Африке сегментируется на сухие и жидкие.

Категория

- Органический

- Общепринятый

По категориям рынок фитонутриентов Ближнего Востока и Африки сегментируется на органический и традиционный.

Природа

- Смешанный

- Чистый

По признаку природы рынок фитонутриентов Ближнего Востока и Африки сегментирован на смешанные и чистые.

Функция

- Иммунная система

- Зрение

- Здоровье кожи

- Здоровье костей

- Здоровье сердечно-сосудистой системы

- Противораковое

- Здоровье легких

- Здоровье кровеносных сосудов

- Здоровье женщины

- Антихолестерин

- Другие

На основе функций рынок фитонутриентов Ближнего Востока и Африки сегментирован на следующие группы: средства для защиты иммунной системы, зрения, здоровья кожи, здоровья костей, сердечно-сосудистых заболеваний, противораковые средства, средства для здоровья легких, кровеносных сосудов, женского здоровья, средства для борьбы с холестерином и другие.

Источник

- специи

- Трава

- Цветок

- Чай

- Фрукты

- Овощи

- Зерновые

- Бобовые

- Масличные семена

- Экстракт морских растений

По признаку природы рынок фитонутриентов Ближнего Востока и Африки сегментирован на специи, травы, цветы, чай, фрукты, овощи, злаки, бобовые, масличные семена, экстракты морских растений.

Приложение

- Продукты питания

- Напитки

- Нутрицевтики

- Диетические добавки

- Косметика и средства личной гигиены

- Корм для животных

- Фармацевтика

- Другие

По сфере применения рынок фитонутриентов Ближнего Востока и Африки сегментируется на продукты питания, напитки, нутрицевтики и диетические добавки, косметику и средства личной гигиены, корма для животных, фармацевтические препараты и т. д.

Региональный анализ/информация о рынке фитонутриентов на Ближнем Востоке и в Африке

Проведен анализ рынка фитонутриентов на Ближнем Востоке и в Африке, а также предоставлены сведения о размерах рынка и тенденциях на основе страны, типа, источника, природы, категории, формы, функции и применения, как указано выше.

В отчете о рынке фитонутриентов на Ближнем Востоке и в Африке рассматриваются следующие страны: Южная Африка, Саудовская Аравия, ОАЭ, Кувейт, Оман, Катар и остальные страны Ближнего Востока и Африки.

Ожидается, что ОАЭ будут доминировать на рынке фитонутриентов Ближнего Востока и Африки с точки зрения доли рынка и доходов рынка и продолжат процветать в течение прогнозируемого периода. Рост в регионе объясняется растущим спросом на косметику и средства личной гигиены в сочетании с растущей осведомленностью о пользе фитонутриентов для здоровья.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые и заменяющие продажи, демография страны, эпидемиология заболеваний и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки, а также их проблемы, связанные с высокой конкуренцией со стороны местных и отечественных брендов, и влияние каналов продаж.

Конкурентная среда и анализ доли рынка фитонутриентов на Ближнем Востоке и в Африке

Конкурентная среда рынка фитонутриентов Ближнего Востока и Африки содержит сведения о конкурентах. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие на Ближнем Востоке и в Африке, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта и доминирование в применении. Приведенные выше данные относятся только к фокусу компаний на рынке фитонутриентов Ближнего Востока и Африки.

Некоторые из ключевых игроков на рынке фитонутриентов на Ближнем Востоке и в Африке включают ConnOils LLC, Ashland, Vitae Caps SA, IFF Nutrition & Biosciences, Kothari Phytochemicals International, Sabinsa, Merck KGaA, BTSA, ExcelVite, NutriScience Innovations, LLC, Cyanotech Corporation, Bio-India Biologicals (BIB) Corporation, Brlb International, Hindustan Herbals, Lycored, DSM, ADM, BASF SE, Cargill, Incorporated., MANUS AKTTEVA BIOPHARMA LLP, Döhler GMBH и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, глобальный и региональный и анализ доли поставщиков. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGIES

4.1.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.1.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.1.3 A VAST NETWORK OF DISTRIBUTION

4.1.4 STRATEGIC DECISIONS BY KEY PLAYERS

4.2 PATENT ANALYSIS OF MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

4.2.1 DBMR ANALYSIS

4.2.2 COUNTRY LEVEL ANALYSIS

4.2.3 YEARWISE ANALYSIS

4.3 EXTRACTION PROCESS

4.4 CERTIFICATION

4.5 TECHNOLOGICAL CHALLENGES

4.6 LIST OF SUBSTITUTES

4.7 HEALTH CLAIMS OF PHYTONUTRIENTS

4.8 NUTRITIONAL FACTS OF PHYTONUTRIENTS

4.8.1 RECOMMENDED INTAKE OF PHYTONUTRIENTS

4.9 RAW MATERIAL PRICING ANALYSIS

4.9.1 GEOGRAPHICAL PRICING

4.9.2 DEMAND FACTOR IN PRICING

4.9.3 GEOGRAPHICAL PRICING

4.9.4 DEMAND FACTOR IN PRICING

4.1 CONSUMPTION ANALYSIS FOR PHYTONUTRIENT INTAKES IN EUROPEAN COUNTRIES

4.11 IMPORT-EXPORT ANALYSIS

4.12 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SUPPLY CHAIN ANALYSIS

4.13 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

4.14 IMPORT-EXPORT ANALYSIS

5 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: REGULATIONS

5.1 FDA REGULATIONS

5.2 EU REGULATIONS

5.3 USDA REGULATIONS

5.4 FAO REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FOOD & BEVERAGE PRODUCTS

6.1.2 INCREASING DEMAND FOR ANIMAL FEED

6.1.3 INCREASING DEMAND FOR NUTRACEUTICAL PRODUCTS

6.1.4 NUMEROUS HEALTH BENEFITS ASSOCIATED WITH PHYTONUTRIENTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES

6.2.2 QUALITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR NATURAL FOOD PRODUCTS

6.3.2 INCREASING DEMAND FOR CAROTENOIDS IN VARIOUS END-USE INDUSTRIES

6.3.3 GROWING DEMAND FOR NATURAL SKINCARE AND COSMETIC PRODUCTS

6.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF PHYTONUTRIENTS

7 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLAVONOIDS

7.3 CAROTENOIDS

7.4 POLYPHENOLS

7.5 ALKALOIDS

7.6 PHYTOSTEROLS

7.7 VITAMIN

7.8 MONOTERPENES

7.9 RESVERATROL

7.1 PHYTOESTROGENS

7.11 ISOTHIOCYANATES

7.12 ALLYL SULFIDES

7.13 GLUCOSINOLATES

7.14 LIGNANS

7.15 BETALAINS

7.16 OTHERS

8 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 FRUIT

8.3 VEGETABLES

8.4 CEREALS

8.5 LEGUMES

8.6 TEA

8.7 FLOWER

8.8 HERBS

8.9 MARINE PLANT EXTRACTS

8.1 OILSEEDS

8.11 SPICE

9 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 BLENDED

11.3 PURE

12 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 IMMUNE SYSTEM

12.3 BONE HEALTH

12.4 CARDIOVASCULAR HEALTH

12.5 VISION

12.6 ANTI-CANCER

12.7 ANTI-CHOLESTEROL

12.8 WOMEN HEALTH

12.9 BLOOD VESSEL HEALTH

12.1 SKIN HEALTH

12.11 LUNG HEALTH

12.12 OTHERS

13 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD PRODUCTS

13.3 BEVERAGES

13.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

13.5 COSMETICS AND PERSONAL CARE

13.6 PHARMACEUTICALS

13.7 ANIMAL FEED

13.8 OTHERS

14 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 KUWAIT

14.1.5 OMAN

14.1.6 QATAR

14.1.7 REST OF MIDDLE EAST AFRICA

15 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MERCK KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 BASF SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 IFF NUTRITION & BIOSCIENCES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KOTHARI PHYTOCHEMICALS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 ASHLAND

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 AAYURITZ PHYTONUTRIENTS PVT.LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 AOM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARBORIS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIO-INDIA BIOLOGICALS (BIB) CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 BRLB INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BTSA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CONNOILS LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 CYANOTECH CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUS ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 DÖHLER GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 DYNADIS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ELEMENTA

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 EXCELVITE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 GUSTAV PARMENTIER GMBH

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 HERBAL CREATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 HINDUSTAN HERBALS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 LYCORED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MATRIX LIFE SCIENCE PVT. LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 MANUS AKTTEVA BIOPHARMA LLP

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 NUTRISCIENCE INNOVATIONS, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PHYTOSOURCE, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 PRINOVA GROUP LLC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 SABINSA

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

17.31 VITAE CAPS S.A.

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 XI'AN HEALTHFUL BIOTECHNOLOGY CO., LTD

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 LIST OF SUBSTITUTE

TABLE 2 POTENTIAL BENEFITS OF PHYTONUTRIENT COMPOUNDS.

TABLE 3 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED FRUITS, YEAR (2019-2021)

TABLE 4 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED VEGETABLES, YEAR (2019-2021)

TABLE 5 EUROPEAN UNION FRUITS PRICES: (2021)

TABLE 6 EUROPEAN UNION VEGETABLES PRICES: (2021)

TABLE 7 WORLD FRUITS AND VEGETABLE PRODUCTION, (MILLION TONS), 2018

TABLE 8 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 9 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 10 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 11 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 12 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 13 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 14 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 15 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 16 LIST OF SOME PHYTONUTRIENTS USED IN NUTRACEUTICAL PRODUCTS

TABLE 17 FLAVONOIDS AND SOURCES

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING USE OF PHYTONUTRIENTS IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS LEAD TO THE GROWTH OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET IN 2022 & 2029

FIGURE 14 PATENT REGISTERED FOR PHYTONUTRIENTS, BY COUNTRY

FIGURE 15 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 16 VALUE CHAIN OF PHYTONUTRIENTS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

FIGURE 18 POULTRY MEAT CONSUMPTION KILOGRAMS PER CAPITA GROWTH FROM 2019-2021

FIGURE 19 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY SOURCE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY CATEGORY, 2021

FIGURE 23 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY NATURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FUNCTION, 2021

FIGURE 25 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY APPLICATION, 2021

FIGURE 26 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY TYPE (2022 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.