Middle East And Africa Passive Fire Protection Coating Market

Размер рынка в млрд долларов США

CAGR :

%

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

| 2024 –2031 | |

| USD 143,277.58 Thousand | |

| USD 184,292.51 Thousand | |

|

|

|

|

Рынок пассивных огнезащитных покрытий на Ближнем Востоке по типу продукции (цементные материалы и вспучивающиеся покрытия), технологии (защитные покрытия на водной основе и защитные покрытия на основе растворителей), конечному использованию (строительство, нефть и газ, автомобилестроение, аэрокосмическая и оборонная промышленность, электротехника и электроника, текстиль, мебель и другие) — отраслевые тенденции и прогноз до 2031 года.

Анализ и аналитика рынка пассивных огнезащитных покрытий на Ближнем Востоке

Отчет о рынке пассивных огнезащитных покрытий на Ближнем Востоке содержит подробную информацию о доле рынка, новых разработках и влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического брифинга, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

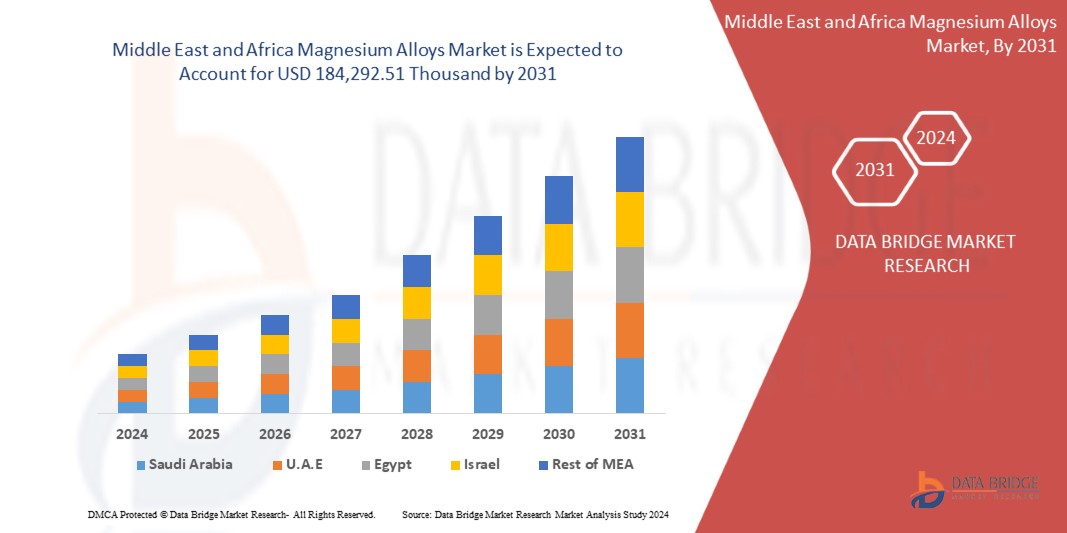

По данным исследования рынка Data Bridge, ожидается, что объем рынка пассивных огнезащитных покрытий на Ближнем Востоке к 2031 году достигнет 184 292,51 тыс. долларов США по сравнению с 143 277,58 тыс. долларов США в 2023 году, при этом среднегодовой темп роста составит 3,4% в прогнозируемый период с 2024 по 2031 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2024-2031 |

|

Базовый год |

2023 |

|

Исторические годы |

2022 (Можно настроить на 2016–2021 гг.) |

|

Количественные единицы |

Выручка в тыс. долл. США и объем в тоннах |

|

Охваченные сегменты |

Тип продукта (цементный материал и вспучивающееся покрытие), технология (защитное покрытие на водной основе и защитное покрытие на основе растворителя), конечное использование (строительство, нефть и газ, автомобилестроение, аэрокосмическая и оборонная промышленность, электротехника и электроника, текстиль , мебель и другие) |

|

Страны, охваченные |

Саудовская Аравия, Объединенные Арабские Эмираты, Кувейт, Израиль, Оман, Бахрейн, Ливан, Египет, остальной Ближний Восток |

|

Охваченные участники рынка |

3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (дочерняя компания Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION и Lanexis Enterprises (P) Ltd. и другие |

Определение рынка

Противопожарные покрытия состоят из различных наполнителей и антипиренов. Они используются для предотвращения быстрого распространения пламени по поверхности и ограничения времени, в течение которого они подвергаются воздействию экстремального тепла. Они также уменьшают образование газов, возникающих в результате сгорания материалов. Пассивная противопожарная защита (ПЗП) — это компоненты здания или сооружения, которые замедляют или препятствуют распространению огня или дыма без активации системы и, как правило, без движения. Примерами пассивных систем являются напольные покрытия и крыши, противопожарные двери, окна и стеновые конструкции, огнестойкие покрытия и другие противопожарные и противодымные конструкции. Пассивные противопожарные системы могут включать активные компоненты, такие как противопожарные заслонки.

Динамика рынка пассивных огнезащитных покрытий на Ближнем Востоке

Драйверы

- Растущее использование пассивных противопожарных покрытий в различных отраслях промышленности

Пассивные системы противопожарной защиты состоят из инструментов и других инженерных решений, которые уменьшают возникновение пожара или задерживают его распространение на объекте на определенный период. Это снижает степень ущерба, риск для жизни и дает людям больше времени, чтобы покинуть учреждение, и достаточно времени для реагирования и действий аварийных служб. Пассивная противопожарная защита обычно используется в высотных зданиях, домах, гостиницах, больницах, промышленных объектах, школах, складах, железных дорогах, автостоянках, железных дорогах, мостах, супермаркетах и наземных и морских углеводородах. Пассивные противопожарные покрытия становятся все более важными в нефтегазовой промышленности. Применяемые на промышленных нефтегазовых установках, покрытия расширяются, образуя изолирующий слой углеродного угля при воздействии высоких температур. Это позволяет стали сохранять свою несущую способность до четырех часов дольше во время пожара, давая людям драгоценное время, чтобы покинуть здание, а пожарным — потушить пожар.

- Растущий спрос на огнезащитные покрытия на водной основе

Строительный и инфраструктурный секторы Ближнего Востока процветают, создавая значительный спрос на огнезащитные покрытия. Покрытия на водной основе предлагают экономически эффективные решения благодаря низкому содержанию летучих органических соединений (ЛОС) и простоте нанесения, что делает их экономически выгодными для крупномасштабных проектов.

Покрытия на водной основе становятся все более привлекательными из-за своих экономических преимуществ. Хотя покрытия на водной основе могут иметь более высокую начальную стоимость, чем покрытия на основе растворителей, они обеспечивают долгосрочные преимущества в плане затрат благодаря своей долговечности, простоте обслуживания и меньшему воздействию на окружающую среду. В развивающихся секторах строительства и инфраструктуры на Ближнем Востоке, где типичны крупномасштабные проекты, экономическая эффективность покрытий на водной основе привлекает разработчиков и руководителей проектов.

Возможности

- Технологический прогресс в разведке нефти и газа

Технологические достижения в области сейсмической визуализации, геофизических исследований и методов дистанционного зондирования позволили проводить более точную и эффективную разведку нефти и газа. Это привело к увеличению объемов разведочных работ на Ближнем Востоке, что привело к повышению спроса на пассивные противопожарные покрытия для защиты критически важной инфраструктуры в нефтегазовом секторе. Разведка нефти и газа часто проводится в суровых условиях, включая морские буровые платформы и удаленные береговые объекты. Современные пассивные противопожарные покрытия необходимы для снижения риска возникновения пожаров в этих сложных условиях, обеспечивая безопасность и целостность конструкций.

Разведка нефти и газа часто происходит в суровых условиях, включая морские буровые платформы и удаленные береговые объекты. Современные пассивные противопожарные покрытия необходимы для снижения риска возникновения пожаров в этих сложных условиях, обеспечивая безопасность и целостность конструкций. Внедрение современных материалов и технологий в пассивные противопожарные покрытия повышает их прочность и долговечность. По мере расширения разведочных работ возникает потребность в покрытиях, которые могут выдерживать суровый климат Ближнего Востока и обеспечивать долгосрочную защиту от пожаров.

Ограничения/Проблемы

- Неправильная установка пассивного противопожарного покрытия

Неправильная установка подрывает эффективность пассивных противопожарных покрытий, снижая их способность сдерживать и предотвращать распространение пожаров. В отраслях с высоким риском, таких как нефтегазовая, нефтехимическая и инфраструктурная, где строгие правила пожарной безопасности имеют жизненно важное значение, любые ошибки при установке могут иметь катастрофические последствия, включая гибель людей, ущерб имуществу и экологические риски. Такие случаи подрывают доверие к пассивным противопожарным покрытиям и отпугивают потенциальных клиентов от инвестиций в эти технологии, ограничивая рост рынка.

Кроме того, неправильная установка может привести к несоблюдению нормативных требований и строительных правил, подвергая застройщиков, подрядчиков и владельцев зданий юридической ответственности и штрафам. Правительства стран Ближнего Востока применяют строгие законы о пожарной безопасности, которые требуют надлежащей установки пассивных противопожарных покрытий в определенных зонах. Несоблюдение этих правил ставит под угрозу не только безопасность, но и корпоративные операции и графики проектов, отбивая у заинтересованных сторон желание инвестировать в пассивные противопожарные покрытия.

- Конкуренция со стороны альтернативных решений по противопожарной защите

Наличие более дешевых альтернатив на рынке является проблемой для роста рынка и в конечном итоге сокращает потребление огнезащитных покрытий. Огнезащитные покрытия сравнительно дороже других огнетушащих продуктов (активные огнезащитные покрытия), поскольку эти покрытия наносятся или распыляются, что требует человеческих ресурсов, а также времени, что делает покрытия более дорогими. Эти системы подразумевают использование активных мер, таких как спринклеры, системы водяного тумана или газовые системы пожаротушения, для быстрого обнаружения и тушения пожаров. Они предназначены для активной борьбы и тушения пожаров на ранних стадиях. В отличие от пассивных решений, таких как покрытия, активные системы пожаротушения обеспечивают немедленное и прямое вмешательство. Строительные материалы с присущими им огнестойкими свойствами являются еще одной альтернативой. Эти материалы, такие как огнестойкие гипсокартонные плиты, обработанная огнезащитным составом древесина или бетон с огнестойкими добавками, интегрированы в конструкцию здания. Они предлагают пассивный подход, изначально противодействуя распространению огня без необходимости в дополнительных покрытиях.

Недавнее развитие

- В феврале 2024 года компания AkzoNobel завершила значительное расширение мощностей на своем заводе по производству порошковых покрытий в Комо, Италия. Ожидается, что это расширение, включающее инвестиции в размере 21 миллиона долларов США, повысит способность компании удовлетворять растущий спрос на свою продукцию в Европе, на Ближнем Востоке и в Африке (EMEA). Завершение четырех новых производственных линий, в частности двух для автомобильных грунтовок и двух для архитектурных покрытий, знаменует собой существенную веху в проекте. Кроме того, включение новых линий оборудования для склеивания дополнительно гарантирует, что производимая продукция не только соответствует, но и превосходит отраслевые стандарты, что подтверждает приверженность AkzoNobel поставке высококачественных покрытий своим клиентам в регионе EMEA

- В декабре 2023 года компания Hempel A/S объявила о запуске HEET Dynamic — инновационного нового программного обеспечения для нанесения покрытий, специально разработанного для того, чтобы сделать оценку огнестойкости вспучивающихся покрытий на стальных секциях более быстрой, простой и точной для инженеров-строителей и сметчиков. Это поможет инженерам более точно исследовать стальные конструкции и другие поверхности, на которые наносятся огнестойкие вспучивающиеся покрытия, что делает его крайне необходимым инструментом. В конечном итоге это увеличит доход компании

Объем рынка пассивных огнезащитных покрытий на Ближнем Востоке

Рынок пассивных огнезащитных покрытий Ближнего Востока классифицируется на основе типа продукта, технологии и конечного использования. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип продукта

- Вспучивающееся покрытие

- Цементный материал

По типу продукции рынок сегментируется на вспучивающиеся покрытия и цементные материалы.

Технологии

- Защитное покрытие на основе растворителя

- Защитное покрытие на водной основе

По технологическому признаку рынок сегментируется на защитные покрытия на основе растворителей и защитные покрытия на водной основе.

Конечное использование

- Строительство и возведение

- Нефть и газ

- Автомобильный

- Аэрокосмическая промышленность и оборона

- Электрика и электроника

- Текстиль

- Мебель

- Другие

По целевому назначению рынок сегментируется на строительство, нефть и газ, автомобилестроение, аэрокосмическую и оборонную промышленность, электротехнику и электронику, текстиль, мебель и другие.

Рынок пассивных огнезащитных покрытий на Ближнем Востоке: региональный анализ/анализ

Рынок пассивных огнезащитных покрытий на Ближнем Востоке сегментирован по типу продукта, технологии и конечному использованию.

Страны, охваченные ближневосточным рынком пассивных огнезащитных покрытий: Саудовская Аравия, Объединенные Арабские Эмираты, Кувейт, Израиль, Оман, Бахрейн, Ливан, Египет и остальные страны Ближнего Востока.

Ожидается, что Саудовская Аравия будет доминировать на рынке благодаря своему бурно развивающемуся строительному сектору, строгим правилам пожарной безопасности и обширным инвестициям в инфраструктурные проекты. Масштабные разработки страны, такие как коммерческие комплексы, промышленные объекты и жилые здания, обуславливают значительный спрос на решения по противопожарной защите.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Анализ цепочек создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Рынок пассивных огнезащитных покрытий на Ближнем Востоке: конкурентная среда и анализ доли

Конкурентная среда рынка пассивных огнезащитных покрытий на Ближнем Востоке содержит сведения о конкурентах. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, производственных площадках и объектах, сильных и слабых сторонах компании, запуске продукта, испытаниях продукта, одобрении продукта, патентах, широте и широте продукта, доминировании приложений, жизненно важной кривой технологии. Приведенные выше данные относятся только к фокусу компании на рынке.

Среди основных игроков, работающих на рынке пассивных огнезащитных покрытий на Ближнем Востоке, можно назвать 3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (дочерняя компания Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION и Lanexis Enterprises (P) Ltd. и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 GEOGRAPHIC SCOPE

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DBMR MARKET SWOT MODEL

2.7 TYPE LIFE LINE CURVE

2.8 MULTIVARIATE MODELING

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET END-USE COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 RAW MATERIAL COVERAGE

4.7.1 RAW MATERIAL PRODUCTION COVERAGE

4.7.2 AMMONIUM POLYPHOSPHATE (APP)

4.7.3 CHLORINATED PARAFFIN 70% (SOLID CP)

4.7.4 EXPANDABLE GRAPHITE

4.7.5 MELAMINE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF PASSIVE FIRE PROTECTION COATINGS IN VARIOUS INDUSTRIES

6.1.2 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS

6.1.3 GOVERNMENT REGULATIONS FAVORING THE FIRE PROTECTION COATINGS

6.2 RESTRAINTS

6.2.1 IMPROPER INSTALLATION OF PASSIVE FIRE PROTECTION COATING

6.2.2 USE OF HARMFUL CHEMICALS IN MANUFACTURING

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENT IN OIL AND GAS EXPLORATION ACTIVITIES

6.3.2 INCREASE IN RESEARCH AND DEVELOPMENT OF NEW PRODUCTS

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FIRE PROTECTION SOLUTIONS

6.4.2 FAILURE IN DIAGNOSING FIREPROOFING

7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 INTUMESCENT COATING

7.3 CEMENTITIOUS MATERIAL

8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 SOLVENT-BASED PROTECTION COATING

8.3 WATER-BASED PROTECTION COATING

9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.3 OIL & GAS

9.4 FURNITURE

9.5 AUTOMOTIVE

9.6 AEROSPACE & DEFENSE

9.7 ELECTRICAL AND ELECTRONICS

9.8 TEXTILE

9.9 OTHERS

10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY

10.1 SAUDI ARABIA

10.2 UNITED ARAB EMIRATES

10.3 KUWAIT

10.4 ISRAEL

10.5 OMAN

10.6 BAHRAIN

10.7 LEBANON

10.8 EGYPT

10.9 REST OF MIDDLE EAST

11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET-: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INTERNATIONAL VS MIDDLE EAST REGION

11.2 EXPANSION

11.3 COLLABORATION

11.4 CERTIFICATION

11.5 CERTIFICATION

11.6 ALLIANCE

11.7 PRODUCT LAUNCH

11.8 COMMITMENT

11.9 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 GCP APPLIED TECHNOLOGIES INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 ETEX GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 PPG INDUSTRIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 3M

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AKZO NOBEL N.V.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ARABIAN VERMICULITE INDUSTRIES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CARBOLINE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CHAROAT PASSIVE FIRE PROTECTION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 HEMPEL A/S

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HILTI

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 ISOLATEK INTERNATIONAL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOTUN

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 KANSAI PAINT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 LANEXIS ENTERPRISES (P) LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SIKA AG

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SVT GROUP OF COMPANIES

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Список таблиц

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 4 MIDDLE EAST INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 10 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 21 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 23 SAUDI ARABIA INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SAUDI ARABIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 27 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 28 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 29 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 32 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 SAUDI ARABIA FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 SAUDI ARABIA AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 SAUDI ARABIA AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 SAUDI ARABIA TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 40 UNITED ARAB EMIRATES INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 UNITED ARAB EMIRATES CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 43 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 44 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 45 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 46 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 49 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 UNITED ARAB EMIRATES FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 UNITED ARAB EMIRATES AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 UNITED ARAB EMIRATES ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 UNITED ARAB EMIRATES TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 57 KUWAIT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 KUWAIT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 60 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 61 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 62 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 63 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 66 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 KUWAIT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 KUWAIT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 KUWAIT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 KUWAIT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 KUWAIT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 74 ISRAEL INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 ISRAEL CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 77 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 78 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 79 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD TONS)

TABLE 80 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 83 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 ISRAEL FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 ISRAEL AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 ISRAEL AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 ISRAEL ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 ISRAEL TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 91 OMAN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 OMAN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 94 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 95 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 96 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 97 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 100 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 OMAN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 OMAN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 OMAN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 OMAN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 OMAN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 108 BAHRAIN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 BAHRAIN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 111 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 112 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 113 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 114 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 117 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 BAHRAIN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 BAHRAIN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 BAHRAIN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 BAHRAIN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 BAHRAIN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 125 LEBANON INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 LEBANON CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 128 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 129 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 130 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 131 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 134 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 LEBANON FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 LEBANON AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 LEBANON AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 LEBANON ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 LEBANON TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 142 EGYPT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 EGYPT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 145 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 146 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 147 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 148 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 151 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 EGYPT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 EGYPT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 EGYPT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 EGYPT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 EGYPT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

Список рисунков

FIGURE 1 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DATA VALIDATION MODEL

FIGURE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS IS DRIVING THE GROWTH OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 15 INTEUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

FIGURE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY PRODUCT TYPE, 2023

FIGURE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY TECHNOLOGY, 2023

FIGURE 21 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY END-USE, 2023

FIGURE 22 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SNAPSHOT (2023)

FIGURE 23 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY SHARE 2023 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.