Middle East And Africa Meat Poultry And Seafood Processing Equipment Market

Размер рынка в млрд долларов США

CAGR :

%

USD

717.65 Million

USD

982.16 Million

2024

2032

USD

717.65 Million

USD

982.16 Million

2024

2032

| 2025 –2032 | |

| USD 717.65 Million | |

| USD 982.16 Million | |

|

|

|

|

Сегментация рынка оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке по типу оборудования (порционирующее оборудование, оборудование для жарки, фильтрующее оборудование, оборудование для нанесения покрытий, оборудование для приготовления пищи, коптильное оборудование, оборудование для убоя/убоя, холодильное оборудование, обработка под высоким давлением (процессор высокого давления), массажное оборудование и другие), процессу (измельчение, увеличение, гомогенизация, смешивание и другие), режиму работы (автоматический, полуавтоматический и ручной), применению (свежеобработанное, сырое приготовленное, предварительно приготовленное, сырое ферментированное, сушеное, вяленое, замороженное и другие), функции (резка, смешивание, тендеризация, наполнение, маринование, нарезка, измельчение, копчение, убой и удаление перьев, обвалка и снятие шкуры, потрошение, потрошение, филетирование и другие), типу перерабатываемых продуктов (мясо, птица и морепродукты) — отрасль Тенденции и прогноз до 2032 года.

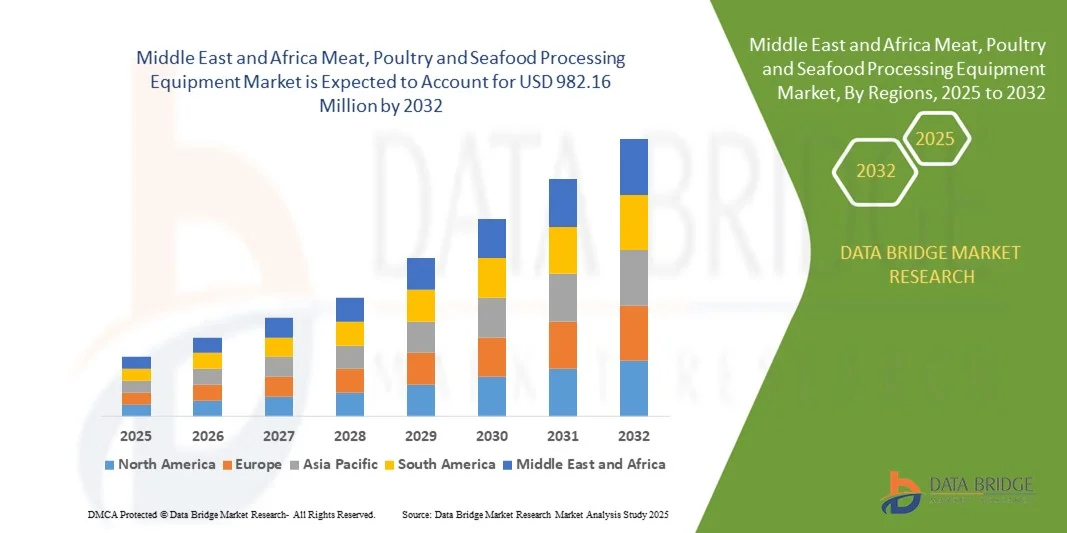

Каковы размер и темпы роста рынка оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке?

- Объем рынка оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке оценивался в 717,65 млн долларов США в 2024 году и , как ожидается, достигнет 982,16 млн долларов США к 2032 году при среднегодовом темпе роста 4,00% в течение прогнозируемого периода.

- Рост потребления переработанного мяса, птицы и морепродуктов, а также рост числа сетей ресторанов быстрого питания и ресторанов на рынке приводят к росту спроса на более качественные переработанные мясные и другие продукты. Кроме того, технологический прогресс на рынке оборудования, особенно в сфере переработки мяса, птицы и морепродуктов, привел к росту рыночной стоимости.

- Факторами, сдерживающими рост рынка, являются высокие капиталовложения, медленная замена оборудования из-за длительного срока службы.

Каковы основные выводы рынка оборудования для переработки мяса, птицы и морепродуктов?

- Повышение автоматизации в пищевой промышленности может стать лучшей возможностью для рынка оборудования для переработки мяса, птицы и морепродуктов.

- Высокая стоимость оборудования, слабая инфраструктура в развивающихся странах и чрезмерное использование воды при переработке и очистке трубопроводов могут представлять угрозу для рынка.

- В 2025 году Саудовская Аравия доминировала на рынке оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке, заняв самую большую долю выручки в 28,7%, что обусловлено растущим спросом на модернизированные мясоперерабатывающие предприятия, автоматизацию и инфраструктуру холодильной цепи.

- Прогнозируется, что рынок оборудования для переработки мяса, птицы и морепродуктов в ОАЭ продемонстрирует самые высокие темпы роста — 12,1%, что обусловлено быстрой урбанизацией, ростом спроса на переработанное мясо и морепродукты, а также государственными инициативами, стимулирующими местное производство продуктов питания.

- Сегмент оборудования для резки и порционирования доминировал на рынке в 2025 году с долей рынка 32,8%, что обусловлено растущим спросом на точную нарезку, контроль порций и автоматизированную разделку на крупных заводах по переработке мяса и морепродуктов.

Область применения отчета и сегментация рынка оборудования для переработки мяса, птицы и морепродуктов

|

Атрибуты |

Ключевые данные о рынке оборудования для переработки мяса, птицы и морепродуктов |

|

Охваченные сегменты |

|

|

Страны действия |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Какова основная тенденция на рынке оборудования для переработки мяса, птицы и морепродуктов?

Технологии автоматизации и устойчивой обработки

- Одной из основных тенденций, определяющих рынок оборудования для переработки мяса, птицы и морепродуктов, является быстрое внедрение автоматизации и экологичных систем переработки, призванных повысить эффективность, сократить отходы и повысить безопасность пищевых продуктов. Растущий акцент на энергоэффективности и гигиеничном дизайне побуждает производителей к внедрению экологически безопасных инноваций.

- Компании все чаще интегрируют робототехнику, системы контроля на базе искусственного интеллекта и системы мониторинга на базе Интернета вещей для оптимизации процессов обвалки, разделки и упаковки, обеспечивая точность и снижая количество человеческих ошибок.

- Кроме того, все большую популярность приобретает использование технологий экономии воды и сокращения отходов, поскольку переработчики стремятся соответствовать нормам устойчивого развития и снижать эксплуатационные расходы.

- Ярким примером является компания GEA Group Aktiengesellschaft (Германия), которая представила свою линию устойчивой переработки, объединяющую интеллектуальную автоматизацию, эффективное охлаждение и системы утилизации отходов для оптимизации производства мяса и морепродуктов.

- Этот переход к интеллектуальным, экологичным и энергосберегающим решениям трансформирует отрасль, стимулируя инвестиции в оборудование нового поколения, сочетающее в себе производительность, безопасность и устойчивое развитие.

Каковы основные движущие силы рынка оборудования для переработки мяса, птицы и морепродуктов?

- Рост мирового потребления богатых белком продуктов и увеличение спроса на переработанное мясо и морепродукты являются ключевыми факторами роста рынка. Потребители ищут удобные, безопасные и гигиеничные варианты продуктов питания, что стимулирует модернизацию оборудования.

- Например, в 2025 году компания Marel (Исландия) расширила свою линейку продукции, добавив автоматизированные системы порционирования и нарезки, которые повышают точность выхода и однородность продукции при переработке птицы и морепродуктов.

- Отрасль также выигрывает от государственных инвестиций в регулирование безопасности пищевых продуктов и экспортную инфраструктуру, стимулируя спрос на современное перерабатывающее оборудование.

- Более того, рост производства готовых к употреблению (RTE) и замороженных продуктов ускорил модернизацию оборудования для улучшения возможностей упаковки, охлаждения и хранения.

- Такие инновации, как системы сортировки на основе искусственного интеллекта, гигиеничные конвейеры и технологии вакуумной герметизации, еще больше повышают качество продукции, продлевают срок ее годности и способствуют расширению рынка в промышленных и коммерческих сегментах.

Какой фактор препятствует росту рынка оборудования для переработки мяса, птицы и морепродуктов?

- Высокие капитальные вложения и затраты на техническое обслуживание остаются основными проблемами, ограничивающими внедрение, особенно среди малых и средних переработчиков. Оборудование, такое как автоматизированные обвалочные машины и вакуумные шприцы, требует значительных первоначальных затрат.

- Например, в 2025 году рост цен на нержавеющую сталь и электронные компоненты привел к увеличению затрат на производство оборудования для таких ключевых игроков, как BAADER (Германия) и JBT Corporation (США), что повлияло на рентабельность.

- Кроме того, сложные требования к очистке и санитарии могут увеличить время простоя, что скажется на эффективности производства.

- Экологические и энергетические нормы также требуют от компаний постоянной модернизации систем для снижения выбросов и сокращения потребления воды.

- Несмотря на эти препятствия, такие компании, как GEA Group Aktiengesellschaft и Key Technology (США), решают эти проблемы, разрабатывая модульные, энергоэффективные и легко моющиеся конструкции. Баланс между стоимостью, соответствием требованиям и устойчивым развитием остаётся критически важным для обеспечения долгосрочного роста и конкурентоспособности на рынке.

Как сегментирован рынок оборудования для переработки мяса, птицы и морепродуктов?

Рынок оборудования для переработки мяса, птицы и морепродуктов сегментирован по типу оборудования, процессу, режиму работы, применению, функциям и типу перерабатываемого продукта.

- По типу оборудования

По типу оборудования рынок сегментируется на оборудование для порционирования, оборудование для жарки, фильтрующее оборудование, оборудование для нанесения покрытий, оборудование для приготовления пищи, коптильное оборудование, оборудование для убоя/убоя, холодильное оборудование, оборудование для обработки под высоким давлением (HPP), массажное оборудование и другие. Сегмент оборудования для резки и порционирования доминировал на рынке в 2025 году с долей рынка 32,8%, что обусловлено растущим спросом на высокоточную нарезку, контроль порций и автоматизированную обрезку на крупных предприятиях по переработке мяса и морепродуктов. Эти системы повышают эффективность, минимизируют отходы и поддерживают стабильное качество продукции.

Прогнозируется, что сегмент оборудования для обработки под высоким давлением (HPP) будет демонстрировать самые быстрые темпы среднегодового роста в период с 2026 по 2033 год, что будет обусловлено более широким внедрением технологий нетермической консервации для увеличения срока годности и обеспечения отсутствия патогенов в мясных и морепродуктовых продуктах без ущерба для питательной ценности или текстуры.

- По процессу

В зависимости от процесса рынок оборудования для переработки мяса, птицы и морепродуктов подразделяется на оборудование для измельчения, укрупнения, гомогенизации, смешивания и другие. В 2025 году сегмент измельчения доминировал на рынке с долей 39,5%, поскольку измельчение, резка и рубка являются важнейшими начальными этапами переработки мяса, обеспечивая постоянную текстуру и однородность продукта для колбас, котлет и продуктов из морепродуктов. Эффективность современных систем измельчения способствует оптимизации производительности и качества.

Ожидается, что сегмент смешивания будет демонстрировать самые высокие среднегодовые темпы роста в период с 2026 по 2033 год, что обусловлено растущим спросом на мясные смеси, маринады и переработанные морепродукты. Современные вакуумные и лопастные миксеры всё чаще используются для равномерного распределения ингредиентов, обеспечения однородности вкуса и повышения стабильности продукта.

- По режиму работы

По принципу работы рынок сегментируется на автоматические, полуавтоматические и ручные системы. В 2025 году сегмент автоматических систем доминировал на рынке с долей рынка 46,7%, что обусловлено растущим внедрением автоматизации для снижения трудозатрат, повышения эффективности производства и обеспечения соблюдения гигиенических норм. Автоматизированные системы объединяют робототехнику, датчики и программное обеспечение для точного выполнения таких сложных задач, как обвалка и упаковка.

Прогнозируется, что сегмент полуавтоматического оборудования будет демонстрировать самые высокие среднегодовые темпы роста в период с 2026 по 2033 год, поскольку малые и средние переработчики стремятся найти баланс между преимуществами автоматизации и доступной ценой. Полуавтоматические системы обеспечивают гибкость, снижение сложности эксплуатации и адаптируемость к различным масштабам производства.

- По применению

В зависимости от сферы применения рынок оборудования для переработки мяса, птицы и морепродуктов сегментируется на следующие категории: свежеобработанное, сыроприготовленное, полуфабрикатное, сыроферментированное, вяленое, консервированное, замороженное и другие. Сегмент свежеобработанного мяса занимал наибольшую долю рынка – 41,2% – в 2025 году благодаря высокому потреблению минимально обработанных мясных и морепродуктовых продуктов, таких как колбасы, наггетсы и котлеты, для которых требуется современное оборудование для нарезки, смешивания и панировки. Спрос поддерживается предпочтением потребителей свежих, готовых к приготовлению блюд.

Ожидается, что сегмент замороженных продуктов будет расти самыми быстрыми темпами в год в период с 2026 по 2033 год, что обусловлено растущей популярностью замороженных морепродуктов и готовых блюд во всем мире. Совершенствование технологий заморозки и логистики холодильной цепи позволяет увеличить срок хранения и сохранить текстуру и вкус.

- По функции

По функциональному назначению рынок подразделяется на следующие категории: разделка, смешивание, отбивание, наполнение, маринование, нарезка, измельчение, копчение, убой и обесперивание, обвалка и обесшкуривание, потрошение, потрошение, филетирование и другие. Сегмент разделки и нарезки доминировал на рынке в 2025 году с долей рынка 36,4%, поскольку он представляет собой ключевую функцию практически во всех операциях по переработке мяса и морепродуктов. Спрос на высокоточные системы резки и нарезки обусловлен необходимостью достижения равномерной толщины, сокращения отходов и сохранения целостности продукта.

Ожидается, что сегмент обвалки и снятия шкуры будет демонстрировать самые быстрые среднегодовые темпы роста в период с 2026 по 2033 год, что обусловлено потребностью в высокоэффективных системах, которые минимизируют ручной труд, повышают выход продукции и улучшают гигиену, особенно на линиях переработки птицы и рыбы.

- По типу переработанной продукции

По типу переработанной продукции рынок сегментирован на мясо, птицу и морепродукты. В 2025 году мясной сегмент доминировал на рынке с долей 44,9%, что обусловлено ростом потребления переработанных мясных продуктов, таких как колбасы, бекон и ветчина, особенно в Северной Америке, на Ближнем Востоке и в Африке. Для обеспечения безопасности и качества мясоперерабатывающие линии требуют использования сложных систем измельчения, посола и упаковки.

Ожидается, что сегмент морепродуктов будет расти самыми быстрыми темпами в год в период с 2026 по 2033 год, чему будет способствовать рост мирового спроса на переработанную рыбу, креветки и моллюски. Рост экспорта морепродуктов в сочетании с технологическим прогрессом в области филетирования и заморозки способствуют автоматизации и расширению мощностей на предприятиях по переработке морепродуктов по всему миру.

Какой регион занимает наибольшую долю рынка оборудования для переработки мяса, птицы и морепродуктов?

- В 2025 году Саудовская Аравия доминировала на рынке оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке, заняв самую большую долю выручки в 28,7%, что обусловлено растущим спросом на модернизированные мясоперерабатывающие предприятия, автоматизацию и инфраструктуру холодильной цепи.

- Инвестиции страны в продовольственную безопасность, промышленное птицеводство и производство мяса, а также инициативы по импортозамещению ускорили внедрение высокопроизводительного перерабатывающего оборудования. Передовые технологии убоя, обвалки и упаковки всё чаще внедряются для обеспечения соответствия стандартам HACCP и ISO по безопасности пищевых продуктов.

- В целом, ориентация Саудовской Аравии на модернизацию, расширение промышленности и соблюдение требований безопасности пищевых продуктов сделала ее ведущей страной на Ближнем Востоке и в Африке по производству оборудования для переработки мяса, птицы и морепродуктов.

Обзор рынка оборудования для переработки мяса, птицы и морепродуктов в ОАЭ

Прогнозируется, что рынок оборудования для переработки мяса, птицы и морепродуктов в ОАЭ продемонстрирует самые высокие темпы роста – 12,1%, что обусловлено быстрой урбанизацией, растущим спросом на переработанное мясо и морепродукты, а также государственными инициативами, стимулирующими местное производство продуктов питания. Производители и переработчики пищевых продуктов из ОАЭ активно инвестируют в автоматизированные системы порционирования, заморозки и упаковки, чтобы удовлетворить растущий спрос со стороны индустрии гостеприимства, розничной торговли и экспортных рынков. Интеграция интеллектуальных систем управления, энергоэффективного холодильного оборудования и гигиеничных производственных линий повышает производительность и снижает эксплуатационные расходы. Акцент ОАЭ на передовых, устойчивых и высокоэффективных технологиях переработки делает страну ключевым центром роста на рынке Ближнего Востока и Африки.

Обзор рынка оборудования для переработки мяса, птицы и морепродуктов в Египте

Рынок оборудования для переработки мяса, птицы и морепродуктов в Египте стабильно растёт, чему способствуют развитие птицеводческой и мореперерабатывающей промышленности, а также государственные инициативы по повышению безопасности пищевых продуктов и достижению самообеспеченности. Египетские производители всё чаще внедряют современное оборудование для убоя, разделки и заморозки, чтобы повысить уровень гигиены, производительности и соответствия международным экспортным стандартам. Инвестиции в инфраструктуру холодильного хранения, автоматизированное порционирование и системы нанесения покрытий дополнительно повышают эффективность. Благодаря своему стратегическому расположению, ёмкому внутреннему рынку и растущему промышленному потенциалу, Египет играет важную роль в развитии региональной отрасли оборудования для переработки мяса, птицы и морепродуктов.

Обзор рынка оборудования для переработки мяса, птицы и морепродуктов в Южной Африке

Рынок оборудования для переработки мяса, птицы и морепродуктов в ЮАР демонстрирует устойчивый рост, чему способствуют развитый экспорт мяса и растущий спрос на высококачественные переработанные продукты. Южноафриканские производители внедряют автоматизированные системы обвалки, нарезки, маринования и упаковки для повышения производительности, снижения трудозатрат и соответствия международным нормам безопасности пищевых продуктов. Инициативы в области устойчивого развития, включая энергоэффективное холодильное оборудование и водосберегающие технологические линии, также способствуют расширению рынка. В целом, сочетание экспортно-ориентированного спроса, промышленного потенциала и ориентации на устойчивое развитие укрепляет позиции ЮАР как ведущего рынка на Ближнем Востоке и в Африке.

Обзор рынка оборудования для переработки мяса, птицы и морепродуктов в Марокко

Рынок оборудования для переработки мяса, птицы и морепродуктов в Марокко стабильно растёт благодаря росту внутреннего потребления, расширению птицеводческих и рыбоводческих хозяйств, а также увеличению инвестиций в современные перерабатывающие мощности. Марокканские переработчики внедряют современное оборудование для заморозки, упаковки и порционирования, чтобы повысить качество, безопасность продукции и её готовность к экспорту. Государственные стимулы, направленные на модернизацию пищевой промышленности и сотрудничество с международными поставщиками, способствуют трансферу технологий и повышению эффективности производства. В результате Марокко становится важным участником общего роста и повышения конкурентоспособности рынка оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке.

Какие компании являются ведущими на рынке оборудования для переработки мяса, птицы и морепродуктов?

Отрасль производства оборудования для переработки мяса, птицы и морепродуктов в основном представлена хорошо зарекомендовавшими себя компаниями, среди которых:

- Equipamientos Cárnicos, SL (Испания)

- BRAHER INTERNACIONAL, SA (Испания)

- РЗПО (Польша)

- Minerva Omega Group srl (Италия)

- GEA Group Aktiengesellschaft (Германия)

- RISCO SpA (Италия)

- PSS SVIDNÍK, as (Slovakia)

- Металбуд (Польша)

- БААДЕР (Германия)

- Корпорация JBT (США)

- Марел (Исландия)

- Key Technology (США)

- Illinois Tool Works Inc. (США)

- Корпорация Миддлби (США)

- Бетчер Индастриз, Инк. (США)

- БИЗЕРБА (Германия)

Каковы последние тенденции на рынке оборудования для переработки мяса, птицы и морепродуктов на Ближнем Востоке и в Африке?

- В феврале 2025 года компания JBT Marel заключила стратегический альянс с Ace Aquatec, назначив компанию своим приоритетным поставщиком решений для оглушения рыбы для оборудования пищевой промышленности. Это сотрудничество укрепляет позиции JBT Marel в области устойчивой переработки морепродуктов и расширяет портфель инновационных решений.

- В январе 2025 года американская компания JBT полностью приобрела Marel, образовав новую компанию JBT Marel Corporation. Это слияние создаёт мощного мирового лидера в области технологий пищевой промышленности, повышая эффективность и инновации во многих секторах пищевой промышленности.

- В ноябре 2024 года компания Fortifi Food Processing Solutions объявила о приобретении интеллектуальной собственности, клиентских отношений, отдельных товарных запасов и основных средств компании JWE-BANSS GmbH (Германия), ведущего производителя систем переработки белка. Это приобретение укрепляет экспертные знания Fortifi в области переработки мяса и укрепляет её присутствие на рынках Ближнего Востока и Африки.

- В июле 2024 года компания Ross Industries представила мембранную машину для снятия шкур AMS 400 — решение, разработанное специально для небольших и средних мясоперерабатывающих предприятий для повышения эффективности работы и качества конечной продукции. Этот запуск отражает стремление Ross Industries удовлетворить растущие потребности в автоматизации для малых и средних производителей продуктов питания.

- В марте 2024 года компания Fortifi Food Processing Solutions официально представила единую глобальную платформу для брендов в сфере переработки пищевых продуктов и автоматизации, работающих на пяти континентах. Это создание знаменует собой стратегический шаг на пути к предоставлению комплексных решений для предприятий по переработке белковых продуктов, молочной продукции, фруктов и овощей.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.