Рынок стеклянной посуды на Ближнем Востоке и в Африке по материалу (натриево-кальциево-кальциевое стекло, свинцовое стекло, термостойкое и другие), стилю (стекло без ножек, бокалы, повседневного использования и другие), каналу сбыта (B2B, специализированные магазины, супермаркеты/гипермаркеты, электронная коммерция и другие), ценовому диапазону (средний, премиум и эконом), конечному использованию (отели и рестораны, бары и кафе, домашние хозяйства, корпоративные столовые и другие). Тенденции отрасли и прогноз до 2029 года.

Анализ и размер рынка

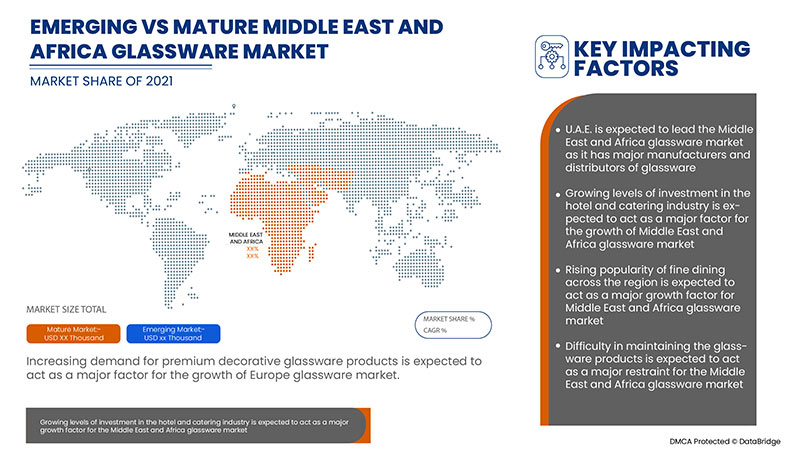

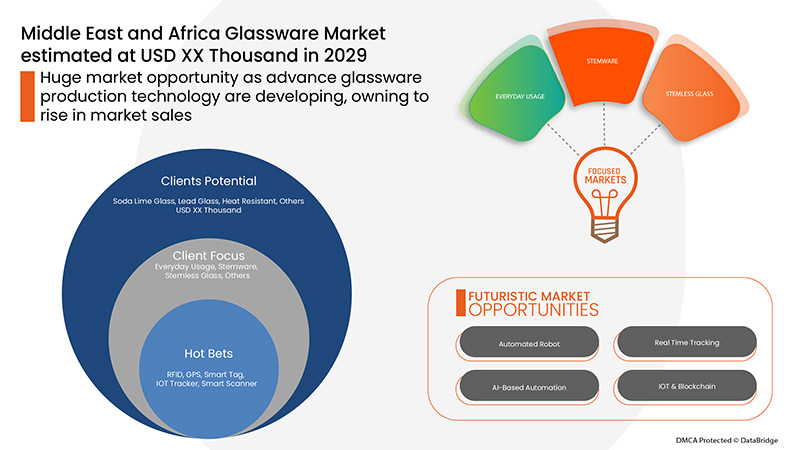

Ожидается, что растущие уровни инвестиций в гостиничный и кейтеринговый бизнес станут движущей силой роста рынка стеклянной посуды в прогнозируемый период. Ожидается, что изменения в образе жизни потребителей станут движущей силой роста рынка стеклянной посуды в прогнозируемый период 2022-2029 гг. Ожидается, что достижения в технологиях производства стеклянной посуды откроют возможности роста для рынка стеклянной посуды в будущем.

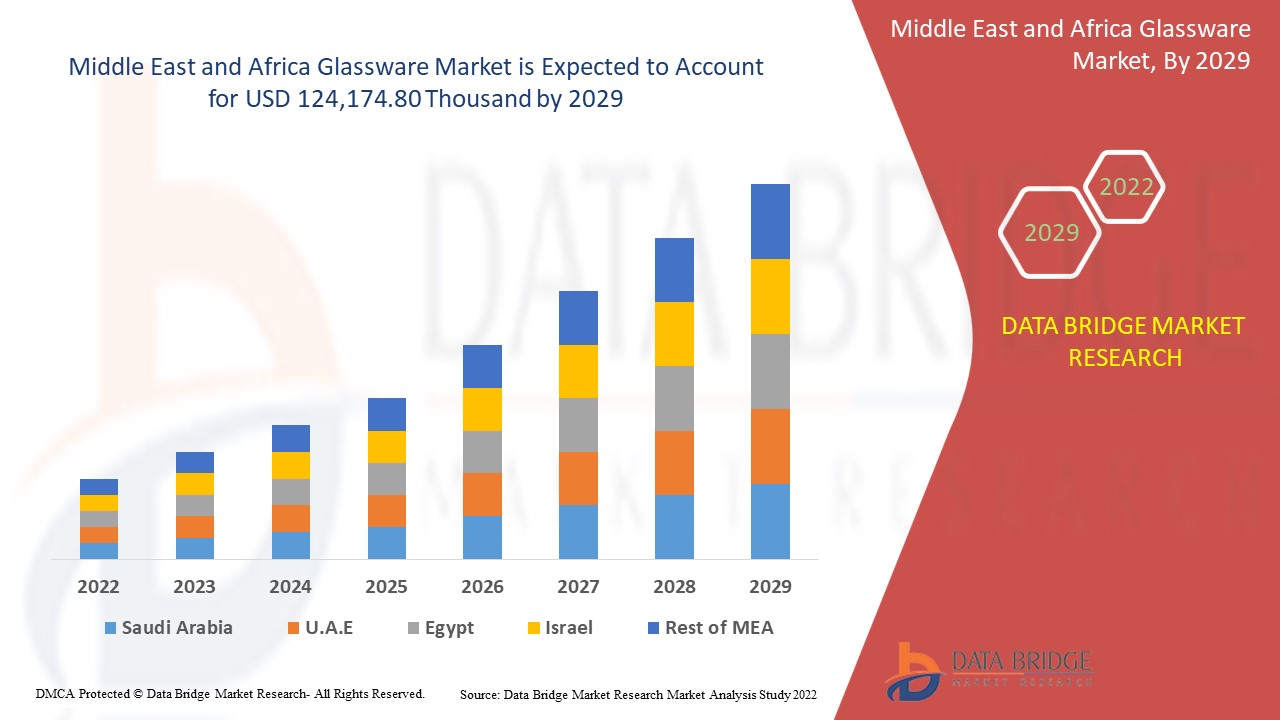

Data Bridge Market Research анализирует, что рынок стеклянной посуды, как ожидается, достигнет значения 124 174,80 тыс. долларов США к 2029 году, при среднегодовом темпе роста 4,2% в течение прогнозируемого периода. «натриевая известь» занимает самый заметный сегмент материала, поскольку этот тип стекла обеспечивает устойчивые к царапинам поверхности. Отчет о рынке стеклянной посуды также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 |

|

Количественные единицы |

Доход в тыс. долл. США, объем в единицах, цена в долл. США |

|

Охваченные сегменты |

По материалу (натриево-кальциевое стекло, свинцовое стекло, термостойкое и другие), стилю (стекло без ножки, бокалы, повседневного использования и другие), каналу сбыта (B2B, специализированные магазины, супермаркеты/гипермаркеты, электронная коммерция и другие), ценовому диапазону (средний, премиум и эконом), конечному использованию (отели и рестораны, бары и кафе, бытовые, корпоративные столовые и другие) |

|

Страны, охваченные |

ОАЭ, Саудовская Аравия, Южная Африка, Египет, Израиль, остальной Ближний Восток и Африка |

|

Охваченные участники рынка |

Hrastnik1860, Oneida, NoritakeUAE, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (дочерняя компания Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware и другие |

Определение рынка

Стекло — это хрупкий, жесткий материал, который обычно прозрачен или полупрозрачен. Он может быть изготовлен из смеси песка, соды, извести или других минералов. Наиболее типичный метод формирования стекла включает нагревание исходных ингредиентов до тех пор, пока они не превратятся в расплавленную жидкость, а затем быстрое охлаждение смеси для получения закаленного стекла. Разновидности стекла можно классифицировать на основе их механических и термических качеств, чтобы определить, какие области применения наиболее подходят.

Натриево-кальциевое стекло: Натриево-кальциевое стекло является наиболее распространенной формой стекла, используемой для изготовления оконных стекол и стеклянных емкостей, таких как бутылки и банки для напитков, продуктов питания и некоторых товаров народного потребления.

Свинцовое стекло: Свинцовое стекло — это стекло с высоким содержанием оксида свинца, обладающее исключительной прозрачностью и яркостью.

Термостойкость: Термостойкое стекло предназначено для выдерживания теплового стресса и обычно используется на кухнях и в промышленных целях.

Динамика рынка стеклянной посуды

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Рост уровня инвестиций в гостиничный и ресторанный бизнес

Туризм расширил бизнес гостиничного и ресторанного сектора по всему миру и предоставил большой простор для гостиничной индустрии. Индустрия процветала в основном за счет туризма и благодаря разнообразным ландшафтам, верованиям и обществам в разных странах, которые обеспечивали большую привлекательность для туристов из разных регионов. Гостиничный и ресторанный секторы многих стран постепенно расширялись в течение последних двух десятилетий, и прогнозируется их развитие в ближайшие годы в сочетании с ростом спроса на различные виды стеклянной посуды.

- Изменения в образе жизни потребителей

Потребительская жизнь постоянно меняется. Потребительские привычки и ценности подвержены влиянию существующих и новых тенденций, а также постоянно меняющегося демографического состава, мировых культурных потрясений и быстрого развития технологий. Компании могут извлечь выгоду из новых возможностей, приобретая глубокое понимание предпочтений клиентов после изменения поведения и убеждений. В последнее время потребители всех поколений все больше внимания уделяют брендовым продуктам во многих областях своей повседневной жизни.

- Растущая популярность изысканной кухни по всему миру

Ресторан изысканной кухни — это либо специализированное, либо многонациональное заведение, которое делает ставку на качественные ингредиенты, подачу и безупречное обслуживание. Категория растет с достойной скоростью в 15%, что способствовало появлению премиальных ресторанов, отмеченных звездами Мишлен, и других местных конкурентов. Таким образом, растущий спрос на изысканную изысканную кухню в основном достигается за счет успешной работы различных марок стеклянной посуды в отелях и ресторанах.

- Наличие дешевой качественной продукции

Стекло является одним из самых сложных и адаптируемых материалов, и оно используется практически в каждой отрасли. Широкое использование стекла способствует созданию очень высокотехнологичного и современного внешнего вида как в жилых, так и в коммерческих зданиях. Стекло бывает разных форм и размеров, чтобы соответствовать различным приложениям, и используется в различных архитектурных приложениях, таких как двери, окна и перегородки. Стекло прошло долгий путь от своего скромного начала в качестве оконного стекла до сложного структурного компонента в наши дни.

- Растущий спрос на посуду для питья на стальной и бумажной основе

Бумага и пластик все чаще используются для изготовления одноразовых тарелок и стаканов из-за их высокой экологической эффективности и растущего спроса на услуги электронной коммерции и доставки. Потребители, бренды и розничные торговцы возлагают большие надежды на перерабатываемые бумажные товары. Уровень переработки бумажных материалов составляет около 85 процентов, и цепочка создания стоимости бумаги улучшается с каждым днем. Чтобы достичь еще более высоких целей по переработке, одновременно продлевая полезность бумажной упаковки, критически важно начать с этапа проектирования, принимая во внимание как предполагаемое назначение, так и окончание срока службы.

Влияние COVID-19 на рынок стеклянной посуды

COVID-19 оказал сильное влияние на рынок стеклянной посуды, поскольку почти все страны решили закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи товаров не первой необходимости, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, который имеет дело с этой пандемической ситуацией, — это основные службы, которым разрешено открываться и осуществлять процессы.

Рост рынка стеклянной посуды увеличивается из-за политики правительства по стимулированию международной торговли после COVID-19. Кроме того, открытие карантина стимулирует индустрию гостеприимства, что увеличивает спрос на стеклянную посуду на рынке. Однако такие факторы, как перегруженность торговых путей и торговые ограничения между некоторыми странами, сдерживают рост рынка. Закрытие производственных предприятий во время пандемической ситуации оказало значительное влияние на рынок.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий, используемых в стеклянной посуде. Благодаря этому компании выведут на рынок передовые и точные решения. Кроме того, правительственные инициативы по стимулированию международной торговли привели к росту рынка.

Последние события

- В октябре 2020 года Libbey Inc. объявила о подтверждении плана реорганизации и рассчитывала завершить реструктуризацию под надзором суда и выйти с более сильным балансом в ближайшие недели. Компания сделала это заявление, чтобы добиться успеха в текущей операционной среде.

- В октябре 2021 года Lenox Corporation приобрела Oneida Consumer LLC с ее брендом столовых приборов, включая столовые приборы, посуду и столовые приборы. Сотрудничество было предпринято с целью продвижения на рынок ведущего портфеля брендов и инновационных товаров с непревзойденной осведомленностью клиентов по широкому спектру розничных каналов.

Масштаб рынка стеклянной посуды на Ближнем Востоке и в Африке

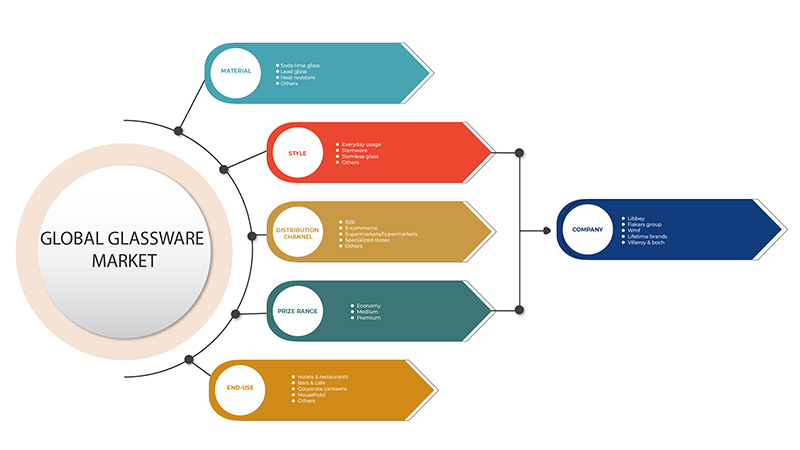

Рынок стеклянной посуды сегментирован по материалу, стилю, каналу сбыта, ценовому диапазону и конечному использованию. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

По материалу

- Стекло из натриево-кальциевого сплава

- Свинцовое стекло

- Термостойкий

- Другие

В зависимости от материала рынок стеклянной посуды сегментируется на натриево-кальциевое стекло, свинцовое стекло, термостойкое стекло и другие.

По стилю

- Стекло без ножки

- Фужеры

- Повседневное использование

- Другие

По стилю рынок стеклянной посуды подразделяется на бесстекольную посуду, стеклянную посуду в форме бокалов, повседневного использования и другие.

По каналу распространения

- В2В

- Специализированные магазины

- Супермаркеты/Гипермаркеты

- Электронная коммерция

- Другие

По каналу сбыта рынок стеклянной посуды сегментируется на b2b, специализированные магазины, супермаркеты/гипермаркеты, электронную коммерцию и другие.

По ценовому диапазону

- Середина

- Премиум

- Экономика

По ценовому диапазону рынок стеклянной посуды сегментирован на средний, премиум и эконом-класс.

По конечному использованию

- Отели и рестораны

- Бары и кафе

- Семья

- Корпоративные столовые

- Другие

По сфере конечного использования рынок стеклянной посуды подразделяется на гостиницы и рестораны, бары и кафе, домашние хозяйства, корпоративные столовые и другие.

Региональный анализ/анализ рынка стеклянной посуды

Проведен анализ рынка стеклянной посуды, а также предоставлены сведения о размерах рынка и тенденциях по странам, материалам, стилям, каналам сбыта, ценовому диапазону и конечному использованию, как указано выше.

В отчете по рынку стеклянной посуды рассматриваются следующие страны: ОАЭ, Саудовская Аравия, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки.

ОАЭ доминируют на рынке стеклянной посуды на Ближнем Востоке и в Африке. ОАЭ, вероятно, будут самым быстрорастущим рынком стеклянной посуды на Ближнем Востоке и в Африке. Рост инфраструктуры, коммерческих и промышленных разработок в развивающихся странах, таких как ОАЭ, приписывают доминированию рынка. С ростом развития в странах увеличивается количество ресторанов и баров, что увеличит спрос на стеклянную продукцию в регионе Ближнего Востока и Африки.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка стеклянной посуды

Конкурентная среда рынка стеклянной посуды содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие на Ближнем Востоке и в Африке, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком стеклянной посуды.

Некоторые из основных игроков, работающих на рынке стеклянной посуды: Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (дочерняя компания Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 49 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 50 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 51 U.A.E. GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 52 U.A.E. STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 53 U.A.E. RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 54 U.A.E. WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 55 U.A.E. STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 56 U.A.E. GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 57 U.A.E. GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 58 U.A.E. GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 61 SAUDI ARABIA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 71 SOUTH AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 79 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 80 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 81 EGYPT GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 82 EGYPT STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 83 EGYPT RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 84 EGYPT WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 85 EGYPT STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 86 EGYPT GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 87 EGYPT GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 88 EGYPT GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 89 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 90 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 91 ISRAEL GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 92 ISRAEL STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 93 ISRAEL RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 94 ISRAEL WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 95 ISRAEL STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 96 ISRAEL GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 97 ISRAEL GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 98 ISRAEL GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 99 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 100 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLASSWARE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA GLASSWARE MARKET

FIGURE 22 MIDDLE EAST & AFRICA LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 MIDDLE EAST AND AFRICA GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.