Middle East and Africa e-Clinical Solutions Market, By Product (Electronic Data Capture and Clinical Trial Data Management Systems, Clinical Trial Management Systems, Clinical Analytics Platforms, Care Coordination Medical Records (CCMR), Randomization and Trial Supply Management, Clinical Data Integration Platforms, Electronic Clinical Outcome Assessment Solutions, Safety Solutions, Electronic Trial Master File Systems, Regulatory Information Management Solutions, and Others), Delivery Mode (Web- hosted (On-Demand) Solutions, Licensed Enterprise (On-Premises) Solutions and Cloud-Based (SAAS) Solutions), Clinical Trial Phase (Phase I, Phase II, Phase III, and Phase IV), Organization Size (Small & Medium and Large), User Device (Desktop, Tablet, Handheld PDA Device, Smart Phone, and Others), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Research Organizations, Consulting Service Companies, Medical Device Manufacturers, Hospitals, and Academic Research Institutes), Industry Trends and Forecast to 2030.

Middle East and Africa e-Clinical Solutions Market Analysis and Size

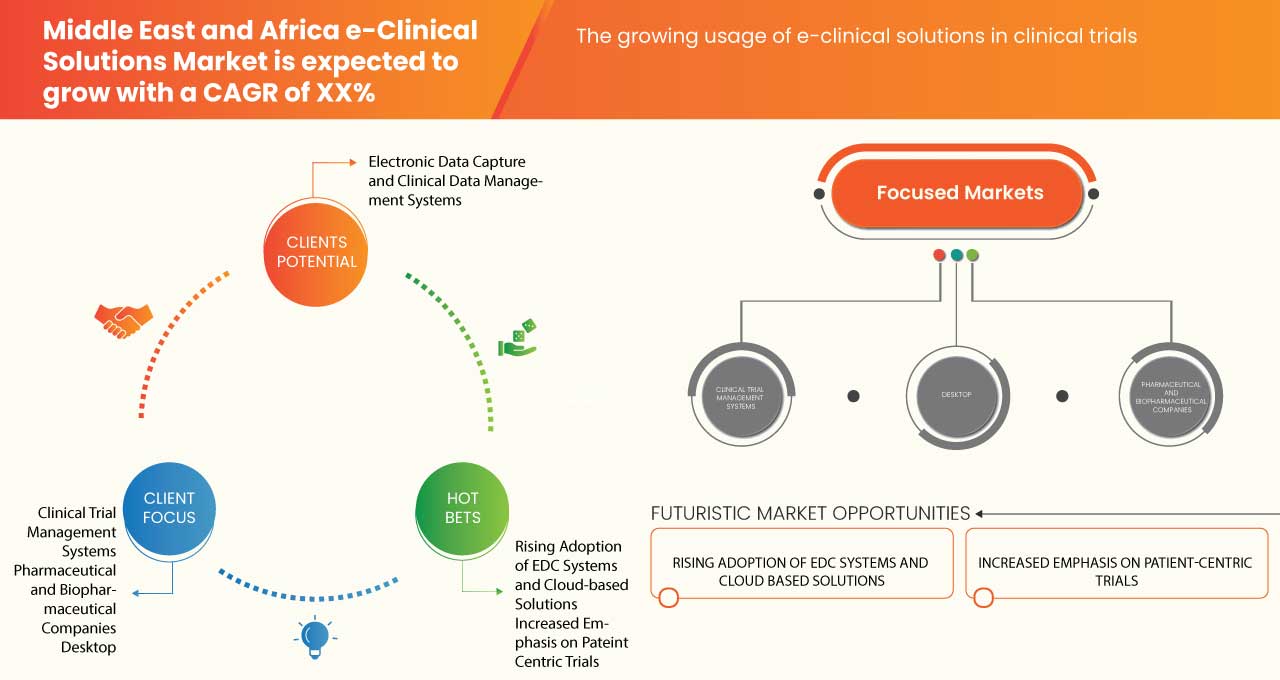

The Middle East and Africa e-clinical solutions market is fragmented, as it consists of many global players such as Oracle, IQVIA Inc., Dassault Systemes, and Clario among others. The presence of these companies produces competitive prices for systems services and software across the region. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products with different specifications and characteristics in all budgets. The growing adoption of electronic data capture (EDC) systems and cloud-based is driving the market growth. Additionally, the growing focus on patient-centric clinical trials is expected to drive market growth.

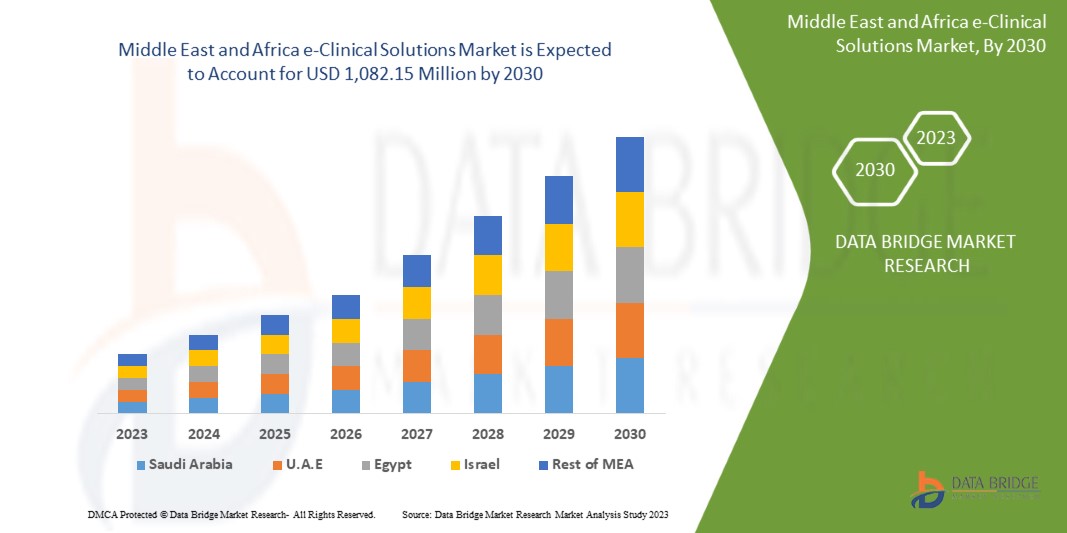

Data Bridge Market Research analyzes that the Middle East and Africa e-clinical solutions market is expected to reach a value of USD 1,082.15 million by 2030, at a CAGR of 11.9% during the forecast period. This market report also covers pricing analysis and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

By Product (Electronic Data Capture and Clinical Trial Data Management Systems, Clinical Trial Management Systems, Clinical Analytics Platforms, Care Coordination Medical Records (CCMR), Randomization and Trial Supply Management, Clinical Data Integration Platforms, Electronic Clinical Outcome Assessment Solutions, Safety Solutions, Electronic Trial Master File Systems, Regulatory Information Management Solutions, and Others), Delivery Mode (Web-Hosted (On- Demand) Solutions, Licensed Enterprise (On-Premises) Solutions, and Cloud-Based (SAAS) Solutions), Clinical Trial Phase (Phase I, Phase II, Phase III, and Phase IV), Organization Size (Small & Medium and Large), User Device (Desktop, Tablet, Handheld PDA Device, Smart Phone, and Others), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Research Organizations, Consulting Service Companies, Medical Device Manufacturers, Hospitals, and Academic Research Institutes) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Egypt, Israel, and the Rest of the Middle East and Africa |

|

Market Players Covered |

Oracle, Signant Health, MaxisIT, Paraxel International Corporation, Dassault Systemes, Clario, Mednet, OpenClinica, LLC, 4G Clinical, Veeva Systems, Saama Technologies, LLC, Anju, Castor, Medrio, Inc., ArisGlobal, Merative, Advarra, eClinical Solutions, LLC, Y-Prime LLC, RealTime Software Solutions LLC, Quretec, Research Manager, Datatrack Int., and IQVIA Inc.

|

Market Definition

The goal of e-clinical solutions is to revolutionize the field of clinical research. The clinical management organization is trying to improve the effectiveness, efficiency, and accessibility of clinical research data to treat patients more quickly. The idea behind the creation of eClinical Solutions was to pinpoint the problems with clinical research data, fix them, and offer creative solutions to make clinical trial data useful and simple to obtain, as well as to facilitate the standardization, reporting, and operation of the clinical research domain. The rising adoption and growing focus on e-clinical solutions and software are expected to drive market growth.

The e-clinical solutions, such as electronic data capture (EDC), electronic patient-reported outcomes (ePRO), clinical trial management systems (CTMS), and electronic trial master file (eTMF) systems, are software programs used in clinical research to manage clinical data. However, strict regulations and standards for the approval of clinical trial studies and product approvals are expected to restrain market growth.

Middle East and Africa e-Clinical Solutions Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

Increasing R&D activities and corresponding expenditure

Исследования и разработки имеют решающее значение во всех отраслях, включая науку о жизни и здравоохранение. Индустрия науки о жизни проводит обширные исследования и разработки для получения дохода и часто приносит результаты, которые включают спасение или улучшение жизни пациента. Разработка лекарств требует проведения клинических испытаний для проверки анализа клинических данных и обзора его исследования и новых данных.

Решения e-clinical используются для комплексного обзора данных, автоматизации процесса преобразования данных и аналитики для ускорения сроков. Фармацевтические и биофармацевтические компании проводят множество клинических испытаний для успешного завершения разработки лекарств или биологических препаратов. Фармацевтические и биофармацевтические компании увеличили свое внимание к исследованиям и разработкам, что повышает спрос на решения e-clinical.

Улучшение инфраструктуры здравоохранения и создание современных лабораторий

Инфраструктура является ключевым столпом, поддерживающим фундаментальную цель продвижения улучшенных стандартов ухода и благополучия для всех пациентов, вместе с хорошим опытом системы здравоохранения. Параллельно система здравоохранения и персонал должны поддерживать эффективное укрепление здоровья, профилактику и самопомощь всего населения.

Инфраструктура должна интегрировать больницу как центр неотложной и стационарной помощи в более широкую систему здравоохранения. Она должна способствовать семи областям качественного опыта пациента, эффективности, результативности, своевременности, безопасности, справедливости и устойчивости. Инфраструктура включает в себя созданную среду и вспомогательные элементы, такие как оборудование, доступ, информационные технологии (ИТ), системы и процессы, инициативы по устойчивости и персонал. Это улучшение инфраструктуры здравоохранения и персонала дает больше возможностей для электронных клинических решений для роста и получения лучших результатов.

ВОЗМОЖНОСТЬ

Увеличение инвестиций различных правительств в клинические испытания

Финансирование клинических испытаний осуществляется из различных источников, включая правительство, коммерческих инвесторов, некоммерческие организации, академические учреждения и другие исследовательские организации. Исторически сложилось так, что Национальные институты здравоохранения (NIH) вложили самые большие государственные инвестиции в фундаментальные исследования по разработке лекарств. Агентство передовых оборонных исследований (DARPA) также внесло свой вклад в стадию открытия, приняв несколько относительно высокорисковых биологических инициатив. Правительства штатов также все чаще берут на себя лидерство в этой области, отчасти из-за разочарования общественности длительным процессом открытия. Таким образом, ожидается, что правительственные инициативы и инвестиции в открытие новых лекарств с помощью испытаний создадут возможность для роста рынка.

СДЕРЖИВАНИЕ / ВЫЗОВ

Вопросы безопасности и конфиденциальности данных

Информационные системы в большой степени озабочены вопросами конфиденциальности и безопасности. Доступ к индивидуальной медицинской информации стал возможен благодаря оцифровке медицинских услуг с любого электронного устройства с подключением к Интернету в любой точке мира. Пользователи обычно не знают, как обрабатываются их данные. Медицинские данные в облаке привлекли внимание хакеров, которые нацеливаются на системы для проведения атак и кражи конфиденциальных данных в обмен на финансовую выгоду.

Утечки данных стали обычным явлением с 2019 года, в 2021 году было взломано более 50 миллионов электронных медицинских карт, и прогнозировалось, что количество нарушений безопасности будет расти с каждым годом. Создание межюрисдикционных соглашений о совместном использовании данных, а также хранение и манипулирование массивами данных существенно затруднены из-за опасений по поводу личной конфиденциальности и конфиденциальности информации, а также недавнего принятия законов о конфиденциальности и конфиденциальности в провинциях и территориях (исключительно в отношении записей пациентов). Таким образом, это является сдерживающим фактором для рынка электронных клинических решений на Ближнем Востоке и в Африке и, как ожидается, будет препятствовать росту рынка.

Влияние COVID-19 на рынок электронных клинических решений на Ближнем Востоке и в Африке

COVID-19 оказал положительное влияние на рынок электронных клинических решений на Ближнем Востоке и в Африке. Ограничение, вызванное карантином, привело к появлению различных возможностей, таких как разработка лекарств, установка приложений EMR и EHR и многих других.

Однако ожидается, что растущая государственная поддержка и передовые и инновационные методы предоставят прибыльные возможности для роста рынка. Более того, ожидается, что рост партнерств, приобретений и сотрудничества между участниками рынка будет способствовать дальнейшему росту рынка. Кроме того, рост был высоким с момента открытия рынка после COVID-19, и ожидается, что в секторе будет значительный рост. Участники рынка проводят многочисленные мероприятия по улучшению методов испытаний. Благодаря этому компании привнесут на рынок прогресс и инновации.

Последние события

- В апреле 2023 года дочерняя компания Medidata компании Dassault Systèmes объявила, что Lambda Therapeutics внедряет облачные клинические продукты Medidata: Rave EDC, Rave RTSM и Rave Imaging, согласно заявлению дочерней компании Dassault Systèmes Medidata. Автоматизация и оптимизация операций по управлению данными и безопасная доставка данных более высокого качества для более быстрого получения информации еще больше повысят производительность клинических испытаний. Это помогло компании продвигать свои предложения по всему миру

- В марте 2023 года Clario запустила облачный инструмент Image Viewer, который помогает спонсорам и CRO просматривать изображения своих клинических испытаний. Ранее нескольким организациям приходилось участвовать в процедуре передачи изображений, чтобы увидеть фотографии для клинического испытания. Это усложняло и без того рискованный процесс и увеличивало вероятность задержек и ошибок. Это помогло бизнесу расширить предложение услуг

Сфера применения электронных клинических решений на Ближнем Востоке и в Африке

Рынок электронных клинических решений Ближнего Востока и Африки сегментирован на шесть заметных сегментов на основе продукта, способа доставки, фазы клинических испытаний, размера организации, пользовательского устройства и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и информацию, которая поможет им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Системы электронного сбора данных и управления клиническими данными

- Системы управления клиническими испытаниями

- Платформы клинической аналитики

- Медицинская карта координации ухода (CCMR)

- Рандомизация и управление поставками для испытаний

- Платформы интеграции клинических данных

- Решения для электронной оценки клинических результатов

- Решения по безопасности

- Электронные системы основных файлов судебных разбирательств

- Решения по управлению нормативной информацией

- Другие

В зависимости от продукта рынок сегментируется на электронный сбор данных и управление клиническими данными, системы управления клиническими испытаниями, платформы клинической аналитики, медицинские карты координации лечения (CCMR), рандомизацию и управление поставками для испытаний, платформы интеграции клинических данных, электронные решения для оценки клинических результатов, решения по безопасности, электронные системы основных файлов испытаний, решения по управлению нормативной информацией и другие.

Способ доставки

- Решения, размещаемые в Интернете (по требованию)

- Лицензированные корпоративные (локальные) решения

- Облачные (SAAS) решения

По способу доставки рынок сегментируется на веб-решения (по запросу), лицензированные корпоративные решения (локальные) и облачные решения (SAAS).

Фаза клинических испытаний

- Фаза 1

- Фаза 2

- Фаза 3

- Фаза 4

На основе фазы клинических испытаний рынок сегментирован на фазу I, фазу II, фазу III и фазу IV.

Размер организации

- Малый и средний

- Большой

В зависимости от размера организации рынок сегментируется на малые, средние и крупные.

Пользовательское устройство

- Рабочий стол

- Планшет

- Карманное устройство PDA

- Смартфон

- Другие

В зависимости от типа пользовательского устройства рынок сегментируется на настольные компьютеры, планшеты, карманные цифровые цифровые устройства (КПК), смартфоны и другие.

Конечный пользователь

- Фармацевтические и биофармацевтические компании

- Контрактные исследовательские организации

- Компании, предоставляющие консалтинговые услуги

- Производители медицинского оборудования

- Больницы

- Научно-исследовательские институты

По признаку конечного пользователя рынок сегментирован на фармацевтические и биофармацевтические компании, контрактные исследовательские организации, консалтинговые компании, производителей медицинского оборудования, больницы и научно-исследовательские институты.

Региональный анализ/информация о рынке электронных клинических решений на Ближнем Востоке и в Африке

Проведен анализ рынка электронных клинических решений на Ближнем Востоке и в Африке, а также предоставлена информация о размере рынка на основе продукта, способа доставки, фазы клинических испытаний, размера организации, пользовательского устройства и конечного пользователя.

В данном отчете о рынке рассматриваются следующие страны: Южная Африка, Саудовская Аравия, ОАЭ, Египет, Израиль, а также остальные страны Ближнего Востока и Африки.

Ожидается, что Южная Африка будет доминировать в регионе Ближнего Востока и Африки за счет растущего внедрения электронных систем сбора данных и облачных решений.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Конкурентная среда и анализ доли рынка электронных клинических решений на Ближнем Востоке и в Африке

Конкурентная среда рынка электронных клинических решений на Ближнем Востоке и в Африке содержит сведения о конкуренте. Сведения включают обзор компании, финансы, полученный доход, рыночный потенциал, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование приложений. Приведенные выше данные относятся только к фокусу компаний на рынке.

Среди основных игроков рынка электронных клинических решений на Ближнем Востоке и в Африке можно назвать Oracle, Signant Health, MaxisIT, Paraxel International Corporation, Dassault Systemes, Clario, Mednet, OpenClinica, LLC, 4G Clinical, Veeva Systems, Saama Technologies, LLC, Anju, Castor, Medrio, Inc., ArisGlobal, Merative, Advarra, eClinical Solutions, LLC, Y-Prime LLC и RealTime Software Solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 ECOSYSTEMS ANALYSIS OF E CLINICAL SOLUTIONS

4.3 USE CASES

5 VALUE CHAIN ANALYSIS

6 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 THE GROWING USAGE OF E-CLINICAL SOLUTIONS IN CLINICAL TRIALS

7.1.2 INCREASING R&D ACTIVITIES AND CORRESPONDING EXPENDITURE

7.1.3 STRATEGIC INITIATIVES TAKEN BY MAJOR BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES

7.1.4 IMPROVED HEALTHCARE INFRASTRUCTURE AND ESTABLISHMENT OF ADVANCED LABORATORIES

7.2 RESTRAINTS

7.2.1 DATA SAFETY AND PRIVACY ISSUES

7.2.2 LACK OF SKILLED PROFESSIONALS

7.2.3 LIMITED ADOPTION OF E-CLINICAL SOLUTIONS IN EMERGING COUNTRIES DUE TO BUDGETARY CONSTRAINTS AND POOR MANAGEMENT POLICIES

7.3 OPPORTUNITIES

7.3.1 RISING ADOPTION OF ELECTRONIC DATA CAPTURE (EDC) SYSTEMS AND CLOUD-BASED SOLUTIONS

7.3.2 INCREASING INVESTMENTS BY VARIOUS GOVERNMENTS IN CLINICAL TRIALS

7.3.3 GROWING FOCUS ON PATIENT-CENTRIC CLINICAL TRIALS

7.4 CHALLENGES

7.4.1 REGULATORY CHALLENGES ASSOCIATED WITH E-CLINICAL SOLUTIONS

7.4.2 HIGH IMPLEMENTATION COSTS

8 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ELECTRONIC DATA CAPTURE AND CLINICAL DATA MANAGEMENT SYSTEMS

8.3 RANDOMIZATION AND TRIAL SUPPLY MANAGEMENT

8.4 CLINICAL TRIAL MANAGEMENT SYSTEMS

8.5 ELECTRONIC TRIAL MASTER FILE SYSTEMS

8.6 ELECTRONIC CLINICAL OUTCOME ASSESSMENT SOLUTIONS

8.7 SAFETY SOLUTIONS

8.8 REGULATORY INFORMATION MANAGEMENT SOLUTIONS

8.9 CLINICAL DATA INTEGRATION PLATFORMS

8.1 CLINICAL ANALYTICS PLATFORMS

8.11 CARE COORDINATION MEDICAL RECORD (CCMR)

8.12 OTHERS

9 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE

9.1 OVERVIEW

9.2 WEB-HOSTED (ON-DEMAND) SOLUTIONS

9.3 CLOUD-BASED (SAAS) SOLUTIONS

9.4 LICENSED ENTERPRISE (ON-PREMISES) SOLUTIONS

10 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE

10.1 OVERVIEW

10.2 PHASE III

10.3 PHASE I

10.4 PHASE II

10.5 PHASE IV

11 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE

11.1 OVERVIEW

11.2 MEDIUM AND SMALL

11.3 LARGE

12 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE

12.1 OVERVIEW

12.2 DESKTOP

12.3 TABLET

12.4 SMART PHONE

12.5 HANDHELD PDA DEVICE

12.6 OTHERS

13 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY END USER

13.1 OVERVIEW

13.2 CONTRACT RESEARCH ORGANIZATIONS

13.3 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

13.4 MEDICAL DEVICE MANUFACTURERS

13.5 HOSPITAL

13.6 CONSULTING SERVICE COMPANIES

13.7 ACADEMIC RESEARCH INSTITUTES

14 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E.

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ORACLE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 DASSAULT SYSTEMES

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CLARIO

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 VEEVA SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ARISMIDDLE EAST & AFRICA

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 4G CLINICAL

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ADVARRA.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 ANJU

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CASTOR.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DATATRAK INT.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ECLINICAL SOLUTIONS LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 IQVIA INC

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MAXISIT

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MEDNET

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MEDRIO, INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 MERATIVE

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 OPENCLINICA, LLC

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 PAREXEL INTERNATIONAL CORPORATION

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 QURETEC

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 REALTIME SOFTWARE SOLUTIONS, LLC

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 RESEARCH MANAGER

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SAAMA TECHNOLOGIES, LLC

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 SIGNANT HEALTH

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 Y-PRIME, LLC.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 THE COSTS OF IMPLEMENTATION ARE AS FOLLOWS, ACCORDING TO SIMPLETRIALS:

TABLE 2 ACCORDING TO ECLINICAL WORKS – ECLINICAL OFFERS TWO ENTERPRISE PRICING PACKAGES:

TABLE 3 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ELECTRONIC DATA CAPTURE AND CLINICAL DATA MANAGEMENT SYSTEMS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA RANDOMIZATION AND TRIAL SUPPLY MANAGEMENT IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CLINICAL TRIAL MANAGEMENT SYSTEMS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ELECTRONIC TRIAL MASTER FILE SYSTEMS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ELECTRONIC CLINICAL OUTCOME ASSESSMENT SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SAFETY SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA REGULATORY INFORMATION MANAGEMENT SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CLINICAL DATA INTEGRATION PLATFORMS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA CLINICAL ANALYTICS PLATFORMS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CARE COORDINATION MEDICAL RECORD (CCMR) IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA WEB-HOSTED (ON-DEMAND) SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CLOUD-BASED (SAAS) SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LICENSED ENTERPRISE (ON-PREMISES) SOLUTIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PHASE III IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA PHASE I IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PHASE II IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PHASE IV IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDIUM AND SMALL IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA LARGE IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA DESKTOP IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA TABLET IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SMART PHONE IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA HANDHELD PDA DEVICE IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL DEVICE MANUFACTURERS IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA HOSPITAL IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA CONSULTING SERVICE COMPANIES IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ACADEMIC RESEARCH INSTITUTES IN E-CLINICAL SOLUTIONS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 49 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 50 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 51 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 52 SOUTH AFRICA E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 59 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 61 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 62 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 63 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 64 U.A.E. E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 65 EGYPT E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 EGYPT E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 67 EGYPT E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 68 EGYPT E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 69 EGYPT E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 70 EGYPT E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY DELIVERY MODE, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY USER DEVICE, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL E-CLINICAL SOLUTIONS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 REST OF MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA E- CLINICAL SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 THE GROWING USAGE OF E-CLINICAL SOLUTIONS IN CLINICAL TRIALS AS WELL AS INCREASING R&D ACTIVITIES AND CORRESPONDING EXPENDITURE, IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST & AFRICA E- CLINICAL SOLUTIONS MARKET FROM 2023 TO 2030

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET

FIGURE 14 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY PRODUCT, 2022

FIGURE 15 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY DELIVERY MODE, 2022

FIGURE 19 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY DELIVERY MODE, 2023-2030 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY DELIVERY MODE, CAGR (2023-2030)

FIGURE 21 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY CLINICAL TRIAL PHASE, 2022

FIGURE 23 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY CLINICAL TRIAL PHASE, 2023-2030 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY CLINICAL TRIAL PHASE, CAGR (2023-2030)

FIGURE 25 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY CLINICAL TRIAL PHASE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 27 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY ORGANIZATION SIZE, CAGR (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY ORGANIZATION SIZE, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY USER DEVICE, 2022

FIGURE 31 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY USER DEVICE, 2023-2030 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY USER DEVICE, CAGR (2023-2030)

FIGURE 33 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY USER DEVICE, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY END USER, 2022

FIGURE 35 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 37 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET: SNAPSHOT (2022)

FIGURE 39 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET: BY COUNTRY (2022)

FIGURE 40 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 MIDDLE EAST AND AFRICA E-CLINICAL SOLUTIONS MARKET: PRODUCT (2023-2030)

FIGURE 43 MIDDLE EAST & AFRICA E-CLINICAL SOLUTIONS MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.