Middle East And Africa Compressed Natural Gas Cng Market

Размер рынка в млрд долларов США

CAGR :

%

USD

8.41 Billion

USD

11.16 Billion

2024

2032

USD

8.41 Billion

USD

11.16 Billion

2024

2032

| 2025 –2032 | |

| USD 8.41 Billion | |

| USD 11.16 Billion | |

|

|

|

|

Сегментация рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке по источнику (попутный и непопутный газ), комплектам (последовательные и Вентури), типу распределения (баллоны/резервуары, аккумуляторы, композитные коллекторы и другие), конечному использованию (легковые автомобили, средние автомобили и тяжелые автомобили) — тенденции отрасли и прогноз до 2032 года.

Размер рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

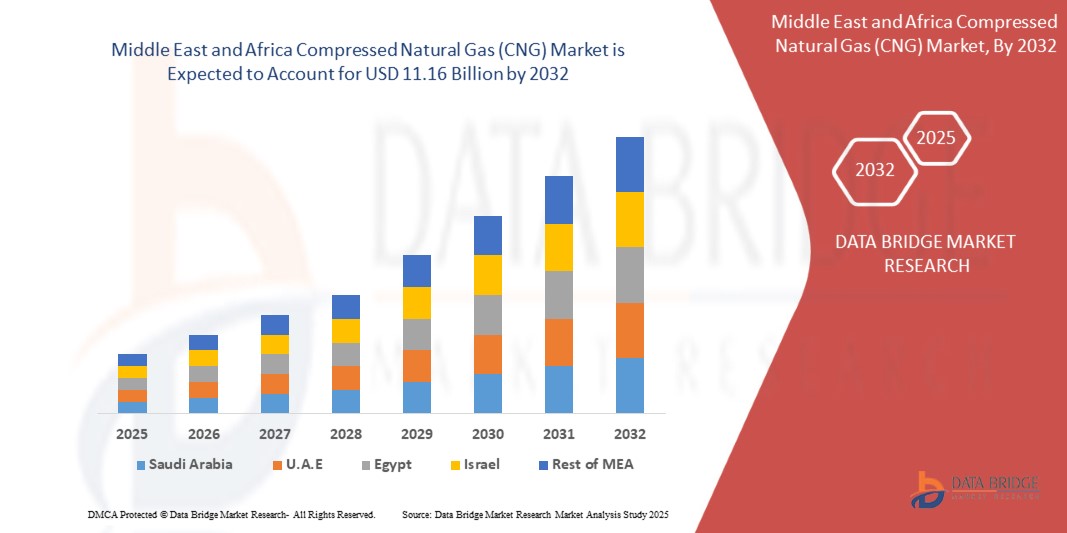

- Объем рынка сжатого природного газа на Ближнем Востоке и в Африке оценивался в 8,41 млрд долларов США в 2024 году и, как ожидается, достигнет 11,16 млрд долларов США к 2032 году , что соответствует среднегодовому темпу роста в 3,6% в течение прогнозируемого периода.

- Рост рынка обусловлен в первую очередь обширными запасами природного газа в регионе, государственной политикой, направленной на диверсификацию топлива, и растущей обеспокоенностью по поводу снижения зависимости от дорогостоящего жидкого топлива.

- Кроме того, растущий спрос на доступное и более чистое топливо стимулирует его внедрение, особенно в парках общественного транспорта и коммерческих транспортных средствах в таких странах, как Египет, Южная Африка, Нигерия и государства Персидского залива.

- Значительные инвестиции в развитие инфраструктуры сжатого природного газа, включая заправочные станции и распределительные трубопроводы, создают новые возможности как для местных, так и для международных игроков.

- В совокупности эти факторы ускоряют переход к использованию сжатого природного газа, делая его жизненно важным компонентом стратегии энергетического перехода на Ближнем Востоке и в Африке.

Анализ рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

- Рынок компримированного природного газа (КПГ) на Ближнем Востоке и в Африке переживает бурный рост, чему способствуют крупные внутренние запасы природного газа, представляющие собой экономичную альтернативу бензину и дизельному топливу. Такие страны, как Иран, Катар, Нигерия и Египет, активно используют свои богатые газовые ресурсы для расширения использования компримированного природного газа в транспортном и промышленном секторах.

- Сегмент легковых автомобилей лидирует по темпам внедрения благодаря росту цен на топливо и опасениям владельцев частных автомобилей по поводу его доступности. Однако, согласно прогнозам, в течение прогнозируемого периода значительно вырастет доля использования компримированного природного газа в парках средне- и большегрузных автомобилей, особенно в сфере логистики и общественного транспорта.

- Иран доминировал на рынке сжатого природного газа на Ближнем Востоке и в Африке, занимая наибольшую долю рынка – 36,14%, что обусловлено его огромными запасами природного газа и развитой сетью заправочных станций. Масштабные государственные программы переоборудования транспортных средств, особенно такси и автобусов, сделали Иран региональным лидером в 2024 году.

- Саудовская Аравия стала самым быстрорастущим рынком в регионе со среднегодовым темпом роста 12,36%, хотя ее текущий уровень внедрения остается ниже, чем в Иране и Египте.

- Сегмент свободного газа занял самую большую долю рынка по выручке в 56,12% в 2024 году, подкрепленную гигантскими выделенными газовыми месторождениями на Ближнем Востоке и в Северной Африке, которые обеспечивают стабильный приток

Область применения отчета и сегментация рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

|

Атрибуты |

Ключевые данные о рынке сжатого природного газа (СПГ) на Ближнем Востоке и в Африке |

|

Охваченные сегменты |

|

|

Страны действия |

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночной стоимости, темпах роста, сегментации, географическом охвате и основных игроках, отчет включает в себя: углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок и цепочки создания стоимости, обзор сырья, критерии выбора поставщиков, анализ PESTLE, анализ пяти сил Портера и нормативную базу. |

Тенденции рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

Поддерживаемые правительством программы расширения и внедрения инфраструктуры КПГ

- Ключевой тенденцией, определяющей рынок компримированного природного газа на Ближнем Востоке и в Африке, является ускоренное инвестирование в инфраструктуру для компримированного природного газа, подкрепляемое государственной политикой и субсидиями, направленными на снижение зависимости от традиционных видов топлива. Такие страны, как Египет, Нигерия и Иран, расширяют сеть заправочных станций для компримированного природного газа и предлагают стимулы для переоборудования транспортных средств для достижения целей энергетической безопасности и устойчивого развития.

- Системы общественного транспорта в таких городах, как Каир, Йоханнесбург и Лагос, всё чаще используют автобусы и такси, работающие на сжатом природном газе, в рамках более масштабных инициатив по развитию экологичной мобильности. Это вызывает резонанс в автомобильной отрасли, стимулируя спрос на комплекты для работы на сжатом природном газе, баллоны и услуги по переоборудованию.

- Эта тенденция дополнительно усиливается государственно-частным партнёрством (ГЧП), в рамках которого крупнейшие мировые энергетические компании сотрудничают с региональными правительствами для масштабирования инфраструктуры. Например, соглашения в странах Персидского залива направлены на внедрение композитных баллонов для сжатого природного газа и комплектов последовательного подключения для повышения эффективности и безопасности транспортных средств.

- Растущее соответствие глобальным климатическим целям и соглашениям КС также стимулирует реформы нормативно-правового регулирования в регионе. Страны позиционируют сжатый природный газ как переходный вид топлива, поощряя его внедрение до тех пор, пока возобновляемые источники энергии и решения в области электромобильности не достигнут полной зрелости.

- Кроме того, рост урбанизации, а также предпочтение потребителями более дешевого топлива ускоряют проникновение сжатого природного газа в легковые автомобили (LMV) и небольшие автопарки, что подчеркивает переход региона к устойчивым и экономически выгодным транспортным решениям.

Динамика рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

Водитель

Растущий спрос на экономичные и более чистые альтернативы топливу

- Рынок компримированного природного газа (КПГ) на Ближнем Востоке и в Африке развивается в условиях растущей потребности в недорогих и экологически чистых топливных решениях. В условиях волатильности цен на сырую нефть и роста уровня загрязнения воздуха правительства и потребители всё чаще рассматривают КПГ как экологичную альтернативу бензину и дизельному топливу.

- Наличие крупных запасов природного газа в таких странах, как Катар, Иран, Нигерия и Алжир, укрепляет надежность поставок и способствует внедрению компримированного природного газа в регионе. Эти запасы создают основу для масштабного развертывания инфраструктуры компримированного природного газа.

- Государственные программы, такие как реформы топливных субсидий и политика развития экологичного транспорта, стимулируют переоборудование транспортных средств и покупку новых автомобилей, работающих на сжатом природном газе. Кроме того, такие стимулы, как налоговые льготы, схемы финансирования и льготное лицензирование для автомобилей, работающих на сжатом природном газе, способствуют дальнейшему росту их внедрения в государственном и частном секторах.

- Быстрый рост населения, урбанизация и растущая зависимость от систем общественного транспорта создают значительные возможности для автобусов, микроавтобусов и такси, работающих на сжатом природном газе, позиционируя сжатый природный газ как важнейший компонент программы устойчивого развития транспорта в регионе.

Сдержанность/Вызов

Ограничения инфраструктуры и высокие первоначальные затраты на преобразование

- Несмотря на высокий потенциал, рынок сжатого природного газа на Ближнем Востоке и в Африке сталкивается со значительными ограничениями в виде ограниченной доступности инфраструктуры, в частности, недостаточного количества заправочных станций за пределами крупных городов. Это снижает доверие потребителей и приводит к неравенству в использовании газа в мегаполисах и сельской местности.

- Например, высокие первоначальные затраты на комплекты для переоборудования автомобилей на сжатый природный газ и композитные баллоны являются сдерживающим фактором для потребителей, чувствительных к цене. Многие владельцы автомобилей, особенно в развивающихся странах региона, продолжают считать переход на сжатый природный газ финансово обременительным, несмотря на долгосрочную экономию.

- Технические проблемы, включая сложность обслуживания, проблемы с безопасностью хранения и нехватку квалифицированной рабочей силы, создают препятствия для плавного внедрения. В некоторых странах ограниченное нормативное регулирование также повышает риски, связанные с некачественными или поддельными комплектами для сжатого природного газа.

- Региональные конфликты, политическая нестабильность и неравномерные инвестиционные приоритеты в странах Африки и Ближнего Востока еще больше затрудняют последовательное развитие рынка, замедляя широкомасштабное внедрение автопарков, работающих на сжатом природном газе.

- Преодоление этих барьеров потребует скоординированных инвестиций, нормативно-правовой базы и кампаний по информированию общественности для повышения доверия потребителей и конкурентоспособности отрасли.

Рынок сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

Рынок сегментирован по признакам источника, комплектации, распространения и конечного использования.

• По источнику

По источникам происхождения рынок компримированного природного газа Ближнего Востока и Африки сегментируется на попутный газ, свободный газ и нетрадиционный газ. Сегмент свободного газа занимал наибольшую долю рынка в 56,12% в 2024 году, благодаря гигантским выделенным газовым месторождениям на Ближнем Востоке и в Северной Африке, которые обеспечивают стабильные поставки больших объемов для городских газоснабжающих сетей и транспортного топлива. Обширные запасы, развитая добывающая инфраструктура и долгосрочные контракты на добычу газа позволили коммунальным компаниям и розничным продавцам топлива обеспечить предсказуемые поставки сырья по конкурентоспособным ценам. Эта стабильность в сочетании с налаженными транспортными трубопроводами и сетями станций превратила свободный газ в основу региональной доступности компримированного природного газа.

Ожидается, что сегмент нетрадиционного газа продемонстрирует самые высокие темпы роста – 22,16% в период с 2025 по 2032 год. Это обусловлено продолжающейся разработкой месторождений плотного/сернистого газа и сланцевых месторождений на ранней стадии разработки по мере диверсификации поставок. Достижения в области бурения и переработки, а также налоговые стимулы для монетизации внутренних ресурсов ускоряют переход от пилотных проектов к масштабным в отдельных бассейнах. По мере расширения сетей и улучшения логистики компримирования ожидается, что нетрадиционные молекулы будут более стабильно поступать в цепочки поставок компримированного природного газа. Это расширит возможности поставок и снизит зависимость развивающихся африканских рынков от импорта.

• По комплекту

По типу комплектов рынок сегментирован на комплекты для переоборудования на двухтопливные автомобили (ретрофит), комплекты для последовательного впрыска и специализированные системы сжатого природного газа (КПГ) от OEM-производителей. Комплекты для переоборудования на двухтопливные автомобили доминировали в структуре выручки рынка в 2024 году благодаря масштабным программам модернизации автопарков такси, микроавтобусов и лёгких коммерческих автомобилей, где экономия топлива быстро окупается. Модернизация минимизирует первоначальные капитальные затраты по сравнению с покупкой новых автомобилей, что обеспечивает более быстрое проникновение в разрозненные автопарки, принадлежащие владельцам-операторам. Широкая доступность запчастей и специалистов ещё больше укрепила экосистему модернизации в метрополитенских коридорах.

Ожидается, что специализированные системы сжатого природного газа (СПГ) от производителей оригинального оборудования (OEM) будут демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, чему будут способствовать тендеры на закупку автопарков, в которых автобусы и грузовики заводского производства выбираются в качестве приоритетных с точки зрения надежности, соответствия нормам выбросов и гарантийного покрытия. По мере снижения совокупной стоимости владения логистические и муниципальные операторы переориентируют закупки на специализированные платформы с увеличенными баками и оптимизированными силовыми агрегатами. В то же время, комплекты с последовательным впрыском топлива (CIP) получат преимущества в плане производительности и снижения выбросов при интенсивном использовании, но рост числа производителей оригинального оборудования (OEM) будет опережать темпы роста по мере локализации сборки и улучшения финансирования.

• По распределению

По принципу дистрибуции рынок сегментирован на общественные станции быстрого заполнения (материнские и дочерние сети), станции с длительным заполнением (собственные автопарки) и виртуальные трубопроводные/мобильные станции сжатого природного газа (каскадные прицепы, дочерние станции). В 2024 году наибольшую долю заняли общественные станции быстрого заполнения, связанные с городскими коридорами с высокой плотностью такси/автобусов, а также с расширением охвата привокзальных площадок национальными нефтегазовыми компаниями. Конфигурации «материнская-дочерняя сеть» позволили быстро масштабировать сеть даже в условиях ограниченного количества трубопроводных соединений, обеспечивая достаточную пропускную способность в часы пик. Стабильный уровень обслуживания и стратегическое расположение вблизи станций и автобусных узлов обеспечили лидерство по объему.

Сегменты заправок по времени и виртуальных трубопроводов готовы к самому быстрому росту в 2025–2032 годах, поскольку операторы расширяют доступ к сжатому природному газу за пределы магистральных трубопроводов, охватывая второстепенные города и промышленные кластеры. Решения по заправке по времени соответствуют ритмам ночной заправки автопарков, сокращая очереди и эксплуатационные расходы. Параллельно с этим, виртуальная трубопроводная логистика (главная станция → каскадные прицепы → дочерние станции) обеспечивает раннюю активацию рынка в регионах с неразвитой инфраструктурой, особенно в странах Африки к югу от Сахары, до тех пор, пока строительство трубопроводов не достигнет своего пика.

• По конечному использованию

По принципу конечного использования рынок сегментирован на транспортный, жилой, коммерческий и промышленный/энергетический. Транспортный сегмент занял наибольшую долю рынка в 2024 году, поскольку транспортные компании, операторы такси и службы доставки «последней мили» увеличили использование сжатого природного газа для снижения расходов на топливо и выбросов выхлопных газов. Государственные стимулы для конвертации, льготные тарифы и политика создания зон с низким уровнем выбросов способствовали внедрению газа в категории легковых и грузовых автомобилей. Рост заказов на городские автобусы и развертывание частных логистических компаний поддерживали высокую загрузку в транспортных узлах быстрого заполнения.

Ожидается, что сегмент промышленного производства/генерации электроэнергии будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено переходом с дизельного топлива на газ в котельных, малых турбинах и распределенной генерации в условиях улучшения доступа к трубопроводам. Сжатый природный газ представляет собой гибкое решение в условиях отсутствия СПГ или трубопроводного газа, позволяя заводам, отелям и жилым комплексам достигать целевых показателей по выбросам и стабилизировать расходы на электроэнергию. По мере укрепления надежности поставок и развития логистики сжатого природного газа в больших объемах этот сегмент будет расширять свою долю наряду с проектами внутренних микросетей и когенерации.

Региональный анализ рынка сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

- Иран доминирует на рынке сжатого природного газа на Ближнем Востоке и в Африке, занимая наибольшую долю рынка в 36,14%, чему способствуют его огромные запасы природного газа и хорошо развитая сеть заправочных станций.

- Иран стал явным лидером рынка в 2024 году. Обладая одними из крупнейших в мире запасов природного газа и хорошо развитой внутренней заправочной инфраструктурой, Иран успешно продвигал широкое внедрение сжатого природного газа как экономичного и более чистого транспортного топлива.

- Правительство поддержало масштабные программы переоборудования такси, автобусов и легковых автомобилей, что прочно вывело Иран на лидирующие позиции в регионе по использованию сжатого природного газа. Его давние инфраструктурные преимущества и обширная база поставок гарантируют Ирану дальнейшее доминирование на рынке.

Обзор рынка сжатого природного газа (СПГ) в ОАЭ

ОАЭ вносят ещё один важный вклад в региональный рост, чему способствуют быстрое развитие инфраструктуры и политика диверсификации источников энергии. В рамках Энергетической стратегии ОАЭ до 2050 года правительство уделяет первостепенное внимание сокращению зависимости от нефти и сокращению выбросов, что делает КПГ привлекательной альтернативой топливу. Государственная компания ADNOC Gas вкладывает значительные средства в строительство новых заправочных станций с КПГ, особенно активно внедряя его в коммерческих автопарках и государственных транспортных средствах. Это сделало ОАЭ одним из самых быстрорастущих рынков компримированного природного газа на Ближнем Востоке.

Обзор рынка сжатого природного газа (СПГ) в Египте

Египет является ведущим рынком внедрения компримированного природного газа. Правительство Египта через Египетскую газовую холдинговую компанию (EGAS) реализовало масштабные инициативы по переводу тысяч транспортных средств на сжатый природный газ. Кроме того, значительные инвестиции в расширение сети заправочных станций с компримированным природным газом сделали это топливо более доступным для широких масс. Общественный транспорт, включая такси, микроавтобусы и городские автобусы, составляет основу спроса на компримированный природный газ в стране, что делает Египет бесспорным лидером в области использования компримированного природного газа в Африке.

Обзор рынка сжатого природного газа (СПГ) в Саудовской Аравии

Саудовская Аравия стала самым быстрорастущим рынком в регионе со среднегодовым темпом роста 12,36%, хотя текущий уровень внедрения остаётся ниже, чем в Иране и Египте. В соответствии с программой развития страны «Видение 2030», которая делает акцент на сокращении выбросов углерода и диверсификации энергобаланса, Саудовская Аравия активно инвестирует в перевод государственных и частных автопарков на сжатый природный газ. Правительство, в партнёрстве с частными инвесторами, также расширяет инфраструктуру заправок сжатым природным газом. Ожидается, что эти инициативы ускорят проникновение на рынок и в ближайшие годы сделают Саудовскую Аравию одним из самых динамично развивающихся центров на рынке сжатого природного газа на Ближнем Востоке и в Африке.

В отрасли сжатого природного газа на Ближнем Востоке и в Африке лидируют в основном хорошо зарекомендовавшие себя компании, среди которых:

- Eni SpA (региональные операции) (Италия)

- QatarEnergy (Катар)

- Египетская холдинговая компания природного газа (EGAS ) (Египет)

- Национальная иранская газовая компания (NIGC) (Иран)

- Sasol Limited (Южная Африка)

- Нигерийская национальная нефтяная корпорация (NNPC) (Нигерия)

- Газпром (операции на Ближнем Востоке и в Африке) (Россия/ОАЭ)

- TotalEnergies (региональные операции) (Франция)

- Национальная нефтяная компания Абу-Даби (ADNOC) (ОАЭ)

Последние события на мировом рынке сжатого природного газа (СПГ) на Ближнем Востоке и в Африке

- В январе 2025 года компания QatarEnergy объявила о расширении своей инициативы по развитию инфраструктуры КПГ, объявив о планах строительства более 200 новых заправочных станций по всему региону Персидского залива к 2030 году. Этот шаг направлен на диверсификацию использования энергии, сокращение выбросов и ускорение внедрения КПГ в общественном и частном транспорте. Проект подчёркивает роль Катара как ключевого игрока в газовом секторе и демонстрирует решительную поддержку правительством экологически чистых транспортных решений.

- В сентябре 2024 года компания TotalEnergies (Франция) заключила партнерское соглашение с ADNOC Distribution (ОАЭ) для создания совместного предприятия по развитию крупных распределительных сетей сжатого природного газа (КПГ) в ОАЭ. Сотрудничество направлено на обеспечение надежных поставок, переоборудование автопарков и развитие инфраструктуры для заправки большегрузных автомобилей. Это развитие повышает доступность КПГ в странах ССЗ и соответствует национальным целям декарбонизации.

- В июне 2024 года Министерство нефти и минеральных ресурсов Египта открыло 100 новых заправочных станций сжатым природным газом (КПГ) в рамках «Программы расширения парка автомобилей, работающих на природном газе». Эта инициатива является частью более широкой стратегии Египта по снижению зависимости от импортного топлива, улучшению качества воздуха и достижению энергетической независимости. Быстрое внедрение станций значительно увеличило популярность КПГ среди легковых и средних автомобилей.

- В апреле 2024 года компания Eni (Италия) расширила своё присутствие в Северной Африке, инвестировав в проекты по распределению КПГ в Алжире. Инвестиции включают разработку заправочных решений на основе композитных коллекторов, предназначенных для обслуживания сельских и пригородных регионов. Проект демонстрирует, как международные энергетические компании поддерживают африканские страны в переходе к чистой энергетике.

- В октябре 2023 года «Газпром» (Россия) подписал соглашение с южноафриканскими энергетическими компаниями о пилотном запуске общественного транспорта на КПГ в Йоханнесбурге и Кейптауне. Это одна из первых масштабных инициатив в странах Африки к югу от Сахары по внедрению КПГ в городскую мобильность, направленная на снижение зависимости от дизельного топлива и сокращение выбросов в городах с высокой плотностью населения.

- В августе 2023 года Saudi Aramco запустила пилотную программу поставок сжатого природного газа (СПГ) для крупных транспортных парков в Эр-Рияде и Джидде. Компания также тестирует гибридные модели, сочетающие СПГ с водородом, позиционируя себя как лидера в области инноваций в области более чистого топлива для транспортного сектора на Ближнем Востоке.

- В мае 2023 года Национальная программа расширения газового сектора Нигерии (NGEP) ускорила внедрение стимулов для внедрения КПГ, включая субсидии на комплекты для переоборудования и налоговые льготы для операторов автопарков, работающих на КПГ. Ожидается, что эта инициатива значительно увеличит проникновение КПГ в легковые и грузовые автомобили в Нигерии, одном из крупнейших автомобильных рынков Африки.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.