Middle East And Africa Bioactive Ingredient Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.55 Billion

USD

6.01 Billion

2025

2033

USD

3.55 Billion

USD

6.01 Billion

2025

2033

| 2026 –2033 | |

| USD 3.55 Billion | |

| USD 6.01 Billion | |

|

|

|

|

Сегментация рынка биоактивных ингредиентов на Ближнем Востоке и в Африке по типу ингредиента (пребиотики, пробиотики, аминокислоты, пептиды, омега-3 и структурированные липидные кислоты, фитохимические вещества и растительные экстракты, минералы, витамины, клетчатка и специальные углеводы, каротиноиды и антиоксиданты и другие), применению (функциональные продукты питания, пищевые добавки, жевательные добавки, корма для животных, средства личной гигиены и другие) и источнику (растительного, животного и микробного происхождения) — отраслевые тенденции и прогноз до 2033 года.

Размер рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

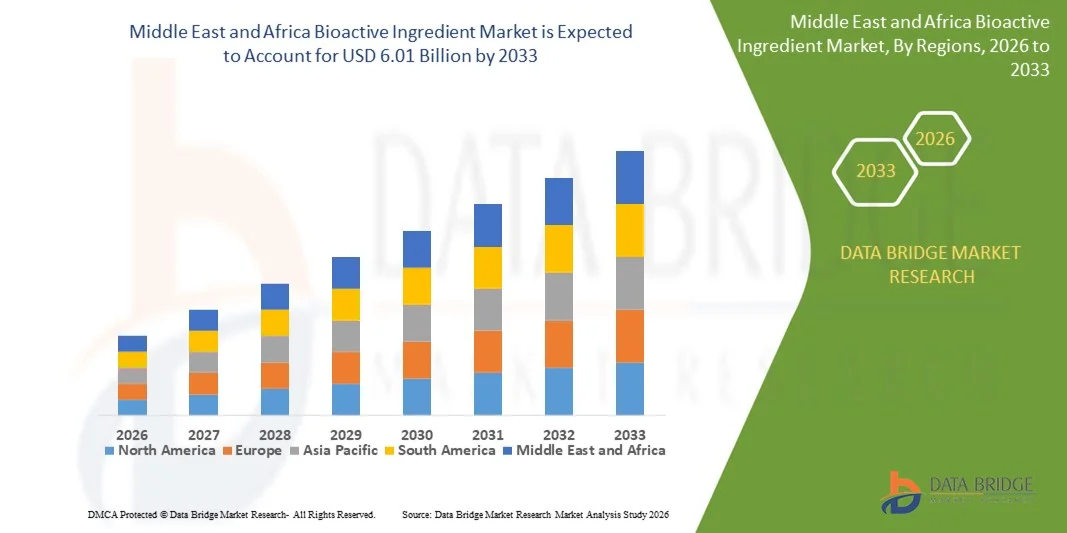

- Объем рынка биоактивных ингредиентов на Ближнем Востоке и в Африке в 2025 году оценивался в 3,55 млрд долларов США и, как ожидается, достигнет 6,01 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 6,80% в течение прогнозируемого периода.

- Рост рынка в значительной степени обусловлен повышением осведомленности потребителей о профилактической медицине, функциональном питании и роли биоактивных соединений в лечении заболеваний, связанных с образом жизни.

- Увеличение доли биоактивных ингредиентов в функциональных продуктах питания, пищевых добавках, нутрицевтиках и средствах личной гигиены способствует дальнейшему устойчивому расширению рынка.

Анализ рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

- Рынок демонстрирует уверенный рост благодаря непрерывным инновациям в технологиях экстракции, составления рецептур и доставки лекарственных средств, которые повышают биодоступность, стабильность и эффективность биологически активных соединений.

- Кроме того, растущая популярность натуральных, растительных и экологически чистых ингредиентов, а также расширение их применения в пищевой, фармацевтической и косметической промышленности повышают общую привлекательность рынка.

- В 2025 году рынок биоактивных ингредиентов в Южной Африке доминировал благодаря росту осведомленности о профилактической медицине и улучшению уровня жизни. Растущее число представителей среднего класса стимулирует спрос на функциональные продукты питания и пищевые добавки.

- Ожидается, что ОАЭ продемонстрируют самый высокий среднегодовой темп роста (CAGR) на рынке биоактивных ингредиентов на Ближнем Востоке и в Африке благодаря растущей осведомленности о здоровье, высоким располагаемым доходам, растущему спросу на высококачественные продукты питания и товары для здоровья, а также правительственным инициативам, поддерживающим сектор функциональных продуктов питания и нутрицевтики.

- В 2025 году сегмент витаминов занимал наибольшую долю рынка по выручке, что было обусловлено широким использованием в функциональных продуктах питания, пищевых добавках и обогащенных напитках, а также растущим вниманием потребителей к иммунитету, энергии и общему благополучию. Витамины широко используются благодаря их доказанным полезным свойствам для здоровья, простоте рецептуры и высокой осведомленности потребителей всех возрастных групп.

Обзор отчета и сегментация рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

|

Атрибуты |

Ключевые тенденции рынка биоактивных ингредиентов на Ближнем Востоке и в Африке: анализ рынка |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, анализ ценообразования, анализ доли брендов, опросы потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Тенденции рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

Растущий спрос на профилактическую медицину и функциональное питание.

- Растущее внимание к поддержанию здоровья и профилактике заболеваний существенно влияет на рынок биоактивных ингредиентов, поскольку потребители все чаще ищут ингредиенты, которые обеспечивают физиологические преимущества, выходящие за рамки базового питания. Биоактивные ингредиенты приобретают все большую популярность благодаря доказанной роли в поддержании иммунитета, здоровья пищеварительной системы, сердечно-сосудистой системы и когнитивных функций. Эта тенденция способствует их широкому применению в функциональных продуктах питания, пищевых добавках, нутрицевтиках и средствах личной гигиены, побуждая производителей разрабатывать инновационные рецептуры, соответствующие моделям потребления, ориентированным на здоровье.

- Растущая осведомленность о заболеваниях, связанных с образом жизни, старении населения и долгосрочном поддержании здоровья ускорила спрос на биоактивные ингредиенты в функциональных продуктах питания, обогащенных напитках, пищевых добавках и спортивном питании. Потребители, заботящиеся о своем здоровье, активно ищут продукты, обогащенные антиоксидантами, пробиотиками, омега-жирными кислотами, полифенолами и растительными экстрактами, что побуждает бренды делать акцент на научной обоснованности, позиционировании «чистой этикетки» и функциональной эффективности при разработке продукции.

- Тенденции в области профилактической медицины и здорового образа жизни влияют на решения о покупке, при этом производители подчеркивают клинически подтвержденные преимущества, использование натуральных ингредиентов и повышение биодоступности. Прозрачная маркировка, заявления о пользе для здоровья, подтвержденные исследованиями, и экологичность помогают брендам дифференцировать продукцию и укреплять доверие потребителей, а также стимулируют инвестиции в исследования и разработки и передовые системы доставки.

- Например, в 2024 году ведущие бренды в сфере питания и здорового образа жизни расширили свои портфолио, представив функциональные продукты питания и добавки, обогащенные биоактивными соединениями, такими как пробиотики, омега-3 жирные кислоты и растительные антиоксиданты. Эти запуски были обусловлены растущим потребительским спросом на продукты, повышающие иммунитет, здоровье кишечника и энергию, и пользовались большим спросом в розничной торговле, электронной коммерции и каналах дистрибуции, ориентированных на здоровье.

- Хотя спрос на биоактивные ингредиенты продолжает расти, устойчивый рост рынка зависит от непрерывных исследований, соблюдения нормативных требований и обеспечения стабильной эффективности различных рецептур. Производители сосредоточены на улучшении биодоступности, стабильности и масштабируемости, одновременно балансируя между стоимостью, качеством и научным обоснованием для поддержки более широкого внедрения.

Динамика рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

Водитель

Растущее внимание к профилактической медицине и потреблению функциональных продуктов питания.

- Растущее внимание потребителей к профилактической медицине является ключевым фактором развития рынка биоактивных ингредиентов. Потребители все чаще обращаются к функциональным продуктам питания, добавкам и нутрицевтикам, обогащенным биоактивными соединениями, для поддержания здоровья в долгосрочной перспективе, лечения хронических заболеваний и улучшения общего самочувствия. Этот сдвиг побуждает производителей заменять традиционные ингредиенты функциональными биоактивными веществами, эффективность которых подтверждена научными исследованиями.

- Расширение сферы применения биоактивных ингредиентов в функциональных продуктах питания, напитках, пищевых добавках, фармацевтических препаратах и средствах личной гигиены способствует росту рынка. Биоактивные ингредиенты помогают повысить пищевую ценность, функциональные характеристики и позиционирование продукта как полезного для здоровья, позволяя производителям удовлетворять меняющиеся ожидания потребителей в отношении продуктов, ориентированных на здоровый образ жизни.

- Производители продуктов питания, пищевых добавок и средств личной гигиены активно продвигают рецептуры на основе биоактивных ингредиентов посредством инноваций в продуктах, клинических исследований и маркетинговых кампаний, ориентированных на здоровье. Эти усилия поддерживаются растущим предпочтением потребителей к натуральным, научно обоснованным и многофункциональным ингредиентам, что способствует развитию партнерских отношений между поставщиками ингредиентов, исследовательскими учреждениями и брендами.

- Например, в 2023 году крупные мировые компании, производящие продукты питания и пищевые добавки, сообщили об увеличении доли пробиотиков, растительных экстрактов и омега-жирных кислот в рецептурах функциональных продуктов питания и добавок. Это расширение последовало за ростом потребительского спроса на решения для укрепления иммунитета, улучшения пищеварения и когнитивных функций, что привело к дифференциации продукции и повторным покупкам.

- Несмотря на то, что тенденции в области профилактической медицины активно способствуют росту рынка, долгосрочный успех зависит от соответствия нормативным требованиям, стабильного качества ингредиентов и постоянных инвестиций в исследования и технологии разработки рецептур для удовлетворения глобального спроса и поддержания конкурентоспособности.

Сдержанность/Вызов

Высокие затраты на разработку и сложность регулирования

- Относительно высокая стоимость разработки и коммерциализации биоактивных ингредиентов остается ключевой проблемой, особенно из-за обширных исследований, клинической проверки и сложных технологических процессов. Процессы экстракции, очистки и стабилизации часто увеличивают производственные затраты, ограничивая внедрение среди производителей, чувствительных к цене.

- Сложность регулирования и различные требования к одобрению заявлений о пользе для здоровья и функциональных ингредиентов создают дополнительные проблемы. Производители должны соблюдать строгие стандарты безопасности, эффективности и маркировки, что может задерживать запуск продукции и увеличивать затраты на соблюдение нормативных требований. Ограниченная ясность регулирования в отношении некоторых новых биоактивных соединений еще больше ограничивает выход на рынок.

- Проблемы с цепочкой поставок и рецептурой также влияют на рост рынка, поскольку некоторые биоактивные ингредиенты чувствительны к теплу, свету и окислению. Обеспечение стабильности, биодоступности и стабильной эффективности в различных форматах продуктов увеличивает сложность рецептуры и операционные затраты.

- Например, производители, выпускающие новые функциональные продукты питания и добавки на основе биоактивных веществ в 2024 году, сообщили о задержках, связанных с увеличением сроков утверждения и необходимостью предоставления дополнительной клинической документации для подтверждения заявлений о пользе для здоровья. Эти факторы увеличили время выхода на рынок и ограничили циклы инноваций.

- Для решения этих задач потребуются оптимизированные нормативные рамки, экономически эффективные технологии экстракции и постоянные инвестиции в научные исследования. Сотрудничество между производителями ингредиентов, регулирующими органами и производителями продукции будет иметь решающее значение для раскрытия долгосрочных возможностей роста и обеспечения устойчивого расширения мирового рынка биоактивных ингредиентов.

Обзор рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

Рынок сегментирован по типу ингредиентов, применению и источнику происхождения.

- По типу ингредиента

В зависимости от типа ингредиента рынок биоактивных ингредиентов на Ближнем Востоке и в Африке сегментирован на пребиотики, пробиотики, аминокислоты, пептиды, омега-3 и структурированные липиды, фитохимические вещества и растительные экстракты, минералы, витамины, клетчатку и специальные углеводы, каротиноиды и антиоксиданты, а также прочие. Сегмент витаминов занимал наибольшую долю рынка по выручке в 2025 году благодаря широкому использованию в функциональных продуктах питания, пищевых добавках и обогащенных напитках, а также растущему вниманию потребителей к иммунитету, энергии и общему благополучию. Витамины широко используются благодаря их доказанным полезным свойствам для здоровья, простоте рецептур и высокой осведомленности потребителей всех возрастных групп.

Ожидается, что сегмент пробиотиков продемонстрирует самый быстрый темп роста в период с 2026 по 2033 год, чему способствует растущая осведомленность о здоровье кишечника, пищеварении и поддержке иммунитета. Рост потребления ферментированных продуктов, функциональных напитков и пробиотических добавок способствует быстрому внедрению пробиотиков, при этом производители инвестируют в разработку новых штаммов и повышение стабильности для более широкого применения.

- По заявлению

В зависимости от области применения рынок биоактивных ингредиентов на Ближнем Востоке и в Африке сегментирован на функциональные продукты питания, пищевые добавки, жевательные добавки, корма для животных, средства личной гигиены и другие. В 2025 году наибольшую долю рынка занимал сегмент пищевых добавок, чему способствовали растущая осведомленность о здоровье, тенденции в области профилактической медицины и растущий спрос на удобные форматы питания. Биоактивные ингредиенты широко используются в капсулах, таблетках и порошках для решения проблем, связанных с иммунитетом, энергией и образом жизни.

Ожидается, что сегмент функциональных продуктов питания продемонстрирует самый высокий темп роста в период с 2026 по 2033 год, чему способствует растущее потребление обогащенных продуктов питания и напитков, обладающих дополнительными преимуществами для здоровья. Производители сосредоточены на включении биоактивных ингредиентов в повседневные продукты питания, чтобы соответствовать меняющимся предпочтениям потребителей в отношении питательной и оздоровительной диеты.

- Источник

В зависимости от источника происхождения, рынок биоактивных ингредиентов на Ближнем Востоке и в Африке сегментирован на растительные, животные и микробные. В 2025 году сегмент растительных ингредиентов доминировал на рынке благодаря сильному предпочтению потребителей к натуральным ингредиентам с «чистой этикеткой» и полученным из экологически чистых источников. Биоактивные вещества растительного происхождения, такие как полифенолы, клетчатка и растительные экстракты, широко используются в пищевой промышленности, производстве пищевых добавок и средств личной гигиены благодаря их предполагаемой безопасности и функциональным преимуществам.

Ожидается, что сегмент микробных продуктов продемонстрирует самый высокий темп роста в период с 2026 по 2033 год, чему будет способствовать растущее использование пробиотиков, ферментов и ингредиентов, полученных методом ферментации. Достижения в области биотехнологий и процессов ферментации позволяют масштабировать производство и обеспечивать стабильное качество, что делает микробные источники все более привлекательными для производителей биоактивных ингредиентов.

Региональный анализ рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

- В 2025 году рынок биоактивных ингредиентов в Южной Африке доминировал благодаря росту осведомленности о профилактической медицине и улучшению уровня жизни. Растущее число представителей среднего класса стимулирует спрос на функциональные продукты питания и пищевые добавки.

- Урбанизация и изменение пищевых привычек влияют на потребление биологически активных ингредиентов.

- Расширение современных розничных и аптечных сетей увеличивает охват рынка. Растущий интерес к товарам для укрепления иммунитета и поддержания хорошего самочувствия поддерживает спрос.

Анализ рынка биоактивных ингредиентов в ОАЭ

Ожидается, что рынок биоактивных ингредиентов в ОАЭ продемонстрирует самые высокие темпы роста в период с 2026 по 2033 год, чему способствуют высокий уровень располагаемых доходов и высокая осведомленность о здоровье. Потребители все чаще выбирают продукты премиум-класса для здорового питания и оздоровления. Растет спрос на функциональные продукты питания, пищевые добавки и обогащенные напитки. Внимание правительства к инициативам в области здравоохранения и оздоровления способствует развитию рынка. Растущие инвестиции в инновации в нутрицевтике ускоряют внедрение новых продуктов.

Доля рынка биоактивных ингредиентов на Ближнем Востоке и в Африке

Индустрия биоактивных ингредиентов на Ближнем Востоке и в Африке в основном представлена хорошо зарекомендовавшими себя компаниями, в том числе:

• Saudi Basic Industries Corporation (Саудовская Аравия)

• Savola Group (Саудовская Аравия)

• Almarai Company (Саудовская Аравия)

• National Food Products Company (ОАЭ)

• IFFCO Group (ОАЭ)

• Al Ain Farms (ОАЭ)

• Aspen Pharmacare Holdings Limited (Южная Африка)

• Adcock Ingram Holdings Limited (Южная Африка)

• RCL Foods Limited (Южная Африка)

• Tiger Brands Limited (Южная Африка)

• Clover Industries Limited (Южная Африка)

• Zamil Industrial Investment Co. (Саудовская Аравия)

• Julphar Gulf Pharmaceutical Industries (ОАЭ)

• Nutrivita Food Industries (Египет)

• Pharco Pharmaceuticals (Египет)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.