Middle East And Africa Aroma Chemicals Market

Размер рынка в млрд долларов США

CAGR :

%

USD

66.66 Billion

USD

144.53 Billion

2025

2033

USD

66.66 Billion

USD

144.53 Billion

2025

2033

| 2026 –2033 | |

| USD 66.66 Billion | |

| USD 144.53 Billion | |

|

|

|

|

Сегментация рынка ароматических химикатов на Ближнем Востоке и в Африке по химическому типу (терпены, бензоиды, мускусные химикаты, сложные эфиры, кетоны и другие), ароматическому узлу (цветочный, древесный, цитрусовый, фруктовый, травяной, тропический и другие), цвету (бесцветный, белый, желтоватый и другие), источнику (натуральный и синтетический), форме (жидкий и сухой), применению (туалетные принадлежности, тонкие ароматы/парфюмерия, средства личной гигиены, напитки, продукты питания и другие), типу продукта (мадагаскарская ванилина, тиксосил 38 x, ванилин, карвакрол, пропиленгликоль USP, дипропиленгликоль, дипропиленгликоль метиловый эфир, дигидромирценол, цис-3-гексенол, альдегид c-18, линалоол, лизмераль, коричный альдегид, цитронелол, Галаксолид, Iso E Super, гераниол, гексилциннамический альдегид, альдегид C-14, изоборнилацетат, фенилэтиловый спирт, анетол, эвгенол, фуранеол, малиновый кетон, гамма-декалактон, тимберсилк, дельта-додекалактон, дифенилоксид, эвкалиптол, анисовый альдегид, цеталокс, гедион // MDJ, альфа-ионон, яра-яра, ионон бета, линалилацетат, изоамилацетат, бутирато де этил, триол 91 кошерный, этилваилин, канфор, цитраль, терпинолеоны, бромелиа, жасмациклен/вердилацетат, альдегид c-12 MNA, вердокс // OTBC ацетат, гамма-окталактон, триацетин, бензилацетат, Цитронелал, бензиловый спирт, гелиотропин, гамма-метилионон, терпинеолы, буржеональ, динаскон, бакданол, тимол, кумарин, дигидрокумарин, амилсалицилат, гексилсалицилат, метилсалицилат, вердилпропионат, ундекавертол, цитрнелилнитрил, метилантранилат, терпинилацетат, метилциклопентенолон, ацетат Ptbc, этилциклопентенолон, масляная кислота, альдегиды c-12 (MOA, MNA и т. д.), альдегиды c-11, розалин, оксид розы 90:10, мальтол, этилмальтол, триплаль, этилкапроат, гексаноаты и гептаноаты этил и метил, ментол, натуральный, синтетический, мятный 60% и 80%, Нерол, Экзальтолид, Стриалилацетат, Тетрагидролиналоол, Тетрагидромирценол, Аллиламилгликолят, Борнеол Кристаллизад, Изоборнеол, Тоналид, Виолифф, Тибутирин, Яванол и другие) и каналы сбыта (косвенные и прямые) — Тенденции отрасли и прогноз до 2033 года

Каковы размер и темпы роста рынка ароматических химикатов на Ближнем Востоке и в Африке?

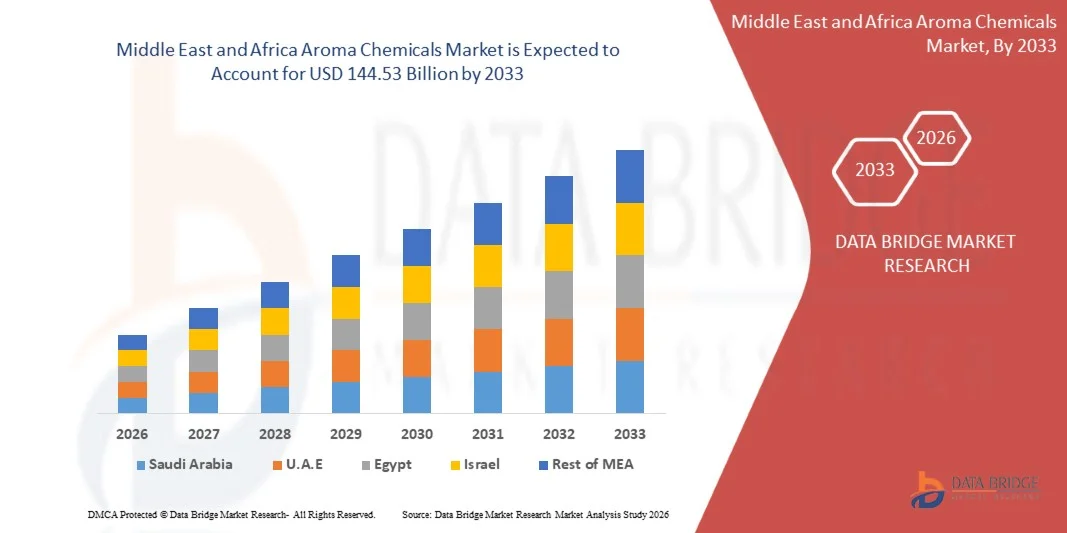

- Объем рынка ароматических химикатов на Ближнем Востоке и в Африке оценивался в 66,66 млрд долларов США в 2025 году и , как ожидается, достигнет 144,53 млрд долларов США к 2033 году при среднегодовом темпе роста 7,0% в течение прогнозируемого периода.

- Рост объемов строительства и развития инфраструктуры, включая коммерческие, жилые и промышленные проекты, обуславливает спрос на химикаты Aroma Chemicals для защиты конструкций от проникновения воды, влаги и ухудшения состояния окружающей среды, тем самым способствуя росту рынка.

- Высокая первоначальная стоимость высококачественных мембран и их установки в сочетании с необходимостью привлечения квалифицированной рабочей силы и специализированной техники увеличивает общие расходы по проекту, что может ограничить их применение в небольших или чувствительных к затратам проектах.

Каковы основные выводы рынка ароматических химикатов?

- Достижения в области технологий гидроизоляции, такие как самоклеящиеся мембраны, жидкие растворы и высокоэффективные синтетические листы, повышают долговечность и простоту монтажа, открывая значительные возможности для роста для участников рынка.

- Такие проблемы, как утечки, неправильная установка и требования к техническому обслуживанию, продолжают влиять на экономическую эффективность и производительность, создавая основные препятствия для широкого внедрения ароматических химикатов на Ближнем Востоке и в Африке.

- Саудовская Аравия доминировала на рынке ароматических химикатов на Ближнем Востоке и в Африке с долей выручки 34,5% в 2025 году, чему способствовало растущее внедрение высококачественных ароматических химикатов в парфюмерную промышленность, производство средств личной гигиены, продуктов питания и напитков.

- По прогнозам, в ОАЭ будет зафиксирован самый быстрый среднегодовой темп роста в 9,8% в период с 2026 по 2033 год, чему будет способствовать внедрение натуральных, устойчивых и инновационных ароматических веществ в парфюмерии, средствах личной гигиены, а также продуктах питания и напитках.

- Сегмент терпенов доминировал на рынке с долей выручки 54% в 2025 году, что обусловлено высоким спросом на ароматизаторы, средства личной гигиены и продукты питания благодаря их универсальности и натуральному ароматическому профилю.

Объем отчета и сегментация рынка ароматических химикатов

|

Атрибуты |

Ключевые данные о рынке ароматических химикатов |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Какова основная тенденция на рынке ароматических химикатов?

« Растущий спрос на устойчивые и высокоэффективные ароматические химикаты »

- На рынке ароматических химикатов Ближнего Востока и Африки наблюдается ключевая тенденция к росту использования экологичных, экологически чистых и многофункциональных ароматических ингредиентов. Эта тенденция обусловлена растущей осведомлённостью потребителей о здоровье, благополучии и устойчивом развитии, особенно в сфере продуктов питания, напитков, косметики и средств личной гигиены.

- Например, такие компании, как Firmenich и Givaudan, разрабатывают биоразлагаемые ароматические химикаты растительного происхождения с повышенной стабильностью и превосходными сенсорными характеристиками, чтобы соответствовать строгим нормативным стандартам и ожиданиям потребителей.

- Растущий спрос на натуральные, гипоаллергенные и экологически чистые ароматизаторы ускоряет их внедрение в пищевой промышленности, производстве напитков и средств личной гигиены на Ближнем Востоке и в Африке.

- Производители внедряют передовые технологии экстракции, микрокапсуляции и обработки без растворителей для повышения производительности, срока годности и безопасности.

- Расширение исследований и разработок в области новых вкусовых соединений, устойчивого снабжения и технологий маскировки запахов способствует инновациям.

- Поскольку потребители продолжают отдавать приоритет здоровью, устойчивому развитию и высококачественным сенсорным ощущениям, ожидается, что высококачественные и натуральные ароматические вещества останутся центральными при разработке продуктов.

Каковы основные движущие силы рынка ароматических химикатов?

- Растущий акцент на экологически чистых, натуральных и экологичных ингредиентах является основным фактором расширения рынка.

- Например, в 2025 году компании DSM и Symrise выпустили ароматизаторы на растительной основе, не содержащие аллергенов, для продуктов питания, напитков и средств личной гигиены, ориентированные на потребителей, заботящихся о своем здоровье.

- Растущий спрос на высококачественные и функциональные ароматизаторы и отдушки в упакованных продуктах питания, напитках и косметике стимулирует их внедрение

- Технологические достижения в области экстракции, очистки и инкапсуляции позволяют производителям производить более стабильные и мощные ароматические ингредиенты.

- Растущее внимание со стороны регулирующих органов к безопасности, маркировке и устойчивому снабжению поддерживает рост рынка.

- Ожидается, что благодаря постоянным инвестициям в НИОКР, устойчивому снабжению и инновациям, ориентированным на потребителя, рынок ароматических химикатов на Ближнем Востоке и в Африке сохранит устойчивую динамику роста в ближайшие годы.

Какой фактор препятствует росту рынка ароматических химикатов?

- Высокая стоимость высококачественных натуральных и растительных ароматизаторов ограничивает их внедрение, особенно для мелких производителей и продуктов, чувствительных к цене.

- Например, в 2024–2025 годах колебания цен на сырье, затрат на добычу и соблюдения нормативных требований повлияли на объемы производства и ценообразования для ведущих игроков.

- Строгие нормативные требования к безопасности, маркировке аллергенов и соблюдению экологических норм увеличивают сложность и стоимость эксплуатации.

- Ограниченная осведомленность потребителей о преимуществах натуральных и функциональных ароматических веществ может сдерживать их массовое внедрение.

- Конкуренция со стороны синтетических ароматических веществ, недорогих местных альтернатив и импортных заменителей создает ценовое давление и влияет на проникновение на рынок.

- Чтобы решить эти проблемы, производители концентрируют внимание на экономически эффективных методах экстракции, устойчивом снабжении, экологически сертифицированной продукции и образовательных программах для предоставления высококачественных, безопасных и устойчивых решений в области ароматических химических веществ.

Как сегментирован рынок ароматических химикатов?

Рынок сегментирован по типу химического вещества, ароматическому узлу, цвету, источнику, форме, применению, типу продукта и каналу сбыта .

• По химическому типу

По типу химических веществ рынок сегментирован на терпены, бензоиды, мускусные вещества, сложные эфиры, кетоны и другие. Сегмент терпенов доминировал на рынке с долей выручки 54% в 2025 году, что обусловлено высоким спросом в сфере изысканных ароматов, средств личной гигиены и продуктов питания благодаря их универсальности и натуральному ароматическому профилю.

Прогнозируется, что производство мускусных химикатов будет расти самыми быстрыми темпами в период с 2026 по 2033 год, что обусловлено растущим спросом на стойкие, премиальные ароматы в элитной парфюмерии и средствах личной гигиены. Постоянные инновации в области экстракции синтетических и натуральных терпенов способствуют расширению рынка, при этом терпены по-прежнему предпочтительны для применения в соответствии с принципами «чистой этикетки» и функциональных областях.

• По ароматическому узлу

По принципу ароматизации рынок сегментирован на цветочные, древесные, цитрусовые, фруктовые, травяные, тропические и другие. Сегмент цветочных ароматов доминировал с долей выручки 38,6% в 2025 году благодаря широкому использованию в парфюмерии, туалетных принадлежностях и средствах личной гигиены.

Прогнозируется, что спрос на древесные ароматизаторы будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему будет способствовать растущий спрос на тёплые, землистые ароматы в люксовых и нишевых продуктах. Инновации в области инкапсуляции и стабилизации обеспечивают стабильное сохранение аромата в различных областях применения.

• По цвету

По цвету рынок сегментирован на бесцветные, белые, желтоватые и другие. Сегмент бесцветных химикатов доминировал на рынке с долей выручки 46,2% в 2025 году, поскольку эти химикаты отличаются высокой универсальностью, легко смешиваются и используются в производстве напитков, косметики и продуктов питания.

Прогнозируется, что объем производства желтоватых ароматических химикатов будет расти самыми быстрыми темпами в период с 2026 по 2033 год, что обусловлено предпочтением потребителей натурально полученных, визуально привлекательных ингредиентов и расширением сфер применения в специализированной парфюмерии.

• По источнику

В зависимости от источника рынок сегментирован на натуральные и синтетические. Синтетический сегмент доминировал с долей выручки 51,3% в 2025 году благодаря стабильному качеству, масштабируемости и более низкой стоимости по сравнению с натуральными экстрактами.

Прогнозируется, что рынок натуральных ароматических веществ будет расти самыми быстрыми среднегодовыми темпами в период с 2026 по 2033 год, чему будет способствовать растущее предпочтение потребителями экологически чистых, органических и устойчивых ароматизаторов в секторах продуктов питания, напитков и средств личной гигиены.

• По форме

По форме рынок сегментирован на жидкие и сухие. Сегмент жидких препаратов доминировал с долей выручки 57,4% в 2025 году благодаря простоте приготовления, высокой растворимости и широкой промышленной применимости.

Прогнозируется, что рынок сухих ароматических веществ будет расти самыми быстрыми темпами в год в период с 2026 по 2033 год, чему будут способствовать достижения в области инкапсуляции, смешивания порошков и технологий стабильности для функциональных продуктов питания и напитков.

• По применению

В зависимости от сферы применения рынок сегментирован на следующие категории: туалетные принадлежности, парфюмерия, средства личной гигиены, напитки, продукты питания и другие. Сегмент парфюмерии занял лидирующие позиции с долей выручки 44,7% в 2025 году, что обусловлено растущим спросом на люксовую и нишевую парфюмерию.

Прогнозируется, что рынок напитков будет расти самыми быстрыми темпами в год в период с 2026 по 2033 год, в основном за счет функциональных напитков, ароматизированной воды и напитков премиум-класса, требующих уникальных ароматических профилей.

• По типу продукта

На основе типа продукта рынок сегментирован на Vainilla Vainas Madagascar, Tixosil 38 x, Vainillin, Carvacrol, Propilenglicol USP, Dipropilenglicol, Dipropilenglicol Metil Eter, Dihydromircenol, Cis-3-Hexenol, Aldehide C-18, Linalool, Lysmeral, Cinnamic Aldehyde, Citronelol, Galaxolide, Iso E Super, Geraniol, Hexylcinnamic Aldehyde, Aldehide C-14, Isoborniyl Acetate, Phenylethyl Alcohol, Anethole, Eugenol, Furaneol, Raspberry Ketone, Gamma-Decalactone, Timbersilk, Delta-Dodecalactona, Diphenyl Oxide, Eucaliptol, Anisaldehyde, Cetalox, Hedione // MDJ, Alpha Ionone, Yara Yara, Ionone Beta, Linalyl Acetate, Isoamyl Acetate, Butirato De Etilo, Triol 91 Kosher, Ethyl Vainilline, Canphor, Citral, Terpinoleones, Bromelia, Jasmacyclene / Verdyl Acetate, Aldehide c-12 MNA, Verdox // OTBC Acetate, Gamma-Octalactone, Triacetine, Benzyl Acetate, Citronelal, Benzyl Alcohol, Heliotropine, Gamma Methyl Ionone, Terpineols, Bourgeonal, Dynascone, Bacdanol, Thymol, Coumarine, Dihydrocoumarine, Amyl Salicylate, Hexyl Salicilate, Methyl Salicilate, Verdyl propionate, Undecavertol, Citrnelyl Nitryle, Methyl Antranilate, Terpinyl Acetate, Methyl Cyclo Pentenolone, Ptbc ацетат, этилциклопентенолон, масляная кислота, альдегиды c-12 (MOA, MNA и т. д.), альдегиды c-11, розалин, оксид розы 90:10, мальтол, этилмальтол, триплал, этилкапроат, гексаноаты и гептаноаты этил и метил, ментол, натуральный, синтетический, мята курчавая 60% и 80%, нерол, экзалтолид, стриалилацетат, тетрагидролиналоол, тетрагидромирценол, аллиламилгликолят, борнеол кристаллический, изоборнеол, тоналид, виолифф, тибутирин, яванол и др. Сегмент ванилина доминировал с долей выручки 36,8% в 2025 году благодаря его широкому использованию в кондитерских изделиях, напитках и парфюмерии.

Прогнозируется, что компания Hedione будет расти самыми быстрыми темпами среднегодового темпа роста в период с 2026 по 2033 год, чему будут способствовать тенденции в области элитной парфюмерии и растущее предпочтение изысканным ароматическим композициям.

• По каналу распространения

По каналам сбыта рынок сегментирован на два сегмента: косвенный и прямой. В 2025 году сегмент прямого сбыта доминировал с долей выручки 53,6%, поскольку производители напрямую поставляют ароматизаторы крупным компаниям, производящим продукты питания, напитки и средства личной гигиены, обеспечивая качество и прослеживаемость.

Прогнозируется, что непрямые каналы будут расти самыми быстрыми среднегодовыми темпами в период с 2026 по 2033 год, чему будет способствовать расширение охвата малых и средних предприятий онлайн-торговыми площадками, дистрибьюторами и специализированными поставщиками.

Какой регион занимает наибольшую долю рынка ароматических химикатов?

- Саудовская Аравия доминировала на рынке ароматических веществ Ближнего Востока и Африки, достигнув 34,5% выручки в 2025 году благодаря растущему использованию высококачественных ароматических веществ в парфюмерии, средствах личной гигиены, продуктах питания и напитках. Рост потребительского интереса к премиальной парфюмерии, натуральным ароматизаторам и продуктам с «чистой этикеткой» является движущей силой регионального роста.

- Государственное регулирование безопасности, маркировки и соблюдения экологических норм стимулирует производителей к использованию экологически чистых источников сырья, экологичных рецептур и передовых производственных процессов. Стремительная урбанизация, расширение розничных сетей и развитие промышленности ускоряют выход продукции на рынок по всему региону.

- Ключевые игроки используют технологические достижения в области экстракции, инкапсуляции и производства синтетических ароматических веществ для повышения однородности, качества и привлекательности продукта для потребителей, особенно в высокотехнологичных коммерческих и розничных приложениях.

Обзор рынка ароматических химикатов в ОАЭ

Прогнозируется, что в ОАЭ будет зафиксирован самый быстрый среднегодовой темп роста в 9,8% в период с 2026 по 2033 год, что обусловлено внедрением натуральных, устойчивых и инновационных ароматических веществ в парфюмерии, средствах личной гигиены, а также продуктах питания и напитках. Инвестиции в производственные мощности, инициативы в области «зеленой химии» и производство высококачественных ингредиентов способствуют долгосрочному росту рынка в стране.

Какие компании являются ведущими на рынке ароматических химикатов?

В отрасли производства ароматических химикатов лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Takasago International Corporation (Япония)

- BASF SE (Германия)

- DSM (Нидерланды)

- Firmenich SA (Швейцария)

- Symrise (Германия)

- Oriental Aromatics (Индия)

- Bordas SA (Франция)

- Privi Speciality Chemicals Limited (Индия)

- Bell Flavors & Fragrances (США)

- Hindustan Mint & Agro Products Pvt. Ltd. (Индия)

- Treatt Plc (Великобритания)

- Vigon International, Inc. (США)

- Сидаром (США)

- INOUE Perfume MFG. CO., LTD. (Япония)

- МАНЕ (Франция)

- Де Мончи Ароматикс (Нидерланды)

- Givaudan (Швейцария)

- Корпорация Као (Япония)

Каковы последние события на рынке ароматических химикатов на Ближнем Востоке и в Африке?

- В апреле 2025 года компании Eternis Fine Chemicals и ChainCraft BV заключили историческое стратегическое партнерство для развития низкоуглеродных биоароматических веществ. Это сотрудничество объединяет инновационную линейку продуктов SensiCraft от ChainCraft, основанную на технологии ферментации растительного происхождения, с производственным опытом и надежной цепочкой поставок Eternis, устанавливая новый стандарт устойчивого развития в парфюмерной индустрии. Ожидается, что это партнерство ускорит внедрение экологичных парфюмерных ингредиентов нового поколения.

- В апреле 2025 года компания BASF выпустила ароматические ингредиенты с уменьшенным углеродным следом, что позволяет клиентам достигать своих целей в области устойчивого развития и снижать воздействие на окружающую среду при производстве различных рецептур. Эта инициатива подтверждает акцент на экологичных и высокоэффективных ароматических веществах.

- В октябре 2024 года компания Prigiv начала работу на недавно созданном заводе по производству ароматических ингредиентов в Махаде, совместном предприятии Givaudan (49%) и Privi (51%). Завод предназначен для производства широкого ассортимента усовершенствованных ароматических продуктов. В ближайшие несколько лет планируется масштабировать производство, что будет способствовать расширению рынка высококачественных ароматических химикатов.

- В мае 2023 года Firmenich International SA завершила слияние с DSM, образовав DSM-Firmenich, ведущего инновационного партнера в области питания, здоровья, красоты и ароматических веществ. Эта консолидация укрепляет глобальные возможности и расширяет возможности разработки экологически чистых ингредиентов.

- В апреле 2023 года компания Bedoukian Research Inc. заключила партнерское соглашение с Inscripta для разработки и коммерциализации натуральных ингредиентов высочайшего качества, стабильности и снижения воздействия на окружающую среду. Используя платформу GenoScaler от Inscripta для оптимизации штаммов микроорганизмов, BRI теперь может эффективно производить экологически чистые ингредиенты в больших объемах, укрепляя принципы устойчивого развития в секторе ароматических химикатов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.