Middle East And Africa Aluminum Casting Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.60 Billion

USD

7.91 Billion

2024

2032

USD

4.60 Billion

USD

7.91 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 7.91 Billion | |

|

|

|

|

Сегментация рынка алюминиевого литья на Ближнем Востоке и в Африке по процессу (литье в формы одноразового использования и литье в формы многоразового использования), источнику (первичный (свежий алюминий) и вторичный (переработанный алюминий), применению (впускные коллекторы, корпуса масляных поддонов, конструктивные детали, детали шасси, головки блока цилиндров, блоки двигателей, трансмиссии, колеса и тормоза, теплопередача и другие), конечному потребителю (автомобилестроение, строительство, промышленность, бытовая техника, аэрокосмическая промышленность, электроника и электротехника, инженерные инструменты и другие) — тенденции отрасли и прогноз до 2032 года

Размер рынка литья алюминия на Ближнем Востоке и в Африке

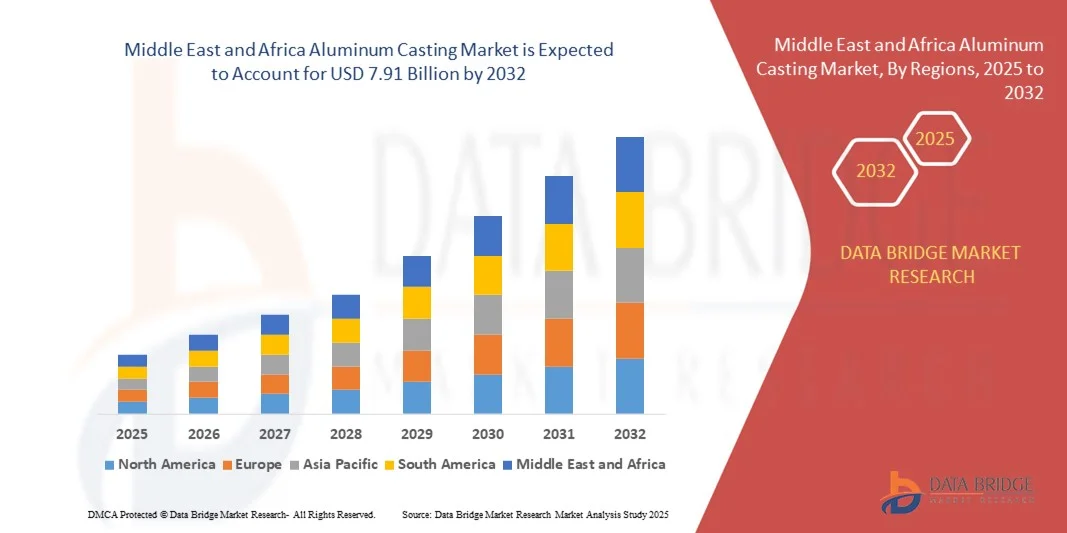

- Объем рынка литья алюминия на Ближнем Востоке и в Африке в 2024 году оценивался в 4,60 млрд долларов США и, по прогнозам, к 2032 году достигнет 7,91 млрд долларов США , при этом среднегодовой темп роста составит 7,00% в течение прогнозируемого периода.

- Рост рынка обусловлен в первую очередь ростом индустриализации, расширением автомобильного и строительного секторов, а также растущим спросом на легкие, высокопроизводительные компоненты для различных сфер применения.

- Кроме того, развитие технологий литья в сочетании с акцентом на устойчивые производственные практики и энергоэффективные решения способствуют их внедрению как на развитых, так и на развивающихся рынках. Сочетание этих факторов ускоряет внедрение решений для литья алюминия, тем самым значительно стимулируя рост отрасли.

Анализ рынка литья алюминия на Ближнем Востоке и в Африке

- Алюминиевые отливки, обеспечивающие получение легких, высокопрочных деталей для автомобильной, строительной и промышленной отраслей, приобретают все большую значимость в современном производстве благодаря своей долговечности, стойкости к коррозии и возможности адаптации к сложным конструкциям.

- Растущий спрос на алюминиевое литье обусловлен, прежде всего, ростом автомобильной отрасли, расширением строительной деятельности и потребностью в энергоэффективных, легких решениях для различных промышленных применений.

- ОАЭ доминируют на рынке литья алюминия на Ближнем Востоке и в Африке, имея наибольшую долю выручки в 37,2% в 2024 году, чему способствуют развитая промышленная инфраструктура, инвестиции в автомобильную и аэрокосмическую отрасли, а также присутствие ключевых производителей литья, особенно в таких странах, как ОАЭ и Саудовская Аравия, где растет спрос на высокопроизводительные алюминиевые компоненты.

- Ожидается, что в прогнозируемый период Саудовская Аравия станет самым быстрорастущим регионом на рынке литья алюминия на Ближнем Востоке и в Африке благодаря быстрой индустриализации, развитию инфраструктуры и увеличению производства автомобилей в таких странах, как Южная Африка и Нигерия.

- Сегмент литья в одноразовые формы доминировал на рынке с наибольшей долей выручки в 57,4% в 2024 году, что обусловлено его пригодностью для производства сложных геометрических форм, легких компонентов и высокопроизводительных деталей для автомобильных и промышленных применений.

Область применения отчета и сегментация рынка литья алюминия на Ближнем Востоке и в Африке

|

Атрибуты |

Ключевые аспекты рынка литья алюминия |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка литья алюминия на Ближнем Востоке и в Африке

Достижения в области легких и высокопроизводительных алюминиевых компонентов

- Важной и набирающей обороты тенденцией на рынке алюминиевого литья Ближнего Востока и Африки является всё более широкое внедрение лёгких и высокопроизводительных алюминиевых компонентов в автомобильной, аэрокосмической и промышленной отраслях. Этот сдвиг обусловлен потребностью в повышении топливной экономичности, снижении выбросов и улучшении структурных характеристик.

- Например, автопроизводители всё чаще используют алюминиевые блоки двигателей, компоненты шасси и кузовные панели, чтобы снизить вес автомобиля, сохранив при этом прочность и долговечность. Аналогичным образом, аэрокосмические компании интегрируют алюминиевые отливки в конструктивные элементы для оптимизации веса без ущерба для безопасности и производительности.

- Достижения в области технологий литья, такие как литье под высоким давлением и вакуумное литье, позволяют производить изделия сложной геометрии с жесткими допусками и превосходным качеством поверхности. Эти инновации повышают производительность и надежность компонентов, сокращая при этом время производства и отходы материала.

- Растущее внимание к устойчивым производственным практикам также способствует их внедрению, поскольку алюминий легко перерабатывается и может быть использован повторно без существенной потери свойств материала. Это соответствует глобальным экологическим нормам и целям компаний в области устойчивого развития, особенно в быстро индустриализирующихся регионах Ближнего Востока и Африки.

- Такие компании, как Emirates Global Aluminium и SABIC, разрабатывают высокопрочные алюминиевые сплавы и передовые литейные решения, адаптированные для автомобильной, строительной и аэрокосмической отраслей, способствуя как оптимизации производительности, так и экологической устойчивости.

- Спрос на легкие, прочные и эффективные алюминиевые отливки стремительно растет на Ближнем Востоке и в Африке, чему способствуют промышленный рост, инфраструктурные проекты и растущее внимание к энергоэффективным и экологически ответственным методам производства .

Динамика рынка литья алюминия на Ближнем Востоке и в Африке

Водитель

Растущий спрос, обусловленный развитием промышленности и внедрением легких материалов

- Быстрая индустриализация на Ближнем Востоке и в Африке, а также растущий спрос со стороны автомобильной, строительной и аэрокосмической отраслей являются важными факторами увеличения потребления алюминиевого литья.

- Например, в 2024 году компания Emirates Global Aluminium расширила свои производственные мощности, чтобы удовлетворить растущий спрос на высокопрочные и лёгкие алюминиевые компоненты для автомобильной и строительной промышленности. Ожидается, что подобные инициативы ключевых компаний будут способствовать росту рынка алюминиевого литья в прогнозируемый период.

- Поскольку производители всё больше внимания уделяют топливной экономичности, снижению веса конструкции и повышению производительности, алюминиевые отливки представляют собой универсальное решение по сравнению с более тяжёлыми традиционными материалами, такими как сталь. Современные отливки обеспечивают долговечность, коррозионную стойкость и гибкость конструкции, что делает их идеальными для высокопроизводительных применений.

- Кроме того, продолжающееся развитие интеллектуальных и энергоэффективных зданий в сочетании с инфраструктурными проектами на развивающихся рынках стимулирует внедрение алюминиевых отливок в структурных и архитектурных приложениях, где важны как прочность, так и малый вес.

- Спрос на прецизионные компоненты, включая детали автомобильных двигателей, шасси и промышленного оборудования, является дополнительным стимулом роста, чему способствуют достижения в области литья под высоким давлением, литья в вакууме и других современных производственных технологий.

Сдержанность/Вызов

Высокие производственные затраты и требования к техническим навыкам

- Относительно высокие первоначальные инвестиции, необходимые для создания современных предприятий, оборудования и технологий для литья алюминия, могут стать проблемой для малых и средних производителей в регионе.

- Например, создание высокоточных линий литья под давлением или внедрение технологий литья под вакуумом требует значительных капитальных затрат и обучения квалифицированной рабочей силы, что может ограничить проникновение на рынки развивающихся регионов.

- Кроме того, поддержание стабильного качества алюминиевого литья требует технической экспертизы и строгого контроля технологического процесса. Изменения состава сплава, температуры и скорости охлаждения могут повлиять на эксплуатационные характеристики и надежность конечной продукции, создавая трудности для производителей с ограниченным опытом и ресурсами.

- Хотя автоматизация и современные технологии литья постепенно сокращают потребность в ручном труде и повышают эффективность, потребность в обученном персонале и процессах обеспечения качества остается серьезным препятствием.

- Преодоление этих проблем посредством инвестиций в передовые технологии литья, обучение рабочей силы и оптимизацию процессов будет иметь решающее значение для устойчивого роста и конкурентоспособности на рынке литья алюминия на Ближнем Востоке и в Африке.

Объем рынка литья алюминия на Ближнем Востоке и в Африке

Рынок литья алюминия на Ближнем Востоке и в Африке сегментирован по признакам процесса, источника, области применения и конечного потребителя.

- По процессу

По технологическому процессу рынок алюминиевого литья Ближнего Востока и Африки сегментируется на литье в одноразовые формы и литье в многоразовые формы. Сегмент литья в одноразовые формы доминировал на рынке с наибольшей долей выручки в 57,4% в 2024 году, что обусловлено его пригодностью для производства деталей сложной геометрии, лёгких компонентов и высокопроизводительных деталей для автомобильной и промышленной промышленности. Производители предпочитают технологии литья в одноразовые формы из-за их способности минимизировать требования к механической обработке и обеспечивать гибкость проектирования.

Ожидается, что сегмент литья многоразовых форм продемонстрирует самые высокие среднегодовые темпы роста на уровне 19,8% в период с 2025 по 2032 год, что обусловлено растущим спросом на экономически эффективные решения для многоразовых форм, особенно в сценариях средне- и крупносерийного производства, где долговечность, повторяемость и низкие эксплуатационные расходы делают их привлекательным выбором.

- По источнику

По источнику рынок сегментирован на первичный (свежий алюминий) и вторичный (переработанный алюминий). Сегмент первичного алюминия обеспечил наибольшую долю выручки в 62,1% в 2024 году благодаря стабильным поставкам высококачественного алюминия и его превосходным механическим свойствам, необходимым для критически важных применений, таких как компоненты двигателей, детали шасси и промышленное оборудование. Рост индустриализации и автомобильного производства в регионе поддерживает этот спрос.

Прогнозируется, что сегмент вторичного алюминия продемонстрирует самый быстрый среднегодовой темп роста на уровне 21,5% в период с 2025 по 2032 год, чему будут способствовать рост экологической осведомлённости, государственные инициативы по стимулированию переработки и ценовые преимущества. Использование переработанного алюминия растёт в строительстве, автомобилестроении и производстве потребительских товаров благодаря его энергоэффективности и экологичности.

- По применению

По областям применения рынок алюминиевого литья на Ближнем Востоке и в Африке сегментируется на впускные коллекторы, корпуса масляных поддонов, конструктивные элементы, детали шасси, головки блока цилиндров, блоки двигателей, трансмиссии, колёса и тормоза, теплообменники и другие. Сегмент конструктивных элементов доминировал на рынке с долей выручки 38,7% в 2024 году благодаря широкому применению в автомобильной промышленности и строительстве, где требуются лёгкие, но прочные компоненты.

Ожидается, что сегмент колес и тормозов продемонстрирует самые быстрые темпы среднегодового темпа роста на уровне 20,3% в период с 2025 по 2032 год, что будет обусловлено ростом производства транспортных средств, стремлением к экономии топлива и растущим внедрением легких алюминиевых сплавов для повышения производительности и снижения выбросов.

- Конечным пользователем

По типу конечного потребителя рынок алюминиевого литья Ближнего Востока и Африки сегментируется на следующие отрасли: автомобилестроение, строительство, промышленность, бытовая техника, аэрокосмическая промышленность, электроника и электротехника, машиностроение и другие. Наибольшая доля выручки в 2024 году пришлась на автомобильный сегмент – 45,6%, что обусловлено спросом на лёгкие и высокопрочные компоненты, нормативными требованиями к сокращению выбросов и распространением электромобилей.

Прогнозируется, что в аэрокосмическом сегменте будет наблюдаться самый быстрый среднегодовой темп роста в 22,1% в период с 2025 по 2032 год в связи с растущим применением алюминиевых отливок в компонентах самолетов для оптимизации веса, топливной эффективности и повышения производительности, а также ростом коммерческой и военной авиации в регионе.

Региональный анализ рынка алюминиевого литья на Ближнем Востоке и в Африке

- ОАЭ доминировали на рынке литья алюминия с наибольшей долей выручки в 37,2% в 2024 году, что было обусловлено быстрой индустриализацией, расширением автомобильного и строительного секторов и растущим спросом на легкие, высокопроизводительные компоненты.

- Производители и конечные потребители в регионе все чаще отдают предпочтение алюминиевым отливкам из-за их соотношения прочности к весу, коррозионной стойкости и универсальности в автомобильной, промышленной и строительной отраслях.

- Широкое распространение этого метода подкрепляется государственными инициативами, направленными на поощрение устойчивого производства, развитием технологий литья и ростом инвестиций в энергоэффективные решения, благодаря чему литье алюминия становится предпочтительным выбором как для устоявшихся отраслей, так и для развивающихся рынков на Ближнем Востоке и в Африке.

Обзор рынка литья алюминия в Саудовской Аравии

Рынок алюминиевого литья Саудовской Аравии в 2024 году обеспечил значительную долю выручки благодаря масштабным инфраструктурным проектам страны, расширению автомобильного производства и государственным инициативам по диверсификации промышленного сектора. Спрос на лёгкие и высокопроизводительные алюминиевые компоненты для строительства, транспорта и промышленного оборудования стимулирует рост рынка. Кроме того, внедрение передовых технологий литья и ориентация на устойчивые и энергоэффективные методы производства дополнительно ускоряют расширение рынка.

Обзор рынка алюминиевого литья в ОАЭ

Ожидается, что рынок алюминиевого литья в ОАЭ в прогнозируемый период продемонстрирует существенный рост, обусловленный быстрой урбанизацией, ростом коммерческого и жилого строительства, а также инвестициями в аэрокосмическую, оборонную и автомобильную отрасли. Использование высококачественного алюминиевого литья в современных зданиях, транспортных средствах и промышленном оборудовании, а также технологический прогресс в производственных процессах, способствуют его освоению рынком. Государственные инициативы, направленные на поддержку промышленных инноваций и энергоэффективности, также способствуют росту.

Обзор рынка литья алюминия в Южной Африке

Прогнозируется, что рынок алюминиевого литья в Южной Африке будет устойчиво расти, чему способствуют автомобилестроение, производство промышленного оборудования и горнодобывающей техники. Растущий спрос на лёгкие и коррозионно-стойкие алюминиевые компоненты, а также усилия правительства по модернизации промышленной базы, способствуют их внедрению в автомобильной, строительной и промышленной отраслях. Инвестиции в передовые технологии литья и повышение энергоэффективности также способствуют расширению рынка.

Обзор рынка литья алюминия в Египте

Ожидается, что рынок алюминиевого литья в Египте будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать развитие инфраструктуры, рост производства автомобилей и инвестиции в строительные и энергетические проекты. Растущий спрос на прочные и лёгкие алюминиевые компоненты для конструкционных, механических и автомобильных применений стимулирует их внедрение на рынок. Интеграция экологически устойчивых производственных технологий и технологических достижений в области литья дополнительно стимулирует рост рынка.

Доля рынка литья алюминия на Ближнем Востоке и в Африке

Лидерами отрасли литья алюминия являются в первую очередь хорошо зарекомендовавшие себя компании, среди которых:

• Gulf Aluminum Rolling Mills (ОАЭ)

• Сабик (Саудовская Аравия)

• Emirates Global Aluminium (ОАЭ)

• Alcoa (США)

• Noranda Aluminum (Канада)

• Constellium (Франция)

• Хиндалко Индастриз (Индия)

• China Zhongwang Holdings (Китай)

• Новелис (США)

• ElvalHalcor (Греция)

• Mubadala Aluminium (ОАЭ)

• Al Jazeera Steel Products (Катар)

• Алюминий Бахрейн (Бахрейн)

• Национальная компания по производству алюминиевых изделий (Саудовская Аравия)

• Мааден Алюминий (Саудовская Аравия)

• Sundwiger Aluminium (Германия)

• AAI (African Aluminium Industries) (Южная Африка)

• Metallum (Южная Африка)

• Alumeco (ОАЭ)

• Алюминиевый прокат Бахрейна (Бахрейн)

Каковы последние события на рынке литья алюминия на Ближнем Востоке и в Африке?

- В апреле 2023 года компания Emirates Global Aluminium (EGA), ведущий производитель алюминия в ОАЭ, объявила о расширении своих современных литейных мощностей для удовлетворения растущего спроса в автомобильной и строительной отраслях. Эта инициатива направлена на производство высококачественных, лёгких и энергоэффективных алюминиевых компонентов, что подчёркивает приверженность EGA инновациям и устойчивым производственным практикам на Ближнем Востоке и в Африке.

- В марте 2023 года компания South African Foundries Ltd. запустила новую линейку прецизионных алюминиевых отливок, предназначенных для промышленного оборудования и автомобилестроения. Это стратегическое развитие подчёркивает стремление компании к повышению производительности и долговечности продукции, поддержке местных производителей и укреплению своего присутствия на растущем региональном рынке алюминиевого литья.

- В марте 2023 года египетская алюминиевая компания (EGAL) успешно открыла современный литейный цех, предназначенный для нужд растущих строительного и транспортного секторов. Внедряя передовые технологии литья, EGAL повышает эффективность производства, улучшает качество компонентов и продвигает регион к более экологичным производственным практикам.

- В феврале 2023 года компания Aluminium Bahrain BSC (Alba) объявила о сотрудничестве с региональными производителями автомобильной техники по поставке высокопроизводительных алюминиевых отливок для двигателей и конструктивных элементов. Это партнерство подчеркивает стремление Alba поддерживать рост промышленности, продвигать облегченные решения и расширять применение алюминиевых отливок в различных областях применения на Ближнем Востоке и в Африке.

- В январе 2023 года компания United Casting Solutions (UCS), региональный лидер в производстве прецизионных алюминиевых компонентов, представила в ОАЭ новую автоматизированную литейную линию, предназначенную для применения в аэрокосмической и автомобильной промышленности. Эта инициатива подчёркивает стремление UCS к интеграции передовых технологий, повышению эффективности производства и производству высококачественных и лёгких алюминиевых компонентов для удовлетворения растущего регионального спроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.