Middle East Africa Polyurethane Foam Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.20 Billion

USD

3.37 Billion

2024

2032

USD

2.20 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.37 Billion | |

|

|

|

Сегментация рынка полиуретановой пены на Ближнем Востоке и в Африке по видам продукции (гибкая пена, жесткая пена и напыляемая пена), категориям (открытые и закрытые ячейки), плотности состава (низкой плотности, средней плотности и высокой плотности), процессу (формованная пена, блочная пена, напыление и ламинирование), конечным потребителям (постельные принадлежности и мебель, строительство, автомобилестроение, электроника, упаковка, обувь и другие) — тенденции отрасли и прогноз до 2032 года.

Анализ рынка пенополиуретана

Рынок полиуретановой пены демонстрирует устойчивый рост, обусловленный растущим спросом со стороны таких отраслей, как строительство, автомобилестроение и мебель, благодаря своим превосходным изоляционным и амортизирующим свойствам. Рынок в целом разделен на жесткие и гибкие пены, причем жесткие пены активно используются в изоляционных приложениях, а гибкие пены широко используются в постельных принадлежностях и мебели. Растущие проблемы устойчивости и экологические нормы стимулируют разработку биооснованных и низкоэмиссионных альтернатив. Азиатско-Тихоокеанский регион лидирует на рынке, чему способствуют быстрая урбанизация, расширение инфраструктуры и промышленный рост. Кроме того, инновации в области легких и энергоэффективных пенных решений продолжают формировать будущее отрасли.

Размер рынка пенополиуретана

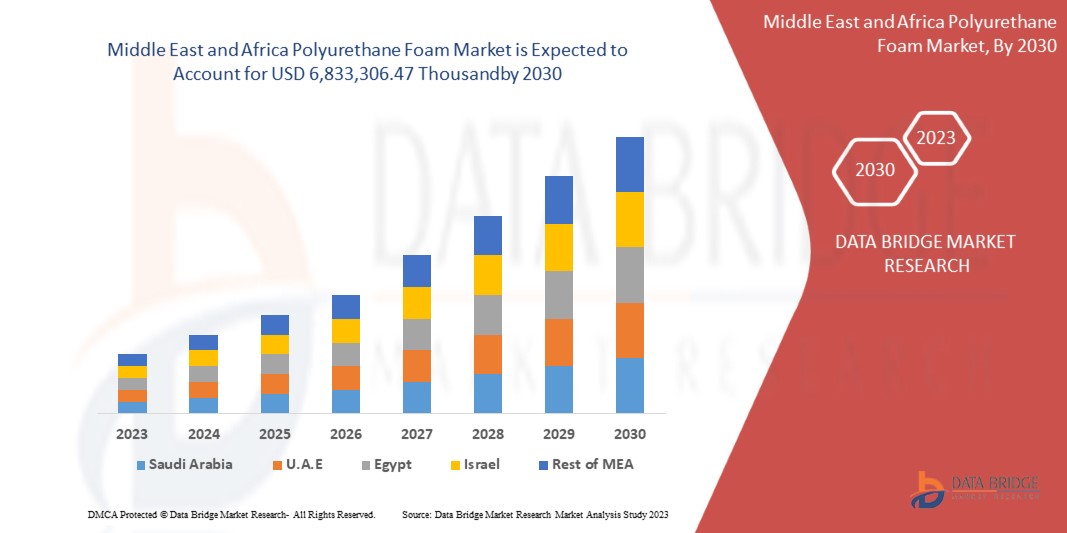

Ожидается, что рынок пенополиуретана на Ближнем Востоке и в Африке достигнет 3,37 млрд долларов США к 2032 году с 2,20 млрд долларов США в 2024 году, увеличившись со значительным среднегодовым темпом роста в 5,6% в прогнозируемый период с 2025 по 2032 год. Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу.

Тенденции рынка пенополиуретана

«Позитивный взгляд на строительный сектор»

Строительная отрасль может стать основной движущей силой в расширении рынка пенополиуретана. Деятельность, связанная со строительством, растет благодаря прямым иностранным инвестициям в развивающиеся экономики. Цемент, дерево, стекло, металлы и глина являются одними из наиболее распространенных материалов, используемых в строительной отрасли. Полиуретан используется в строительстве для создания высокопроизводительных изделий, которые прочны, но легки по весу, хорошо функционируют, долговечны и легко адаптируются. Пенополиуретан — это гибкий химический продукт, используемый во многих типичных строительных применениях, таких как склеивание, заполнение, герметизация и изоляция. Его высокие тепло- и звукоизоляционные свойства делают его идеальным продуктом для изоляции водопроводных труб, склеивания и герметизации крыш и стен и, что наиболее важно, установки оконных и дверных рам. Такой рост деятельности, связанной со строительством, и широкое применение пенополиуретана в строительной отрасли увеличили рост рынка пенополиуретана.

Область применения отчета и сегментация рынка пенополиуретана

Атрибуты | Обзор рынка полиуретановой пены |

Охваченные сегменты |

|

Страны, охваченные | Южная Африка, Саудовская Аравия, ОАЭ, Египет, Израиль и остальной Ближний Восток и Африка |

Ключевые игроки рынка | Henkel AG & Co. KGaA (Германия), Saint-Gobain (Франция), Huntsman International LLC (США), BASF (Германия), INOAC CORPORATION (Япония), Dow (США), SEKISUI CHEMICAL CO., LTD. (Япония), Sunpreeth Engineers (Индия), Recticel NV/SA (Бельгия), Sheela Foam Ltd. (Индия), Eurofoam Srl (Италия), Rogers Corporation (США), UFP Technologies, Inc. (США), General Plastics Manufacturing Company, Inc. (США), Meenakshi Polymers Pvt. Ltd. (Индия), Foamcraft Inc. (США), ALSTONE INDUSTRIES PVT. LTD. (Индия), Wisconsin Foam Products (США), Tirupati Foam Ltd (Индия) |

Возможности рынка |

|

Информационные наборы данных с добавленной стоимостью | Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Определение рынка пенополиуретана

Пенополиуретан — это полимер, полученный в результате реакции диизоцианата и полиола. Пенополиуретан обычно называют пенополиуретаном или пеной PUR. Пенополиуретан обеспечивает изоляцию и защиту материалов от внешних источников, вызывающих коррозию. Тип реагента или катализатора, используемого с изоцианатом в производстве пенополиуретана, зависит от области применения пенополиуретана. Существует три типа пенополиуретана: жесткий, гибкий и распыляемый.

Динамика рынка пенополиуретана

Драйверы

- Растущее признание в автомобильном и авиационном секторе

Пенополиуретан — это полимерный материал с высокой прочностью на разрыв, малым весом, химической стойкостью, технологичностью и механическими характеристиками, который используется в различных приложениях. Благодаря своим отличительным свойствам растет спрос на легкие и высокопроизводительные материалы в аэрокосмической и автомобильной промышленности. В автомобильной промышленности автомобильная пена играет важную роль, поскольку она играет важную роль в безопасности и комфорте пассажиров, от автомобильных сидений до подложки коврового покрытия. Пенополиуретан используется в автомобильной промышленности для отделки, сидений, подголовников, звукоизоляции и фильтров кондиционеров. Это связано с тем, что пена — это материал, который обеспечивает широкий спектр свойств, таких как блокировка вибрации, поглощение звука и изоляция. Как открытые, так и закрытые поры пены могут использоваться в автомобильной амортизации и сиденьях в современных автомобилях. Пенополиуретан в современных автомобилях обеспечивает транспортным средствам больший пробег благодаря своей прочной и чрезвычайно легкой природе, что еще больше снижает общий вес автомобиля. В результате повышается топливная экономичность и снижается воздействие на окружающую среду. Такие высокопроизводительные приложения в автомобильном секторе будут стимулировать рост рынка пенополиуретана.

Применение полиуретановой пены в аэрокосмической промышленности слишком разнообразно. Она используется в таких структурных элементах, как стены пассажирских салонов, багажные отсеки, потолки, элементы туалетов, подушки кабины экипажа, а также разделители классов и секций. Пена может защитить самолет и пассажиров внутри него от чрезмерных колебаний температуры. Плотность аэрокосмической пены также помогает предотвратить утечку воздуха в самолет и из него, тем самым сохраняя давление в салоне. Она также может служить звуковым барьером, защищающим пассажиров от высоких уровней децибел двигателей самолетов. Например, в июне 2022 года, согласно статье, опубликованной Linden Industries, LLC. Полиуретановая пена широко используется в салонах автомобилей благодаря своим амортизирующим, долговечным и шумопоглощающим свойствам. Она повышает комфорт и поддержку в автомобильных сиденьях и подголовниках, а также обеспечивает амортизацию. Приборные панели и дверные панели используют ее для изоляции и минимизации дорожного шума. Ее прочность обеспечивает долговечность, несмотря на частое использование. Она необходима для повышения безопасности и удобства пассажиров, она остается ключевым материалом в конструкции транспортных средств

- Растущий спрос на различные предметы домашнего обихода

Домашняя обстановка — это предметы, которые размещаются в комнате, чтобы сделать ее более комфортной и приятной. К ним относятся любые подвижные предметы, такие как мебель, шторы, ковры и предметы декора, которые дополняют дизайн комнаты. Пенополиуретаны широко применяются в домашней обстановке благодаря своим уникальным характеристикам, таким как низкая плотность, высокие механические свойства и низкая теплопроводность. Пенополиуретаны — это легкие пористые материалы, которые обладают многообещающими эксплуатационными характеристиками. Такие материалы также применяются в конечных приложениях в подушках, присутствующих в предметах мебели, таких как диваны и кресла, что стимулирует рост рынка пенополиуретана.

Такие факторы, как рост населения, рост урбанизации, склонность к качественным матрасам и улучшение институциональной инфраструктуры стимулируют продажи матрасов в сегментах недвижимости и гостеприимства. Гибкий пенополиуретан имеет ячеистую структуру, которая обеспечивает определенную компрессию и упругость, что обеспечивает амортизирующий эффект. Эта особенность широко используется в мебели, матрасах, подушках и ковровых покрытиях. Рост таких секторов, как жилье, гостеприимство и железные дороги, является еще одним фактором роста рынка матрасов из пенополиуретана. Например, По данным ISPF, исследование было проведено Индийской федерацией товаров для сна. В Индии общий рынок матрасов составил около 18,6 млн единиц, при этом ожидаемый новый спрос на матрасы составил 7 млн единиц в год. Кроме того, средний цикл замены матрасов составил 12 лет, а спрос на замену матрасов составил 11,6 млн единиц. Исследование также показало, что канал мебели имеет важное значение для нового спроса, составляя 50% от общего объема продаж матрасов. Кроме того, матрасы на основе пены составили 52,6% от общего объема продаж, тогда как матрасы на основе пружин составили 13,5%, а матрасы на основе кокосового волокна — 34%.

Возможности

- Прибыльные перспективы в отношении экологически чистых пен

Пенополиуретаны стали одним из самых важных материалов в отрасли, поскольку они являются одними из самых адаптируемых полимеров. Они используются в автомобильной промышленности для сидений, обивки и бамперов; в мебели в качестве наполнителей для подушек сидений, диванов и матрасов; в упаковочном секторе; в строительстве для тепло- и звукоизоляции; и среди других применений. Помимо их низкой плотности, низкой теплопроводности и выдающихся механических характеристик, одним из основных преимуществ пенополиуретанов является возможность регулировать их плотность и жесткость в соответствии с требованиями рынка.

Однако этот полимер в основном основан на нефти. Опасения по поводу окружающей среды требуют, чтобы полиуретаны производились более устойчиво, например, с использованием возобновляемых сырьевых ресурсов или переработкой полиуретановых пен. Изменение поведения потребителей в сторону использования устойчивых материалов, строгие правила и положения правительства и шаги производителей по сокращению использования нефтяного сырья при производстве пен — вот несколько факторов, которые привели к позитивному взгляду на экологически чистые пены. Такие шаги приведут к разработке полиуретановых пен, которые являются биоразлагаемыми и экологически чистыми. Производители также сотрудничают с другими компаниями и разрабатывают мощности по переработке полиуретановой пены. Например, в сентябре 2023 года, согласно статье, опубликованной Crain Communications, Inc., Covestro сотрудничала с Selena Group с целью разработки устойчивых полиуретановых (ПУ) пен для изоляции зданий. Она использовала биоатрибутированный МДИ Covestro в модернизированной пене Ultra-Fast 70, что сократило ее углеродный след на 60%. Пена затвердела в течение 90 минут и дала выход 70 литров на контейнер. Она соответствовала качеству пен на основе ископаемых и поддерживала бесшовную интеграцию. Selena включила в свой ассортимент пены биополиолы и переработанные ПЭТ-материалы

- Поддерживающая политика правительства в отношении инвестиций на внутренних рынках

Рост располагаемого дохода, быстрая урбанизация, разнообразные промышленные приложения, высокое потребление, увеличение прямых иностранных инвестиций и многообещающий экспортный потенциал — вот некоторые факторы, способствующие росту химической промышленности в развивающихся экономиках, таких как Индия и Китай. Различные предстоящие возможности для производства специальных химикатов и полимерных продуктов создадут огромный внутренний спрос. Развивающиеся страны будут самоэффективны в производстве сырья и конечного продукта. Кроме того, инвестиции из развитых стран или создание химического завода в странах с развивающейся экономикой могут предложить широкие возможности для роста рынка полиуретановой пены на Ближнем Востоке и в Африке.

Пенополиуретан применяется в различных отраслях промышленности, таких как автомобилестроение, мебель, строительство, упаковка, текстиль, обувь и другие. Рост рынка этих отраслей будет способствовать дальнейшему росту экономики развивающихся стран. Научно-исследовательские и опытно-конструкторские работы, технологические достижения, рост спроса со стороны отраслей конечного потребителя, а также благоприятная политика и рамки повлияли на рост химической промышленности в таких странах. Например, в сентябре 2022 года, по данным Arab News, с общими расходами в размере 1,1 триллиона долларов США на инфраструктурные и проекты в сфере недвижимости с момента объявления Саудовской Аравией Vision 2030 в 2016 году, страна Саудовская Аравия уверенно движется к тому, чтобы стать крупнейшей в мире строительной площадкой. Саудовская Аравия легко станет крупнейшей в мире строительной площадкой, с более чем 555 000 жилых единиц, более 275 000 гостиничных номеров, более 4,3 миллиона квадратных метров торговых площадей и более 6,1 миллиона квадратных метров офисных помещений, запланированных для королевства. Такая масштабная инфраструктурная установка приведет к широкому использованию пенополиуретана в строительном секторе в ближайшие годы.

Ограничения/Проблемы

- Использование вредных химикатов при производстве пенополиуретана

Пенополиуретаны используются в различных областях применения, от мебели до изоляции. Однако использование различных химикатов при производстве пенополиуретанов вызывает проблемы с экологией и здоровьем у рабочей силы, участвующей в производстве. Полиуретан является продуктом полимеризации различных полиолов и диизоцианатов, полученных из сырой нефти. В процессе участвуют различные вспениватели, отвердители, антипирены, поверхностно-активные вещества и катализаторы. Обычно используемые полиолы — полиэтиленгликоль, полипропиленгликоль и политетраметиленгликоль. В то же время толуолдиизоцианат (ТДИ) и метилендифенилдиизоцианат (МДИ) являются обычно используемыми диизоцианатными материалами. Например, по данным Агентства по охране окружающей среды США (EPA), в марте 2023 года диизоцианаты, такие как МДИ и ТДИ, как утверждается, вызывают астму, повреждение легких и даже смерть в некоторых случаях у задействованных рабочих. EPA разработало план действий по их защитному контролю в рабочих подразделениях. Выброс летучих органических соединений в процессе производства, как утверждается, создает проблемы для окружающей среды.

- Нестабильность цен на сырье

Производственный процесс в любой отрасли зависит от цены на сырье. Чем выше волатильность цены на сырье, тем выше вероятность колебания себестоимости продукции и роста рынка.

Основным сырьем для производства пенополиуретана являются полиолы и диизоцианаты, полученные из сырой нефти. Цена на это сырье определяется несколькими причинами, такими как климат, цепочка поставок, спрос, доступность, ограничения и экономическое положение страны. Например, в ноябре 2024 года, согласно статье, опубликованной Polymerupdate, нефтеперерабатывающие компании столкнулись со значительным снижением рентабельности в третьем квартале 2024 года из-за слабой маржи переработки, при этом GRM упала до 1,3 доллара США за баррель в сентябре 2024 года, самого низкого уровня с момента пика COVID-19. Это стало результатом низких цен на сырую нефть, увеличения доступности российской сырой нефти и слабого спроса, особенно со стороны Китая. Экономический рост на Ближнем Востоке и в Африке оставался стабильным на уровне 3,1% в 2024 году, с рисками снижения из-за геополитической напряженности и сектора недвижимости Китая. Он также пострадал, поскольку внедрение электромобилей, биотоплива и СПГ снизило спрос на нефтяное топливо в Азии и Европе. Новые мощности по переработке нефти еще больше оказали давление на маржу

Влияние и текущий рыночный сценарий нехватки сырья и задержек поставок

Data Bridge Market Research предлагает высокоуровневый анализ рынка и предоставляет информацию, учитывая влияние и текущую рыночную среду нехватки сырья и задержек поставок. Это приводит к оценке стратегических возможностей, созданию эффективных планов действий и оказанию помощи предприятиям в принятии важных решений.

Помимо стандартного отчета, мы также предлагаем углубленный анализ уровня закупок на основе прогнозируемых задержек поставок, картирования дистрибьюторов по регионам, анализа товаров, анализа производства, тенденций ценового картирования, поиска поставщиков, анализа эффективности категорий, решений по управлению рисками в цепочке поставок, расширенного сравнительного анализа и других услуг по закупкам и стратегической поддержке.

Ожидаемое влияние экономического спада на ценообразование и доступность продукции

Когда экономическая активность замедляется, отрасли начинают страдать. Прогнозируемое влияние экономического спада на ценообразование и доступность продуктов учитывается в отчетах по анализу рынка и услугах по разведке, предоставляемых DBMR. Благодаря этому наши клиенты обычно могут быть на шаг впереди своих конкурентов, прогнозировать свои продажи и доходы, а также оценивать свои расходы на прибыль и убытки.

Масштаб рынка пенополиуретана

Рынок сегментирован на основе продукта, категории, плотности состава, процесса и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Эластичная пена

- Жесткая пена

- Распыляемая пена

Категория

- Открытая ячейка

- Закрытая ячейка

Плотность состава

- Низкоплотный состав

- Состав средней плотности

- Высокоплотный состав

Процесс

- Формованная пена

- Плитный пенопласт

- Распыление

- Ламинирование

Конечный пользователь

- Постельные принадлежности и мебель

- Строительство и возведение

- Автомобильный

- Электроника

- Упаковка

- Обувь

- Другие

Региональный анализ рынка пенополиуретана

Проводится анализ рынка и предоставляются сведения о его размерах и тенденциях по продукту, категории, плотности, процессу и конечному пользователю, как указано выше.

Страны, охваченные рынком: Южная Африка, Саудовская Аравия, ОАЭ, Египет, Израиль, а также остальные страны Ближнего Востока и Африки.

Ожидается, что Южная Африка будет доминировать на рынке полиуретана Ближнего Востока и Африки благодаря своей хорошо развитой строительной, автомобильной и мебельной промышленности. Страна имеет мощную производственную базу, поддерживаемую растущим спросом на прочные и энергоэффективные материалы. Кроме того, наличие ключевых производителей полиуретана и доступ к сырью еще больше укрепляют лидирующие позиции Южной Африки в регионе.

Ожидается, что Южная Африка станет самым быстрорастущим рынком из-за быстрой урбанизации, развития инфраструктуры и растущего спроса на высокопроизводительные материалы в различных отраслях промышленности. Правительственные инициативы, способствующие промышленному росту и иностранным инвестициям в производственный сектор, также способствуют расширению рынка полиуретана в стране.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка пенополиуретана

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии на Ближнем Востоке и в Африке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Лидерами рынка пенополиуретана являются:

- Henkel AG & Co. KGaA (Германия)

- Сен-Гобен (Франция)

- Huntsman International LLC (США)

- БАСФ (Германия)

- КОРПОРАЦИЯ INOAC (Япония)

- Доу (США)

- SEKISUI CHEMICAL CO., LTD. (Япония)

- Sunpreeth Engineers (Индия)

- Recticel NV/SA (Бельгия)

- Sheela Foam Ltd. (Индия)

- Eurofoam Srl (Италия)

- Корпорация Роджерс (США)

- UFP Technologies, Inc. (США)

- General Plastics Manufacturing Company, Inc. (США)

- Meenakshi Polymers Pvt. Ltd. (Индия)

- Foamcraft Inc. (США)

- ALSTONE INDUSTRIES PVT. LTD. (Индия)

- Изделия из пенопласта Wisconsin (США)

- Tirupati Foam Ltd (Индия)

Последние разработки на рынке пенополиуретана:

- В сентябре 2022 года Saint-Gobain получила все необходимые разрешения от соответствующих органов на приобретение GCP Applied Technologies Inc. (крупный игрок на Ближнем Востоке и в Африке на рынке строительной химии). Это приобретение помогает компании получить большее признание в сфере строительной химии

- В мае 2020 года корпорация Huntsman объявила о ребрендинге своего ведущего мирового бизнеса по производству распыляемой полиуретановой пены в Huntsman Building Solutions. Huntsman Building Solutions — это всемирная платформа в рамках подразделения полиуретанов компании Huntsman. Этот ребрендинг помог компании расширить свой бизнес в сфере полиуретановой пены.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UNITED ARAB EMIRATES

12.1.4 EGYPT

12.1.5 QATAR

12.1.6 OMAN

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 156 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 158 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 160 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 162 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 176 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 178 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 179 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 180 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 182 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 183 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 184 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 185 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 187 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 198 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 200 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 201 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 202 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 203 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 204 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 205 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 206 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 220 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 222 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 224 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 226 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 228 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 KUWAIT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 236 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 KUWAIT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 242 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 244 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 246 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 248 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 250 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 258 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 260 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 BAHRAIN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

Список рисунков

FIGURE 1 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 21 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.