Рынок пластиковых труб Саудовской Аравии, по типу продукции (трубы ПВХ, трубы ПЭ, трубы PPR, фитинги ПВХ, фитинги PPR, коллекторы PPR, электрические трубы, стретч-пленка и другие), отрасль (частная и государственная), конечное использование (строительство, больницы, сельское хозяйство, недвижимость, нефтяная и химическая промышленность и другие), канал (D2C, розничная торговля, проекты/строители, онлайн и другие), города (Аль-Ахса, Арар, Даммам, Джидда, Хамис, Мадина, Эр-Рияд, Табук, Касим и остальная часть Саудовской Аравии). Тенденции отрасли и прогноз до 2026 года.

Анализ и размер рынка

Пластиковые трубы — это термопластичные материалы, получаемые путем полимеризации этилена. Пластиковые трубы производятся методом экструзии в размерах от ½" до 63". Материалы доступны в рулонах различной длины или прямых отрезках длиной до 40 футов. Как правило, трубы малого диаметра сворачиваются в рулоны, а трубы большого диаметра — в прямые отрезки. Полиэтиленовые трубы из пластика доступны во многих вариантах толщины стенок. Значительным преимуществом пластиковых труб является их малое воздействие на окружающую среду по сравнению с другими материалами.

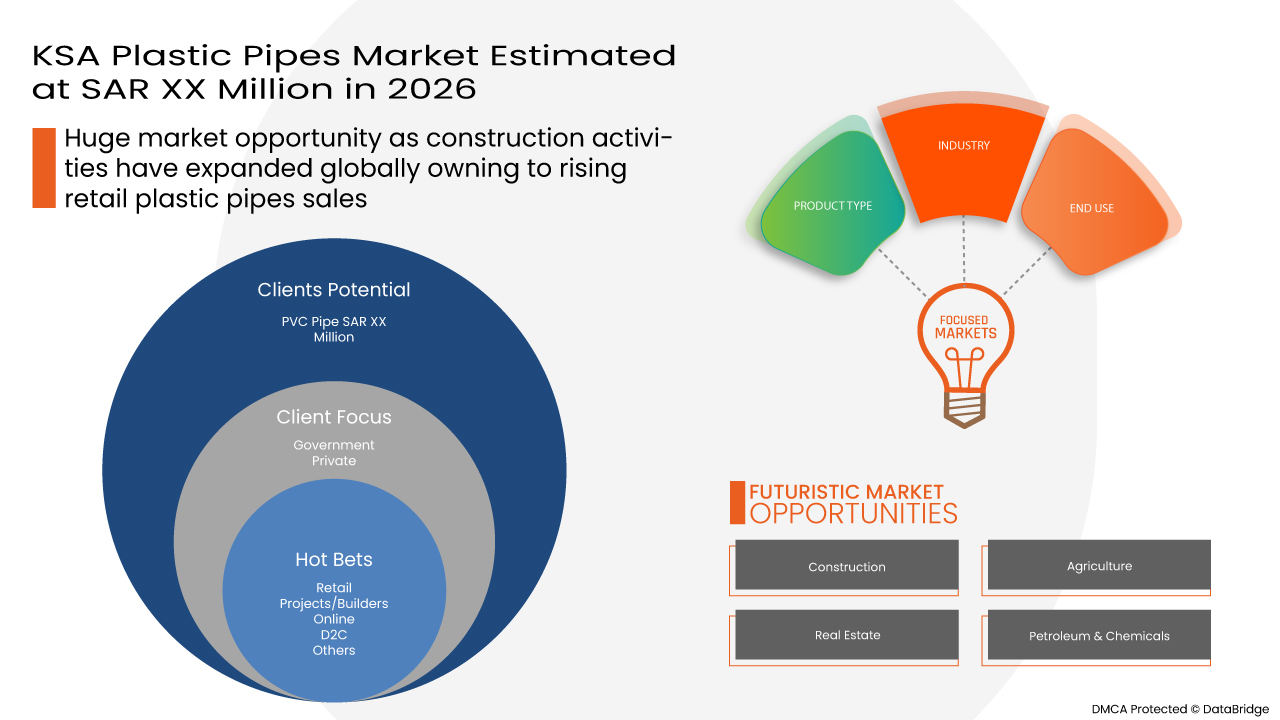

Эти пластиковые трубы очень полезны для замены старых или устаревших муниципальных систем труб . Data Bridge Market Research анализирует, что рынок пластиковых труб, как ожидается, достигнет значения 4 755,01 млн саудовских реалов к 2026 году при среднегодовом темпе роста 4,5% в течение прогнозируемого периода. «Трубы из ПВХ» составляют наиболее заметный сегмент типа продукта на соответствующем рынке из-за роста строительной деятельности. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления производства и сценарий климатической цепочки.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2026 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в миллионах саудовских реалов, цены в саудовских реалах |

|

Охваченные сегменты |

По типу продукции (трубы ПВХ, трубы ПЭ, трубы PPR, фитинги ПВХ, фитинги PPR, коллекторы PPR, электрические трубы, стретч-пленка и другие), отраслям (частная и государственная), конечному использованию (строительство, больницы, сельское хозяйство, недвижимость, нефть и химикаты и другие), каналу (D2C, розничная торговля, проекты/строители, онлайн и другие) и городам (Аль-Ахса, Арар, Даммам, Джидда, Хамис, Медина, Эр-Рияд, Табук, Касим и остальная часть Саудовской Аравии) |

|

Страна покрытия |

Саудовская Аравия |

|

Охваченные участники рынка |

AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group LLC, Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO и SAUDI PIPE SYSTEM |

Определение рынка

Большинство типовых сантехнических кодексов признают пластиковые или полиэтиленовые трубы приемлемыми для водоснабжения, дренажа и канализации. Пластик можно использовать при низких температурах без риска хрупкого разрушения. Таким образом, основным применением определенных составов полиэтиленовых труб является низкотемпературная передача тепла, например, лучистое напольное отопление, снеготаяние, ледовые катки и геотермальные тепловые насосы.

Нормативная база

- ISO 13953: 2001: Этот международный стандарт описывает метод испытаний для определения предела прочности на растяжение и режима разрушения при растяжении сборок труб из ПЭ, сваренных встык. Метод применим к сварным соединениям между трубами из ПЭ с номинальным наружным диаметром. Метод может использоваться вместе с другими методами испытаний для оценки качества сварных соединений встык

- API SPEC 15LE: 2008: Целью данной спецификации является предоставление стандартов для пластиковых (ПЭ) линейных труб, пригодных для транспортировки нефти, газа и непитьевой воды в подземных, надземных и релайнерных приложениях для нефтегазодобывающей промышленности. Стандарт не предлагает решать все проблемы безопасности, связанные с проектированием, установкой или использованием предлагаемых здесь продуктов

Эти стандарты обеспечивают квалификацию для производства пластиковых труб, протоколы и инструкции, которые гарантируют высокий уровень безопасности и сертифицируют материал для использования.

COVID-19 оказал минимальное влияние на рынок пластиковых труб Саудовской Аравии

COVID-19 повлиял на различные отрасли обрабатывающей промышленности в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако значительное влияние было отмечено на рынке пластиковых труб. Операции и цепочка поставок пластиковых труб с несколькими производственными предприятиями все еще работали в регионе. Поставщики услуг продолжали предлагать продукцию из пластиковых труб после принятия мер санитарии и безопасности в пост-COVID-сценарии.

Динамика рынка пластиковых труб Саудовской Аравии включает:

- Растущий спрос на готовые к употреблению продукты питания

Готовые к приготовлению продукты требуют идеальных упаковочных решений для защиты продуктов от биологического загрязнения и физического воздействия. Это увеличило спрос на термоизоляционные упаковочные материалы, способствуя росту рынка термоизоляционной упаковки в Северной Америке.

- Текущая реконструкция и строительство старых или устаревших муниципальных трубопроводных систем

Муниципальные разрывы канализационных линий представляют собой целый ряд опасностей для окружающей среды и безопасности и требуют немедленного внимания со стороны должностных лиц по городскому планированию. Пренебрежение разрывом канализационной линии может привести к более дорогостоящим и серьезным проблемам, включая токсичное загрязнение воды или затопление, повреждение улиц и тротуаров и многое другое. Поэтому новые линии трубопроводных систем заменяются поврежденными и скомпрометированными канализационными системами с использованием новых технологий труб из полиэтилена. В заключение следует сказать, что использование систем из полиэтилена сделало систему ремонта и строительства муниципальных труб более простой и безопасной. Это, в свою очередь, увеличило спрос на пластиковые трубы и, таким образом, способствовало росту рынка пластиковых труб в Саудовской Аравии.

- Растущее применение труб из ПНД в различных отраслях конечного потребления

Создание новых и передовых инноваций для конечного использования приведет к высокому проникновению на рынок и разнообразию новых продуктов. Кроме того, трубы HDPE используются по всему миру для таких применений, как водопроводные магистрали, газопроводы, канализационные магистрали, линии передачи шлама, сельская ирригация, линии подачи пожарной системы, а также электрические и коммуникационные каналы, а также трубы ливневой и дренажной системы. В заключение следует отметить, что высокая пластичность HDPE и его способность противостоять прогибам от движения грунта могут выдерживать удары, давление и движение, которые потенциально могут разрушить жесткую трубу. Это, в свою очередь, увеличило спрос на пластиковые трубы и, таким образом, способствовало росту рынка пластиковых труб KSA.

- Рост спроса на системы орошения в сельском хозяйстве

Трубы из ПВХ ПЭ долговечны и могут легко выдерживать внезапное давление и напряжение в течение многих лет. Таким образом, длительный срок службы труб из ПВХ дает им преимущество перед другими трубами, особенно когда речь идет о сельскохозяйственном использовании. При соответствующих условиях труба может прослужить даже более 50 лет без замены. По сравнению с металлической трубой, сельскохозяйственная труба из ПВХ ПЭ стоит в разы дешевле, что довольно экономично для фермеров. В заключение следует сказать, что трубы из ПВХ ПЭ очень настраиваемы, и, следовательно, рынок переполнен многочисленными фитингами различных типов и размеров труб. Это, в свою очередь, увеличило спрос на пластиковые трубы и, таким образом, способствовало росту рынка пластиковых труб в Саудовской Аравии.

- Инновации и технологические достижения в области полиэтиленовых труб

Достижения в области модели и технологии труб HDPE улучшаются для использования в трубах PE, которые в дальнейшем используются в строительстве, проводах и кабелях, медицинских трубках, напольных покрытиях, тканях и других промышленных приложениях. Новые достижения включают фитинги из ПВХ-О, ориентированный PPR и модифицированные фитинги из ПВХ. Трубы PE значительно прочнее, что позволяет уменьшить толщину стенки почти на 50% при сохранении той же прочности на сжатие. Кроме того, растущий и быстро развивающийся прогресс в технологии производства пластиковых труб поможет производителям получить больше прибыли и поможет им увеличить свои производственные мощности, что, в свою очередь, удовлетворит растущий спрос на пластиковые трубы. Это станет важной возможностью для расширения и роста рынка пластиковых труб KSA.

Ограничения/Проблемы, с которыми сталкивается рынок пластиковых труб Саудовской Аравии

- Риск, связанный с разрывами труб

Разрыв водопроводных труб — одна из распространенных проблем с сантехникой, с которой приходится сталкиваться домовладельцам. Будь то водопроводная сеть дома или трубы подачи, водопроводные трубы могут лопнуть без предупреждения, что приводит к капитальному ремонту, требующему внимания квалифицированного сантехника. Разрывы труб часто являются результатом значительного уровня структурных повреждений, включая плохую конструкцию труб и низкое качество. В заключение, когда в трубах происходит засор, это может привести к повышению давления в этих трубах, что приводит к разрывам труб. Это, в свою очередь, снижает спрос на полиэтиленовые трубы и, таким образом, ограничивает спрос на рынке пластиковых труб Саудовской Аравии.

- Волатильность цен на сырье

В процессе производства пластиковых труб вредные газы могут вызывать заболевания растений, подавлять производство семян и препятствовать оплодотворению. Таким образом, строгие правила, касающиеся производства пластиковых труб, могут принести обществу и промышленности различные выгоды, тем самым делая производство и цепочки поставок более чистыми и безопасными и снижая риск несчастных случаев. Это также дает стимулы для разработки более безопасных трубных изделий и более ресурсоэффективных наряду с более безопасными методами производства. В заключение, полиэтиленовая труба признана приемлемой сантехнической трубой для водоснабжения, дренажа и канализации в большинстве типовых сантехнических кодексов, что дополнительно требует установления различных правил и положений для применения полиэтиленовых труб. Это, в свою очередь, снижает спрос на пластиковые трубы и, следовательно, бросает вызов росту рынка пластиковых труб Саудовской Аравии

В этом отчете о рынке пластиковых труб KSA содержатся сведения о новых последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке родентицидов, свяжитесь с Data Bridge Market Research для получения аналитического обзора. Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Недавнее развитие

- В октябре 2016 года компания Tahweel Pipes получила сертификат (DVGW), немецкий сертификат, подтверждающий, что трубы Tahweel являются здоровыми, свободными от микробного роста и вредных отложений, что делает их пригодными для питья. Это помогло компании занять хорошую долю рынка во всем мире.

- В октябре 2020 года Alwasail Industrial Company осуществила ирригационные проекты в Неоме, Саудовская Аравия, способствуя превращению города в ведущий мировой инновационный и торговый центр. Это помогло компании получить больше дохода в долгосрочной перспективе

- В марте 2021 года Alwasail Industrial Company провела обучение студентов для высшего института пластмассовой промышленности на территории завода Alwasail Industrial Company в Аль-Касиме. Это помогло компании увеличить производственные мощности по производству пластиковых труб.

Масштаб рынка пластиковых труб в Саудовской Аравии

Рынок пластиковых труб KSA сегментирован по типу продукта, отрасли, конечному использованию, каналу и городам. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип продукта

- ПВХ труба

- Трубы ПЭ

- Трубы ППР

- ПВХ фитинги

- Фитинги из ППР

- PPR-коллекторы

- Электрические трубы

- Стретч-пленка

- Другие

По типу продукции рынок пластиковых труб Саудовской Аравии сегментирован на трубы из ПВХ, трубы из ПЭ, трубы из ППР, фитинги из ПВХ, фитинги из ППР, коллекторы из ППР, электропроводные трубы, стретч-пленку и др. Ожидается, что сегмент труб из ПВХ будет доминировать на рынке, поскольку они легкие, что делает их простыми в транспортировке и безопасными в использовании, что увеличивает спрос на них в стране.

Промышленность

- Правительство

- Частный

На основе отрасли рынок пластиковых труб KSA сегментирован на частный и государственный. Ожидается, что государственный сегмент будет доминировать на рынке из-за растущей индустриализации вместе с принятием различных государственных проектов в последнее время, что увеличивает его спрос в KSA

Конечное использование

- Строительство

- Недвижимость

- Сельское хозяйство

- Нефть и химикаты

- Больницы

- Другие

На основе конечного использования рынок пластиковых труб Саудовской Аравии сегментируется на строительство, больницы, сельское хозяйство, недвижимость, нефть и химикаты и др. Ожидается, что строительный сегмент будет доминировать на рынке из-за растущего населения и быстрого строительства офисов и зданий, что увеличивает спрос на него в стране.

Канал

- Розничная торговля

- Проекты/Строители

- Онлайн

- D2C

- Другие

На основе канала рынок пластиковых труб Саудовской Аравии сегментируется на D2C, розничную торговлю, проекты/строителей, онлайн и др. Ожидается, что розничный сегмент будет доминировать на рынке, поскольку розничные магазины предлагают широкий ассортимент продукции и легкодоступны, что увеличивает спрос на нее в стране

Города

- Эр-Рияд

- Джидда

- Арар

- Даммам

- Хамис

- Табук

- Касим

- Аль-Ахса

- Медина

- Остальная часть Саудовской Аравии

По городам рынок пластиковых труб Саудовской Аравии сегментирован на AL-Ahsa, Arar, Dammam, Jeddah, Khamis, Madinah, Riyadh, Tabuk, Qassim и остальную часть Саудовской Аравии. Ожидается, что город Эр-Рияд будет доминировать на рынке, поскольку большая часть строительных работ ведется в этом городе, что увеличивает спрос на него в стране.

Анализ конкурентной среды и доли рынка пластиковых труб в Саудовской Аравии

Конкурентная среда рынка пластиковых труб KSA содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие KSA, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные касаются только фокуса компаний, связанного с рынком пластиковых труб KSA.

Среди основных игроков, работающих на рынке пластиковых труб Саудовской Аравии, можно назвать AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group LLC, Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO и SAUDI PIPE SYSTEM.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA PLASTIC PIPES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMMISSIONS/REWARDS OFFERED TO PLUMBERS BY THE KEY PLAYERS

4.2 COMMISSION/BONUS STRUCTURE PROVIDED BY KEY PLAYERS

4.2.1 SALE TEAM

4.2.2 MARKETING TEAM

4.3 DETAILS SCENARIO OF SHOPS BY CITY

4.3.1 RIYADH

4.3.2 JEDDAH

4.3.3 MECCA

4.3.4 MEDINA

4.3.5 SULTANAH

4.3.6 DAMMAM

4.3.7 TAIF

4.3.8 REST OF KSA

4.4 DETAILS OF SHOPS IN KSA

4.5 MARKET SHARE OF TOP MANUFACTURES

4.5.1 TOP MANUFACTURERS, BY PRODUCT TYPE

4.5.1.1 ALWASAIL INDUSTRIAL COMPANY

4.5.1.2 ALMUNIF PIPES

4.5.1.3 TAHWEEL PIPES

4.5.1.4 UNION PIPES INDUSTRY

4.5.1.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.2 TOP MANUFACTURERS, BY CITIES

4.5.2.1 ALWASAIL INDUSTRIAL COMPANY

4.5.2.2 ALMUNIF PIPES

4.5.2.3 TAHWEEL PIPES

4.5.2.4 UNION PIPES INDUSTRY

4.5.2.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.3 TOP MANUFACTURERS, BY CHANNEL

4.5.3.1 ALWASAIL INDUSTRIAL COMPANY

4.5.3.2 ALMUNIF PIPES

4.5.3.3 TAHWEEL PIPES

4.5.3.4 UNION PIPES INDUSTRY

4.5.3.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.6 CREDIT TERMS OFFERED BY KEY PLAYERS

4.7 TRADE DISCOUNTS & SALES REBATES OFFERED BY KEY PLAYERS

4.8 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (%) (2021)

4.9 PRIMARY REASONS FOR RETURNS

5 CLIMATE CHANGE SCENARIO

5.1 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 ONGOING REHABILITATION AND CONSTRUCTION OF OLD OR OBSOLETE MUNICIPAL PIPE SYSTEMS

7.1.2 INCREASING APPLICATION OF HDPE PIPES IN VARIOUS END-USE INDUSTRIES

7.1.3 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES

7.2.2 RISK ASSOCIATED WITH PIPE BREAKAGES

7.3 OPPORTUNITIES

7.3.1 RAPID URBANIZATION ALONG WITH INCREASING INDUSTRIAL PRODUCTION

7.3.2 INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN PE PIPE

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY COMPLIANCES REGARDING THE USAGE OF PE BASED PIPES

8 KSA PLASTIC PIPES MARKET, COUNTRY ANALYSIS

8.1 OVERVIEW

9 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PVC PIPE

9.3 PE PIPES

9.4 PPR PIPES

9.5 PVC FITTINGS

9.6 PPR FITTINGS

9.7 PPR MANIFOLDS

9.8 ELECTRICAL PIPES

9.9 STRETCH FILM

9.1 OTHERS

10 KSA PLASTIC PIPES MARKET, BY INDUSTRY

10.1 OVERVIEW

10.2 GOVERNMENT

10.3 PRIVATE

11 KSA PLASTIC PIPES MARKET, BY END-USE

11.1 OVERVIEW

11.2 CONSTRUCTION

11.3 REAL ESTATE

11.4 AGRICULTURE

11.5 PETROLEUM & CHEMICALS

11.6 HOSPITALS

11.7 OTHERS

12 KSA PLASTIC PIPES MARKET, BY CHANNEL

12.1 OVERVIEW

12.2 RETAIL

12.3 PROJECTS/BUILDERS

12.4 ONLINE

12.5 D2C

12.6 OTHERS

13 KSA PLASTIC PIPES MARKET, BY CITIES

13.1 OVERVIEW

13.2 RIYADH

13.3 JEDDAH

13.4 ARAR

13.5 DAMMAM

13.6 KHAMIS

13.7 TABUK

13.8 QASSIM

13.9 AL-AHSA

13.1 MADINAH

13.11 REST OF KSA

14 KSA PLASTIC PIPES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

14.1.1 EXPANSIONS

14.1.2 NEW PRODUCT DEVELOPMENT

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ALWASAIL INDUSTRIAL COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT UPDATES

16.2 ALMUNIF PIPES

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT UPDATES

16.3 TAHWEEL PIPES

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT UPDATES

16.4 UNION PIPES INDUSTRY

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT UPDATES

16.5 AL KOLBAN THERMOPIPE FACTORY CO.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT UPDATE

16.6 SAUDI HEPCO

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATE

16.7 SAPPCO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 ABDUR RAHMAN A. AL-RAJHI GROUP L.L.C.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 KNOAH TECHNOLOGY

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 NEW PRODUCTS INDUSTRIES CO LTD. (NEPROPLAST)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 SAUDI PIPE SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 EXPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE (PE), HS - 391721 (SAR MILLION)

TABLE 2 IMPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE, HS - 391721 (SAR MILLION)

TABLE 3 SALARY STRUCTURE OF SALE TEAM

TABLE 4 SALARY STRUCTURE OF MARKETING TEAM

TABLE 5 NUMBER OF SHOPS IN RIYADH

TABLE 6 NUMBER OF SHOPS IN JEDDAH

TABLE 7 NUMBER OF SHOPS IN MECCA

TABLE 8 NUMBER OF SHOPS IN MEDINA

TABLE 9 NUMBER OF SHOPS IN SULTANAH

TABLE 10 NUMBER OF SHOPS IN DAMMAM

TABLE 11 NUMBER OF SHOPS IN MEDINA

TABLE 12 NUMBER OF SHOPS IN REST OF KSA

TABLE 13 DETAILS OF SHOPS IN KSA

TABLE 14 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (IN %) (2021)

TABLE 15 KSA PLASTIC PIPES MARKET, BY COUNTRY, 2017-2026 (SAR MILLION)

TABLE 16 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2017-2026 (SAR MILLION)

TABLE 17 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2017-2026 (SAR MILLION)

TABLE 18 KSA PLASTIC PIPES MARKET, BY END-USE, 2017-2026 (SAR MILLION)

TABLE 19 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2017-2026 (SAR MILLION)

TABLE 20 KSA PLASTIC PIPES MARKET, BY CITIES, 2017-2026 (SAR MILLION)

Список рисунков

FIGURE 1 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 2 KSA PLASTIC PIPES MARKET: DATA TRIANGULATION

FIGURE 3 KSA PLASTIC PIPES MARKET: DROC ANALYSIS

FIGURE 4 KSA PLASTIC PIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 KSA PLASTIC PIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA PLASTIC PIPES MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 KSA PLASTIC PIPES MARKET: MULTIVARIATE MODELLING

FIGURE 8 KSA PLASTIC PIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 KSA PLASTIC PIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 KSA PLASTIC PIPES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 KSA PLASTIC PIPES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 KSA PLASTIC PIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 14 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY IS EXPECTED TO DRIVE THE KSA PLASTIC PIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2026

FIGURE 15 PVC PIPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA PLASTIC PIPES MARKET IN 2022 & 2026

FIGURE 16 ALWASAIL INDUSTRIAL COMPANY, BY PRODUCT TYPE, 2021 (%)

FIGURE 17 ALMUNIF PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 18 TAHWEEL PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 19 UNION PIPES INDUSTRY, BY PRODUCT TYPE, 2021 (%)

FIGURE 20 AL KOLBAN THERMOPIPE FACTORY CO., BY PRODUCT TYPE, 2021 (%)

FIGURE 21 ALWASAIL INDUSTRIAL COMPANY, BY CITIES, 2021 (%)

FIGURE 22 ALMUNIF PIPES, BY CITIES, 2021 (%)

FIGURE 23 TAHWEEL PIPES, BY CITIES, 2021 (%)

FIGURE 24 UNION PIPES INDUSTRY, BY CITIES, 2021 (%)

FIGURE 25 AL KOLBAN THERMOPIPE FACTORY CO., BY CITIES, 2021 (%)

FIGURE 26 ALWASAIL INDUSTRIAL COMPANY, BY CHANNEL, 2021 (%)

FIGURE 27 ALMUNIF PIPES, BY CHANNEL, 2021 (%)

FIGURE 28 TAHWEEL PIPES, BY CHANNEL, 2021 (%)

FIGURE 29 UNION PIPES INDUSTRY, BY CHANNEL, 2021 (%)

FIGURE 30 AL KOLBAN THERMOPIPE FACTORY CO., BY CHANNEL, 2021 (%)

FIGURE 31 PLASTIC PIPE MANUFACTURING - SUPPLY CHAIN ANALYSIS

FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE KSA PLASTIC PIPES MARKET

FIGURE 33 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2021

FIGURE 34 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2021

FIGURE 35 KSA PLASTIC PIPES MARKET, BY END-USE, 2021

FIGURE 36 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2021

FIGURE 37 KSA PLASTIC PIPES MARKET, BY CITIES, 2021

FIGURE 38 KSA PLASTIC PIPES MARKET: COMPANY SHARE 2021 (%)

FIGURE 39 PROFILED COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.