India Robotic Arm Market

Размер рынка в млрд долларов США

CAGR :

%

USD

5.19 Billion

USD

13.90 Billion

2024

2032

USD

5.19 Billion

USD

13.90 Billion

2024

2032

| 2025 –2032 | |

| USD 5.19 Billion | |

| USD 13.90 Billion | |

|

|

|

Рынок роботизированных рук в Индии по типу робота (шарнирные роботы, декартовы роботы, коллаборативные роботы, роботы SCARA, параллельные роботы, цилиндрические роботы и другие), типу (электрические, гидравлические и пневматические), грузоподъемности (100–500 кг, 500–1000 кг, менее 100 кг, от 1000 до 3000 кг и более 3000 кг), типу осей (6 осей, 7 осей, 5 осей, 4 оси, 3 оси, 2 оси и 1 ось), применению (обработка, сборка и разборка, сварка и пайка, дозирование, проверка и тестирование качества, обработка, сортировка, склеивание и герметизация и другие), конечным пользователям (автомобильная промышленность, электротехника и электроника, металлы и машиностроение, продукты питания и напитки, пластмассы и упаковка, химикаты, здравоохранение и фармацевтика, аэрокосмическая и оборонная промышленность, логистика и транспорт, строительство, нефть и газ, управление отходами и их переработка, розничная торговля, сельское хозяйство и другие) - отраслевые тенденции и прогноз до 2031 года.

Анализ и размер рынка роботизированных рук в Индии

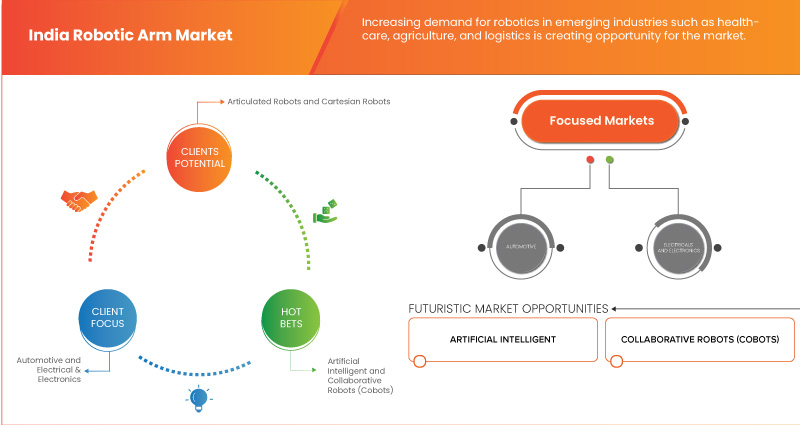

Рынок роботизированных рук в Индии демонстрирует устойчивый рост, обусловленный ростом автоматизации в различных отраслях, таких как автомобилестроение, электроника, здравоохранение и производство. Спрос на роботизированные руки в Индии обусловлен потребностью в точности, эффективности и экономичности производственных процессов. Кроме того, растет внедрение роботизированных рук в таких секторах, как здравоохранение, для таких приложений, как помощь при хирургических операциях и реабилитация, что еще больше стимулирует рост рынка.

По данным исследования рынка Data Bridge, ожидается, что объем рынка роботизированных рук в Индии к 2031 году достигнет 12,29 млрд долларов США по сравнению с 4,70 млрд долларов США в 2023 году, а среднегодовой темп роста составит 13,1% в прогнозируемый период с 2024 по 2031 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2024-2031 |

|

Базовый год |

2023 |

|

Исторические годы |

2022 (Можно настроить на 2016-2021) |

|

Количественные единицы |

Доход в млрд долларов США |

|

Охваченные сегменты |

Тип робота (шарнирные роботы, декартовы роботы, коллаборативные роботы, роботы SCARA, параллельные роботы, цилиндрические роботы и другие), тип (электрический, гидравлический и пневматический), грузоподъемность (100–500 кг, 500–1000 кг, менее 100 кг, от 1000 до 3000 кг и более 3000 кг), тип осей (6 осей, 7 осей, 5 осей, 4 оси, 3 оси, 2 оси и 1 ось), применение (обработка, сборка и разборка, сварка и пайка, дозирование, проверка и тестирование качества, обработка, сортировка, склеивание и герметизация и другие), конечные пользователи (автомобилестроение, электротехника и электроника, металлургия и машиностроение, пищевая и Напитки, пластик и упаковка, химикаты , здравоохранение и фармацевтика , аэрокосмическая и оборонная промышленность, логистика и транспорт, строительство, нефть и газ, управление отходами и их переработка, розничная торговля, сельское хозяйство и другие) |

|

Страна покрытия |

Индия |

|

Охваченные участники рынка |

Mitsubishi Electric Corporation, MCI Robotics, Seiko Epson Corporation, Mecademic, Kawasaki Heavy Industries, Asimov Robotics, DENSO CORPORATION., Systematics, Svaya Robotics Pvt. Ltd, Gridbots Technologies Private Limited., JanyuTech, ABB, FANUC CORPORATION, Universal Robots A/S, YASKAWA ELECTRIC CORPORATION, OMRON Corporation и KUKA AG и другие. |

Определение рынка

Роботизированная рука — это механическое устройство, которое программируется и способно манипулировать объектами с точностью. Обычно оно состоит из нескольких сегментов, известных как звенья, которые соединены суставами. Эти суставы позволяют руке двигаться с диапазоном движения, аналогичным диапазону человеческой руки, что позволяет ей выполнять различные задачи. Роботизированные руки часто оснащены конечным эффектором, таким как захват или инструмент, который позволяет им взаимодействовать с окружающей средой.

Динамика рынка роботизированных рук в Индии

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Растущий спрос на автоматизацию в различных отраслях промышленности

Растущий спрос на автоматизацию в различных отраслях промышленности является ключевым фактором роста рынка роботизированных рук. В производственном секторе роботизированные руки широко применяются для повышения эффективности и точности в таких задачах, как сборка, сварка и обработка материалов. Эти роботы позволяют производителям удовлетворять растущие требования потребителей за счет повышения производственных мощностей и обеспечения постоянного качества продукции. Способность роботизированных рук выполнять повторяющиеся задачи с высокой точностью сводит к минимуму человеческие ошибки и повышает общую эффективность работы, что делает их незаменимыми в современных производственных условиях.

- Правительственная инициатива и стимулы для производственных компаний инвестировать в Индустрию 4.0

Правительство Индии активно продвигает внедрение технологий промышленности 4.0, включая робототехнику, посредством различных инициатив и стимулов. Значимой инициативой является схема стимулирования производства (PLI), которая предоставляет субсидии компаниям, инвестирующим в производственные мощности в таких секторах, как автомобилестроение, металлургия, фармацевтика и пищевая промышленность — ключевых пользователях роботизированных рук. Эта схема направлена на повышение конкурентоспособности этих отраслей и привлечение дополнительных инвестиций, тем самым стимулируя спрос на роботизированные руки на рынке.

Кроме того, усилия правительства по улучшению простоты ведения бизнеса и созданию благоприятной среды для производственных компаний, чтобы внедрять передовые технологии, такие как робототехника, являются еще одним важным фактором. Благодаря реформам политики, развитию инфраструктуры и программам развития навыков правительство способствует созданию поддерживающей экосистемы для внедрения технологий Индустрии 4.0, что, как ожидается, еще больше ускорит спрос на роботизированные руки.

Возможности

- Быстрое развитие робототехнических технологий, включая искусственный интеллект (ИИ) и машинное обучение

Стремительное развитие робототехники, особенно в области искусственного интеллекта (ИИ) и машинного обучения, произвело революцию в различных отраслях. Эти технологии позволяют роботизированным системам воспринимать, обучаться и адаптироваться к динамическим средам с беспрецедентной точностью и эффективностью. Робототехника на базе ИИ расширяет возможности принятия решений. Алгоритмы машинного обучения позволяют роботам постоянно повышать производительность с помощью аналитических данных, что приводит к повышению производительности и эффективности работы.

- Растущий спрос на повышение производительности и снижение затрат на рабочую силу

Растущий спрос на повышение производительности и сокращение затрат на рабочую силу стимулировал быстрое внедрение робототехнических технологий во всех отраслях. Благодаря достижениям в области искусственного интеллекта (ИИ) и машинного обучения предприятия ищут автоматизированные решения для оптимизации процессов и повышения эффективности. Робототехника предлагает потенциал для оптимизации производственных рабочих процессов, минимизации ошибок и повышения общей производительности. Этот сдвиг не только способствует экономии затрат, но и повышает производительность организаций. В результате спрос на робототехнику продолжает расти, поскольку предприятия отдают приоритет операционной эффективности и гибкости.

Ограничения/Проблемы

- Недостаточно квалифицированная рабочая сила, не имеющая опыта в области передовой робототехники

Растущая интеграция передовой робототехники и автоматизации в различных отраслях промышленности требует специализированных знаний для программирования, эксплуатации и обслуживания, что создает значительный разрыв в навыках. Поскольку такие технологии, как ИИ и глубокое обучение, становятся все более сложными, растет спрос на высококвалифицированных специалистов, которые могут управлять этими системами и оптимизировать их. Однако нынешняя рабочая сила часто не имеет необходимой подготовки и опыта для работы с этими сложными инструментами, что приводит к несоответствию между потребностями отрасли и имеющимися талантами. Для устранения этого разрыва в навыках требуются целенаправленные образовательные программы, постоянное профессиональное развитие и совместные усилия между промышленностью и академическими учреждениями для оснащения работников необходимыми компетенциями.

- Сложности интеграции роботизированных рук в существующие производственные процессы

Интеграция роботизированных рук в существующие производственные процессы может быть сложной и трудоемкой. Эти проблемы часто возникают из-за необходимости согласования роботизированной системы с существующими рабочими процессами, оборудованием и протоколами безопасности, обеспечивая при этом бесперебойную связь и координацию с операторами-людьми. Такие факторы, как сложность программирования, совместимость оборудования и ограничения пространства, еще больше усложняют процесс интеграции.

Последние события

- В мае 2024 года компания ABB расширила свою линейку модульных промышленных роботов-манипуляторов, представив IRB 7710 и IRB 7720, предложив 16 новых вариантов, ориентированных в первую очередь на секторы OEM и поставщиков Tier для автомобильной промышленности, а также на области логистики, литейного производства, машиностроения, строительства и сельского хозяйства. Стандартизированная модульная конструкция упрощает установку, повышая гибкость и экономическую эффективность. Благодаря точности траектории до 0,6 мм и грузоподъемности до 620 кг эти роботы отлично справляются с высокоточными задачами, подчеркивая приверженность ABB инновациям и удовлетворенности клиентов.

- В январе 2024 года компании ABB и Simpliforge Creations объединились для продвижения возможностей 3D-печати в строительном секторе Индии. Вместе они разработали крупнейший в Южной Азии роботизированный 3D-принтер для бетона, который уже использовался для создания первого в Индии 3D-печатного храма и 3D-печатного моста. Целью этого сотрудничества является революция в строительстве за счет внедрения более быстрых, устойчивых и безопасных методов строительства.

- В сентябре 2023 года YASKAWA ELECTRIC CORPORATION преуспела на выставке WeldfabMeet Pune 2023, продемонстрировав передовые решения для автоматизации сварки и подчеркнув важность качественной сварки в проектировании и производстве. Благодаря своему выдающемуся присутствию и приверженности инновациям Yaskawa India укрепила свое лидерство в отрасли автоматизации сварки, готовая продолжать предоставлять первоклассные решения для удовлетворения потребностей клиентов в автоматизации

- В феврале 2022 года YASKAWA ELECTRIC CORPORATION открыла новый Robotic Solution Facility в Манесаре, Гургаон, с целью усовершенствования промышленной роботизированной автоматизации. На объекте были представлены передовые технологии для различных применений, таких как дуговая сварка, паллетирование и обслуживание машин, что способствовало более тесному сотрудничеству с клиентами. С современным цехом площадью 45 000 кв. футов, на объекте поддерживалось производство, сборка, тестирование и системная интеграция индивидуальных роботизированных систем

- В августе 2023 года FANUC CORPORATION India открыла свой новый технологический центр в Ченнаи. Объект подтверждает приверженность FANUC CORPORATION обслуживанию страны с помощью современных решений по автоматизации производства. Центр, оснащенный необходимой инфраструктурой, нацелен на предоставление расширенных услуг быстрорастущему промышленному узлу в Ченнаи, предлагая пожизненную поддержку и способствуя развитию технологий. Экологичный дизайн подчеркивает приверженность FANUC CORPORATION устойчивому развитию, одновременно удовлетворяя потребности индийского рынка и продвигая инициативы Make-in-India

Масштаб рынка роботизированных рук в Индии

Рынок роботизированных рук в Индии сегментирован на шесть заметных сегментов, которые основаны на типе робота, типе, грузоподъемности, типе оси, применении и конечном пользователе. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип робота

- Шарнирный робот

- Декартов робот

- Коллаборативный робот

- Роботы SCARA

- Параллельные роботы

- Цилиндрический робот

- Другие

По типу робота рынок роботизированных рук в Индии сегментируется на шарнирных роботов, декартовых роботов, коллаборативных роботов, роботов SCARA, параллельных роботов, цилиндрических роботов и других.

Тип

- Электрический

- Гидравлический

- Пневматический

По типу рынок роботизированных рук в Индии сегментируется на электрические, гидравлические и пневматические.

Грузоподъемность

- 100 кг-500 кг

- 500-1000 кг

- Менее 100 кг

- 1000 кг до 3000 кг

- Более 3000 кг

По грузоподъемности рынок роботизированных рук в Индии сегментируется на следующие категории: 100–500 кг, 500–1000 кг, 1000–3000 кг, менее 100 кг и более 3000 кг.

Тип оси

- 6 осей

- 7 осей

- 5 осей

- 4 оси

- 3 оси

- 2 оси

- 1 ось

По типу оси рынок роботизированных рук в Индии сегментирован на 6-осевые, 7-осевые, 5-осевые, 4-осевые, 3-осевые, 2-осевые и 1-осевые.

Приложение

- Умение обращаться

- Сборка и разборка

- Сварка и пайка

- Выдача

- Инспекция и проверка качества

- Обработка

- Сортировка

- Склеивание и герметизация

- Другие

В зависимости от сферы применения рынок роботизированных рук в Индии сегментирован на следующие виды работ: погрузочно-разгрузочные работы, сборка и разборка, сварка и пайка, дозирование, проверка и испытание качества, обработка, сортировка, склеивание и герметизация и другие.

Конечный пользователь

- Автомобильный

- Электрика и электроника

- Металлы и Машиностроение

- Еда и напитки

- Пластик и упаковка

- Химикаты

- Здравоохранение и фармацевтика

- Аэрокосмическая промышленность и оборона

- Логистика и перевозки

- Конструкции

- Нефть и газ

- Управление отходами и переработка

- Розничная торговля

- Сельское хозяйство

- Другие

В зависимости от конечного пользователя рынок роботизированных рук в Индии сегментирован следующим образом: автомобилестроение, электротехника и электроника, металлургия и машиностроение, продукты питания и напитки, пластик и упаковка, химическая промышленность, здравоохранение и фармацевтика, аэрокосмическая и оборонная промышленность, логистика и транспорт, строительство, нефть и газ, управление отходами и их переработка, розничная торговля, сельское хозяйство и другие.

Анализ конкурентной среды и доли рынка роботизированных рук в Индии

Конкурентная среда рынка роботизированных рук в Индии содержит сведения о конкуренте. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком роботизированных рук в Индии.

Среди основных игроков, работающих на индийском рынке роботизированных рук, можно назвать ABB, Kawasaki Heavy Industries, DENSO CORPORATION, YASKAWA ELECTRIC CORPORATION и FANUC CORPORATION.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.