Global Treasury Software Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.67 Billion

USD

4.68 Billion

2024

2032

USD

3.67 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Сегментация мирового рынка программного обеспечения для казначейства по операционной системе (Windows, Linux, iOS, Android и MAC), области применения (управление ликвидностью и денежными средствами, управление инвестициями, управление задолженностью, управление финансовыми рисками, управление соответствием требованиям, налоговое планирование и другие), способу развертывания (локально и в облаке), размеру организации (крупные предприятия, малые и средние предприятия), вертикали (банковское дело, финансовые услуги и страхование, государственный сектор, производство, здравоохранение, потребительские товары, химическая промышленность, энергетика и другие) — отраслевые тенденции и прогноз до 2032 года

Размер рынка казначейского программного обеспечения

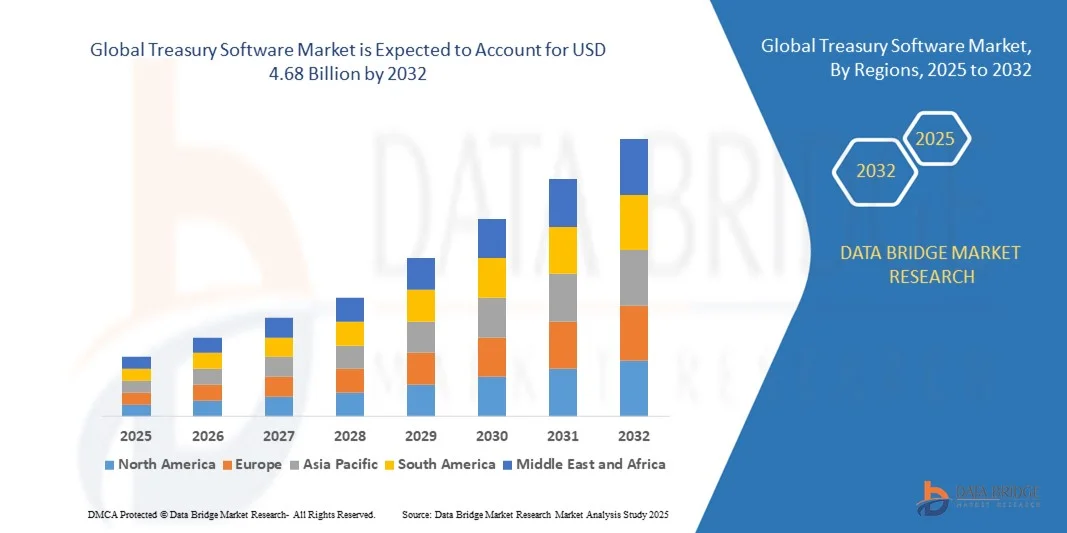

- Объем мирового рынка программного обеспечения для казначейства оценивался в 3,67 млрд долларов США в 2024 году и, как ожидается, достигнет 4,68 млрд долларов США к 2032 году при среднегодовом темпе роста 3,1% в течение прогнозируемого периода .

- Рост рынка во многом обусловлен растущим внедрением цифровых решений по управлению финансами и продолжающимся технологическим прогрессом в казначейских операциях, что приводит к повышению уровня автоматизации, отчетности в режиме реального времени и улучшению прозрачности денежных потоков для предприятий.

- Более того, растущий спрос организаций на безопасные, интегрированные и удобные платформы для управления ликвидностью, инвестициями, рисками и соблюдением нормативных требований превращает казначейское программное обеспечение в важнейший инструмент современного финансового управления. Эти факторы ускоряют внедрение казначейских решений, тем самым значительно стимулируя рост рынка.

Анализ рынка казначейского программного обеспечения

- Программное обеспечение для казначейства относится к цифровым платформам, которые позволяют организациям эффективно управлять денежными средствами, ликвидностью, инвестициями, задолженностью, финансовыми рисками и соблюдением нормативных требований. Эти системы интегрируются с системами планирования ресурсов предприятия (ERP) и банковскими платформами, обеспечивая централизованный контроль, доступ к аналитике в режиме реального времени и автоматизацию рутинных процессов.

- Растущий спрос на программное обеспечение для казначейства обусловлен в первую очередь потребностью в операционной эффективности, повышенной финансовой прозрачности, соблюдении нормативных требований и растущим предпочтением облачных и мобильных решений, которые позволяют казначеям удаленно контролировать и управлять корпоративными финансами.

- Северная Америка доминировала на рынке программного обеспечения для казначейства с долей 41,55% в 2024 году благодаря растущему спросу на цифровое управление финансами и автоматизацию на предприятиях.

- Ожидается, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке программного обеспечения для казначейства в течение прогнозируемого периода из-за роста урбанизации, более широкого внедрения цифровых технологий и технологических достижений в таких странах, как Китай, Япония и Индия.

- Локальный сегмент доминировал на рынке с долей рынка 52,8% в 2024 году, что обусловлено стремлением организаций к полному контролю над конфиденциальными финансовыми данными, соблюдению требований безопасности и возможностям индивидуальной настройки. Многие крупные предприятия продолжают инвестировать в локальные решения для поддержания внутреннего управления и глубокой интеграции с существующей ИТ-инфраструктурой. Надежность и стабильность локальных решений делают их предпочтительным выбором для критически важных казначейских операций.

Область отчета и сегментация рынка казначейского программного обеспечения

|

Атрибуты |

Ключевые аспекты рынка программного обеспечения для казначейства |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

Тенденции рынка казначейского программного обеспечения

Растущее внедрение облачных и мобильных казначейских решений

- Рынок программного обеспечения для казначейства всё больше формируется за счёт интеграции облачных и мобильных решений, обеспечивающих улучшенную доступность, масштабируемость и безопасность для корпоративных финансовых отделов. Облачные технологии позволяют организациям централизовать казначейские операции в разных географических регионах, снижая затраты на инфраструктуру и повышая операционную гибкость.

- Например, Kyriba завоевала известность в сфере облачных платформ казначейства и управления рисками, предоставляя корпоративным клиентам безопасные облачные инструменты для управления ликвидностью, контроля денежных средств и мобильного доступа. Партнёрство компании с финансовыми учреждениями демонстрирует, как поставщики предлагают облачные инновации для удовлетворения меняющихся потребностей казначейства.

- Внедрение мобильных казначейских решений обеспечивает руководителям и финансовым директорам круглосуточный доступ к критически важным финансовым данным через смартфоны и планшеты. Это гарантирует, что казначейские операции, такие как авторизация платежей, проверка позиций ликвидности и мониторинг рыночных рисков, могут осуществляться в режиме реального времени, независимо от местоположения.

- Облачные казначейские платформы также предоставляют встроенную аналитику и машинное обучение для прогнозирования движения денежных средств и анализа сценариев, повышая скорость и точность принятия решений. Эти достижения позволяют компаниям заблаговременно выявлять валютные риски, управлять процентными рисками и согласовывать стратегии управления ликвидностью с рыночными колебаниями.

- Интеграция облачного казначейства с инфраструктурами цифровых платежей и блокчейном дополнительно повышает прозрачность транзакций и эффективность трансграничных платежей. Такие поставщики, как FIS Global, внедряют решения на основе блокчейна для ускорения проведения платежей и повышения безопасности процессов сверки, стимулируя инновации в финансовых рабочих процессах.

- Растущая зависимость от облачных и мобильных казначейских решений отражает более широкий переход к цифровой трансформации в корпоративных финансах. Эта тенденция обеспечивает устойчивость и гибкость казначейских операций, а также способствует достижению стратегических целей, таких как повышение уровня соответствия требованиям и снижение рисков в диверсифицированных финансовых сетях.

Динамика рынка казначейского программного обеспечения

Водитель

Спрос на управление денежными потоками и рисками в режиме реального времени

- Потребность в получении информации о корпоративной ликвидности и управлении рисками в режиме реального времени стала основным фактором внедрения программного обеспечения для казначейства. Компании сталкиваются с растущей сложностью финансовых операций, требующей от казначейских отделов точной и быстрой обработки колебаний валютных рисков, волатильности процентных ставок и глобальных платежных проблем.

- Например, модули SAP для казначейства и управления рисками позволяют корпорациям интегрировать данные о денежных остатках, прогнозировать потребности в ликвидности и автоматизировать процессы учета хеджирования. Обеспечивая прозрачность и контроль в режиме реального времени, эти инструменты помогают организациям минимизировать финансовые риски, соблюдая при этом требования меняющейся нормативно-правовой базы.

- Программное обеспечение для казначейства обеспечивает централизованный контроль денежных позиций по нескольким организациям и в нескольких валютах, предоставляя финансовым директорам и казначеям мгновенный доступ к остаткам денежных средств и потребностям в финансировании. Такой уровень прозрачности позволяет организациям оптимизировать распределение ликвидности, сокращать неиспользуемые остатки и совершенствовать стратегии инвестирования свободных средств.

- Растущая глобализация бизнеса и сложные трансграничные финансовые транзакции обостряют потребность в надежных инструментах управления рисками. Казначейские платформы поддерживают компании, предоставляя расширенную аналитику для оценки рисков, управления соблюдением нормативных требований и предоставления отчетности заинтересованным сторонам в режиме реального времени.

- Растущий спрос на непрерывный мониторинг ликвидности и проактивную оценку рисков делает казначейские решения незаменимыми. По мере того, как корпорации масштабируют свою деятельность по всему миру, методы казначейства в режиме реального времени становятся важнейшим фактором обеспечения стабильности и финансовой эффективности в различных отраслях.

Сдержанность/Вызов

Интеграция с устаревшими ERP и банковскими системами

- Одной из важнейших проблем внедрения казначейского программного обеспечения является сложность интеграции передовых цифровых решений с существующими системами планирования ресурсов предприятия (ERP) и различными банковскими платформами. Многие международные компании работают в устаревших ИТ-средах, что затрудняет бесперебойную миграцию данных и взаимодействие с ними.

- Например, компании, использующие традиционные ERP-системы, такие как Oracle E-Business Suite, или устаревшие банковские интерфейсы, часто сталкиваются с задержками и повышенными затратами при интеграции современных казначейских приложений. Это ограничивает эффективность отслеживания движения денежных средств в режиме реального времени и сверки транзакций.

- Зависимости от устаревших систем приводят к фрагментации данных, что затрудняет получение комплексной финансовой информации. Без оптимизированных связей между казначейским программным обеспечением, модулями ERP и банковскими сетями компании сталкиваются с необходимостью ручной сверки, дублированием процессов и неэффективной отчётностью.

- Проблемы взаимодействия включают ограничения в автоматизации платежных процессов и обеспечении стандартизации форматов в различных международных банках. Казначейские службы часто сталкиваются с несоответствиями в обмене данными и расчетных сообщениях, что может привести к увеличению количества ошибок и рискам несоответствия.

- Решение этих проблем интеграции требует инвестиций в технологии промежуточного программного обеспечения, открытые банковские API и постепенную модернизацию ERP-систем. Устранение этих барьеров будет иметь решающее значение для обеспечения оптимального функционирования передовых казначейских платформ в рамках взаимосвязанных финансовых экосистем.

Сфера применения рынка казначейского программного обеспечения

Рынок сегментирован по признакам операционной системы, приложения, режима развертывания, размера организации и вертикали.

- По операционной системе

По типу операционной системы рынок программного обеспечения для казначейства сегментирован на Windows, Linux, iOS, Android и MAC. В 2024 году сегмент Windows занял наибольшую долю рынка благодаря широкому внедрению в корпоративные ИТ-среды и совместимости с устаревшими финансовыми системами. Предприятия часто предпочитают казначейские решения на базе Windows благодаря их надежной экосистеме поддержки, удобному интерфейсу и возможностям интеграции с системами планирования ресурсов предприятия (ERP) и финансовым программным обеспечением. Знакомство ИТ-отделов со средами Windows дополнительно стимулирует их дальнейшее внедрение в казначейские операции, обеспечивая бесперебойность рабочих процессов и эффективное управление системами.

Ожидается, что сегмент Android будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим использованием мобильных казначейских приложений и потребностью в доступе к финансовым данным в режиме реального времени. Решения для казначейства на базе Android позволяют специалистам удаленно управлять ликвидностью, платежами и инвестициями, повышая операционную эффективность. Масштабируемость платформы, широкая совместимость с устройствами и более низкие затраты на разработку по сравнению с iOS способствуют ее быстрому внедрению среди предприятий разного размера.

- По применению

По области применения рынок сегментируется на следующие сегменты: управление ликвидностью и денежными средствами, управление инвестициями, управление задолженностью, управление финансовыми рисками, управление соответствием требованиям, налоговое планирование и другие. Сегмент управления ликвидностью и денежными средствами обеспечил наибольшую долю выручки в 2024 году, поскольку организации уделяют первостепенное внимание мониторингу денежных позиций в режиме реального времени и оптимизации оборотного капитала. Эти решения помогают казначеям поддерживать достаточный уровень ликвидности, управлять краткосрочными инвестициями и оптимизировать внутренние денежные потоки, обеспечивая непрерывность операционной деятельности. Растущая сложность финансовых транзакций и потребность в автоматизированном прогнозировании денежных средств дополнительно стимулируют внедрение программного обеспечения для казначейства, ориентированного на ликвидность.

Ожидается, что сегмент управления финансовыми рисками будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год, что обусловлено растущей подверженностью рыночным, кредитным и операционным рискам. Организации всё чаще используют казначейские решения для моделирования, мониторинга и снижения рисков, связанных с колебаниями валютных курсов, процентными ставками и контрагентами. Расширенные инструменты аналитики, планирования сценариев и обеспечения соответствия нормативным требованиям, интегрированные в эти системы, повышают уверенность в принятии стратегических решений, способствуя быстрому их внедрению в различных секторах.

- По режиму развертывания

По способу развертывания рынок программного обеспечения для казначейства сегментируется на локальные и облачные решения. Локальный сегмент доминировал на рынке с долей 52,8% в 2024 году, что обусловлено стремлением организаций к полному контролю над конфиденциальными финансовыми данными, соблюдению требований безопасности и широкими возможностями настройки. Многие крупные предприятия продолжают инвестировать в локальные решения для поддержания внутреннего управления и глубокой интеграции с существующей ИТ-инфраструктурой. Надежность и стабильность локальных решений делают их предпочтительным выбором для критически важных казначейских операций.

Ожидается, что сегмент облачных технологий будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на масштабируемые, доступные и экономичные решения для казначейства. Облачные системы предлагают удаленный доступ, отчетность в режиме реального времени и бесперебойные обновления, позволяя организациям быстро адаптироваться к динамичной финансовой среде. Малые и средние предприятия, в частности, все чаще внедряют облачные решения для снижения ИТ-расходов и получения функциональности корпоративного уровня.

- По размеру организации

В зависимости от размера организации рынок сегментируется на крупные предприятия и малые и средние предприятия (МСП). Сегмент крупных предприятий доминировал по доле выручки рынка в 2024 году, поскольку эти организации управляют сложными казначейскими операциями в различных географических регионах и валютах. Крупные предприятия получают выгоду от передовых казначейских решений для консолидации управления денежными средствами, автоматизации платежей, снижения рисков и обеспечения соответствия международным финансовым нормам. Их значительный инвестиционный потенциал позволяет настраивать и интегрировать казначейское программное обеспечение с другими корпоративными системами, стимулируя его внедрение.

Ожидается, что сегмент малого и среднего бизнеса продемонстрирует самые быстрые темпы роста в период с 2025 по 2032 год, что обусловлено растущей осведомлённостью об инструментах цифрового казначейства и потребностью в эффективном управлении денежными средствами и рисками. Малые и средние предприятия внедряют масштабируемые и экономичные решения для повышения операционной эффективности, получения информации о денежных потоках в режиме реального времени и оптимизации процесса принятия решений. Облачные решения и модели ценообразования по подписке дополнительно способствуют внедрению решений среди малого бизнеса с ограниченными ИТ-ресурсами.

- По вертикали

По вертикали рынок казначейского программного обеспечения сегментируется на следующие сферы: банковское дело, финансовые услуги и страхование (BFSI), государственный сектор, производство, здравоохранение, потребительские товары, химическая промышленность, энергетика и другие. Сегмент BFSI доминировал на рынке в 2024 году благодаря необходимости управления большими объемами финансовых транзакций, ликвидности и соблюдения нормативных требований. Банки и финансовые учреждения активно используют казначейские решения для оптимизации управления денежными средствами, инвестиционных операций и мониторинга рисков, обеспечивая соблюдение нормативных требований и операционную эффективность. Расширенная аналитика и возможности мониторинга в режиме реального времени делают эти решения незаменимыми для вертикали BFSI.

Ожидается, что производственный сегмент будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год, что обусловлено растущей сложностью цепочек поставок, международных транзакций и требований к управлению денежными потоками. Производители внедряют программное обеспечение для казначейства для оптимизации оборотного капитала, управления валютными рисками и улучшения общего финансового планирования. Интеграция с ERP-системами и автоматизированная обработка платежей дополнительно повышают эффективность, способствуя быстрому внедрению этой технологии в отрасли.

Региональный анализ рынка казначейского программного обеспечения

- Северная Америка доминировала на рынке программного обеспечения для казначейства с наибольшей долей выручки в 41,55% в 2024 году, что обусловлено растущим спросом на цифровое управление финансами и автоматизацию на всех предприятиях.

- Организации в регионе высоко ценят мониторинг денежных потоков в режиме реального времени, управление рисками и оптимизированное соблюдение требований, предлагаемые казначейскими решениями.

- Широкое внедрение также поддерживается технологически развитой инфраструктурой, высокими расходами на ИТ и присутствием крупных финансовых учреждений, что делает казначейское программное обеспечение ключевым инструментом для эффективных корпоративных финансовых операций.

Обзор рынка программного обеспечения Казначейства США

Рынок программного обеспечения для казначейства США в 2024 году занял наибольшую долю выручки в Северной Америке благодаря быстрой цифровой трансформации и внедрению автоматизированных казначейских решений. Предприятия всё чаще уделяют первостепенное внимание оптимизации ликвидности, контролю инвестиций и снижению рисков с помощью интегрированных программных платформ. Растущий спрос на облачные решения, мобильный доступ и расширенную аналитику для принятия решений в режиме реального времени дополнительно стимулирует рост рынка. Кроме того, присутствие ведущих поставщиков программного обеспечения и акцент страны на финтех-инновациях вносят значительный вклад в расширение рынка.

Обзор европейского рынка программного обеспечения для казначейства

Ожидается, что европейский рынок программного обеспечения для казначейства будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, что обусловлено, главным образом, требованиями регулирующих органов и растущей потребностью в повышении финансовой прозрачности бизнеса. Организации внедряют казначейские решения для оптимизации управления денежными средствами, управления финансовыми рисками и улучшения надзора за инвестициями. Рост трансграничных транзакций в сочетании с растущим внедрением цифровых технологий в корпоративном секторе стимулирует внедрение казначейского программного обеспечения. Европейские компании также интегрируют казначейские системы с ERP-системами и платформами финансовой отчетности для обеспечения эффективности и соблюдения нормативных требований.

Обзор рынка программного обеспечения казначейства Великобритании

Ожидается, что рынок казначейского программного обеспечения Великобритании будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, что обусловлено спросом на надежные решения для управления финансовыми рисками и автоматизированного управления ликвидностью. Предприятия уделяют особое внимание отслеживанию движения денежных средств в режиме реального времени, соблюдению нормативных требований и эффективному распределению средств, что стимулирует внедрение казначейского программного обеспечения. Развитая финтех-экосистема Великобритании, инфраструктура цифрового банкинга и широкое использование облачных решений дополнительно способствуют росту рынка среди крупных предприятий и субъектов малого и среднего предпринимательства.

Обзор рынка программного обеспечения для казначейства Германии

Ожидается, что рынок казначейского программного обеспечения в Германии будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать внедрение передовых цифровых финансовых решений и акцент на управлении рисками и соблюдении нормативных требований. Предприятия всё чаще внедряют казначейское программное обеспечение для оптимизации ликвидности, мониторинга инвестиционных портфелей и автоматизации процессов отчётности. Мощная промышленная база Германии, акцент на цифровизацию и строгое финансовое регулирование стимулируют внедрение казначейских решений как в корпоративном, так и в государственном секторах.

Обзор рынка программного обеспечения для казначейства в Азиатско-Тихоокеанском регионе

Рынок казначейского программного обеспечения в Азиатско-Тихоокеанском регионе, как ожидается, будет расти самыми быстрыми среднегодовыми темпами в прогнозируемый период с 2025 по 2032 год, что обусловлено ростом урбанизации, внедрением цифровых технологий и технологическим прогрессом в таких странах, как Китай, Япония и Индия. Предприятия региона всё чаще используют облачные и мобильные казначейские решения для улучшения управления ликвидностью и контроля финансовых рисков. Государственные инициативы по развитию цифровых финансов в сочетании с появлением региональных поставщиков программного обеспечения стимулируют внедрение казначейского программного обеспечения во всех отраслях.

Обзор рынка программного обеспечения казначейства Японии

Рынок казначейского программного обеспечения Японии набирает обороты благодаря развитой технологической инфраструктуре страны и всё более широкому внедрению автоматизации финансовых операций. Предприятия используют казначейские решения для оптимизации денежных потоков, мониторинга инвестиций и обеспечения соответствия нормативным требованиям. Интеграция казначейского программного обеспечения с системами планирования ресурсов предприятия и финансовой отчётности стимулирует рост, при этом спрос на удобные и безопасные решения как со стороны крупных предприятий, так и со стороны малого и среднего бизнеса продолжает расти.

Обзор рынка программного обеспечения для казначейства Китая

Рынок казначейского программного обеспечения Китая обеспечил наибольшую долю выручки в Азиатско-Тихоокеанском регионе в 2024 году благодаря быстрой урбанизации, внедрению технологий и росту корпоративных финансовых операций. Организации внедряют казначейское программное обеспечение для эффективного управления ликвидностью, контроля инвестиций и снижения рисков. Активное развитие цифровых финансов в сочетании с доступностью экономически эффективных решений от отечественных и международных поставщиков стимулирует рост рынка во многих секторах, включая обрабатывающую промышленность, банковские и финансовые услуги (BFSI) и потребительские товары.

Доля рынка казначейского программного обеспечения

В отрасли программного обеспечения для казначейства лидируют в основном хорошо зарекомендовавшие себя компании, среди которых:

- Финастра (Великобритания)

- ZenTreasury Ltd (Финляндия)

- Emphasys Software (США)

- SS&C Technologies, Inc. (США)

- CAPIX (Австралия)

- Adenza (Великобритания и США)

- Coupa Software Inc. (США)

- DataLog Finance (Франция и Сингапур)

- ФИС (США)

- Access Systems (UK) Limited (Великобритания)

- Treasury Software Corp. (США)

- MUREX SAS (Франция)

- EdgeVerve Systems Limited (Индия)

- Financial Sciences Corp. (США)

- Broadridge Financial Solutions, Inc. (США)

- CashAnalytics (Ирландия)

- Oracle (США)

- Fiserv, Inc. (США)

- ИОН (Великобритания)

- SAP (Германия)

- Solomon Software (США)

- ABM CLOUD (Грузия)

Последние события на мировом рынке программного обеспечения для казначейства

- В июне 2023 года компания ZenTreasury представила значительные усовершенствования своего программного обеспечения для учета аренды, отвечающего требованиям МСФО (IFRS) 16, оптимизируя процессы соответствия для компаний. Обновлённое программное обеспечение обладает расширенными возможностями автоматизации, позволяя отслеживать и отчитываться по арендным обязательствам в режиме реального времени. Это улучшение сокращает ручной ввод данных и минимизирует риск ошибок, обеспечивая точность финансовой отчётности. Благодаря полной интеграции с существующими системами планирования ресурсов предприятия (ERP), программное обеспечение обеспечивает более быструю проверку и повышает общую операционную эффективность. Это обновление позиционирует ZenTreasury как лидера в предоставлении комплексных решений для учёта аренды, отвечающих меняющимся нормативным требованиям.

- В мае 2023 года Treasury Intelligence Solutions (TIS) и Delega расширили сотрудничество, чтобы улучшить функциональность электронного управления банковскими счетами (eBAM). Интеграция теперь предлагает расширенные возможности управления правами подписи в рамках нескольких банковских отношений. Это нововведение позволяет корпоративным казначеям автоматизировать создание, изменение и удаление записей о подписях, значительно сокращая объем ручного вмешательства и связанные с ним риски. Расширенные возможности eBAM обеспечивают соблюдение международных банковских норм и повышают эффективность казначейских операций. Это стратегическое улучшение подчеркивает стремление TIS и Delega предоставлять передовые решения для современного управления казначейством.

- В апреле 2023 года компания ZenTreasury запустила мультивалютный модуль в рамках своего программного обеспечения для учёта аренды, отвечающего требованиям МСФО (IFRS) 16, что решает сложные задачи, с которыми сталкиваются транснациональные корпорации. Эта новая функция позволяет компаниям управлять обязательствами по аренде в разных валютах на единой платформе. Модуль автоматизирует конвертацию валют и обеспечивает точность финансовой отчётности в соответствии с международными стандартами бухгалтерского учёта. Централизуя данные по аренде и предоставляя аналитику в режиме реального времени, мультивалютный модуль улучшает процессы принятия решений и способствует глобальной финансовой консолидации. Это дополнение подтверждает стремление ZenTreasury предлагать масштабируемые решения для компаний, работающих в различных финансовых условиях.

- В марте 2022 года компания ZenTreasury и её местный партнёр MCA предоставили компании Redington Gulf программное обеспечение для учёта аренды в соответствии с МСФО (IFRS) 16. Клиентам больше не нужно импортировать данные из нескольких источников и хранить их на нескольких платформах. Всё выполняется с помощью одного программного обеспечения. Такая интеграция упрощает рабочие процессы, снижает избыточность данных и повышает их точность, что приводит к более эффективному учёту аренды. Комплексный подход решения оптимизирует задачи по обеспечению соответствия требованиям и составлению отчётности, позволяя компаниям сосредоточиться на стратегическом финансовом управлении.

- В сентябре 2022 года TIS и Delega объединились, чтобы предоставить клиентам автоматизированное управление правами подписи нового поколения в нескольких банках. Благодаря этому соглашению клиенты TIS и Delega могут воспользоваться преимуществами электронного управления банковскими счетами (eBAM) NextGen. Это сотрудничество позволяет организациям автоматизировать и централизовать управление правами подписи банковских счетов, повышая эффективность и снижая риск ошибок. Оптимизируя процесс, компании могут обеспечить более строгое соблюдение банковских правил и повысить безопасность своих финансовых операций.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.