Global Thin And Ultra Thin Films Market

Размер рынка в млрд долларов США

CAGR :

%

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

| 2022 –2029 | |

| USD 5,313.17 Million | |

| USD 22,812.53 Million | |

|

|

|

|

Глобальный рынок тонких и сверхтонких пленок по методам нанесения покрытия (газообразное состояние, состояние раствора, расплавленное или полурасплавленное состояние), типу (тонкие, сверхтонкие), методам осаждения (физическое осаждение, химическое осаждение), применению (электроника и полупроводники, возобновляемые источники энергии, здравоохранение и биомедицинские приложения, автомобилестроение, аэрокосмическая и оборонная промышленность, другие) — отраслевые тенденции и прогноз до 2029 г.

Анализ и размер рынка

Тонкие и сверхтонкие пленки широко используются благодаря их легкому материалу, который может использоваться для покрытия других материалов, включая металл или пластик. Эти пленки широко применяются в различных областях, таких как фотоэлектричество (PV), защита от коррозии, батареи, топливные элементы, а также краски и покрытия и т. д.

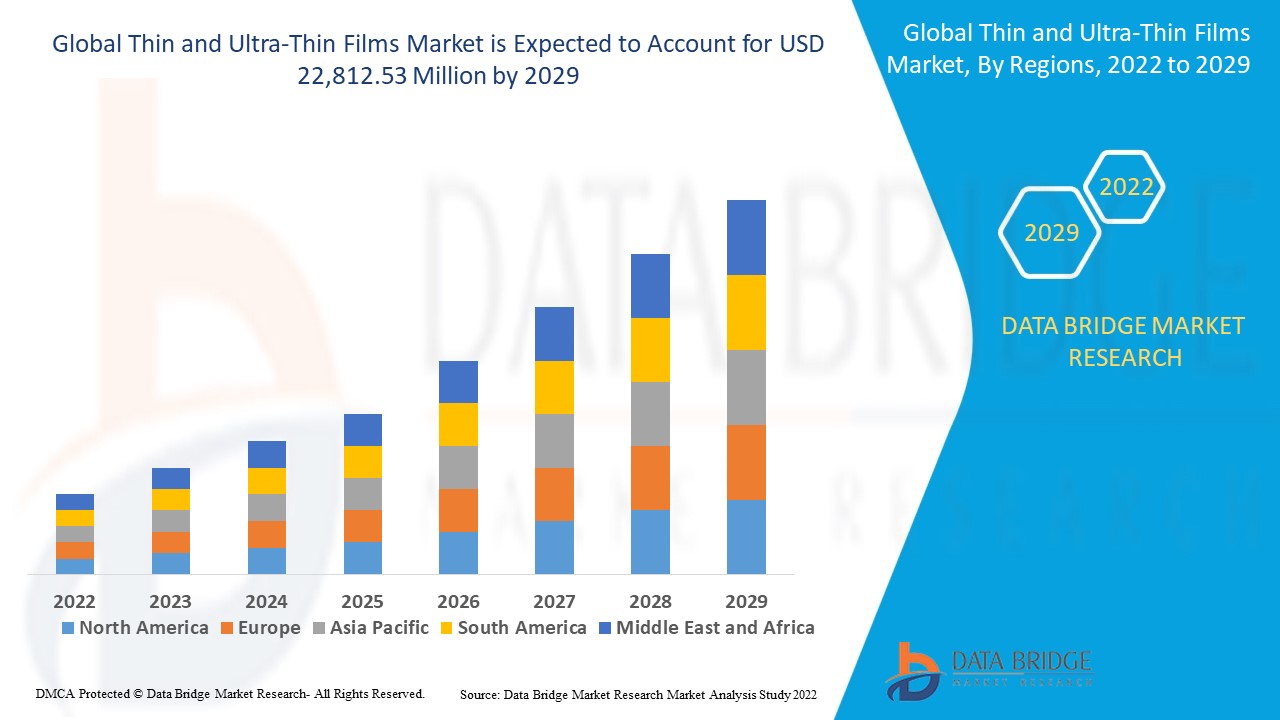

Глобальный рынок тонких и сверхтонких пленок оценивался в 5 313,17 млн долларов США в 2021 году и, как ожидается, достигнет 22 812,53 млн долларов США к 2029 году, регистрируя среднегодовой темп роста в 15,40% в прогнозируемый период 2022-2029 годов. Электроника и полупроводники составляют сегмент приложений на соответствующем рынке из-за высокого использования для обертывания и покрытия полупроводниковых материалов. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ производства и потребления, а также анализ песта.

Определение рынка

Тонкие пленки относятся к пленкам, толщина которых составляет менее 1 мкм. Эти пленки в основном представляют собой слои материала, нанесенного на любую поверхность. Сверхтонкие пленки определяются как пленки, нанесенные с использованием сложных химических и физических методов осаждения, включая газофазные прекурсоры и плазменный процесс.

Область отчета и сегментация рынка

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Методы нанесения покрытия (газообразное состояние, состояние раствора, расплавленное или полурасплавленное состояние), тип (тонкое, сверхтонкое), методы осаждения (физическое осаждение, химическое осаждение), применение (электроника и полупроводники, возобновляемая энергетика, здравоохранение и биомедицинские приложения, автомобилестроение, аэрокосмическая и оборонная промышленность, другие) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Израиль, Египет, Южная Африка, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки |

|

Охваченные участники рынка |

American Elements (США), LEW TECHNIQUES LTD (Великобритания), Denton Vacuum (США), KANEKA CORPORATION (Япония), Umicore (Бельгия), Materion Corporation (США), AIXTRON (Германия), Kurt J. Lesker Company (США), Vital Materials Co., Limited (Китай), AJA INTERNATIONAL, Inc. (США), Praxair ST Technology, Inc. (США), PVD Products, Inc. (США), GEOMATEC Co., Ltd. (Япония), INTEVAC, INC. (США), Plasma-Therm (Великобритания), Arrow Thin Films, Inc. (США), Super Conductor Materials, Inc. (США), Angstrom Engineering Inc. (Канада), ThinFilms Inc. (США), Orange Thin Films (Нидерланды) и другие |

|

Возможности рынка |

|

Динамика рынка тонких и сверхтонких пленок

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Рост миниатюризации

Рост миниатюризации в полупроводниках выступает в качестве одного из основных факторов, стимулирующих рост рынка тонких и сверхтонких пленок. Кроме того, расширение нанотехнологий в различных областях материаловедения оказывает положительное влияние на рынок.

- Спрос со стороны различных секторов

Рост спроса на тонкие и сверхтонкие пленки в многочисленных отраслях промышленности, таких как полупроводниковая, медицинская и упаковочная, среди прочих, ускоряет рост рынка. Различные методы осаждения тонких пленок способствуют расширению рынка.

- Достижения в фильмах

Рост инноваций и прогресс ведущих компаний, которые патентуют свою продукцию, еще больше влияют на рынок. Рост спроса на эти пленки из-за их высокой степени гибкости стимулирует рынок.

Кроме того, быстрая урбанизация, изменение образа жизни, резкий рост инвестиций и увеличение потребительских расходов оказывают положительное влияние на рынок тонких и сверхтонких пленок.

Возможности

Более того, революционный рост в области нанотехнологий расширяет прибыльные возможности для участников рынка в прогнозируемый период с 2022 по 2029 год. Кроме того, резкий рост инвестиций будет способствовать дальнейшему расширению рынка.

Ограничения/Проблемы

С другой стороны, ожидается, что отсутствие эффективности преобразования при предложении кремниевых ячеек будет препятствовать росту рынка. Кроме того, ожидается, что отсутствие осведомленности будет бросать вызов рынку тонких и сверхтонких пленок в прогнозируемый период 2022-2029 гг.

В этом отчете о рынке тонких и сверхтонких пленок содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке тонких и сверхтонких пленок, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок тонких и сверхтонких пленок

COVID-19 повлиял на рынок тонких и сверхтонких пленок. Ограниченные инвестиционные затраты и нехватка сотрудников препятствовали продажам и производству технологии отображения на электронной бумаге (e-paper). Однако правительство и ключевые игроки рынка приняли новые меры безопасности для разработки практик. Достижения в области технологий увеличили темпы продаж тонких и сверхтонких пленок, поскольку они были нацелены на нужную аудиторию. Ожидается, что увеличение продаж потребительской электроники по всему миру будет и дальше стимулировать рост рынка в постпандемическом сценарии.

Масштаб и размер мирового рынка тонких и сверхтонких пленок

Рынок тонких и сверхтонких пленок сегментирован на основе методов покрытия, типа, методов осаждения и применения. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Методы нанесения покрытия

- Газообразное состояние

- Решения Состояние

- Расплавленное или полурасплавленное состояние

Тип

- Тонкий

- Ультратонкий

Методы осаждения

- Физическое осаждение

- Химическое осаждение

Приложение

- Электроника и полупроводники

- Возобновляемая энергия

- Здравоохранение и биомедицинские приложения

- Автомобильный

- Аэрокосмическая промышленность и оборона

- Другие

Региональный анализ/анализ рынка тонких и сверхтонких пленок

Проведен анализ рынка тонких и сверхтонких пленок, а также предоставлены сведения о размерах рынка и тенденциях по странам, методам нанесения покрытий, типам, технологиям осаждения и областям применения, как указано выше.

Страны, охваченные отчетом о рынке тонких и сверхтонких пленок: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Израиль, Египет, Южная Африка, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Азиатско-Тихоокеанский регион (APAC) доминирует на рынке тонких и сверхтонких пленок из-за роста популярности этой технологии в регионе.

Ожидается, что в прогнозируемый период с 2022 по 2029 год в Северной Америке будет наблюдаться значительный рост в связи с внедрением технологий и усилением давления по сокращению выбросов углерода в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и внутренних брендов, влияние внутренних тарифов и торговых путей.

Конкурентная среда и рынок тонких и сверхтонких пленок

Конкурентная среда рынка тонких и сверхтонких пленок содержит сведения по конкурентам. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании в применении. Приведенные выше данные касаются только фокуса компаний на рынке тонких и сверхтонких пленок.

Некоторые из основных игроков, работающих на рынке тонких и сверхтонких пленок, это

- Американские элементы (США)

- LEW TECHNIQUES LTD (Великобритания)

- Denton Vacuum (США)

- KANEKA CORPORATION (Япония)

- Umicore (Бельгия)

- Корпорация Materion (США)

- AIXTRON (Германия)

- Компания Курта Дж. Лескера (США)

- Vital Materials Co., Limited (Китай)

- AJA INTERNATIONAL, Inc. (США)

- Praxair ST Technology, Inc. (США)

- PVD Products, Inc. (США)

- GEOMATEC Co., Ltd. (Япония)

- INTEVAC, INC. (США)

- Plasma-Therm (Великобритания)

- Arrow Thin Films, Inc. (США)

- Super Conductor Materials, Inc. (США)

- Angstrom Engineering Inc. (Канада)

- ThinFilms Inc. (США)

- Тонкие пленки Orange (Нидерланды)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COATING METHODS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT ANALYSIS OF COVID-19

5.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 IMPACT ON DEMAND

5.4 IMPACT ON SUPPLY CHAIN

5.5 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN WIND ENERGY

6.1.2 GROWING DEMAND FOR CONSUMERS ELECTRONIC

6.1.3 INCREASING USE OF THIN FILM FOR MEDICAL DEVICES

6.1.4 INCREASING ADOPTION OF SOLAR ENERGY

6.2 RESTRAINT

6.2.1 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWING ADVANCEMENT IN NANOTECHNOLOGY

6.3.2 INCREASING DEMAND FROM THE AEROSPACE AND DEFENSE INDUSTRY FOR THIN FILM APPLICATIONS

6.3.3 GOVERNMENT INITIATIVES TO REDUCE CARBON EMISSION

6.4 CHALLENGE

6.4.1 POOR CONVERSION EFFICIENCY OF THIN FILM SOLAR CELLS

7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS

7.1 OVERVIEW

7.2 GASEOUS STATE

7.3 SOLUTIONS STATE

7.4 MOLTEN OR SEMI-MOLTEN STATE

8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 THIN

8.3 ULTRA-THIN

9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES

9.1 OVERVIEW

9.2 PHYSICAL DEPOSITION

9.2.1 TYPE

9.2.1.1 Evaporation Techniques

9.2.1.2 Sputtering Deposition

9.2.1.3 Pulsed Laser Deposition (PLD)

9.2.1.4 Others

9.2.2 MATERIAL

9.2.2.1 Sputtering Targets

9.2.2.2 Pellets

9.2.2.3 Others

9.3 CHEMICAL DEPOSITION

9.3.1 TYPE

9.3.1.1 Chemical Vapor Deposition (CVD)

9.3.1.2 Sol-Gel Deposition

9.3.1.3 Plating

9.3.1.4 Others

9.3.2 MATERIAL

9.3.2.1 Metal Halides

9.3.2.2 Metal Hydrides

9.3.2.3 Reactive Gases

9.3.2.4 Organometallic Compounds

9.3.2.5 Metal Salts

9.3.2.6 Others

10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS & SEMICONDUCTOR

10.2.1 FULLY TRANSPARENT ELECTRICAL CONDUCTORS

10.2.2 INTEGRATED CIRCUIT FABRICATION

10.2.3 THIN FILM BATTERIES

10.2.4 OTHERS

10.3 RENEWABLE ENERGY

10.3.1 SOLAR

10.3.2 WIND

10.4 HEALTHCARE AND BIOMEDICAL APPLICATIONS

10.5 AUTOMOTIVE

10.6 AEROSPACE & DEFENSE

10.7 OTHERS

11 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY GEOGRAPHY

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 AUSTRALIA

11.2.6 SINGAPORE

11.2.7 THAILAND

11.2.8 MALAYSIA

11.2.9 INDONESIA

11.2.10 PHILIPPINES

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 RUSSIA

11.4.4 U.K.

11.4.5 ITALY

11.4.6 SPAIN

11.4.7 NETHERLANDS

11.4.8 BELGIUM

11.4.9 SWITZERLAND

11.4.10 TURKEY

11.4.11 REST OF EUROPE

11.5 MIDDLE EAST & AFRICA

11.5.1 ISRAEL

11.5.2 SAUDI ARABIA

11.5.3 SOUTH AFRICA

11.5.4 U.A.E.

11.5.5 EGYPT

11.5.6 REST OF MIDDLE EAST & AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 KANEKA CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 UMICORE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATERION CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 PRAXAIR S.T. TECHNOLOGY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 INTEVAC, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AIXTRON

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AJA INTERNATIONAL, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AMERICAN ELEMENTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANGSTROM ENGINEERING INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ARROW THIN FILMS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 DENTON VACUUM

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GEOMATEC CO., LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KURT J. LESKER COMPANY

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LEW TECHNIQUES LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORANGE THIN FILMS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PLASMA-THERM

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PVD PRODUCTS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SUPER CONDUCTOR MATERIALS, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 THINFILMS INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 VITAL MATERIALS CO., LIMITED

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

LIST OF TABLES

TABLE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, MARKET FORECAST 2020-2027 (USD MILLION) 65

TABLE 2 GLOBAL GASEOUS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 65

TABLE 3 GLOBAL SOLUTIONS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 66

TABLE 4 GLOBAL MOLTEN OR SEMI-MOLTEN STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 67

TABLE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION) 70

TABLE 6 GLOBAL THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 70

TABLE 7 GLOBAL ULTRA-THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 71

TABLE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, MARKET FORECAST 2020-2027 (USD MILLION) 74

TABLE 9 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 74

TABLE 10 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 74

TABLE 11 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 75

TABLE 12 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 76

TABLE 13 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 76

TABLE 14 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 78

TABLE 15 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, MARKET FORECAST 2020-2027 (USD MILLION) 82

TABLE 16 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 82

TABLE 17 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 83

TABLE 18 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 84

TABLE 19 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 84

TABLE 20 GLOBAL HEALTHCARE AND BIOMEDICAL APPLICATIONS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 21 GLOBAL AUTOMOTIVE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 22 GLOBAL AEROSPACE & DEFENSE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 23 GLOBAL OTHERS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY REGION, 2018-2027 (USD MILLION) 92

TABLE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 96

TABLE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 96

TABLE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 96

TABLE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 97

TABLE 29 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 30 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 97

TABLE 31 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 32 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 98

TABLE 33 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 34 ASIA-PACIFIC ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 35 ASIA-PACIFIC RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 99

TABLE 36 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 100

TABLE 37 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 100

TABLE 38 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 100

TABLE 39 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 40 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 101

TABLE 41 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 42 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 102

TABLE 43 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 44 CHINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 45 CHINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 46 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 104

TABLE 47 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 104

TABLE 48 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 104

TABLE 49 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 50 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 105

TABLE 51 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 52 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 106

TABLE 53 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 54 INDIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 55 INDIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 56 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 108

TABLE 57 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 108

TABLE 58 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 108

TABLE 59 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 60 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 109

TABLE 61 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 62 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 110

TABLE 63 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 64 SOUTH KOREA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 65 SOUTH KOREA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 111

TABLE 66 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 112

TABLE 67 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 112

TABLE 68 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 112

TABLE 69 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 70 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 113

TABLE 71 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 72 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 114

TABLE 73 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 74 JAPAN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 75 JAPAN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 76 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 116

TABLE 77 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 116

TABLE 78 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 116

TABLE 79 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 80 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 117

TABLE 81 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 82 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 118

TABLE 83 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 84 AUSTRALIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 85 AUSTRALIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 119

TABLE 86 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 120

TABLE 87 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 120

TABLE 88 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 120

TABLE 89 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 90 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 121

TABLE 91 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 92 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 122

TABLE 93 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 94 SINGAPORE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 95 SINGAPORE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 123

TABLE 96 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 124

TABLE 97 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 124

TABLE 98 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 124

TABLE 99 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 100 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 125

TABLE 101 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 102 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 126

TABLE 103 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 104 THAILAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 105 THAILAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 127

TABLE 106 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 128

TABLE 107 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 128

TABLE 108 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 128

TABLE 109 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 110 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 129

TABLE 111 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 112 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 130

TABLE 113 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 114 MALAYSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 115 MALAYSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 131

TABLE 116 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 132

TABLE 117 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 132

TABLE 118 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 132

TABLE 119 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 120 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 133

TABLE 121 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 122 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 134

TABLE 123 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 124 INDONESIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 125 INDONESIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 135

TABLE 126 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 136

TABLE 127 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 136

TABLE 128 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 136

TABLE 129 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 130 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 137

TABLE 131 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 132 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 138

TABLE 133 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 134 PHILIPPINES ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 135 PHILIPPINES RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 139

TABLE 136 REST OF ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 140

TABLE 137 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 144

TABLE 138 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 144

TABLE 139 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 144

TABLE 140 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 144

TABLE 141 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 142 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 145

TABLE 143 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 144 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 146

TABLE 145 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 146 NORTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 147 NORTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 147

TABLE 148 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 148

TABLE 149 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 148

TABLE 150 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 148

TABLE 151 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 152 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 149

TABLE 153 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 154 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 150

TABLE 155 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 156 U.S. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 157 U.S. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 151

TABLE 158 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 152

TABLE 159 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 152

TABLE 160 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 152

TABLE 161 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 162 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 153

TABLE 163 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 164 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 154

TABLE 165 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 166 CANADA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 167 CANADA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 168 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 156

TABLE 169 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 156

TABLE 170 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 156

TABLE 171 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 172 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 157

TABLE 173 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 174 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 158

TABLE 175 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 176 MEXICO ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 177 MEXICO RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 178 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 163

TABLE 179 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 163

TABLE 180 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 163

TABLE 181 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 164

TABLE 182 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 164

TABLE 183 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 164

TABLE 184 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 165

TABLE 185 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 165

TABLE 186 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 187 EUROPE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 188 EUROPE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 166

TABLE 189 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 167

TABLE 190 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 167

TABLE 191 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 167

TABLE 192 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 193 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 168

TABLE 194 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 195 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 169

TABLE 196 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 197 GERMANY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 198 GERMANY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 170

TABLE 199 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 171

TABLE 200 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 171

TABLE 201 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 171

TABLE 202 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 203 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 172

TABLE 204 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 205 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 173

TABLE 206 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 207 FRANCE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 208 FRANCE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 209 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 175

TABLE 210 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 175

TABLE 211 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 175

TABLE 212 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 213 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 176

TABLE 214 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 215 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 177

TABLE 216 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 217 RUSSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 218 RUSSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 219 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 179

TABLE 220 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 179

TABLE 221 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 179

TABLE 222 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 223 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 180

TABLE 224 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 225 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 181

TABLE 226 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 227 U.K. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 228 U.K. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 182

TABLE 229 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 183

TABLE 230 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 183

TABLE 231 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 183

TABLE 232 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 233 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 184

TABLE 234 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 235 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 185

TABLE 236 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 237 ITALY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 238 ITALY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 239 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 187

TABLE 240 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 187

TABLE 241 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 187

TABLE 242 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 243 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 188

TABLE 244 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 245 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 189

TABLE 246 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 247 SPAIN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 248 SPAIN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 249 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 191

TABLE 250 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 191

TABLE 251 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 191

TABLE 252 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 253 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 192

TABLE 254 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 255 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 193

TABLE 256 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 257 NETHERLANDS ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 258 NETHERLANDS RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 194

TABLE 259 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 195

TABLE 260 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 195

TABLE 261 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 195

TABLE 262 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 263 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 196

TABLE 264 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 265 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 197

TABLE 266 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 267 BELGIUM ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 268 BELGIUM RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 198

TABLE 269 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 199

TABLE 270 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 199

TABLE 271 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 199

TABLE 272 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 273 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 200

TABLE 274 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 275 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 201

TABLE 276 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 277 SWITZERLAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 278 SWITZERLAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 202

TABLE 279 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 203

TABLE 280 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 203

TABLE 281 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 203

TABLE 282 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 283 204

TABLE 284 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 204

TABLE 285 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 286 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 205

TABLE 287 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 288 TURKEY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 289 TURKEY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 290 REST OF EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 207

TABLE 291 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 211

TABLE 292 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 211

TABLE 293 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 211

TABLE 294 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 211

TABLE 295 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 296 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 212

TABLE 297 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 298 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 213

TABLE 299 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 300 MIDDLE EAST & AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 301 MIDDLE EAST & AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 214

TABLE 302 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 215

TABLE 303 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 215

TABLE 304 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 215

TABLE 305 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 306 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 216

TABLE 307 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 308 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 217

TABLE 309 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 310 ISRAEL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 311 ISRAEL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 312 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 219

TABLE 313 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 219

TABLE 314 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 219

TABLE 315 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 316 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 220

TABLE 317 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 318 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 221

TABLE 319 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 320 SAUDI ARABIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 321 SAUDI ARABIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 222

TABLE 322 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 223

TABLE 323 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 223

TABLE 324 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 223

TABLE 325 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 326 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 224

TABLE 327 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 328 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 225

TABLE 329 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 330 SOUTH AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 331 SOUTH AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 226

TABLE 332 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 227

TABLE 333 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 227

TABLE 334 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 227

TABLE 335 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 336 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 228

TABLE 337 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 338 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 229

TABLE 339 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 340 U.A.E. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 341 U.A.E. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 342 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 231

TABLE 343 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 231

TABLE 344 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 231

TABLE 345 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 346 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 232

TABLE 347 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 348 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 233

TABLE 349 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 350 EGYPT ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 351 EGYPT RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 352 REST OF MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 235

TABLE 353 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 239

TABLE 354 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 239

TABLE 355 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 239

TABLE 356 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 239

TABLE 357 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 358 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 240

TABLE 359 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 360 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 241

TABLE 361 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 362 SOUTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 363 SOUTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 242

TABLE 364 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 243

TABLE 365 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 243

TABLE 366 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 243

TABLE 367 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 368 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 244

TABLE 369 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 370 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 245

TABLE 371 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 372 BRAZIL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 373 BRAZIL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 374 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 247

TABLE 375 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 247

TABLE 376 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 247

TABLE 377 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 378 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 248

TABLE 379 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 380 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 249

TABLE 381 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 382 ARGENTINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 383 ARGENTINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 250

TABLE 384 REST OF SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 251

Список рисунков

LIST OF FIGURES

FIGURE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 38

FIGURE 2 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DATA TRIANGULATION 41

FIGURE 3 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DROC ANALYSIS 42

FIGURE 4 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS 43

FIGURE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY RESEARCH ANALYSIS 43

FIGURE 6 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: INTERVIEW DEMOGRAPHICS 44

FIGURE 7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DBMR MARKET POSITION GRID 45

FIGURE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: VENDOR SHARE ANALYSIS 46

FIGURE 9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: MARKET APPLICATION COVERAGE GRID 48

FIGURE 10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 51

FIGURE 11 GROWING DEMAND FOR CONSUMERS ELECTRONIC IS EXPECTED TO DRIVE THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 52

FIGURE 12 GASEOUS STATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN 2020 & 2027 52

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 53

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR THIN AND ULTRA-THIN FILMS MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027 54

FIGURE 15 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET 58

FIGURE 16 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS, 2019 64

FIGURE 17 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY TYPE, 2019 69

FIGURE 18 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY DEPOSITION TECHNIQUES, 2019 73

FIGURE 19 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY APPLICATION, 2019 81

FIGURE 20 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 89

FIGURE 21 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019) 90

FIGURE 22 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2020 & 2027) 90

FIGURE 23 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019 & 2027) 91

FIGURE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 91

FIGURE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 93

FIGURE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 94

FIGURE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 94

FIGURE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 95

FIGURE 29 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 95

FIGURE 30 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 141

FIGURE 31 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 142

FIGURE 32 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 142

FIGURE 33 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 143

FIGURE 34 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 143

FIGURE 35 EUROPE THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 160

FIGURE 36 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 161

FIGURE 37 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 161

FIGURE 38 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 162

FIGURE 39 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 162

FIGURE 40 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 208

FIGURE 41 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 209

FIGURE 42 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 209

FIGURE 43 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 210

FIGURE 44 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 210

FIGURE 45 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 236

FIGURE 46 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 237

FIGURE 47 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 237

FIGURE 48 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 238

FIGURE 49 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 238

FIGURE 50 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 252

FIGURE 51 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 253

FIGURE 52 EUROPE THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 254

FIGURE 53 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 255

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.