Global Point Of Sale System Requirement Market

Размер рынка в млрд долларов США

CAGR :

%

USD

13.28 Billion

USD

30.17 Billion

2024

2032

USD

13.28 Billion

USD

30.17 Billion

2024

2032

| 2025 –2032 | |

| USD 13.28 Billion | |

| USD 30.17 Billion | |

|

|

|

|

Сегментация глобального рынка требований к системам точек продаж по области применения (стационарные и мобильные POS-терминалы), способу развертывания (локальные и облачные), размеру организации (крупные предприятия, малые и средние предприятия (МСП)), конечному пользователю (рестораны, гостиничный бизнес, здравоохранение, розничная торговля, склады, развлечения и другие) — тенденции отрасли и прогноз до 2032 года

Требования к системе точек продаж Размер рынка

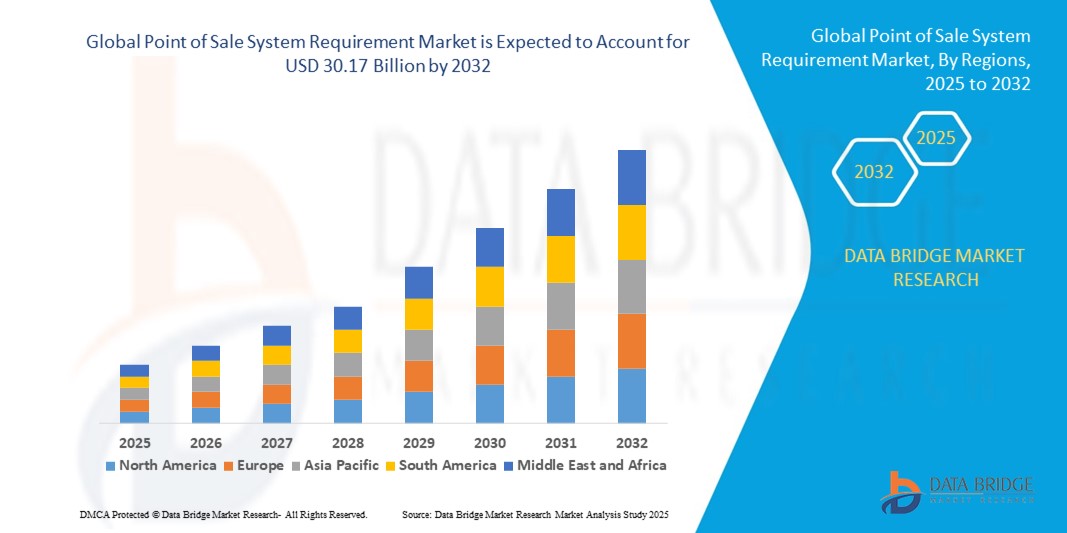

- Объем мирового рынка систем точек продаж оценивался в 13,28 млрд долларов США в 2024 году и, как ожидается , достигнет 30,17 млрд долларов США к 2032 году при среднегодовом темпе роста 10,80% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим внедрением цифровых платежных решений в секторах розничной торговли, гостеприимства и электронной коммерции, а также растущим спросом на управление запасами в режиме реального времени и улучшение качества обслуживания клиентов.

- Рост популярности облачных POS-решений, интеграции мобильных платежей и многоканальной розничной торговли еще больше ускоряет расширение рынка, предоставляя компаниям операционную эффективность, масштабируемость и аналитику на основе данных.

Анализ рынка требований к системе точек продаж

- Глобальный рынок POS-систем демонстрирует уверенный рост, обусловленный всё более широким внедрением цифровых платёжных решений в розничной торговле, гостиничном бизнесе и электронной коммерции. POS-системы обеспечивают более быстрые транзакции, улучшенное управление запасами и повышение качества обслуживания клиентов.

- Растущий спрос на облачные POS-решения стимулирует расширение рынка, поскольку эти системы обеспечивают аналитику данных в режиме реального времени, возможности удалённого управления и бесшовную интеграцию с другим бизнес-программным обеспечением. Компании используют облачные POS-решения для повышения операционной эффективности и снижения затрат.

- Северная Америка доминировала на рынке требований к POS-системам с наибольшей долей выручки в 38,5% в 2024 году, что обусловлено широким внедрением цифровых платежных решений, ускоренной модернизацией розничной торговли и ростом осведомленности о передовых POS-технологиях.

- Ожидается, что Азиатско-Тихоокеанский регион станет свидетелем самых высоких темпов роста на мировом рынке требований к системам точек продаж , что обусловлено быстрой урбанизацией, ростом проникновения смартфонов и интернета, ростом активности в сфере электронной коммерции и внедрением мобильных и облачных POS-решений в розничной торговле, гостиничном бизнесе и других секторах услуг.

- Сегмент стационарных POS-терминалов занял наибольшую долю рынка в 2024 году благодаря широкому внедрению в розничных магазинах, супермаркетах и крупных ресторанах. Эти системы отличаются стабильностью, надёжной функциональностью и бесперебойной интеграцией с платёжными шлюзами, системами управления запасами и бухгалтерским программным обеспечением, что делает их популярными среди компаний с устойчивым развитием.

Область применения отчета и требования к системе точек продаж. Сегментация рынка.

|

Атрибуты |

Требования к системе точек продаж: ключевые аспекты рынка |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

• Растущее внедрение облачных решений для точек продаж |

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса. |

Требования к системе точек продаж Тенденции рынка

Рост популярности облачных и мобильных POS-решений

• Растущий переход на облачные POS-решения трансформирует секторы розничной торговли и гостеприимства, обеспечивая отслеживание транзакций в режиме реального времени и централизованное управление. Эти системы обеспечивают мгновенный доступ к данным о продажах, уровне запасов и аналитике, помогая компаниям принимать более быстрые и обоснованные решения, что повышает операционную эффективность и удовлетворенность клиентов.

• Высокий спрос на мобильные POS-терминалы и решения для бесконтактной оплаты ускоряет их внедрение среди малого и среднего бизнеса, а также крупных розничных продавцов. Мобильные POS-системы особенно эффективны для компаний, работающих в удаленных районах или временных магазинах, обеспечивая бесперебойную оплату и улучшая процесс оплаты. Эта тенденция также поддерживается банками и финтех-компаниями, продвигающими цифровые транзакции.

• Доступность и простота интеграции современных POS-систем делают их привлекательными для управления несколькими магазинами и франчайзинговыми операциями. Компании получают выгоду от снижения операционных расходов, упрощения бухгалтерского учета и повышения вовлеченности клиентов, что приводит к увеличению доходов.

• Например, в 2023 году несколько розничных сетей по всей Индии сообщили о сокращении времени оформления заказа на 25% после внедрения мобильных POS-систем с интеграцией с облаком. Эти системы позволили обновлять данные о товарных запасах в режиме реального времени, ускорить выставление счетов и улучшить качество обслуживания клиентов, одновременно сократив количество ошибок и операционные расходы.

• Облачные и мобильные POS-решения ускоряют цифровую трансформацию и повышают операционную эффективность, но их эффективность зависит от безопасного сетевого подключения, обучения пользователей и интеграции с существующими бизнес-системами. Поставщикам следует сосредоточиться на масштабируемых решениях и локализованных стратегиях развертывания, чтобы в полной мере воспользоваться растущим спросом.

Динамика рынка требований к системе точек продаж

Водитель

Растущее использование цифровых способов оплаты и многоканальной розничной торговли

• Рост цифровых платежей и внедрение многоканальной розничной торговли подталкивают компании к тому, чтобы отдавать приоритет передовым POS-системам как ключевому инструменту для обеспечения бесперебойного взаимодействия с клиентами. POS-системы теперь интегрируют платежные шлюзы, программы лояльности и управление запасами, способствуя эффективной работе и росту продаж.

• Торговые компании всё больше осознают эксплуатационные преимущества и потенциальную прибыль, которые предоставляют POS-системы, включая ускоренное оформление заказов, снижение человеческого фактора и аналитику продаж в режиме реального времени. Это понимание способствует внедрению этих систем в секторах розничной торговли, гостиничного бизнеса и здравоохранения, включая малый и средний бизнес.

• Государственные инициативы и нормативно-правовая база, стимулирующие безналичные платежи, способствуют их внедрению на рынке. Стимулирование цифровых платежей, субсидирование установки POS-терминалов для малого бизнеса и рост платформ электронной коммерции дополнительно стимулируют спрос.

• Например, в 2022 году Европейский союз запустил кампанию, поощряющую внедрение цифровых платежей в малых и средних розничных магазинах, что способствовало росту спроса на облачные и мобильные POS-системы в регионе.

• В то время как внедрение POS-систем стремительно растёт, предприятиям необходимо обеспечить бесперебойную интеграцию с другими корпоративными системами, обучение пользователей и меры кибербезопасности для максимальной эффективности и безопасной обработки транзакций.

Сдержанность/Вызов

Высокая стоимость современных POS-систем и сложность интеграции

• Высокая стоимость современного POS-оборудования и программного обеспечения, предоставляемого по подписке, делает их менее доступными для небольших компаний и стартапов. Эти системы часто предпочитают крупные розничные торговцы, в то время как малый бизнес сталкивается с финансовыми и техническими препятствиями при их внедрении.

• Во многих регионах наблюдается нехватка квалифицированного персонала, способного управлять и обслуживать сложные POS-системы. Недостаточная ИТ-поддержка и проблемы интеграции с существующими системами бухгалтерского учета и ERP-системами еще больше затрудняют внедрение.

• Проникновение на рынок также ограничено нестабильностью сетевого подключения и проблемами безопасности, особенно в отдалённых или сельских районах, где цифровая инфраструктура может быть недостаточно развита. Эти факторы часто заставляют компании полагаться на традиционные методы оплаты наличными, что снижает эффективность и качество анализа данных.

• Например, в 2023 году несколько небольших розничных торговцев в странах Африки к югу от Сахары сообщили о задержке внедрения POS-систем из-за высоких первоначальных инвестиционных затрат и отсутствия местной технической поддержки.

• Несмотря на продолжающееся развитие POS-технологий, решение проблем, связанных со стоимостью, интеграцией и обучением персонала, имеет первостепенное значение. Участникам рынка следует сосредоточиться на доступных, удобных и масштабируемых решениях для расширения внедрения и стимулирования долгосрочного роста.

Требования к системе точек продаж. Область применения.

Рынок сегментирован по принципу применения, способа развертывания, размера организации и конечного пользователя.

- По применению

В зависимости от сферы применения рынок POS-систем сегментируется на стационарные и мобильные POS-терминалы. Сегмент стационарных POS-терминалов занял наибольшую долю рынка в 2024 году благодаря широкому внедрению в розничных магазинах, супермаркетах и крупных ресторанах. Эти системы отличаются стабильностью, надёжной функциональностью и бесшовной интеграцией с платёжными шлюзами, системами управления запасами и бухгалтерским программным обеспечением, что делает их популярными среди компаний с устойчивым развитием.

Ожидается, что сегмент мобильных POS-терминалов будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на гибкие решения для мобильных платежей в малых и средних предприятиях (МСП) и временных магазинах. Мобильные POS-системы пользуются всё большей популярностью благодаря своей портативности, возможности бесконтактной оплаты и способности оптимизировать операции в удалённых или временных условиях.

- По режиму развертывания

По способу развертывания рынок сегментируется на локальные и облачные решения. В 2024 году локальный сегмент занимал наибольшую долю рынка по выручке, пользуясь спросом у организаций, которым необходим безопасный и контролируемый доступ к данным о транзакциях. Эти системы обеспечивают высокую степень кастомизации, конфиденциальность данных и надежность для корпоративных операций.

Ожидается, что облачный сегмент будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год благодаря более широкому внедрению SaaS-решений, аналитики в реальном времени и возможностей удалённого управления. Облачные POS-системы привлекательны благодаря масштабируемости, низким первоначальным затратам и простоте интеграции с мобильными устройствами и платформами электронной коммерции.

- По размеру организации

В зависимости от размера организации рынок сегментируется на крупные предприятия и малые и средние предприятия (МСП). Сегмент крупных предприятий обеспечил наибольшую долю рынка в 2024 году благодаря внедрению современных POS-систем, способных обрабатывать большие объемы транзакций, управлению несколькими магазинами и сложным инструментам отчетности.

Ожидается, что сегмент МСП продемонстрирует самые высокие темпы роста в период с 2025 по 2032 год, чему будет способствовать растущая осведомленность о экономичных POS-решениях, которые упрощают операции, сокращают количество ошибок и поддерживают рост бизнеса за счет возможностей мобильного и облачного развертывания.

- Конечным пользователем

По типу конечного потребителя рынок сегментируется на рестораны, гостиничный бизнес, здравоохранение, розничную торговлю, складские услуги, развлечения и другие. Розничный сегмент занимал наибольшую долю рынка в 2024 году, что обусловлено растущей потребностью в эффективных кассовых операциях, отслеживании запасов и интеграции с программами лояльности.

Ожидается, что в сегменте общественного питания будут наблюдаться самые быстрые темпы роста в период с 2025 по 2032 год благодаря растущему внедрению мобильных POS-терминалов, систем заказа блюд у столика и облачных решений для управления, которые улучшают качество обслуживания клиентов и повышают эффективность работы.

Анализ регионального рынка требований к системе точек продаж

• Северная Америка доминировала на рынке требований к POS-системам с наибольшей долей выручки в 38,5% в 2024 году, что было обусловлено широким внедрением цифровых платежных решений, ускоренной модернизацией розничной торговли и ростом осведомленности о передовых POS-технологиях.

• Предприятия региона высоко ценят удобство, обработку транзакций в режиме реального времени и возможности интеграции, предлагаемые современными POS-системами с другим программным обеспечением для управления предприятием, включая инструменты управления запасами и взаимоотношениями с клиентами.

• Такому широкому внедрению также способствуют высокая технологическая готовность, большое количество розничных сетей и растущий спрос на многоканальные платежные решения, что превращает POS-системы в важнейший инструмент для эффективных бизнес-операций.

Обзор рынка требований к системам точек продаж в США

Рынок POS-систем США в 2024 году занял наибольшую долю выручки в Северной Америке благодаря быстрому переходу на безналичные платежи и интеграции мобильных и облачных POS-решений. Компании всё больше ценят удобство оплаты, ускорение процесса оплаты и безопасную обработку транзакций. Растущее внедрение бесконтактных и мобильных POS-устройств в сочетании с их активным внедрением в ресторанах, розничных магазинах и медицинских учреждениях дополнительно стимулирует расширение рынка. Более того, растущее использование аналитики и POS-систем на базе искусственного интеллекта повышает операционную эффективность и улучшает понимание потребностей клиентов.

Обзор рынка требований к системам точек продаж в Европе

Ожидается, что рынок POS-систем в Европе будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено, главным образом, соблюдением нормативных требований, повышением автоматизации розничной торговли и спросом на бесконтактные платежные решения. Урбанизация в сочетании с ростом электронной коммерции и многоканальной розничной торговли способствует внедрению современных POS-систем. Европейские компании привлекают удобство, эффективность и принятие решений на основе данных, которые предлагают интегрированные POS-платформы. В регионе наблюдается значительное внедрение POS-систем в ресторанном, гостиничном и розничном секторах, при этом как новые заведения, так и существующие компании модернизируют свою POS-инфраструктуру.

Обзор рынка требований к системам точек продаж в Великобритании

Ожидается, что рынок POS-систем Великобритании будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на прием цифровых платежей, эффективное управление транзакциями и повышение качества обслуживания клиентов. Кроме того, расширение сетей розничной торговли и гостиничного бизнеса, а также государственные инициативы по продвижению безналичных платежей, стимулируют компании к внедрению современных POS-систем. Развитая цифровая инфраструктура страны и развитая экосистема электронной коммерции продолжают стимулировать рост рынка во многих отраслях.

Обзор рынка требований к системе точек продаж в Германии

Ожидается, что рынок POS-систем в Германии будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будут способствовать рост осведомлённости о цифровых платежах, соблюдение налогового законодательства и спрос на технологически передовые и безопасные платёжные решения. Развитые секторы розничной торговли и услуг в Германии, а также акцент на операционной эффективности и инновациях, способствуют внедрению POS-систем в ресторанах, торговых точках и медицинских учреждениях. Облачные и интегрированные POS-решения набирают популярность благодаря оптимизации операций, предоставлению отчётности в режиме реального времени и повышению удовлетворенности клиентов.

Обзор рынка требований к системам точек продаж в Азиатско-Тихоокеанском регионе

Ожидается, что рынок POS-систем Азиатско-Тихоокеанского региона будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено быстрой урбанизацией, ростом проникновения смартфонов и растущим внедрением цифровых платежей в таких странах, как Китай, Индия и Япония. Растущая популярность безналичных платежей в регионе, поддерживаемая государственными инициативами и финтех-инновациями, стимулирует внедрение POS-терминалов в розничной торговле, гостиничном бизнесе и индустрии развлечений. Кроме того, по мере того, как Азиатско-Тихоокеанский регион становится центром производства программного и аппаратного обеспечения для POS-терминалов, доступность и доступность этих систем становятся доступнее для более широкого круга потребителей и предприятий.

Обзор рынка требований к системе точек продаж в Японии

Ожидается, что рынок POS-систем в Японии будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год благодаря передовой технологической инфраструктуре страны, растущей модернизации розничной торговли и акценту на улучшении качества обслуживания клиентов. Японские компании всё чаще внедряют облачные и мобильные POS-решения для ускорения транзакций, отслеживания запасов и принятия решений на основе аналитики. Интеграция POS-систем с цифровыми кошельками, бесконтактными платежами и программным обеспечением для управления предприятием дополнительно стимулирует рост. Ожидается, что старение населения Японии и растущая потребность в эффективных и простых в использовании платёжных решениях будут поддерживать спрос как в коммерческом, так и в розничном секторах.

Обзор рынка требований к системе точек продаж в Китае

В 2024 году китайский рынок POS-систем обеспечил наибольшую долю выручки в Азиатско-Тихоокеанском регионе благодаря бурно развивающемуся сектору электронной коммерции, расширению розничных сетей и растущему интересу потребителей к безналичным платежам. POS-системы становятся неотъемлемой частью ресторанов, розничных магазинов, медицинских учреждений и развлекательных заведений. Государственная поддержка инфраструктуры цифровых платежей в сочетании с доступностью экономически эффективных POS-решений и сильными отечественными поставщиками технологий значительно стимулирует рост рынка в городских и пригородных регионах.

Требования к системе точек продаж Доля рынка

Лидерами отрасли системных требований к точкам продаж являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- Square, Inc. (США)

- Toast, Inc. (США)

- Shopify Inc. (Канада)

- Lightspeed (Канада)

- Группа Ingenico (Франция)

- Verifone (США)

- Корпорация Toshiba (Япония)

- PAX Technology (Китай)

- Корпорация NCR (США)

- Clover Network, Inc. (США)

- Fujitsu Limited (Япония)

- Panasonic Corporation (Япония)

- Корпорация Oracle (США)

- Diebold Nixdorf (США)

- ShopKeep (США)

- Vend Limited (Новая Зеландия)

- Revel Systems (США)

- Heartland Payment Systems (США)

- TouchBistro (Канада)

- Paytm (Индия)

Последние разработки на мировом рынке требований к системам точек продаж

- В октябре 2023 года компания Ingenico Group, ведущий поставщик платёжных решений, запустила новую систему для точек продаж (POS) с интегрированной обработкой платежей. Эта новая система разработана для оптимизации процесса оплаты для предприятий и упрощения процесса оплаты для клиентов. Система включает в себя ряд функций, таких как сенсорный экран, встроенный платёжный терминал и поддержка различных способов оплаты. Она также совместима с различными программными обеспечениями для управления бизнесом, что позволяет компаниям легко интегрировать её в свои существующие системы.

- В сентябре 2023 года компания Verifone, мировой лидер в области платёжных решений, представила новую бесконтактную POS-систему, специально разработанную для малого бизнеса. Эта новая система разработана для того, чтобы упростить для малого бизнеса приём бесконтактных платежей, которые становятся всё более популярными среди потребителей. Система включает в себя множество функций, таких как сенсорный экран, встроенный считыватель бесконтактных платежей и поддержка различных способов оплаты. Она также проста в настройке и использовании, что делает её идеальным решением для малого бизнеса с ограниченным ИТ-ресурсом.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.