Global Plant Based Protein Market

Размер рынка в млрд долларов США

CAGR :

%

USD

13.02 Billion

USD

21.39 Billion

2024

2032

USD

13.02 Billion

USD

21.39 Billion

2024

2032

| 2025 –2032 | |

| USD 13.02 Billion | |

| USD 21.39 Billion | |

|

|

|

|

Сегментация мирового рынка растительного белка по источнику (соевый белок, пшеничный белокгороховый белокбелок канолы , картофельный белок, рисовый белок, кукурузный белок, овсяный белок, белок семян льна, конопляный белок, белок киноа, белок чиа и другие), концентрации белка (концентрат, изолят и гидролизат), уровню гидролизации (целый, слабогидролизованный и сильногидролизованный), природе (органический и обычный), форме (сухой и жидкий), функции (растворимость, гелеобразование, эмульгирование, связывание воды, пенообразование и другие), конечному потребителю (пищевые продукты, хлебобулочные изделия, готовые к употреблению, закуски и злаки, молочные продукты, кондитерские изделия и десерты, полуфабрикаты, напитки, корма для животных и другие) — тенденции отрасли и прогноз до 2032 года

Каковы размер и темпы роста мирового рынка растительного белка?

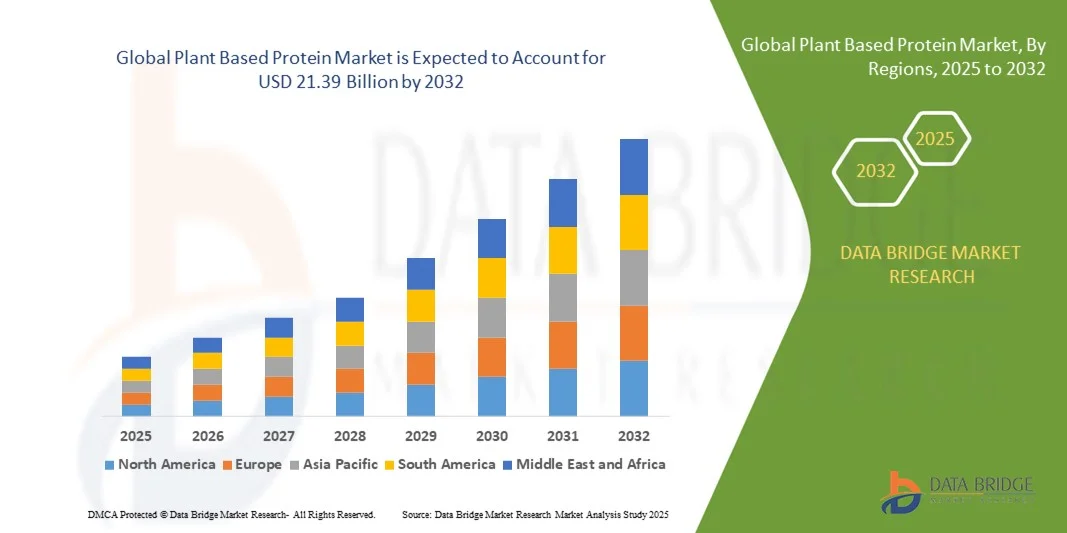

- Объем мирового рынка растительного белка в 2024 году оценивался в 13,02 млрд долларов США , а к 2032 году, как ожидается , он достигнет 21,39 млрд долларов США при среднегодовом темпе роста 6,40% в прогнозируемый период.

- Потребители всё чаще переходят на растительную диету, поскольку считают её полезной для здоровья, включая снижение риска хронических заболеваний, контроль веса и улучшение самочувствия. Эта тенденция обусловлена стремлением к более чистым и экологичным продуктам питания, что способствует росту спроса на продукты на основе растительного белка.

Каковы основные выводы рынка растительного белка?

- Обеспокоенные изменением климата и воздействием традиционного животноводства на окружающую среду, потребители ищут устойчивые альтернативы.

- Растительные белки, полученные из культур с низким воздействием на окружающую среду, рассматриваются как более экологичный вариант, привлекающий потребителей, стремящихся согласовать свой рацион питания с целями охраны окружающей среды. Этот спрос, обусловленный принципами устойчивого развития, стимулирует инновации и инвестиции в индустрию производства растительных белков.

- Северная Америка доминировала на рынке растительного белка с наибольшей долей выручки в 41,69% в 2024 году, что обусловлено растущим переходом потребителей к растительному рациону питания, здоровому образу жизни и растущей доступностью альтернатив мясу и молочным продуктам.

- Рынок растительного белка в Азиатско-Тихоокеанском регионе, как ожидается, будет расти самыми быстрыми темпами в год на уровне 10,69% в период с 2025 по 2032 год, что обусловлено ростом располагаемых доходов, быстрой урбанизацией и растущей осведомленностью о здоровье и устойчивом развитии.

- Сегмент соевого белка доминировал на рынке с наибольшей долей выручки в 39,4% в 2024 году, что объясняется его высокой концентрацией белка, экономической эффективностью и универсальностью применения в напитках, хлебобулочных изделиях, заменителях мяса и молочных продуктах.

Объем отчета и сегментация рынка растительного белка

|

Атрибуты |

Ключевые данные о рынке растительного белка |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Какова основная тенденция на рынке растительного белка?

Инновации в текстуре и вкусе благодаря передовым технологиям обработки

- Значимой и набирающей обороты тенденцией на мировом рынке растительного белка является использование передовых технологий обработки пищевых продуктов, таких как экструзия, ферментация и ферментативная обработка, для улучшения текстуры, вкуса и пищевой ценности. Эти инновации направлены на максимальное приближение к сенсорным ощущениям, получаемым при употреблении животного белка.

- Например, компании Nestlé SA и Impossible Foods Inc. активно инвестируют в экструзию с высокой влажностью и прецизионную ферментацию для улучшения вкусовых ощущений и сочности растительных заменителей мяса. Такие технологии помогают устранить бобовый привкус и улучшить усвояемость белка.

- Использование искусственного интеллекта (ИИ) и аналитики данных также революционизирует разработку продуктов, позволяя предсказывать взаимодействие ингредиентов и оптимизировать рецептуры для повышения удовлетворенности потребителей. Givaudan и Tate & Lyle используют сенсорное картирование на основе ИИ для ускорения циклов инноваций.

- Кроме того, белки, полученные методом ферментации из грибов, водорослей и бактерий, становятся устойчивыми и высокофункциональными альтернативами. Эти белки могут улучшить аминокислотный профиль и однородность текстуры в таких областях применения, как производство заменителей молочных продуктов и протеиновых напитков.

- Эта тенденция к технологически улучшенным растительным белкам меняет ожидания потребителей, сокращая сенсорный разрыв между продуктами растительного и животного происхождения, способствуя более широкому признанию на основных рынках.

Каковы основные движущие силы рынка растительного белка?

- Растущий интерес потребителей к устойчивому и здоровому питанию в сочетании с опасениями по поводу благополучия животных и воздействия на окружающую среду является ключевым фактором развития рынка растительного белка.

- Например, в марте 2024 года компания Danone SA объявила о расширении своей линейки продуктов на растительной основе в Европе, сосредоточившись на напитках на основе соевого, овсяного и горохового белка, чтобы удовлетворить растущий потребительский спрос на экологически чистое питание.

- Рост числа случаев непереносимости лактозы и проблем со здоровьем, связанных с употреблением мяса, подталкивает потребителей к выбору растительных альтернатив, которые не содержат холестерина и богаты клетчаткой и антиоксидантами.

- Государственные инициативы, продвигающие рацион питания, ориентированный на растительное сырье, и инвестиции в устойчивое сельское хозяйство, дополнительно способствуют росту рынка. Такие программы, как План ЕС по белку, направлены на снижение зависимости от импорта кормового белка животного происхождения и стимулирование местного производства растительного белка.

- Более того, возросшая доступность готовых к употреблению продуктов на растительной основе, инновации в области упаковки и сроков хранения, а также партнерские отношения между стартапами в сфере пищевых технологий и традиционными производителями мяса расширяют проникновение на рынок в секторах розничной торговли и общественного питания.

Какой фактор препятствует росту рынка растительного белка?

- Одной из основных проблем, препятствующих росту рынка, является высокая стоимость производства, связанная с передовыми технологиями переработки и использованием высококачественных ингредиентов, что повышает цены на продукцию по сравнению с традиционными белками животного происхождения.

- Например, компании Beyond Meat, Inc. и Impossible Foods Inc. подверглись критике за относительно высокие розничные цены, которые ограничивают доступность продукции на чувствительных к цене рынках, несмотря на высокий спрос.

- Кроме того, сенсорные ограничения, такие как непостоянная текстура, посторонние привкусы или отсутствие сочности в некоторых рецептах, продолжают влиять на повторные покупки, особенно среди потребителей, придерживающихся принципа флекситарианства и ищущих аутентичные мясные впечатления.

- Ограничения в цепочке поставок и колебания цен на сырье, такое как изоляты горохового и соевого белка, также создают препятствия для стабильного производства и ценообразования.

- Решение этих задач посредством оптимизации затрат, диверсификации ингредиентов и технологических инноваций будет иметь решающее значение для обеспечения масштабируемости и доступности. Ожидается, что постоянные инвестиции в ферментацию, разработку рецептур с использованием ИИ и устойчивое снабжение станут движущей силой следующей волны роста мирового рынка растительного белка.

Как сегментирован рынок растительного белка?

Рынок сегментирован по признакам источника, концентрации белка, уровня гидролизации, формы, природы, функции и конечного потребителя.

- По источнику

По источнику происхождения рынок растительного белка сегментируется на соевый белок, пшеничный белок, гороховый белок, белок канолы, картофельный белок, рисовый белок, кукурузный белок, овсяный белок, белок льняного семени, белок конопли, белок киноа, белок чиа и другие. Сегмент соевого белка доминировал на рынке, обеспечив наибольшую долю выручки в 39,4% в 2024 году. Это объясняется высокой концентрацией белка, экономической эффективностью и универсальностью применения в напитках, хлебобулочных изделиях, заменителях мяса и молочных продуктах. Полный аминокислотный профиль и отлаженная технология переработки делают его предпочтительным выбором для производителей.

Ожидается, что сегмент горохового белка будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом потребителей на источники белка без аллергенов и ГМО. Превосходные эмульгирующие и текстурирующие свойства горохового белка в сочетании с преимуществами устойчивого развития расширяют его применение в производстве аналогов мяса и пищевых продуктов по всему миру.

- По концентрации белка

По концентрации белка рынок сегментируется на концентрат, изолят и гидролизат. Сегмент изолятов белка доминировал на рынке, обеспечив наибольшую долю выручки в 45,7% в 2024 году благодаря высокой степени чистоты (до 90% белка), нейтральному вкусу и превосходной усвояемости. Изоляты широко используются в спортивном питании, напитках и высокобелковых функциональных продуктах. Минимальное содержание жиров и углеводов делает их идеальными для потребителей, заботящихся о своем здоровье.

Ожидается, что сегмент гидролизатов будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, что обусловлено расширением их применения в детском питании, лечебном питании и спортивных восстановительных добавках. Гидролизаты обладают быстрой усвояемостью, повышенной растворимостью и улучшенной биодоступностью, что делает их подходящими для специализированного питания и послетренировочных составов.

- По уровню гидролиза

По степени гидролизации рынок сегментируется на интактные, слабогидролизованные и сильногидролизованные белки. Сегмент интактных белков занимал наибольшую долю рынка – 41,2% в 2024 году. Он сохраняет естественную структуру и питательные свойства белка, что делает его пригодным для использования в пищевых продуктах общего назначения, таких как выпечка, молочные продукты и снеки. Интактные белки пользуются популярностью благодаря своему нейтральному вкусу и функциональной универсальности.

Ожидается, что сегмент слабогидролизованных продуктов будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на легкоусвояемые и гипоаллергенные составы. Слабый гидролиз повышает растворимость, не влияя существенно на вкус или структуру, что делает его идеальным для приготовления питательных напитков и детских смесей.

- По природе

По принципу происхождения рынок сегментирован на органические и традиционные. Сегмент традиционных белков доминировал на рынке растительного белка, обеспечив наибольшую долю выручки в 68,5% в 2024 году благодаря своей доступности, широкой доступности и налаженным цепочкам поставок. Традиционные растительные белки продолжают доминировать в продуктах массового потребления, включая выпечку, закуски и напитки.

Однако, согласно прогнозам, сегмент органических продуктов будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, поскольку потребители всё больше требуют источников белка с «чистой этикеткой» и без использования химикатов. Рост числа органических сертификаций и внедрение устойчивых методов ведения сельского хозяйства сделали органические растительные белки более доступными, привлекая потребителей по всему миру, заботящихся о своём здоровье и окружающей среде.

- По форме

По форме рынок сегментирован на сухие и жидкие продукты. Сухие продукты доминировали на рынке с долей выручки 72,8% в 2024 году благодаря более длительному сроку годности, стабильности и удобству транспортировки и хранения. Сухие порошки широко используются в протеиновых коктейлях, смесях для выпечки и питательных батончиках благодаря своей совместимости и способности к восстановлению.

Ожидается, что сегмент жидких продуктов будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, что обусловлено ростом потребления готовых к употреблению напитков и растительных заменителей молочных продуктов. Удобство прямого приготовления без регидратации и растущая популярность питания на ходу являются основными факторами, способствующими расширению сегмента.

- По функции

По функциональному признаку рынок сегментируется на следующие категории: растворимость, гелеобразование, эмульгирование, связывание воды, пенообразование и другие. Сегмент эмульгирования доминировал на рынке растительного белка с долей выручки 34,6% в 2024 году, поскольку растительные белки широко используются в качестве натуральных эмульгаторов в мясных аналогах, заправках и начинках для выпечки. Их способность стабилизировать жиро-водные смеси улучшает текстуру и консистенцию продукта.

Ожидается, что сегмент растворимости будет расти самыми быстрыми темпами в период с 2025 по 2032 год, чему будет способствовать рост спроса на напитки и функциональные напитки, обогащенные белком. Улучшенная растворимость улучшает вкусовые ощущения, смешиваемость и усвояемость, что делает её критически важным параметром эффективности современных белковых рецептур.

- Конечным пользователем

По типу конечного потребителя рынок сегментирован на продукты питания, хлебобулочные изделия, готовые к употреблению продукты, снеки и хлопья, молочные продукты, кондитерские изделия и десерты, полуфабрикаты, напитки, корма для животных и другие. Сегмент продуктов питания доминировал на рынке с долей 29,8% в 2024 году благодаря росту потребления протеиновых добавок, коктейлей и батончиков среди любителей фитнеса и потребителей, заботящихся о своем здоровье. Растительные белки приобретают все большую популярность благодаря своей усвояемости и меньшему воздействию на окружающую среду по сравнению с аналогами животного происхождения.

Прогнозируется, что сегмент напитков будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, чему будут способствовать инновации в производстве растительного молока, протеиновых вод и смузи. Растущий спрос на веганские и безлактозные напитки как на развитых, так и на развивающихся рынках стимулирует диверсификацию и расширение ассортимента продукции в этом сегменте.

Какой регион занимает наибольшую долю рынка растительного белка?

- Северная Америка доминировала на рынке растительного белка с наибольшей долей выручки в 41,69% в 2024 году, что обусловлено растущим переходом потребителей к растительному рациону питания, здоровому образу жизни и растущей доступностью альтернатив мясу и молочным продуктам.

- Потребители в регионе все больше ценят экологичность, благополучие животных и питательную ценность, что стимулирует спрос на белковые продукты на основе сои, гороха и овса в пищевой промышленности, производстве напитков и пищевых добавок.

- Присутствие ведущих компаний, таких как Cargill, ADM и Ingredion Incorporated, а также надежная розничная инфраструктура и инновации в области формул продуктов на растительной основе продолжают укреплять региональное доминирование.

Обзор рынка растительного белка в США

Рынок растительных белков США занял наибольшую долю выручки в Северной Америке в 2024 году – 81%. Это обусловлено широким распространением веганской и флекситарианской диет, а также быстрым расширением брендов растительных продуктов питания в супермаркетах и ресторанах быстрого обслуживания. Рынок США выигрывает от растущей осведомлённости о влиянии на климат и здоровье, побуждая потребителей заменять животные белки растительными альтернативами. Крупные игроки, такие как Beyond Meat, Impossible Foods и ADM, продолжают инвестировать в исследования и крупномасштабное производство для улучшения вкуса, текстуры и доступности. Кроме того, растущий спрос на готовые к употреблению растительные блюда и протеиновые напитки способствует расширению рынка в розничных сетях и сфере общественного питания.

Обзор европейского рынка растительного белка

Европейский рынок растительного белка, по прогнозам, будет расти значительными среднегодовыми темпами в течение всего прогнозируемого периода, чему способствуют строгие экологические нормы, переход на веганский образ жизни и правительственные инициативы, направленные на продвижение экологически чистых источников белка. Европейские потребители всё больше осознают углеродный след, связанный с животноводством, что способствует переходу на растительное питание. В таких странах, как Германия, Великобритания и Франция, наблюдается активный рост производства молочных продуктов, хлебобулочных изделий и снеков на растительной основе. Присутствие крупных производителей пищевых продуктов, таких как Roquette Frères и DSM, дополнительно способствует проникновению на рынок в регионе.

Обзор рынка растительного белка в Великобритании

Ожидается, что рынок растительного белка в Великобритании будет расти высокими среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать растущая популярность флекситарианства и веганства, а также расширение ассортимента растительных продуктов в розничной торговле и сфере общественного питания. Рост числа потребителей, заботящихся о своем здоровье и ищущих продукты без холестерина, богатые белком, стимулирует инновации в области заменителей мяса, протеиновых напитков и выпечки. Государственные кампании в поддержку выбора экологически чистых продуктов питания и растущее число ресторанов, предлагающих растительную пищу, по всей Великобритании ускоряют рост спроса на рынке.

Обзор рынка растительного белка в Германии

Ожидается, что рынок растительных белков в Германии будет устойчиво расти в течение прогнозируемого периода благодаря растущей осведомлённости об устойчивом производстве продуктов питания, защите окружающей среды и высоком питательном качестве. Немецкие потребители находятся в авангарде движения за растительные продукты в Европе, отдавая предпочтение продуктам из соевого, горохового и овсяного белка. Развитая инфраструктура пищевой промышленности в стране и акцент на исследования и инновации в области функциональных ингредиентов способствуют расширению ассортимента растительных продуктов в супермаркетах и онлайн-магазинах.

Какой регион является самым быстрорастущим на рынке растительного белка?

Рынок растительного белка в Азиатско-Тихоокеанском регионе, как ожидается, будет расти самыми быстрыми темпами среднегодового темпа роста в 10,69% в период с 2025 по 2032 год, что обусловлено ростом располагаемых доходов, быстрой урбанизацией и растущей осведомлённостью о здоровье и устойчивом развитии. В таких странах, как Китай, Япония и Индия, наблюдается растущее предпочтение альтернатив мясу в связи с изменением пищевых привычек и государственной поддержкой инноваций в области растительного белка. Расширение производственной базы региона и доступное сырье, такое как соевый и рисовый белок, делают его мировым центром производства и экспорта растительной продукции.

Обзор рынка растительного белка в Японии

Рынок растительного белка в Японии стремительно растёт, чему способствуют технологические инновации, старение населения и акцент на функциональном питании. Японские потребители всё чаще используют растительный белок в традиционных продуктах питания и современных напитках, стремясь найти более здоровую и экологичную альтернативу. Рост числа гибридных пищевых инноваций, сочетающих растительные и ферментированные источники белка, дополнительно способствует разнообразию продукции. Ожидается, что растущее сотрудничество между местными стартапами в сфере пищевых технологий и международными производителями ускорит внедрение этой технологии как в розничной торговле, так и в сфере общественного питания.

Обзор рынка растительного белка в Китае

В 2024 году китайский рынок растительного белка обеспечил наибольшую долю выручки в Азиатско-Тихоокеанском регионе, чему способствовали рост среднего класса, повышение уровня осведомленности о здоровом образе жизни и расширение производственных мощностей в сфере производства растительных белков. Китай является одним из крупнейших потребителей соевых продуктов, и в последние годы наблюдается резкий рост производства белковых смесей на основе гороха, овса и риса. Поддержка правительством низкоуглеродных диет и популярность отечественных альтернатив мясу являются ключевыми факторами роста. Увеличение инвестиций международных компаний в местные производственные мощности продолжает укреплять позиции Китая как важнейшего центра мировой индустрии растительного белка.

Какие компании являются ведущими на рынке растительного белка?

Лидерами отрасли по производству растительного белка являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- DSM (Нидерланды)

- СОТЕКСПРО (Франция)

- Batory Foods (США)

- Glanbia plc (Ирландия)

- AGT Food and Ingredients (Канада)

- Axiom Foods, Inc. (США)

- Яньтай Шуанта Фуд Ко. Лтд. (Китай)

- АДМ (США)

- Wilmar International Ltd. (Сингапур)

- COSCURA (Австрия)

- Общество с ограниченной ответственностью «Эмсланд-Штерке» (Германия)

- Cargill, Incorporated (США)

- DuPont (США)

- Ingredion Incorporated (США)

- Roquette Frères (Франция)

- ETChem (Тайвань)

- Green Labs LLC (США)

- Шаньдунская группа Цзяньюань (Китай)

Каковы последние тенденции на мировом рынке растительного белка?

- В июле 2023 года компании Burcon NutraScience Corporation и HPS Food and Ingredients Inc. отметили важную веху, выпустив первый высокоочищенный растворимый изолят белка из семян конопли, что внесло вклад в развитие производства растительного белка.

- В декабре 2022 года компания Royal DSM представила текстурированный горохово-каноловый белок Vertis — продукт без молочных продуктов, глютена и сои с оптимальным аминокислотным составом, представляющий собой уникальный текстурированный растительный белок с комплексными питательными свойствами.

- В апреле 2022 года компания Cargill расширила поставки горохового белка Radipure на Ближний Восток, в Турцию, Африку и Индию, отвечая на растущий спрос на гороховый белок как предпочтительный альтернативный источник белка в этих регионах.

- В марте 2022 года компания Mighty Foods разработала продукты на основе растительного белка для индийского рынка, предложив разнообразный ассортимент простых в приготовлении блюд, таких как жареная рыба, кебаб сикх и кебаб галаути, чтобы удовлетворить особые диетические предпочтения индийских потребителей.

- В июле 2021 года компания ADM приобрела компанию Sojaprotein (Сербия), что расширило ее возможности по производству растительного белка и стратегически позиционировало ее для удовлетворения растущего мирового спроса на растительные белки.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.