Global Para Aramid Fibers Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.06 Billion

USD

5.30 Billion

2021

2029

USD

3.06 Billion

USD

5.30 Billion

2021

2029

| 2022 –2029 | |

| USD 3.06 Billion | |

| USD 5.30 Billion | |

|

|

|

|

Глобальный рынок параарамидных волокон, по форме продукции филаментная пряжа, короткие волокна, целлюлоза и другие), применению (фрикционные материалы, защита, электроизоляция, защитная одежда, армирование резины, армирование шин, промышленная фильтрация, оптические волокна и другие), конечным пользователям (автомобилестроение, аэрокосмическая и оборонная промышленность, электроника и телекоммуникации, электротехника и другие) — отраслевые тенденции и прогноз до 2029 года.

Анализ и размер рынка параарамидных волокон

Значение параарамидных волокон растет с каждым днем из-за их свойств, таких как прочность, легкость и термостойкость по сравнению с другими волокнами. «Нитевая пряжа» является самым быстрорастущим сегментом стимула рынка из-за растущего спроса на производство защитной одежды в армии и обороне в течение прогнозируемого периода.

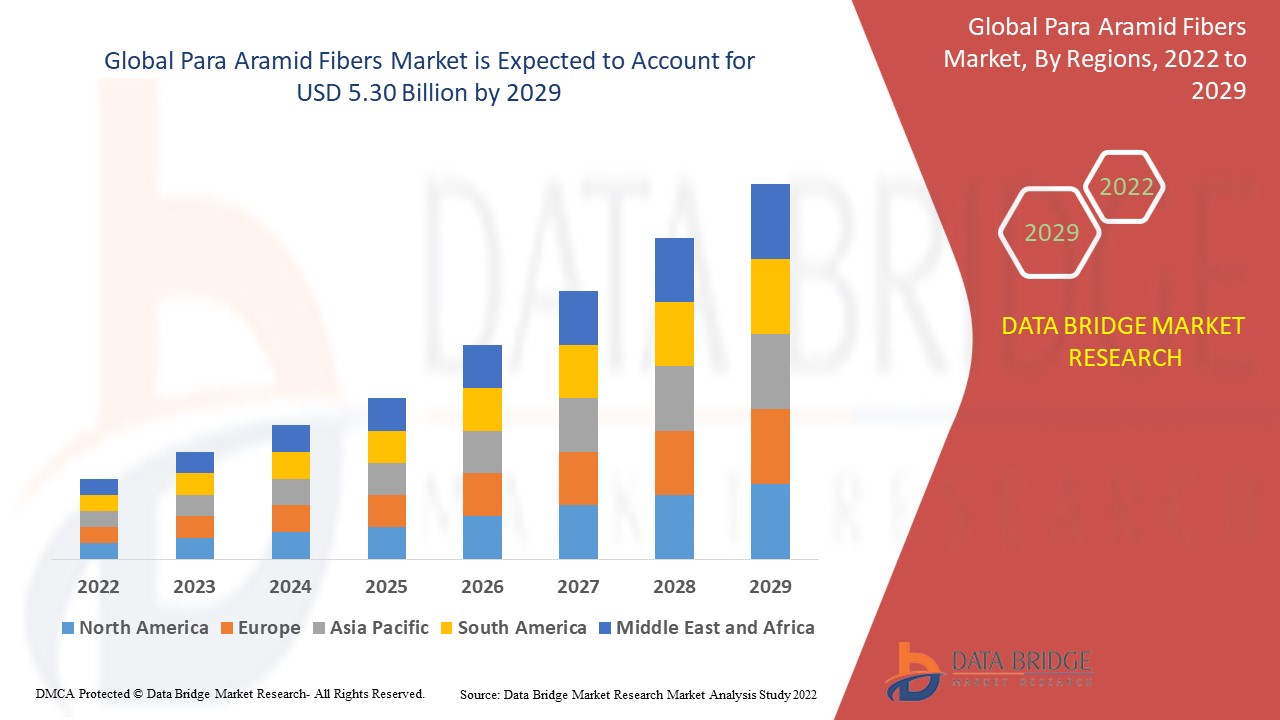

Data Bridge Market Research анализирует, что рынок параарамидных волокон, как ожидается, будет испытывать CAGR в 7,10% в течение прогнозируемого периода. Это означает, что рыночная стоимость, которая составляла 3,06 млрд долларов США в 2021 году, взлетит до 5,30 млрд долларов США к 2029 году. Помимо понимания рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, курируемые Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленное производство и мощности компаний, сетевые схемы дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

Масштаб и сегментация рынка параарамидных волокон

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2014 - 2019) |

|

Количественные единицы |

Выручка в млрд долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Форма продукта ( филаментная пряжа, короткие волокна, целлюлоза и др.), Применение (фрикционные материалы, защита, электроизоляция, защитная одежда, армирование резины, армирование шин, промышленная фильтрация, оптические волокна и др.), Конечный пользователь (автомобилестроение, аэрокосмическая и оборонная промышленность, электроника и телекоммуникации, электротехника и др.) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки |

|

Охваченные участники рынка |

Toray Industries Inc., (Япония), Dow and Dupont (США), Teijin limited (Япония), SOLVAY (Бельгия), Yantai Tayho Advanced Materials Co Ltd. (Китай), Hyosung (Южная Корея), Kolon Industries Inc. (Южная Корея), Huvis Corp, (Южная Корея), Kermel (Франция), China National Bluestar (Group) Co., Ltd. (Китай), X-FIPER NEW MATERIAL CO.,LTD (Китай), Fibrex (США), Aramid Hpm, LLC (США) |

|

Возможности рынка |

|

Определение рынка

Параарамид — это синтетическое волокно , используемое для производства защитных перчаток и других защитных изделий и оборудования. Перчатки из параарамида устойчивы к истиранию, но основная цель использования волокна — его высокая термостойкость. Кроме того, параарамид гораздо более устойчив к механическим воздействиям, чем другие материалы.

Динамика мирового рынка параарамидных волокон

Драйверы

- Высокое использование легких и экономичных материалов

Строгие правила по сокращению выбросов углерода заставляют многих участников рынка выбирать замещающие материалы, которые являются экономичными, легкими и прочными. Таким образом, многочисленные отрасли заменяют традиционные материалы, такие как алюминий и сталь, на современные материалы, такие как параарамидные волокна, для снижения веса и снижения потребления энергии. Параарамидные волокна также используются в нескольких приложениях в качестве альтернативы стали, поскольку они помогают снизить общий вес продукции и обеспечивают более длительный срок службы. Ожидается, что растущий спрос на легкие и экономичные материалы будет стимулировать рост рынка.

- Высокая степень использования параарамидных волокон из-за их многочисленных свойств

Параарамидные волокна пользуются большим спросом из-за их многочисленных характеристик, таких как прочность на разрыв, легкость, удобство и многофункциональность по сравнению с другими обычными волокнами. Это один из основных факторов, способствующих росту рынка параарамидных волокон в прогнозируемый период 2022-2029 гг.

- Растущий спрос на параарамидные волокна в автомобильной промышленности

Параарамидные волокна легче и прочнее других заменителей или других материалов. Они обычно легче по весу и прочнее стали. Автомобильный сектор фокусируется на производстве более легких автомобилей, что создает спрос на более легкие материалы. Производителям автомобилей необходимо снизить средний расход топлива транспортных средств, и эта цель может быть достигнута за счет использования легких материалов, таких как параарамидные волокна. Ожидается, что растущий спрос на легкие материалы будет стимулировать темпы роста рынка параарамидных волокон.

Возможности

- Растущий спрос на параарамидные волокна в военном и оборонном секторе

Значительные государственные расходы на оборону и военную промышленность будут поддерживать рост рынка параарамидных волокон. Рост оборонного бюджета позволяет правительствам многих стран инвестировать в легкое и передовое защитное снаряжение для вооруженных сил. Параарамидные волокна используются в военных и аэрокосмических приложениях, включая морские канаты и арматуру корпуса, бронежилетную ткань с баллистической защитой и баллистические композиты, а также в качестве замены асбеста. Таким образом, значительные государственные расходы на оборону и военную промышленность будут поддерживать рост рынка арамидных волокон и создавать огромные возможности для рынка

Ограничения/Проблемы

- Высокая стоимость, связанная с параарамидными волокнами

Высокая себестоимость производства и первоначальные инвестиции в сочетании с колебаниями цен на сырье будут сдерживать рынок и еще больше затруднять рост рынка параарамидных волокон в прогнозируемый период 2022–2029 гг.

В этом отчете о рынке параарамидных волокон содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке параарамидных волокон, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние и текущий рыночный сценарий нехватки сырья и задержек поставок

Data Bridge Market Research предлагает высокоуровневый анализ рынка и предоставляет информацию, учитывая влияние и текущую рыночную среду нехватки сырья и задержек поставок. Это приводит к оценке стратегических возможностей, созданию эффективных планов действий и оказанию помощи предприятиям в принятии важных решений.

Помимо стандартного отчета, мы также предлагаем углубленный анализ уровня закупок на основе прогнозируемых задержек поставок, картирования дистрибьюторов по регионам, анализа товаров, анализа производства, тенденций ценового картирования, поиска поставщиков, анализа эффективности категорий, решений по управлению рисками в цепочке поставок, расширенного сравнительного анализа и других услуг по закупкам и стратегической поддержке.

Влияние COVID-19 на рынок параарамидных волокон

Вспышка covid-19 затронула почти все секторы по всему миру. Рынок параарамидного волокна умеренно пострадал из-за сбоев в цепочке поставок и ограничений в нефтехимической и нефтеперерабатывающей промышленности, которые являются основными конечными потребителями параарамидного волокна. Рынок сильно зависит от химической, нефтегазовой, автомобильной и телекоммуникационной отраслей.

Пандемия умеренно повлияла на потребительские настроения и бизнес на основных рынках мира. Хотя рынок постепенно восстанавливается, потребуется некоторое время, прежде чем нефтехимический и химический секторы вернутся к стабильной траектории роста. Ожидается, что рост в нефтехимии и нефтепереработке восстановится быстрее, чем в сегментах производства электроэнергии и строительства. Таким образом, COVID-19 оказал серьезное влияние на рост рынка параарамидных волокон.

Ожидаемое влияние экономического спада на ценообразование и доступность продукции

Когда экономическая активность замедляется, отрасли начинают страдать. Прогнозируемое влияние экономического спада на ценообразование и доступность продуктов учитывается в отчетах по анализу рынка и услугах по разведке, предоставляемых DBMR. Благодаря этому наши клиенты обычно могут быть на шаг впереди своих конкурентов, прогнозировать свои продажи и доходы, а также оценивать свои расходы на прибыль и убытки.

Масштаб мирового рынка параарамидных волокон

Рынок параарамидных волокон сегментирован на основе формы продукта, применения и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Форма продукта

- Филаментная пряжа

- Короткие волокна

- Целлюлоза

- Другие

Приложение

- Фрикционные материалы

- Тормозная колодка

- Прокладка

- Защита

- Бронежилет

- Пуленепробиваемые автомобили

- Боевой шлем

- Электрическая передача

- Оптическое волокно

- Другие

- Защитная одежда

- Перчатки

- Одежда для пожарных

- Резиновое армирование

- Ленточный конвейер

- Другие

- Усиление шин

- Нефть и газ

- Другие

- Промышленная фильтрация

- Оптические волокна

- Другие

Конечный пользователь

- Автомобильный

- Аэрокосмическая промышленность и оборона

- Электроника и телекоммуникации

- Электрические

- Другие

Региональный анализ/информация о рынке параарамидных волокон

Проведен анализ рынка параарамидных волокон , а также предоставлены сведения о размерах рынка и тенденциях по странам, формам продукции, областям применения и конечным пользователям, как указано выше.

Страны, охваченные отчетом о рынке параарамидных волокон : США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Азиатско-Тихоокеанский регион доминирует на рынке параарамидных волокон с точки зрения доходов рынка благодаря расширению применения мер защиты и безопасности по всему региону, а растущий спрос на Интернет со стороны развивающихся стран будет способствовать росту телекоммуникационной отрасли в этом регионе.

В Северной Америке по-прежнему будут прогнозироваться самые высокие совокупные годовые темпы роста в прогнозируемый период 2022–2029 годов из-за растущего числа мероприятий по реконструкции в сочетании со строгими правилами, касающимися защиты и безопасности работников в ряде отраслей промышленности в этом регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка параарамидных волокон

Конкурентная среда рынка параарамидных волокон содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные касаются только фокуса компаний, связанного с рынком параарамидных волокон.

Некоторые из основных игроков, работающих на рынке параарамидных волокон :

- Toray Industries Inc, (Япония)

- Dow и Dupont (США)

- Teijin Limited (Япония)

- СОЛЬВЕЙ (Бельгия)

- Yantai Tayho Advanced Materials Co Ltd. (Китай)

- Хёсун (Южная Корея)

- Колон Индастриз Инк. (Южная Корея)

- Huvis Corp, (Южная Корея)

- Кермель (Франция)

- China National Bluestar (Group) Co., Ltd. (Китай)

- X-FIPER NEW MATERIAL CO.,LTD (Китай)

- Файбрекс (США)

- Арамид Хпм, ООО (США)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.