Global Nicotine Replacement Therapy Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.92 Billion

USD

7.93 Billion

2021

2029

USD

2.92 Billion

USD

7.93 Billion

2021

2029

| 2022 –2029 | |

| USD 2.92 Billion | |

| USD 7.93 Billion | |

|

|

|

|

Глобальный рынок никотинзаместительной терапии по типу продукции (пластыри, жевательные резинки, леденцы, ингаляторы, назальные спреи , сублингвальные таблетки), конечные пользователи (больницы, специализированные клиники, уход на дому и другие), канал сбыта (больничная аптека, розничная аптека, интернет-аптека и другие) — тенденции отрасли и прогноз до 2029 г.

Анализ и размер рынка

По данным Агентства по исследованиям и качеству здравоохранения США, за исключением беременных женщин и подростков, никотинзаместительная терапия (НЗТ) безопасна для всех взрослых, которые хотят бросить курить. Никотинзаместительная терапия (НЗТ) — это метод помощи людям в отказе от курения. Никотин поставляется в малых дозах в форме ингаляторов, леденцов, пластырей, спреев или жевательной резинки, в то время как другие токсины, содержащиеся в табачных сигаретах, избегаются. Основная цель никотинзаместительной терапии — уменьшить тягу к никотину за счет облегчения симптомов отмены никотина.

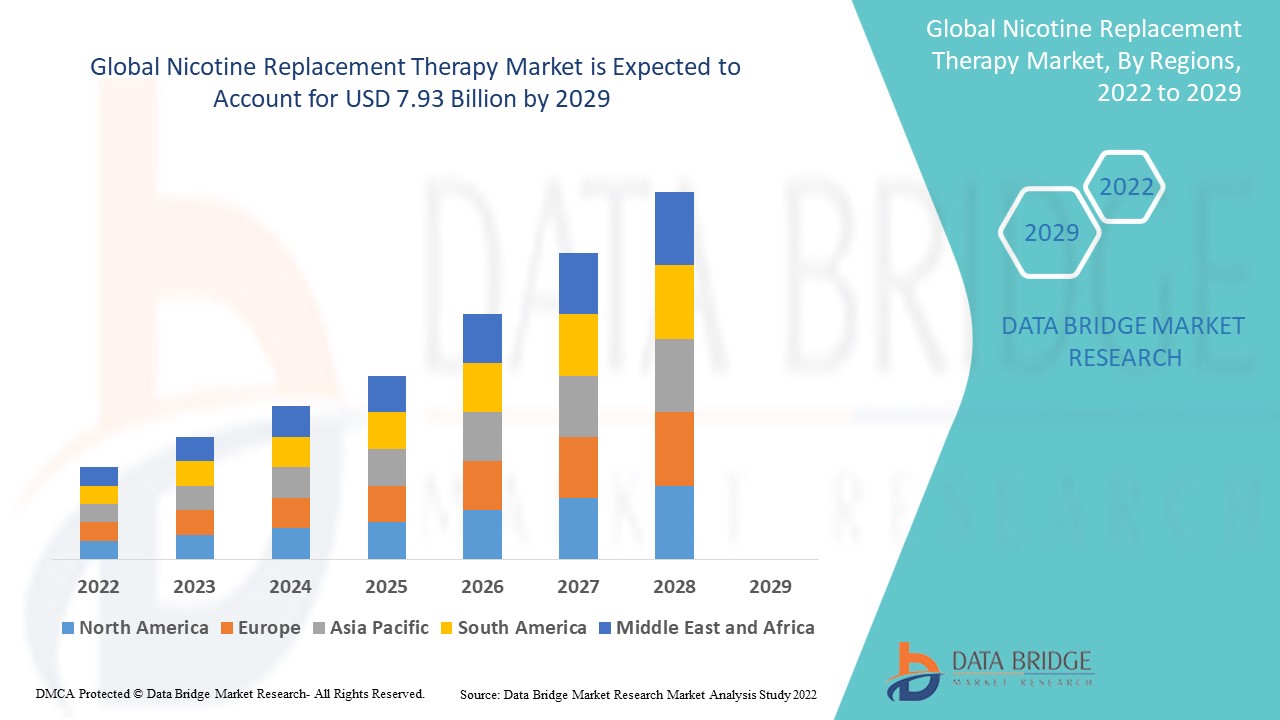

По данным Data Bridge Market Research, рынок никотинзаместительной терапии в 2021 году оценивался в 2,92 млрд долларов США, а к 2029 году, как ожидается, достигнет 7,93 млрд долларов США, что соответствует среднегодовому темпу роста (CAGR) в 13,31% в прогнозируемый период с 2022 по 2029 год. Помимо таких данных о рынке, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, также включает в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ линейки продуктов, анализ ценообразования и нормативно-правовую базу.

Область отчета и сегментация рынка

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2014 - 2019) |

|

Количественные единицы |

Выручка в млрд долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Тип продукта (пластыри, жевательные резинки, леденцы, ингаляторы, назальный спрей, сублингвальные таблетки), конечные пользователи (больницы, специализированные клиники, уход на дому и другие), канал сбыта (больничная аптека, розничная аптека, интернет-аптека и другие) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки |

|

Охваченные участники рынка |

Pfizer Inc. (США), GlaxoSmithKline plc (Великобритания), Novartis AG (Швейцария), Mylan NV (США), Teva Pharmaceutical Industries Ltd. (Израиль), Sanofi (Франция), AstraZeneca (Великобритания), Johnson & Johnson Private Limited (США), Merck & Co., Inc. (США), Cipla Inc. (США), Takeda Pharmaceutical Company Limited (Япония), Perrigo Company plc (Ирландия), McNeil AB (Швеция), Imperial Brands (Великобритания), Philip Morris Products SA (США), BAT (Великобритания), NJOY (США), Fertin Pharma (Дания), Glenmark Pharmaceuticals Limited (Индия), Pierre Fabre Group (Франция) |

|

Возможности рынка |

|

Определение рынка

Никотиновая заместительная терапия — это лечение, которое подразумевает введение никотина курильщикам в виде пластырей, ингаляторов , жевательных резинок, спреев и леденцов, не содержащих токсичных соединений, содержащихся в табаке. В отличие от сигарет, которые содержат большое количество никотина и поэтому вызывают рак легких, астму и другие хронические проблемы, никотиновая заместительная терапия использует лекарства, которые обеспечивают никотин в низкой дозе. Никотиновая заместительная терапия уменьшает или устраняет потребление табака, снижая частоту и интенсивность тяги к курению.

Динамика рынка никотинзаместительной терапии

Драйверы

- Рост распространенности хронических заболеваний

Растущая распространенность хронических заболеваний является основным фактором, определяющим темпы роста рынка никотинзаместительной терапии в прогнозируемый период 2022-2029 гг. Центры по контролю и профилактике заболеваний (CDC) оценивают, что курение сигарет ежегодно становится причиной примерно 80–90 % случаев смерти от рака легких в Соединенных Штатах. Табачный дым содержит более 7000 соединений, более 70 из которых, как известно, вызывают рак у людей. Кроме того, растущая распространенность хронических заболеваний побуждает крупные корпорации разрабатывать прорывные решения НЗТ, которые помогают людям противостоять потребности курить. Растущая распространенность табачной зависимости среди подростков подпитывает спрос на продукцию НЗТ, что будет способствовать росту мирового рынка никотинзаместительной терапии в прогнозируемый период.

- Увеличение инвестиций в инфраструктуру здравоохранения

Другим существенным фактором, влияющим на темпы роста рынка никотинзаместительной терапии, является рост расходов на здравоохранение, что помогает в улучшении его инфраструктуры. Кроме того, различные государственные организации стремятся улучшить инфраструктуру здравоохранения путем увеличения финансирования, и это еще больше повлияет на динамику рынка.

- Повышение осведомленности о вреде курения

Растущая осведомленность общественности о вредных последствиях курения, как ожидается, станет основным драйвером рынка. Во всем мире число курильщиков превысило 1,1 миллиарда. Люди обращаются к методам лечения отказа от курения в результате государственных инициатив, таких как «закон о доступном медицинском обслуживании», правила страхования и программы по повышению осведомленности о вредных последствиях курения для здоровья посредством консультирования. В 2018 году 55 процентов из 34,2 миллиона курильщиков в Соединенных Штатах пытались бросить курить.

Кроме того, малоподвижный образ жизни людей и рост численности гериатрического населения приведут к расширению рынка никотинзаместительной терапии. Наряду с этим, благоприятная политика возмещения расходов повысит темпы роста рынка.

Возможности

- Технологический прогресс

Технологические разработки на рынке никотинзаместительной терапии продолжаются, что приводит к увеличению числа людей, переходящих на передовые продукты. Ожидается, что принятию НЗТ будут способствовать такие инновации, как продукты heat-not-burn, ароматизированные жевательные резинки и леденцы. Табачные гиганты, такие как British American Tobacco, разработали бездымные и менее опасные альтернативы. В сравнении с традиционными сигаретами эти усовершенствования имеют разный диапазон эффективности и принимаются обществом, способствуя их принятию и усиливая рост рынка. Это создаст новые рыночные возможности в ближайшие годы.

- Растет число запусков продуктов

Крупнейшие компании, такие как GlaxoSmithKline plc и Johnson & Johnson Inc, занимают более 80% от общей доли рынка и постоянно укрепляют свои позиции, выводя на мировой рынок новые продукты никотинзаместительной терапии. Более того, в прогнозируемый период другие участники рынка пытаются укрепить свои позиции, реализуя такие стратегии, как сотрудничество, слияние и поглощение, а также вывод на рынок новых продуктов. Это создаст новые рыночные возможности.

Более того, рост рынка подпитывается увеличением числа научно-исследовательских и опытно-конструкторских работ. Никотинозамещающая терапия показала свою эффективность в клинических испытаниях, увеличив вероятность отказа от курения на 50–70%. Это предоставит благоприятные возможности для роста рынка никотинозамещающей терапии.

Ограничения/Проблемы

- Запрет на электронные сигареты

Одной из важнейших причин, препятствующих росту рынка, является запрет на электронные сигареты. Например, правительство Индии запретило импорт, производство и продажу электронных сигарет в сентябре 2019 года. С более чем 100 миллионами курильщиков в Индии это могло бы стать огромной возможностью для расширения рынка. Другие страны, включая Мексику, Бразилию, Малайзию и Таиланд, запретили использование, импорт и производство электронных сигарет. К 2020 году более 20 стран запретят использование электронных сигарет. По прогнозам, это задушит расширение рынка.

С другой стороны, факторы высокой стоимости и неосведомленность будут препятствовать темпам роста рынка. Отсутствие инфраструктуры здравоохранения в развивающихся экономиках и нехватка квалифицированных специалистов будут бросать вызов рынку заместительной никотиновой терапии. Кроме того, побочные эффекты, связанные с заместительной никотиновой терапией, такие как головная боль, тошнота и другие проблемы с пищеварением, будут выступать в качестве сдерживающего фактора и еще больше препятствовать темпам роста рынка в прогнозируемый период 2022-2029 гг.

В этом отчете о рынке никотинзаместительной терапии содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрение продуктов, запуски продуктов, географическое расширение, технологические инновации на рынке. Чтобы получить больше информации о рынке никотинзаместительной терапии, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Анализ эпидемиологии пациентов

Рынок заместительной никотиновой терапии также предоставляет вам подробный анализ рынка для анализа пациентов, прогнозов и излечения. Распространенность, заболеваемость, смертность, показатели приверженности — вот некоторые из переменных данных, которые доступны в отчете. Анализируется прямое или косвенное влияние эпидемиологии на рост рынка для создания более надежной и когортной многомерной статистической модели для прогнозирования рынка в период роста.

Влияние COVID-19 на рынок никотинзаместительной терапии

Вспышка COVID-19 и последующий карантин во многих странах мира оказали огромное влияние на финансовое положение предприятий во всех секторах. Частный сектор здравоохранения является одной из областей, где пандемия оказала значительное влияние. Смертельные последствия нового коронавируса наблюдались по всему миру. Миллионы людей уже умерли в результате вспышки, и еще больше людей боролись с симптомами по всему миру. Заболевание, поражающее органы дыхания, считается крайне смертельным для тех, кто активно употребляет табачные изделия. Чтобы уменьшить воздействие на курильщиков, различные государственные органы продвигают инициативы по борьбе с курением и назначают никотинзаместительную терапию тем, кто пристрастился к сигаретам.

Недавнее развитие

- В июне 2020 года Taat Herb Co. объявила о запуске новых сигарет с коноплей от Taat. По словам компании, новый продукт очень похож на ощущения от курения обычной сигареты и содержит 50 мг каннабидиола (КБД), который эффективен для снижения табачной зависимости.

Глобальный охват рынка никотинзаместительной терапии

Рынок никотинзаместительной терапии сегментирован на основе типа продукта, конечных пользователей и канала сбыта. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип продукта

- Патчи

- Десны

- Логензы

- Ингаляторы

- Назальный спрей

- Сублингвальные таблетки

Конечные пользователи

- Больницы

- Специализированные клиники

- Уход на дому

- Другие

Канал распространения

- Больничная аптека

- Розничная аптека

- Интернет-аптека

- Другие

Региональный анализ/информация о рынке никотинзаместительной терапии

Проведен анализ рынка никотинзаместительной терапии, а также предоставлены сведения о размерах рынка и тенденциях по странам, типам продукции, конечным пользователям и каналам сбыта, как указано выше.

Страны, охваченные отчетом о рынке никотинзаместительной терапии: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки.

Северная Америка доминирует на рынке никотинзаместительной терапии с точки зрения доли рынка и доходов рынка и продолжит процветать в течение прогнозируемого периода. Это связано с растущим уровнем принятия электронных сигарет и нагреваемого табака, а растущие расходы на здравоохранение еще больше подстегнут темпы роста рынка в этом регионе. Кроме того, рост распространенности заболеваний, связанных с курением, и количество благоприятных государственных инициатив еще больше подстегнут темпы роста рынка в этом регионе.

Ожидается, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом в прогнозируемый период 2022-2029 гг. из-за растущей конкуренции между крупными табачными компаниями в этом регионе. Кроме того, развитие инфраструктуры здравоохранения и растущий спрос на продукты НЗТ будут и дальше стимулировать темпы роста рынка в этом регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и внутренних брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка никотинзаместительной терапии

Конкурентная среда рынка заместительной никотиновой терапии содержит сведения по конкурентам. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком заместительной никотиновой терапии.

Некоторые из основных игроков, работающих на рынке никотинзаместительной терапии:

- Pfizer Inc. (США)

- GlaxoSmithKline plc (Великобритания)

- Новартис АГ (Швейцария)

- Mylan NV (США)

- Teva Pharmaceutical Industries Ltd. (Израиль)

- Санофи (Франция)

- АстраЗенека (Великобритания)

- Johnson & Johnson Private Limited (США)

- Merck & Co., Inc. (США)

- Cipla Inc. (США)

- Takeda Pharmaceutical Company Limited (Япония)

- Perrigo Company plc (Ирландия)

- McNeil AB (Швеция)

- Imperial Brands (Великобритания)

- Philip Morris Products SA (США)

- БАТ (Великобритания)

- NJOY (США)

- Fertin Pharma (Дания)

- Glenmark Pharmaceuticals Limited (Индия)

- Группа Пьера Фабра (Франция)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NICOTINE REPLACEMENT THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NICOTINE REPLACEMENT THERAPY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S 5 FORCES

4.2 PESTEL ANALYSIS

4.3 PATEINT TREATMENT SUCCESS RATES

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH PHYSICIANS

5.8 OTHER KOL SNAPSHOTS

6 REGULATORY SCENARIO

6.1 FDA APPROVALS

6.2 EMA APPROVALS

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 PIPELINE ANALYSIS

8.1 CLINICAL TRIALS AND PHASE ANALYSIS

8.2 DRUG THERAPY PIPELINE

8.3 PHASE III CANDIDATES

8.3.1 NICVAX VACCINE

8.4 PHASE II CANDIDATE

8.4.1 VACCINE

8.4.1.1. NIC002

8.4.1.2. TANIC

8.5 PHASE I CANDIDATE

8.5.1 SEL-069 VACCINE

8.6 OTHERS (PRE-CLINICAL AND RESEARCH)

9 MARKET OVERVIEW

9.1 DRIVERS

9.2 RESTRAINS

9.3 OPPURTUNITY

9.4 CHALLENGES

10 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY TYPE

10.1 OVERVIEW

10.2 OVER THE COUNTER

10.2.1 TRANSDERMAL PATCHES

10.2.1.1. FULL STRENGHT PATCH (15-22 MG OF NICOTINE)

10.2.1.1.1. MARKET VALUE (USD MN)

10.2.1.1.2. MARKET VOLUME (UNITS)

10.2.1.1.3. AVERAGE SELLING PRICE (USD)

10.2.1.2. WEAKER PATCH (5-14 MG OF NICOTINE)

10.2.1.2.1. MARKET VALUE (USD MN)

10.2.1.2.2. MARKET VOLUME (UNITS)

10.2.1.2.3. AVERAGE SELLING PRICE (USD)

10.2.2 NICOTINE GUM

10.2.2.1. MARKET VALUE (USD MN)

10.2.2.2. MARKET VOLUME (UNITS)

10.2.2.3. AVERAGE SELLING PRICE (USD)

10.2.3 SUBLINGUAL TABLET

10.2.3.1. MARKET VALUE (USD MN)

10.2.3.2. MARKET VOLUME (UNITS)

10.2.3.3. AVERAGE SELLING PRICE (USD)

10.2.4 LOZENGE

10.2.4.1. MARKET VALUE (USD MN)

10.2.4.2. MARKET VOLUME (UNITS)

10.2.4.3. AVERAGE SELLING PRICE (USD)

10.3 PRESCRIPTION

10.3.1 NICOTINE INHALERS

10.3.1.1. MARKET VALUE (USD MN)

10.3.1.2. MARKET VOLUME (UNITS)

10.3.1.3. AVERAGE SELLING PRICE (USD)

10.3.2 NICOTINE METERED NASAL SPRAY

10.3.2.1. MARKET VALUE (USD MN)

10.3.2.2. MARKET VOLUME (UNITS)

10.3.2.3. AVERAGE SELLING PRICE (USD)

10.3.3 ELECTRONIC CIGARETTE

10.3.3.1. MARKET VALUE (USD MN)

10.3.3.2. MARKET VOLUME (UNITS)

10.3.3.3. AVERAGE SELLING PRICE (USD)

10.3.4 OTHERS

11 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 NASAL

11.4 TRANSDERMAL

12 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADOLESCENTS

12.3 ADULTS

12.4 GERIATRIC

13 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 CLINICS

13.4 HOME HEALTHCARE

13.5 OTHERS

14 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 RETAIL PHARMACY

14.4 OTHERS

15 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY GEOGRAPHY

GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.1.1. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY TYPE

15.1.1.2. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY ROUTE OF ADMINISTRATION

15.1.1.3. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY END USER

15.1.1.4. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1.2 CANADA

15.1.3 MEXICO

15.1.4 DOMINICAN REPUBLIC

15.1.5 JAMAICA

15.1.6 PANAMA

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 HUNGARY

15.2.5 LITHUANIA

15.2.6 AUSTRIA

15.2.7 IRELAND

15.2.8 NORWAY

15.2.9 POLAND

15.2.10 ITALY

15.2.11 SPAIN

15.2.12 RUSSIA

15.2.13 TURKEY

15.2.14 NETHERLANDS

15.2.15 SWITZERLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 TAIWAN

15.3.4 SOUTH KOREA

15.3.5 INDIA

15.3.6 AUSTRALIA

15.3.7 SINGAPORE

15.3.8 THAILAND

15.3.9 MALAYSIA

15.3.10 INDONESIA

15.3.11 PHILIPPINES

15.3.12 VIETNAM

15.3.13 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ECUADOR

15.4.3 CHILE

15.4.4 COLOMBIA

15.4.5 VENEZUELA

15.4.6 ARGENTINA

15.4.7 PERU

15.4.8 CURAÇAO

15.4.9 PARAGUAY

15.4.10 URUGUAY

15.4.11 TRINIDAD AND TOBAGO

15.4.12 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 KUWAIT

15.5.6 ISRAEL

15.5.7 BOLIVIA

15.5.8 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, COMPANY PROFILE

18.1 JOHNSON & JOHNSON

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 GSK

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 PERRIGO COMPANY PLC

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 PIERRE FABRE SA

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 PFIZER

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 CIPLA

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 BRITISH AMERICAN TOBACCO PLC

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 SPARSHA PHARMA

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 DR REDDY LABORATORIES

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 NOVARTIS

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 TEVA PHARMAMCEUTICALS

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 TAKEDA PHARMACEUTICALS

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BRISTOL MEYERS SQUIBB

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 MERCK & CO., INC

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 SANOFI

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 ELI LILLY

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 SHIRE PHARMACEUTICALS

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 BOEHRINGER INGELHEIM

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 ASTRAZENCA

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 SUN PHARMA

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 F-HOFFMANN LA ROCHE

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 ABBVIE

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 AMGEN

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 BAUSCH HEALTH

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 EISAI CO.,

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 GRIFOLS

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 ALEXION PHARMACEUTICALS

18.27.1 COMPANY OVERVIEW

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 CETLIC PHARMA

18.28.1 COMPANY OVERVIEW

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 SELECTA BIOSCIENCE

18.29.1 COMPANY OVERVIEW

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHIC PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

18.3 NABI BIOPHARMACEUTICALS

18.30.1 COMPANY OVERVIEW

18.30.2 REVENUE ANALYSIS

18.30.3 GEOGRAPHIC PRESENCE

18.30.4 PRODUCT PORTFOLIO

18.30.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.