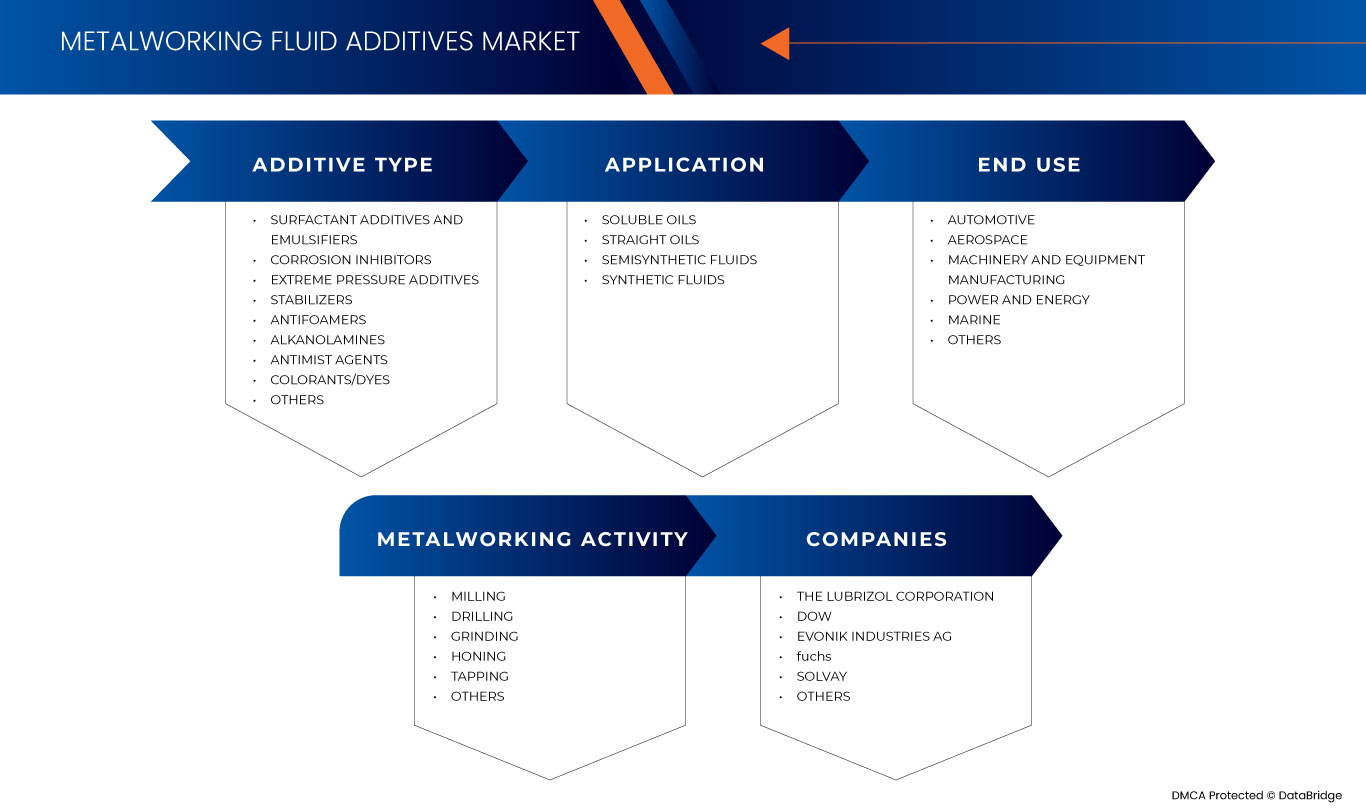

Global Metalworking Fluid Additives Market, By Additive Type (Surfactant Additives and Emulsifiers, Corrosion Inhibitors, Extreme Pressure Additives, Stabilizers, Antifoamers, Alkanolamines, Antimist Agents, Colorants/Dyes, and Others), Application (Soluble Oils, Straight Oils, Semisynthetic Fluids, and Synthetic Fluids), Metalworking Activity (Milling, Drilling, Grinding, Honing, Tapping, and Others), End Use (Automotive, Aerospace, Machinery and Equipment Manufacturing, Power and Energy, Marine, and Others) - Industry Trends and Forecast to 2030.

Metalworking Fluid Additives Market Analysis and Insights

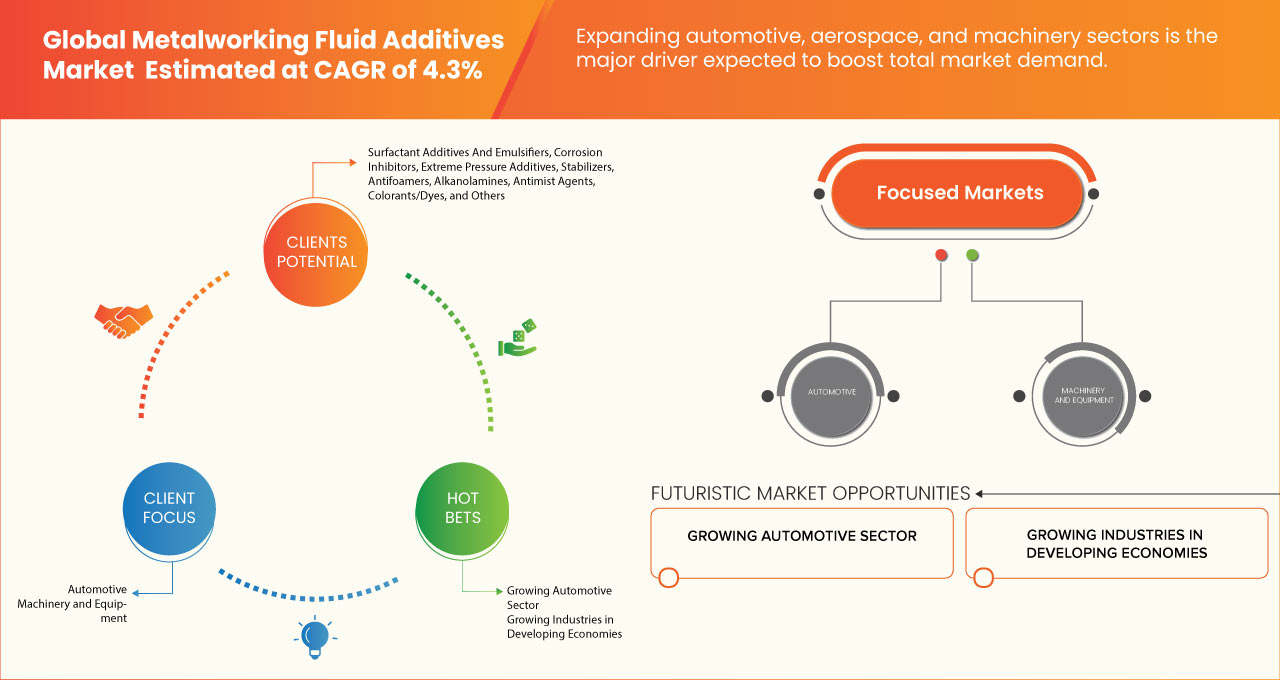

The expanding automotive, aerospace, and machinery sectors is the key factor fueling the market expansion. The escalation of quality standards and the increasing integration of automation within industries are instrumental in fostering opportunities for market growth.

The increasing adoption of dry machining across industries serves as a notable restraint affecting the market. Furthermore, fluctuations in raw material prices and availability represent a substantial challenge to market growth. The shift towards eco-friendly additives appears to be a rising opportunity that has the potential to lead to the market growth. Environmental regulations and sustainability factors have emerged as significant challenges impacting the growth trajectory of the market.

The global metalworking fluid additives market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

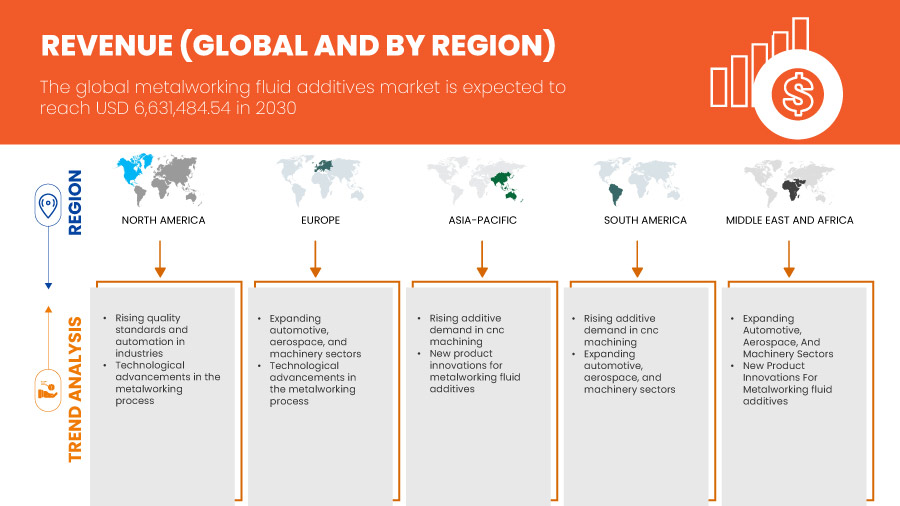

The global metalworking fluid additives market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing at a CAGR of 4.3% in the forecast period of 2023 to 2030 and is expected to reach USD 6,631,484.54 thousand by 2030. The rising additive demand in CNC machining are some of the driving factors expected to propel the market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Тип присадки (поверхностно-активные присадки и эмульгаторы, ингибиторы коррозии , противозадирные присадки, стабилизаторы, пеногасители, алканоламины, противотуманные агенты, красители и другие), применение (растворимые масла, чистые масла, полусинтетические жидкости и синтетические жидкости), металлообрабатывающая деятельность (фрезерование, сверление, шлифование, хонингование, нарезание резьбы и другие), конечное использование (автомобилестроение, аэрокосмическая промышленность, производство машин и оборудования, энергетика, судостроение и другие) |

|

Страны, охваченные |

США, Канада, Мексика, Германия, Франция, Испания, Великобритания, Италия, Россия, Бельгия, Нидерланды, Турция, Швеция, Швейцария, Дания, Норвегия, Финляндия, остальная Европа, Китай, Индия, Япония, Южная Корея, Сингапур, Австралия, Тайвань, Таиланд, Индонезия, Малайзия, Гонконг, Новая Зеландия, Филиппины, остальная часть Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальная часть Южной Америки, Саудовская Аравия, Египет, Южная Африка, Катар, ОАЭ, Израиль, Оман, Кувейт, Бахрейн и остальная часть Ближнего Востока и Африки |

|

Охваченные участники рынка |

Lubrizol Corporation, Dow, Evonik Industries AG, FUCHS, Solvay, LANXESS, BP plc, CLARIANT, Ingevity и связанные с ней компании, Ashland, Italmatch Chemicals SpA, Kao Corporation, Umicore, Colonial Chemical, Biosynthetic Technologies, DOVER CHEMICAL CORPORATION, Emery Oleochemicals, Pilot Chemical Corp., RT Vanderbilt Holding Company, Inc. и ZSCHIMMER & SCHWARZ, INC. |

Определение рынка

Добавки для металлообрабатывающих жидкостей (PFPE) — это низкомолекулярная фторированная синтетическая жидкость. Добавки для металлообрабатывающих жидкостей нетоксичны и не воспламеняемы в своем естественном состоянии. Они используются при суровых температурах от 80°C до 200°C. Молекулярная структура PFPE может быть линейной, разветвленной или представлять собой комбинацию того и другого в зависимости от области применения. PFPE обеспечивает термостойкость, смазывающую способность, износостойкость и летучесть жидкости.

Динамика мирового рынка присадок к жидкостям для металлообработки

Драйверы

- Расширение автомобильного, аэрокосмического и машиностроительного секторов

На мировом рынке спрос на добавки для металлообрабатывающих жидкостей обусловлен быстрым ростом и расширением важных секторов промышленности, включая автомобилестроение, аэрокосмическую промышленность и машиностроение. Эти отрасли представляют собой современное производство в целом, постоянно расширяя границы инноваций и технического развития.

Автомобильный сектор, являющийся опорой экономики во всем мире, постоянно ищет способы повышения производительности, безопасности и эффективности транспортных средств. Для производства прецизионных компонентов эта деятельность требует сложных процедур обработки. Добавки для металлообрабатывающей жидкости играют решающую роль в обеспечении бесперебойной работы и позволяют производить высококачественные автомобильные детали, предлагая смазку, охлаждение и удаление стружки.

- Повышение стандартов качества и автоматизации в промышленности

Повышение стандартов качества и растущая интеграция автоматизации в отраслях промышленности играют важную роль в создании возможностей для роста рынка. Эти два фактора в тандеме инициировали смену парадигмы в производственных практиках и изменяют динамику спроса на добавки для металлообрабатывающих жидкостей. Повышенные стандарты качества стали первостепенными в современных производственных процессах. Отрасли находятся под давлением необходимости поддержания точности, последовательности и соблюдения строгих спецификаций для обеспечения целостности и производительности продукта. Добавки для металлообрабатывающих жидкостей играют ключевую роль в достижении этих целей. Добавки, улучшающие смазочные, охлаждающие и антикоррозионные свойства, стали обязательными для оптимизации процессов обработки, повышения долговечности инструментов и достижения превосходной отделки продукции. Спрос на передовые добавки для металлообрабатывающих жидкостей должен расти, поскольку отрасли во всех секторах стремятся соответствовать или превосходить эти эталонные показатели качества, что приводит к ускорению роста рынка.

Возможности

- Технологические достижения в процессе металлообработки

Достижения в области технологий стали ключевым фактором роста рынка. Эти технологические разработки существенно повлияли на формулу, применение и производительность присадок для металлообрабатывающих жидкостей, создав множество возможностей для расширения рынка.

Одной из ключевых областей технологического прогресса является усовершенствование формул присадок. Производители используют передовые исследования и инновации для разработки присадок, которые обеспечивают превосходные смазочные, антикоррозионные и охлаждающие свойства. Такие точно спроектированные присадки улучшают процессы обработки, увеличивают срок службы инструмента и способствуют получению более качественной готовой продукции. Этот уровень оптимизации производительности создает убедительное ценностное предложение для конечных пользователей, стимулируя спрос на присадки к жидкостям для металлообработки. Кроме того, достижения в области нанотехнологий открыли новые пути для повышения эффективности присадок к жидкостям для металлообработки. Наночастицы, благодаря своим уникальным свойствам, могут придавать жидкостям для металлообработки улучшенные смазочные, теплопередающие и противоизносные характеристики.

- Переход на экологически чистые добавки

Рынок переживает трансформационный сдвиг, вызванный растущим акцентом на экологической устойчивости. Поскольку отрасли по всему спектру стремятся сократить свой экологический след, внедрение экологически чистых добавок в процессы металлообработки стало ключевым фактором, формирующим траекторию рынка.

В традиционном ландшафте присадок для металлообрабатывающих жидкостей долгое время доминировали формулы, содержащие соединения на основе нефти и присадки с потенциальными рисками для здоровья и окружающей среды. Однако растущая осведомленность об этих опасностях в сочетании со строгими правилами и растущим спросом потребителей на устойчивые продукты привели к изменению парадигмы в сторону более экологически ответственных альтернатив.

Ограничения / Проблемы

- Отрасли переходят на традиционную сухую обработку

Растущее внедрение сухой обработки в различных отраслях промышленности служит заметным сдерживающим фактором, влияющим на рынок. Сухая обработка, технология, при которой в процессе обработки практически не используется охлаждающая жидкость или смазка, приобрела популярность благодаря своему потенциалу снижения затрат, экологическим преимуществам и улучшению условий труда. Этот переход не лишен проблем, и его влияние отражается на рынке.

Одним из основных факторов, обуславливающих переход на сухую обработку, является потенциальная экономия средств. Традиционные металлообрабатывающие жидкости, а также сопутствующие добавки, требуют усилий по закупке, обслуживанию и утилизации. Сухая обработка устраняет эти расходы, что делает ее привлекательным вариантом для отраслей, ориентированных на экономию средств. Кроме того, сухая обработка снижает образование отходов, оптимизируя утилизацию отходов и способствуя более экономичному производственному процессу.

- Колебания цен на сырье

Этот фактор, тесно связанный с экономической, геополитической и цепочкой поставок динамикой, напрямую влияет на себестоимость продукции, ценообразование и общую стабильность рынка. Добавки для металлообрабатывающих жидкостей изготавливаются с использованием комбинации основных сырьевых материалов, включая базовые масла, пакеты присадок, включающие противозадирные агенты, противоизносные составы, антипенные агенты, ингибиторы коррозии и специальные химикаты, такие как эмульгаторы, биоциды и растворители .

Эти компоненты в совокупности улучшают смазку, охлаждение, коррозионную стойкость и общую производительность металлообрабатывающих жидкостей, что оказывает решающее влияние на процессы обработки. Состав формулы адаптирован к конкретным приложениям и требованиям обработки, что делает ее универсальным решением для ряда операций по металлообработке. Из этого можно сделать вывод, что сырье, такое как базовые масла, присадки и специальные химикаты, составляет значительную часть структуры затрат на присадки к металлообрабатывающим жидкостям. Восприимчивость рынка к колебаниям цен на это сырье является результатом таких факторов, как геополитическая напряженность, изменения в динамике спроса и предложения и сбои в глобальных торговых путях. Быстрые изменения цен могут привести к непредсказуемому росту затрат для производителей, оказывая давление на прибыль. Такая волатильность не только увеличивает эксплуатационную неопределенность, но и препятствует возможности предлагать конечным пользователям конкурентоспособные цены.

- Экологические нормы и факторы устойчивого развития

Экологические нормы и факторы устойчивости стали существенными проблемами, влияющими на траекторию роста рынка. Эти факторы вытекают из растущего глобального внимания к сокращению экологического следа промышленных процессов и соответствия устойчивым практикам.

Эта проблема соответствия нормативным требованиям может препятствовать росту рынка, повышая планку для входа и увеличивая эксплуатационную сложность. Кроме того, императив устойчивости подталкивает отрасли к принятию более экологичных методов, влияя на выбор добавок для металлообрабатывающих жидкостей. Конечные пользователи теперь требуют экологически чистых добавок, которые соответствуют их целям устойчивости. Биоразлагаемость, сниженная токсичность и возобновляемые источники становятся ключевыми критериями при выборе добавок. Этот сдвиг ставит перед производителями задачу переформулировать свои продукты, что часто требует существенных инвестиций в исследования и разработки. Баланс производительности с устойчивостью еще больше усложняет ситуацию, потенциально замедляя расширение рынка, поскольку производители работают над удовлетворением этих новых требований.

В заключение следует отметить, что экологические нормы и факторы устойчивости представляют собой сложные проблемы для рынка. Развивающийся нормативный ландшафт, необходимость соответствия целям устойчивости, спрос на экологичную упаковку и появление концепций экономики замкнутого цикла в совокупности бросают вызов производителям с точки зрения соответствия, формулирования, стоимости и инноваций. Успешное преодоление этих проблем потребует стратегической адаптации и сосредоточения на экологически ответственных решениях, которые, как ожидается, бросят вызов росту рынка.

Последние события

- В августе 2023 года Boecore выбрала Колорадо-Спрингс для расширения, движимая экспертизой в области кибербезопасности. Стимулы роста и аэрокосмическая экосистема усиливают привлекательность Колорадо на фоне соображений Хантсвилла, Алабама, и округа Вебер, Юта

- В июле 2023 года Godrej Aerospace сыграла решающую роль в космических миссиях Индии, поставляя компоненты для Chandrayaan-3. Опыт компании демонстрирует ее приверженность аэрокосмическому прогрессу и инновациям, поддерживая как космические исследования, так и коммерческую авиацию

- В июне 2023 года, по данным BBC, ОПЕК контролирует почти 40% мировых запасов нефти. В дополнение к предыдущему сокращению добычи в апреле 2003 года Саудовская Аравия и другие производители нефти ОПЕК+ объявили о дальнейшем сокращении добычи нефти примерно на 1,16 млн баррелей в день. ОПЕК может повлиять на мировые поставки нефти и, следовательно, повлиять на цены на нефть и газ по всему миру, что в конечном итоге повлияет на стоимость продуктов, в которых в качестве сырья используется сырая нефть

- В июле 2023 года, согласно статье, опубликованной LNG, Европейское химическое агентство предлагает семилетний переходный период для среднецепочечных хлорированных парафинов и других веществ, содержащих хлоралканы с длиной углеродной цепи от C14 до C17. Ограничение направлено на оценку потенциальных рисков для здоровья человека или окружающей среды от производства, использования или торговли этими веществами. Среднецепочечный хлорированный парафин используется в смазочно-охлаждающих жидкостях в качестве противозадирного агента для сложных операций, защищая инструменты и компоненты от трения, износа и перегрева при высоких скоростях и давлениях.

Масштаб мирового рынка добавок для металлообрабатывающих жидкостей

Глобальный рынок присадок для металлообрабатывающих жидкостей сегментирован на четыре заметных сегмента на основе типа присадки, применения, металлообрабатывающей деятельности и конечного использования. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для выхода на рынок и определять ваши основные области применения и разницу в ваших целевых рынках.

Тип добавки

- Поверхностно-активные добавки и эмульгаторы

- Ингибиторы коррозии

- Противозадирные присадки

- Стабилизаторы

- Пеногасители

- Алканоламины

- Противотуманные агенты

- Красители /красители

- Другие

По типу присадок рынок сегментируется на поверхностно-активные присадки и эмульгаторы, ингибиторы коррозии, противозадирные присадки, стабилизаторы, пеногасители, алканоламины, противотуманные присадки, красители и другие.

Приложение

- Растворимые масла

- Прямые масла

- Полусинтетические жидкости

- Синтетические жидкости

По области применения рынок сегментируется на растворимые масла, чистые масла, полусинтетические жидкости и синтетические жидкости.

Металлообрабатывающая деятельность

- Фрезерование

- Бурение

- Шлифовка

- Хонингование

- Нажатие

- Другие

По виду металлообработки рынок сегментируется на фрезерование, сверление, шлифование, хонингование, нарезание резьбы и другие.

Конечное использование

- Автомобильный

- Аэрокосмическая промышленность

- Производство машин и оборудования

- Сила и энергия

- Морской

- Другие

По признаку конечного использования рынок сегментируется на автомобилестроение, аэрокосмическую промышленность, машиностроение и производство оборудования, энергетику, судостроение и другие.

Региональный анализ мирового рынка присадок к жидкостям для металлообработки

Проведен анализ мирового рынка присадок к жидкостям для металлообработки, а также предоставлена информация о размерах рынка по типу присадки, области применения, металлообрабатывающей деятельности и конечному использованию, как указано выше.

Страны, охваченные данным рыночным отчетом: США, Канада, Мексика, Германия, Франция, Испания, Великобритания, Италия, Россия, Бельгия, Нидерланды, Турция, Швеция, Швейцария, Дания, Норвегия, Финляндия, остальные страны Европы, Китай, Индия, Япония, Южная Корея, Сингапур, Австралия, Тайвань, Таиланд, Индонезия, Малайзия, Гонконг, Новая Зеландия, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальные страны Южной Америки, Саудовская Аравия, Египет, Южная Африка, Катар, ОАЭ, Израиль, Оман, Кувейт, Бахрейн и остальные страны Ближнего Востока и Африки.

Ожидается, что Азиатско-Тихоокеанский регион будет доминировать на рынке из-за быстрой индустриализации и высокого спроса на производство в регионе. Китай является самой быстрорастущей страной в этом регионе, имеет сильную промышленную базу, надежный производственный сектор и высокий спрос на жидкости для металлообработки. США в Северной Америке являются самой быстрорастущей страной в этом регионе из-за своей быстрорастущей обрабатывающей промышленности, расширяющегося автомобильного сектора и увеличивающейся металлообрабатывающей деятельности. Германия в Европе доминирует на этом рынке из-за своей хорошо налаженной производственной инфраструктуры, внедрения передовых технологий.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Конкурентная среда и анализ доли мирового рынка присадок к жидкостям для металлообработки

Конкурентная среда мирового рынка присадок для металлообрабатывающих жидкостей содержит сведения о конкурентах. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, сильных и слабых сторонах компании, запуске продукта, клинических испытаниях, анализе бренда, одобрении продукта, патентах, широте и дыхании продукта, доминировании приложений, жизненно важной кривой технологий. Приведенные выше данные относятся только к фокусу компании на рынке.

Основными игроками, рассматриваемыми в этом отчете, являются: The Lubrizol Corporation, Dow, Evonik Industries AG, FUCHS, Solvay, LANXESS, BP plc, CLARIANT, Ingevity и связанные с ней компании, Ashland, Italmatch Chemicals SpA, Kao Corporation, Umicore, Colonial Chemical, Biosynthetic Technologies, DOVER CHEMICAL CORPORATION, Emery Oleochemicals, Pilot Chemical Corp., RT Vanderbilt Holding Company, Inc., ZSCHIMMER & SCHWARZ, INC. и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL METALWORKING FLUID ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANDING AUTOMOTIVE, AEROSPACE, AND MACHINERY SECTORS

5.1.2 RISING QUALITY STANDARDS AND AUTOMATION IN INDUSTRIES

5.1.3 RISING ADDITIVE DEMAND IN CNC MACHINING

5.2 RESTRAINTS

5.2.1 SUPPLY CHAIN DISRUPTIONS IN THE METALWORKING FLUID ADDITIVES MARKET

5.2.2 INDUSTRIES SHIFTING TO TRADITIONAL DRY MACHINING

5.2.3 FLUCTUATION IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE METALWORKING PROCESS

5.3.2 SHIFT TOWARD ECO-FRIENDLY ADDITIVES

5.3.3 NEW PRODUCT INNOVATIONS FOR METALWORKING FLUID ADDITIVES

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY FACTORS INVOLVED

5.4.2 STABILITY ASSOCIATED WITH METALFORMING FLUID ADDITIVES

6 GEOGRAPHICAL ANALYSIS

6.1 GLOBAL

6.2 EUROPE

6.3 ASIA PACIFIC

6.4 NORTH AMERICA

6.5 MIDDLE EAST AND AFRICA

6.6 SOUTH AMERICA

7 GLOBAL METALWORKING FLUID ADDITIVES MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS & CONTRACTS

7.6 EVENT

7.7 AWARD

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 THE LUBRIZOL CORPORATION

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 EVONIK INDUSTRIES AG

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 DOW

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENT

9.4 FUCHS

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENT

9.5 SOLVAY

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 ASHLAND

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 BIOSYNTHETIC TECHNOLOGIES

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 BP P.L.C.

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENT

9.9 CLARIANT

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 COLONIAL CHEMICAL

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

9.11 DOVER CHEMICAL CORPORATION

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 EMERY OLEOCHEMICALS

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENT

9.13 INGEVITY AND ITS RELATED ENTITIES

9.13.1 COMPANY SNAPSHOT

9.13.2 REVENUE ANALYSIS

9.13.3 PRODUCT PORTFOLIO

9.13.4 RECENT DEVELOPMENT

9.14 ITALMATCH CHEMICALS S.P.A

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 KAO CORPORATION

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENT

9.16 LANXESS

9.16.1 COMPANY SNAPSHOT

9.16.2 REVENUE ANALYSIS

9.16.3 PRODUCT PORTFOLIO

9.16.4 RECENT DEVELOPMENT

9.17 PILOT CHEMICAL

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENT

9.18 R.T. VANDERBILT HOLDING COMPANY, INC.

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENT

9.19 UMICORE

9.19.1 COMPANY SNAPSHOT

9.19.2 REVENUE ANALYSIS

9.19.3 PRODUCT PORTFOLIO

9.19.4 RECENT DEVELOPMENT

9.2 ZSCHIMM ER & SCHWARZ, INC.

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Список рисунков

FIGURE 1 GLOBAL METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 2 GLOBAL METALWORKING FLUID ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL METALWORKING FLUID ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL METALWORKING FLUID ADDITIVES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL METALWORKING FLUID ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL METALWORKING FLUID ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL METALWORKING FLUID ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL METALWORKING FLUID ADDITIVES MARKET: MARKET END USE COVERAGE GRID

FIGURE 9 GLOBAL METALWORKING FLUID ADDITIVES MARKET: SEGMENTATION

FIGURE 10 STRONG SPENDING TOWARDS PHARMA INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL METALWORKING FLUID ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 11 THE SURFACTANT ADDITIVES AND EMULSIFIERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL METALWORKING FLUID ADDITIVES MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL METALWORKING FLUID ADDITIVES MARKET

FIGURE 13 GLOBAL METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 14 EUROPA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 15 ASIA PACIFIC METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 17 MIDDLE EAST AND AFRICA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA METALWORKING FLUID ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 19 GLOBAL METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

FIGURE 20 EUROPE METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 ASIA-PACIFC METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 NORTH AMERICA METALWORKING FLUID ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.